RIF Capital 2025 Review: Everything You Need to Know

Executive Summary

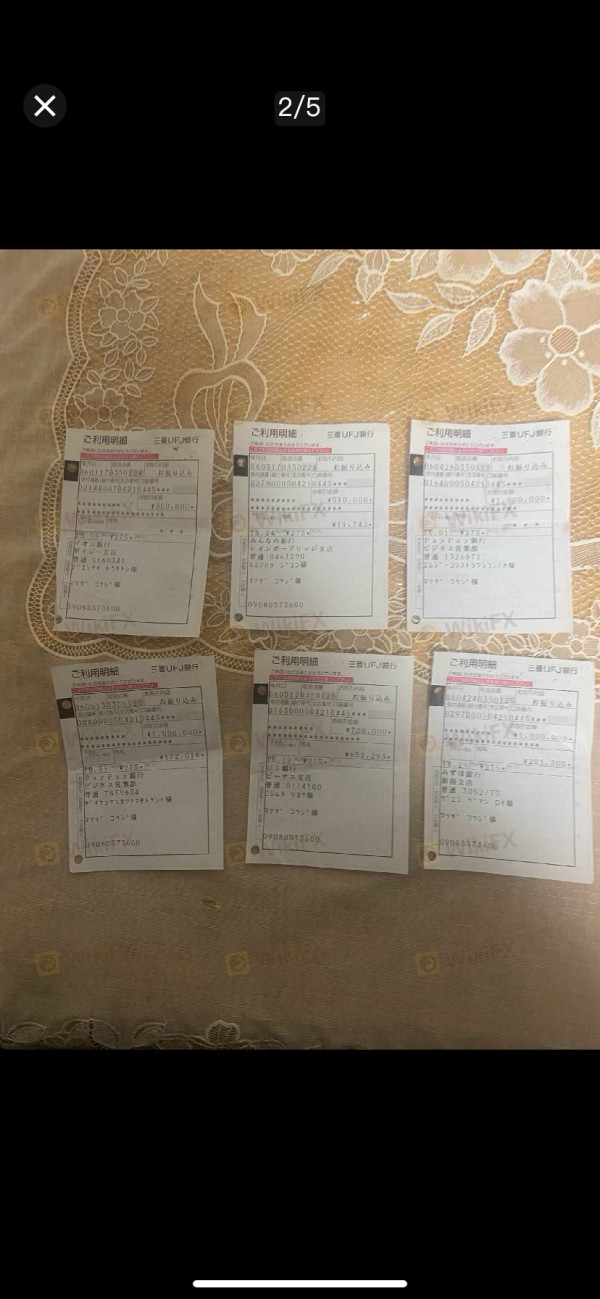

RIF Capital has been evaluated and flagged as an unregulated trading platform with serious fraud risks. It earns an extremely low user trust rating of about 1%. This rif-capital review shows that the platform claims to offer multi-asset brokerage services in forex and CFD markets, but many warning signs suggest it may be a sophisticated scam operation that targets unsuspecting investors.

Review websites and regulatory watchdogs have identified the platform as a fraudulent entity. There are consistent reports of deceptive practices and user complaints. Potential investors should exercise extreme caution when considering this platform, especially beginners and those with low risk tolerance.

Our comprehensive analysis shows that RIF Capital lacks proper regulatory oversight, transparent business practices, and reliable customer support systems. These are essential for legitimate financial services providers. Based on extensive user feedback and cross-platform analysis, RIF Capital demonstrates all the hallmarks of a fraudulent operation designed to exploit investors rather than provide genuine trading services.

Important Notice

Regional Entity Differences: RIF Capital operates as an unregulated platform. This means investors across different regions may face varying levels of legal protection, with most jurisdictions offering little to no recourse for potential losses. The platform's lack of regulatory compliance means it operates outside established financial protection frameworks that legitimate brokers must follow.

Review Methodology: This evaluation is based on comprehensive analysis of multiple user feedback sources, regulatory warnings, and independent review platforms. These sources have consistently flagged RIF Capital as a fraudulent operation requiring investor caution.

Rating Framework

Broker Overview

RIF Capital presents itself as a multi-asset brokerage service provider claiming to offer trading opportunities in forex and CFD markets. However, detailed investigation reveals significant gaps in the company's background information. No verifiable establishment date or legitimate corporate structure is publicly available.

The platform's business model appears designed to attract investors through false promises rather than providing genuine trading services. The lack of transparent company information, combined with numerous fraud allegations, suggests that RIF Capital operates as a front for fraudulent activities rather than as a legitimate financial services provider. Multiple independent sources have identified inconsistencies in the platform's claims and operations that are characteristic of investment scams.

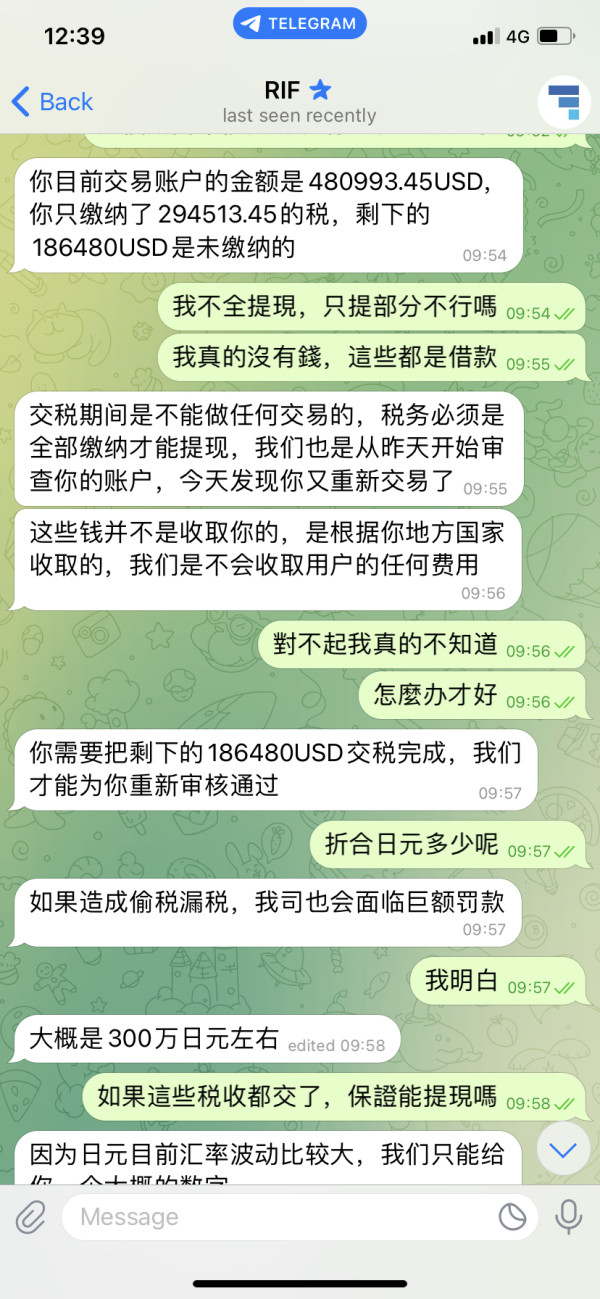

According to various review platforms and regulatory warnings, RIF Capital operates without proper licensing or regulatory oversight. This makes it extremely risky for potential investors. The platform's claims about providing professional trading services cannot be verified through legitimate financial regulatory bodies, which is a major red flag for any rif-capital review analysis.

Regulatory Status: RIF Capital operates as an unregulated platform with no verified licensing from recognized financial authorities. This creates significant risks for investor protection and fund security.

