MUFG 2025 Review: Everything You Need to Know

Executive Summary

MUFG (Mitsubishi UFJ Financial Group) is Japan's largest financial company. It offers complete financial services across many different areas. In this mufg review, we give a neutral assessment with an overall rating of 3 out of 5 stars, which shows the institution's mixed performance. The company shows stability through its wide range of services, including fund administration, asset servicing, custody solutions, and securities lending.

However, recent performance numbers show some problem areas. Employee satisfaction ratings show a moderate 58% recommendation rate among staff members, while overall internal ratings have dropped by 3% over the past 12 months. MUFG's complete approach to financial services makes it a good option for investors who want stable, institutional-grade financial solutions.

The firm's strength comes from its established market presence and varied service offerings that cover the entire investment value chain. This includes fund financing, banking services, foreign exchange overlay solutions, and emerging payment technologies currently under development. The institution's focus on customized solutions designed to fuel sustainable growth makes it particularly attractive to institutional clients and sophisticated investors who put long-term stability over cutting-edge features.

Important Notice

Due to MUFG's global operations being so complex, potential clients should know that rules and service offerings may vary a lot across different areas. The financial group operates under various regulatory bodies depending on the region, and specific terms, conditions, and available services may differ based on your location and regulatory environment.

This review is based on publicly available information and general company background data. Specific regulatory details and localized service parameters were not detailed in available sources. Prospective clients are strongly advised to verify current regulatory status, available services, and specific terms applicable to their jurisdiction before making any investment decisions.

The evaluation presented here reflects general institutional characteristics and should be supplemented with direct consultation with MUFG representatives for location-specific information.

Rating Framework

Broker Overview

MUFG's origins trace back to the big 2005 merger between Mitsubishi Tokyo Financial Group and UFJ Holdings. This created what would become Japan's most substantial financial institution. This strategic combination positioned the company as a dominant force in Asian financial markets and established its foundation for global expansion.

The merger represented one of the most significant financial sector combinations in Japanese history. It combined decades of banking expertise and market presence from both legacy institutions. The company's business model centers on providing complete financial services across the entire investment value chain.

According to MUFG Investor Services, their approach covers fund administration and asset servicing. They extend support to back-office, middle-office, and front-office operations. Their service portfolio includes fund financing, traditional banking services, securities lending, custody solutions, and foreign exchange overlay services.

The institution is also developing innovative payment solutions. This shows its commitment to evolving financial technology landscapes. MUFG's operational philosophy emphasizes customized solutions built around client objectives, focusing on sustainable growth strategies.

This mufg review reveals that the company's strength lies in its ability to create tailored financial solutions rather than offering standardized products. This approach particularly appeals to institutional investors and large-scale financial operations requiring sophisticated, multi-faceted financial services rather than simple trading platforms.

Regulatory Landscape

Specific regulatory information was not detailed in available sources. MUFG operates as a major Japanese financial institution subject to relevant Japanese financial regulations and international compliance standards where applicable.

