Billion FX 2025 Review: Everything You Need to Know

Executive Summary

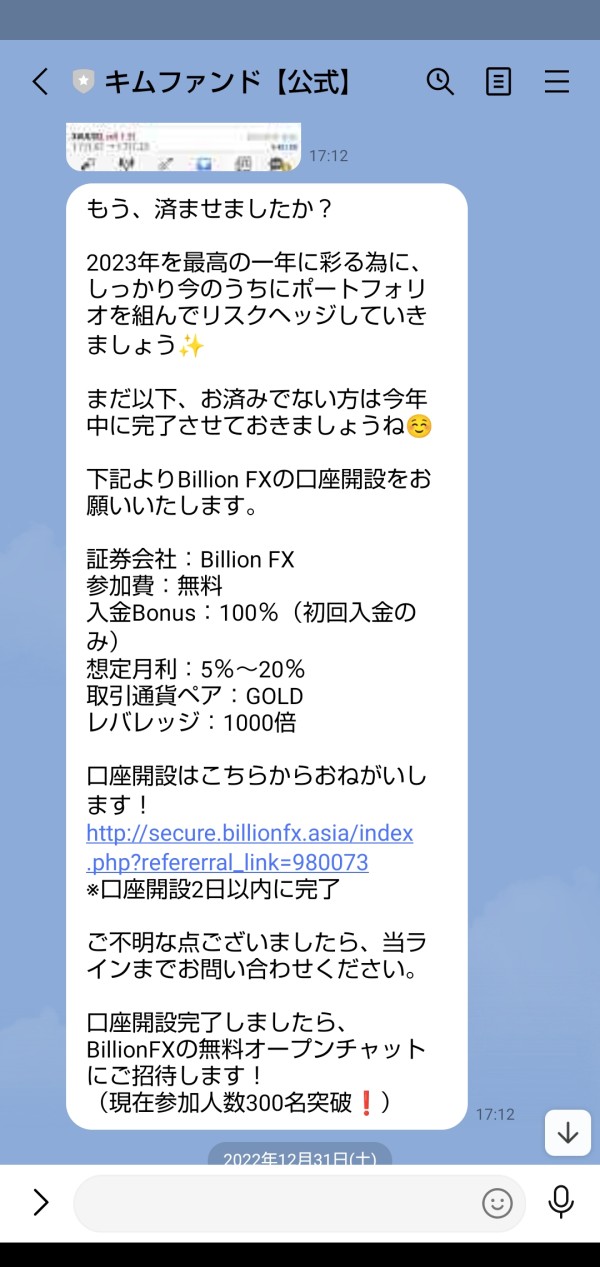

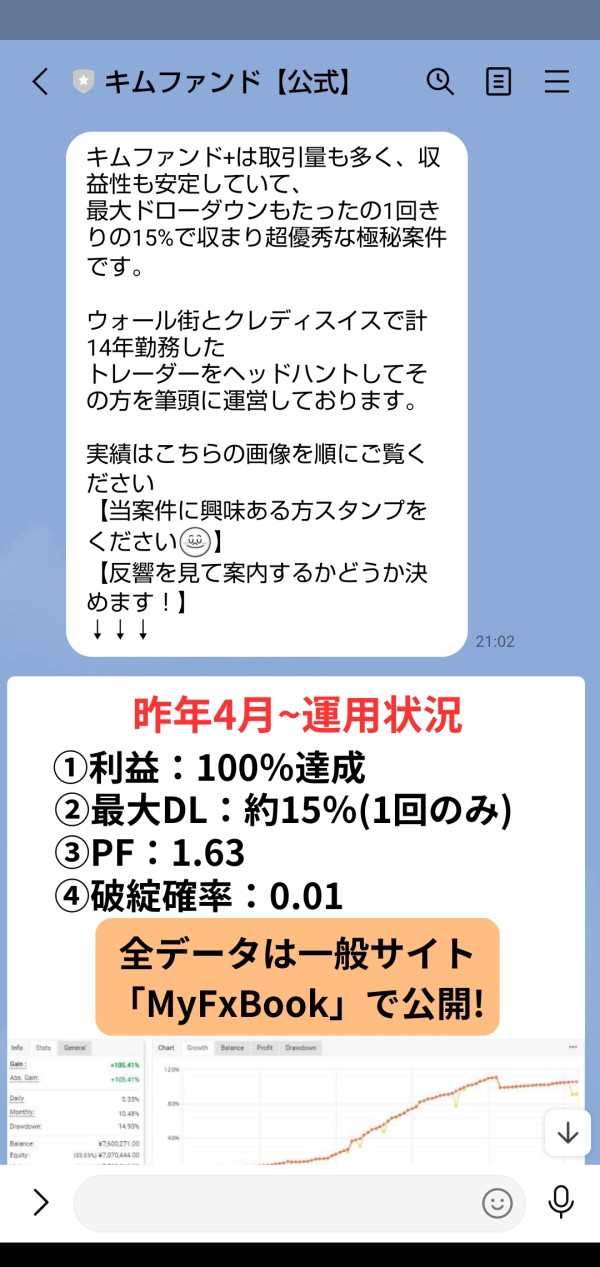

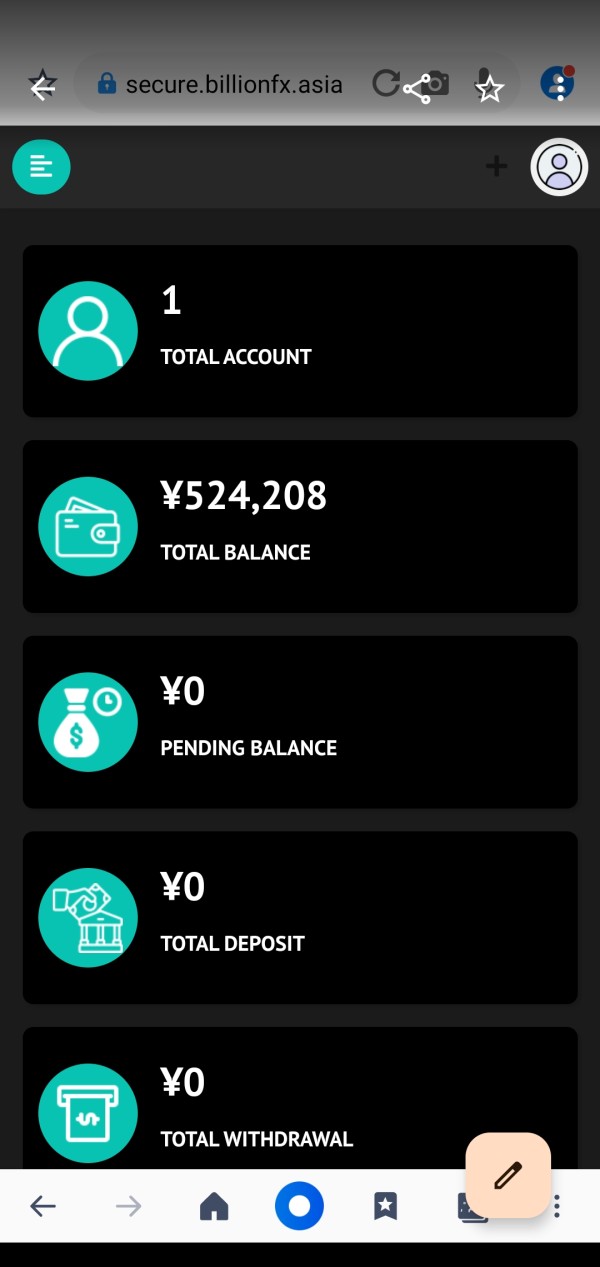

Billion FX is an unregulated forex broker. This broker poses significant potential investment risks for traders who choose to use their services. According to multiple industry reports, including those from WikiBit and various review platforms, this billion fx review reveals that the broker operates without oversight from any major regulatory authority, which creates serious concerns about trader protection and fund security. The platform offers WebTrader and MetaTrader 4 trading platforms. It focuses primarily on forex trading services for clients around the world.

