Is freshforex safe?

Software Index

License

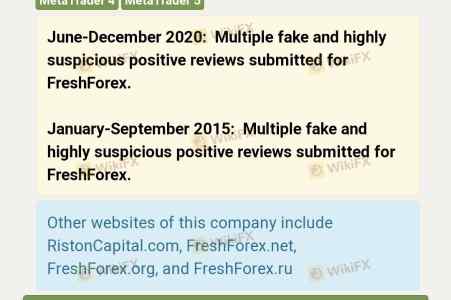

Is FreshForex A Scam?

Introduction

FreshForex, established in 2004, positions itself as a global player in the forex trading market, offering a variety of trading instruments and account types. As a broker operating in a highly competitive and sometimes volatile market, it is essential for traders to carefully assess the credibility and reliability of any forex broker before committing their capital. The forex trading landscape is rife with risks, including potential scams and unregulated entities that may jeopardize investors' funds. Therefore, a thorough evaluation of FreshForex's regulatory status, company background, trading conditions, and customer experiences is vital for traders considering this broker. This article will utilize a combination of qualitative analysis and structured data to provide an objective assessment of FreshForex's legitimacy and safety.

Regulation and Legitimacy

When evaluating a forex broker, regulatory oversight is a critical factor that can significantly impact the safety of client funds and the overall integrity of the trading environment. FreshForex is registered in Saint Vincent and the Grenadines and claims to operate under the jurisdiction of the Financial Services Authority (FSA) of SVG. However, it is important to note that the FSA is not recognized as a reputable regulatory body in the forex industry, which raises concerns about the broker's legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 20623 IBC 2012 | Saint Vincent and the Grenadines | Unverified |

The absence of regulation from tier-1 authorities such as the FCA (UK) or ASIC (Australia) indicates a lack of stringent oversight, which is a significant red flag for potential investors. While FreshForex claims to implement various security measures, the lack of comprehensive regulatory compliance may expose traders to higher risks, including potential fraud or difficulty in withdrawing funds.

Company Background Investigation

FreshForex is operated by Riston Capital Ltd., a company that has been in the forex trading business for nearly two decades. The broker has expanded its services across multiple regions, catering to a diverse clientele. However, the companys transparency regarding its ownership structure and management team is limited, which can be a cause for concern among potential investors.

The management team‘s expertise and experience in the forex market play a crucial role in establishing trust. Unfortunately, detailed information about the qualifications of the management team is not readily available, making it difficult for traders to assess the broker's reliability. Moreover, the level of transparency in the company’s operations and disclosure of essential information is critical for building trust with clients.

Trading Conditions Analysis

FreshForex offers various account types, including Classic, Market Pro, and ECN accounts, each with distinct features and trading conditions. However, the overall cost structure and any unusual fees associated with trading are essential factors to consider.

The broker promotes itself with attractive trading conditions, such as high leverage up to 1:2000 and tight spreads. However, traders should be cautious of the potential costs that may arise during trading.

| Fee Type | FreshForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Variable | Variable |

The spreads offered by FreshForex are higher than the industry average, particularly for major currency pairs. Additionally, the commission structure may vary based on the account type, which can complicate the overall cost of trading. Traders should be aware of any hidden fees that may apply, especially regarding withdrawals and overnight positions.

Client Funds Security

The security of client funds is paramount when selecting a forex broker. FreshForex claims to implement several measures to protect traders funds, including negative balance protection and SSL encryption for personal data. However, the absence of segregated accounts and a lack of investor compensation schemes are significant drawbacks.

FreshForex does not provide comprehensive information regarding its fund security measures, which raises concerns about the overall safety of client deposits. Traders should be cautious, as any historical issues regarding fund security could indicate systemic problems within the broker.

Customer Experience and Complaints

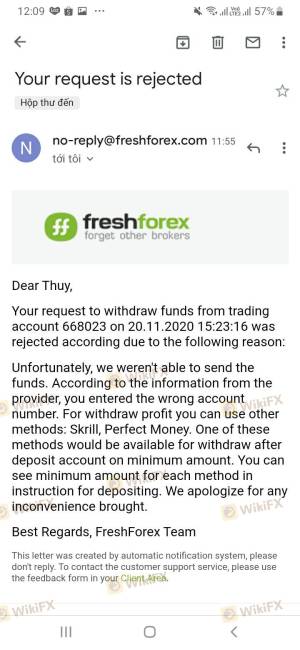

Customer feedback is a valuable resource for assessing a broker's reliability and overall service quality. FreshForex has received mixed reviews from clients, with some praising its trading conditions and customer support, while others have reported issues with fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Average Response |

Common complaints include difficulties in withdrawing funds and delays in customer service responses. For instance, some users have reported that their withdrawal requests took longer than expected, leading to frustration. The company's response to these issues has been described as average, with some customers feeling that their concerns were not adequately addressed.

Platform and Trade Execution

The trading platform offered by FreshForex includes the widely-used MetaTrader 4 and MetaTrader 5, which provide a user-friendly interface and a range of trading tools. However, the performance and stability of the platform are critical factors that can impact the trading experience.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejected orders during high volatility periods. Such issues can significantly affect trading outcomes and should be considered when evaluating the broker's reliability.

Risk Assessment

Using FreshForex poses several risks that traders should be aware of. The lack of reputable regulation, combined with mixed customer feedback and potential issues with fund withdrawals, creates an environment of uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of tier-1 regulation |

| Withdrawal Risk | Medium | Reports of slow withdrawal times |

| Trading Platform Risk | Medium | Instances of slippage reported |

To mitigate these risks, traders are advised to conduct thorough research, start with a demo account, and only invest funds they can afford to lose. Additionally, they should consider using risk management tools such as stop-loss orders to protect their investments.

Conclusion and Recommendations

In conclusion, while FreshForex has been operating for nearly two decades and offers competitive trading conditions, several red flags raise concerns about its legitimacy. The lack of regulation from a reputable authority, combined with mixed customer feedback and potential withdrawal issues, suggests that traders should exercise caution when considering this broker.

For those who value regulatory oversight and a transparent trading environment, it may be prudent to explore alternatives such as brokers regulated by the FCA or ASIC, which provide a higher level of investor protection. Overall, traders should weigh the potential benefits against the risks before deciding to engage with FreshForex.

Is freshforex a scam, or is it legit?

The latest exposure and evaluation content of freshforex brokers.

freshforex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

freshforex latest industry rating score is 2.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.