flowbank 2025 Review: Everything You Need to Know

1. Abstract

This comprehensive flowbank review examines FlowBank, a Switzerland-based forex broker. The company combines banking and brokerage services in a unique way. FlowBank offers many trading platforms including MetaTrader 4, MetaTrader 5, and its own FlowBank Pro platform. The broker supports mobile trading and works with Mac devices too. This gives traders a flexible trading experience that works across different systems. User feedback stays positive overall. Many traders like how quickly customer service responds, as shown on Trustburn reviews. FlowBank serves small and medium-sized investors mainly. The broker also helps traders who want access to multiple asset classes like forex, stocks, and commodities. Fees cost CHF 10-50 per quarter, which is clearly stated. However, some important information is missing from available sources. This includes specific regulatory details, minimum deposit requirements, and leverage options that traders need to know. This review uses public data and user reviews to give a balanced view. We cover both the broker's strengths and its weak points.

2. Disclaimer

FlowBank's services and conditions may differ by region, which is important to remember. Users from different areas might face different regulatory environments and service terms. We recommend that potential clients check the local conditions that apply to them before signing up. This flowbank review uses public information and user feedback from sources like Trustburn and Invezz. Online data can change or may not tell the whole story sometimes. Some details might be incomplete, including regulatory information, minimum deposit requirements, and other service details that matter to traders. We advise readers to do more research and check the most current information before making investment decisions.

3. Scoring Framework

4. Broker Overview

FlowBank operates from Switzerland and has its headquarters in Zurich at Seidengasse 20, 8001 Zurich, Switzerland. The company uses a special model that combines both banking and brokerage services together. FlowBank doesn't share detailed public information about when it was founded, but the company has built a strong position in the market. The broker offers a unique mix of services aimed at giving traders a complete trading experience that covers multiple needs. Its business model serves traders interested in different asset classes, so it helps not only forex traders but also investors in stocks, commodities, and other financial instruments. User reports and reviews show that having banking capabilities helps make financial operations smoother. This makes the overall trading experience work better for many different types of users.

FlowBank provides a good selection of trading platforms that includes global industry standards. The broker offers MetaTrader 4 and MetaTrader 5, plus its own FlowBank Pro platform that was built specifically for their users. This range of options lets traders pick a platform that works best with their technical preferences and trading styles. Mobile trading features and Mac device compatibility make the broker even more appealing to modern traders. The broker supports multiple asset classes including stocks, forex, and commodities, giving users plenty of choices for their portfolios. However, specific details about its main regulatory body are not mentioned in available sources, which creates some uncertainty. This flowbank review shows that while the broker's strengths include multi-platform offerings and positive client feedback, transparency issues about fees and regulatory oversight remain concerns for potential clients.

-

Regulatory Regions :

FlowBank's regulatory information has not been clearly provided in available sources. The broker operates from Zurich, Switzerland, but there are no clear details about which regulatory bodies watch over the broker's operations. This lack of detailed regulatory information should be something potential traders think about carefully. Traders need to assess the levels of protection and oversight that are actually provided before they start trading.

Deposit and Withdrawal Methods :

The specific deposit and withdrawal methods that FlowBank offers are not detailed in the source material we found. The broker supports standard processes through Credit/Debit Cards and Bank Transfers, which is typical for most brokers. However, concrete details about the processing procedures and available payment systems remain unclear in the available documentation that we could access.

Minimum Deposit Requirement :

FlowBank doesn't mention specific information about the minimum deposit required in the available sources. This gap in important account opening details may affect traders who are trying to figure out the barrier to entry. Potential clients should contact FlowBank directly to learn about minimum deposit requirements.

Bonus and Promotion Offers :

No detailed information about bonus promotions or special offers has been provided by the available data we reviewed. Potential clients should know that any promotional incentives, if they exist, are not currently documented in public sources. Further inquiry with the broker may be necessary to get clear information about any bonuses or special offers that might be available.

