Bright Review 1

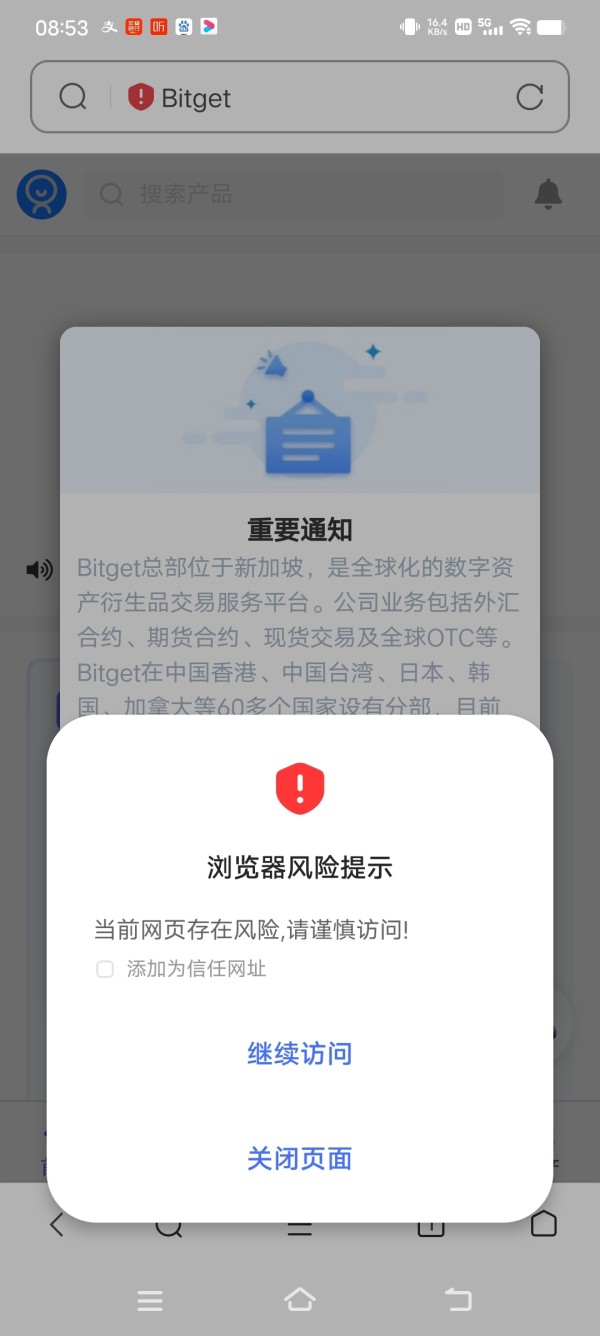

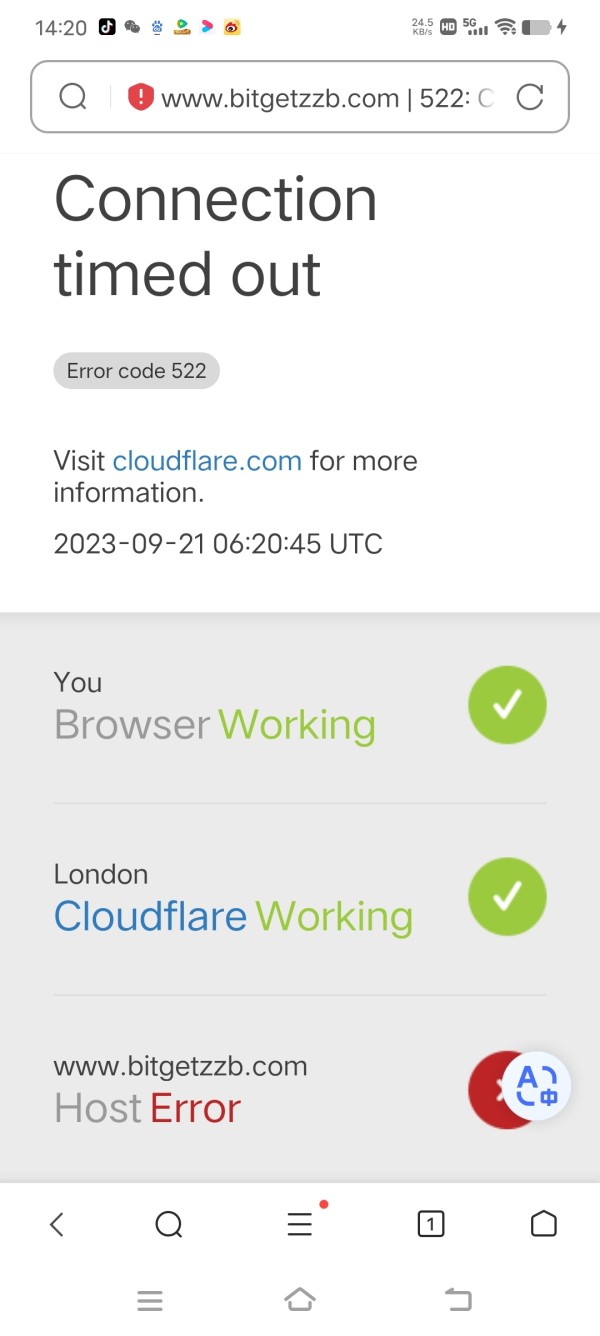

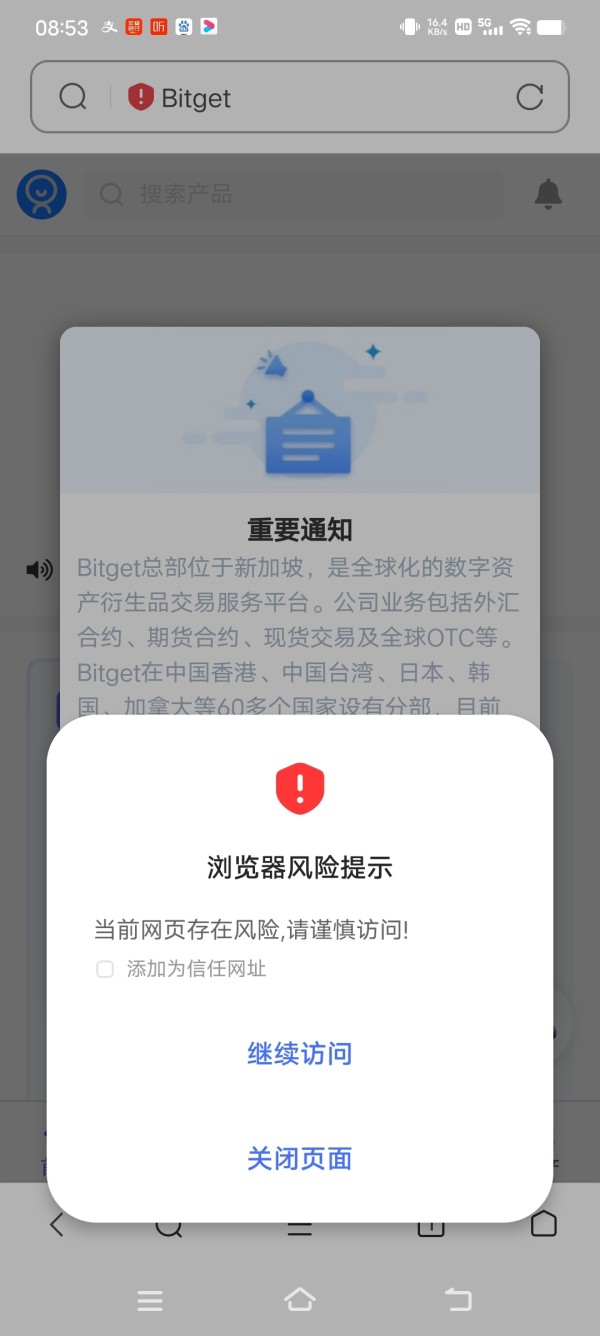

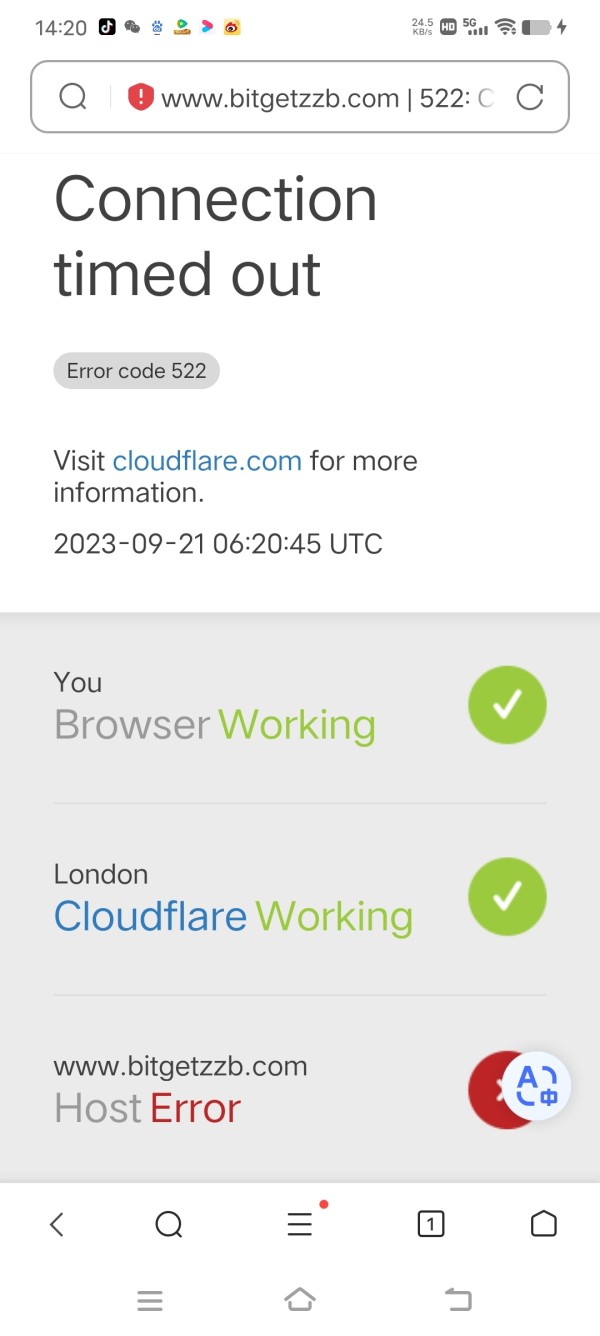

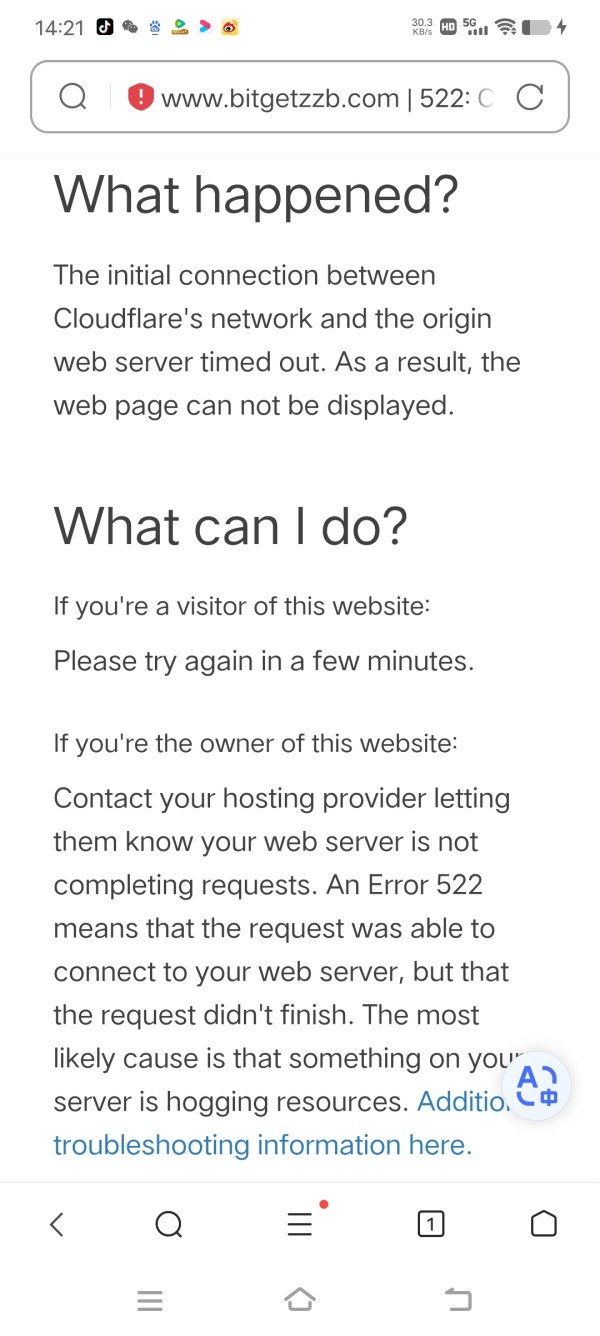

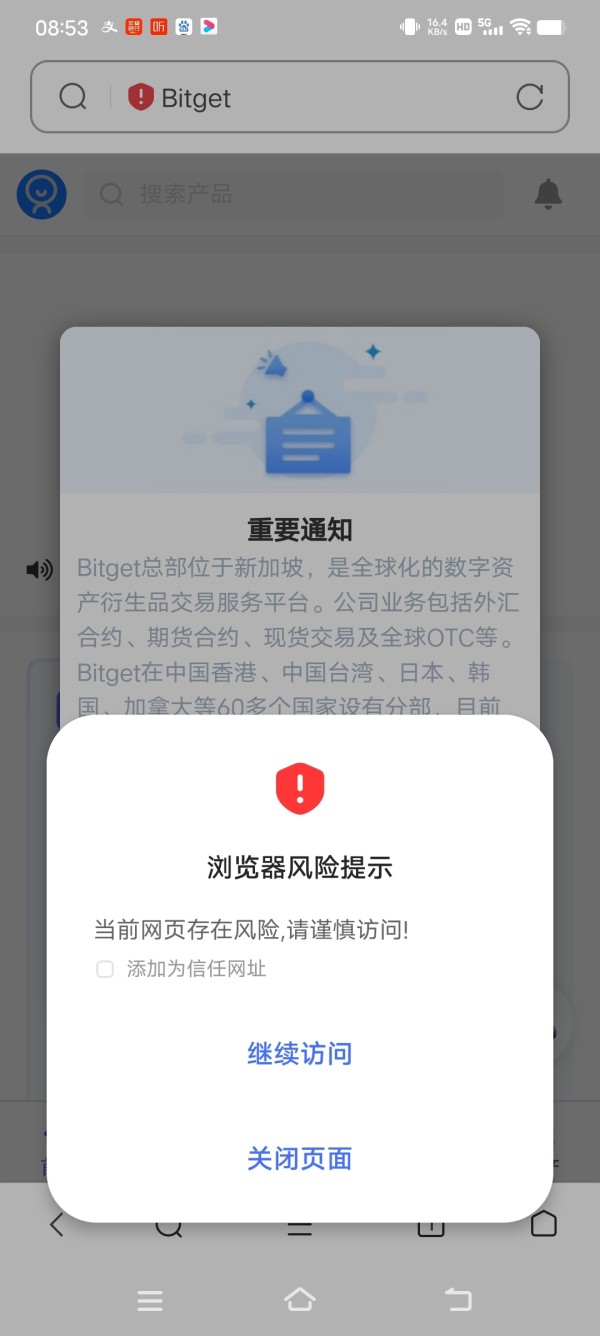