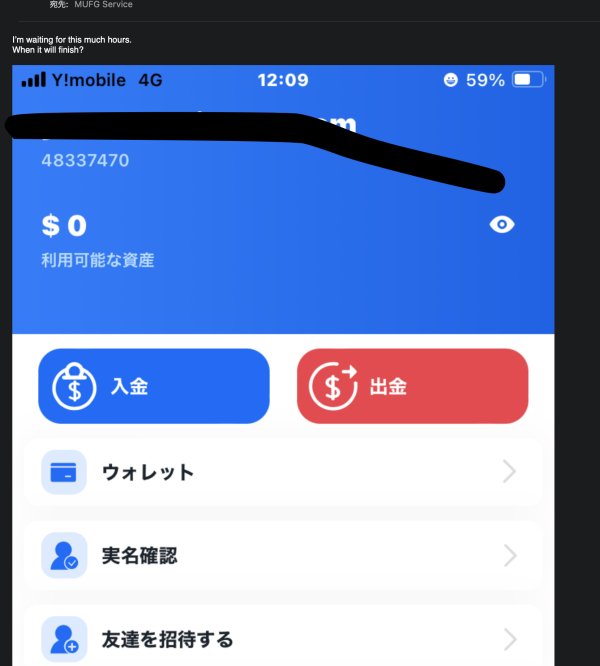

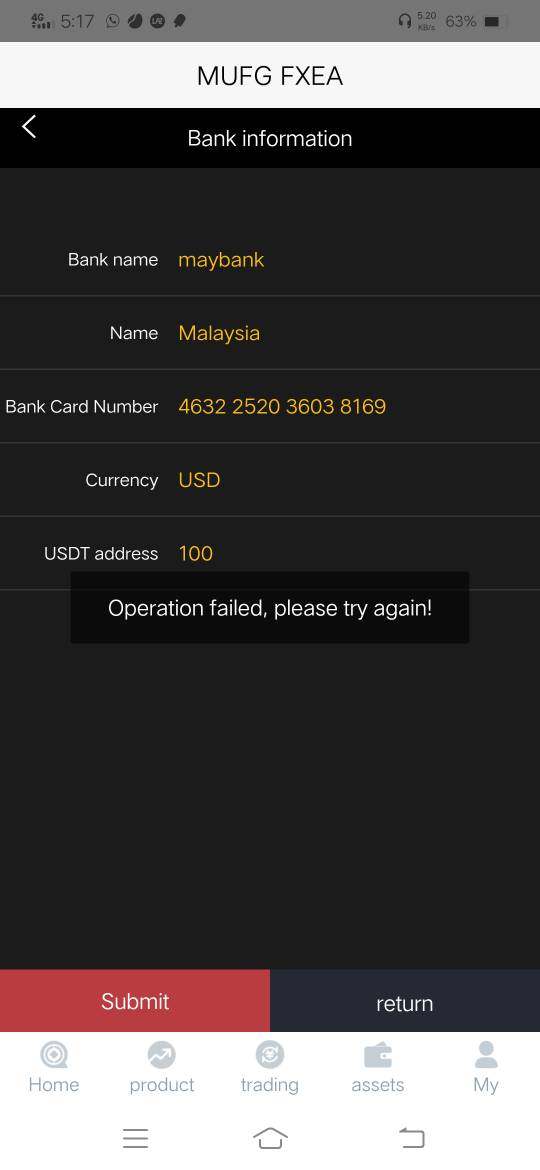

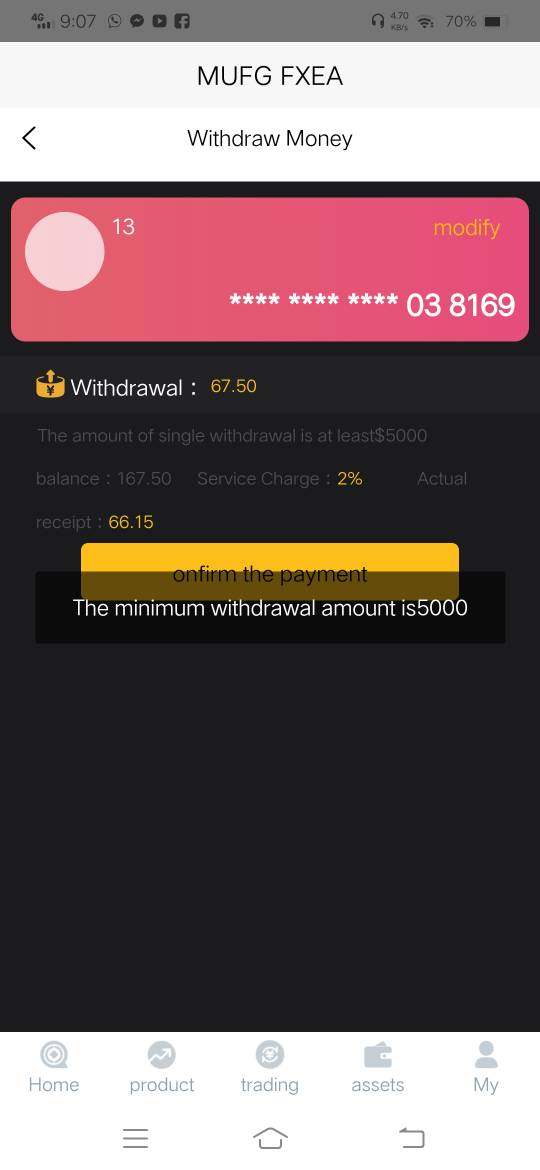

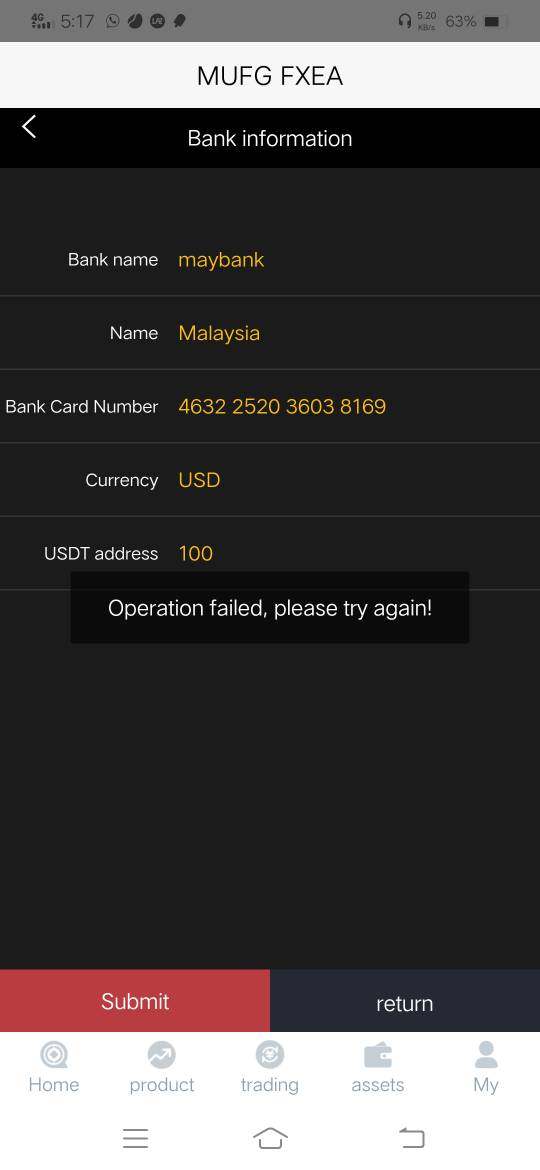

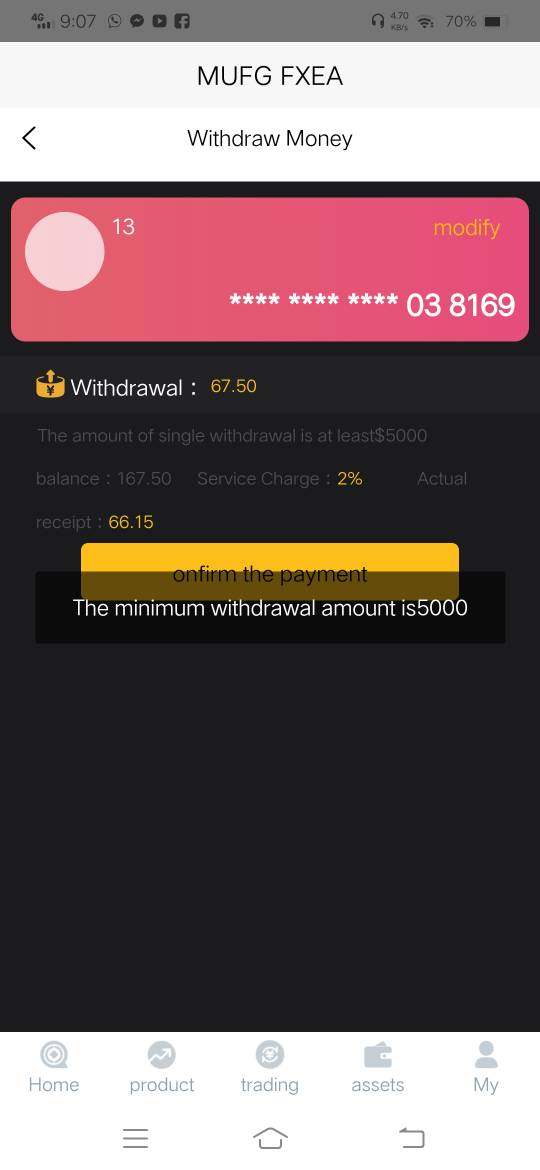

Funding and Withdrawal Methods

Detailed information regarding deposit and withdrawal mechanisms was not specified in available source materials.

Minimum Deposit Requirements

Specific minimum deposit thresholds were not mentioned in accessible documentation.

Current bonus or promotional programs were not detailed in the reviewed materials.

Available Assets

While comprehensive financial services are mentioned, specific tradeable assets and instruments were not listed in source materials.

Cost Structure

Detailed fee schedules and cost breakdowns were not provided in available information sources.

Leverage Options

Specific leverage ratios and margin requirements were not detailed in accessible materials.

Particular trading platforms and technological infrastructure details were not specified in source documentation.

Geographic Restrictions

Specific regional limitations were not outlined in available materials.

Customer Support Languages

Supported languages for customer service were not specified in reviewed sources.

This mufg review acknowledges that while MUFG's institutional presence is well-established, many operational specifics require direct consultation with company representatives for comprehensive details.

Detailed Rating Analysis

Account Conditions Analysis

MUFG's account structure reflects its institutional focus. Specific account types and their characteristics were not detailed in available source materials. The company's emphasis on customized solutions suggests that account conditions are likely tailored to individual client needs rather than following standardized retail trading account models.

This approach typically benefits larger institutional clients who require specialized arrangements. However, it may present challenges for smaller investors seeking straightforward account options. The absence of detailed minimum deposit information indicates that MUFG likely operates with significant entry thresholds consistent with institutional service providers.

