AMarkets 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

AMarkets positions itself as a competitive trading platform offering substantial leverage of up to 1:3000 across a wide range of assets including forex, commodities, cryptocurrencies, and more. While it appeals to experienced traders, particularly those interested in algorithmic and high-frequency trading, its unregulated status raises serious concerns regarding fund safety. With mixed user feedback on service reliability and withdrawal processes, prospective clients must navigate the trade-offs between high potential rewards and significant risks. This review aims to dissect the broker's offerings while highlighting its strengths and weaknesses, particularly for seasoned traders looking for advanced tools and flexibility.

⚠️ Important Risk Advisory & Verification Steps

Investing with AMarkets carries significant risks. Prior to opening an account:

- Verify Regulatory Status: AMarkets operates under offshore licenses and lacks tier-1 regulatory oversight, which poses risks.

- Understand Leverage Risks: High leverage can amplify losses, particularly for inexperienced traders.

- Consider Mixed Feedback: Users have reported inconsistent experiences regarding fund withdrawals and customer support.

Self-Verification Steps:

- Visit the official AMarkets site and identify its claimed regulatory bodies (e.g., FSA in Saint Vincent and the Grenadines).

- Check AMarkets' registration details through authoritative regulatory websites.

- Review online forums and customer testimonials for firsthand experiences.

- Assess the broker's transparency in terms of fees and conditions.

Ratings Framework

Broker Overview

Company Background and Positioning

Founded in 2007, AMarkets is registered in Saint Vincent and the Grenadines, presenting itself as a provider of various trading services—including forex, stocks, commodities, and cryptocurrencies—targeting not only retail traders but also institutions. Despite its rapid growth and a customer base exceeding 1 million users, AMarkets is unregulated by a respected financial authority, raising substantial concerns over investor protection and fund safety.

Core Business Overview

AMarkets aims to cater to a diverse clientele by providing multiple account types, including Standard, Fixed, and ECN accounts, each designed to meet specific trading needs. The broker claims to offer competitive trading conditions, highlighted by average execution speeds of 35-50 ms and floating spreads starting from 0.0 pips on ECN accounts. Furthermore, the availability of analytical tools such as Autochartist, along with a copy trading platform, distinguishes AMarkets in the crowded forex brokerage landscape.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

AMarkets operates under the oversight of several low-tier regulatory bodies, including the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. Users are cautioned about the potential for low investor protection due to the offshore nature of the regulations, as only minimal requirements apply. The absence of strict oversight raises concerns regarding fund safety and regulatory compliance.

User Self-Verification Guide

- Step 1: Visit the FSA website to check license status under registration #22567.

- Step 2: Use reputable international financial regulator databases to see if AMarkets is listed.

- Step 3: Look for any complaints lodged against AMarkets on regulatory sites or forums.

- Step 4: Read independent reviews from financial industry websites to gauge the general sentiment towards AMarkets.

Industry Reputation Summary

Overall feedback has been mixed, with several users expressing satisfaction with account performance and customer service. However, numerous complaints highlight difficulties in fund withdrawals and customer support responsiveness. The potential for heavy financial loss has made many traders wary, particularly those with less experience.

Trading Costs Analysis

Advantages in Commissions

AMarkets offers competitive trading costs relative to industry standards. For instance, its ECN account provides spreads starting as low as 0.0 pips with a commission of $2.5 per lot, making it appealing for high-frequency traders looking to maximize margins.

The "Traps" of Non-Trading Fees

However, users should be cautious of withdrawal fees that can range from 0.5% to 1.8% depending on the chosen payment method. This can significantly cut into profits, especially for those making frequent withdrawals. It's crucial for traders to consider the overall cost structure before committing.

Cost Structure Summary

For professional traders seeking to minimize costs, the ECN account represents a suitable option. On the other hand, novice traders may find the commissions and fees on standard accounts less favorable, particularly if they engage in less frequent, smaller trades.

