Radex Markets 2025 Review: Everything You Need to Know

Executive Summary

This radex markets review shows big concerns about this offshore broker. Traders should think carefully before opening an account with them. The company started in 2019 and has its main office in Seychelles. Radex Markets works under the rules of the Seychelles Financial Services Authority (SFSA) and lets people trade over 350 different financial products like forex, indices, stocks, commodities, and cryptocurrencies.

The broker offers some good features like high leverage up to 1:500, popular MetaTrader 4 and MetaTrader 5 platforms, and a low minimum deposit of $200. However, many user reviews and industry reports have raised serious red flags about how the company operates. Many sources show that user ratings are very poor, with lots of reviews pointing to possible fraud and bad customer service.

The broker targets new and small investors with easy entry requirements and many different assets to trade. But the huge amount of negative feedback from users suggests that potential clients should be very careful when thinking about Radex Markets as their trading partner. The mix of offshore regulation and worrying user stories makes this broker wrong for careful traders who want reliable trading conditions.

Important Notice

Regional Entity Differences: Radex Markets operates mainly from Seychelles under loose regulatory oversight compared to major financial centers. The broker claims regulation by both SFSA and ASIC, though potential clients need to carefully check if these regulatory relationships are real and valid.

Review Methodology: This complete evaluation uses user feedback from multiple review platforms, industry reports, and information from the broker itself. All assessments reflect available data as of 2025. Traders should do their own research to verify all claims before making investment decisions.

Rating Framework

Broker Overview

Radex Markets entered the competitive forex brokerage world in 2019. The company set up its headquarters in Seychelles to take advantage of the area's friendly regulatory environment for financial services companies. Radex Markets operates as a Straight Through Processing (STP) broker and claims to give direct market access to its clients across multiple asset classes. The broker says it focuses on delivering trading solutions for retail traders who want exposure to global financial markets including major and minor currency pairs, stock indices, individual stocks, precious metals, energy commodities, and popular cryptocurrencies.

The broker's business model centers around providing technology and market access rather than acting as a market maker. This should reduce conflicts of interest with client trades in theory. Radex Markets positions itself as a technology-driven platform suitable for both new traders seeking simple market access and more experienced traders who need advanced analytical tools. However, user feedback suggests big gaps between the company's marketing promises and actual service delivery, especially regarding execution quality and customer support response times.

The company offers trading through industry-standard MetaTrader 4 and MetaTrader 5 platforms, plus Trading Central analytical services. This radex markets review finds that while the platform selection meets industry norms, the overall execution and reliability have drawn major criticism from actual users. This creates concerns about the broker's operational abilities and commitment to client satisfaction.

Regulatory Status: Radex Markets operates under the Seychelles Financial Services Authority (SFSA), with additional claims of Australian Securities and Investments Commission (ASIC) regulation that need independent verification. The SFSA regulation provides basic oversight but lacks the strict consumer protection measures found in major regulatory areas.

Funding Methods: The broker supports multiple deposit and withdrawal options including traditional bank wire transfers, major credit and debit cards, and various electronic wallet solutions. This provides reasonable flexibility for international clients.

Minimum Deposit: Radex Markets sets its entry barrier at $200, positioning itself in the accessible range for retail traders. However, this low threshold combined with negative reviews raises questions about the broker's client acquisition strategy.

Promotional Offers: Available information does not specify current bonus or promotional programs. This suggests either absence of such offerings or lack of transparency in marketing materials.

Trading Instruments: The broker provides access to over 350 tradeable assets across five major categories: foreign exchange pairs, global stock indices, individual company stocks, commodities including metals and energy, and cryptocurrency CFDs.

Cost Structure: Radex Markets uses a variable spread model with commission rates starting from $0. However, actual trading costs depend on account type and trading volume, with specific details requiring direct broker consultation.

Leverage Options: Maximum leverage reaches 1:500, which while attractive to traders seeking capital efficiency, also significantly amplifies risk exposure. This is particularly concerning given the broker's questionable reputation.

Platform Technology: Trading infrastructure relies on MetaTrader 4 and MetaTrader 5 platforms with additional analytical support from Trading Central. This represents industry-standard technology solutions.

This radex markets review notes that while basic service specifications appear competitive, the critical factor remains the execution quality and reliability issues highlighted in user feedback.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Radex Markets' account structure presents a mixed picture for potential traders. The broker's $200 minimum deposit requirement places it in the accessible category for retail traders, especially those testing new brokerage relationships or operating with limited capital. However, this radex markets review finds that the low entry threshold may serve as a warning sign rather than an advantage, particularly when combined with overwhelmingly negative user feedback.