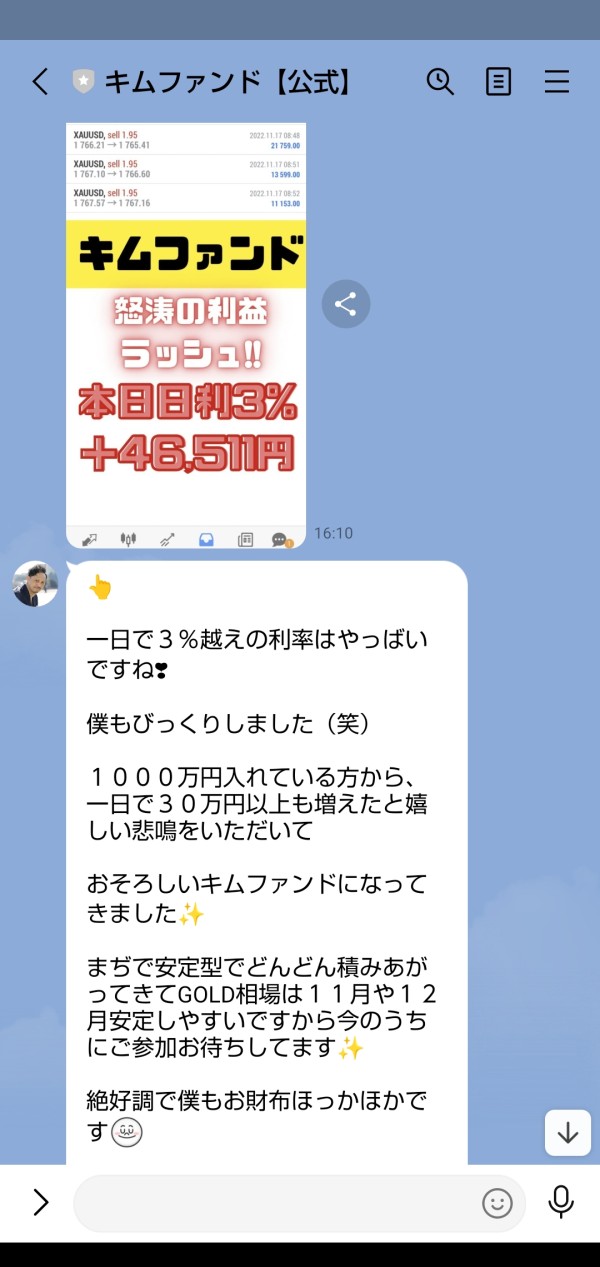

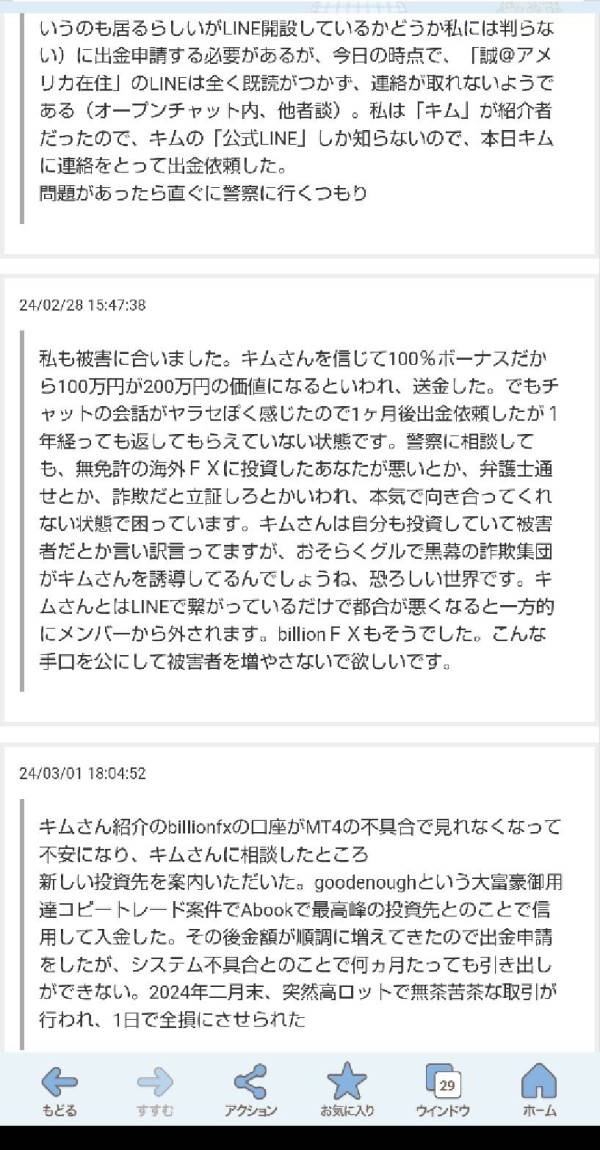

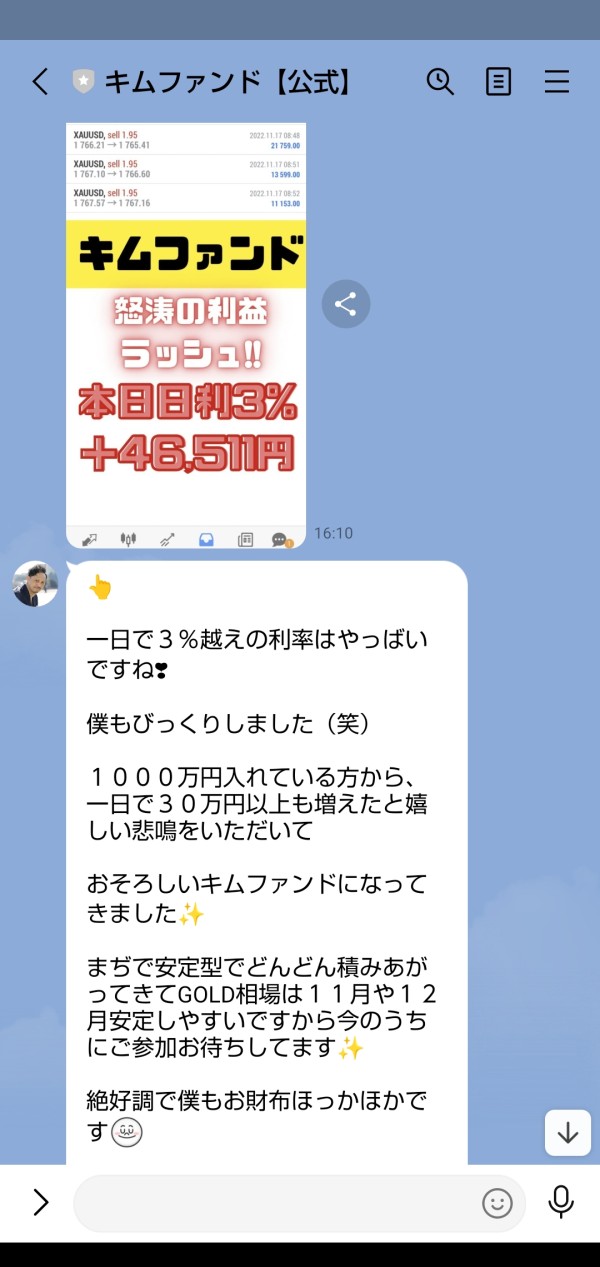

The broker appears to target traders with higher risk tolerance. The lack of regulatory protection means client funds and trading activities are not subject to standard industry safeguards that most traders expect. Based on available information from Trustpilot reviews and comprehensive broker analysis platforms, Billion FX's legitimacy has been questioned by multiple sources, with some reports suggesting potential scam activities that traders should be aware of before making any investment decisions.

This evaluation is based on publicly available information, user feedback, and industry analysis as of 2025. Traders considering this broker should exercise extreme caution and thoroughly understand the risks associated with trading through an unregulated entity that lacks proper oversight.

