New Win FX 2025 Review: Everything You Need to Know

Executive Summary

This new win fx review gives a fair look at a forex broker that offers good trading conditions but has some concerns about regulatory transparency. New Win FX calls itself an easy-to-use trading platform. It has competitive spreads starting from 0 pips and a very low minimum deposit of just $20, which makes it great for people new to forex trading.

The broker mainly uses the MT5 trading platform. It targets beginning traders and small investors who want a cheap way to enter the forex markets. User feedback shows people are generally happy with the trading experience, especially with how well the platform works and the quality of customer service.

However, the lack of clear regulatory information has started discussions among traders about the platform's oversight and compliance. While New Win FX shows strengths in being affordable and providing a good user experience, potential clients should carefully think about the regulatory transparency issues before choosing this platform. The broker seems best for traders who care most about low-cost trading conditions and are comfortable with platforms that may have limited regulatory disclosure.

Important Notice

Traders should know that limited regulatory information may create different levels of risk for users in different places. The lack of clearly shown regulatory oversight could potentially affect trader protection and dispute resolution processes.

This review is based on available market information, user feedback, and public data about New Win FX's services. Future traders should do their own research and think about their risk tolerance before opening accounts with any forex broker.

Rating Framework

Broker Overview

New Win FX works as a forex trading service provider. Specific details about when it was founded and its corporate background are not well documented in available materials. The company focuses on delivering forex trading services through modern technology platforms.

It positions itself within the competitive online trading sector. The broker's business model centers on providing easy forex trading opportunities through the MetaTrader 5 platform. This new win fx review finds that the company emphasizes low barriers for new traders while keeping competitive trading conditions.

The platform mainly serves the foreign exchange market. However, complete information about additional asset classes remains limited in available documentation. New Win FX's operational structure appears designed to help smaller-scale traders and those beginning their forex trading journey.

However, specific regulatory oversight information is not clearly shown in available materials. This represents a notable consideration for potential clients evaluating the platform's compliance framework.

Regulatory Region: Specific regulatory jurisdiction information is not clearly detailed in available materials. This represents a key consideration for prospective traders.

Deposit and Withdrawal Methods: Detailed information about available funding methods is not extensively documented in current materials.

Minimum Deposit: The platform requires a minimum deposit of $20. This makes it highly accessible for beginning traders and small-scale investors.

Bonuses and Promotions: Specific promotional offers and bonus structures are not detailed in available documentation.

Tradeable Assets: The platform focuses on forex trading services. However, comprehensive asset class information is limited.

Cost Structure: Trading spreads begin from 0 pips. However, detailed commission structures are not extensively documented in available materials.

Leverage Ratios: Maximum leverage of 1:500 is available to traders. This provides significant position sizing flexibility.

Platform Options: MetaTrader 5 serves as the primary trading platform for New Win FX clients.

Geographic Restrictions: Specific regional limitations are not detailed in available documentation.

Customer Support Languages: Available support languages are not specified in current materials.

This new win fx review notes that while basic trading conditions are competitive, comprehensive operational details require further clarification from the broker directly.

