Is Multibank safe?

Pros

Cons

Is MultiBank A Scam?

Introduction

MultiBank Group, established in 2005, has positioned itself as a significant player in the forex market, offering a diverse range of trading services, including forex, CFDs, commodities, and cryptocurrencies. As the trading landscape becomes increasingly crowded, it is crucial for traders to carefully evaluate the legitimacy of their chosen brokers. The potential for scams in the forex industry is a reality that can lead to significant financial losses for unsuspecting traders. Thus, assessing a broker's credibility is essential for safeguarding ones investments.

This article employs a comprehensive investigative approach, analyzing MultiBank's regulatory status, corporate background, trading conditions, client safety measures, and user experiences. The evaluation framework focuses on key aspects that determine the trustworthiness of a broker and aims to provide a balanced view of whether MultiBank is a reliable trading partner or a potential scam.

Regulation and Legitimacy

The regulatory framework surrounding a broker is one of the most critical factors in determining its legitimacy. MultiBank Group operates under several regulatory authorities, which adds a layer of credibility to its operations. A broker that is regulated by reputable authorities is generally held to strict financial standards, ensuring that client funds are protected and that the broker operates transparently.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 416279 | Australia | Verified |

| BaFin | HRB 73406 | Germany | Verified |

| MAS | CMS 101174 | Singapore | Verified |

| CySEC | 430/23 | Cyprus | Verified |

| FMA | 491129Z | Austria | Verified |

| CIMA | 1811316 | Cayman Islands | Verified |

| VFSC | 700443 | Vanuatu | Verified |

MultiBank is regulated by multiple tier-1 and tier-2 authorities, which indicates a robust regulatory framework. The presence of these licenses suggests that MultiBank adheres to stringent compliance standards and best practices in the financial industry. Moreover, the broker provides negative balance protection, ensuring that clients do not lose more than their initial investment. Overall, the regulatory status of MultiBank supports the assertion that it is a legitimate broker and not a scam.

Company Background Investigation

MultiBank Group has a rich history, having been founded in California and later expanding its operations globally. The company has established a significant presence with offices in various countries, including Australia, Germany, and the UAE. The ownership structure of MultiBank is transparent, with its founder, Naser Taher, at the helm, guiding its growth and development.

The management team comprises experienced professionals from the financial services sector, bringing a wealth of knowledge and expertise to the organization. This experience is crucial in fostering a culture of compliance and operational excellence. Furthermore, MultiBank's commitment to transparency is evident in its willingness to disclose information about its financial standing and operational practices.

With over 320,000 clients and a paid-up capital exceeding $322 million, MultiBank has demonstrated its capability to maintain a stable business model. The companys history of compliance and its proactive approach to regulatory adherence further bolster its credibility, making it a trustworthy option for traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. MultiBank provides various account types, each with distinct features, spreads, and fees. The overall fee structure is competitive, particularly for the ECN accounts, which provide raw spreads starting from 0.0 pips.

However, traders should be aware of certain fees that could impact their trading experience. For instance, MultiBank charges an inactivity fee of $60 per month after three months of inactivity, which is relatively high compared to industry standards.

| Fee Type | MultiBank Group | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.1 - 1.5 pips | 1.2 pips |

| Commission Model | $3 per lot (ECN) | $6 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads on the ECN account are competitive, the higher spreads on the standard account may deter some traders. Additionally, the commission structure and potential overnight fees should be thoroughly considered by traders to ensure they align with their trading strategies. Overall, the trading conditions at MultiBank appear favorable, but potential clients should remain vigilant regarding the fee structure.

Client Funds Safety

Client funds' safety is paramount in the forex trading industry. MultiBank implements several measures to protect client deposits, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice minimizes the risk of funds being misused or lost in the event of financial difficulties faced by the broker.

Furthermore, MultiBank offers negative balance protection, which means that clients cannot lose more than their deposited amount, providing an additional safety net. These safety measures are crucial for building trust and confidence among traders.

Despite these protections, it is essential to note that MultiBank does not participate in a formal investor compensation scheme in all jurisdictions, which could be a concern for some traders. However, the broker's strong regulatory oversight and commitment to client safety suggest that it is a reliable option for trading.

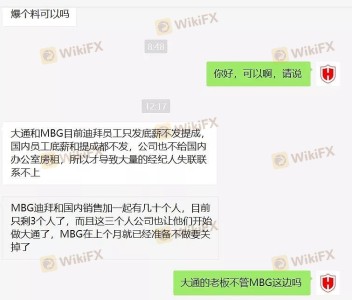

Customer Experience and Complaints

User feedback and experiences provide valuable insights into a broker's reliability. Overall, MultiBank has received a mix of positive and negative reviews. Many clients appreciate the competitive trading conditions and responsive customer support. However, some common complaints have emerged.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Inactivity Fees | Low | Addressed in FAQs |

| Customer Support Quality | Moderate | Generally positive |

For example, some users have reported delays in processing withdrawal requests, which can be frustrating. However, the majority of clients have noted that the customer support team is generally knowledgeable and responsive to inquiries. This level of service is vital for addressing concerns and ensuring a positive trading experience.

Platform and Trade Execution

MultiBank offers several trading platforms, including the popular MetaTrader 4 and MetaTrader 5, which are known for their stability and user-friendly interfaces. The execution quality is generally regarded as high, with minimal slippage and no requotes reported by users.

However, some traders have expressed concerns about the platform's performance during high volatility periods, highlighting the importance of a reliable trading environment. Overall, MultiBank's trading platforms provide a satisfactory experience for most traders, although occasional issues may arise during peak trading times.

Risk Assessment

When considering whether to trade with MultiBank, it is essential to evaluate the associated risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight. |

| Financial Risk | Medium | Potential for high leverage losses. |

| Withdrawal Risk | Medium | Some reports of delays in withdrawals. |

| Trading Conditions Risk | Medium | Higher fees on certain accounts. |

Traders should be aware of these risks and take appropriate measures to mitigate them, such as using risk management strategies and being informed about the broker's fee structure.

Conclusion and Recommendations

In conclusion, the evidence suggests that MultiBank is not a scam. The broker is well-regulated, with a strong track record and multiple licenses from reputable authorities. However, potential clients should be aware of certain fees, particularly the inactivity fee, and the mixed reviews regarding withdrawal processing times.

For traders looking for a reliable broker, MultiBank offers competitive trading conditions and a wide range of tradable instruments. However, beginners may want to consider their trading strategy carefully and possibly start with a demo account to familiarize themselves with the platform.

If you are seeking alternatives, brokers such as FXTM or OANDA may also provide strong regulatory frameworks and competitive trading conditions. Ultimately, it is crucial for traders to conduct thorough research and choose a broker that aligns with their trading goals and risk tolerance.

Is Multibank a scam, or is it legit?

The latest exposure and evaluation content of Multibank brokers.

Multibank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Multibank latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.