Important Notice

Regional Entity Differences: Billion FX operates as an unregulated entity without authorization from major financial regulatory bodies such as the FCA, CySEC, ASIC, or other recognized authorities. This means traders in different regions face similar risks regarding fund protection and regulatory recourse, regardless of where they are located.

Review Methodology: This assessment is compiled from available public information, user testimonials, and industry reports. Due to the broker's unregulated status, comprehensive and verified information may be limited or incomplete, which makes it difficult to provide a complete picture of their operations. Potential traders should conduct additional due diligence before making any investment decisions.

Rating Framework

Broker Overview

Billion FX presents itself as a forex trading platform. Specific details about its establishment date and corporate background remain unclear in available documentation, which raises immediate red flags about transparency. The broker operates without regulatory supervision from major financial authorities, which immediately raises concerns about trader protection and operational transparency that most serious traders would expect from a legitimate broker. According to industry analysis platforms, Billion FX has been flagged as potentially problematic due to its unregulated status and lack of verifiable company information.

The broker's business model appears to focus on attracting traders through the provision of popular trading platforms, specifically WebTrader and MetaTrader 4. However, the absence of regulatory oversight means that standard industry protections, such as segregated client funds, compensation schemes, and regulatory complaint procedures, are not available to traders who choose to use this platform. This billion fx review emphasizes that potential clients should be aware of these significant limitations before considering any engagement with the platform.

Regulatory Status: Available information indicates that Billion FX operates without authorization from any major financial regulatory authority. This unregulated status means the broker is not subject to standard industry oversight and client protection measures that traders typically rely on for security.

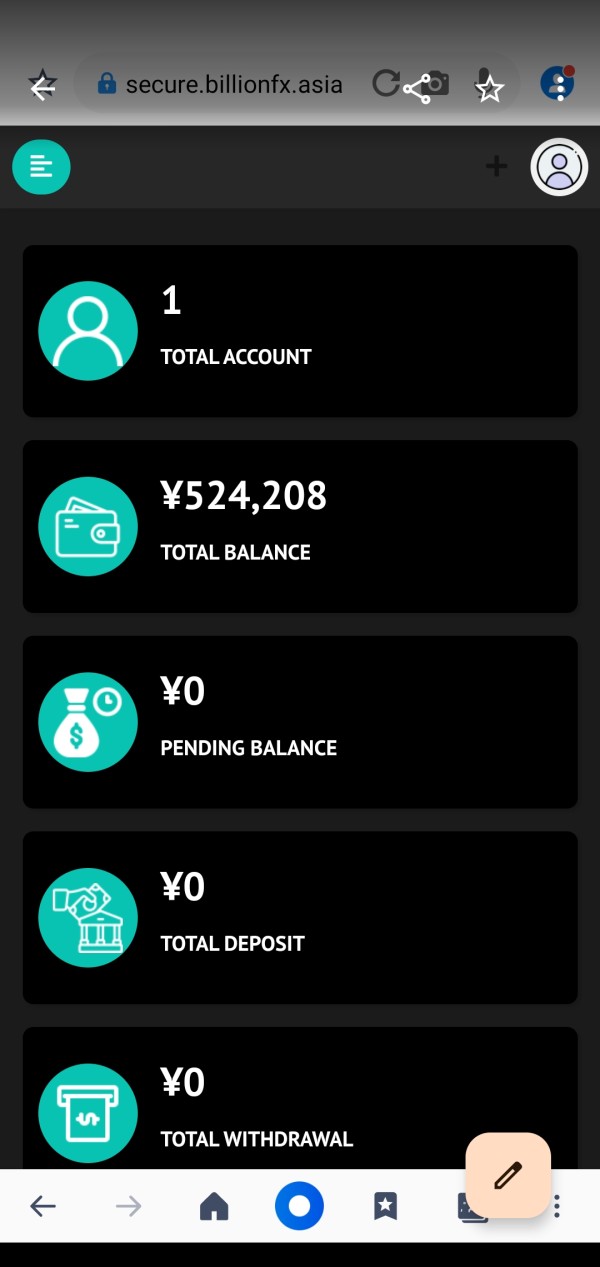

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal options has not been detailed in available sources. This lack of transparency itself raises concerns about operational transparency and whether traders will be able to access their funds when needed.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Billion FX has not been specified in available documentation. This absence of basic information makes it difficult for potential traders to plan their investment approach.