Tradable Assets :

FlowBank offers tradable assets that include stocks, forex, and commodities, among other options. This diverse asset selection allows traders to spread their portfolios across multiple markets, which can help reduce risk. The variety of assets gives users flexibility in their trading strategies and investment approaches. However, while these asset classes are confirmed, details about additional instruments, such as indices or cryptocurrencies, are not mentioned clearly in the provided information we could find.

Cost Structure :

FlowBank's fee structure shows as CHF 10-50 per quarter, which is straightforward. However, detailed information about spreads, commission structures, and any potential hidden costs has not been provided clearly in available sources. The lack of transparency in these cost components is a downside, especially for traders who want clear comparisons against other international brokers. The quarterly fee is easy to understand, but additional transaction details and complex costs remain unclear according to available data. This situation requires careful consideration and further inquiry for those who want a precise cost breakdown before they start trading.

Leverage Ratio :

There is no available information about FlowBank's leverage ratios in the provided sources we reviewed. This leaves a big gap in understanding for traders who need clear details about available leverage options. Potential clients should ask about leverage directly before opening an account with the broker.

Platform Selection :

FlowBank provides strong platform choices, including MetaTrader 4, MetaTrader 5, and the company's own FlowBank Pro. Each platform supports desktop and mobile trading, with additional compatibility for Mac devices, which many traders appreciate. This variety ensures that traders have access to both familiar and advanced trading interfaces. The selection accommodates different trading preferences and styles that various users prefer.

Geographical Restrictions :

No specific geographical restrictions have been noted in the available data for FlowBank's services. However, different regulatory environments and local terms may apply based on client location. This means potential clients should verify their local situation before signing up.

Customer Service Languages :

Customer service receives high ratings from users, which is encouraging. However, specific details about the languages supported by FlowBank's client service team are not provided in available materials.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

FlowBank's account conditions show both strengths and areas of concern that potential traders should consider. The fee structure is clear at CHF 10-50 per quarter, which gives traders a predictable cost. However, the broker lacks clarity about minimum deposit requirements and leverage specifications, which creates problems for new traders. This gap makes it hard for people to evaluate the real cost of keeping an account open. There is also no detailed information about the variety of account types, specific account features, or how easy the account opening process actually is. These details matter a lot for understanding whether special accounts, such as Islamic or segregated accounts, are available for different types of traders. Many reviews and expert analyses show that transparency in account conditions is a major sign of a broker's commitment to customer satisfaction and following regulations properly. The missing clear, detailed terms in this area may make traders question whether the broker's financial disclosures can be trusted. Despite these problems, existing client feedback doesn't show major unhappiness with account-related matters. Instead, it shows that more clarity and detailed communication could make the user experience much better. Available information suggests that potential clients should ask for more clarification directly from FlowBank before putting money into accounts. This careful consideration is part of this flowbank review's approach to weighing both the good points and the notable problems in the broker's account conditions.

FlowBank offers a strong set of trading tools and research resources that stand out in several ways. The broker supports multiple platforms including MetaTrader 4, MetaTrader 5, and the company's own FlowBank Pro platform. These platforms let traders use many different strategies using well-known software that most traders recognize. The platforms provide access to advanced charting tools, technical indicators, and market analysis features that help with trading decisions. The compatibility with mobile devices and Mac computers makes the broker more appealing to modern traders. This flexibility helps traders who value being able to trade while they're away from their main computer. However, the available information doesn't include details about dedicated research and educational resources, such as webinars or market analysis reports that many traders find helpful. Features like automated trading or algorithmic support are not explained clearly either. User feedback has been positive about the platforms' reliability and design that works well for multiple functions. Yet the missing detailed descriptions of extra trading tools and research materials remains a limitation for traders who want more support. While FlowBank provides the basic trading platforms needed for daily trading, potential clients might need more information about additional resources. These extra tools can help with strategy development and getting better market insights. This detailed analysis contributes to our ongoing efforts to provide a balanced flowbank review.

