Liberty FX 2025 Review: Everything You Need to Know

Summary

Liberty FX shows a complex picture in the forex brokerage landscape. This liberty fx review reveals that while some traders like the platform's competitive trading conditions, big concerns have come up about the broker's regulatory status and overall legitimacy. The broker offers spreads starting from 0 pips and leverage up to 1:400, which may attract traders who want aggressive trading conditions. However, multiple sources point to serious questions about Liberty FX's regulatory compliance and safety measures.

The platform mainly targets traders interested in high-leverage trading and diversified asset classes, including forex, indices, commodities, precious metals, stocks, and cryptocurrencies. User feedback shows a split response, with some positive experiences contrasted by concerning reports about the broker's legitimacy. According to WikiFX monitoring, Liberty FX has received mixed reviews from real users, including positive feedback, neutral assessments, and exposure reports that raise red flags about the broker's operations.

Important Notice

This review is based on publicly available information and user feedback as of 2025. Liberty FX's regulatory status remains unclear across different jurisdictions, and potential clients should use extreme caution when considering this broker. The information presented in this liberty fx review is compiled from various sources for informational purposes only and should not be considered as investment advice. Traders are strongly advised to conduct their own research and consider regulated alternatives before making any financial commitments.

Rating Framework

Broker Overview

Liberty FX was established in 2018 as a CFD trading provider. The broker operates in the competitive online trading space, offering various financial instruments to retail and institutional clients. However, specific information about the company's headquarters location and corporate structure remains notably absent from publicly available sources, which raises immediate transparency concerns for potential clients.

The broker's business model centers around providing CFD trading services across multiple asset classes. Liberty FX positions itself as a platform for traders seeking access to global financial markets through a single trading account. The company claims to offer competitive trading conditions, though the lack of clear regulatory oversight has become a major point of concern among industry observers and potential clients.

According to available information, Liberty FX uses the MetaTrader 4 platform as its primary trading interface. The broker provides access to forex currency pairs, stock indices, commodities, precious metals, individual stocks, and cryptocurrency CFDs. This diverse offering aims to attract traders with varying interests and risk appetites. However, the absence of specific regulatory information in this liberty fx review highlights a critical gap that potential clients must carefully consider.

Regulatory Status: Available information does not specify any regulatory oversight for Liberty FX, which represents a major red flag for potential clients seeking secure trading environments.

