Is LIBERTY FX safe?

Business

License

Is Liberty FX A Scam?

Introduction

Liberty FX is a forex broker that emerged in the competitive landscape of online trading, primarily targeting the Japanese market. Established in 2020, it offers various trading instruments, including forex pairs, commodities, and indices, through the popular MetaTrader 4 platform. As the forex market continues to grow, traders must exercise caution in selecting brokers, as the potential for scams and unregulated entities is prevalent. This article aims to provide a comprehensive analysis of Liberty FX, assessing its safety and legitimacy through regulatory status, company background, trading conditions, client experiences, and risk factors.

To evaluate whether Liberty FX is safe, we will analyze multiple dimensions, including regulatory compliance, historical performance, and customer feedback. Our findings are based on data gathered from reputable financial review platforms, user testimonials, and regulatory databases, ensuring a balanced perspective on the broker's reliability.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial for establishing its credibility and protecting traders' interests. Liberty FX, however, raises significant concerns regarding its regulatory status. According to multiple sources, Liberty FX is not regulated by any recognized financial authority, which poses a considerable risk to potential investors.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Liberty FX does not adhere to the stringent standards and practices mandated by financial authorities. Regulated brokers are required to maintain transparent operations, segregate client funds, and provide avenues for dispute resolution. In contrast, unregulated brokers like Liberty FX may not offer these protections, leaving clients vulnerable in the event of disputes or financial mismanagement.

Moreover, the lack of regulatory oversight can lead to potential issues such as fraud or misappropriation of funds. Traders are advised to approach Liberty FX with caution, as the absence of a regulatory framework significantly increases the risks associated with trading through this broker.

Company Background Investigation

Liberty FX was founded in 2020, positioning itself as a modern trading platform for retail traders. However, details about its ownership structure and management team remain limited, raising questions about the transparency and credibility of the broker.

The lack of publicly available information about the company's history and operational practices can be concerning for potential investors. A reputable broker typically provides thorough disclosures about its management team, including their qualifications and experience in the financial industry. In Liberty FX's case, the absence of such information may indicate a lack of accountability and professionalism.

Furthermore, the company's transparency regarding its operational practices is crucial in building trust with clients. If a broker fails to disclose essential information about its ownership, management, and operational history, it may signal underlying issues that could jeopardize client funds and trading experiences.

Trading Conditions Analysis

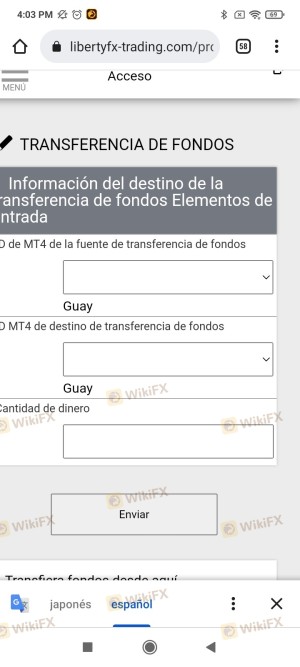

When evaluating a forex broker, understanding the trading conditions they offer is essential. Liberty FX presents various account types with differing minimum deposit requirements and leverage options. However, the overall fee structure and trading costs can be a mixed bag.

| Fee Type | Liberty FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.0 pips | 0.5 - 1.5 pips |

| Commission Model | Varies by account | Flat or Tiered |

| Overnight Interest Range | Not disclosed | 2-3% (typical) |

While Liberty FX offers competitive spreads starting from 1.0 pips, the lack of transparency regarding commission structures and overnight interest rates raises concerns. Traders should be aware of any hidden fees that may not be readily disclosed, as these can significantly impact overall trading profitability.

Moreover, the absence of clear information on commission models and additional fees can complicate the trading experience, making it difficult for traders to assess their potential costs accurately. This lack of clarity may lead to unexpected charges, further questioning the broker's reliability and overall trading conditions.

