Edge Markets Review 1

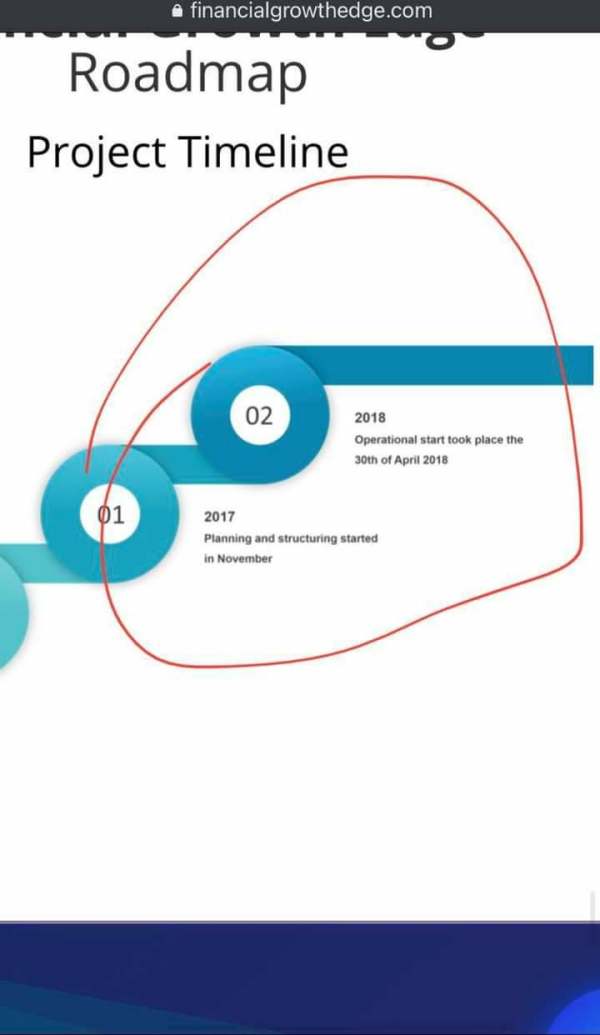

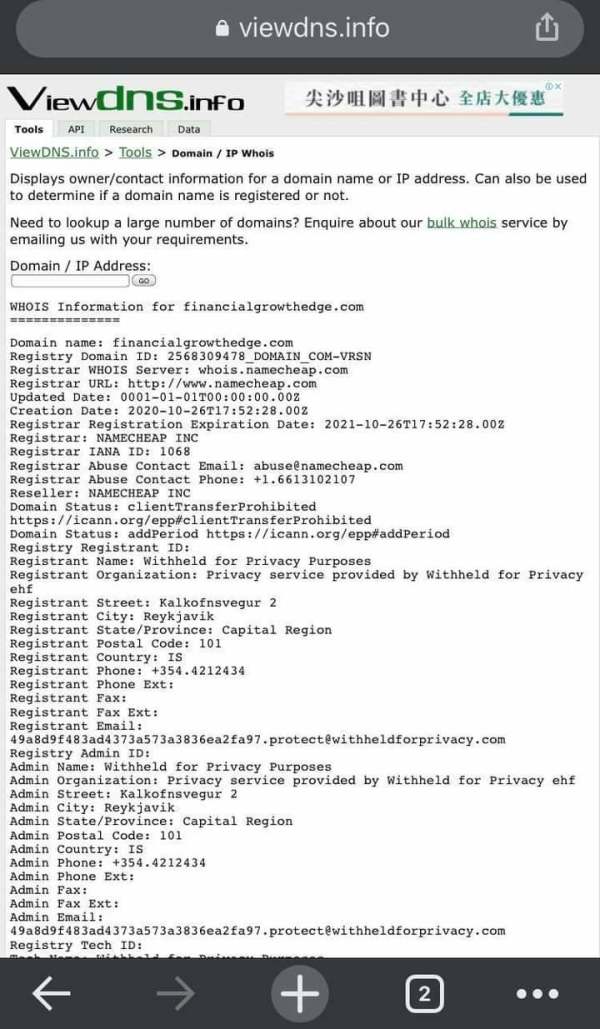

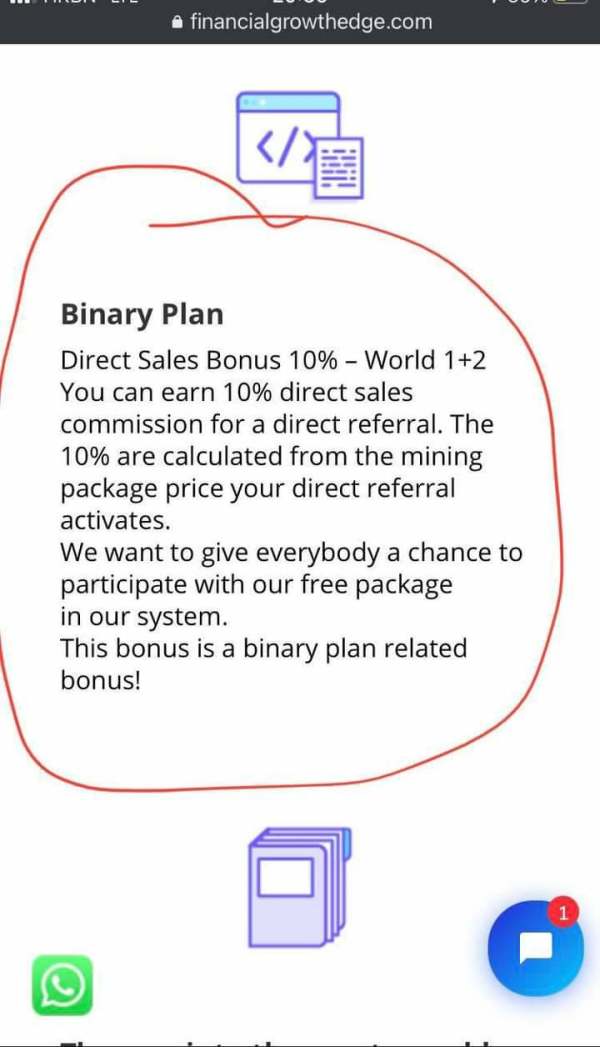