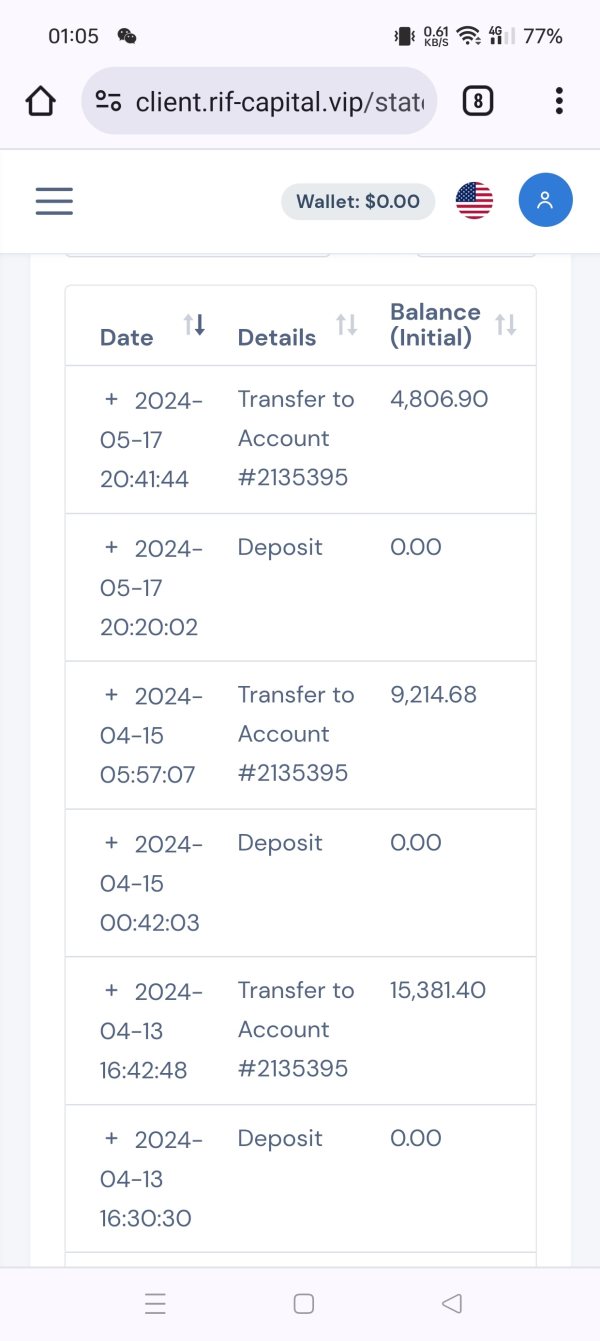

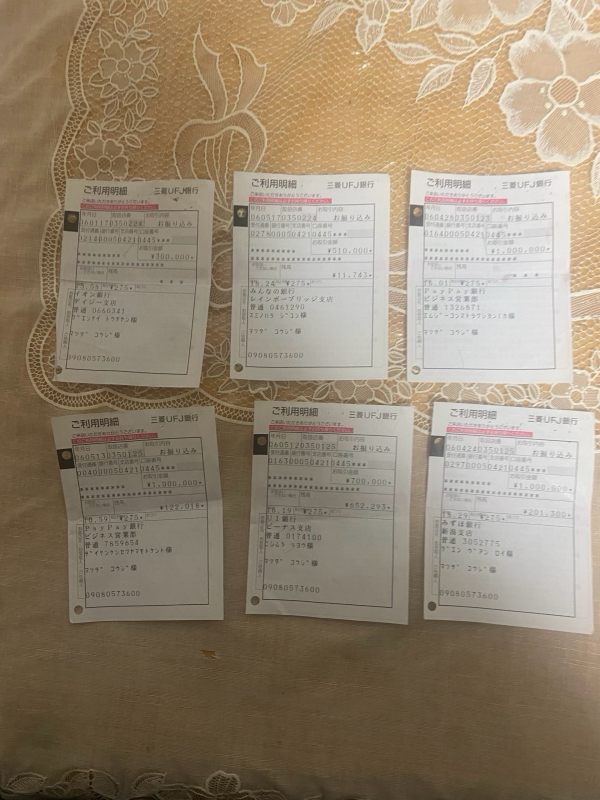

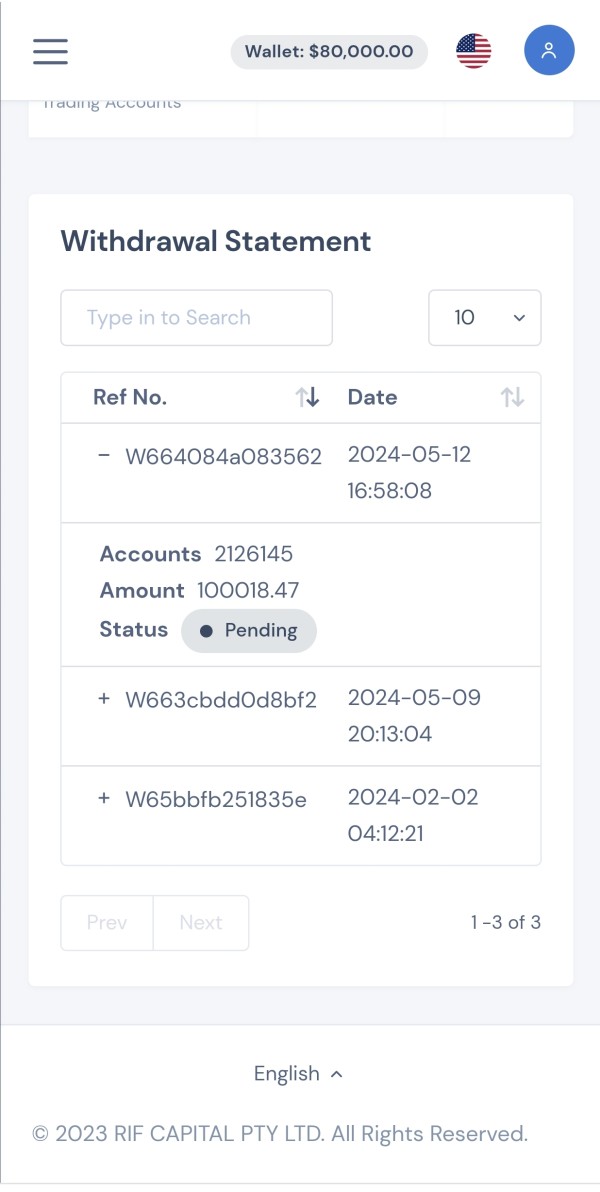

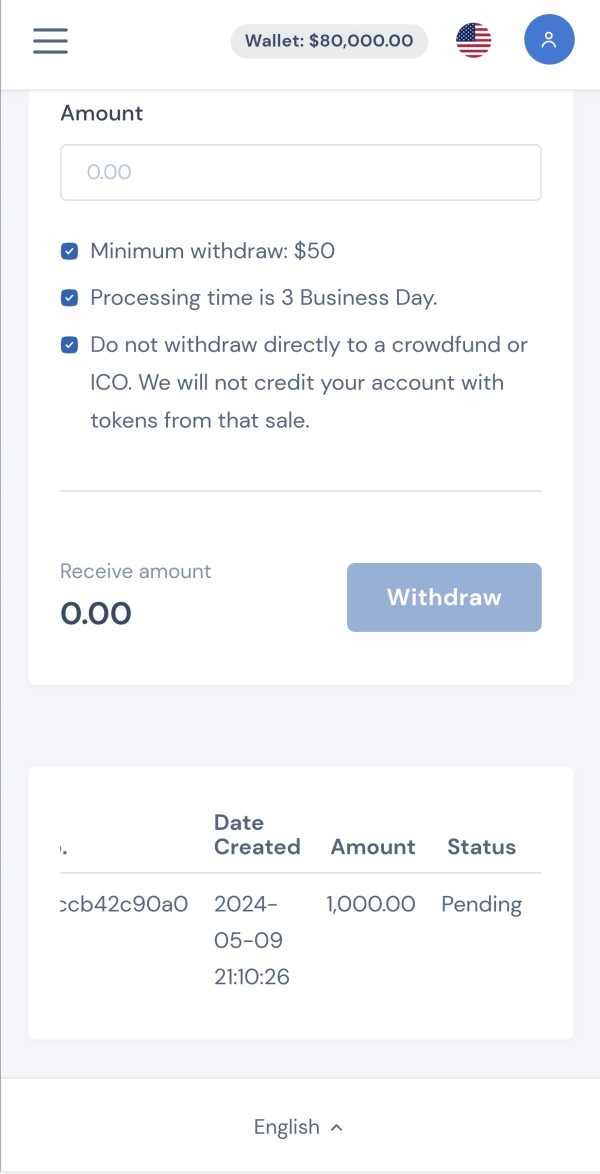

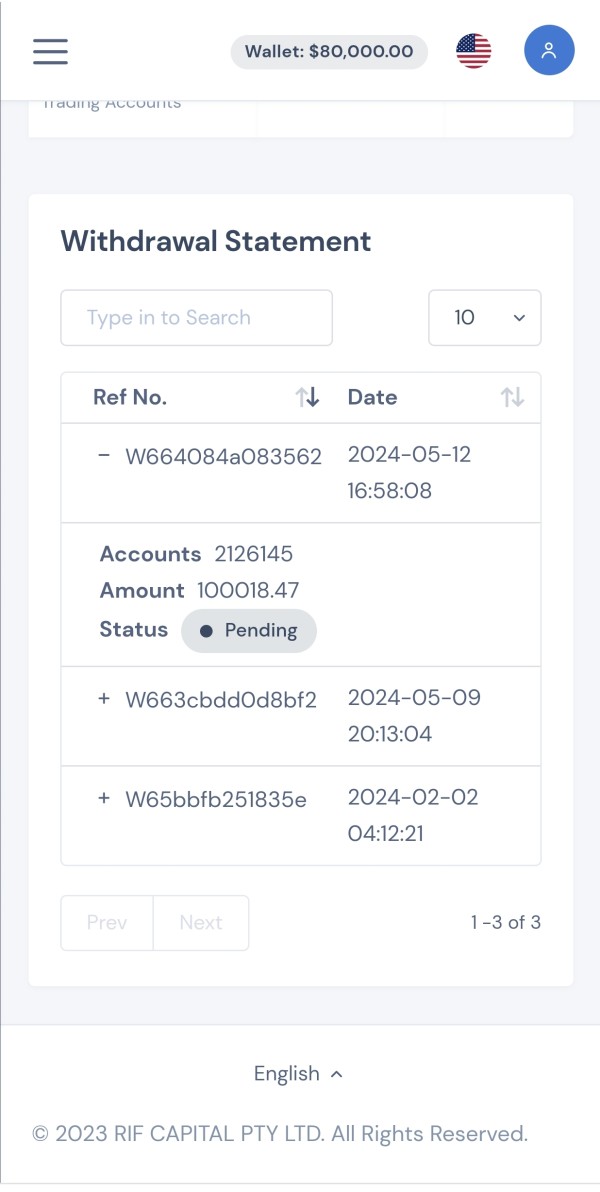

Deposit and Withdrawal Methods: Specific information about payment processing methods is not disclosed in available materials. This itself raises concerns about transparency.

Minimum Deposit Requirements: The platform has not provided clear information about minimum deposit requirements in publicly available sources.

Bonus and Promotions: No legitimate promotional offers or bonus structures have been identified in the available review materials.

Tradeable Assets: The platform claims to offer forex and CFD trading. However, the actual availability and quality of these instruments remain unverified.

Cost Structure: Critical information about spreads, commissions, and other trading costs is notably absent from available materials. This prevents informed decision-making.

Leverage Ratios: Specific leverage information has not been disclosed in the reviewed materials.

Platform Options: The trading platform technology and software options are not clearly specified in available documentation.

Regional Restrictions: Geographic limitations and availability are not clearly outlined in the reviewed materials.

Customer Support Languages: Language support options for customer service are not specified in available information.

This rif-capital review reveals concerning gaps in essential trading information that legitimate brokers typically provide transparently to potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

The account conditions offered by RIF Capital receive the lowest possible rating due to complete lack of transparency and verifiable information. Unlike legitimate brokers who provide detailed specifications about account types, minimum deposits, and trading conditions, RIF Capital fails to offer any concrete details about their account structures. This absence of fundamental information makes it impossible for potential traders to make informed decisions about their investments.

The platform does not specify different account tiers, special features, or any unique benefits. These would typically distinguish a professional brokerage service. There is no mention of Islamic accounts, VIP services, or other specialized account types that serious traders often require.

The account opening process lacks the standard verification and documentation procedures that regulated brokers implement for compliance purposes. User feedback consistently indicates confusion and frustration regarding account setup and management, with many reporting difficulties in understanding the basic terms and conditions. This rif-capital review finds that the platform's approach to account management appears designed to obscure rather than clarify important trading conditions, which is characteristic of fraudulent operations.

RIF Capital's trading tools and resources receive an extremely low rating due to the apparent lack of professional-grade trading infrastructure. While the platform makes vague claims about providing multi-asset trading capabilities, there is no evidence of sophisticated analytical tools, research resources, or educational materials that legitimate brokers typically offer to support their clients' trading success.

The platform fails to demonstrate access to market analysis, economic calendars, technical indicators, or other essential trading tools. Professional traders rely on these for informed decision-making. There is no mention of automated trading support, expert advisors, or integration with popular trading platforms like MetaTrader 4 or 5, which are industry standards.

Educational resources, which are crucial for trader development, appear to be completely absent from RIF Capital's offerings. Legitimate brokers invest heavily in providing webinars, tutorials, market insights, and trading guides to help their clients improve their trading skills and market understanding.

Customer Service and Support Analysis (Score: 1/10)

