Established in 2008, IKOFX operates under the company name IKO Global Limited and is registered at Vanuatu House, 133 Santina Parade, Elluk, Port Vila, Vanuatu. Initially recognized as a legitimate trading option, the broker has faced scrutiny following its de-registration as a financial service provider in New Zealand in 2015. Despite claiming to be regulated by the VFSC (License No: 14547), extensive verification has found no substantiation for this claim. This absence of credible regulation severely hampers trustworthiness, particularly among potential retail traders looking for secure trading avenues.

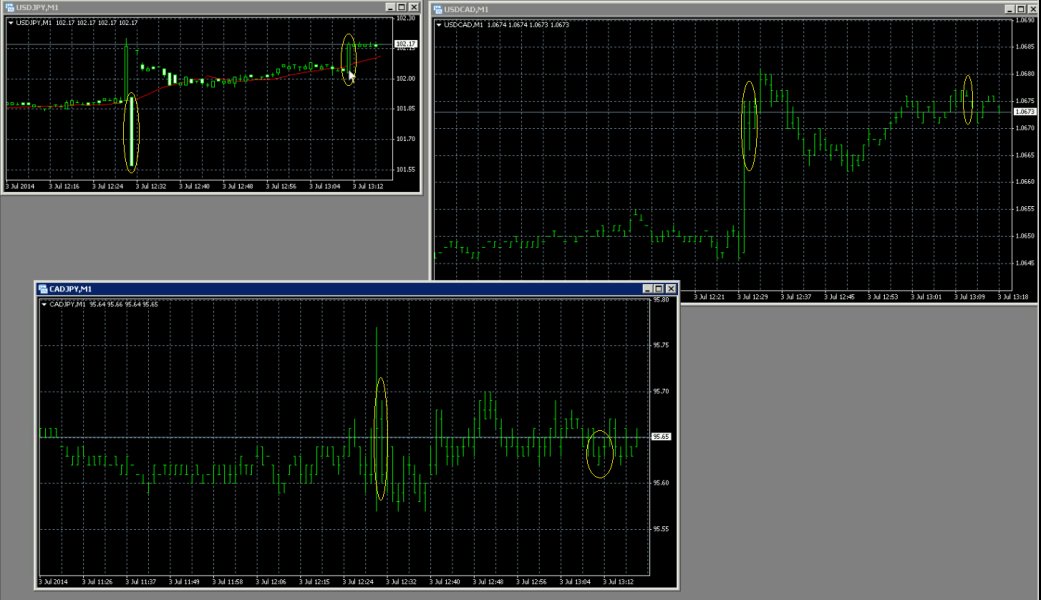

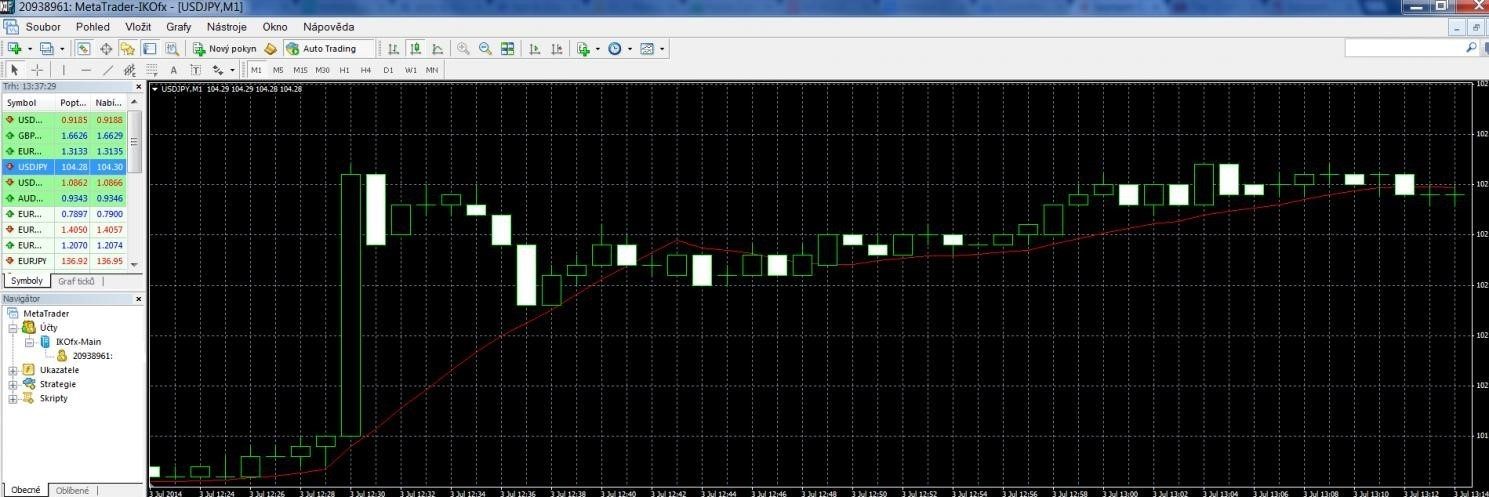

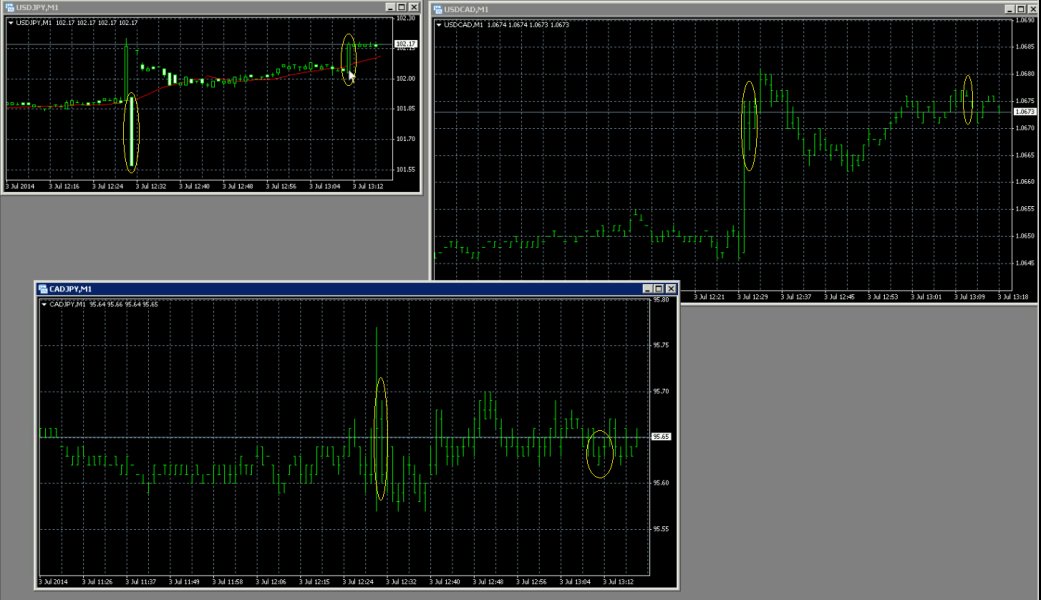

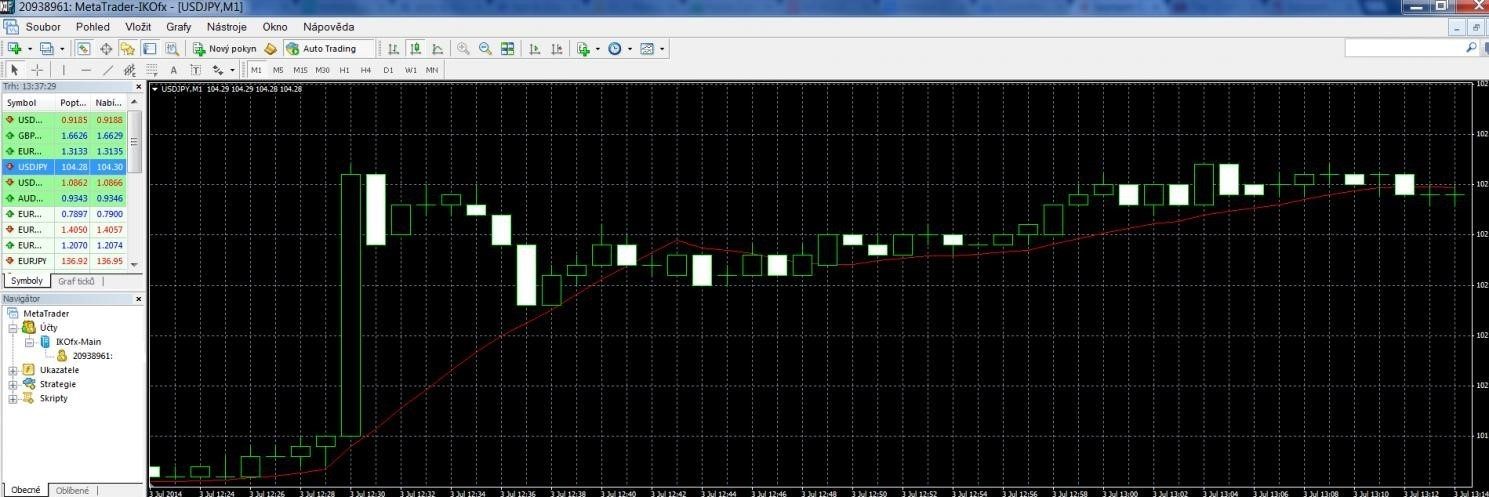

IKOFX's primary offering is forex trading, providing access to over 25 currency pairs alongside commodities such as gold and silver. The broker supports various account types—including mini, standard, and ECN accounts—all of whose features can be navigated via the acclaimed MetaTrader 5 platform. However, the lack of transparency regarding its claimed regulatory status, coupled with a scattered reputation highlighted by numerous user complaints, poses a substantial risk for new investors.

The importance of trust in the forex trading environment cannot be overstated. When evaluating a broker's reliability, regulatory information is pivotal.

Regrettably, IKOFXs claims of being regulated by the VFSC are not verified, as source checks suggest that no regulatory record aligns with this broker. This lack of credible oversight presents significant risks, including potential fund mismanagement. The absence of recourse against fraudulent activity heightens concerns for potential investors.

