blaze markets 2025 Year Review: Everything You Need to Know

Abstract

Blaze Markets is a new forex broker that started in 2020. It quickly became a good choice for retail traders who want low entry costs and flexible leverage options. The broker gives traders many different trading conditions, including access to the popular MetaTrader 4 platform and over 120 trading pairs that cover forex, metals, indices, and cryptocurrencies. With a minimum deposit of $100 and maximum leverage of 1:200, Blaze Markets works well for retail investors who like highly leveraged positions and need an easy-to-use interface. Fast customer support is one of its best features. Users often praise how quickly their online and email questions get answered. While Blaze Markets offers good trading conditions and many asset choices, the lack of clear regulatory information means potential clients should be careful. This blaze markets review gives a fair view based on available data and user feedback, making it helpful for traders who want to understand the benefits and risks before opening an account.

Caveats and Disclaimers

Blaze Markets operates in multiple countries, but regulatory details and licenses are not clearly provided in the available data. Investors should know that the lack of clear regulation may affect account security and oversight. This review uses publicly available information, user testimonials, and data from review materials. Some differences between data sources have been noted; for example, while some users report excellent support, others have had problems with demo account logins. The review method includes analysis of known market practices and feedback from different sources. While every effort has been made to ensure accuracy, some aspects of the broker's operations remain unclear, and readers should do more research before starting live trading.

Scoring Framework

Broker Overview

Blaze Markets Limited started in 2020 and is based in Saint Vincent and the Grenadines. The company operates under a business model called STP/ECN. The broker wants to help retail investors through flexible account requirements and easy trading conditions. With a minimum deposit of $100, Blaze Markets gives new traders a way to enter the forex market using leverage up to 1:200. The company's simple approach to trading and commission structures starting at $4 per trade show its commitment to keeping entry costs low while maintaining competitive spreads. Users like the broker's promise of fast customer service, which has been consistently highlighted in user reviews and ratings across various platforms. However, without detailed regulatory information, potential clients must balance the good trading conditions against possible concerns about oversight and transparency.

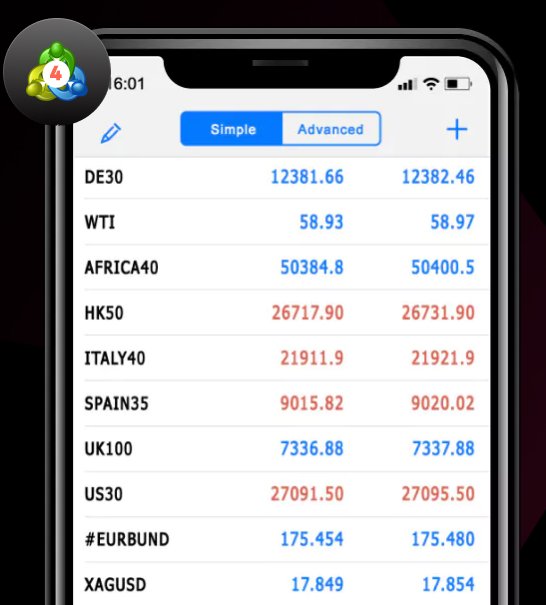

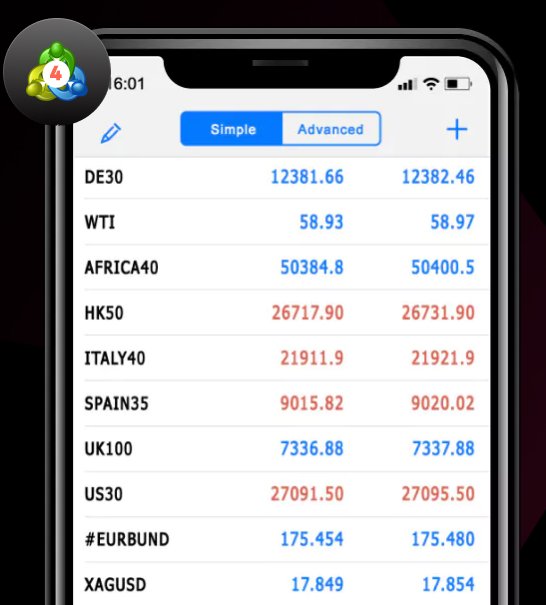

The trading environment at Blaze Markets centers around the well-known MetaTrader 4 platform. This platform remains the industry favorite for its strong technical analysis tools and user-friendly interface. Through this platform, traders can use many different strategies, accessing over 120 trading pairs including major and minor forex pairs, precious metals, indices, and some cryptocurrencies. Despite these appealing features, Blaze Markets does not clearly state its regulatory connections, which may cause worries about fund security and company transparency. While the broker's flexible trading conditions and wide asset selection are strong selling points, careful consideration is needed given the regulatory uncertainty. This blaze markets review advises traders to do thorough personal research and weigh the benefits of low-cost entry against the potential risks from the lack of regulatory oversight.