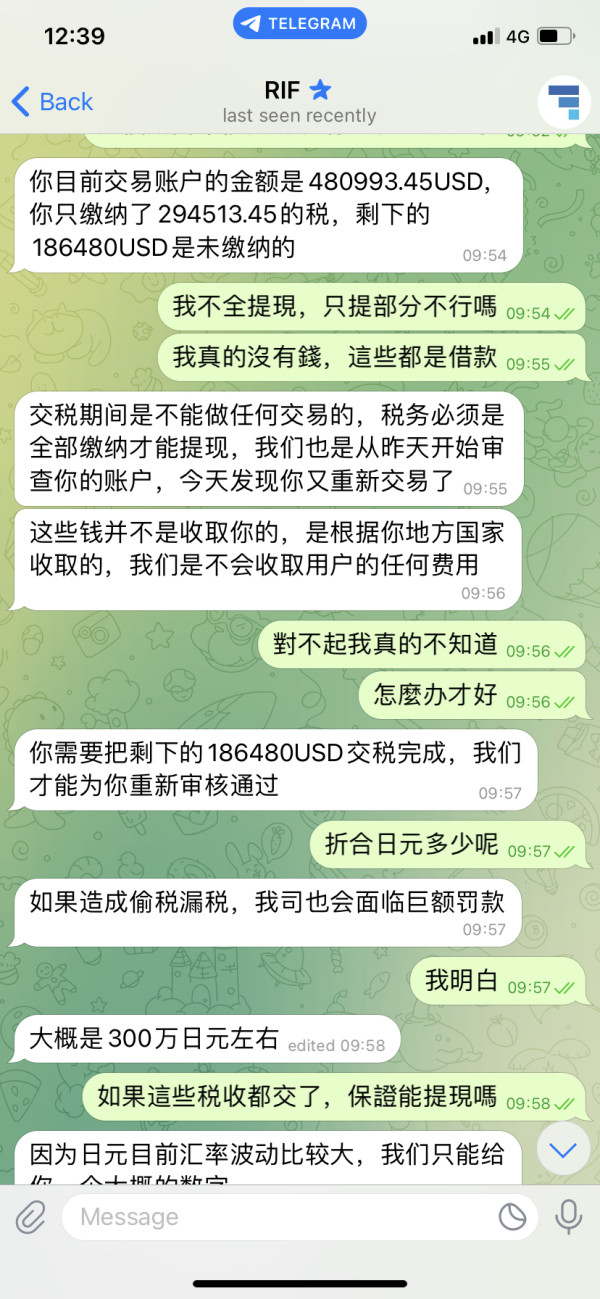

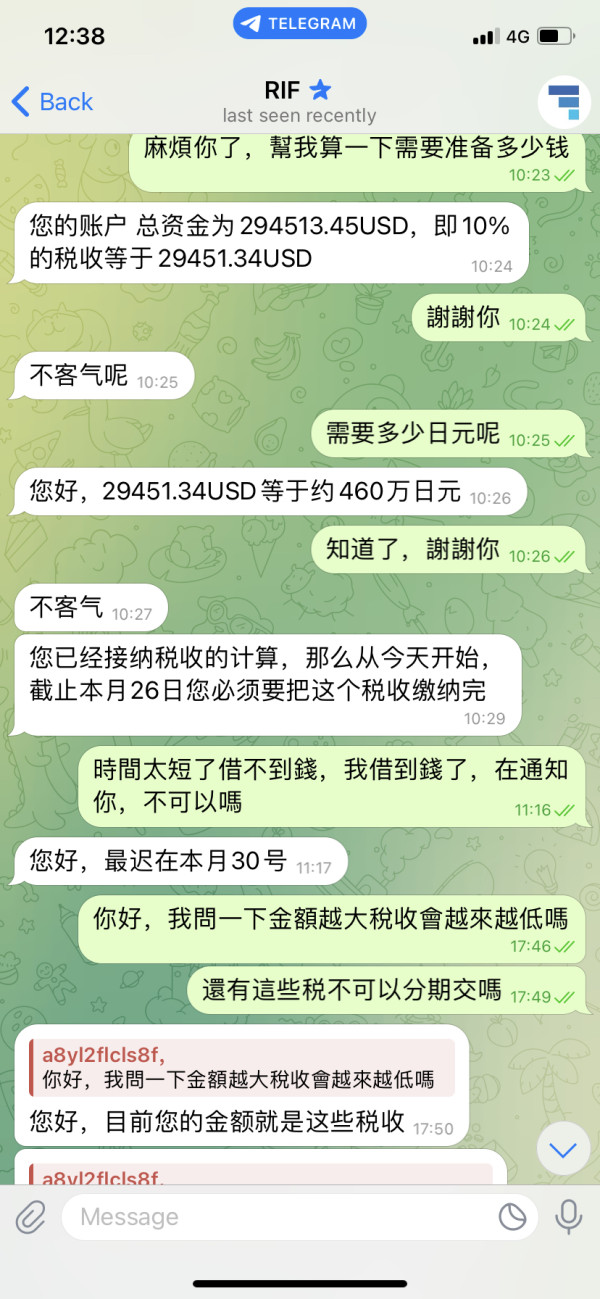

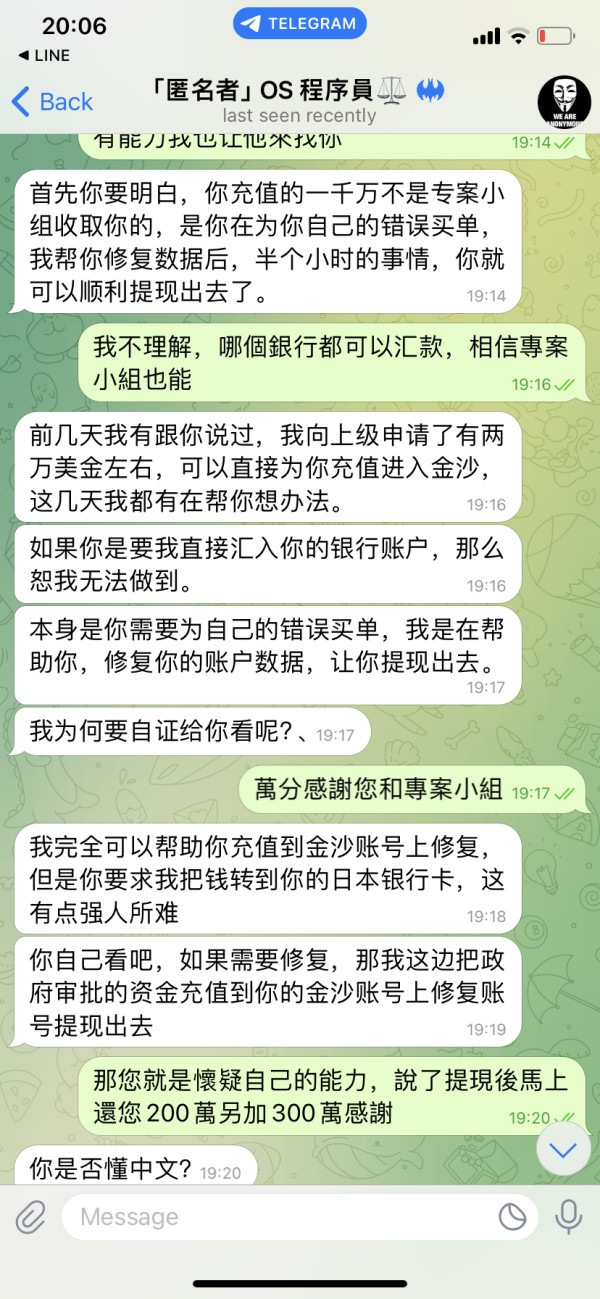

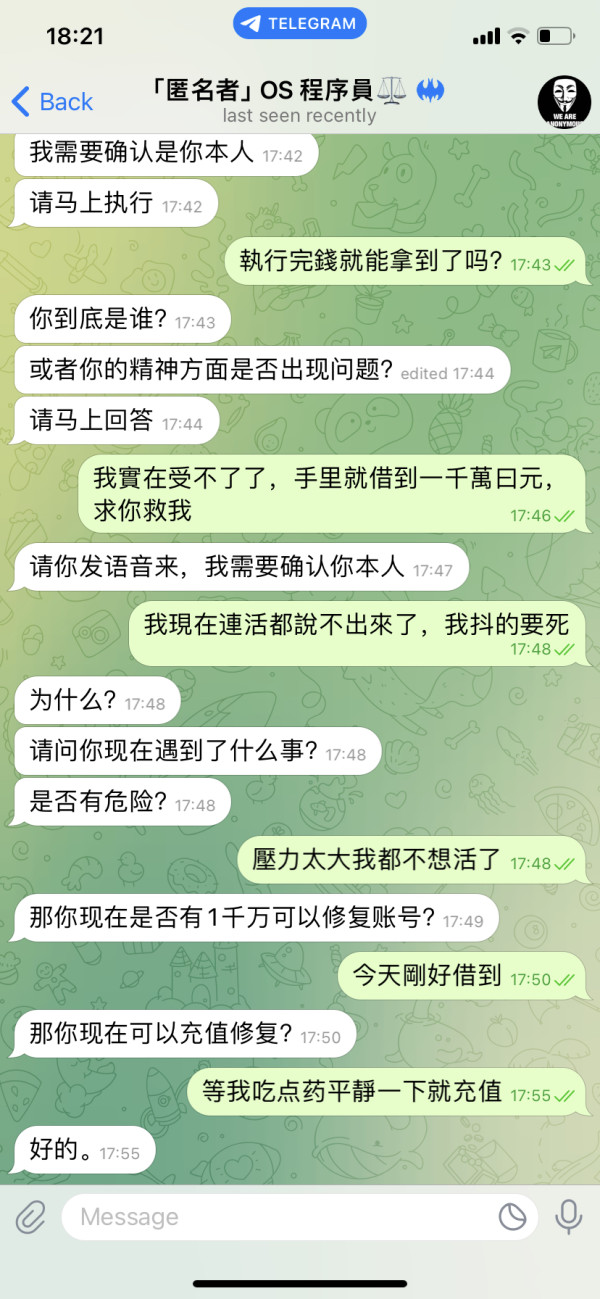

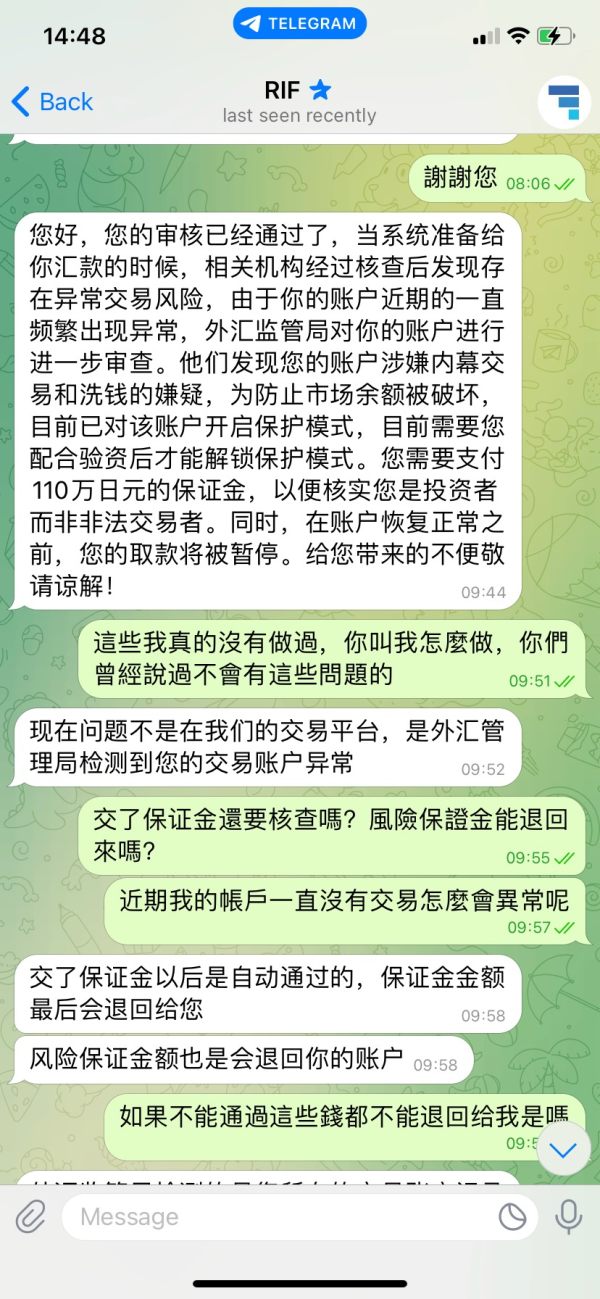

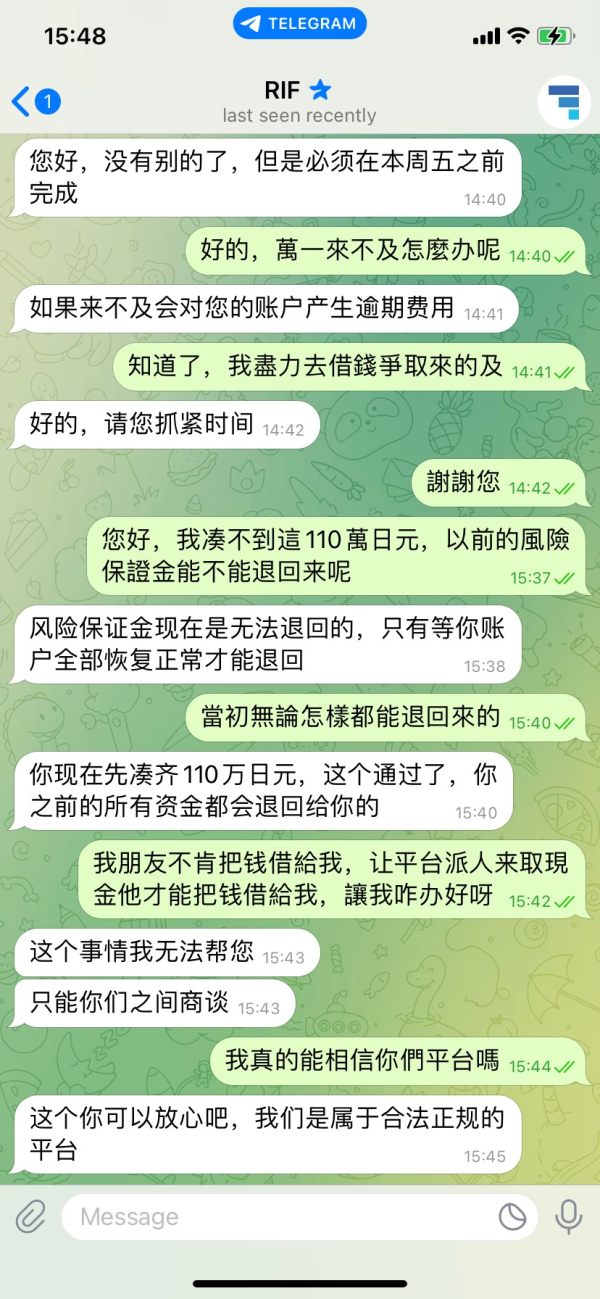

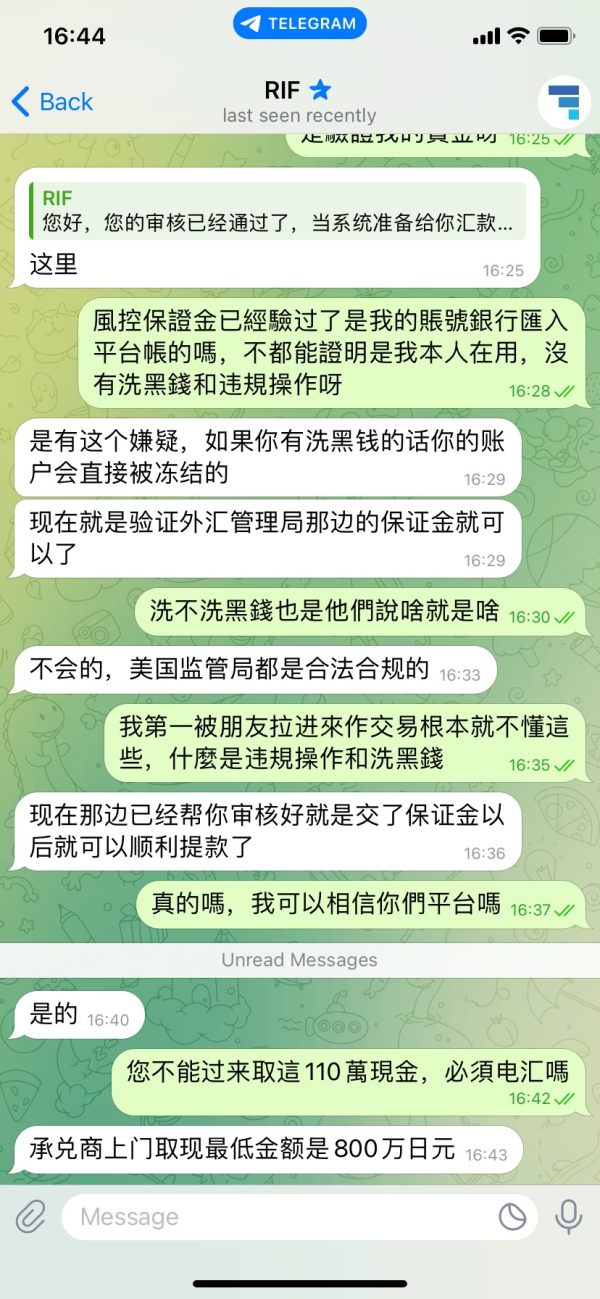

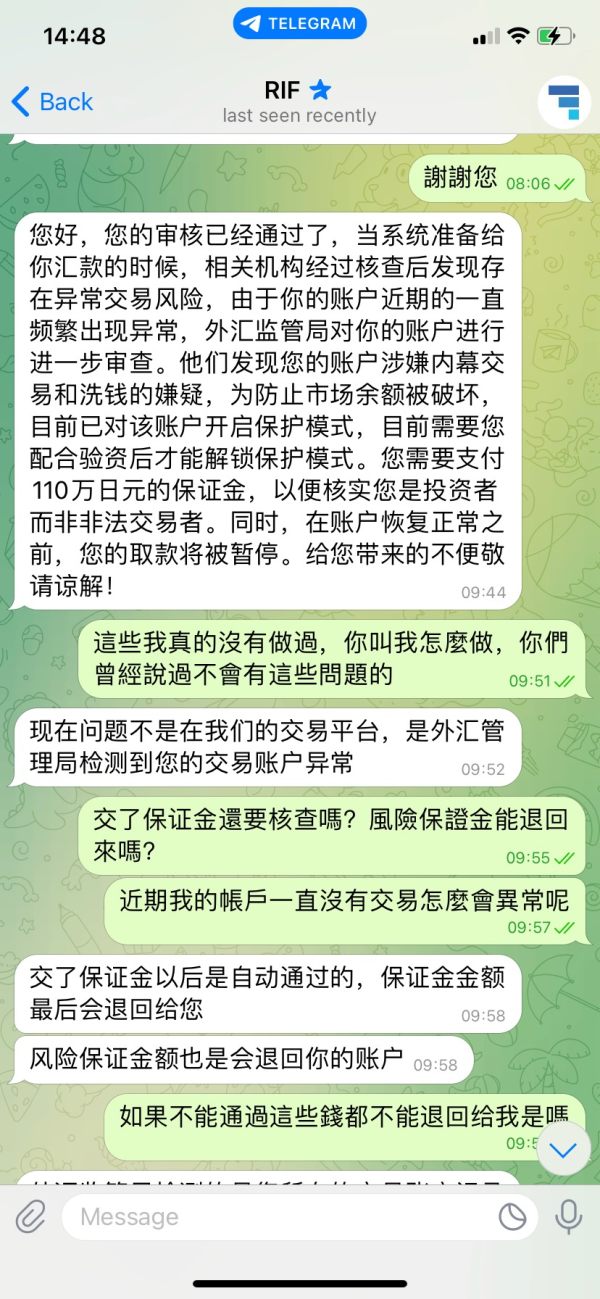

Customer service represents one of RIF Capital's most significant weaknesses. User trust ratings indicate widespread dissatisfaction with support quality and responsiveness. Multiple user reports describe poor communication, unresponsive customer service channels, and inadequate problem resolution capabilities that are hallmarks of fraudulent operations.

The platform appears to lack the multi-channel support infrastructure that legitimate brokers maintain. This includes live chat, phone support, email assistance, and comprehensive FAQ sections. Response times, when support is provided, are reportedly excessive and often fail to address user concerns effectively.

User feedback consistently highlights difficulties in reaching customer service representatives and receiving meaningful assistance with account-related issues. The absence of professional customer support standards suggests that RIF Capital prioritizes acquiring new clients over maintaining existing relationships, which aligns with typical scam operation patterns rather than legitimate business practices.

Trading Experience Analysis (Score: 1/10)

