Monfex 2025 Review: Everything You Need to Know

Executive Summary

This Monfex review gives you a complete look at a cryptocurrency trading platform that has gotten mixed reactions from traders. Monfex shows itself as a broker that targets retail investors who want to trade cryptocurrency, and it offers zero-fee trading as its main selling point.

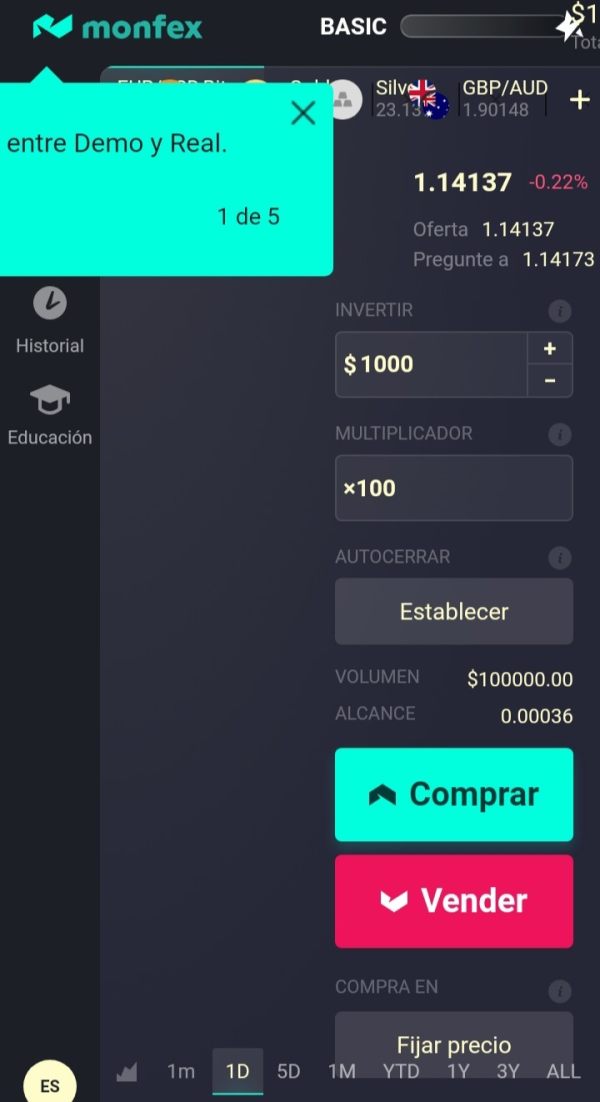

Monfex's key features include commission-free trading across more than 12 different cryptocurrencies and leverage options up to 50x. The platform focuses only on cryptocurrency markets, which makes it a specialized service for digital asset trading. However, WikiFX reports show that the broker's score has been cut because of too many complaints, which raises concerns about service quality and user satisfaction.

The platform mainly targets retail investors who want exposure to cryptocurrency markets without traditional commission structures. While the zero-fee trading model may look attractive to cost-conscious traders, the lack of detailed regulatory information and the concerning user feedback patterns suggest potential traders should be careful when considering this broker.

Our analysis shows significant information gaps about fundamental aspects such as regulatory oversight, company background, and comprehensive user support systems, which are crucial factors for trader confidence and security.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. The analysis does not involve personal trading experience with Monfex.

Traders should know that broker services and conditions may vary across different regions, and regulatory requirements may differ based on geographical location. The information presented in this review reflects the most current data available at the time of writing.

However, broker terms, conditions, and services may change without notice. Potential clients are advised to verify all information directly with the broker before making any trading decisions.

Rating Framework

Broker Overview

Monfex operates as a cryptocurrency-focused trading platform, though specific details about its establishment date and corporate background remain unclear. The broker has positioned itself within the competitive cryptocurrency trading market by emphasizing a zero-commission trading model.

This approach distinguishes it from many traditional brokers that charge trading fees. The company's primary business model revolves around cryptocurrency trading services, supporting over 12 different digital currencies.

This specialization suggests Monfex targets traders specifically interested in cryptocurrency markets rather than offering a diversified range of traditional financial instruments like forex, stocks, or commodities. The platform offers leverage up to 50 times the initial investment, which can significantly amplify both potential profits and losses for traders.

This high leverage ratio places Monfex among the more aggressive offerings in the cryptocurrency trading space, appealing to traders seeking enhanced market exposure with smaller capital requirements. However, this Monfex review must note that crucial information regarding regulatory oversight, company registration details, and comprehensive operational background remains limited in publicly available sources.