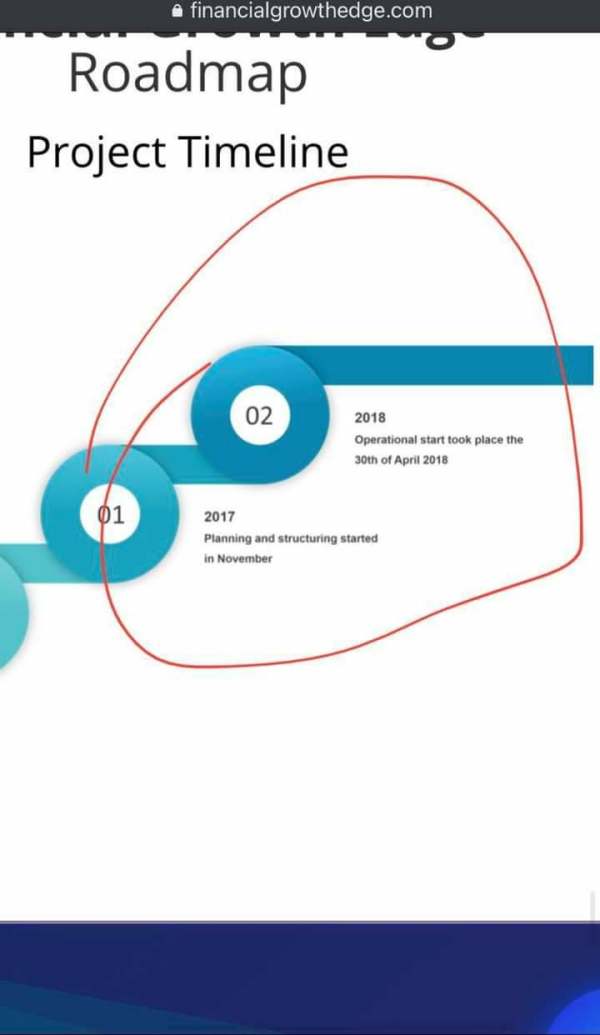

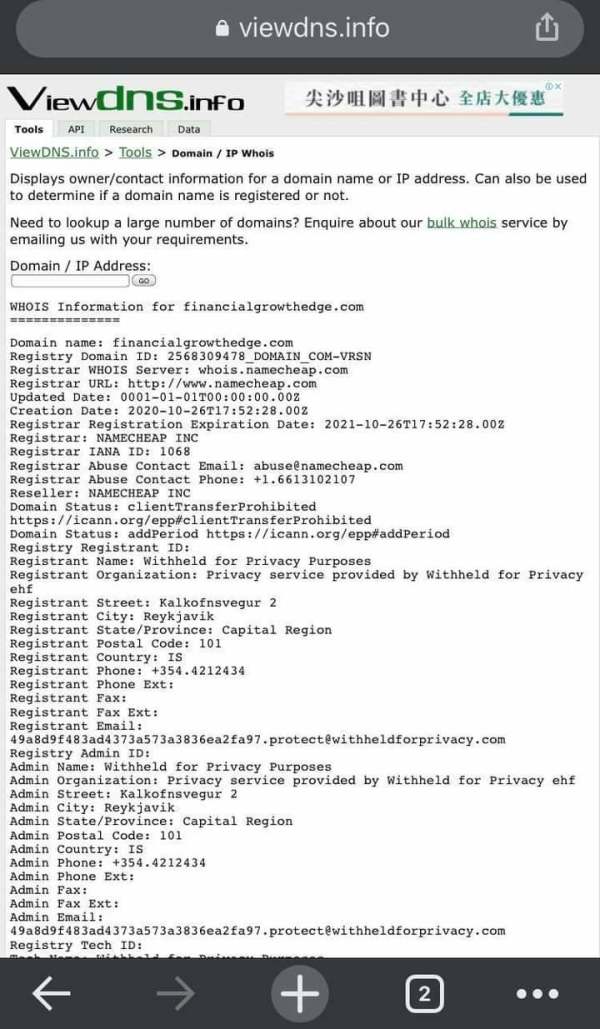

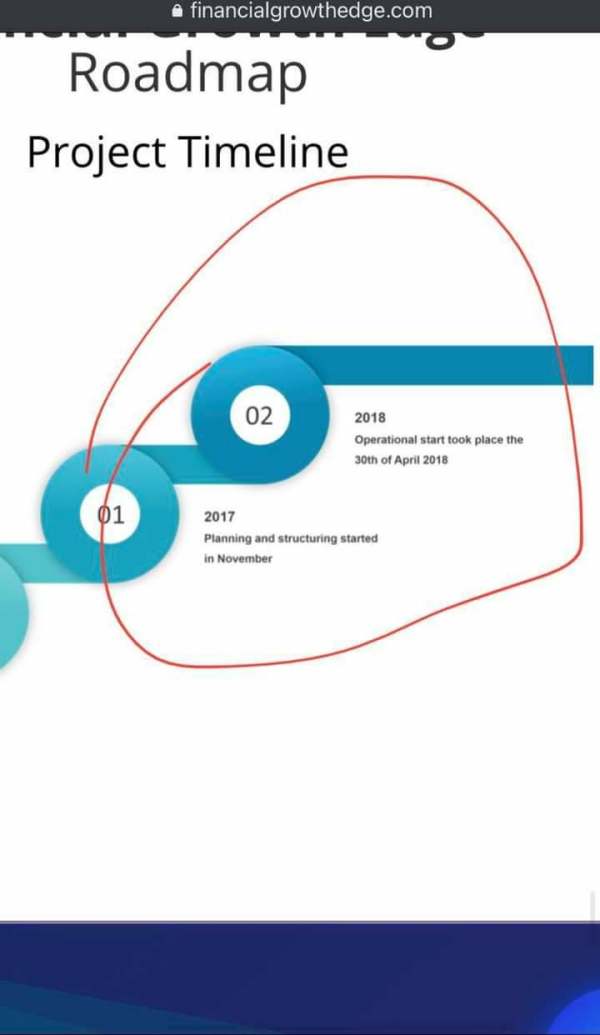