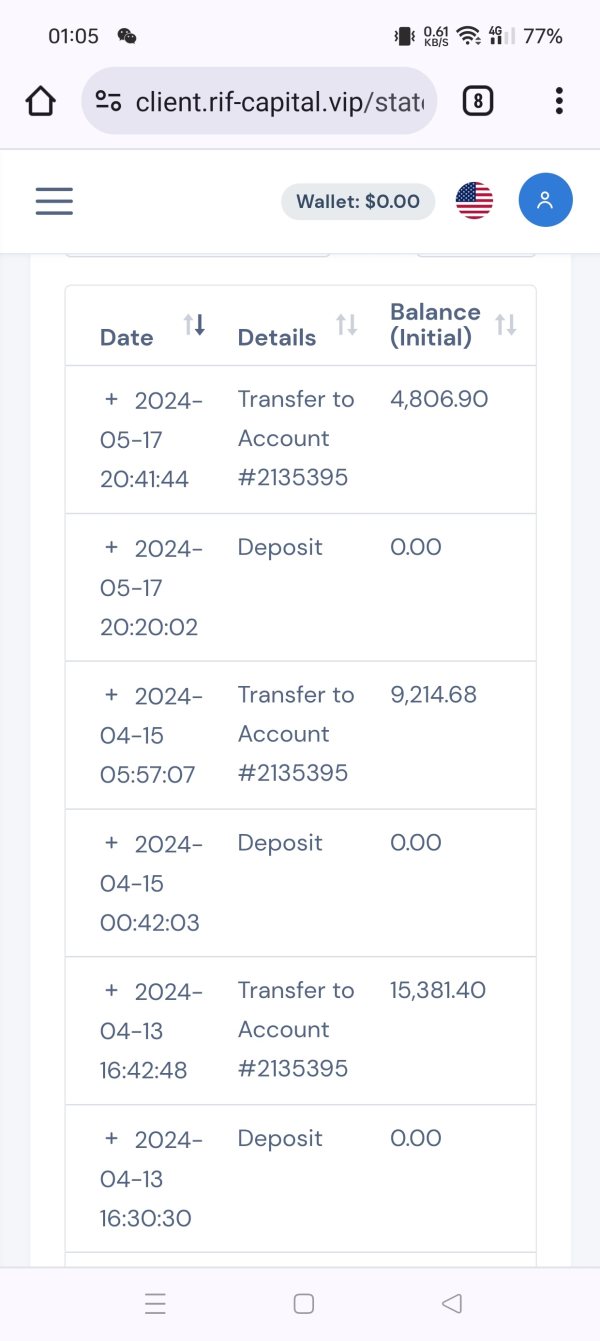

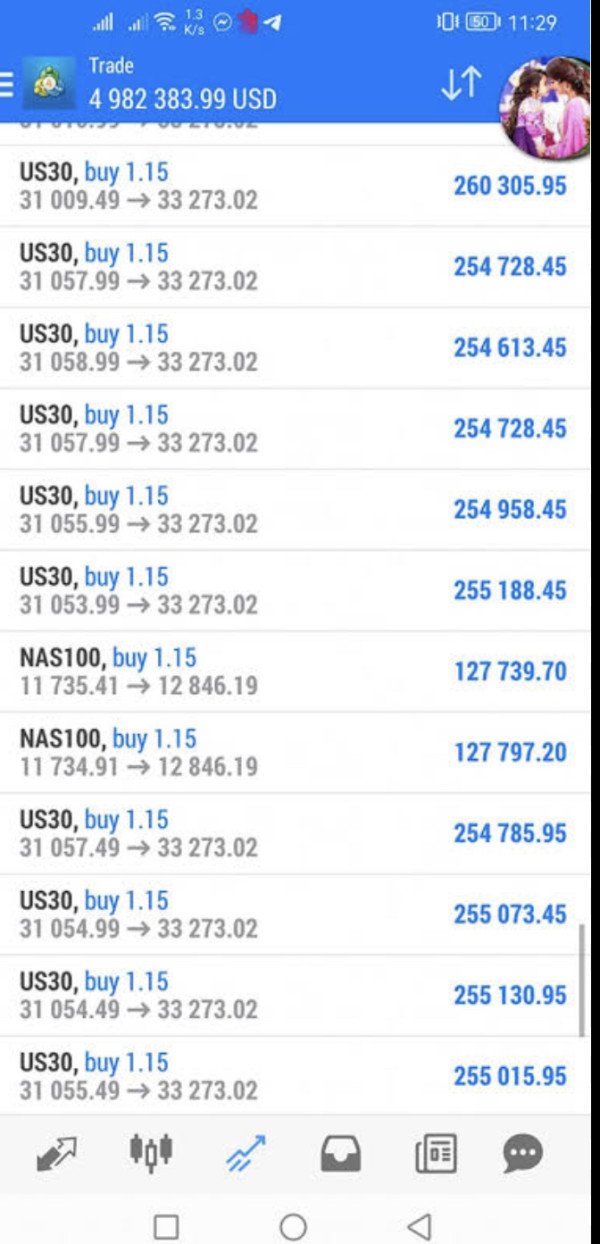

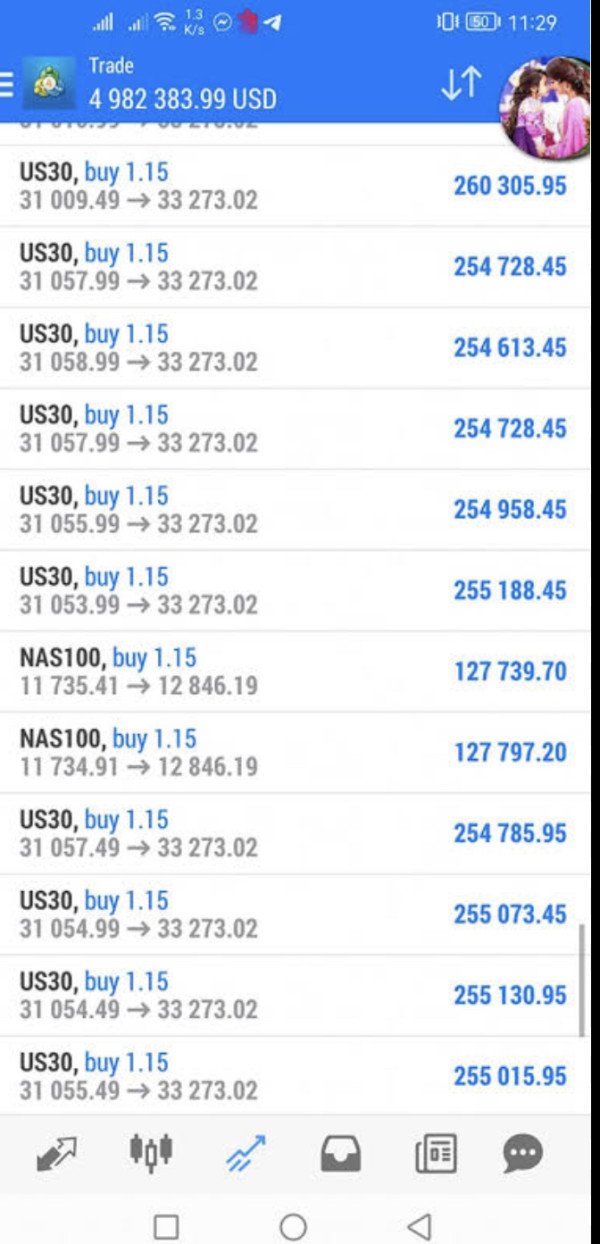

The trading experience provided by RIF Capital receives the lowest possible rating due to numerous reports of poor platform performance and unreliable execution. Users consistently report technical issues, platform instability, and execution problems that significantly impact trading effectiveness and profitability.

Platform functionality appears to be substandard compared to industry norms. Reports include slow order processing, execution delays, and system outages that can result in significant trading losses. The mobile trading experience, which is crucial for modern traders, appears to be particularly problematic based on available user feedback.

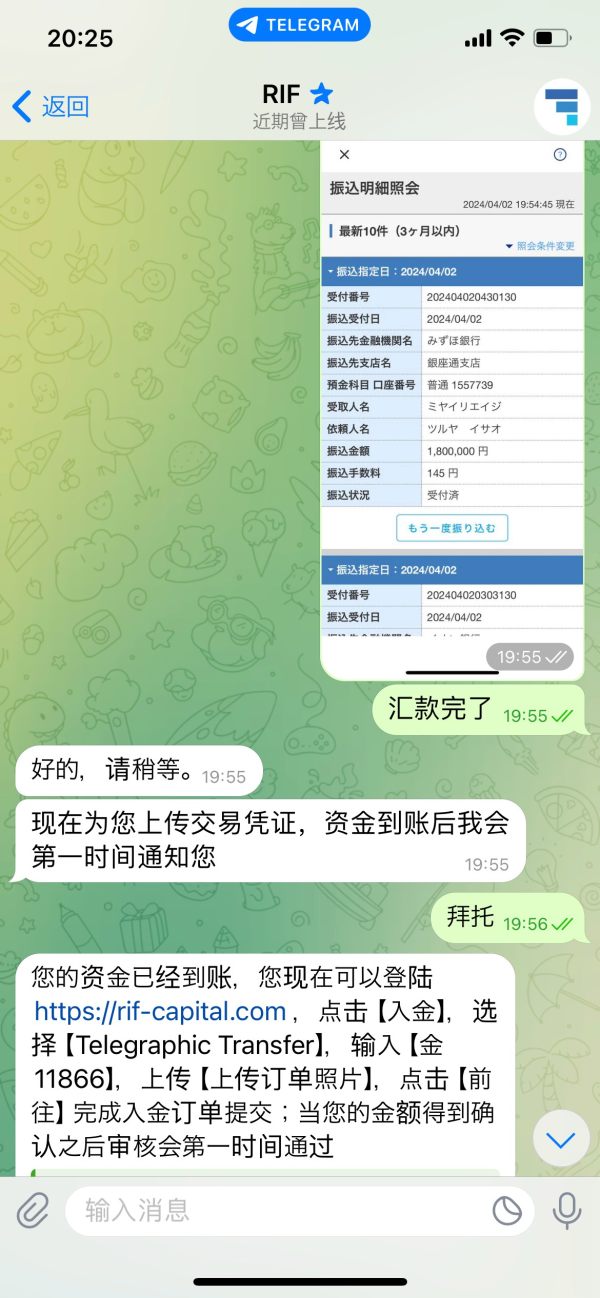

Order execution quality, which is fundamental to successful trading, reportedly suffers from significant issues including slippage, requotes, and delayed fills that disadvantage traders. This rif-capital review indicates that the platform's technical infrastructure is inadequate for serious trading activities, suggesting that the focus is on collecting deposits rather than providing genuine trading services.

Trust and Security Analysis (Score: 1/10)

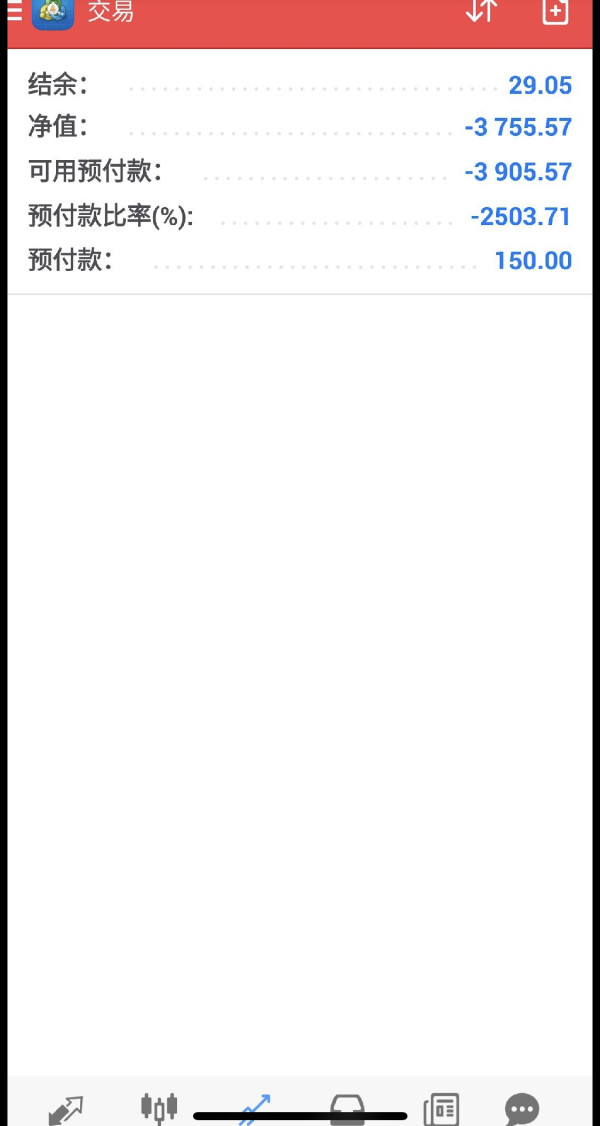

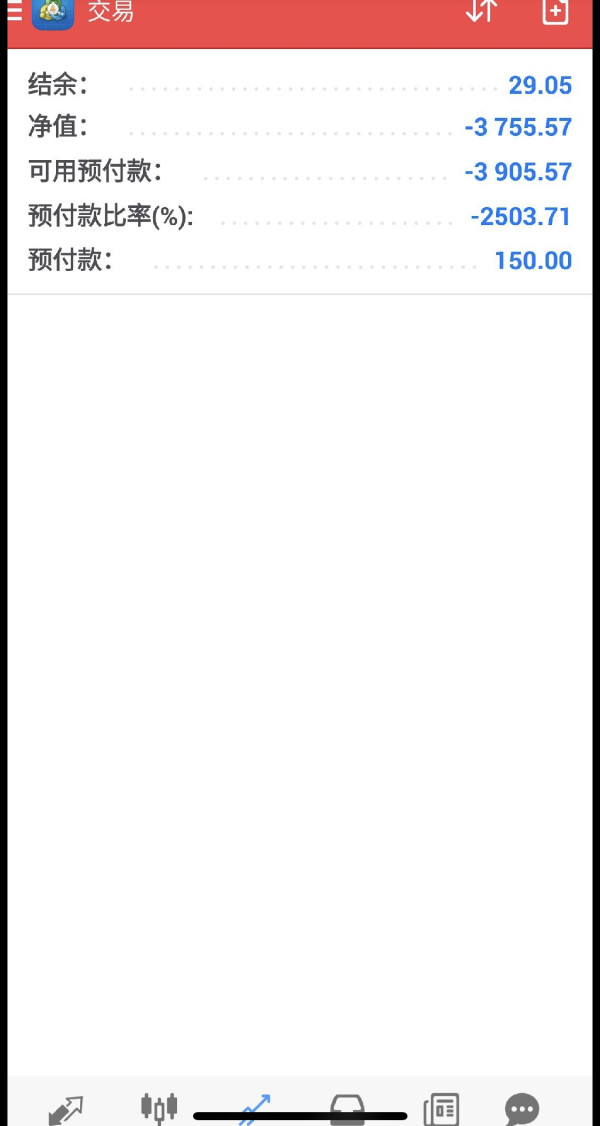

Trust and security represent RIF Capital's most critical weaknesses. The platform is widely identified as an unregulated entity operating outside legitimate financial oversight. The absence of proper licensing from recognized regulatory authorities creates enormous risks for investor fund security and legal protection.

Multiple review platforms and financial watchdog organizations have flagged RIF Capital as a fraudulent operation. There are consistent warnings about the platform's deceptive practices and lack of legitimate business operations. The company's transparency regarding its corporate structure, leadership, and business operations is virtually non-existent, which is a major red flag for potential investors.