This lack of transparency may concern potential clients who prioritize regulatory compliance and corporate accountability when selecting a trading platform.

Regulatory Status: Available documentation does not provide clear information about Monfex's regulatory status or oversight by recognized financial authorities. This absence of regulatory clarity represents a significant concern for traders prioritizing compliance and protection.

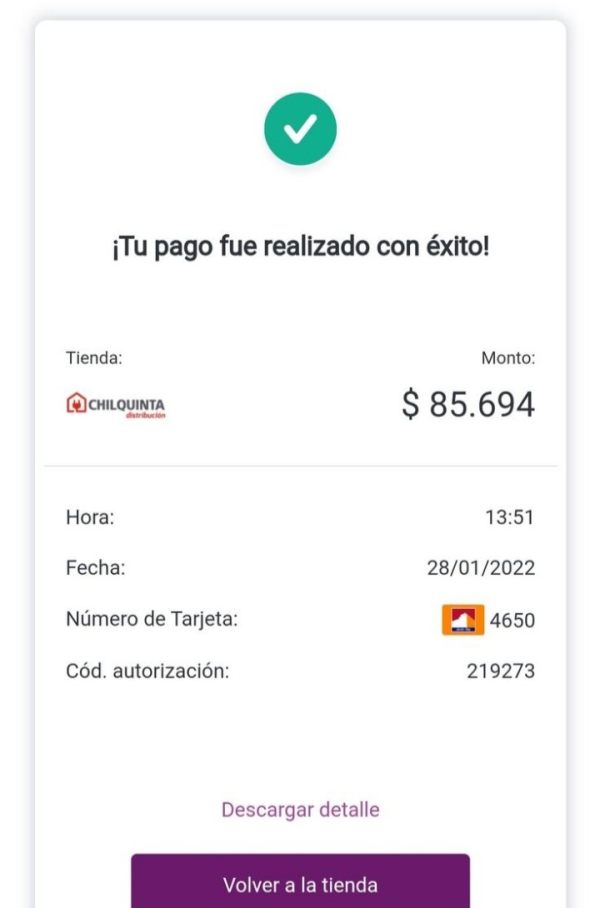

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: The platform's minimum deposit requirements are not specified in accessible documentation. This makes it difficult for potential clients to assess entry barriers.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in available information sources.

Tradeable Assets: Monfex supports trading in more than 12 different cryptocurrencies, focusing exclusively on digital asset markets rather than traditional financial instruments.

Cost Structure: The broker advertises zero-commission trading, though specific details about spreads, overnight fees, or other potential charges are not comprehensively outlined in this Monfex review.

Leverage Options: Maximum leverage of 50x is available. This provides significant amplification potential for cryptocurrency positions.

Platform Options: Specific information about trading platform types, mobile applications, or web-based interfaces is not detailed in available sources.

Geographic Restrictions: Regional availability and restrictions are not clearly specified in accessible documentation.

Customer Support Languages: Available support languages and communication channels are not detailed in current information sources.

Account Conditions Analysis

The account conditions offered by Monfex present a mixed picture for potential traders. The zero-commission trading structure represents the platform's primary competitive advantage, potentially saving traders significant costs compared to traditional fee-based brokers.

This cost structure could particularly benefit high-frequency traders or those working with smaller account balances where commission fees might otherwise erode profits. The availability of up to 50x leverage provides substantial amplification potential for cryptocurrency positions.

While this high leverage ratio can enhance profit opportunities, it simultaneously increases risk exposure significantly. Experienced traders may appreciate this flexibility, but novice traders should understand the substantial risk implications before utilizing maximum leverage options.

However, this Monfex review identifies concerning gaps in account condition transparency. Specific details about account types, minimum deposit requirements, and account opening procedures are not clearly outlined in available documentation.

The absence of information about different account tiers, special features for various client categories, or Islamic account options limits potential clients' ability to assess suitability. Furthermore, the lack of detailed information about account protection measures, such as negative balance protection or segregated client funds, raises questions about trader security.

These omissions, combined with the concerning complaint patterns mentioned in WikiFX reports, suggest potential clients should seek additional clarification directly from the broker before committing funds.

