boforex 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

boforex positions itself as a compelling trading platform tailored for experienced traders looking for competitive trading conditions, advanced tools, and a diverse selection of assets. Catering mainly to this audience, it promotes a wide array of features appealing to traders seeking to hone their strategies effectively. However, this broker raises significant concerns regarding its regulatory legitimacy and customer support reliability, which could pose risks to its users. With various warning signs suggesting potential pitfalls, beginners or traders relying heavily on customer support may find this broker unsuitable for their trading needs.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement:

Engaging with boforex may expose traders to considerable financial risk due to unverified regulatory status and ongoing user complaints regarding withdrawals.

Potential Harms:

- Users may face challenges in accessing their funds due to withdrawal issues.

- Lack of robust regulatory oversight raises concerns about fund safety.

- Limited educational resources may hinder new traders.

How to Self-Verify:

- Visit Regulatory Websites: Check the National Futures Association (NFA) and Forex Peace Army websites to verify the brokers registration status.

- Search for User Reviews: Visit reputable financial review platforms for user feedback on boforex.

- Check for Complaints: Look for documented complaints on forums and trading communities such as Forex Factory or BabyPips to gauge trader experiences.

- Contact Customer Service: Assess response times and the quality of assistance by inquiring about common issues, such as withdrawal processes.

- Review Regulatory Status: Confirm that the broker is regulated in its jurisdiction to ensure compliance with necessary financial legislation.

Ratings Framework

Broker Overview

Company Background and Positioning

Founded recently in the dynamic financial climate, boforex has quickly positioned itself as a competitive player in the forex trading market. Headquartered in an offshore zone with less stringent regulatory requirements, it aims to cater primarily to traders with considerable experience, capitalizing on the appeal of flexibility and lower trading costs. The company seeks to establish a foothold among seasoned traders who desire diverse asset offerings within a platform that blends advanced trading tools with accessibility.

Core Business Overview

boforex specializes in futures and contracts for difference (CFDs), allowing its clients access to a variety of asset classes, including forex, commodities, and indices. The broker claims to operate under regulatory oversight, though specifics regarding the regulatory bodies involved are often vague or conflicting. Its platforms include popular trading applications such as MetaTrader 4 and MetaTrader 5, which are noted for their advanced analytical capabilities.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Many potential clients express concerns over the unclear regulatory status of boforex. The absence of specific details surrounding its licensing raises flags regarding trust and reliability in an industry where compliance is critical. Vague claims of regulation may lead to misconceptions, forcing users to risk funds without proper oversight.

User Self-Verification Guide

- Visit NFA Basic Database: Go to the NFA's BASIC website.

- Search Broker Name: Input boforex into the search field to check its regulatory status.

- Review Findings: Take note of the registration status and any public warnings or sanctions.

- Re-check on Forex Peace Army: Use the Forex Peace Army to find trader experiences with boforex.

- Consult Community Forums: Examine comments on forums like Forex Factory to understand the experiences of other traders.

Industry Reputation and Summary

Reports from users paint a complicated picture of the brokers trustworthiness. For instance, one review states:

“Ive faced numerous issues withdrawing my profits. It makes me question their legitimacy.”

This illustrates the necessity for potential traders to be vigilant and perform thorough due diligence before proceeding.

Trading Costs Analysis

Advantages in Commissions

One strong selling point for boforex is its competitive commission structure, appealing mainly to experienced traders who can leverage lower costs effectively. Users noted that spreads for major currency pairs can be as low as 0.1 pips, encouraging high-volume trading strategies.

The "Traps" of Non-Trading Fees

While the commission structure is attractive, several users have reported unexpected withdrawal fees. For example, a common complaint highlights:

“They charged $30 for a withdrawal that I expected to be free.”

This lack of transparency regarding fees can strain relationships with clients, leading to dissatisfaction.

Cost Structure Summary

Overall, while trading costs may seem appealing, hidden fees and lack of clarity undermine the potential benefits, leading traders to reassess whether the broker fits their financial goals.