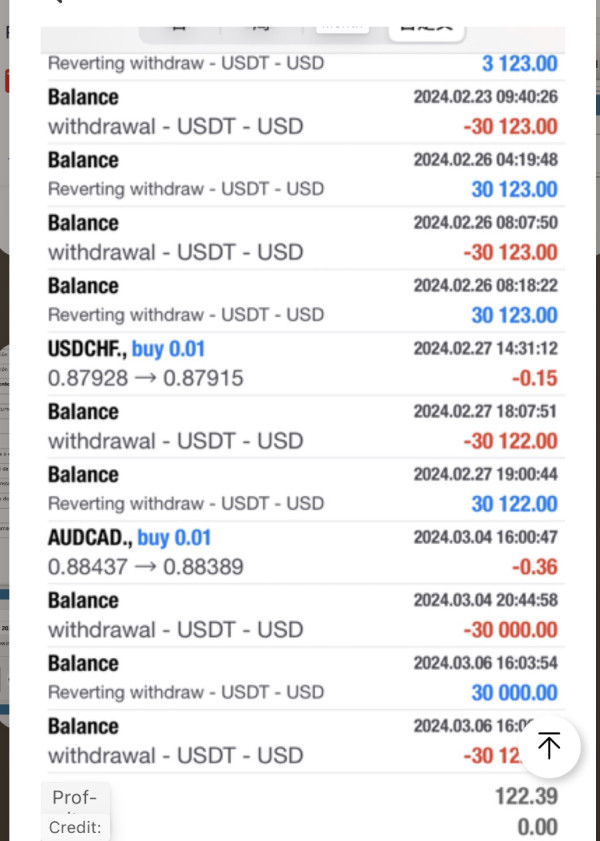

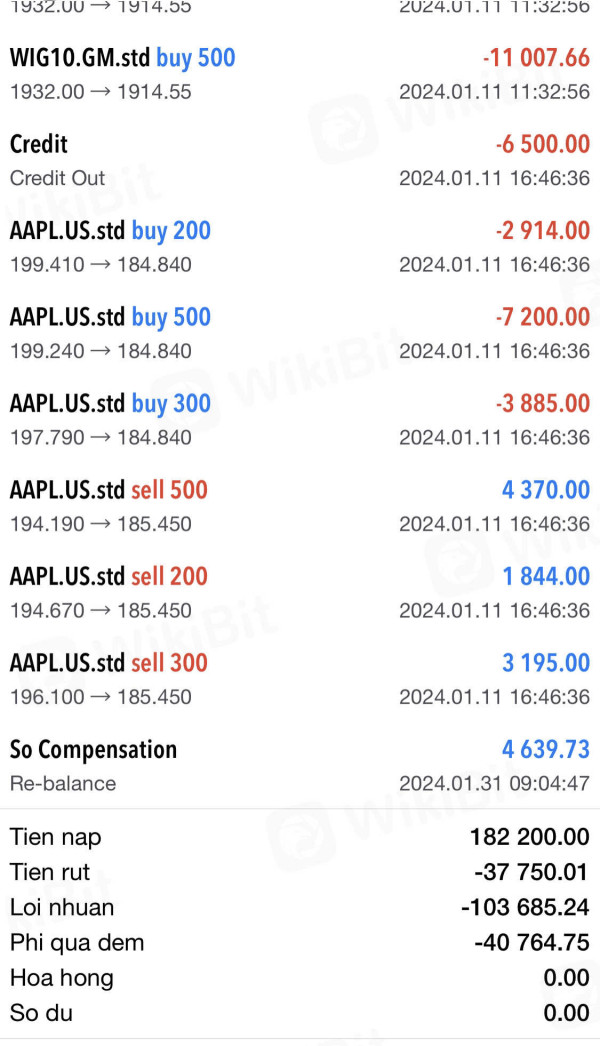

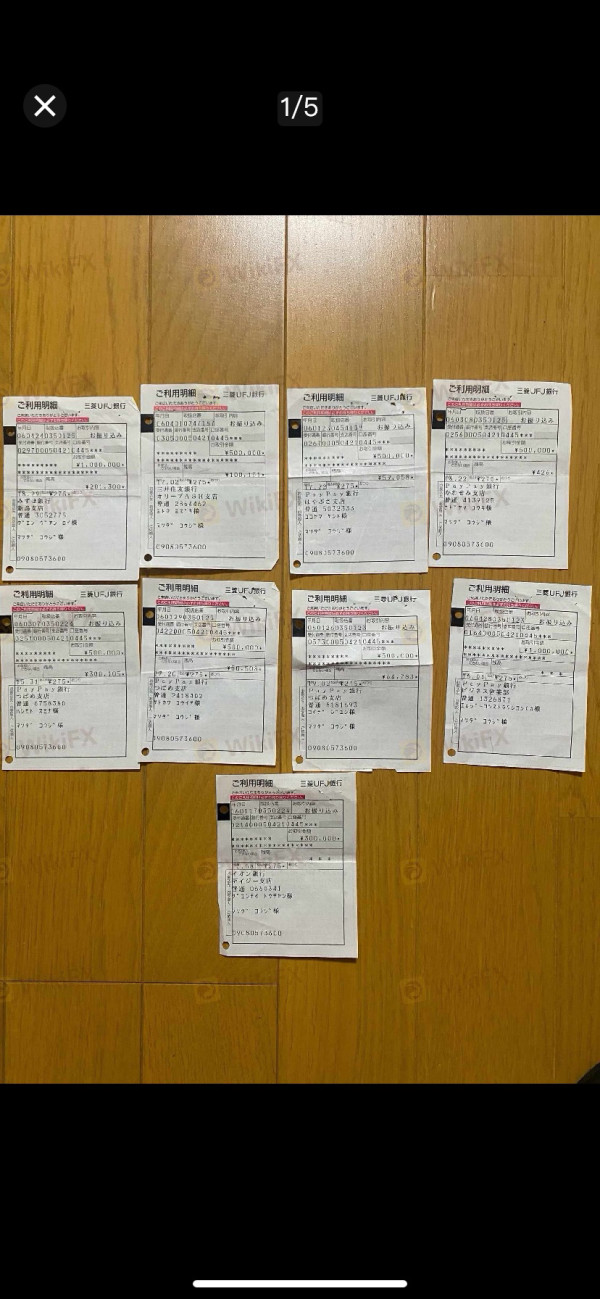

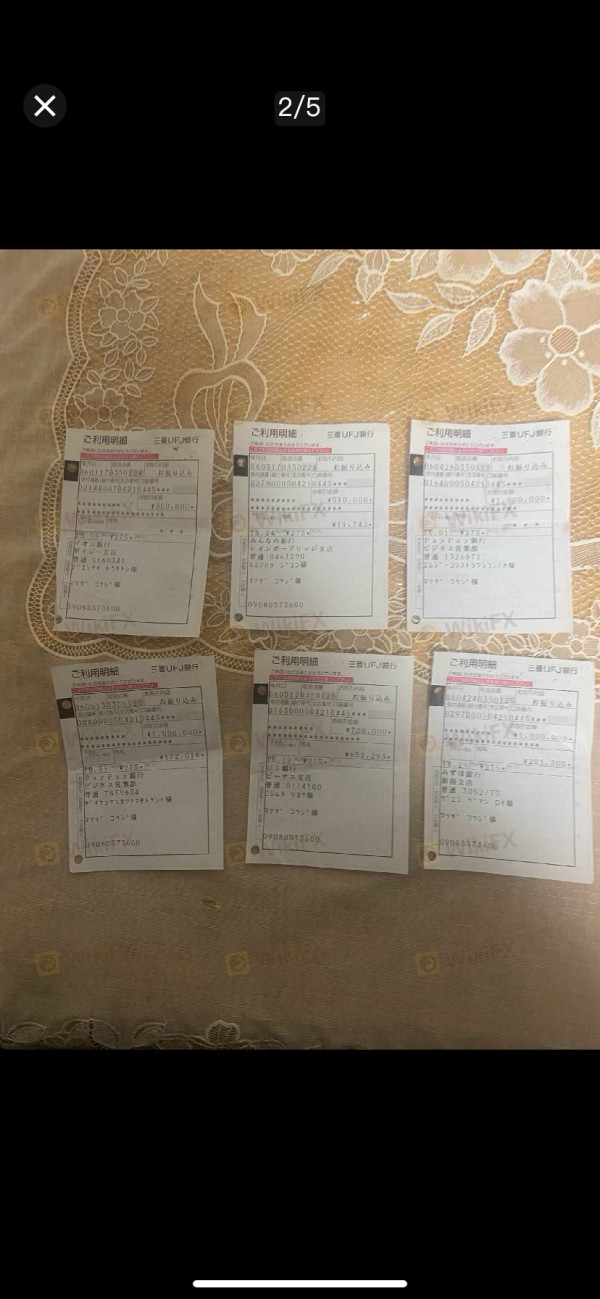

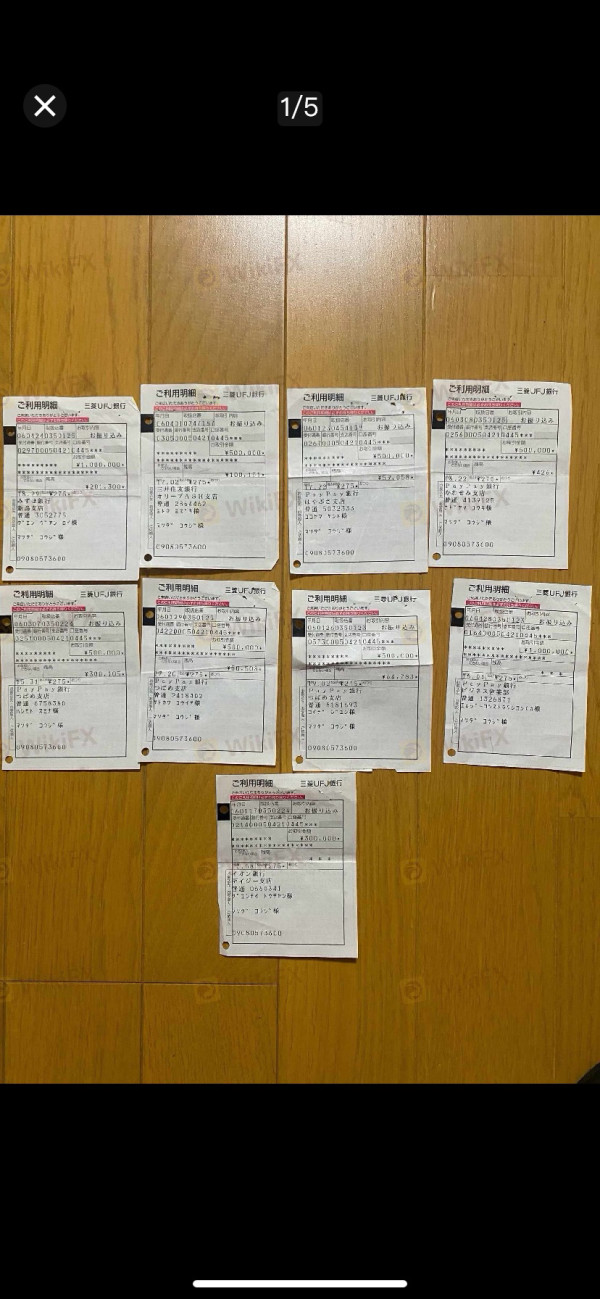

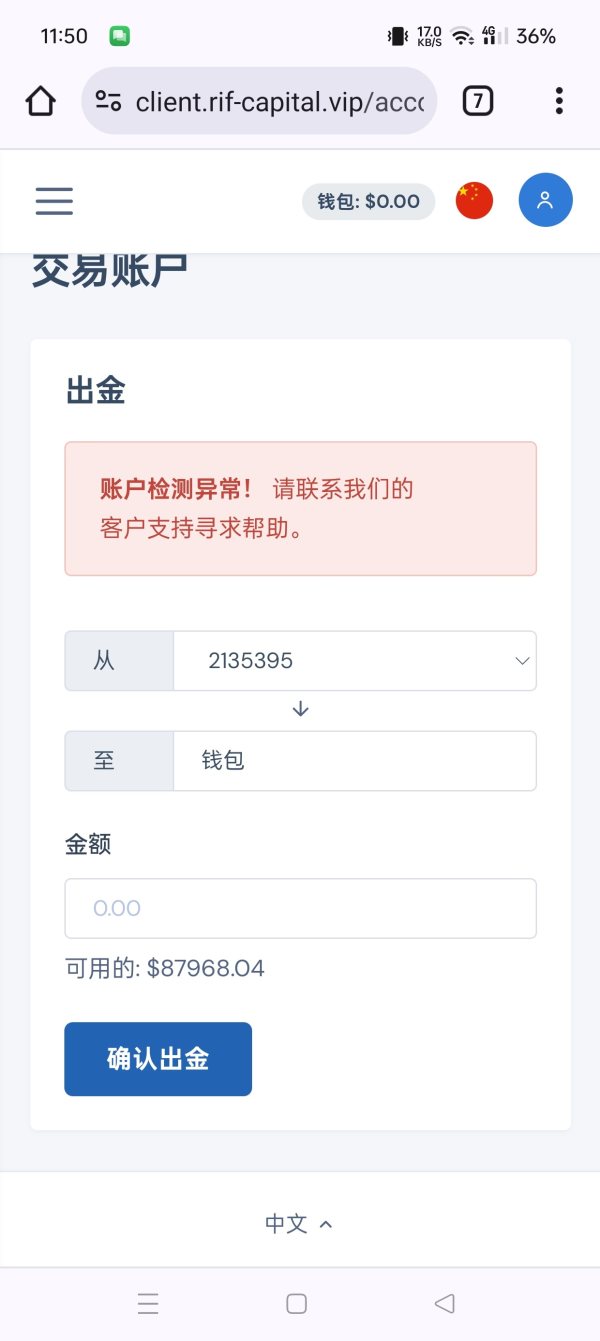

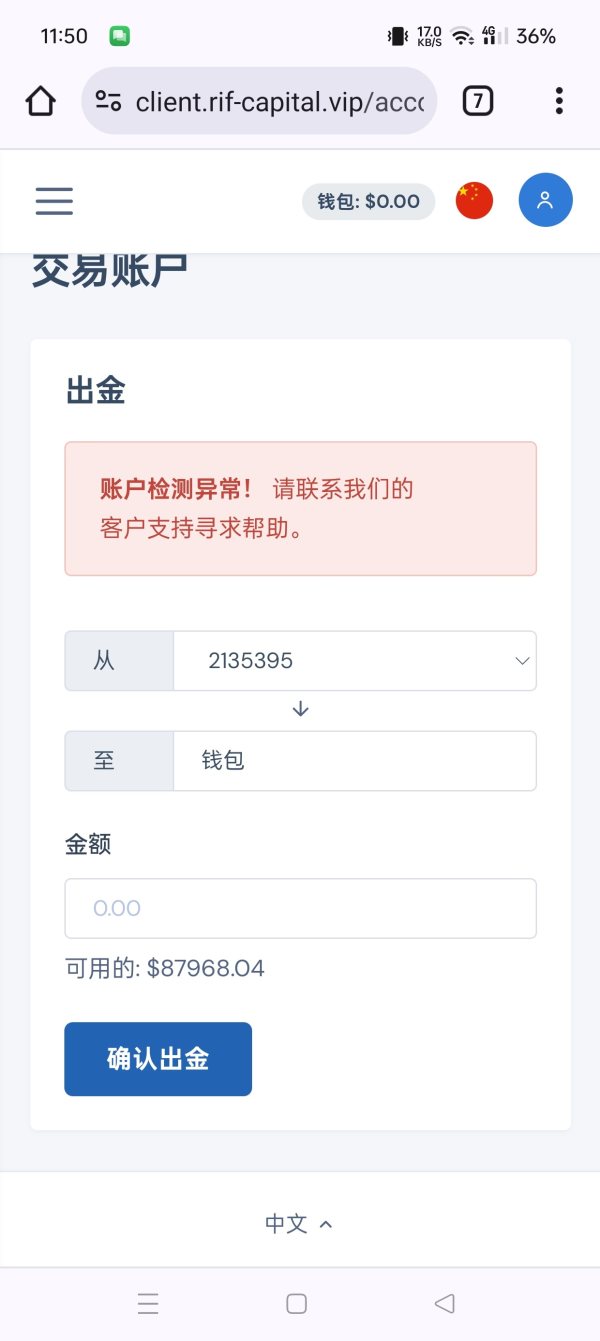

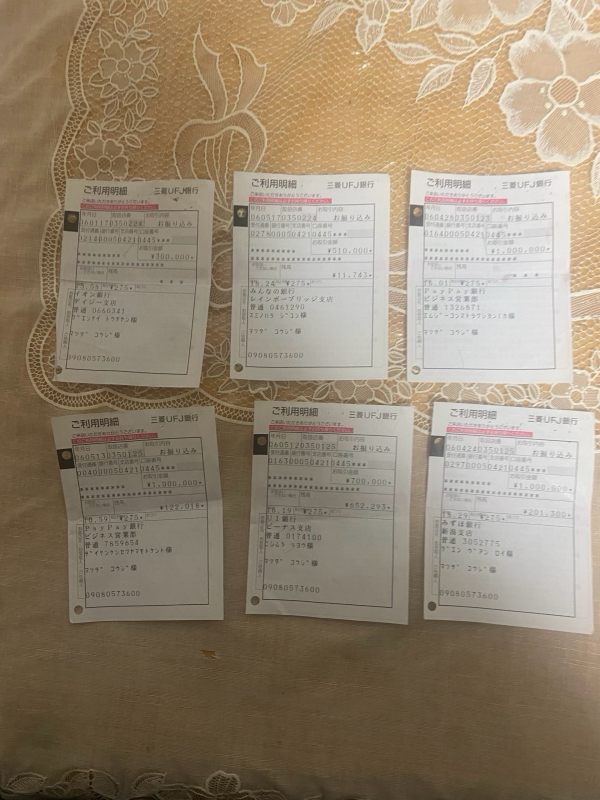

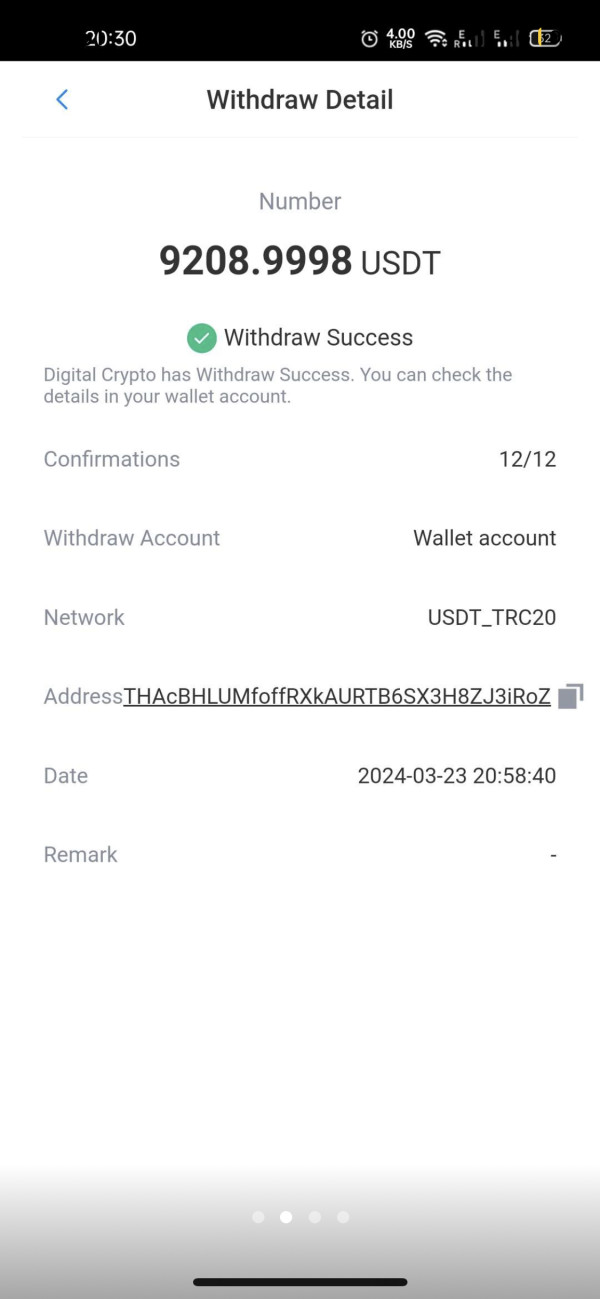

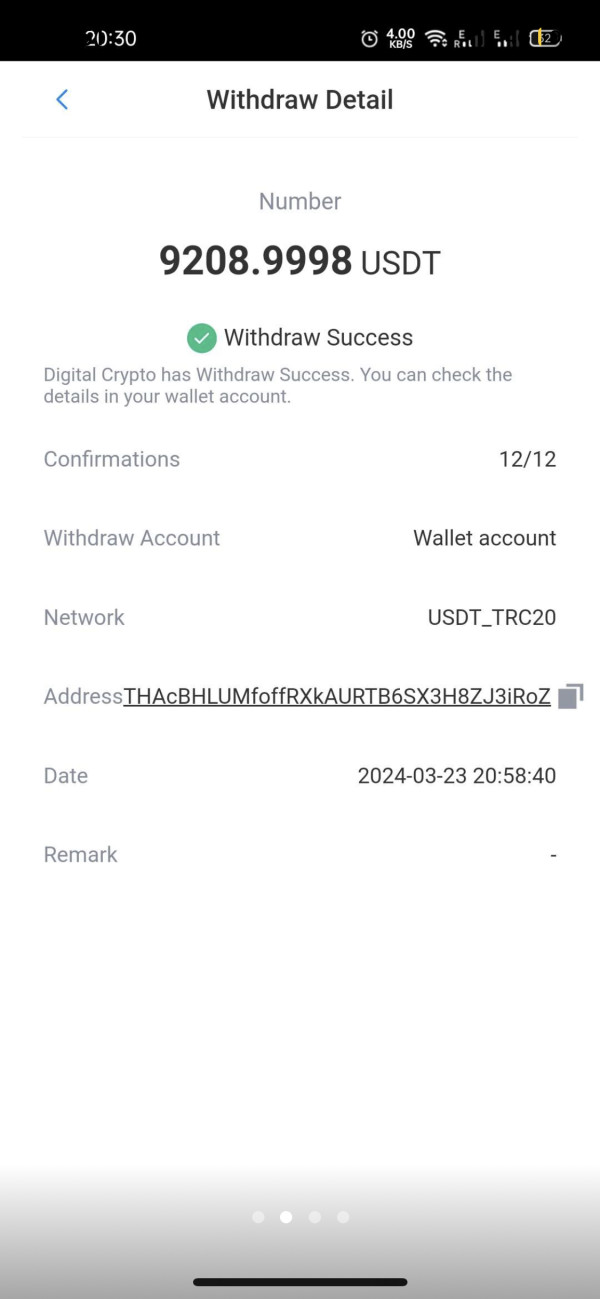

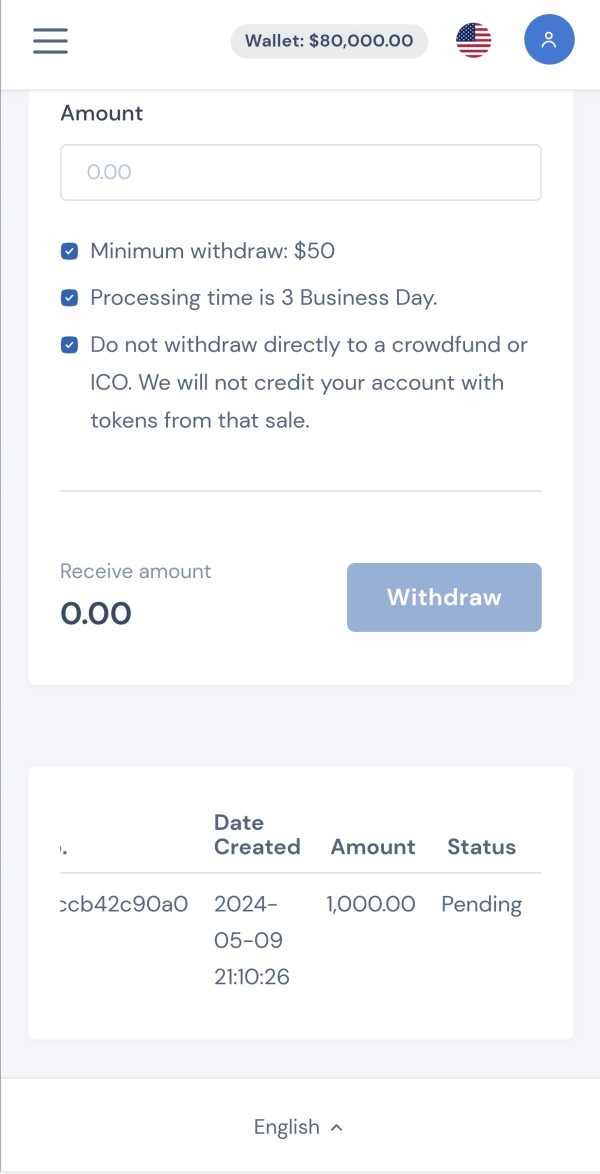

Fund security measures, which are essential for protecting client deposits, appear to be inadequate or non-existent. Legitimate brokers typically maintain segregated client accounts, insurance coverage, and other protective measures that RIF Capital has not demonstrated. The platform's handling of negative events and user complaints suggests a pattern of avoiding responsibility rather than addressing legitimate concerns.

User Experience Analysis (Score: 1/10)