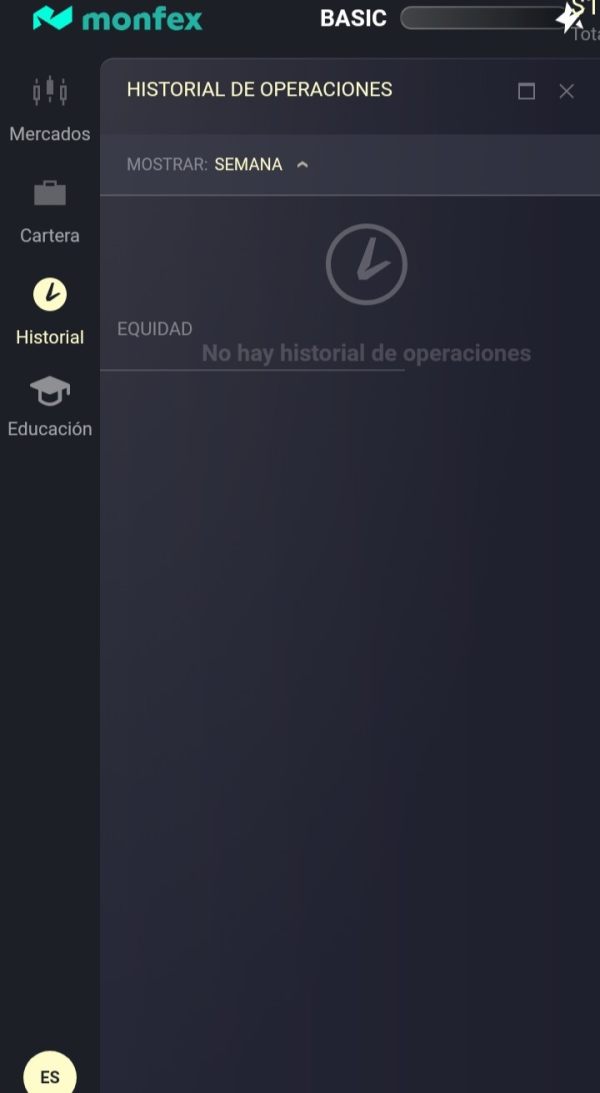

The evaluation of Monfex's trading tools and resources reveals significant information limitations that hinder comprehensive assessment. Available documentation does not provide detailed information about the specific trading platforms offered, their features, or technological capabilities.

This lack of transparency makes it difficult for traders to evaluate whether the platform meets their technical requirements and trading style preferences. Research and analysis resources, which are crucial for informed cryptocurrency trading decisions, are not detailed in accessible information sources.

The absence of market analysis, economic calendars, trading signals, or educational content descriptions suggests either limited offerings in these areas or insufficient promotional communication about available resources. Educational resources, particularly important for cryptocurrency trading given market volatility and complexity, are not mentioned in available documentation.

The lack of information about webinars, tutorials, market guides, or trading education materials may indicate limited support for trader development and skill enhancement. Automated trading support, including expert advisors, algorithmic trading capabilities, or API access for advanced users, is not addressed in current information sources.

These features are increasingly important for serious cryptocurrency traders seeking to implement sophisticated trading strategies or maintain market presence across multiple time zones.