Bonus and Promotions: No specific information about promotional offers or bonus programs has been identified in the available materials. Most legitimate brokers clearly outline their promotional offerings to attract new clients.

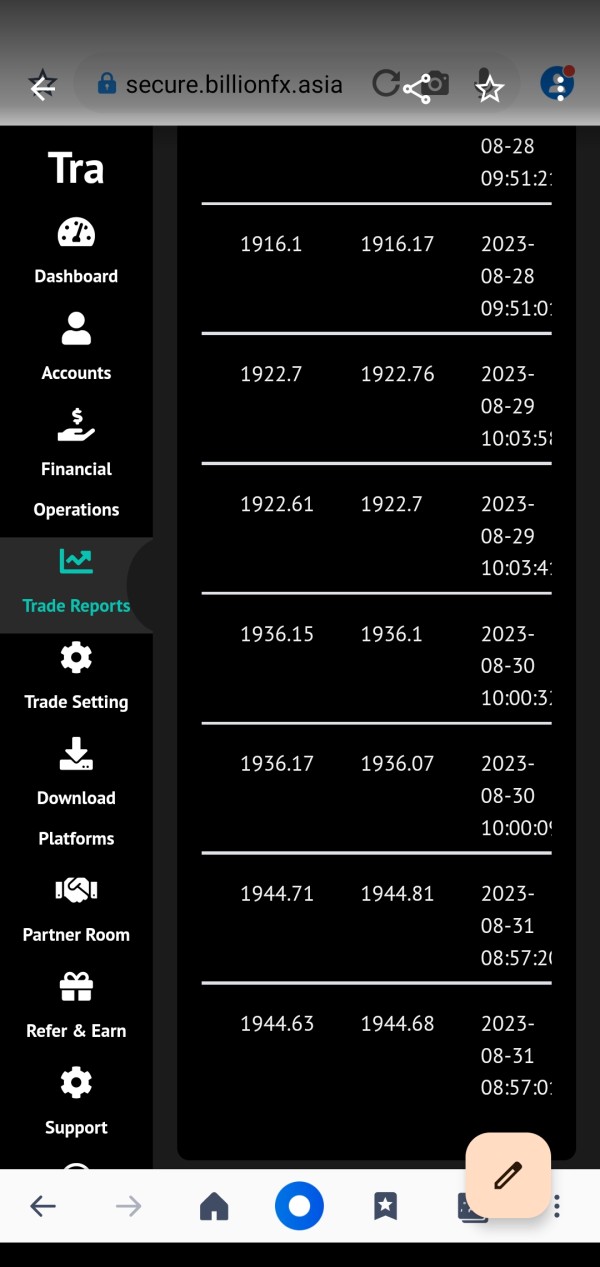

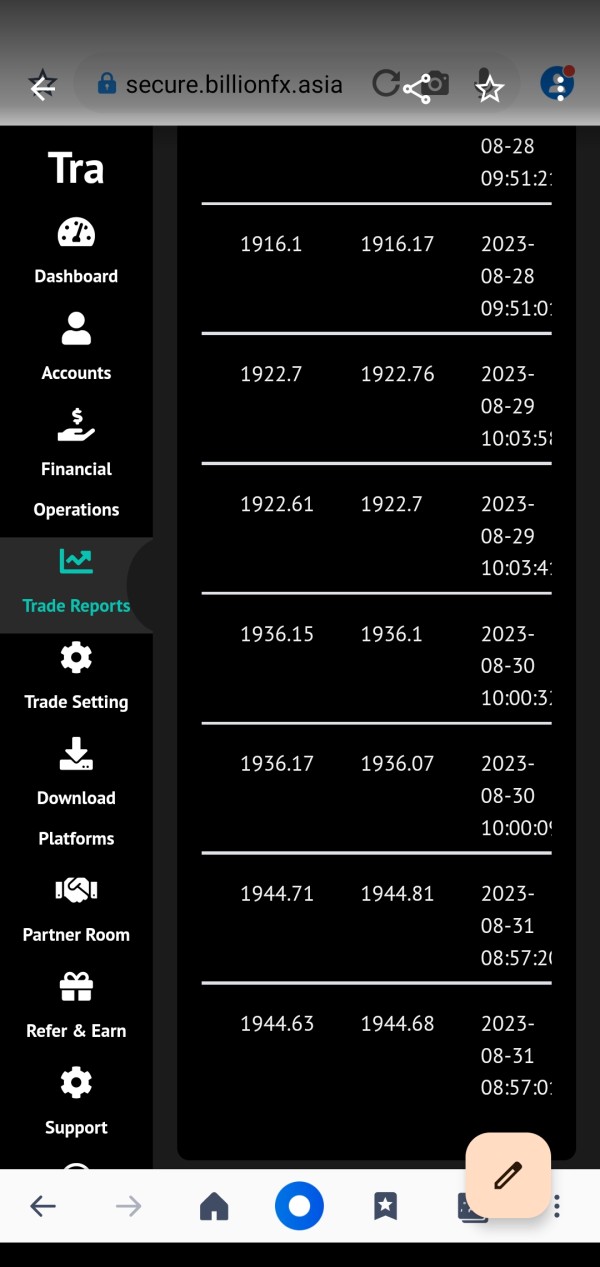

Available Trading Assets: The broker primarily focuses on forex trading services. The complete range of available currency pairs and other potential instruments has not been comprehensively detailed in available sources.

Cost Structure: Specific information about spreads, commissions, and other trading costs has not been clearly outlined in available sources. This makes it difficult for potential traders to assess the true cost of trading with this platform.

Leverage Ratios: Available documentation does not specify the maximum leverage ratios offered by Billion FX. This is crucial information that traders need to manage their risk effectively.

Platform Options: The broker provides access to WebTrader and MetaTrader 4 trading platforms. These are well-established platforms that many traders are familiar with.

Geographic Restrictions: Specific information about regional restrictions has not been detailed in available sources. This lack of clarity could lead to compliance issues for traders in certain jurisdictions.

Customer Support Languages: Available documentation does not specify which languages are supported for customer service. This billion fx review highlights the significant lack of transparency regarding essential trading conditions and operational details.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Billion FX's account conditions is severely hampered by the lack of available detailed information. Standard account features that traders typically expect to find clearly outlined, such as different account tiers, specific minimum deposit requirements, and account-specific benefits, are not readily available in public documentation, which creates uncertainty for potential clients. This absence of transparency is concerning for potential traders who need to understand exactly what they're signing up for.