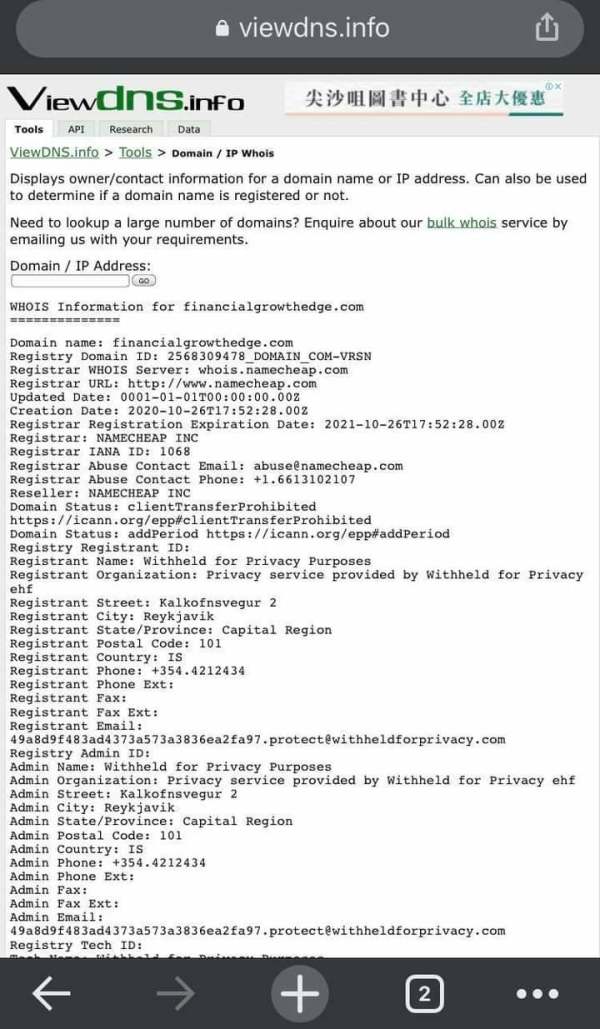

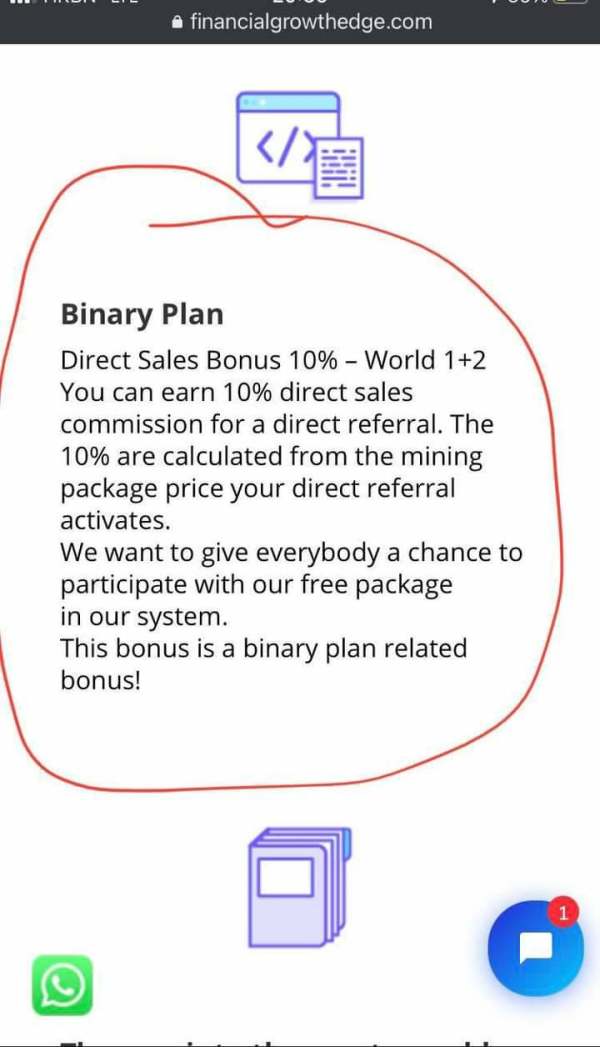

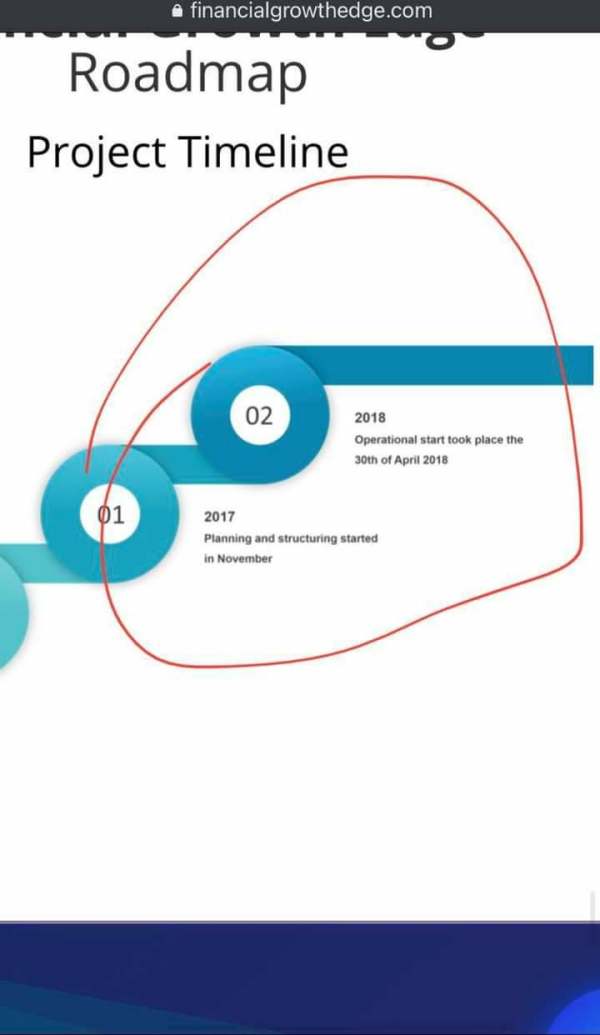