Customer Service and Support Analysis

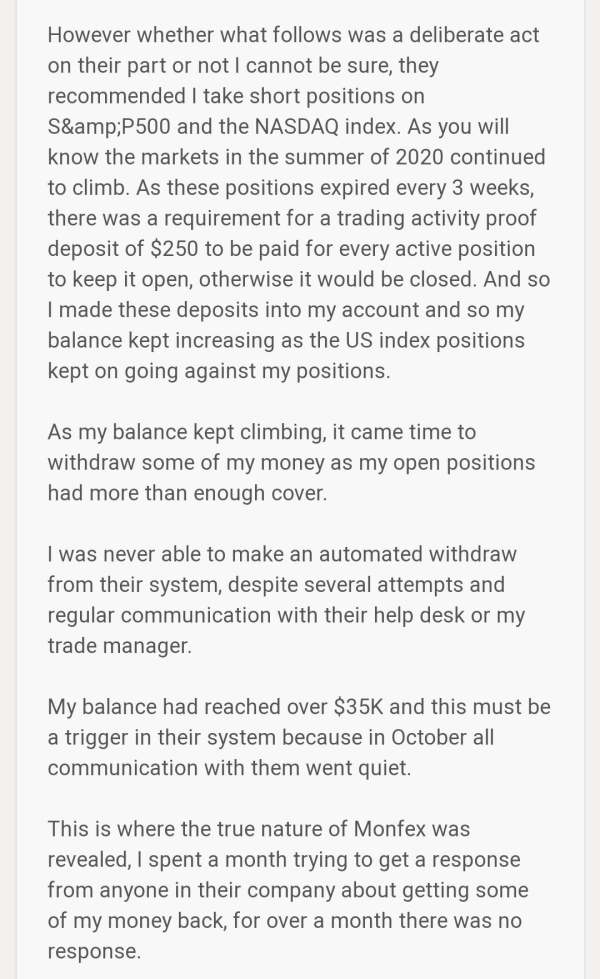

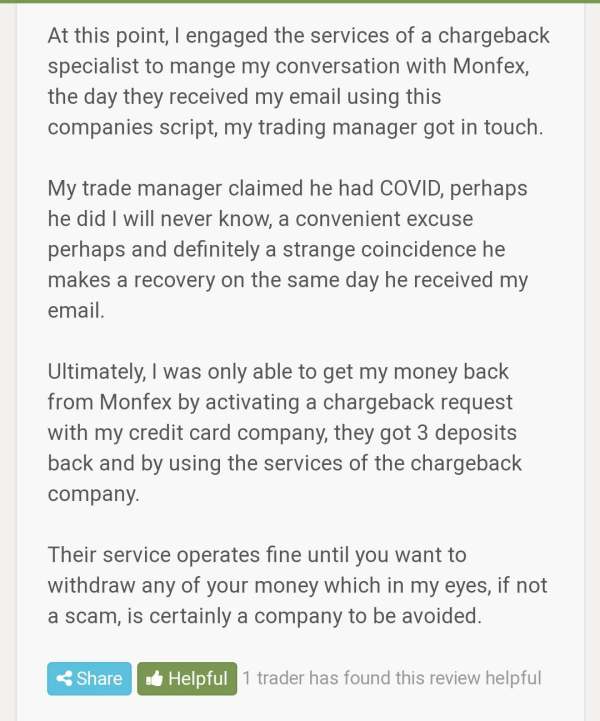

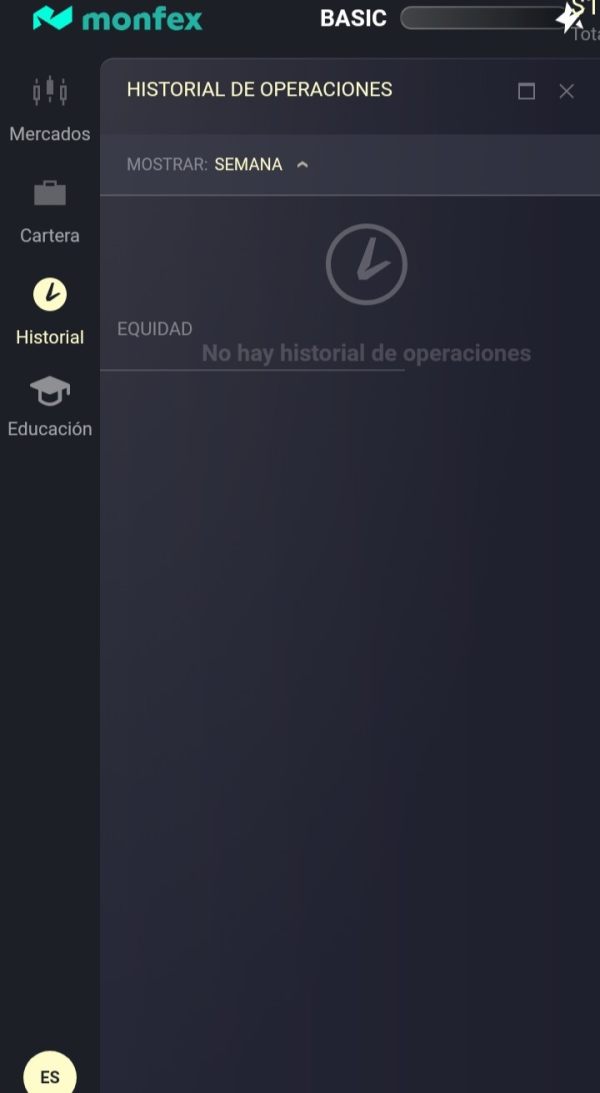

Customer service quality emerges as a significant concern in this analysis. WikiFX reports indicate that Monfex's rating has been reduced specifically due to excessive complaints, suggesting systemic issues with customer support effectiveness or service delivery.

This pattern of complaints raises serious questions about the broker's ability to address client concerns satisfactorily. The lack of detailed information about customer service channels, availability hours, and response times further compounds these concerns.

