Stockity 2025 Review: Everything You Need to Know

Executive Summary

This Stockity review gives you a fair look at a trading platform that has caught attention in the forex and investment world. Based on user feedback we found, Stockity calls itself a new platform built for easy stock investment, with technical analysis tools you can use on both phones and computers.

User reviews from Trustpilot show that "Stockity turned out to be solid" with experiences that "exceeded expectations." This suggests the platform does what it promises. The broker targets traders who want complete trading solutions with focus on technical analysis tools and access from multiple devices.

However, our review shows big gaps in important information about the broker including rules they follow, account details, and clear fee information. While user feedback stays mostly positive, the lack of clear regulatory information and specific details about how they operate could worry future clients. The platform seems best for traders who care most about user experience and technical analysis tools, though we recommend doing more research since there's limited public information about rule compliance and how open they are about their operations.

Important Notice

This review uses available user feedback, platform features, and public information. Readers should know that complete regulatory information was not easy to find in the sources we reviewed, which may show possible compliance risks. Our review method includes user reviews, platform feature analysis, and industry standard checks.

Since regulatory transparency is limited, future users should strongly verify the broker's licensing status and rule compliance on their own before starting any trading activities.

Rating Framework

Broker Overview

Stockity appears as a trading platform focused on giving new solutions for stock investment and forex trading. The company positions itself as a technology-driven broker, focusing on smooth user experience and complete technical analysis abilities. While specific founding details and company background information were not detailed in available sources, the platform shows a clear focus on accessibility and user-friendly trading environments.

The broker's business model centers around giving traders sophisticated analytical tools while keeping platform accessibility across multiple devices. User feedback suggests the company has successfully created an engaging trading environment that exceeds initial user expectations, with particular strength in delivering consistent platform performance.

About platform infrastructure, Stockity offers technical analysis tools accessible through both mobile and desktop interfaces, though specific details about whether the platform uses industry-standard solutions like MT4 or MT5 were not specified in available sources. The broker appears to focus on stock investment primarily, though the exact range of tradeable assets and specific regulatory oversight remains unclear from current documentation.

Regulatory Status: Specific regulatory information was not detailed in available sources, which represents a significant transparency concern for potential users.

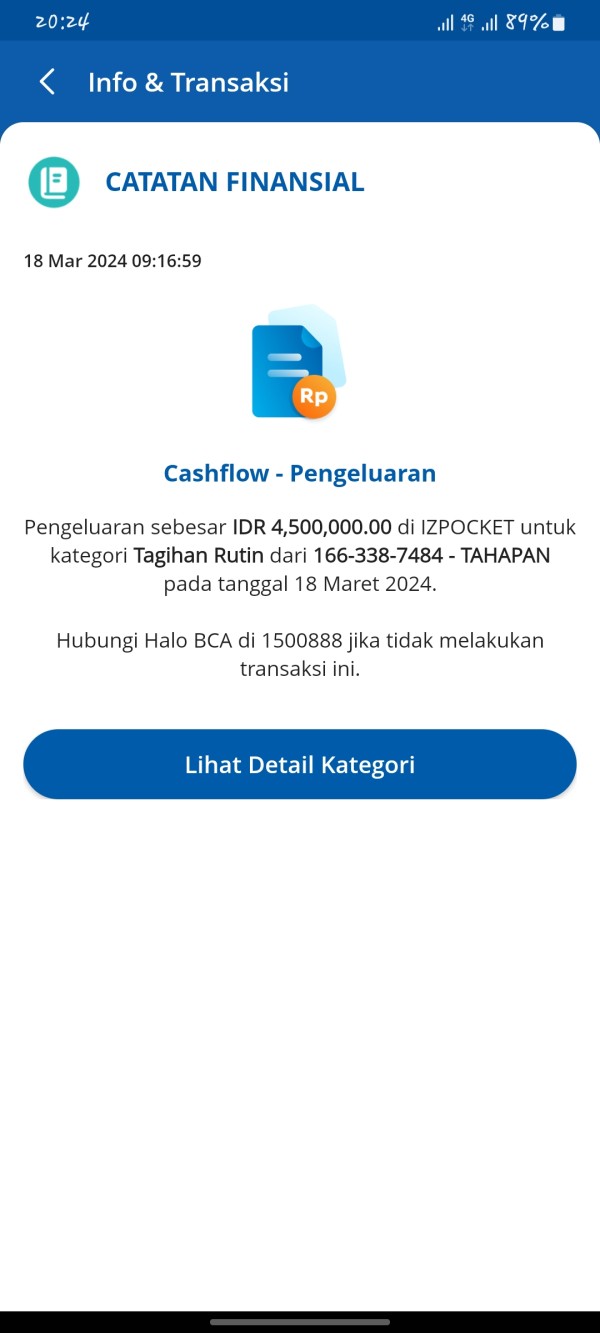

Deposit and Withdrawal Methods: Payment processing options and withdrawal procedures were not specified in the reviewed materials.