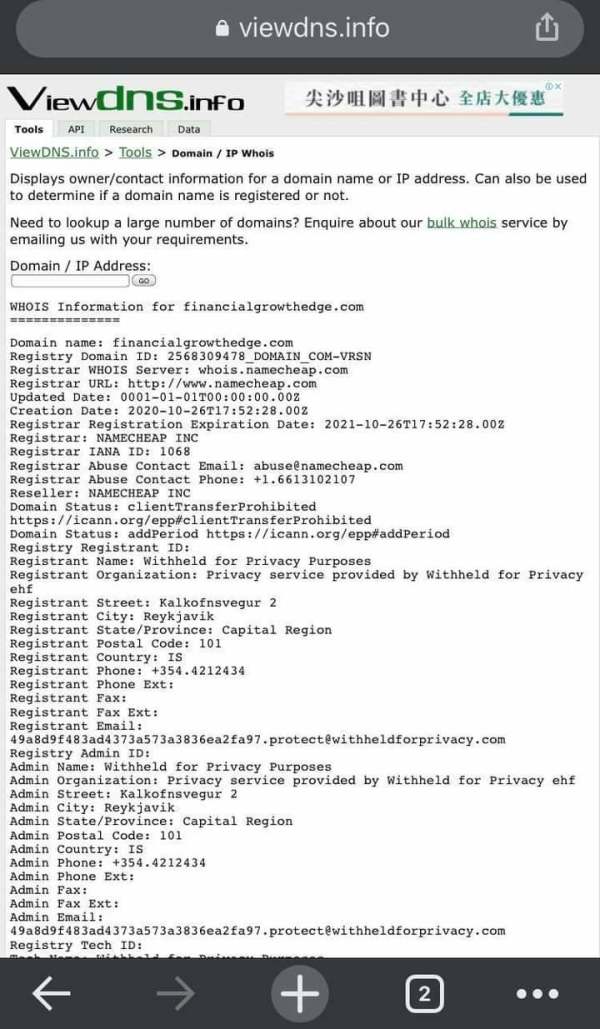

SCAM WARNING I am issuing a scam warning on this fake investment platform called financial growth edge. Reason 1. Fake address 2. Anonymous ownership. 3. Namecheap domain. 4. Illegal MLM investment. 5 fake domain age.