6.3 Customer Service and Support Analysis

FlowBank's customer service has earned high marks from user reviews and ratings across different platforms. The reported responsiveness shows a real commitment to keeping clients satisfied with their experience. Users on platforms like Trustburn have praised how efficient and helpful the service team is in solving problems. They note that support is both quick and effective in addressing client issues when they come up. Despite the positive feedback, the specific ways that support is offered are not clearly explained in available documentation. Whether support comes through live chat, email, or telephone is not detailed enough for potential clients to understand. While customer service gets good reviews, there is no information about the range of languages supported or the exact hours when client support is available. This lack of detailed information makes it difficult for potential clients from non-English speaking regions to fully assess how well the system will work for them. People who need after-hours support also can't tell if the service will meet their needs. However, the overall satisfaction levels reported in user feedback suggest that FlowBank's customer service is a feature that really stands out. The quick responses and clear commitment to solving problems contribute a lot to the overall positive reputation. This thorough evaluation is an important part of our flowbank review. It ensures that potential clients have a detailed understanding of what to expect from FlowBank's customer service operations.

6.4 Trading Experience Analysis

The trading experience at FlowBank combines strong platform functionality with certain gaps in important information. The broker provides multiple platforms including MetaTrader 4, MetaTrader 5, and FlowBank Pro, which gives traders access to advanced technology. Many users have reported that these platforms are stable and easy to use for daily trading activities. The availability of mobile trading makes the trading environment more flexible for modern traders. This allows people to watch and execute trades when they're not at their main computer. Despite these good points, there is a notable lack of detailed information about critical aspects like order execution quality, specific spreads, and possible commission fees. The missing data on these key performance indicators makes it challenging to fully judge the overall trading experience. This is especially true for high-frequency traders or those with strict execution requirements for their strategies. While user feedback generally recognizes that the platforms work reliably overall, individual experiences about slippage or re-quotes have not been documented thoroughly. Users need this information to make informed decisions about whether the broker fits their trading style. In summary, although the basic structure and performance of FlowBank's trading platforms are good, the insufficient detail about transaction costs and order execution quality is an area that needs improvement. This insight is a crucial part of this flowbank review. It directly affects the daily trading operations and long-term satisfaction of clients.

6.5 Trustworthiness Analysis

When looking at trustworthiness, several critical factors must be considered, and FlowBank presents a mixed case for potential clients. The broker has achieved a Trust Score of 81 according to available user feedback, which suggests a moderately positive perception from people who use their services. However, the transparency about regulatory oversight remains lacking, as no specific regulatory bodies are mentioned in available information. There are also no detailed explanations about how funds are protected or kept separate from company money. This absence of clear regulatory credentials raises concerns, particularly for traders who put account safety and regulatory compliance at the top of their priority list. Additional aspects such as comprehensive financial reporting, management background, and any public records of negative events have not been provided by the source materials we could access. In many reputable flowbank review comparisons, clearly stated regulatory credentials and strong funds protection measures are essential signs of a broker's reliability. Without these details, even a strong customer service record and positive user interactions cannot fully make up for the risk associated with unclear oversight. Therefore, while the broker's overall user feedback on aspects such as responsiveness and service quality is encouraging, the unexplained regulatory and safety measures are significant drawbacks. This analysis shows the importance of transparency and continuous disclosure for building trust. Potential clients are advised to do further research about these aspects before engaging with FlowBank.