Minimum Deposit Requirements: Specific minimum deposit amounts were not disclosed in available documentation.

Bonuses and Promotions: Information about promotional offers and bonus structures was not available in the sources reviewed.

Available Trading Assets: While stock investment is emphasized, the complete range of tradeable instruments was not comprehensively detailed.

Cost Structure: Specific spread information, commission rates, and fee schedules were not provided in the available materials, making cost comparison difficult.

Leverage Options: Maximum leverage ratios and margin requirements were not specified in the reviewed sources.

Platform Options: Technical analysis tools are confirmed, though specific platform software details remain unspecified.

Geographic Restrictions: Regional availability and access limitations were not detailed in available information.

This Stockity review highlights the need for greater transparency in key operational areas, particularly regarding regulatory compliance and fee structures.

Account Conditions Analysis

The account conditions assessment for Stockity reveals significant information gaps that impact our ability to provide complete evaluation. Available sources do not specify the variety of account types offered, making it impossible to assess whether the broker provides tiered services for different trader categories such as beginners, intermediate, or professional traders.

Minimum deposit requirements, a crucial factor for accessibility, remain undisclosed in the reviewed materials. This lack of transparency makes it difficult for potential clients to assess affordability and entry barriers. Similarly, the account opening process, verification requirements, and documentation needed for account activation are not detailed in available sources.

Special account features such as Islamic accounts for traders requiring swap-free trading, demo account availability, or premium account benefits are not mentioned in the accessible information. This absence of detail suggests either limited account variety or insufficient public disclosure of available options.

The evaluation is further complicated by the lack of information about account funding requirements, maintenance fees, or inactivity charges that might apply to different account tiers. Without access to complete account condition details, prospective traders cannot make informed comparisons with industry alternatives or assess the broker's competitiveness in this crucial area.

This Stockity review emphasizes the importance of direct broker inquiry to obtain essential account condition information before making trading decisions.

Stockity demonstrates notable strength in its tools and resources offering, particularly in technical analysis capabilities. The platform provides various technical analysis tools designed to support trader decision-making processes, though specific tool varieties and advanced features were not completely detailed in available sources.

The broker's commitment to accessibility is evident through confirmed multi-device support, allowing traders to access analytical tools through both mobile devices and desktop platforms. This cross-platform compatibility ensures traders can maintain market engagement and analysis capabilities regardless of their location or preferred device.

However, the evaluation reveals gaps in information about research resources, market analysis reports, and educational materials. The availability of economic calendars, market news feeds, fundamental analysis resources, or expert commentary was not specified in reviewed materials. Similarly, educational resources such as trading guides, webinars, video tutorials, or market analysis training were not detailed.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or copy trading features, remains unspecified. The absence of information about API access for advanced traders or third-party tool integration limits our assessment of the platform's sophistication level.

Despite these information gaps, user feedback suggests satisfaction with available tools, indicating that the platform delivers functional analytical capabilities that meet basic trader requirements for technical analysis and market evaluation.

Customer Service and Support Analysis

The customer service evaluation for Stockity faces significant limitations due to insufficient information about support infrastructure and service quality metrics. Available sources do not specify the customer service channels offered, such as live chat, email support, telephone assistance, or help desk ticket systems.

Response time commitments, service level agreements, and support availability hours remain unspecified in reviewed materials. This lack of transparency makes it impossible to assess whether the broker provides 24/7 support, business hours only assistance, or regional support scheduling that might affect traders in different time zones.

Service quality indicators such as first-contact resolution rates, customer satisfaction scores, or support team expertise levels are not documented in available sources. The absence of information about dedicated account managers, premium support tiers, or specialized assistance for different account types further limits evaluation capabilities.

Multi-language support availability, crucial for international traders, was not detailed in the reviewed materials. Similarly, the geographical distribution of support centers or local language expertise remains unspecified, potentially affecting service quality for non-English speaking traders.

Without user testimonials specifically addressing customer service experiences or documented case studies of problem resolution, this evaluation cannot provide definitive assessment of support quality. The lack of customer service information represents a significant transparency gap that prospective traders should address through direct broker inquiry before account opening.