Client Funds Security

The safety of client funds is a paramount concern for any trader. Liberty FX's approach to fund security is a critical aspect to consider. The broker reportedly keeps client funds in segregated accounts; however, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Traders should be aware of the following security aspects:

- Segregation of Funds: While Liberty FX claims to keep client funds separate from its operational funds, the absence of regulatory scrutiny means there is no guarantee that these funds are secure.

- Investor Protection: Without regulation, there is no investor compensation scheme in place to protect traders in the event of the broker's insolvency.

- Negative Balance Protection: Liberty FX does not clearly state its policy on negative balance protection, which is an important feature that prevents traders from losing more than their deposited amount.

- Limit Capital Exposure: Only invest what you can afford to lose, given the high-risk nature of trading with an unregulated broker.

- Diversify Investments: Consider spreading investments across multiple brokers to reduce reliance on any single entity.

- Stay Informed: Regularly monitor the broker's practices and any changes in regulatory status or customer feedback.

The historical performance of Liberty FX regarding fund safety has not been well-documented, and any past incidents related to fund security could further undermine traders' confidence in the broker. Therefore, potential clients should carefully consider these factors before depositing funds with Liberty FX.

Client Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews of Liberty FX indicate a mixed bag of experiences, with some clients expressing satisfaction with the trading platform, while others report concerning issues.

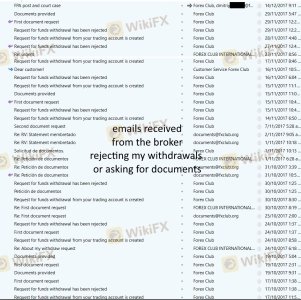

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Non-responsive |

| Poor Customer Support | Medium | Inconsistent |

| Lack of Transparency | High | No Clear Information |

Common complaints include difficulties with fund withdrawals, slow customer support responses, and a general lack of transparency regarding trading conditions and fees. Some users have reported that their withdrawal requests were either delayed or denied, raising red flags about the broker's operational practices.

Several testimonials indicate that clients have faced challenges when attempting to access their funds, which is a significant concern for any trader. A broker's ability to facilitate timely withdrawals is a critical aspect of its credibility, and ongoing issues in this area may suggest deeper operational problems.

Platform and Execution

The trading platform offered by Liberty FX is based on the widely used MetaTrader 4, which is known for its user-friendly interface and robust trading capabilities. However, the quality of execution and order handling can vary.

Traders have reported mixed experiences regarding order execution, with some experiencing slippage during high volatility periods. The lack of clear statistics on rejection rates and execution speeds raises concerns about the platform's reliability, particularly during critical trading moments.

While the platform is generally stable, any signs of manipulation or unfair practices can significantly undermine trader confidence. Therefore, it is essential to monitor execution quality and ensure that the trading environment remains fair and transparent.

Risk Assessment

Using Liberty FX presents several risks that traders should consider before proceeding.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of investor protection |

| Execution Risk | Medium | Potential slippage and rejections |

| Transparency Risk | High | Limited information on fees and practices |

The absence of regulation and investor protection schemes significantly elevates the risks associated with trading through Liberty FX. Traders are encouraged to conduct thorough due diligence and consider alternative options that offer better regulatory oversight and client protections.

To mitigate these risks, traders should:

Conclusion and Recommendations

In conclusion, the analysis of Liberty FX raises several red flags regarding its safety and legitimacy. The broker's lack of regulation, limited transparency, and mixed client feedback suggest that traders should exercise caution when considering this platform.

While Liberty FX may offer competitive trading conditions, the absence of essential protections raises significant concerns about its reliability. It is advisable for traders, especially beginners, to seek alternative brokers that provide robust regulatory oversight and a proven track record of customer satisfaction.

If you are considering trading with Liberty FX, it may be prudent to explore other reputable options such as regulated brokers with positive reviews and comprehensive client protection measures. Always prioritize safety and due diligence in your trading endeavors.

Is LIBERTY FX a scam, or is it legit?

The latest exposure and evaluation content of LIBERTY FX brokers.

LIBERTY FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LIBERTY FX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.