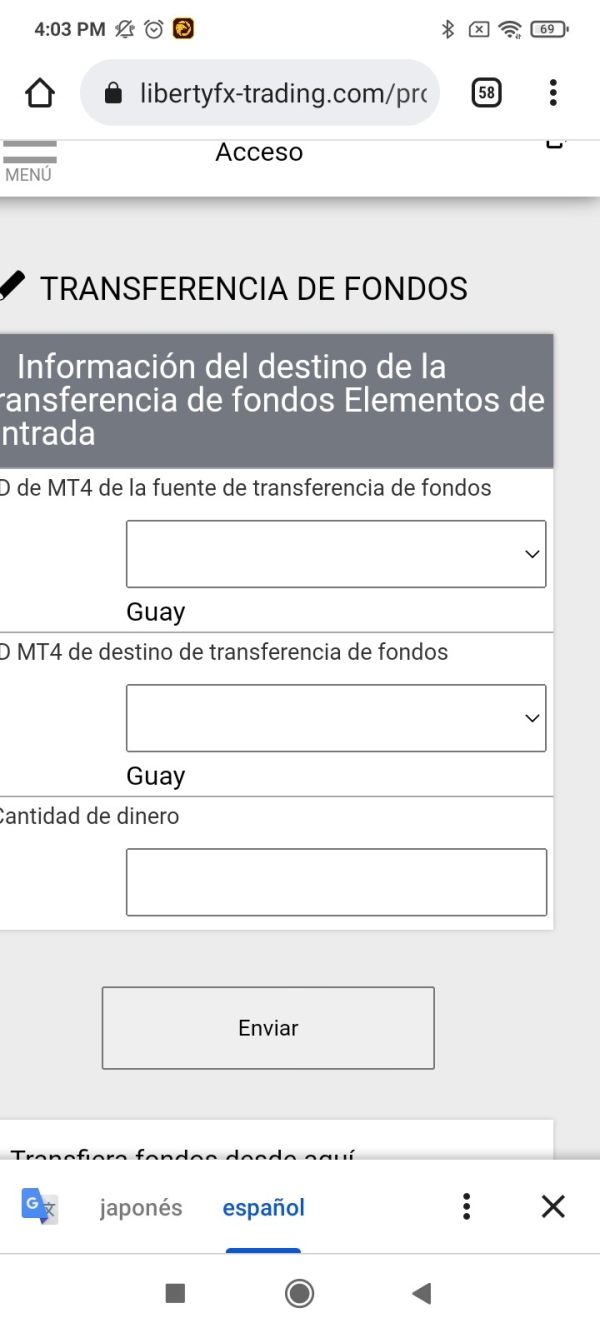

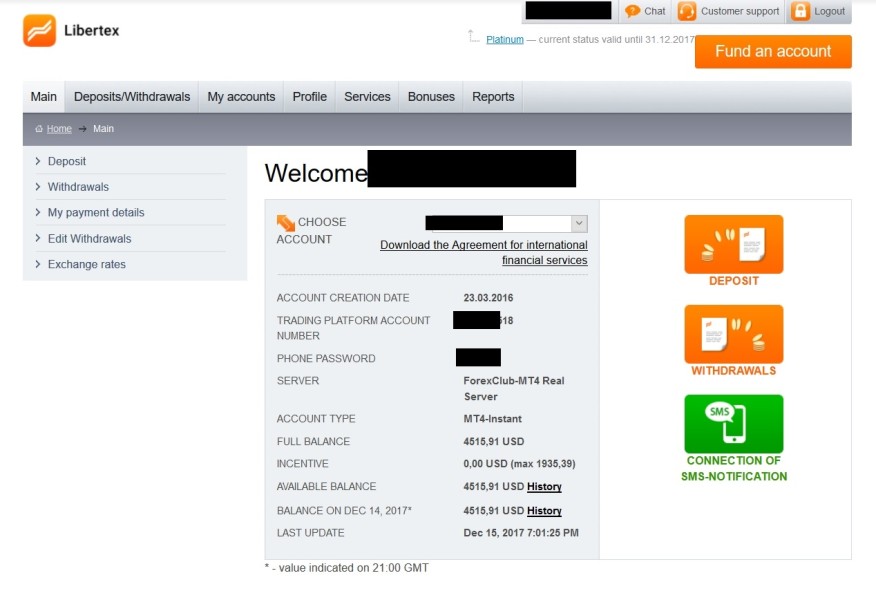

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources, creating uncertainty about fund management procedures.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Liberty FX is not specified in available documentation.

Bonuses and Promotions: Current promotional offers or bonus programs are not mentioned in available source materials.

Tradeable Assets: Liberty FX offers forex currency pairs, stock indices, commodities, precious metals, individual stocks, and cryptocurrency CFDs, providing a comprehensive range of trading instruments.

Cost Structure: The broker advertises spreads starting from 0 pips, though commission structures and additional fees are not clearly detailed in available information.

Leverage Ratios: Maximum leverage of up to 1:400 is available, which represents extremely high risk exposure for retail traders.

Platform Options: MetaTrader 4 serves as the primary trading platform, though mobile and web-based versions are not specifically detailed.

Geographic Restrictions: Information about geographic restrictions or prohibited countries is not available in current source materials.

Customer Support Languages: Available customer support languages are not specified in accessible documentation.

This liberty fx review reveals concerning gaps in essential information that reputable brokers typically provide transparently to potential clients.