Edge Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

SCAM WARNING I am issuing a scam warning on this fake investment platform called financial growth edge. Reason 1. Fake address 2. Anonymous ownership. 3. Namecheap domain. 4. Illegal MLM investment. 5 fake domain age.

Edge Markets presents itself as an online CFD trading broker offering access to global financial markets. This Edge Markets review reveals significant gaps in transparency that potential traders should carefully consider. While the broker claims to provide "many ways to trade on the financial markets" with a team of industry specialists possessing years of experience in the global financial industry, crucial details about trading conditions remain undisclosed.

The broker emphasizes its comprehensive approach to CFD trading. It offers what it describes as a "bespoke Edge Markets account" designed to give traders "an edge in CFD trading." According to available information, Edge Markets provides access to the world's most active markets through a global network of customer support agents and experienced account managers. However, the absence of specific information about commissions, spreads, minimum deposits, and regulatory oversight raises questions about the broker's transparency.

For context, EdgeClear, a related futures brokerage, maintains a user rating of 3.5 out of 5 stars based on 69 ratings. This suggests moderate user satisfaction in the broader network. Edge Markets appears to target small to medium-sized investors seeking diversified trading instruments, though the lack of detailed trading conditions makes it challenging to assess its suitability for specific trader profiles.

This review is based on publicly available information and user feedback available at the time of writing. Traders should note that Edge Markets may operate under different regulatory frameworks across various jurisdictions, and services may vary by region. The regulatory status of Edge Markets itself remains unclear from available sources. However, related entity EdgeClear operates under CFTC and NFA regulation in the United States.

Our assessment methodology relies on available public information, official broker communications, and comparative analysis with industry standards. Due to limited detailed information about Edge Markets' specific trading conditions, some evaluations are based on general industry practices and available comparative data. Prospective traders are strongly advised to verify all information directly with the broker and ensure compliance with local regulations before opening any trading account.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 6/10 | Average |

| Tools and Resources | 7/10 | Good |

| Customer Service and Support | 7/10 | Good |

| Trading Experience | 6/10 | Average |

| Trust and Regulation | 5/10 | Below Average |

| User Experience | 5/10 | Below Average |

Edge Markets positions itself as an online CFD trading broker. Specific details about its establishment date and corporate background remain limited in available public information. The broker emphasizes its connection to industry specialists with extensive experience in the global financial sector, suggesting a foundation built on professional expertise. However, the absence of clear information about headquarters location, founding year, and corporate structure creates uncertainty about the broker's operational transparency.

The company's business model centers on providing online CFD trading services across multiple financial instruments and asset classes. Edge Markets claims to offer competitive trading conditions and an optimal trading experience, though specific details about these conditions are not readily available. The broker's approach appears to focus on providing comprehensive market access rather than specializing in particular asset classes or trading styles.

Edge Markets operates in the competitive online CFD trading space, where regulatory compliance and transparency are crucial factors for trader confidence. While related entity EdgeClear maintains clear regulatory standing with CFTC and NFA oversight, Edge Markets' own regulatory status remains unclear from available sources. This regulatory ambiguity represents a significant consideration for potential traders evaluating the broker's credibility and operational security.

Regulatory Status: The regulatory framework governing Edge Markets operations remains unclear from available public information. While the related EdgeClear entity operates under CFTC and NFA regulation in the United States, Edge Markets' specific regulatory oversight is not detailed in accessible sources. This creates uncertainty about compliance standards and trader protection measures.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and associated fees for deposits and withdrawals is not available in current public sources. This lack of transparency regarding financial transactions represents a significant information gap for potential traders.

Minimum Deposit Requirements: Edge Markets has not disclosed minimum deposit requirements in available public information. This makes it difficult for traders to assess accessibility and account opening requirements.