- Check Regulator's Database: Visit the VFSC website and search for IKOFX under their licensing database.

- Review Financial News: Keep updated with any financial disputes involving IKOFX reported in trustworthy financial news.

- Interactive Trading Communities: Engage with trading communities to obtain firsthand accounts of experiences with IKOFX.

Industry Reputation and Summary

User sentiment is mixed. Many traders report positive experiences regarding trade execution speed; however, a resonating theme in feedback highlights withdrawal issues. One user shared:

“I‘m happy with the fast services they provide; however, I’ve faced numerous challenges getting my withdrawls processed.”

Trading Costs Analysis

The financial landscape of IKOFX is a mix of enticing low commissions paired with potential hidden costs.

Advantages in Commissions

With a minimum deposit of just $1, IKOFX attracts many beginners. The commission structure can be attractive, particularly for those executing larger trades due to the leverage offered.

The "Traps" of Non-Trading Fees

However, initial costs can quickly escalate due to withdrawal fees. For instance, complaints on user forums mention:

"Whenever I try to withdraw, they deduct a hefty fee of $25, which chips away at my profits."

Cost Structure Summary

While IKOFX can suit the trader seeking minimal initial costs, frequent charges can be detrimental—especially to newly initiated traders who may not budget for these expenses. This presents a double-edged sword for the uninformed trader.

Professional depth versus beginner-friendliness is a crucial consideration when evaluating a trading platform.

Platform Diversity

IKOFX operates on the widely respected MetaTrader 5 platform, which is renowned for its customizable features and user-friendly interface. Additionally, it is accessible through various devices, allowing effective trading on-the-go.

Quality of Tools and Resources

Though advanced charting and analytical tools are available, users have reported a lack of educational resources which could support novices.

Platform Experience Summary

User feedback indicates the platform is relatively straightforward. However, some users express frustration over the execution speed during volatile market conditions, saying:

“While I enjoy the interface, I've encountered lag during crucial trading windows.”

Continuing this level of detailed analysis, we can evaluate the areas of User Experience, Customer Support, and Account Conditions, mirroring the detailed examination of Trustworthiness, Trading Costs, and Platforms.

Conclusion

In summary, while IKOFX presents itself as an attractive option for traders seeking low-cost entry and high leverage, underlying concerns persist. The lack of reliable regulation, alongside complaints regarding fund safety and withdrawal processes, urges caution. Retail traders, particularly those new to the forex market, would be wise to consider alternative, more regulated brokers to safeguard their investments. IKOFX offers significant trading opportunities, but potential users must remain vigilant and informed to navigate the risks associated with unregulated trading.