The available information lacks detailed specification of distinct account types. This suggests either a simplified single-tier offering or insufficient transparency in product documentation. Industry standards typically include multiple account categories with varying features, spreads, and service levels. The absence of clear account differentiation raises questions about the broker's commitment to serving diverse client needs and experience levels.

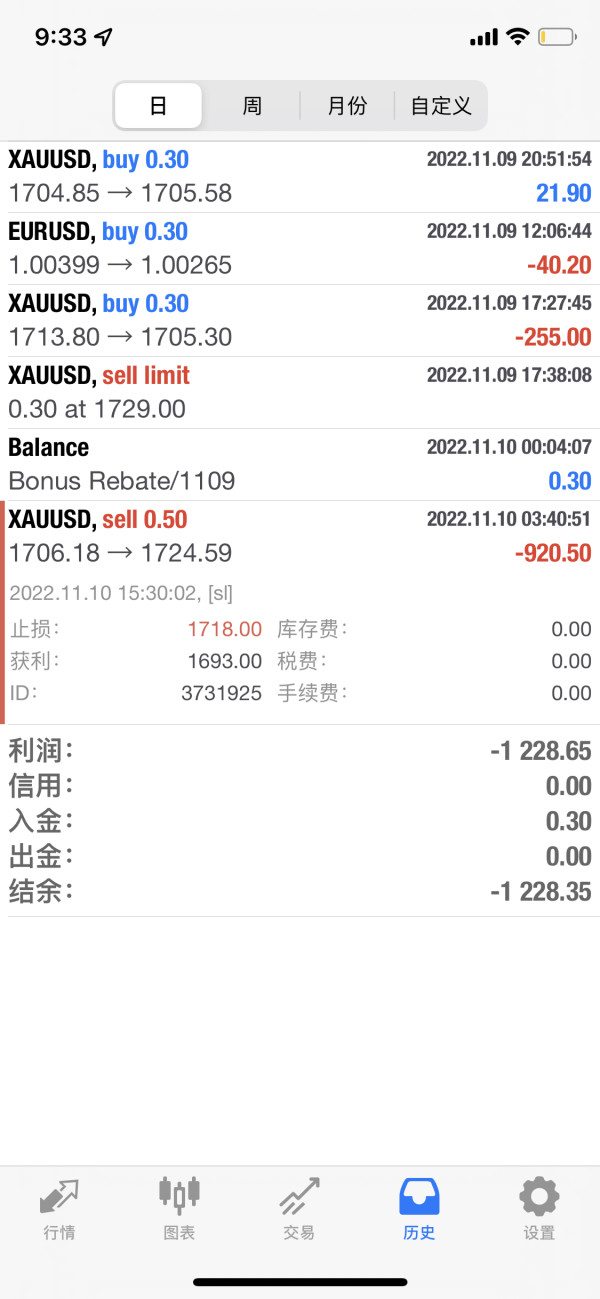

Commission structures starting from $0 appear attractive on the surface. But user reports suggest hidden costs and unfavorable execution that may offset any apparent savings. The variable spread model requires careful evaluation of actual trading costs during different market conditions, information that appears insufficiently documented in available materials.

User feedback referenced in various reviews shows that account opening processes and ongoing account management have generated significant dissatisfaction. This contributes to the poor overall rating in this category.

The technological infrastructure offered by Radex Markets meets basic industry expectations through its provision of MetaTrader 4 and MetaTrader 5 platforms. These widely-recognized trading platforms provide comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and mobile accessibility that most traders expect from professional brokerage services.

Trading Central integration adds analytical depth with professional market research, trading signals, and technical analysis reports. This can benefit both novice and experienced traders. This third-party service provider maintains a solid reputation in the industry for delivering actionable market insights and educational content.

However, this evaluation reveals significant gaps in educational resources and trader development programs that distinguish leading brokers from basic service providers. The absence of comprehensive educational materials, webinar programs, or advanced analytical tools beyond the standard platform offerings limits the broker's value proposition for traders seeking growth and skill development.

User feedback fails to provide positive reinforcement for the quality and reliability of these tools in actual trading environments. Reports of platform stability issues and analytical tool effectiveness raise concerns about the practical utility of the available resources. This prevents a higher rating in this category despite the theoretical adequacy of the tool selection.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of the most critical weaknesses identified in this radex markets review. Available information provides insufficient detail about support channels, response times, or service quality standards. This itself indicates poor transparency and communication practices.