Account Conditions Analysis

Liberty FX's account conditions present a mixed picture that requires careful examination. The broker advertises competitive spreads starting from 0 pips, which could be attractive to cost-conscious traders. However, the lack of detailed information about different account types, minimum deposit requirements, and account features creates major uncertainty for potential clients.

The absence of clear information about account opening procedures represents a major concern. Legitimate brokers typically provide comprehensive details about their account structures, including different tiers of service, minimum funding requirements, and specific features available to each account type. The fact that such fundamental information is not readily available in this liberty fx review suggests either poor transparency or inadequate business practices.

User feedback regarding account conditions appears limited, with available sources not providing substantial detail about the actual experience of opening and maintaining accounts with Liberty FX. This lack of user testimony about account management, funding processes, and account-related customer service further adds to concerns about the broker's operational transparency.

The high leverage ratio of 1:400 advertised by Liberty FX greatly exceeds regulatory limits in many jurisdictions, which may indicate the broker operates in unregulated territories or targets markets with less strict investor protection measures.

Liberty FX uses MetaTrader 4 as its primary trading platform, which is a well-established and widely respected platform in the forex industry. MT4 provides essential trading functions including real-time charting, technical analysis tools, automated trading capabilities through Expert Advisors, and mobile trading access. This platform choice represents one of the broker's more positive aspects.