Overall user satisfaction with RIF Capital is extremely poor. Widespread negative feedback indicates fundamental problems with the platform's service delivery and business practices. User reviews consistently describe experiences that suggest fraudulent intent rather than legitimate business operations.

The registration and verification processes reportedly lack the professional standards expected from legitimate financial service providers. Users describe confusion and inadequate guidance through account setup procedures. Interface design and usability appear to be secondary concerns, with functionality focused more on deposit collection than user experience optimization.

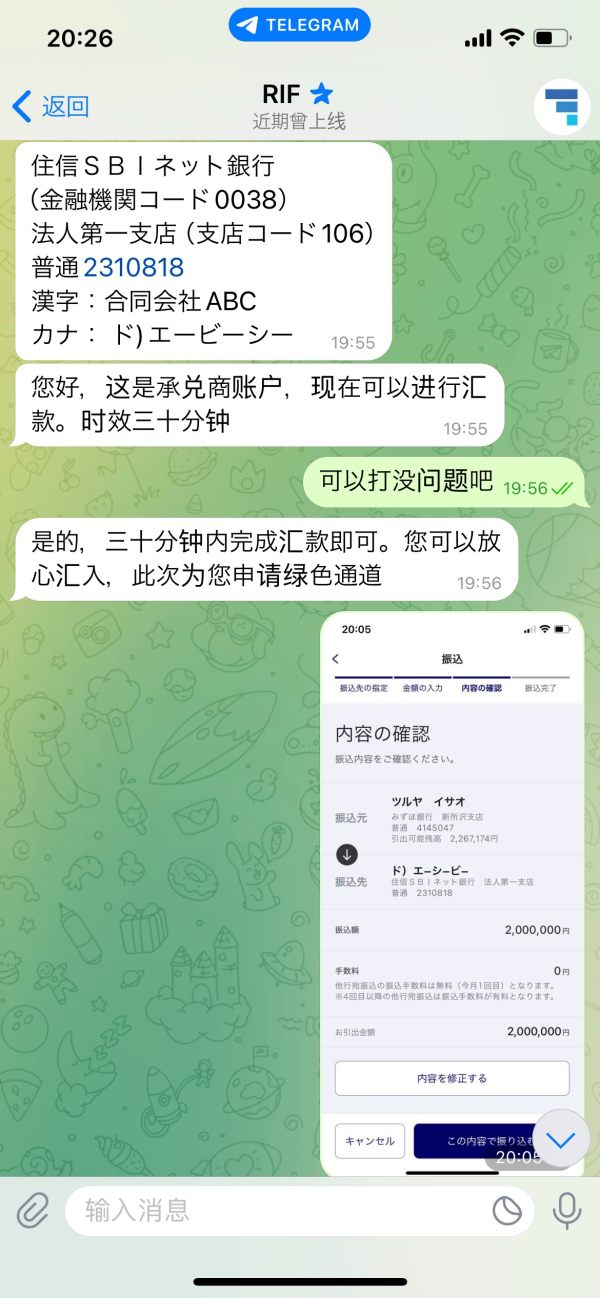

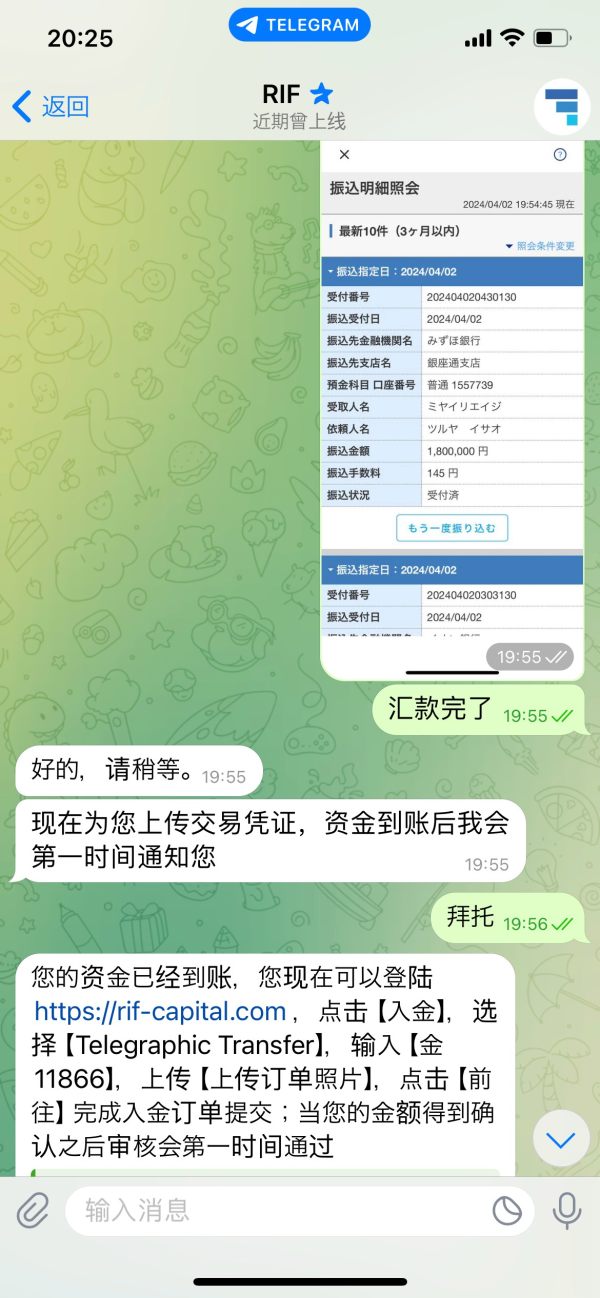

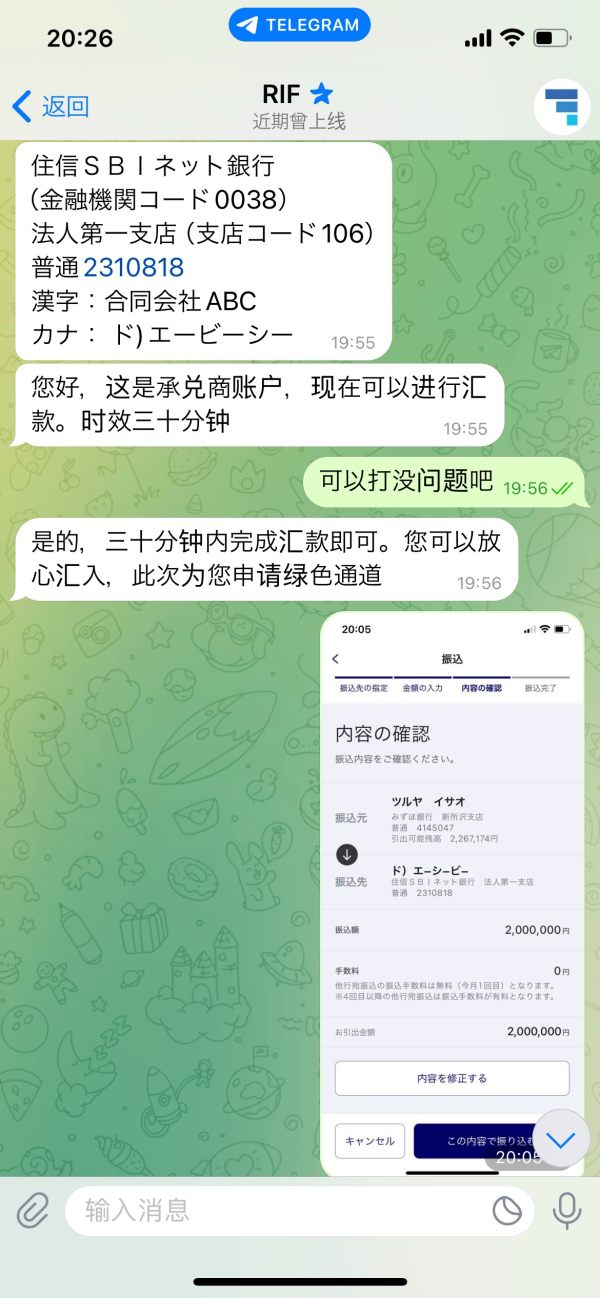

Common user complaints center around difficulties with fund withdrawals, poor communication from the platform, and inability to access promised services. The user demographic analysis suggests that RIF Capital targets inexperienced investors who may be less likely to recognize warning signs of fraudulent operations. This review strongly recommends that all potential users avoid this platform entirely.

Conclusion

This comprehensive rif-capital review concludes that RIF Capital should be avoided by all potential investors. There is overwhelming evidence of fraudulent operations and complete lack of regulatory compliance. The platform demonstrates none of the characteristics of a legitimate financial service provider and exhibits multiple warning signs consistent with investment scams.

The platform is not suitable for any type of investor, regardless of experience level or risk tolerance, due to the high probability of financial loss and lack of legal recourse. The main disadvantages include absence of regulatory oversight, extremely low user trust ratings, poor customer feedback, and lack of transparency in business operations. There are no identifiable advantages for potential users.