User feedback consistently highlights inadequate customer service experiences, with reports of unresponsive support staff, lengthy resolution times, and insufficient assistance with account-related issues. These experiences directly contradict the service quality expectations that traders reasonably hold for professional brokerage relationships.

The absence of detailed information about multilingual support capabilities, operating hours, or escalation procedures suggests either non-existent or poorly developed customer service infrastructure. Professional brokers typically provide comprehensive support documentation and clear communication channels. This makes the information gaps particularly concerning.

Multiple user reviews reference difficulties in reaching customer service representatives and unsatisfactory problem resolution. This contributes to the overall negative perception of the broker's commitment to client relationships. The pattern of poor customer service feedback aligns with other operational concerns and supports the low trust rating assigned to this broker.

Trading Experience Analysis (Score: 4/10)

The trading experience evaluation reveals substantial concerns about execution quality and platform reliability that significantly impact trader satisfaction. While MetaTrader platforms provide solid technological foundations, user reports indicate frequent issues with order execution, slippage, and requoting that undermine the practical trading environment.

Platform stability problems reported by users suggest inadequate technical infrastructure or poor server management. This leads to disconnections and execution delays during critical trading periods. These technical failures can result in significant financial losses and represent unacceptable operational standards for professional trading services.

Order execution quality appears problematic based on user feedback, with reports of unfavorable fill prices, delayed execution, and frequent requoting during volatile market conditions. Such execution issues directly impact trading profitability and indicate either inadequate liquidity relationships or intentionally poor execution practices.

The mobile trading experience, while supported through standard MetaTrader mobile applications, receives no positive reinforcement from user feedback. This suggests that the technical problems extend across all platform interfaces. This radex markets review concludes that the trading experience falls well below industry standards and poses significant risks to trader capital and satisfaction.

Trust and Safety Analysis (Score: 2/10)

Trust and safety concerns represent the most serious issues identified in this evaluation. Radex Markets' regulation by the Seychelles Financial Services Authority provides minimal investor protection compared to major regulatory jurisdictions. This offers limited recourse for dispute resolution or fund recovery in case of operational failures.

Multiple independent sources have identified significant red flags suggesting potential fraudulent activities, with user reports indicating possible scam operations. These allegations, while requiring independent verification, create substantial concerns about the safety of client funds and the legitimacy of the broker's operations.

The absence of detailed information about client fund segregation, insurance coverage, or other investor protection measures further undermines confidence in the broker's safety standards. Reputable brokers typically provide comprehensive documentation of their security measures and regulatory compliance procedures.

Company transparency appears inadequate, with insufficient disclosure of ownership structure, financial stability, or operational procedures that would allow independent verification of the broker's legitimacy. The combination of offshore regulation, negative user reports, and transparency deficiencies creates an extremely poor trust profile. This should concern any potential client.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Radex Markets appears extremely poor based on available feedback and rating information. The consistently low user ratings across multiple review platforms indicate widespread dissatisfaction with various aspects of the broker's services. This ranges from technical performance to customer support quality.

Interface design and platform usability, while built on established MetaTrader foundations, receive no positive reinforcement from user experiences. This suggests that implementation quality may suffer from technical or operational shortcomings that impact daily trading activities.

The account registration and verification processes, though not specifically detailed in available information, appear to contribute to user frustration based on general feedback patterns. Professional brokers typically streamline these procedures to minimize client inconvenience while maintaining necessary compliance standards.

Funding and withdrawal experiences represent particular areas of user concern, with reports suggesting difficulties in accessing deposited funds and poor communication about transaction processing. These issues directly impact trader confidence and represent fundamental operational failures. They distinguish problematic brokers from reputable service providers.

The pattern of user complaints focuses consistently on trust, reliability, and service quality issues that indicate systematic operational problems rather than isolated incidents. This supports the poor overall rating assigned to user experience.

Conclusion

This comprehensive radex markets review reveals substantial concerns that make the broker unsuitable for most traders seeking reliable, professional brokerage services. While the company offers competitive specifications including high leverage, diverse asset selection, and popular trading platforms, the overwhelming negative user feedback and trust concerns far outweigh any potential advantages.

The combination of offshore regulation, poor user ratings, and reports of potential fraudulent activities creates an unacceptable risk profile for traders of all experience levels. Risk-averse investors should definitely avoid this broker. Even risk-tolerant traders would find better alternatives in the competitive forex brokerage market.

The main advantages of low minimum deposits and high leverage are completely overshadowed by fundamental issues including poor customer service, execution problems, and serious trust concerns. Traders seeking reliable brokerage relationships should focus on well-regulated, transparent brokers with positive user feedback and established industry reputations.