Account Conditions Analysis

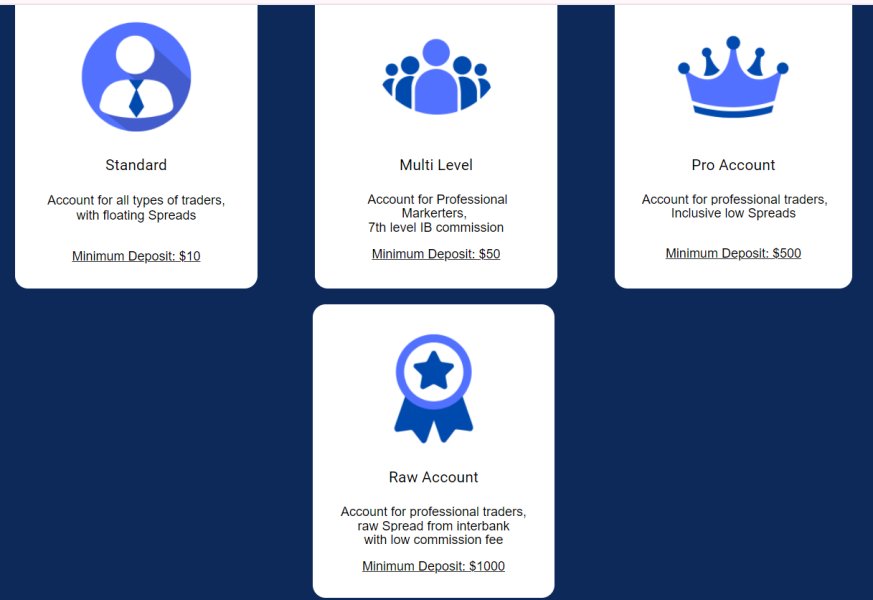

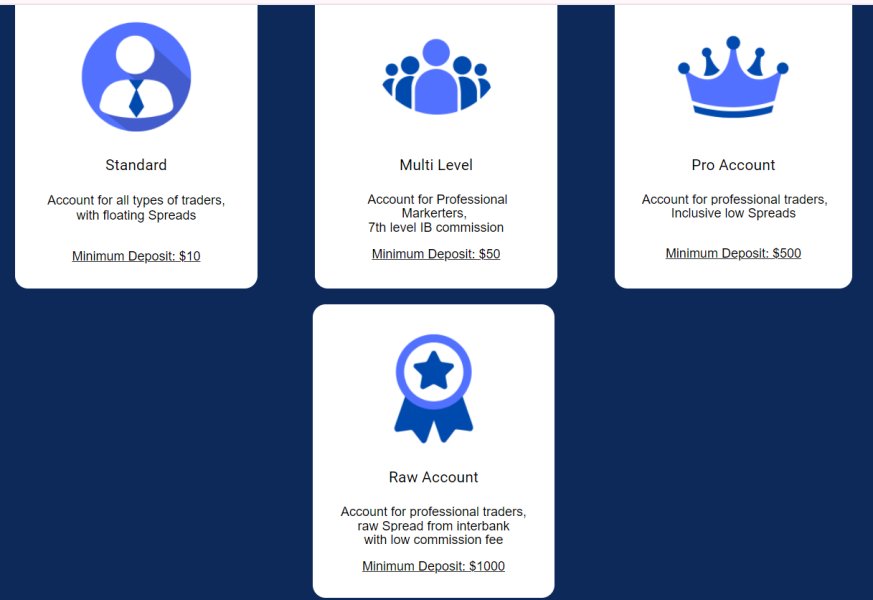

New Win FX's account structure shows a clear focus on accessibility and affordability. However, specific account type variations are not extensively detailed in available materials. The $20 minimum deposit requirement stands out as exceptionally competitive within the forex brokerage industry.

This potentially makes professional trading platforms accessible to a broader group of retail traders. The maximum leverage offering of 1:500 provides substantial position sizing flexibility. It allows traders to maximize their market exposure relative to their capital investment.

This leverage level aligns with industry standards and caters to both conservative and aggressive trading strategies. However, traders should carefully consider the associated risks. Account opening procedures and specific verification requirements are not comprehensively documented in available materials.

This suggests potential clients should contact the broker directly for detailed onboarding information. The absence of detailed information about specialized account types, such as Islamic accounts or professional trader classifications, represents an area where additional clarity would benefit prospective clients. This new win fx review finds that while the basic account conditions appear competitive, the limited documentation of account features and opening procedures may require direct broker consultation for comprehensive understanding.

The MetaTrader 5 platform serves as New Win FX's primary trading technology. It provides clients with access to professional-grade trading tools and analytical capabilities. User feedback indicates general satisfaction with the MT5 platform's performance.

This suggests stable connectivity and reliable order execution within the trading environment. However, specific details about additional trading tools, research resources, and educational materials are not extensively documented in available information. The absence of detailed information about market analysis resources, economic calendars, or trading signals represents a potential limitation for traders who rely on comprehensive research support.

Automated trading capabilities through MT5's Expert Advisor functionality would theoretically be available. However, specific support levels and restrictions are not clearly outlined. The platform's standard charting tools and technical indicators provide basic analytical capabilities.

However, enhanced research resources remain undocumented. Educational resources, webinars, and training materials are not specifically detailed in available materials. This could impact the platform's appeal to beginning traders who benefit from comprehensive learning support.