Blaze Markets has not provided specific regulatory details, so no regulatory agency or license number is available. This lack of clear regulatory oversight should be noted by future traders when considering the broker's overall safety.

Blaze Markets supports many deposit and withdrawal methods including bank transfers, credit/debit cards, and cryptocurrency wallets. This offers a wide range of funding options to meet different trader preferences. The minimum deposit requirement is set at $100, making the broker accessible to many retail investors.

Specific bonus promotions or incentive programs are not detailed in the provided information. Any current bonus offerings would require direct contact with the broker or further investigation.

The range of tradable assets includes forex, metals, indices, and cryptocurrencies, with over 120 trading pairs total. This variety allows traders to spread out their portfolios effectively.

Cost structures use variable spreads and commissions starting at $4. The exact fee schedule may change depending on market conditions and the account type chosen by the trader.

The maximum leverage available is 1:200. This aligns with the broker's focus on providing high-risk, high-reward trading opportunities for retail investors.

Platform selection is currently limited to MetaTrader 4, a reliable and industry-standard trading platform. It supports both manual and automated trading strategies.

There are also regional restrictions in place. For example, traders from Iraq, North Korea, Sudan, Syria, and the United States cannot open accounts with Blaze Markets.

Customer support is available in English only. This may affect non-English speaking users seeking help.

This detailed breakdown is meant to give a clearer picture for traders interested in understanding every aspect of Blaze Markets' operations, as supported by this blaze markets review.

Detailed Scoring Analysis

1. Account Conditions Analysis

Blaze Markets offers competitive account conditions with a low minimum deposit of $100. This helps new and retail investors get started. The commission structure starts at $4 per trade, making it accessible for traders with lower capital requirements while still offering the flexibility needed for active trading. The maximum leverage of 1:200 provides a big boost to trading potential, though it naturally increases risk exposure, which traders must manage carefully. Account opening processes have generally been seen as straightforward; however, there have been some reports of difficulties when trying to log into demo accounts. This small problem does not overshadow the overall good account conditions, but it does show the need for continuous support and troubleshooting in the early stages of account setup. Users have noted that while the trading conditions are largely positive, the absence of specialized account types such as Islamic accounts might be a minor drawback for specific trader groups. Overall, user feedback is largely positive about the account conditions, with many appreciating the low barriers to entry and the clear fee structures. This detailed assessment forms a key part of this blaze markets review, stressing the importance of balancing attractive trading terms with the need for consistent platform reliability.

Blaze Markets provides many trading tools and resources that help both beginner and experienced traders. The broker's chosen platform, MetaTrader 4, comes with many technical indicators, advanced charting features, and automated trading capabilities such as Expert Advisors – features that are important for creating and executing various trading strategies. Besides the platform's built-in strengths, Blaze Markets also offers access to market analysis tools that provide real-time data and help with effective decision-making. This aspect is highly appreciated in user feedback, with many traders emphasizing the reliability and completeness of the analytical tools available. While there is no detailed discussion of dedicated educational materials or webinars, the overall resource package remains strong enough to support technical analysis and strategy development. Furthermore, research tools built into the platform help users stay updated with current market trends. This combination of technology and analytical tools shows the broker's commitment to improving the overall trading experience. Given these features, this blaze markets review emphasizes the importance of strong resource libraries in encouraging a dynamic and responsive trading environment, even if opportunities for formal education and training seem less developed at this time.

