Founded in 2011, NetoTrade is positioned as a global investment firm, fostering access to financial markets. Although its operations today are centralized in the offshore zone of St. Vincent and the Grenadines, it also claims a presence in multiple jurisdictions, which has raised concerns about its regulatory compliance. The broker's business model is designed to attract a broad spectrum of traders, particularly experienced ones looking to exploit high leverage and tight spreads.

NetoTrade operates on a multi-asset trading model, providing access to a wide array of instruments such as currency pairs, CFDs, commodities, and indices. The platform seeks to cater to traders with varied expertise levels by offering different types of accounts, though it has faced criticism regarding its operational transparency and fund security. Notably, it claims to offer competitive trading conditions, but it lacks the regulatory backing typical of more established brokers.

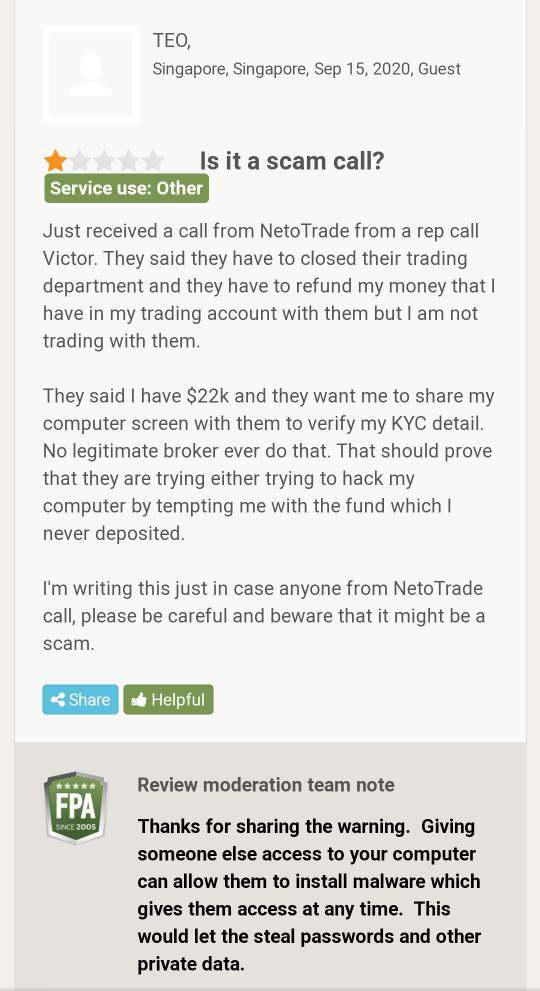

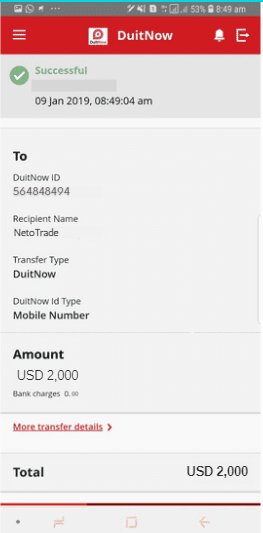

Conflicts concerning regulatory claims abound with NetoTrade, highlighting critical concerns for potential traders. Many users report significant difficulties when attempting to withdraw their funds, connecting to broader themes of fund safety in unregulated environments. User feedback has revealed that, "the broker has been blacklisted by the regulatory authority, and a warning has been published on the regulator's website," underscoring the risks involved.

- Access the regulatory websites relevant to your location.

- Search for NetoTrade or its parent company to verify its licensing status.

- Review user experiences on forums to gauge overall satisfaction.

- Perform withdrawal tests with minimal amounts to ascertain response times and reliability.

A consensus from user reviews reveals a concerning picture around fund safety and the importance of independent verification. Many complaints echo a demand for accountability that remains largely unmet by the broker, reflecting the crucial role of regulatory oversight in protecting investor capital.

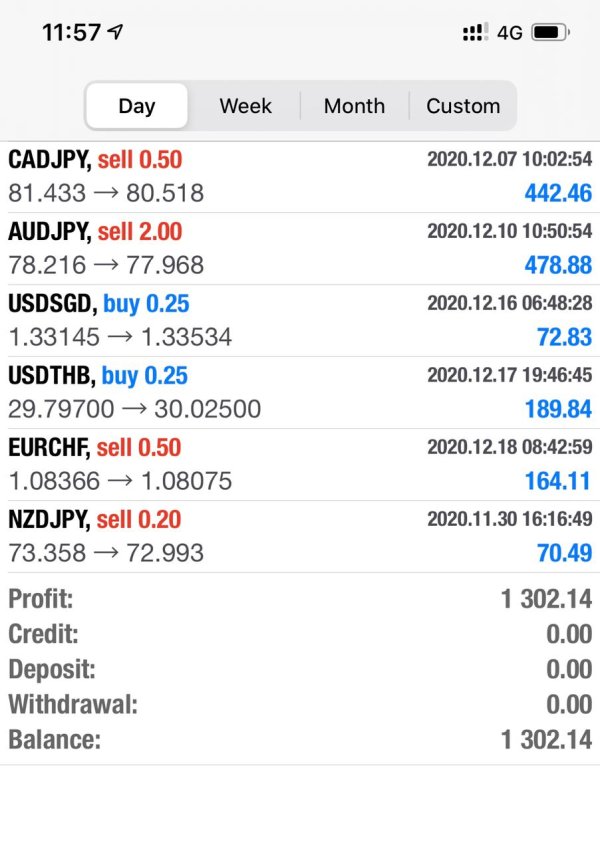

Trading Costs Analysis

The double-edged sword effect.