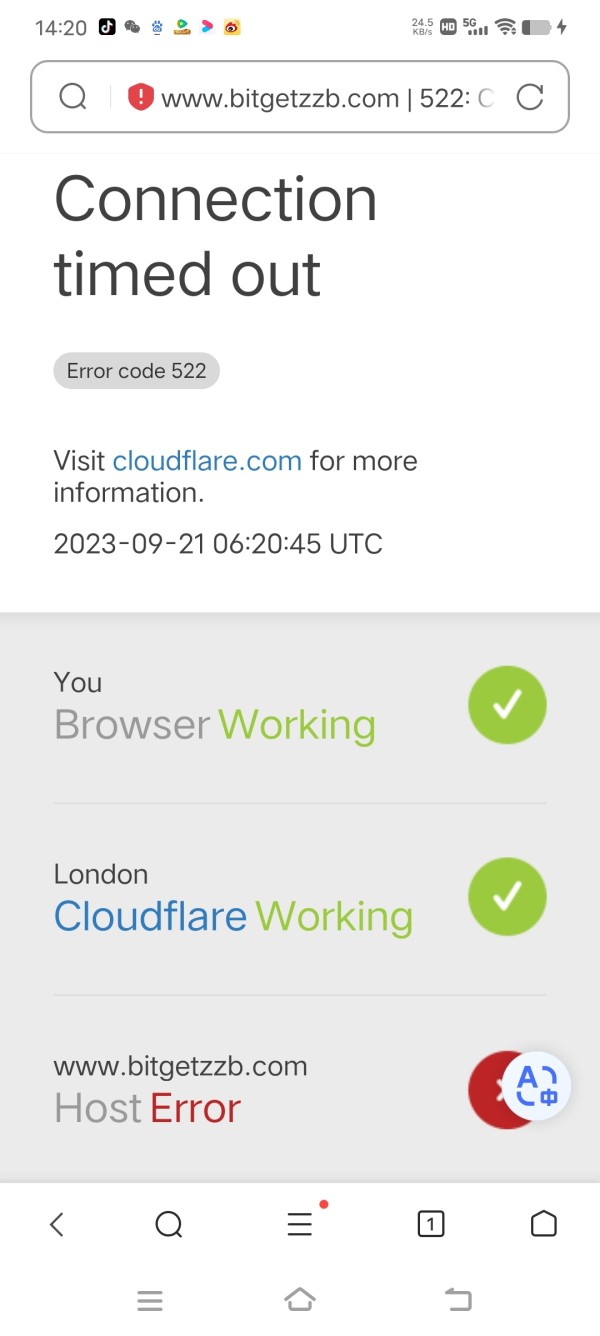

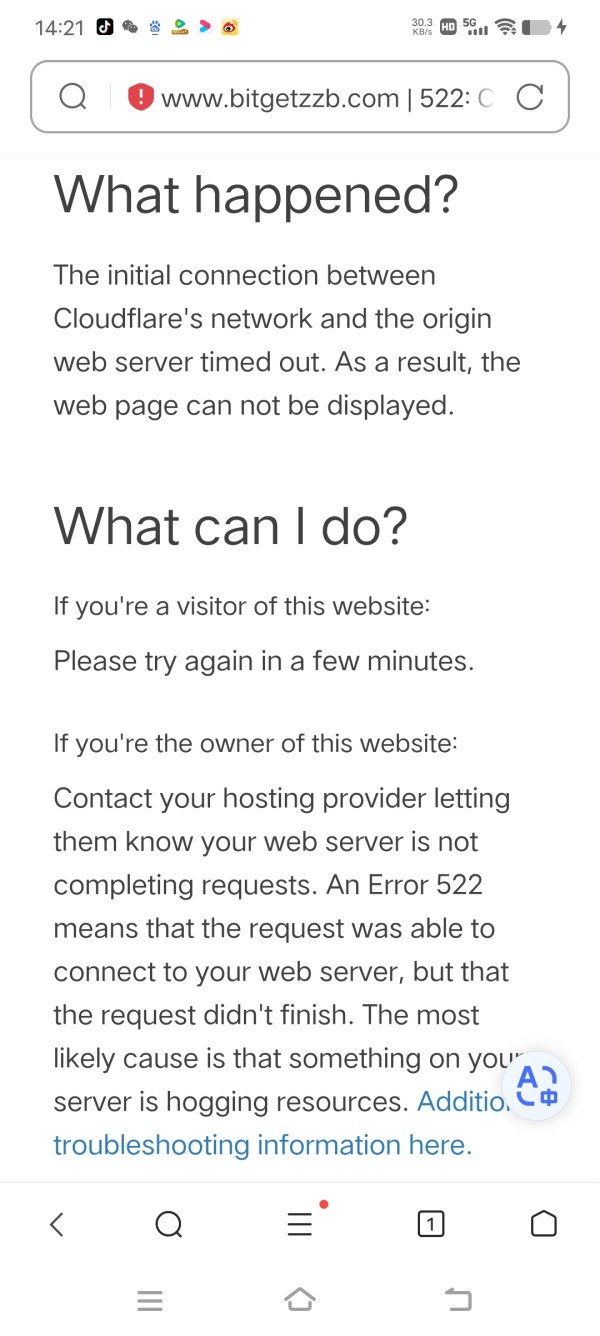

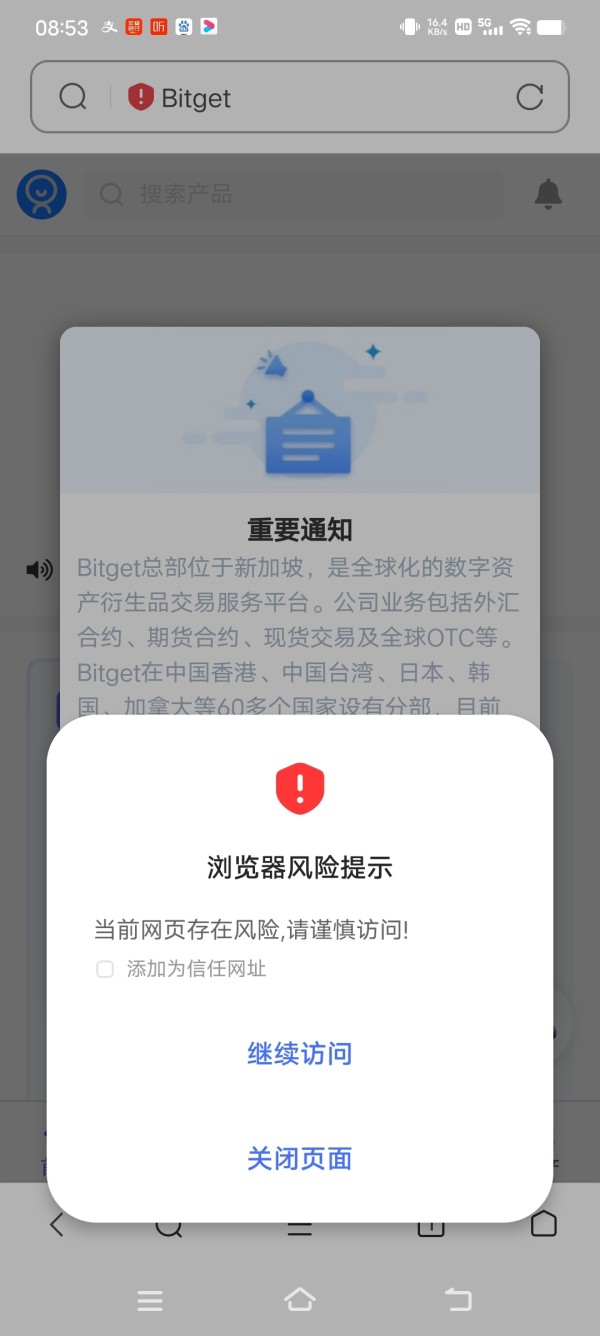

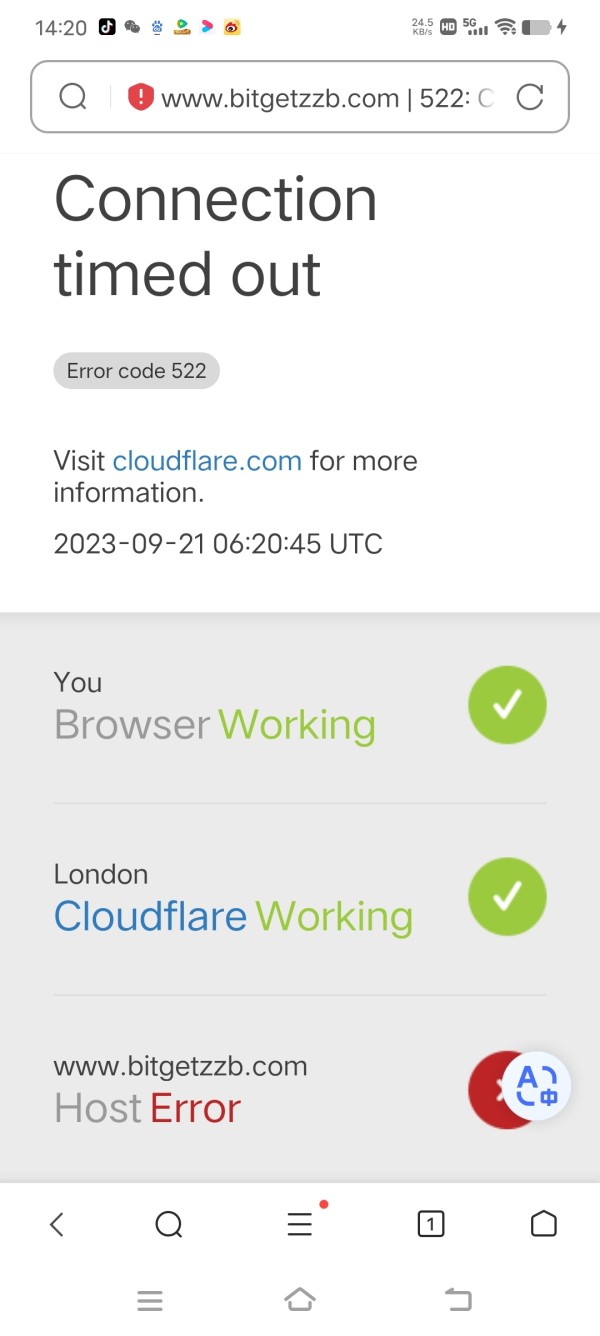

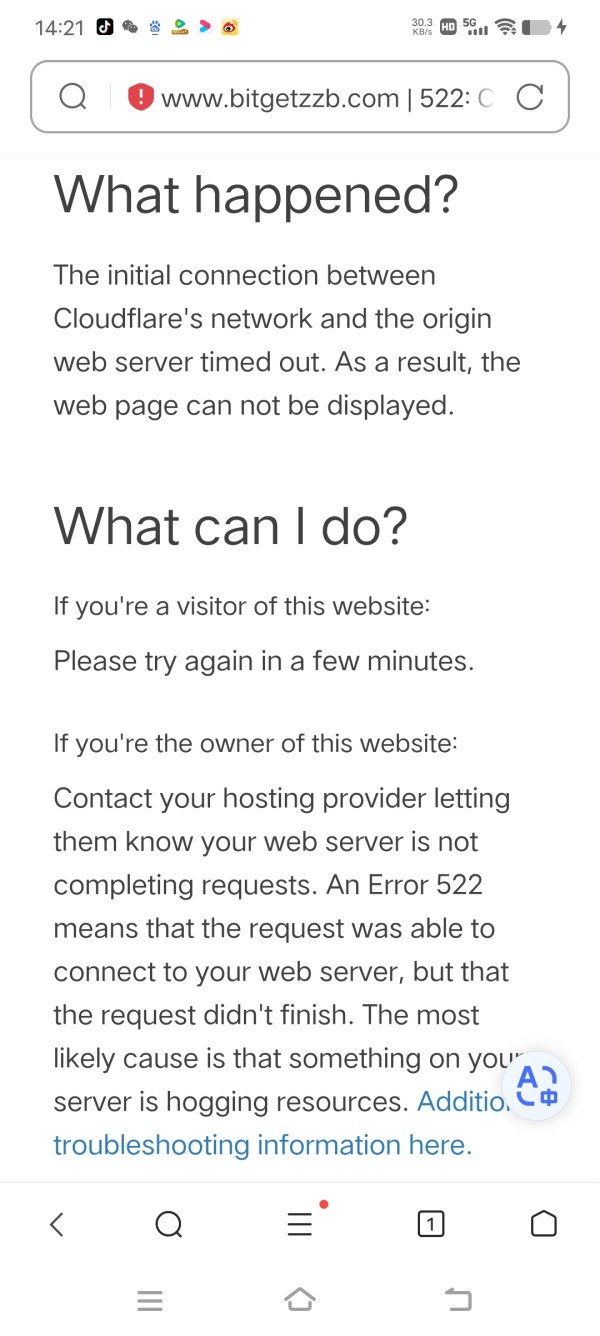

I still have 1,658 US dollars in this foreign exchange exchange. I submitted a withdrawal application and it has been under review for two days. The exchange website cannot be opened today!

Bright Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I still have 1,658 US dollars in this foreign exchange exchange. I submitted a withdrawal application and it has been under review for two days. The exchange website cannot be opened today!

Bright Broker and Bright Finance present a landscape rife with potential yet fraught with risks that savvy investors should carefully consider. The platforms promise a range of trading instruments, appealing particularly to experienced traders seeking exposure to diverse markets like stocks, futures, options, and forex. However, the allure of these offerings is significantly overshadowed by serious regulatory concerns that indicate not just the absence of oversight but potential scams linked to each platform.

While Bright Broker operates under some regulation in Hong Kong through the Securities and Futures Commission (SFC), Bright Finance lacks any credible regulatory backing, receiving warnings from multiple authorities about its operations. Investors interested in these platforms must weigh the potential rewards against the underlying risks, particularly concerning fund safety and withdrawal difficulties. Those lacking experience or seeking stringent regulatory compliance would undoubtedly be better served elsewhere.