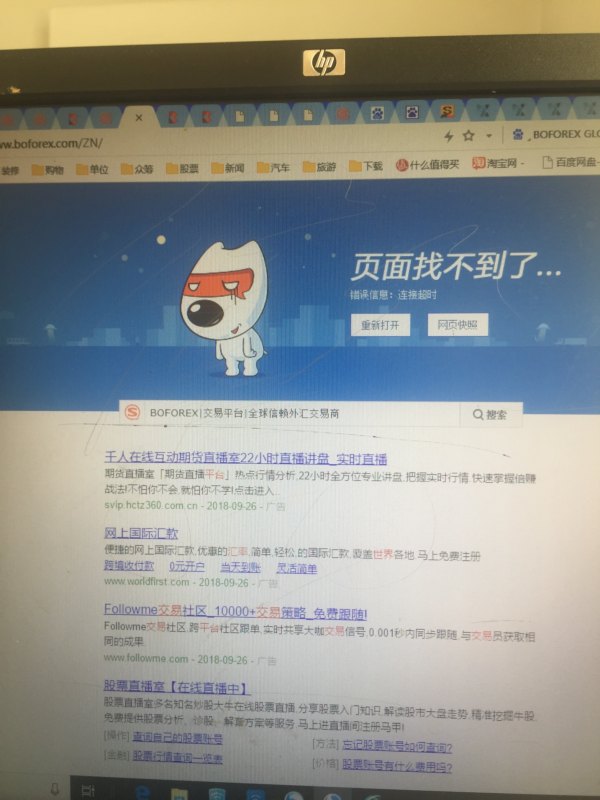

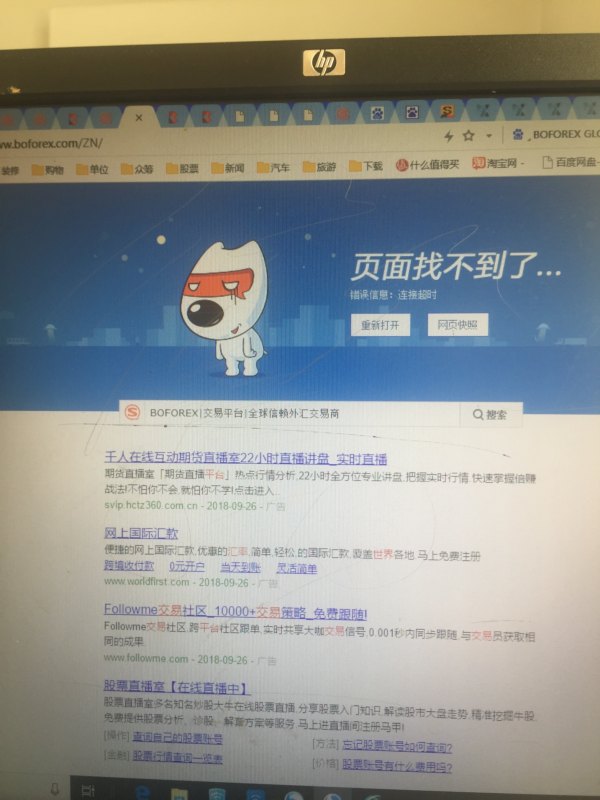

boforex offers industry-standard trading platforms like MetaTrader 4 and 5, renowned for their extensive features, including charting tools, market indicators, and automated trading capabilities. This enables users to implement diverse trading strategies effectively.

However, boforex appears to lack in providing comprehensive educational materials, primarily aimed at novice traders. Feedback from users indicates a necessity for enhanced educational resources and tutorials that are critical for building trading skills.

User feedback suggests mixed experiences with platform performance. Some indicate high functionality and low lag, while others report difficulties with execution speed during volatile market conditions. As one trader noted:

“It was frustrating to miss opportunities due to slow order execution, especially during major news events.”

User Experience Analysis

User Interface and Accessibility

The design and functionality of boforex's platforms garnered mixed reviews. While some users appreciate the straightforward interface, others found navigation cumbersome, especially when looking to access various trading tools.

Trade execution speeds are crucial, particularly during high market activity. Users have expressed concerns about intermittent lags, affecting trade outcomes. Some have reported slippage issues, impacting profitability during crucial trades.

Overall User Satisfaction

While many experienced traders value the competitive spreads, the lack of user-friendly features can lead to dissatisfaction. A notable user comment reflects this imbalance:

“While the fees are great, the platform lacks certain intuitive features, which can be a drawback.”

Customer Support Analysis

Availability and Response Times

Customer support has emerged as a critical shortcoming for boforex. Many users cite slow response times, particularly when urgent issues arise around withdrawals or platform functionalities.