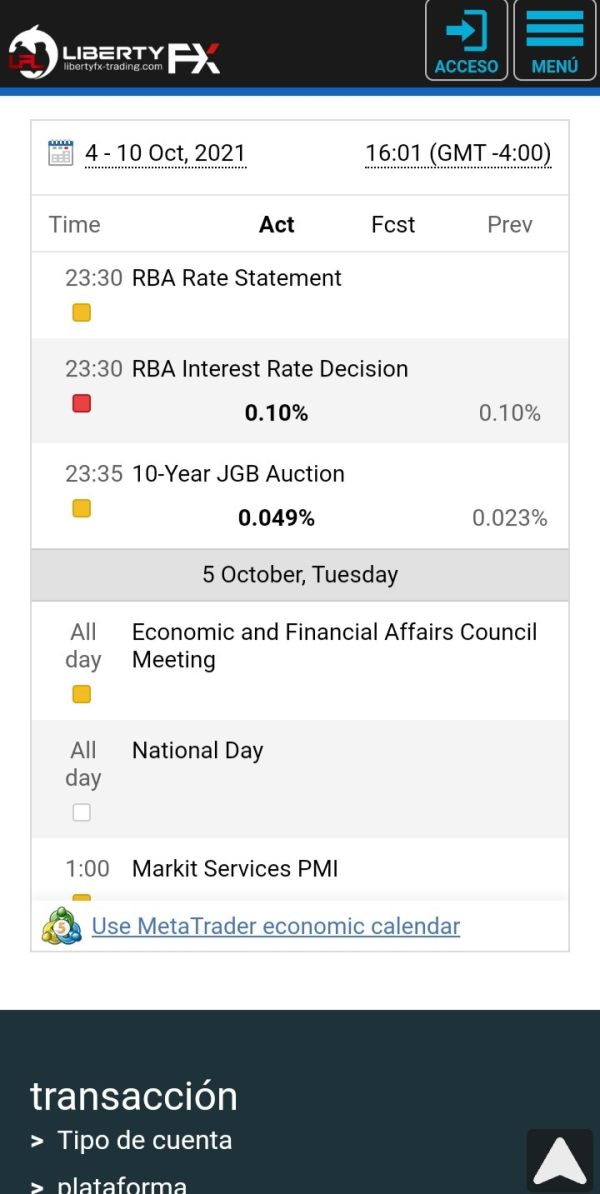

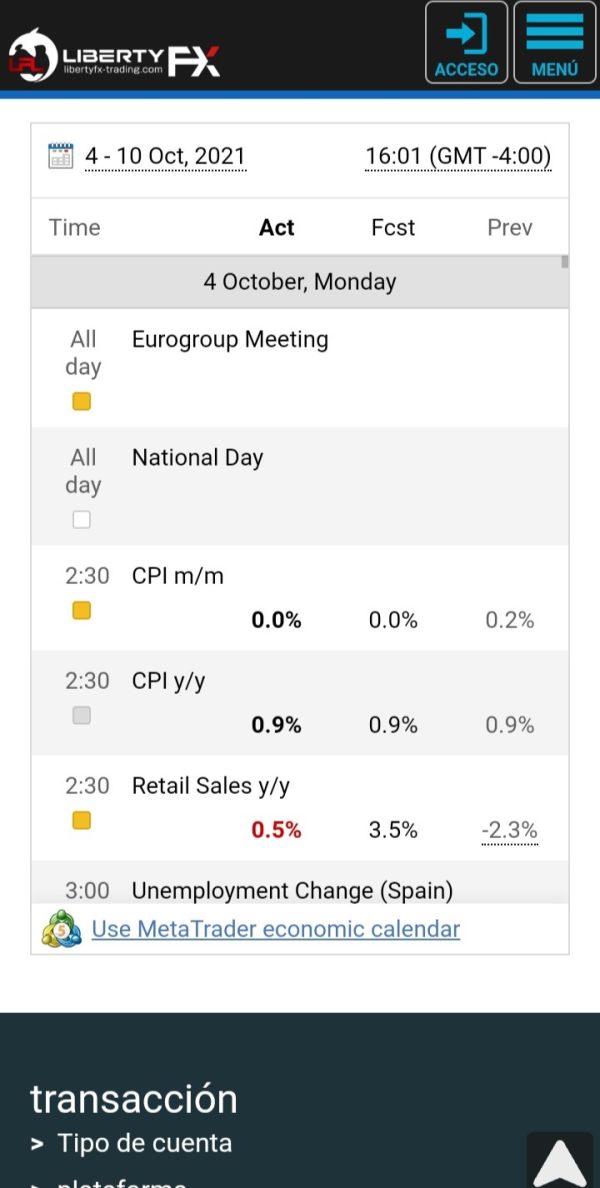

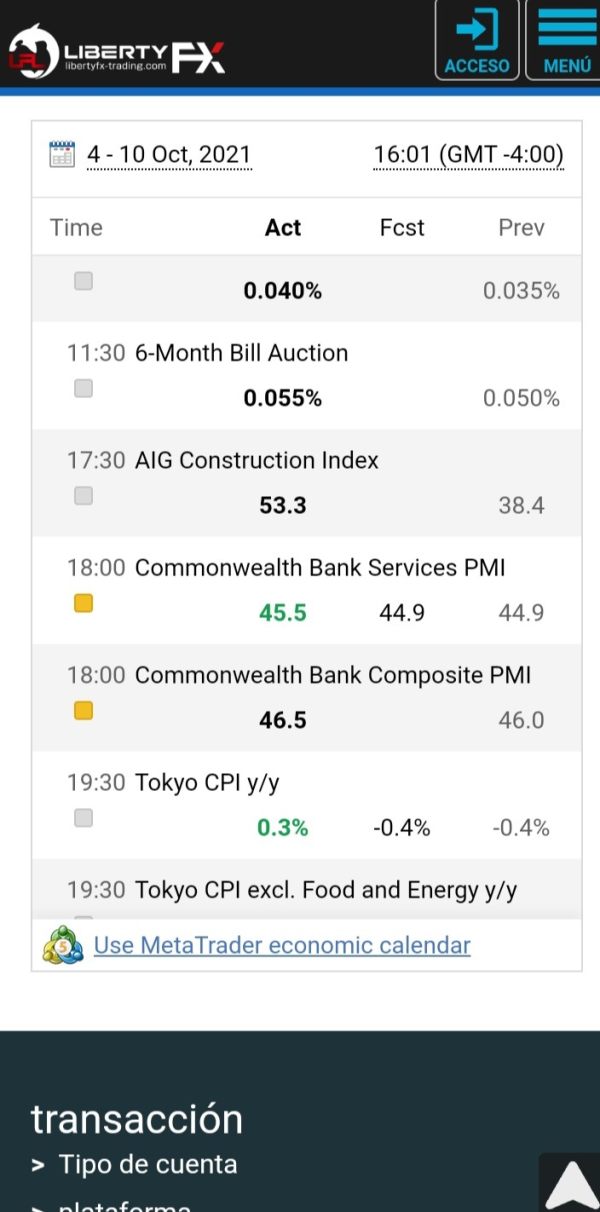

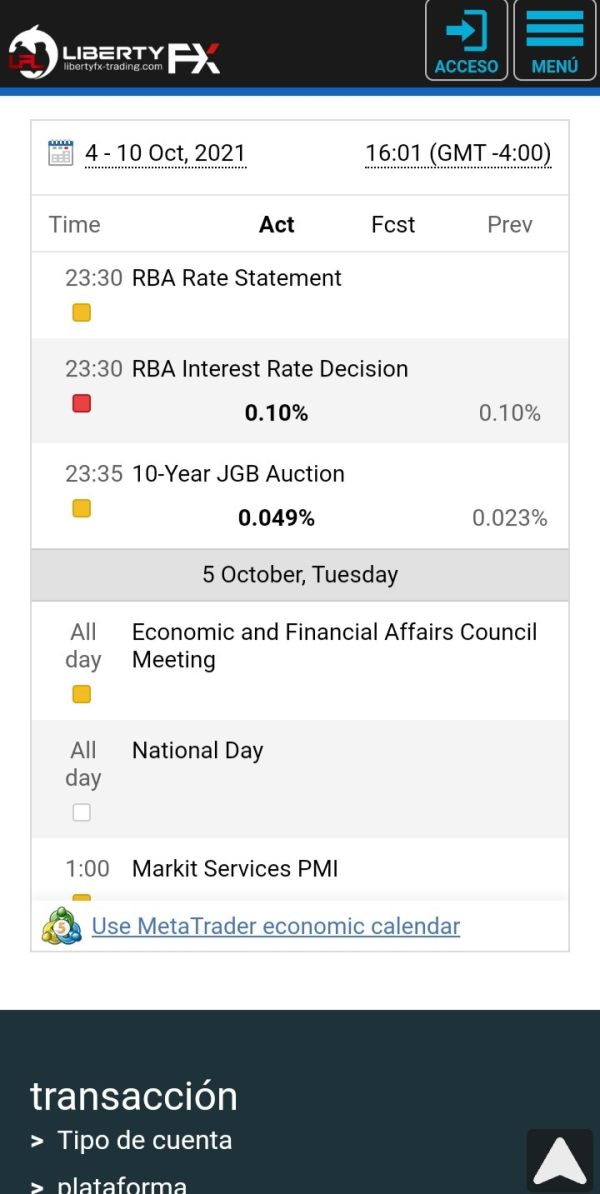

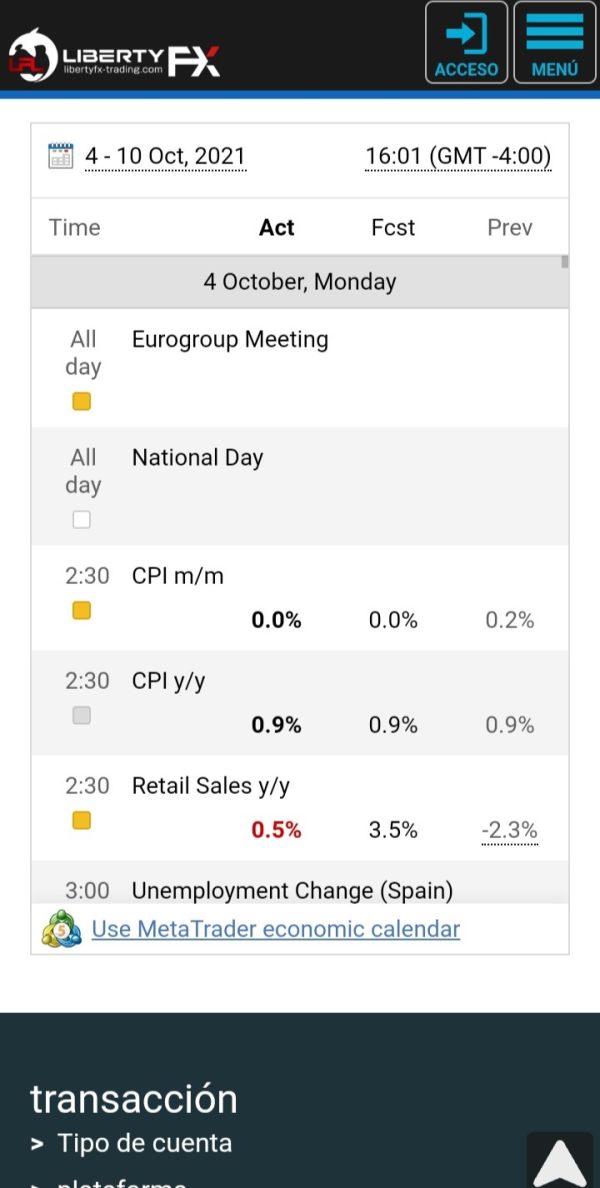

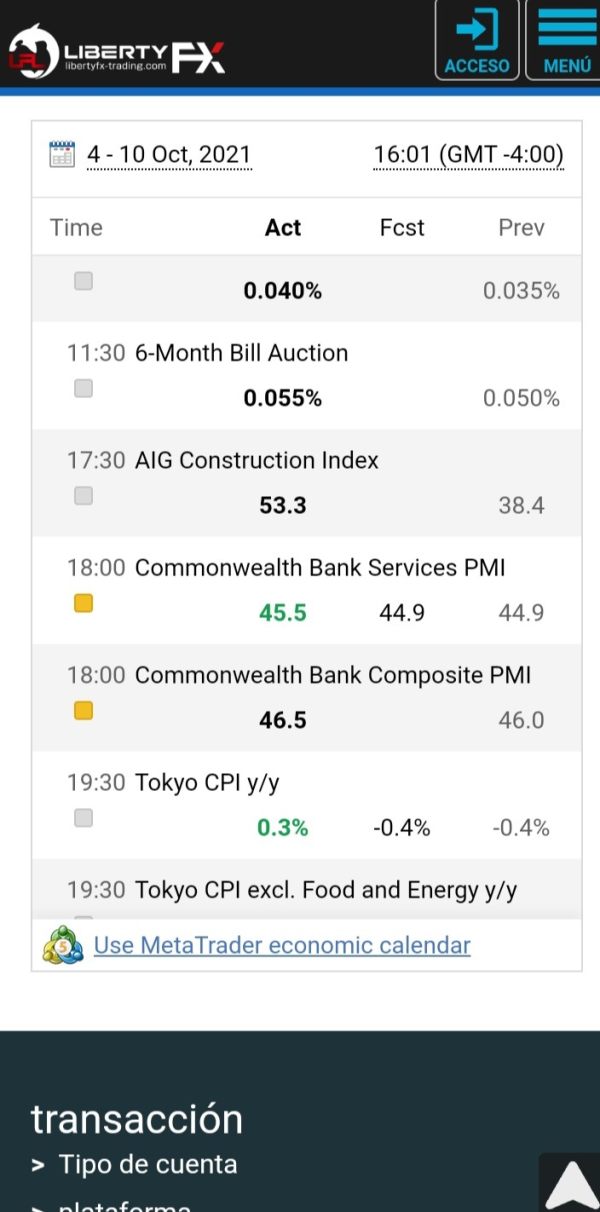

However, beyond the MT4 platform, available information does not detail additional trading tools, research resources, or educational materials that Liberty FX might provide. Reputable brokers typically offer comprehensive market analysis, economic calendars, trading signals, and educational content to support their clients' trading activities. The absence of such information suggests either limited additional resources or poor communication about available services.