Without clear information about account opening procedures, verification requirements, or special account features such as Islamic accounts for Muslim traders, it becomes difficult for potential clients to make informed decisions. The lack of detailed account condition information also suggests poor operational transparency, which is already a concern given the broker's unregulated status and the risks that come with it.

Industry standards typically require brokers to clearly outline all account conditions, fees, and requirements upfront. The absence of such information in this billion fx review contributes to the overall concerns about the broker's legitimacy and operational standards that traders should expect. Traders considering this platform should request comprehensive account information directly before proceeding with any investment.

Billion FX does offer access to two well-established trading platforms: WebTrader and MetaTrader 4. MetaTrader 4 is widely recognized as an industry-standard platform that provides comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors, which gives traders access to professional-level trading tools. The WebTrader option allows for browser-based trading without requiring software downloads.

However, the availability of additional trading tools, research resources, market analysis, and educational materials has not been specified in available documentation. Modern traders typically expect access to economic calendars, market news, technical analysis reports, and educational content to support their trading decisions and improve their performance over time.

The lack of information about research and analysis resources is particularly concerning, as these tools are essential for informed trading decisions. While the platform selection shows some commitment to providing functional trading technology, the absence of comprehensive tool descriptions limits the overall assessment of this category and raises questions about the broker's commitment to trader success.