Quality of Support Offered

The effectiveness and efficiency of customer support have come under scrutiny. Responses from support staff often feel insufficient, according to user feedback, indicating a potential area for improvement.

Overall Customer Service Experience

The combination of slow response times and inadequate support staff training has led to dissatisfaction among users. One user articulated their frustration succinctly:

“I felt ignored when trying to resolve my withdrawal issues. Its a huge red flag for me.”

Account Conditions Analysis

Account Types Offered

boforex provides a limited range of account types, mostly catering to traders experienced enough to navigate a more mature trading environment. The minimum deposit required is considered steep compared to some peers in the industry.

Leverage and Margin Requirements

While leverage up to 1:500 is offered, this can amplify risks, which is crucial for users to underscore. This flexibility is enticing but can lead to significant losses if not managed carefully.

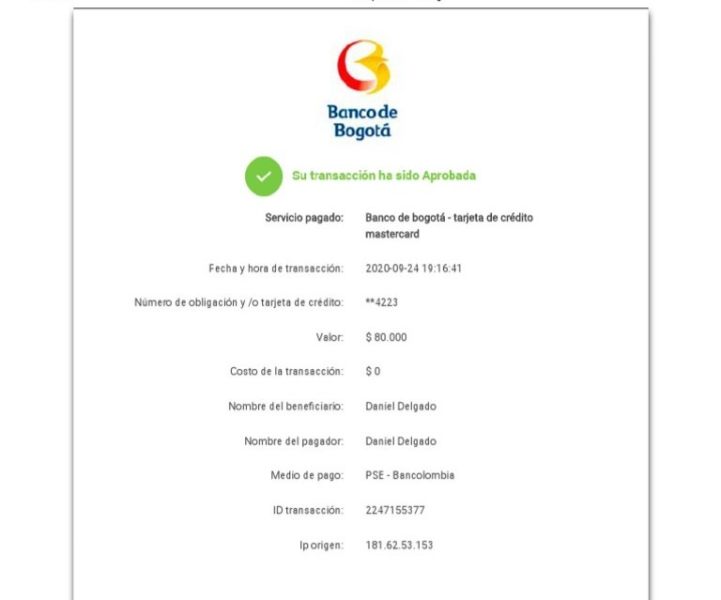

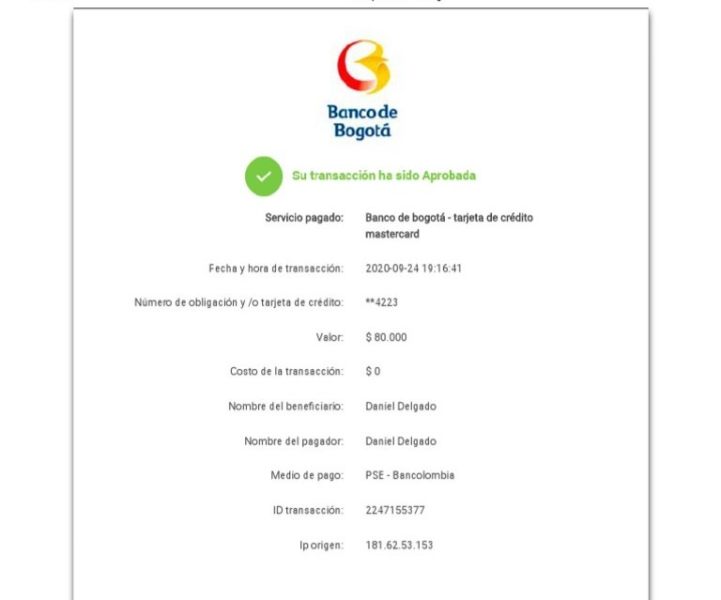

Withdrawal Processes and Transparency

Withdrawal timings and requirements have shown inconsistency, leading to frustrated clients. Users often report lengthy delays, which is especially concerning as traders typically expect rapid access to their funds.

Conclusion

In summary, boforex provides enticing trading opportunities with competitive costs and robust platforms well-suited for experienced traders. However, the prominent risks associated with unclear regulatory status, withdrawal issues, and mixed customer service experiences present significant concerns for potential users. While this brokers offerings may appeal to seasoned traders, it remains prudent to approach with caution, especially for those new to trading or requiring dependable customer support. Engaging with this broker without proper verification could lead to unwanted financial distress. Always conduct thorough research and due diligence before proceeding with boforex or any broker in the dynamic forex landscape.