Trading Experience Analysis

The trading experience assessment reveals mixed information availability, with some positive user indicators but limited technical performance data. User feedback suggests satisfactory overall trading experiences, with testimonials indicating that platform performance "exceeded expectations" and proved "solid" in practical use.

Mobile accessibility represents a confirmed strength, with the platform supporting trading activities through mobile devices. This mobile compatibility ensures traders can maintain market access and execute trades regardless of location, addressing modern trading mobility requirements. Desktop platform access is also confirmed, providing traders with complete device options.

However, critical trading experience factors remain unspecified in available sources. Platform stability metrics, server uptime statistics, and connection reliability data were not provided. Order execution quality, including execution speed, slippage rates, and fill quality statistics, lack documentation in reviewed materials.

Trading environment characteristics such as available order types, one-click trading capabilities, advanced order management features, or risk management tools are not detailed. The absence of information about market depth displays, level II pricing, or advanced charting capabilities limits assessment of platform sophistication.

Technical performance benchmarks, stress testing results during high volatility periods, or platform capacity during major market events remain undocumented. This Stockity review indicates that while user satisfaction appears positive, complete technical performance evaluation requires additional information gathering.

Trust and Safety Analysis

The trust and safety evaluation reveals significant concerns regarding transparency and regulatory disclosure. Available sources do not provide specific information about regulatory licenses, supervisory authorities, or compliance frameworks governing Stockity's operations. This regulatory information gap represents a primary concern for trader safety and fund security.

Fund protection measures, including client fund segregation, deposit insurance coverage, or compensation scheme participation, are not detailed in reviewed materials. The absence of information about banking relationships, fund custody arrangements, or third-party auditing further complicates safety assessment.

Company transparency metrics such as detailed company registration information, ownership structure disclosure, or financial reporting availability are not specified. Corporate governance information, including board composition, compliance officer details, or regulatory filing history, remains undisclosed in accessible sources.

Industry reputation indicators, including regulatory sanctions, warning notices, or compliance violations, were not identified in the review process. However, the absence of negative regulatory actions may simply reflect limited public disclosure rather than clean regulatory records.

Third-party verification through regulatory databases, financial authority websites, or industry oversight organizations was not possible due to insufficient regulatory identification information. User feedback regarding security experiences and fund safety was not specifically detailed in available testimonials, limiting empirical safety assessment capabilities.

User Experience Analysis

User experience evaluation shows notably positive indicators based on available feedback from Trustpilot and other user review platforms. Testimonials consistently indicate satisfaction levels that exceed initial expectations, with users describing the platform as "solid" and expressing surprise at the positive experience quality.

The overall user satisfaction appears strong, with feedback suggesting that Stockity delivers on its core user experience promises. Users report positive impressions of platform functionality and express satisfaction with their trading interactions, indicating effective user interface design and intuitive navigation structures.

However, specific user experience details remain limited in available sources. Interface design characteristics, navigation efficiency, visual appeal, and user workflow optimization are not completely detailed. Registration and account verification process efficiency, including required documentation, processing times, and user guidance quality, lack specific documentation.

Fund management experience, including deposit processing speed, withdrawal efficiency, and transaction transparency, was not detailed in user feedback reviews. Common user complaints, feature requests, or improvement suggestions are not systematically documented in available sources.

User demographic analysis and trader type suitability assessment cannot be completed due to limited user profile information in available testimonials. The absence of detailed user journey analysis, from registration through active trading, limits complete user experience evaluation despite generally positive feedback indicators.

Conclusion

This Stockity review presents a nuanced evaluation of a trading platform that demonstrates both strengths and significant information gaps. The broker shows particular competence in user experience delivery and technical analysis tool provision, with consistently positive user feedback indicating satisfactory platform performance that exceeds initial expectations.

The platform appears most suitable for traders prioritizing user-friendly interfaces and technical analysis capabilities, particularly those requiring multi-device accessibility for mobile and desktop trading. However, the significant lack of regulatory transparency, detailed fee structures, and complete operational information presents substantial concerns for prospective users.

Primary weaknesses include insufficient regulatory disclosure, limited account condition transparency, and absence of detailed cost structure information. These gaps necessitate direct broker inquiry and independent verification before account opening. While user satisfaction indicators remain positive, the regulatory uncertainty and operational transparency issues suggest this broker may be more appropriate for experienced traders capable of conducting thorough due diligence rather than beginners requiring complete broker transparency and regulatory assurance.