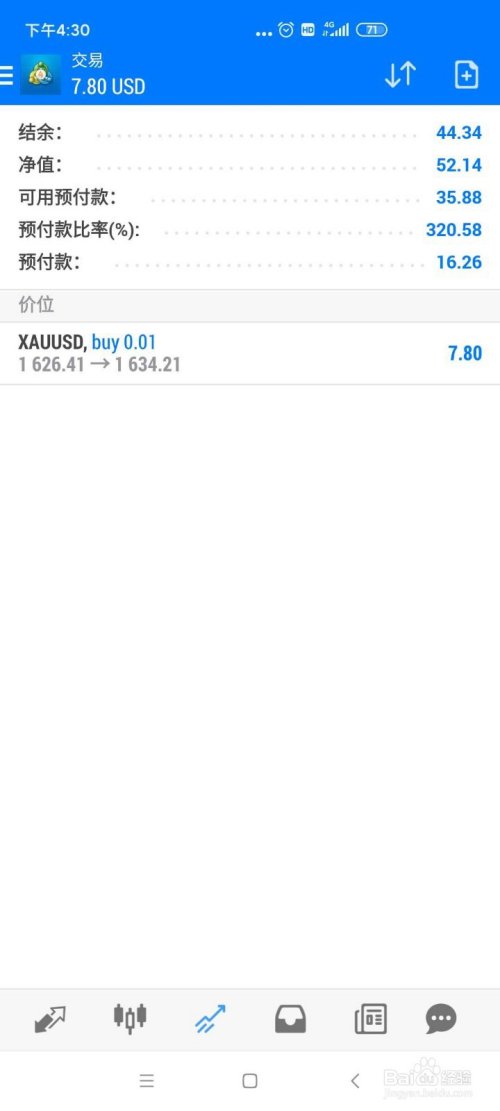

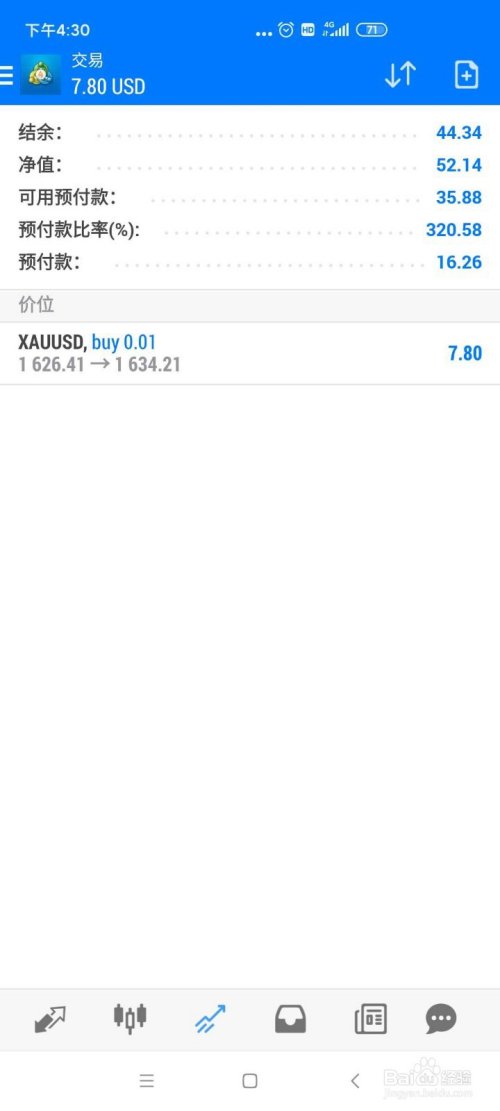

AMarkets offers MT4 and MT5 trading platforms, alongside its proprietary mobile app. Both MT4 and MT5 provide various functionalities including automated trading, extensive analytical tools, and a user-friendly interface, appealing to both new and experienced traders.

The trading platforms are equipped with advanced features such as charting tools, multiple time frames, and built-in indicators that enhance trading strategies. However, some users have noted the lack of a proprietary platform with advanced options compared to competitors.

User feedback suggests that the platforms perform reliably with few glitches, though there remains a learning curve for less experienced traders. Overall, AMarkets offerings in this area enhance its appeal, particularly among algorithmic trading enthusiasts.

User Experience Analysis

User Satisfaction and Navigation

General feedback on user experience indicates that while navigation is relatively straightforward, new users may struggle with the complexity of available tools. The user interface of the platforms is often praised for being intuitive, though comprehensive educational resources are lacking.

Trading Environment Overview

The execution speed is highlighted as a strong point, providing the conditions needed for effective high-frequency trading. However, the absence of extensive educational resources may exclude potential new traders.

User Feedback on Overall Experience

User reviews reflect a mixed bag, with experienced traders appreciating the speed and tools, while novices express feelings of being overwhelmed. Improved onboarding resources could benefit overall user experience.

Customer Support Analysis

Availability and Channels

AMarkets provides customer support through multiple channels including email, live chat, and phone—a positive feature. However, it does not operate on weekends, causing potential stress during market fluctuations.

Response Times and Effectiveness

The speed of response is generally favorable, with users reporting quick assistance via live chat. Nonetheless, some have highlighted slower response times when addressing more complex inquiries via email.

Customer Support Challenges

While the available support is satisfactory, the inability to assist on weekends during active trading periods proves a disadvantage for traders who might need immediate assistance. More comprehensive support during critical trading times could improve user satisfaction.

Account Conditions Analysis

Account Types and Flexibility

AMarkets offers several account types to cater to different trading styles, including Standard, Fixed, and ECN accounts. This diversity appeals to a broad range of traders, though the minimum deposit amounts may be prohibitive for total newcomers.

Deposit and Withdrawal Processes

The broker supports a variety of funding methods without deposit fees, which is advantageous for new traders. However, some withdrawal methods incur fees that may deter users from making regular withdrawals.

Overall Account Availability

Although the account conditions appear favorable for seasoned traders, novice traders may find the minimum deposit requirements challenging compared to other accessible platforms.

Conclusion

In summary, AMarkets remains a compelling option for experienced traders who can leverage its substantial trading tools, high leverage, and fast execution times. However, its unregulated status and inconsistent user feedback warrant caution. Traders should carefully weigh their own risk tolerance and ensure they conduct thorough research—particularly given the mixed reviews centered around fund handling and customer service responsiveness. Overall, while AMarkets has its merits, potential clients must approach with caution, particularly if they are new to trading or value comprehensive regulatory oversight.

Final Notes

Potential Users: Consider starting with a demo account to familiarize yourself with the trading environment and assess if AMarkets aligns with your trading objectives before making any commitments.

Stay Informed: Remain updated on AMarkets regulatory status and user experiences as the broker navigates a highly competitive and often scrutiny-filled environment.

This extensive review of AMarkets has provided a comprehensive insight into its offerings, underlying considerations, and operational landscape, equipping traders with the necessary information to make informed decisions.