The variety of tradeable assets including forex, indices, commodities, precious metals, stocks, and cryptocurrencies indicates that Liberty FX attempts to provide comprehensive market access. However, without detailed information about specific instruments, trading conditions for each asset class, or execution quality, it's difficult to assess the actual value of these offerings.

User feedback about the platform's performance, stability, and functionality is notably limited in available sources, making it challenging to evaluate the actual trading experience that clients can expect from Liberty FX's tools and resources.

Customer Service and Support Analysis

Customer service represents one of Liberty FX's weakest areas based on available information and user feedback. Multiple sources indicate that users have experienced poor response times and inadequate service quality when attempting to contact the broker's support team. This is particularly concerning given the importance of reliable customer support in financial services.

The lack of detailed information about available customer service channels, operating hours, and supported languages further adds to concerns about Liberty FX's commitment to client support. Reputable brokers typically provide multiple contact methods including phone, email, live chat, and sometimes social media support, with clear information about availability and response time expectations.

User reports suggest that when issues arise, clients may face difficulties in obtaining timely and effective assistance from Liberty FX's support team. This is especially problematic in trading environments where quick resolution of technical issues, account problems, or trading disputes can be critical to protecting client interests and funds.

The absence of comprehensive FAQ sections, detailed help documentation, or self-service resources also indicates limited investment in client support infrastructure, which could lead to frustrating experiences for users seeking to resolve issues independently.

Trading Experience Analysis

The trading experience with Liberty FX appears to be inconsistent based on available user feedback. While some traders report satisfactory experiences with the MetaTrader 4 platform and competitive spreads, others have raised concerns about various aspects of the trading environment. The platform's stability, order execution quality, and overall reliability have not been comprehensively documented in available sources.

The extremely high leverage of 1:400 offered by Liberty FX may appeal to aggressive traders but represents major risk that could lead to rapid account depletion. Such high leverage ratios are often prohibited or strictly regulated in jurisdictions with strong investor protection measures, which raises questions about the broker's target market and regulatory compliance.

Information about order execution speed, slippage rates, and requote frequency is not available in current sources, making it difficult to assess the quality of trade execution that clients can expect. These factors are crucial for evaluating a broker's trading environment, particularly for active traders or those employing specific trading strategies.

The diversity of available instruments across forex, indices, commodities, and other asset classes could provide opportunities for portfolio diversification, though without specific details about trading conditions for each asset class, it's challenging to evaluate the actual liberty fx review trading experience comprehensively.

Trust and Safety Analysis

Trust and safety represent the most major concerns in this liberty fx review. The absence of clear regulatory oversight is a critical red flag that potential clients must seriously consider. Regulated brokers are required to maintain segregated client funds, provide negative balance protection, participate in compensation schemes, and submit to regular audits - protections that may not be available with Liberty FX.

Multiple sources have raised questions about Liberty FX's legitimacy, with some reviews explicitly labeling the broker as potentially fraudulent. The lack of transparency about company ownership, corporate structure, and regulatory status creates an environment where client funds could be at major risk. Brokers-exchange.com specifically identifies Liberty FX as a "sham broker," which represents a serious warning for potential clients.

The absence of information about client fund protection measures, such as segregated accounts or insurance coverage, further adds to safety concerns. Legitimate brokers typically provide detailed information about how client funds are protected and what recourse is available in case of broker insolvency or misconduct.

