VoloFinance 2025 Review: Everything You Need to Know

Executive Summary

This volofinance review shows a trading platform with serious problems. Many people say VoloFinance is a scam that steals money from traders who want to invest in forex, CFDs, and cryptocurrencies.

Users give VoloFinance terrible reviews. They rate it 1 out of 5 stars and warn others to stay away from this platform completely.

The company tricks people through social media ads. Hundreds or thousands of users have lost money to this platform, and the FCA has looked into their business practices.

VoloFinance targets people who want to trade forex and crypto. We strongly tell potential users to avoid this platform and choose regulated brokers instead.

This review will look at all parts of VoloFinance's business. We want to give traders the facts they need to make smart choices about their money.

Important Notice

This review uses public information and user stories from many sources. VoloFinance works without clear rules from government agencies, which makes it very risky for people who invest money.

We looked at user reviews, industry reports, and public records to write this review. The platform's bad reputation made it impossible for us to test their services directly or get official papers to check their claims.

Readers should know that information about unregulated brokers can be hard to find and might not be trustworthy. Always be careful when dealing with companies that don't have proper licenses from government agencies.

Rating Framework

Broker Overview

VoloFinance says it manages money and provides financial services online. The company hides important details about when it started, who owns it, and who runs the business.

This lack of clear information is very worrying for a financial company. Most legitimate brokers must follow strict rules and share basic facts about their business with customers and government agencies.

The platform has become famous for all the wrong reasons. Users across many review websites warn others to avoid VoloFinance completely because of fraud and theft.

The company finds customers through social media marketing. However, the service they provide fails to meet even basic standards that traders expect from legitimate brokers.

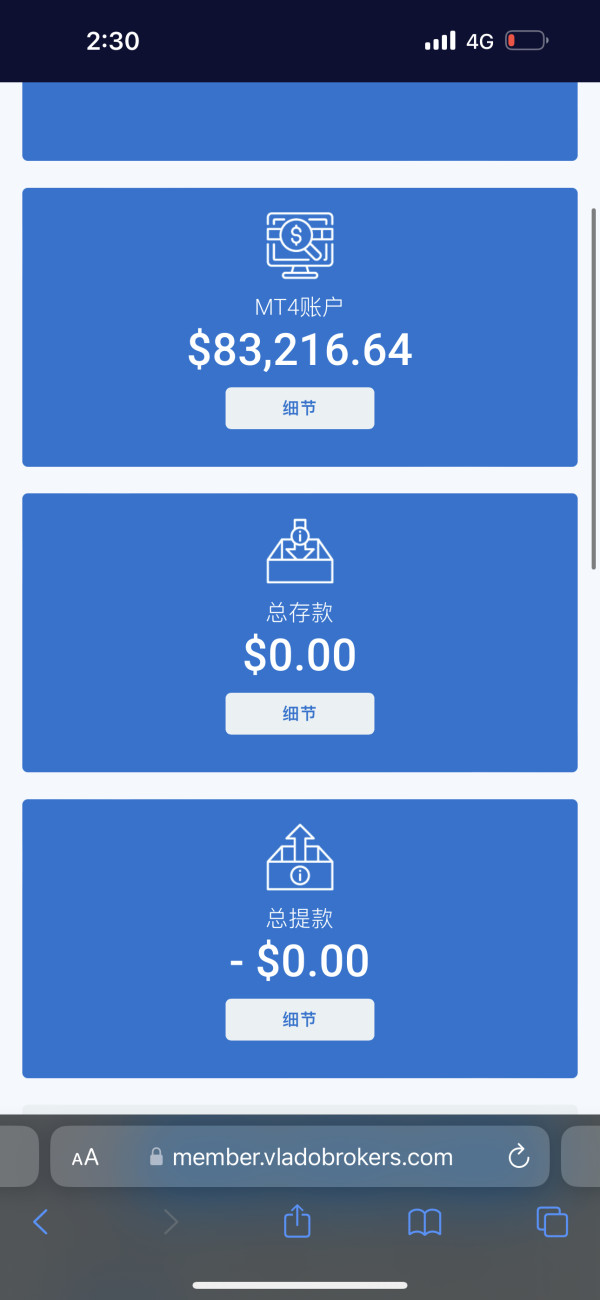

VoloFinance offers trading in forex, CFDs, and cryptocurrency markets. The platform has an online trading system, but they don't share details about the technology they use or whether it works with popular platforms like MetaTrader 4 or 5.