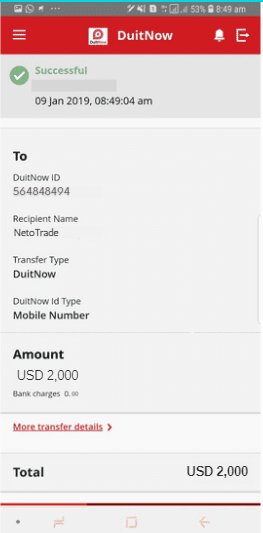

NetoTrade strives to remain competitive in the forex landscape through its low commission structure. Many experienced traders appreciate the opportunity to engage in low-cost trading with claims of spreads starting as low as 0.1 pips. However, these low commissions can be misleading; numerous users express frustration over high withdrawal fees, described as, "up to $25 for wire transfers and 3% for card withdrawals."

Here's a summary of the costs:

- Pros: The broker offers variable spreads based on account types, leading to lower commission costs for active traders.

- Cons: High non-trading fees and withdrawal constraints can significantly affect profit margins, especially for high-volume traders.

This juxtaposition highlights the necessity for traders to balance potential savings on trading costs against unanticipated charges lurking in the withdrawal process.

Professional depth vs. beginner-friendliness.

NetoTrade offers a range of trading platforms to cater to its user base—primarily the popular Metatrader 4 and its proprietary platform designed for both web and mobile trading. The platforms provide advanced features like toolkits for analysis, order execution, and high-speed processing designed for both seasoned traders and newcomers to the trading environment.

Overall, user feedback surrounding the platforms has been mixed. A common sentiment points out that, "traders report good execution speed but have experienced platform errors during highly volatile periods," which can directly affect trading performance.

User Experience Analysis

User experiences with NetoTrade vary greatly, reflecting fundamental challenges in service delivery and operational reliability. The broker has received both praise and criticism, with the latter heavily focused on issues like unresponsiveness from customer support and withdrawal delays.

Despite initial convenience in opening an account and making trades, users consistently report issues such as inconsistent customer service, leading to a negative overall sentiment. For instance, complaints about slow response times bolster concerns about the broker's reliability in supporting its users.

Customer Support Analysis

A significant critique of NetoTrade lies in its limited customer support capabilities. Users frequently report a lack of accessible support channels, particularly noting the absence of live chat options. Email and phone support, while available, have been described as painfully slow, "with responses that can take days to materialize."

The overall consensus indicates that traders may find it challenging to resolve immediate issues due to these deficiencies, raising alarms about the broker's commitment to user satisfaction.

Account Conditions Analysis

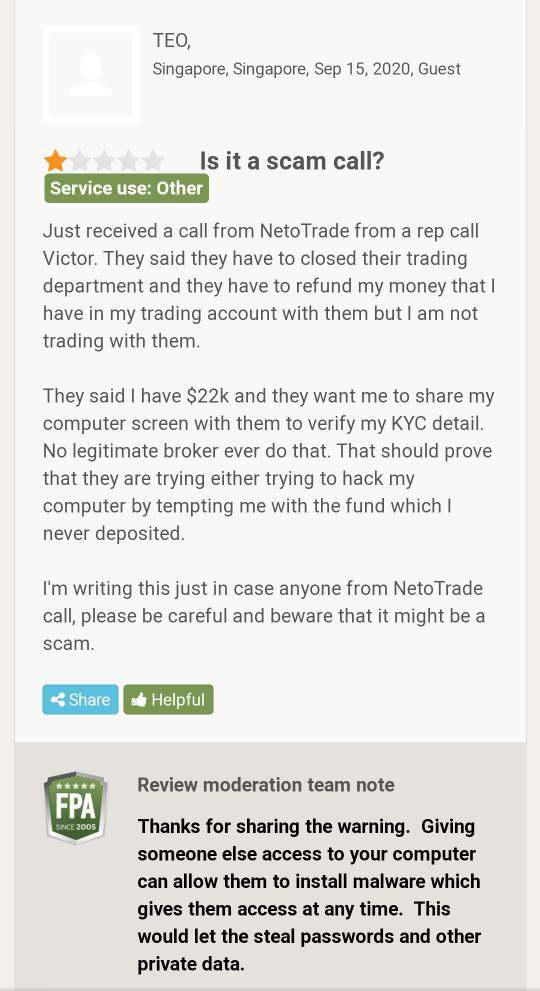

NetoTrade offers various account types—mini, gold, platinum, and ECN—designed to attract different levels of traders. However, the high minimum deposits required for higher-tier accounts create a barrier for many inexperienced traders. For example, a minimum deposit requirement of $500 or more is outlined depending on the chosen account type, which could deter those just starting with trading.

Conclusion

Ultimately, NetoTrade offers a compelling suite of tools and trading conditions that may be beneficial for experienced traders looking for high-risk, high-reward opportunities. However, substantial risks tied to withdrawal issues and the absence of regulatory oversight create significant obstacles. New traders and those who prioritize the safety of their funds should approach this broker with extreme caution, favoring regulated alternatives with verified reputations for reliable service and customer support.

In summary, while NetoTrade may present an opportunity for seasoned traders, diligence in researching and considering the potential pitfalls is essential. Always assess your risk tolerance and verify the broker before proceeding.