This aspect represents an area where additional information would strengthen the overall service proposition.

Customer Service and Support Analysis

User feedback consistently highlights positive experiences with New Win FX's customer service team. This indicates responsive and professional support interactions. Traders report satisfaction with the quality of assistance received.

This suggests that the broker maintains competent support staff capable of addressing client inquiries effectively. However, specific details about available support channels, operating hours, and response time guarantees are not comprehensively documented in available materials. The absence of detailed information about live chat availability, telephone support, or email response timeframes represents a gap in service transparency that potential clients might find concerning.

Multilingual support capabilities are not specifically outlined. This could impact international traders seeking assistance in their native languages. The geographic scope of support services and any regional variations in service levels remain unclear from available documentation.

While user feedback suggests positive support experiences, the limited documentation of specific service standards and availability metrics prevents comprehensive evaluation of the support infrastructure. Prospective clients may need to directly test support responsiveness before committing to the platform.

Trading Experience Analysis

User feedback indicates general satisfaction with the MetaTrader 5 trading experience provided by New Win FX. This suggests stable platform performance and reliable connectivity. Traders report positive experiences with order execution.

However, specific performance metrics such as execution speeds and slippage rates are not documented in available materials. The competitive spread structure starting from 0 pips receives positive user feedback. This indicates that traders find the pricing conditions attractive for their trading strategies.

This pricing competitiveness appears to be a significant factor in overall user satisfaction with the trading environment. Platform stability and technical performance seem adequate based on user reports. There are no significant mentions of connectivity issues or system downtime in available feedback.

However, comprehensive stress testing data or third-party performance verification is not available in current documentation. Mobile trading capabilities through MT5's mobile applications would theoretically be available. However, specific mobile experience feedback is not detailed in available materials.

The overall trading environment appears suitable for various trading styles. However, detailed performance analytics would strengthen this new win fx review assessment.

Trust and Reliability Analysis

The most significant concern identified in this evaluation relates to regulatory transparency. Specific oversight information is not clearly disclosed in available materials. This lack of regulatory clarity has generated user discussions and represents a primary consideration for traders evaluating the platform's compliance framework.

Fund security measures, segregated account structures, and client protection protocols are not comprehensively detailed in available documentation. The absence of clear information about deposit insurance, regulatory compensation schemes, or third-party auditing represents a notable gap in transparency that impacts overall trust assessment. Company background information, including founding details, corporate structure, and operational history, is not extensively documented.

This limited corporate transparency contributes to uncertainty about the broker's long-term stability and operational track record. User concerns about regulatory oversight indicate that transparency improvements would significantly enhance the platform's credibility within the trading community. The handling of these concerns and the broker's response to regulatory inquiries would be important factors for prospective clients to consider.

User Experience Analysis

Overall user satisfaction appears positive regarding core trading functionality. Users particularly appreciate the competitive spread conditions and MT5 platform performance. The low minimum deposit requirement receives positive feedback from users who value accessible entry requirements for forex trading.

Interface design and platform usability through MT5 generally meet user expectations. However, specific customization options and user interface enhancements are not detailed in available feedback. The standard MT5 experience provides familiar navigation for traders experienced with the platform.

Registration and account verification processes are not comprehensively documented. However, the absence of significant user complaints suggests reasonably straightforward onboarding procedures. However, detailed timeline expectations and documentation requirements remain unclear.

The primary user concern centers on regulatory transparency rather than operational functionality. This indicates that the platform's technical performance meets expectations while compliance clarity represents the main area for improvement. This suggests that New Win FX successfully serves traders prioritizing cost-effective trading conditions while acknowledging regulatory transparency limitations.

Conclusion

New Win FX presents a mixed proposition for forex traders. It offers attractive trading conditions including competitive spreads from 0 pips and an exceptionally accessible $20 minimum deposit, while facing questions about regulatory transparency. The platform appears most suitable for beginning traders and small-scale investors who prioritize cost-effective trading conditions and are comfortable with platforms that may have limited regulatory disclosure.

The broker's strengths lie in its affordability, competitive pricing structure, and positive user feedback regarding customer service and MT5 platform performance. However, the lack of clear regulatory information represents a significant consideration that potential clients must carefully evaluate based on their individual risk tolerance and compliance requirements.