This volofinance review found no proof that major financial authorities have given them permission to operate. This missing approval is a huge red flag for any trading platform in today's regulated world.

Regulatory Status: We found no proof of valid licenses from recognized financial authorities. This missing oversight creates major risks for trader protection and money safety.

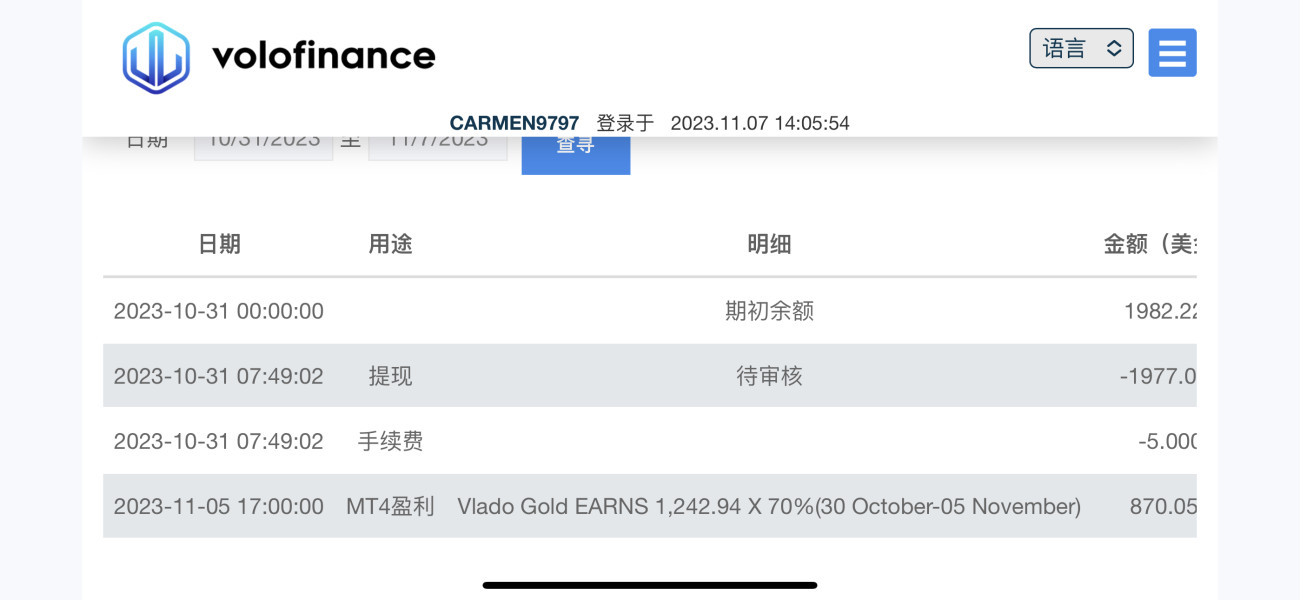

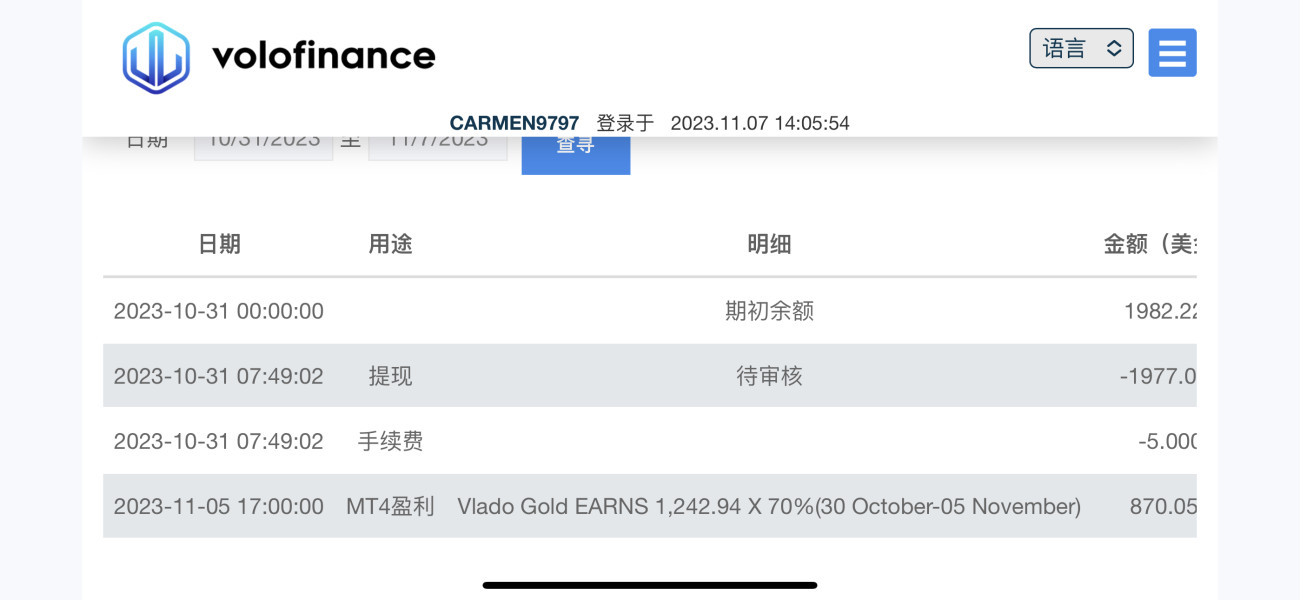

Deposit and Withdrawal Methods: The platform doesn't share clear information about payment methods, how long transfers take, or what fees they charge.

Minimum Deposit Requirements: VoloFinance has not told potential clients how much money they need to start trading. This makes it hard for people to understand what they need to begin.

Bonuses and Promotions: We found no information about special offers or bonus programs. Unregulated brokers often use fake promotions to trick new customers.

Tradeable Assets: The platform says it offers forex pairs, CFDs on various tools, and cryptocurrency trading. However, the specific choices and conditions remain unclear.

Cost Structure: Important details about spreads, fees, overnight charges, and other trading costs were not available. This represents a major failure in being honest with customers.

Leverage Ratios: The platform doesn't share specific leverage options. This information is essential for managing risk when trading.

Platform Options: They mention an online trading platform but don't give technical details, mobile access information, or reliability facts.

Geographic Restrictions: The platform doesn't clearly explain which countries can use their services. They also don't mention any related restrictions that might apply.

Customer Support Languages: We couldn't find information about what languages their support team speaks.

This volofinance review shows the worrying lack of basic honesty that regulated brokers normally provide to their clients.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

VoloFinance's account conditions represent one of the worst problems with this platform. Our research found no clear information about account types, their features, or the rules that control how they work.

This lack of honesty is shocking compared to legitimate trading platforms. It raises immediate warning signs about the company's business standards.

Real brokers usually give detailed information about different account levels and minimum deposit requirements. They also explain the specific benefits that come with each account type.