Bonuses and Promotions: Current promotional offerings, welcome bonuses, or trading incentives are not detailed in available sources. This suggests either absence of such programs or limited marketing transparency.

Tradeable Assets: While Edge Markets claims to offer "a wide range of financial tools and instruments," specific asset categories, number of available instruments, and market coverage details are not provided in accessible information.

Cost Structure: Perhaps most significantly for this Edge Markets review, specific information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This absence of pricing transparency makes it challenging for traders to evaluate the broker's competitiveness and calculate potential trading expenses.

Leverage Ratios: Maximum leverage offerings and leverage policies across different asset classes are not specified in available public information.

Platform Options: Details about trading platforms, whether proprietary or third-party solutions like MetaTrader, are not provided in current sources.

Geographic Restrictions: Information about restricted countries or regional limitations is not available in accessible sources.

Customer Support Languages: While multilingual support is mentioned, specific supported languages are not detailed for Edge Markets specifically.

Edge Markets' account conditions evaluation suffers significantly from the lack of transparent information about fundamental trading parameters. Without specific details about account types, minimum deposit requirements, or tiered account structures, it becomes challenging to assess the broker's accessibility and suitability for different trader profiles. This Edge Markets review finds that the absence of clear account categorization information places the broker at a disadvantage compared to more transparent competitors.

The account opening process details remain unclear, with no specific information about required documentation, verification timeframes, or approval procedures. This lack of procedural transparency can create uncertainty for prospective traders planning their account setup timeline. Additionally, the absence of information about special account features, such as Islamic accounts for Sharia-compliant trading, limits the broker's appeal to diverse trader demographics.

For comparison, EdgeClear maintains a more structured approach with clear account information and has garnered 69 user ratings with a 3.5/5 average score. This suggests that users value transparency in account conditions. Edge Markets would benefit from providing similar clarity about its account structures and requirements. The broker's emphasis on "bespoke Edge Markets account" suggests customization options, but without specific details, traders cannot evaluate whether these offerings meet their individual needs.

The overall account conditions rating reflects the fundamental challenge of evaluating a broker without access to essential account information. This results in an average score that could improve significantly with enhanced transparency.

Edge Markets demonstrates strength in its commitment to providing comprehensive trading tools. The broker positions itself as offering "many ways to trade on the financial markets." The broker's emphasis on a "wide range of financial tools and instruments" suggests a robust toolkit for traders, though specific details about individual tools remain limited in available sources.

The broker's connection to industry specialists with extensive global financial experience indicates potential access to professional-grade resources and market insights. This background suggests that Edge Markets may offer sophisticated analytical tools and trading resources, though the specific nature and quality of these offerings require further clarification from official sources.

However, the absence of detailed information about research resources, market analysis, educational materials, and automated trading support limits the comprehensive evaluation of the broker's tools and resources. Many competitive brokers provide extensive educational content, daily market analysis, and advanced charting tools, but Edge Markets' offerings in these areas remain unclear from available information.

The tools and resources score reflects the broker's apparent commitment to comprehensive market access and professional backing. This is balanced against the need for more detailed information about specific offerings. Traders seeking advanced analytical tools may find value in Edge Markets' professional approach, but would benefit from more detailed tool specifications.

Edge Markets demonstrates a clear commitment to customer support through its advertised "global network of customer support agents, experienced and knowledgeable account and portfolio managers." This emphasis on comprehensive support infrastructure suggests the broker recognizes the importance of client service in the competitive CFD trading market.

The broker's focus on providing both customer support agents and dedicated account managers indicates a tiered support approach. This could benefit traders with varying needs and account sizes. The mention of "experienced and knowledgeable" staff suggests professional competency in handling trader inquiries and account management requirements.

However, critical details about support accessibility remain unclear, including specific contact channels, response time commitments, operating hours, and language support options. While the broker mentions global support network capabilities, the practical implementation of this support system requires verification through direct experience or user testimonials.

The customer service evaluation benefits from the broker's stated commitment to comprehensive support but is limited by the lack of specific operational details. Effective customer support requires not only knowledgeable staff but also accessible communication channels and reasonable response times, information that remains to be clarified by Edge Markets.