Professional trading environments require reliable, accessible customer support, particularly for cryptocurrency trading where market conditions can change rapidly and technical issues may require immediate resolution. Multi-language support capabilities are not specified in available documentation, potentially limiting accessibility for international traders.

Given the global nature of cryptocurrency markets, comprehensive language support is often expected from reputable brokers serving diverse client bases. The absence of information about dedicated account management, technical support specialization, or escalation procedures suggests potential limitations in service sophistication.

These service gaps, combined with the concerning complaint patterns, indicate that customer support may represent a significant weakness in Monfex's service offering.

Trading Experience Analysis

The trading experience evaluation reveals both potential advantages and significant uncertainties. The zero-commission trading model could enhance the trading experience by reducing transaction costs, particularly beneficial for active traders who execute multiple positions.

Combined with the availability of 50x leverage, this cost structure may appeal to traders seeking maximum capital efficiency. However, crucial aspects of trading experience remain unclear due to limited available information.

Platform stability, execution speed, and order processing quality are not detailed in accessible sources. These factors are fundamental to successful trading, particularly in volatile cryptocurrency markets where rapid price movements require reliable platform performance.

The absence of information about platform features, charting capabilities, order types, and risk management tools makes it difficult to assess whether Monfex provides a comprehensive trading environment. Modern traders expect sophisticated analytical tools, customizable interfaces, and advanced order management capabilities that are not described in available documentation.

Mobile trading experience, increasingly important for cryptocurrency markets that operate continuously, is not addressed in current information sources. The lack of details about mobile applications, responsive web platforms, or cross-device synchronization capabilities represents another gap in this Monfex review that potential clients should investigate independently.

Trust and Reliability Analysis

Trust and reliability represent perhaps the most concerning aspects of this evaluation. The absence of clear regulatory information immediately raises questions about oversight, compliance standards, and client protection measures.

Reputable brokers typically provide transparent information about regulatory licenses, supervisory authorities, and compliance frameworks. The WikiFX report indicating score reduction due to excessive complaints suggests patterns of client dissatisfaction that may reflect underlying operational or service delivery issues.

This concerning feedback pattern, combined with limited regulatory transparency, creates significant trust challenges for potential clients. Fund security measures, including client money segregation, deposit insurance, and operational risk management, are not detailed in available information.

These protections are fundamental expectations for financial service providers and their absence from promotional or informational materials raises serious concerns about client asset security. Corporate transparency, including company registration details, management information, and operational history, remains limited in accessible sources.

This lack of transparency contrasts sharply with industry standards where reputable brokers provide comprehensive corporate information to build client confidence and demonstrate accountability.

User Experience Analysis

User experience assessment is significantly hampered by the limited availability of detailed user feedback and satisfaction metrics. While WikiFX reports concerning complaint patterns, specific details about user satisfaction levels, common issues, or positive experiences are not comprehensively available in current information sources.

The target user profile appears to focus on retail investors interested in cryptocurrency trading, particularly those attracted to zero-commission structures. However, without detailed user feedback, it's difficult to assess whether the platform successfully serves this demographic or meets their specific needs and expectations.

Interface design and usability information is not available in current documentation, making it impossible to evaluate whether the platform provides intuitive navigation, efficient workflow, or user-friendly features. These aspects are crucial for trader productivity and satisfaction, particularly for less experienced users.

Registration and verification processes, which significantly impact initial user experience, are not detailed in available sources. The absence of information about account opening procedures, documentation requirements, or verification timelines represents another gap that potential clients must investigate independently before committing to the platform.

Conclusion

This comprehensive analysis reveals that Monfex presents a mixed proposition for cryptocurrency traders. While the zero-commission trading model and high leverage options may attract cost-conscious traders seeking enhanced market exposure, significant concerns about regulatory transparency, customer service quality, and overall trustworthiness cannot be overlooked.

The platform appears most suitable for experienced cryptocurrency traders who prioritize low trading costs and are comfortable navigating platforms with limited regulatory oversight. However, the concerning complaint patterns and lack of comprehensive information make it difficult to recommend Monfex for novice traders or those prioritizing security and regulatory compliance.

Key advantages include the zero-fee trading structure and support for multiple cryptocurrencies, while primary disadvantages encompass limited regulatory transparency, concerning user feedback patterns, and insufficient information about crucial operational aspects. Potential clients should conduct thorough due diligence and consider these factors carefully before making trading decisions.