VoloFinance's failure to provide this basic information suggests either poor business practices or deliberate hiding of important terms. The missing information about Islamic accounts, which are standard offerings for brokers serving Muslim clients, shows the platform's lack of professional service standards.

User feedback points to major problems with account management. However, specific details about account opening processes, verification requirements, or account fees remain unknown.

The overwhelming negative user feelings suggest that whatever account conditions exist are either unfair to traders or are lied about during the signup process. The lack of honesty about account conditions makes it impossible for potential clients to make smart decisions about their trading setup.

This volofinance review found no proof of the detailed terms and conditions paperwork that regulated brokers must provide. This represents a basic failure in client service and following regulations.

VoloFinance's trading tools and resources appear very limited based on available information. The platform mentions providing an online trading system with access to multiple types of investments, but the specifics of what tools and analysis resources are actually available remain mostly hidden.

This lack of detailed information about trading tools is concerning for serious traders. Professional traders rely on complete analysis and execution abilities to make money in the markets.

The platform's mention of forex, CFD, and cryptocurrency trading suggests some level of market access. However, without details about charting abilities, technical indicators, economic calendars, or research resources, it's impossible to judge the quality of the trading environment.

Professional trading platforms usually provide extensive educational resources, market analysis, and trading tools to help clients succeed. We found no evidence of such resources in relation to VoloFinance.

The missing information about automated trading support, API access, or integration with popular trading platforms represents a major limitation. Traders who depend on computer-based strategies or advanced trading tools will find this platform inadequate.

We also found no mention of mobile trading apps or cross-platform sync abilities that are standard in today's trading world. User feedback suggests that whatever tools are provided fall well short of industry standards, with complaints about platform functionality and reliability.