Account opening procedures presumably involve comprehensive due diligence processes typical of major financial institutions. Specific requirements were not outlined in accessible materials. The lack of mentioned special account features such as Islamic-compliant options suggests either limited retail focus or specialized arrangements handled through direct consultation.

For this mufg review, the account conditions receive a neutral assessment due to insufficient specific information. The institutional nature of services suggests robust but potentially complex account structures suited for sophisticated investors rather than retail traders.

MUFG's comprehensive service portfolio suggests substantial analytical and operational tools. Specific trading tools and their quality parameters were not detailed in available documentation. The company's mention of supporting the entire investment value chain implies access to institutional-grade research and analysis resources, though particular offerings were not listed.

Educational resources and training materials were not specifically mentioned in source materials. This suggests that MUFG may focus more on direct client consultation rather than self-service educational platforms. This approach aligns with institutional service models where personalized guidance takes precedence over standardized educational content.

Automated trading support capabilities were not detailed in accessible information. The company's technological development initiatives, including emerging payment solutions, suggest ongoing platform enhancement efforts. The institutional focus implies that any automated trading features would likely be sophisticated but potentially complex for retail users.

Customer Service and Support Analysis

Customer service quality indicators were not specifically detailed in available source materials. The 58% employee recommendation rate provides some insight into internal satisfaction levels that may correlate with client service quality. The institutional nature of MUFG's operations suggests that customer support likely follows high-touch, relationship-based service models rather than standardized retail support structures.

Response times and service quality metrics were not provided in accessible documentation. This makes specific performance assessment challenging. However, major financial institutions typically maintain comprehensive support structures, though these may be geared toward institutional clients with different expectations than retail traders.

Multilingual support capabilities and service hours were not specified in reviewed materials. MUFG's global operations suggest international service capabilities. The lack of detailed customer service information reflects the institutional focus where service arrangements are typically customized rather than standardized.

Trading Experience Analysis

Platform stability and execution quality metrics were not detailed in available source materials. MUFG's established institutional presence suggests robust technological infrastructure. The company's focus on comprehensive financial services rather than specific trading platforms indicates that trading experience may be delivered through institutional-grade systems rather than retail-focused trading interfaces.

Order execution quality and platform functionality details were not provided in accessible documentation. This makes specific performance assessment difficult. However, the institutional service model typically emphasizes reliability and comprehensive functionality over user-friendly retail trading features.

Mobile trading experience and platform accessibility were not mentioned in source materials. This suggests that MUFG may prioritize institutional desktop solutions over mobile retail trading applications. This mufg review notes that trading experience assessment is limited by available information, though institutional service standards typically ensure robust execution capabilities.

Trust and Reliability Analysis

MUFG's trust profile is anchored by its position as Japan's largest financial institution. Specific regulatory credentials were not detailed in available source materials. The company's 2005 establishment through a major merger of established financial institutions provides historical credibility, though recent performance indicators show some areas of concern.

Fund safety measures and security protocols were not specifically outlined in accessible documentation. Major financial institutions typically maintain comprehensive security standards. Company transparency regarding operations and financial health was not detailed in reviewed materials, limiting specific transparency assessment.

Industry reputation appears solid based on the company's market position. The 3% decline in internal ratings over the past 12 months suggests some operational challenges. Negative event handling and crisis management capabilities were not detailed in available information, though institutional-scale operations typically maintain comprehensive risk management protocols.

User Experience Analysis

Overall user satisfaction metrics show mixed results. The 58% employee recommendation rate provides moderate confidence in internal satisfaction levels. While this doesn't directly measure client satisfaction, employee sentiment often correlates with service quality and organizational effectiveness.

The 3% decline in ratings over the past 12 months indicates some deterioration in user experience or operational performance. Interface design and usability characteristics were not detailed in available source materials, though institutional service models typically prioritize functionality over consumer-friendly design elements. Registration and verification processes were not specified, though major financial institutions typically maintain comprehensive onboarding procedures that may be complex but thorough.

Fund operation experience and transaction processing details were not provided in accessible documentation. This limits specific user experience assessment. Common user complaints were not detailed in reviewed materials, though the declining rating trend suggests some areas of user dissatisfaction that warrant monitoring.

Conclusion

MUFG presents a mixed profile as a financial service provider. Its strength lies in institutional credibility and comprehensive service offerings, while facing challenges indicated by declining internal satisfaction metrics. The 58% employee recommendation rate suggests reasonable internal confidence, though the 3% rating decline over the past 12 months indicates areas requiring attention.

This institution appears most suitable for investors seeking stable, institutional-grade financial services rather than cutting-edge retail trading experiences. The primary advantages include MUFG's established market position as Japan's largest financial group and its comprehensive service portfolio spanning the entire investment value chain. However, the recent rating decline and limited transparency regarding specific service parameters present notable concerns for potential clients seeking detailed operational information before engagement.