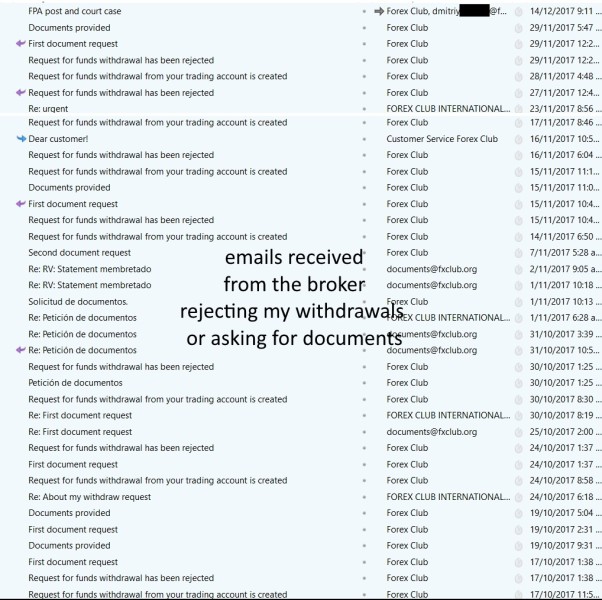

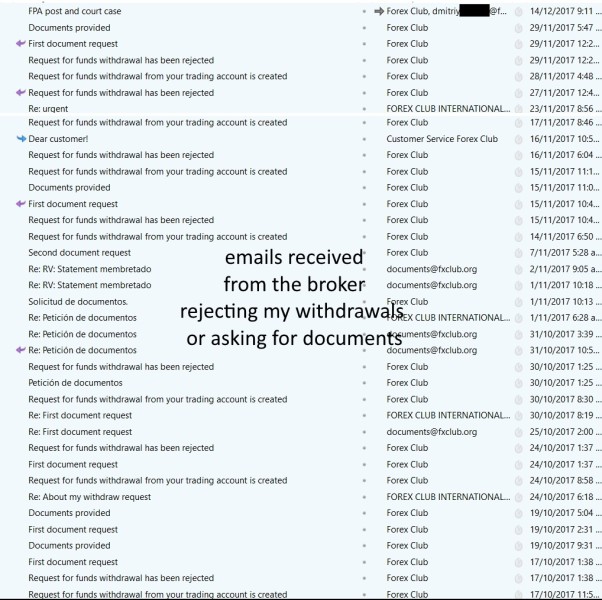

Industry monitoring services like WikiFX have noted exposure reports about Liberty FX, indicating that some clients have experienced problems with the broker that warranted public warnings. Such exposure reports often relate to withdrawal difficulties, unexpected account closures, or other serious operational issues.

User Experience Analysis

User experience with Liberty FX appears highly variable, with feedback ranging from positive to deeply concerning. Some users report satisfactory experiences with the platform's trading conditions and interface, while others have raised serious questions about the broker's legitimacy and operational practices. This split in user feedback is itself a warning sign that suggests inconsistent service delivery.

The registration and verification processes are not well-documented in available sources, which creates uncertainty about the onboarding experience for new clients. Legitimate brokers typically provide clear information about account opening requirements, documentation needed, and timeframes for account approval.

User complaints appear to focus primarily on concerns about the broker's regulatory status and overall legitimacy rather than specific technical or service issues. This pattern suggests that users who have researched the broker thoroughly have identified fundamental concerns about safety and compliance that override considerations about trading conditions or platform functionality.

The limited availability of comprehensive user testimonials and detailed experience reports may indicate either a small user base or reluctance among users to publicly discuss their experiences, both of which could be concerning indicators about the broker's operations and reputation within the trading community.

Conclusion

This comprehensive liberty fx review reveals major concerns that potential clients must carefully consider. While Liberty FX offers some competitive trading conditions including tight spreads and high leverage, the absence of regulatory oversight and multiple warnings about the broker's legitimacy create substantial risks that likely outweigh any potential benefits.

The broker may appeal to traders seeking high-leverage trading opportunities and access to diverse asset classes, but the lack of regulatory protection and transparency makes it unsuitable for most retail traders who prioritize fund safety and reliable service. The mixed user feedback and specific warnings from industry sources suggest that Liberty FX poses major risks to client funds and trading success.

Potential clients are strongly advised to consider regulated alternatives that provide comprehensive investor protections, transparent operations, and reliable customer service. The forex market offers numerous well-regulated brokers that can provide competitive trading conditions without the substantial risks associated with unregulated entities like Liberty FX.