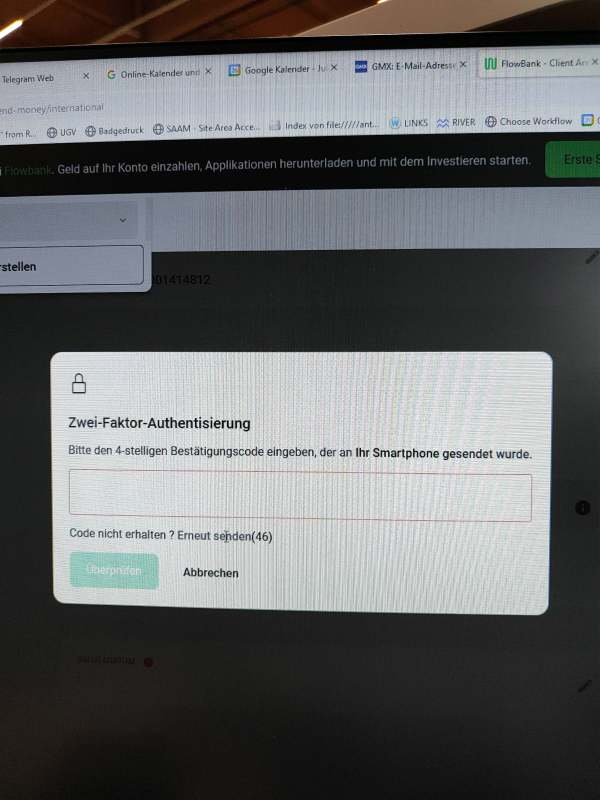

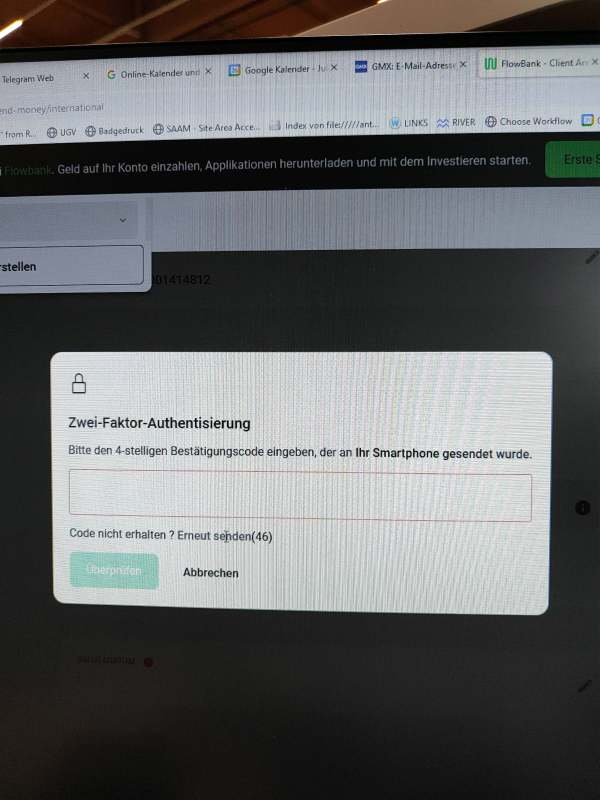

6.6 User Experience Analysis

User experience at FlowBank appears generally favorable, although several important aspects need further clarification for a complete picture. Overall satisfaction among traders is positive, with many users liking the ease-of-use offered by the multiple trading platforms. The responsive customer service also gets praise from users who have needed help. The design and functionality of the platforms, including support for both desktop and mobile devices, contribute to an accessible and flexible trading environment that works for different types of users. However, essential details such as the registration process, identity verification steps, and a clear description of deposit and withdrawal workflows remain poorly detailed in available information. This lack of clarity can potentially lead to confusion for new users who want a smooth onboarding experience when they start trading. While many reviews indicate that the user interface is intuitive and user-friendly, there is limited data on specific problems. Issues such as delays in funds transfer or account management problems are not well documented. Feedback from the trading community has been mixed in these areas, with some people calling for greater transparency in process details that affect their daily experience. However, the overall tone in customer testimonials is positive, and many traders recommend FlowBank for its multi-asset capabilities and reliable customer support. This analysis, as part of our comprehensive flowbank review, highlights both the strengths in usability and the areas where further improvement could enhance the overall trading experience.

7. Conclusion

FlowBank is a Switzerland-based forex broker that successfully blends banking and brokerage services in one platform. The company offers a diverse range of trading platforms such as MetaTrader 4, MetaTrader 5, and FlowBank Pro. Positive features include responsive customer service and strong mobile trading support, which work together to create a favorable impression among small and medium-sized investors. However, gaps in transparency pose challenges for traders who demand complete information before making decisions. These gaps particularly affect regulatory oversight, minimum deposit requirements, and detailed cost structures that are important for trading decisions. This flowbank review recommends careful consideration and further investigation by potential clients. Traders should do additional research before committing to trading with FlowBank to ensure it meets their specific needs.