Is SKI safe?

Pros

Cons

Is Ski Safe or Scam?

Introduction

Ski, a relatively new entrant in the forex trading market, has garnered attention for its trading platform and various offerings. However, as with any financial service, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market, known for its volatility and the potential for significant financial loss, necessitates that traders choose their brokers wisely. This article aims to assess whether Ski is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our investigation is based on a comprehensive analysis of multiple sources, including user reviews, regulatory databases, and expert opinions in the financial industry.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy and safety. In the case of Ski, it has been reported that the broker operates without valid regulation, which raises significant concerns about its trustworthiness. Unregulated brokers often lack the oversight necessary to protect traders' interests, making them susceptible to fraudulent activities.

Here is a summary of Ski's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation indicates that Ski does not adhere to the strict standards imposed by recognized financial authorities. This lack of oversight can lead to a higher risk of malpractice, including issues related to fund security and fair trading practices. Moreover, the absence of a regulatory body means that traders have limited recourse in the event of disputes or fraudulent activities. The quality of regulation is paramount; brokers overseen by top-tier regulators are generally expected to provide a safer trading environment compared to those under less stringent authorities. Given Ski's unregulated status, traders should approach this broker with caution.

Company Background Investigation

To further understand whether Ski is safe or a scam, it is essential to delve into the company's history and ownership structure. Ski appears to be relatively new in the forex trading landscape, with limited information available about its establishment and operational history. This lack of transparency can be a red flag for potential investors.

The management teams background plays a crucial role in determining a broker's reliability. Unfortunately, there is scant information regarding the qualifications and experiences of Ski's management team. A broker's transparency in disclosing its ownership and management details is vital for building trust with clients. Without clear information about who runs the company, traders may find it challenging to assess the broker's credibility.

Moreover, the company's communication regarding its operations and policies is essential in establishing a trustworthy relationship with clients. Ski's apparent lack of transparency in these areas may lead potential clients to question its legitimacy and safety. In the forex trading arena, established brokers typically provide clear information about their operational history and management team, which helps instill confidence among traders. Given the limited data available on Ski, traders should remain vigilant and conduct further research before engaging with this broker.

Trading Conditions Analysis

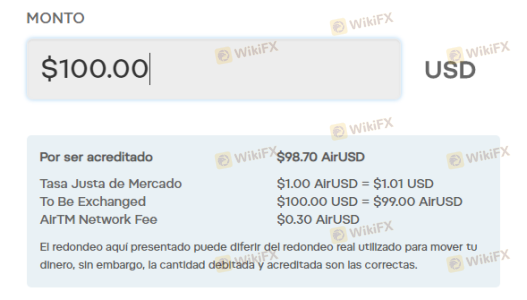

Examining the trading conditions offered by Ski is crucial in determining its overall appeal to traders. According to available information, Ski's fee structures and trading conditions appear to lack clarity, which can be problematic for traders looking for transparency. Understanding the costs associated with trading is essential for effective risk management and profitability.

Here is a comparison of Ski's trading costs with industry averages:

| Fee Type | Ski | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Moderate |

| Commission Model | None | Varies |

| Overnight Interest Range | Unclear | Standard |

The high spreads reported for major currency pairs may indicate that Ski is not as competitive as other brokers in the market. High trading costs can erode profits and deter traders from engaging in frequent trading activities. Furthermore, the lack of a clear commission structure raises concerns about hidden fees that may arise during trading. Traders should be wary of brokers that do not provide transparent information about their fee structures, as this could lead to unexpected costs and reduced profitability.

Customer Funds Safety

Ensuring the safety of client funds is paramount for any forex broker. In the case of Ski, there are significant concerns regarding its fund safety measures. The absence of regulatory oversight raises questions about the broker's ability to protect client funds adequately. Traders should be cautious if a broker does not implement robust security measures, such as segregating client funds from the company's operating funds.

Additionally, it is essential to evaluate whether Ski offers investor protection policies, such as negative balance protection, which safeguards traders from losing more than their initial investment. The lack of such policies can expose traders to significant financial risks, particularly in a volatile market like forex. Historical issues related to fund safety or disputes with clients can further indicate the reliability of a broker. Unfortunately, reports suggest that Ski has been involved in incidents where clients faced difficulties in withdrawing their funds, which raises serious red flags regarding its operational integrity.

Customer Experience and Complaints

Customer feedback is invaluable when assessing whether Ski is safe or a scam. Numerous user reviews have highlighted a pattern of complaints regarding withdrawal issues and poor customer service. Common complaints include difficulties in accessing funds, lack of responsive support, and challenges in resolving disputes.

Here is a summary of the main complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inconsistent |

| Transparency of Fees | Medium | Lacking |

Several users have reported being unable to withdraw their funds after making deposits, which is a critical concern for any trader. The inability to access funds not only reflects poorly on the broker's reliability but also raises questions about its operational practices. A broker's response to complaints is equally important; a lack of timely and effective communication can exacerbate customer dissatisfaction and distrust.

For instance, one user shared their experience of depositing funds only to face repeated delays in withdrawals, leading to frustration and a sense of betrayal. Such accounts underscore the importance of thorough research and caution when dealing with brokers like Ski.

Platform and Trade Execution

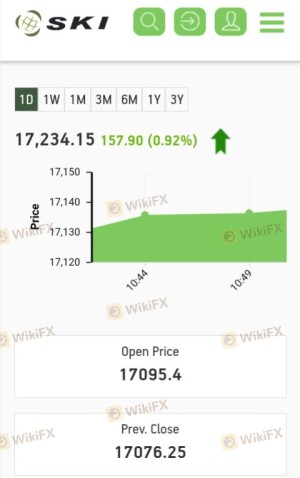

The performance of a trading platform is a crucial factor influencing a trader's experience. Ski's platform has received mixed reviews regarding its stability and user experience. Traders have reported issues with order execution, including slippage and rejections, which can hinder trading performance and lead to financial losses.

Effective order execution is vital for successful trading, particularly in the fast-paced forex market. Traders expect their orders to be executed promptly and at the expected prices. Any signs of manipulation or unfair practices can severely damage a broker's reputation. In the case of Ski, reports of execution problems may indicate underlying issues with the platform's reliability.

Risk Assessment

Assessing the overall risk associated with using Ski is imperative for potential traders. Given the broker's unregulated status, lack of transparency, and numerous customer complaints, the risks appear to be elevated. A summary of the key risk areas is provided below:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Fund Safety | High | Withdrawal issues reported |

| Trading Conditions | Medium | High spreads and unclear fees |

To mitigate risks while trading with Ski, potential clients should consider starting with a small investment and thoroughly reviewing the terms and conditions before committing larger amounts. Additionally, it is advisable to explore alternative brokers with a proven track record of reliability and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ski may not be a safe option for forex trading. The lack of regulatory oversight, numerous customer complaints, and issues related to fund withdrawals raise significant concerns about the broker's integrity. Traders should remain vigilant and exercise caution when considering Ski as a trading partner.

For those seeking reliable alternatives, it is advisable to explore brokers with established reputations, regulatory oversight, and positive customer feedback. Brokers regulated by top-tier authorities can provide a safer trading environment and greater protection for client funds. Ultimately, thorough research and due diligence are essential for traders to make informed decisions in the forex market.

Is SKI a scam, or is it legit?

The latest exposure and evaluation content of SKI brokers.

SKI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SKI latest industry rating score is 1.65, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.65 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.