The trading experience evaluation for this Edge Markets review faces significant limitations due to the absence of specific platform information, execution quality data, and user experience testimonials. While Edge Markets emphasizes providing "competitive trading conditions and an optimal trading experience," the lack of concrete details about platform stability, execution speeds, and order processing quality makes comprehensive assessment challenging.

Edge Markets' commitment to serving "the world's most active markets" suggests broad market access that could enhance trading opportunities. However, without specific information about platform features, mobile trading capabilities, or trading environment characteristics, traders cannot adequately evaluate the practical trading experience the broker provides.

The absence of user reviews specifically addressing trading experience with Edge Markets limits the ability to assess real-world platform performance. In contrast, EdgeClear's user rating of 3.5/5 from 69 reviews provides some context for related services, but may not directly reflect Edge Markets' trading environment quality.

Platform reliability, order execution quality, and user interface design are crucial factors in trading experience that require specific information for proper evaluation. The current score reflects the uncertainty surrounding these critical trading elements while acknowledging the broker's stated commitment to optimal trading conditions.

The trust and regulation assessment represents a significant concern in this Edge Markets review. This is primarily due to the unclear regulatory status of the broker. While related entity EdgeClear operates under clear CFTC and NFA regulation, Edge Markets' specific regulatory oversight remains undisclosed in available public information, creating uncertainty about compliance standards and trader protection measures.

Regulatory transparency is fundamental to establishing trust in the forex and CFD trading industry, where client fund protection and operational oversight are paramount concerns. The absence of clear regulatory information makes it difficult for traders to assess the safety of their investments and the recourse available in case of disputes or operational issues.

Edge Markets' professional presentation and industry experience claims provide some credibility indicators, but these cannot substitute for clear regulatory compliance information. The broker's emphasis on industry specialists and global market access suggests operational sophistication, but without regulatory verification, these claims remain unsubstantiated from a trust perspective.

The trust evaluation reflects the critical importance of regulatory clarity in broker selection while acknowledging that Edge Markets may operate under valid regulatory frameworks. These frameworks are simply not clearly communicated in available public information. Prospective traders should prioritize obtaining clear regulatory information before proceeding with account opening.

User experience evaluation for Edge Markets faces significant limitations due to the absence of specific user feedback and detailed interface information. Unlike EdgeClear, which has accumulated 69 user ratings averaging 3.5/5 stars, Edge Markets lacks readily available user testimonials or satisfaction metrics that would provide insight into real-world user experiences.

The broker's emphasis on providing "bespoke Edge Markets account" services suggests attention to user customization and individual needs. However, without specific information about user interface design, account management processes, registration procedures, or fund management systems, comprehensive user experience assessment becomes challenging.

Critical user experience factors such as website navigation, account opening simplicity, verification processes, and ongoing account management convenience remain unclear from available sources. These practical elements significantly impact trader satisfaction and operational efficiency but require specific information for proper evaluation.

The user experience score reflects the fundamental challenge of evaluating satisfaction without access to user feedback or detailed interface information. Edge Markets would benefit from providing more transparent information about user processes and encouraging user feedback publication to enable better experience assessment for prospective traders.

This Edge Markets review reveals a broker with apparent professional backing and comprehensive market access ambitions, but significant transparency limitations that impact its overall assessment. While Edge Markets presents itself as offering extensive CFD trading opportunities through experienced industry specialists and global market access, the absence of crucial information about trading conditions, regulatory status, and specific service details creates substantial evaluation challenges.

Edge Markets appears most suitable for traders who prioritize global market access and professional account management support over detailed cost transparency. However, the lack of specific information about spreads, commissions, minimum deposits, and regulatory compliance makes it difficult to recommend the broker for cost-conscious traders or those requiring clear regulatory protection assurances.

The primary advantages include the broker's stated commitment to comprehensive market access and professional support infrastructure. The main disadvantages center on transparency limitations regarding costs, regulatory status, and specific trading conditions. Prospective traders should prioritize obtaining detailed information directly from Edge Markets about all trading conditions and regulatory compliance before making account opening decisions.

FX Broker Capital Trading Markets Review