Customer Service and Support Analysis (1/10)

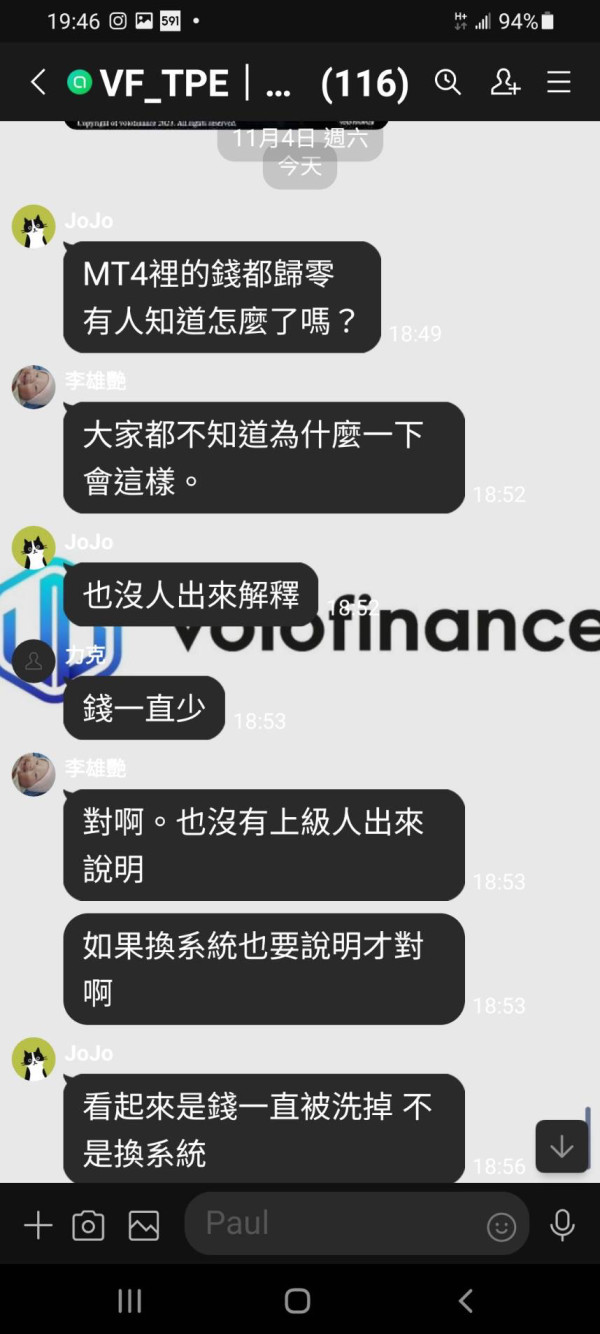

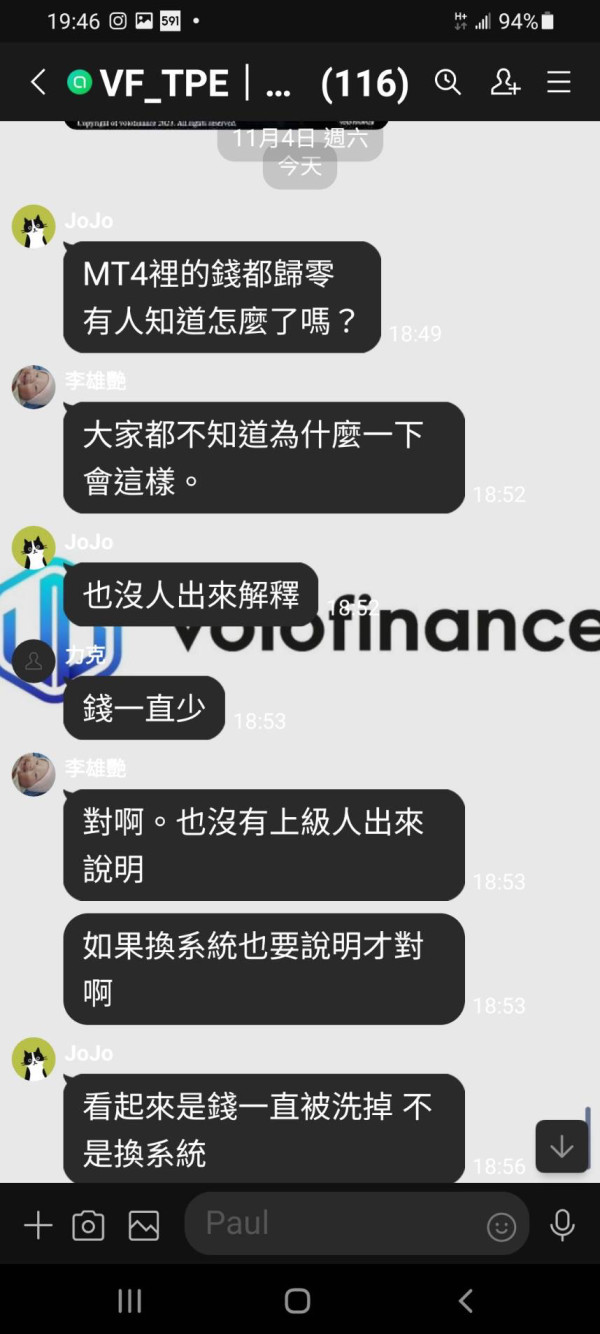

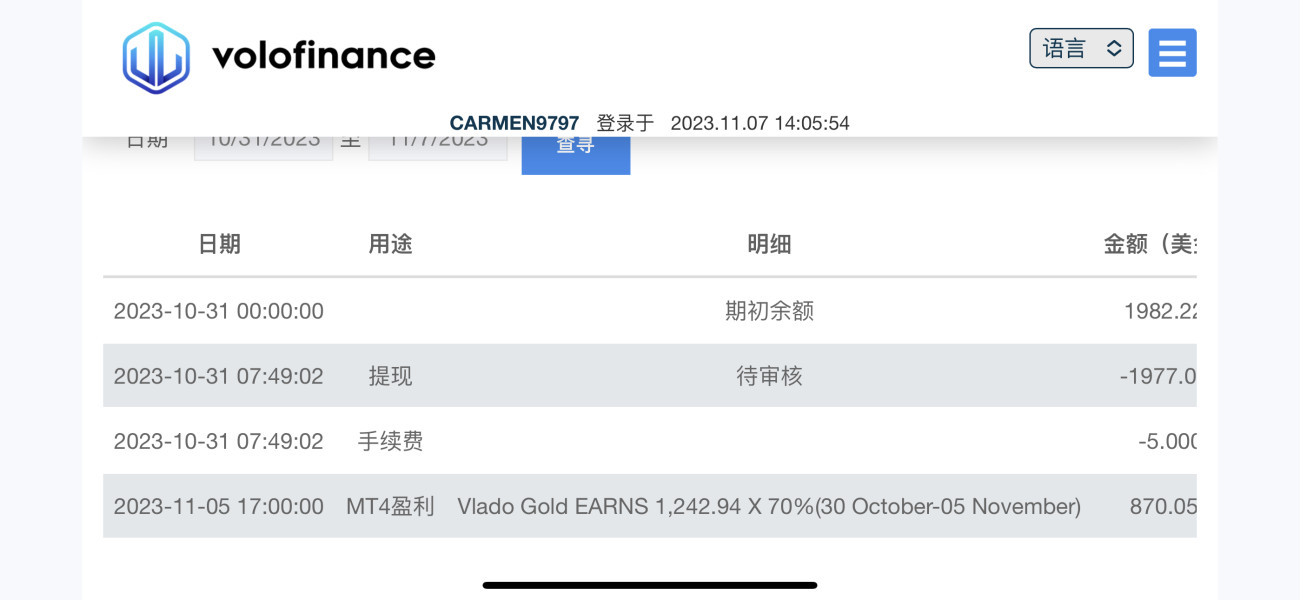

Customer service represents the most damaging part of VoloFinance's operations. User reports consistently describe the support experience as fraudulent and unresponsive.

The overwhelming agreement among users who have dealt with the platform is that customer service is not just bad but actively deceptive. Many people label their experiences as outright scams.

The missing information about customer support channels, operating hours, or available languages suggests a basic lack of professional support structure. Legitimate brokers usually provide multiple contact methods including phone, email, live chat, and sometimes social media support, along with clear procedures for handling complex issues.

VoloFinance appears to lack these basic support structures. User stories consistently report difficulties in reaching support representatives, receiving adequate responses to questions, and most critically, getting help with withdrawal requests.

The pattern of complaints suggests systematic issues with customer service that go beyond typical operational challenges. These problems point to potentially fraudulent practices designed to block client access to their funds.

The regulatory investigations mentioned in various sources, including scrutiny from the FCA, further highlight the severity of customer service failures. When regulatory bodies investigate a broker's practices, it usually means that customer complaints have reached levels that need official attention.