Customer Service and Support Analysis

Information about Billion FX's customer service capabilities is notably absent from available documentation. Essential details such as available contact methods, customer support hours, response times, and multilingual support options have not been specified, which creates uncertainty for traders who may need assistance. This lack of transparency regarding customer service is particularly problematic for an unregulated broker, where trader recourse options are already limited.

Effective customer support is crucial for resolving trading issues, account problems, and technical difficulties that traders inevitably encounter. Without clear information about how to contact support, when support is available, or what level of service to expect, traders face additional uncertainty when considering this platform for their trading activities.

The absence of customer service information also raises questions about the broker's operational infrastructure and commitment to client service. Industry best practices require clear communication channels and responsive support systems, neither of which can be properly evaluated based on available information about this broker.

Trading Experience Analysis

The trading experience evaluation for Billion FX is limited by the lack of comprehensive user feedback and technical performance data. While the broker offers MetaTrader 4 and WebTrader platforms, which are generally reliable trading solutions, specific information about execution quality, platform stability, and overall trading conditions is not readily available to potential clients. Order execution speed, slippage rates, and platform uptime are critical factors that affect trading experience, but these metrics have not been documented in available sources.

The absence of detailed trading condition information makes it difficult for potential traders to assess whether the platform can meet their performance expectations. Mobile trading capabilities, which are increasingly important for modern traders, have also not been specifically addressed in available documentation about the broker's services. This billion fx review emphasizes that without comprehensive trading experience data, traders cannot adequately assess the platform's suitability for their needs.

Trust Factor Analysis

The trust factor evaluation for Billion FX receives the lowest score due to several significant concerns. The broker's unregulated status means it operates without oversight from recognized financial authorities, eliminating standard client protections such as deposit insurance, segregated funds, and regulatory complaint procedures that traders rely on for security.

Multiple industry sources, including WikiBit and other review platforms, have raised questions about Billion FX's legitimacy, with some reports suggesting potential scam activities. The lack of transparent company information, regulatory authorization, and clear operational details further undermines trust in the platform and creates serious concerns for potential clients.

Fund security measures, which are typically mandated by regulators, cannot be verified for an unregulated broker. This means client deposits may not be protected through segregated accounts or insurance schemes that are standard with regulated brokers in the industry. The combination of regulatory concerns and industry warnings creates a significant trust deficit that potential traders must carefully consider before investing their money.

User Experience Analysis

User experience evaluation for Billion FX is complicated by limited available user feedback and the absence of detailed operational information. The broker appears to target traders with higher risk tolerance, but specific user satisfaction data is not comprehensively available in public sources, which makes it difficult to assess actual client experiences.

Interface design, ease of use, registration processes, and fund management procedures have not been thoroughly documented, making it difficult to assess the overall user journey. The lack of transparent information about basic operational procedures suggests potential difficulties in user experience that could frustrate traders.

Negative reports and industry warnings about the broker's legitimacy create additional user experience concerns, as traders may face uncertainty about fund security and platform reliability. Without comprehensive user feedback and clear operational procedures, potential clients cannot adequately assess whether the platform will meet their usability expectations and trading needs.

Conclusion

This comprehensive billion fx review reveals significant concerns about the broker's operations and suitability for most traders. Billion FX operates as an unregulated forex broker, which immediately eliminates standard industry protections and oversight that traders typically rely on for security and peace of mind.

The lack of regulatory authorization, combined with limited transparency about operational details and multiple industry warnings, creates substantial risks for potential clients. While the broker does offer access to established trading platforms like MetaTrader 4 and WebTrader, these technological offerings cannot compensate for the fundamental trust and security issues associated with unregulated operations that put trader funds at risk.

The platform may only be suitable for traders with extremely high risk tolerance who fully understand the implications of trading with an unregulated entity. The main advantages include access to popular trading platforms, while significant disadvantages encompass the lack of regulatory protection, limited operational transparency, and concerning industry reports about legitimacy that should give most traders pause.

Most traders would be better served by choosing regulated alternatives that provide comprehensive client protections and transparent operations. This approach ensures that their investments are protected and that they have recourse if problems arise with their trading activities.