Caution is advised when considering both Bright Broker and Bright Finance. Here are crucial steps to protect yourself:

| Dimension | Rating (/5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Multiple regulatory warnings and a low trust score indicate high risk. |

| Trading Costs | 2 | Competitive trading costs but high non-trading fees and withdrawal issues exist. |

| Platforms & Tools | 3 | Offers some tools but lacks popular platforms like MetaTrader 4. |

| User Experience | 2 | Mixed reviews regarding speed and reliability of services. |

| Customer Support | 2 | Reports of poor response times from customer support reported by users. |

| Account Conditions | 2 | High minimum deposits and limited account options create barriers for entry. |

Founded in 1994, Bright Broker is a Hong Kong-based entity licensed under the SFC, focusing on a diverse suite of trading options including stocks, futures, options, and forex. On the other hand, Bright Finance operates without any substantive regulatory oversight, claiming various international registrations while facing significant scrutiny from bodies such as the FCA and AMF. This level of obscurity jeopardizes investor trust and highlights potential scam risks.

Bright Broker offers three types of accounts with a minimum deposit starting at $100, trading on a well-known platform, MetaTrader 4. In contrast, Bright Finance has five account types, each requiring hefty initial deposits, starting at $250, yet provides limited transparency regarding trading conditions, fees, or support. The former has actual market regulation, whereas the latter operates unregulated, raising red flags for potential investors.

| Details | Bright Broker | Bright Finance |

|---|---|---|

| Regulation | SFC (Hong Kong) | Unregulated |

| Minimum Deposit | $100 | $250 |

| Leverage | Low, specifics not disclosed | Not disclosed |

| Major Fees | Competitive trading fees, high withdrawal fees | Unclear, possibly high non-trading fees |

| Withdrawal Issues | Some reports of delays | Frequent complaints about difficulties |

Analyzing the regulatory landscape surrounding Bright Broker and Bright Finance unearths significant contrast in their trustworthiness. Bright Broker, regulated by the Hong Kong SFC, suggests a degree of operational legitimacy. In stark contrast, Bright Finance has received numerous warnings from regulators including the FCA and AMF due to its unregulated nature and vague corporate claims.

"Deposited $250 but was unable to withdraw when I needed my funds back. Support just stopped replying." – Anonymous User

The trading costs associated with Bright Broker appear attractive at first; however, dissecting the broader cost structure reveals potential traps.

Bright Broker predominantly utilizes the popular MT4 platform, which is favored among traders for its comprehensive suite of trading tools, whereas Bright Finance operates a proprietary web-based platform with basic functionality.

"Trading on Bright Finance feels like using a demo version. Barely any tools!" – Anonymous User

When it comes to user experience, Bright Broker enjoys better feedback and rapport due to its reliable resources and user-friendly interfaces. In contrast, Bright Finance encounters a slew of complaints ranging from ineffective support to poor functionality.

"I was thrilled with my trading on Bright Broker; withdrawals were manageable and customer support responsive." – Bright Broker User

"Tried to reach out to Bright Finance multiple times; no one ever answered." – Bright Finance User

Quality customer support is crucial in the forex market, a dimension that presents a stark contrast between the two brokers.

"Bright Broker's support was always quick to answer my queries, making trading smoother." – Happy User

"With Bright Finance, I've sent multiple emails with zero replies. Feels like they just want my money." – Frustrated User

Bright Broker provides reasonable account conditions relative to industry standards, whereas Bright Finance's limited visibility makes it challenging to assess the true cost and environment of trading.

"Bright Finance's starting deposit requirements scared me away. I demand clarity before commiting large funds." – Concerned Trader

Given the landscape surrounding Bright Broker and Bright Finance, it is clear that while investment opportunities exist, they come shrouded in significant risks. Experienced traders may navigate these waters with cautiously curated strategies, but for newcomers or risk-averse investors, the consequences of engaging with these platforms could be dire. Regulatory scrutiny, hidden fees, and problematic withdrawal experiences loom large over this brokerage duo, suggesting that potential investors would benefit from considering more established and regulated platforms. In trading, vigilance is as crucial as strategy; ensure thorough research and careful consideration before proceeding with any investment decisions regarding Bright.

FX Broker Capital Trading Markets Review