Trading Experience Analysis (2/10)

The trading experience offered by VoloFinance appears to be severely damaged based on user reports and available evidence. The platform claims to provide access to forex, CFD, and cryptocurrency markets through an online trading system, but user experiences suggest major problems with trade execution, pricing accuracy, and overall platform reliability.

Reports from users show issues with slippage and requotes. These are critical problems that can significantly hurt trading profits.

Slippage happens when trades are completed at prices different from those requested. Requotes involve the broker rejecting the initial price and offering a different one, often less favorable to the trader.

These issues suggest either poor liquidity management or potentially manipulative practices designed to hurt clients. The lack of detailed information about the trading platform's technical specifications, execution speeds, or server reliability makes it impossible to assess the quality of the trading infrastructure.

Professional trading requires stable, fast, and reliable platform performance. This is particularly important in volatile market conditions where timing can be crucial for trade success.

User feedback suggests that the overall trading environment is unreliable and potentially rigged against client success. The missing transparent information about execution policies, order types available, or platform uptime statistics further adds to concerns about the quality of the trading experience.

This volofinance review found no evidence of the professional trading standards that legitimate brokers maintain to ensure fair and efficient trade execution.

Trustworthiness Analysis (1/10)

Trustworthiness represents the most critical failure point for VoloFinance. Overwhelming evidence points to fraudulent operations and a complete absence of regulatory compliance.

The platform operates without valid licensing from recognized financial authorities. This is a basic requirement for legitimate broker operations in virtually all major financial jurisdictions.

The widespread user reports labeling VoloFinance as a "scammer" and the documented impact on hundreds or thousands of users paint a clear picture of systematic fraudulent activity. These aren't isolated complaints but represent a consistent pattern of deceptive practices that have attracted regulatory attention from bodies including the FCA.

The lack of corporate transparency eliminates any foundation for trust that potential clients might consider. This includes undisclosed company ownership, unclear operational headquarters, and absence of regulatory registration numbers.

Legitimate brokers are required to maintain transparent corporate structures. They must provide clear regulatory information to demonstrate their accountability to both clients and regulatory authorities.

The regulatory investigations mentioned in various sources, combined with the decision by authorities not to pursue prosecution despite documented fraudulent activities, suggests a complex situation. The platform may operate in regulatory grey areas or jurisdictions with limited enforcement capabilities.

This regulatory uncertainty provides no protection for potential clients. It represents an unacceptable risk level for serious traders.

User Experience Analysis (1/10)

The user experience with VoloFinance represents a complete failure across all measurable areas. Consistent reports show deceptive practices, poor platform functionality, and fraudulent behavior.

User satisfaction ratings consistently show 1 out of 5 stars across multiple review platforms. This indicates universal dissatisfaction among those who have attempted to use the service.

The initial user journey appears to be designed to attract clients through social media marketing. However, the subsequent experience consistently fails to meet even basic service expectations.

Users report difficulties with account setup, verification processes, and particularly with fund withdrawal procedures. This suggests that the platform may be designed to capture client funds rather than provide legitimate trading services.

Interface design and platform usability appear to be secondary concerns for VoloFinance. There's no evidence of investment in user experience optimization or client satisfaction initiatives.

The absence of mobile applications, platform tutorials, or user support resources indicates a fundamental disregard for client experience. Legitimate brokers prioritize these features to build and maintain their client base.

The consistent pattern of negative user experiences, combined with the widespread warnings from previous clients, creates an environment where potential users are actively discouraged. This represents a complete breakdown in the trust and satisfaction metrics that successful trading platforms depend upon.

Conclusion

This comprehensive volofinance review reveals a trading platform that fails to meet even the most basic standards expected of legitimate financial service providers. With overwhelming evidence of fraudulent activities, absence of regulatory compliance, and universally negative user experiences, VoloFinance represents an unacceptable risk for any serious trader or investor.

The platform cannot be recommended to any category of user, regardless of experience level or risk tolerance. The combination of regulatory warnings, user fraud allegations, and complete lack of operational transparency creates a risk profile that far exceeds any potential trading benefits.

Serious traders should focus their attention on properly regulated brokers that maintain transparent operations and positive user relationships. The main deficiencies include complete absence of regulatory oversight, systematic user complaints about fraudulent practices, lack of basic operational transparency, and documented negative impacts on hundreds of users.

These issues represent fundamental failures that cannot be addressed through minor operational improvements. They indicate systematic problems with the platform's business model and execution that make it unsuitable for legitimate trading activities.