Is DS investment Limited safe?

Business

License

Is DS Investment Limited Safe or a Scam?

Introduction

DS Investment Limited has emerged as a player in the forex trading market, attracting the attention of both novice and experienced traders. As the allure of the forex market grows, so does the necessity for traders to carefully evaluate the credibility of their chosen brokers. The potential for substantial financial gain comes with significant risk, particularly when engaging with unregulated entities. This article aims to provide an objective assessment of DS Investment Limited, delving into its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigative approach combines a review of credible online sources, user feedback, and regulatory databases to form a comprehensive evaluation framework.

Regulatory Status and Legitimacy

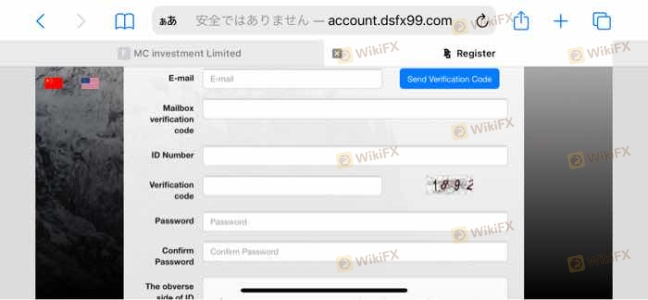

Understanding the regulatory environment in which a broker operates is crucial for assessing its safety. DS Investment Limited operates without oversight from any recognized financial regulatory authority, raising significant red flags regarding its legitimacy. An unregulated status implies that there are no formal safeguards to protect investors' funds, making it imperative for potential clients to exercise caution.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulatory oversight means that DS Investment Limited is not bound by the stringent standards that govern reputable brokers. Such regulations typically include requirements for transparency, financial reporting, and client fund protection. The lack of these protections significantly increases the risk of fraud and mismanagement. Historically, unregulated brokers have been known to engage in practices that can lead to significant financial losses for their clients, further underscoring the importance of regulatory compliance.

Company Background Investigation

DS Investment Limited's history and ownership structure also play a pivotal role in evaluating its trustworthiness. Established in recent years, the company has not yet built a reputation for reliability within the forex market. Information regarding its management team and their professional backgrounds is scarce, which raises concerns about the level of expertise guiding the company. Transparency in corporate governance is essential for fostering trust among clients, and the lack of readily available information about the team behind DS Investment Limited is troubling.

Moreover, the company's operational history has not been without controversy. Reports suggest that DS Investment Limited has faced numerous complaints from clients regarding withdrawal issues and unresponsive customer service. Such patterns are often indicative of deeper operational problems, which can compromise the safety of clients' funds. As potential investors consider their options, the opacity surrounding DS Investment Limited's management and operational history warrants a thorough investigation.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. DS Investment Limited presents a range of trading options, but the specifics of its fee structure and trading conditions require careful scrutiny. Traders often face hidden fees that can erode profits, making it vital to understand all associated costs before committing funds.

| Fee Type | DS Investment Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Structure | Not Disclosed | Varies (0-10 USD) |

| Overnight Interest Range | Not Disclosed | 0.5-2% |

The lack of transparency regarding fee structures raises concerns about potential hidden costs that could affect trading profitability. Many traders have reported difficulties in accessing their funds, often citing unexpected fees or conditions that were not clearly communicated at the outset. This lack of clarity can lead to frustration and financial loss, further emphasizing the need for potential clients to seek brokers with transparent fee structures and clear communication.

Client Fund Security

The safety of client funds is a paramount concern when selecting a forex broker. DS Investment Limited's lack of regulatory oversight raises significant questions about its fund security measures. Reliable brokers typically employ stringent security measures, including segregated accounts for client funds, investor protection schemes, and negative balance protection policies. Unfortunately, there is no evidence to suggest that DS Investment Limited adheres to these industry standards.

The absence of such protections leaves clients vulnerable to potential losses in the event of mismanagement or insolvency. Furthermore, historical reports indicate that clients have experienced challenges in withdrawing their funds, which is a major warning sign for any potential investor. Ensuring that a broker has robust security measures in place is critical for safeguarding investments, and the lack of such assurances from DS Investment Limited is concerning.

Customer Experience and Complaints

Evaluating customer feedback provides valuable insights into a broker's operational integrity. DS Investment Limited has received numerous complaints from clients, primarily centered around withdrawal issues and poor customer service. Many users have reported being unable to access their funds, often citing unresponsive support teams and unclear withdrawal conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | High | Unresolved |

| Misleading Information | Medium | Partial Response |

One notable case involved a client who was unable to withdraw funds despite following all necessary procedures. After weeks of waiting, the client reported that their account was closed without explanation, leaving them with significant financial losses. Such experiences are not isolated, as numerous clients have shared similar sentiments regarding the lack of support and transparency from DS Investment Limited. This pattern of complaints raises serious concerns about the broker's reliability and operational practices.

Platform and Execution

The trading platform offered by a broker is a critical component of the overall trading experience. DS Investment Limited provides access to a trading platform, but user feedback indicates that the platform may have performance issues, including frequent downtimes and execution delays. These factors can severely impact traders' ability to execute timely trades, particularly in a fast-paced market like forex.

Moreover, reports of slippage and rejected orders have surfaced, leading to further dissatisfaction among users. Such issues can hinder a trader's ability to capitalize on market opportunities, raising questions about the broker's commitment to providing a reliable trading environment. Traders must be cautious when selecting platforms that exhibit signs of instability or manipulation, as these can significantly impact trading outcomes.

Risk Assessment

Engaging with DS Investment Limited presents several risks that potential clients must consider. The absence of regulatory oversight, coupled with a history of customer complaints and withdrawal issues, paints a concerning picture of the broker's operational integrity.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing potential for fraud. |

| Financial Risk | High | Lack of fund protection measures leaves clients vulnerable. |

| Operational Risk | Medium | Reports of poor customer service and platform performance issues. |

To mitigate these risks, potential investors should conduct thorough research, seek out brokers with strong regulatory credentials, and consider using smaller amounts of capital when testing new platforms. Engaging with reputable brokers that have established track records can significantly reduce exposure to potential losses.

Conclusion and Recommendations

In summary, the investigation into DS Investment Limited raises significant concerns regarding its safety and reliability. The lack of regulatory oversight, coupled with a history of customer complaints and operational issues, suggests that potential clients should exercise extreme caution.

For traders seeking to engage in forex trading, it is advisable to consider alternatives with a proven track record of reliability and customer support. Brokers regulated by top-tier authorities, such as the FCA or ASIC, provide a safer trading environment and greater protections for client funds. Ultimately, the question of "Is DS Investment Limited safe?" leans heavily towards "no," and traders are encouraged to prioritize safety and transparency in their trading decisions.

Is DS investment Limited a scam, or is it legit?

The latest exposure and evaluation content of DS investment Limited brokers.

DS investment Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DS investment Limited latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.