3. Customer Service and Support Analysis

Customer service and support at Blaze Markets are consistently highlighted as one of the broker's strongest points. The broker offers multiple ways to get support including online chat, telephone, and email, ensuring that users have several ways to seek help. According to multiple user reports, the response time is notably fast, with customer support teams frequently solving questions in a timely manner. The efficiency in addressing issues, from simple account questions to more complex trading concerns, has been a common theme in user testimonials. While the support is limited to English, the quality and professionalism of the service provided have helped reduce concerns related to the absence of detailed regulatory backing. It is important to note that although some users have reported minor problems, particularly when accessing demo accounts, these instances appear to be exceptions rather than the norm. The quality of customer service, as reflected in user reviews and feedback, convinces many that Blaze Markets places a high priority on client satisfaction. This dedication to support and service reliability is a vital part of this blaze markets review, enriching the overall perspective on the broker's operational strengths despite some regulatory uncertainties.

4. Trading Experience Analysis

The trading experience at Blaze Markets combines advanced technology with user convenience, mainly delivered through the MetaTrader 4 platform. Traders have praised the platform for its stable performance, quick execution speeds, and reliable connectivity under most market conditions. The variable spread structure is generally competitive, though occasional slippage has been noted during periods of high market volatility. The platform's complete suite of technical analysis tools, combined with customizable features, provides traders with plenty of opportunity to tailor their trading strategies effectively. While many users appreciate the platform's strong functionality, there have been occasional reports of issues during the login process for demo accounts, which could slow down the onboarding process for new traders. Despite this setback, the overall trading environment remains good for both manual and automated trading, providing a favorable balance between speed, reliability, and functionality. The integration of these essential trading tools and features significantly contributes to a positive trading experience overall, as highlighted by numerous user reviews. This detailed evaluation within the blaze markets review reinforces the idea that while the trading conditions are largely strong and efficient, attention to technical problems is necessary to ensure smooth user experiences in the long term.

5. Trustworthiness Analysis

Trustworthiness remains a critical issue when looking at Blaze Markets. One of the main concerns comes from the unclear regulatory status; the broker has not provided clear details about a regulatory body or license number. This lack of following standard regulatory disclosure practices hurts traders' confidence, as proper oversight is fundamental for investor protection. Additionally, there is a noticeable gap in the transparency of company information, with limited insights into the operational risk management measures or fund safety protocols used by the broker. Although the trading conditions and customer service are rated positively, the absence of regulatory data creates doubt among potential users. Stories from a number of user reviews show that while many traders have had satisfactory experiences, the overall trust level is reduced by institutional uncertainties. Different sources have shown varying opinions on the broker's legitimacy, showing the challenges faced by Blaze Markets in establishing a strong reputation in an environment where regulatory oversight is critically important. As such, this blaze markets review highlights trustworthiness as the area most in need of improvement, urging potential traders to exercise caution and conduct further due diligence before committing significant capital.

6. User Experience Analysis

User experience at Blaze Markets is mixed, showing both notable strengths and areas needing improvement. Many traders appreciate the easy design of the MetaTrader 4 interface, which makes navigation simple and ensures that even new users can quickly understand the trading functions. The account registration and verification processes are generally straightforward, contributing to a positive first impression. Additionally, the availability of multiple deposit and withdrawal methods adds to the overall convenience, providing flexibility in fund management. However, some users have reported challenges, particularly concerning the login process for demo accounts, which can take away from an otherwise smooth experience. These occasional issues have caused some frustration among clients, although the majority of reviews indicate that once past these initial hurdles, the platform delivers a satisfactory trading environment. Overall, while the design and functionality largely meet the needs of retail traders seeking a low-entry, efficient trading experience, the occasional technical problem shows the need for continued improvements. This detailed user experience analysis, as captured in this blaze markets review, emphasizes that while the broker offers a promising trading environment, attention to resolving technical issues is essential to fully satisfy user expectations.

Conclusion

Blaze Markets appears as a promising new forex broker that offers competitive and flexible trading conditions designed for retail investors. The attractive features include a low minimum deposit of $100, access to the MetaTrader 4 platform with more than 120 trading pairs, and responsive customer support. However, the lack of clear regulatory information remains a significant concern, potentially undermining traders' overall trust in the broker. While the trading conditions and customer service are praiseworthy, technical issues, such as difficulties in demo account logins, indicate room for improvement. Overall, this blaze markets review suggests that Blaze Markets is best suited for new and retail traders who value low entry thresholds and strong trading tools, while caution is advised due to the regulatory uncertainties and occasional technical obstacles.