HXEX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive hxex review reveals major concerns about this new broker. Traders should think carefully before investing with HXEX, which was founded in 2024 and operates from Singapore. The company presents itself as a forex and cryptocurrency trading platform for both new and experienced investors who want diverse trading options. However, our investigation finds serious red flags that need immediate attention.

The broker's regulatory status creates major concerns. HXEX appears as a suspicious clone under NFA oversight, which suggests possible fraud. This classification alone puts the platform in a high-risk category for potential investors.

The company focuses mainly on forex and cryptocurrency trading services. It positions itself to attract traders interested in these volatile markets. Our analysis shows that HXEX targets newcomers to cryptocurrency and forex markets, plus high-risk investors who want more trading options.

However, the platform lacks clear information about account conditions, trading tools, and customer service quality. Combined with the suspicious regulatory status, this results in a very negative overall assessment. The platform's recent start in 2024, while not necessarily bad, adds to concerns about its track record and reliability in the competitive brokerage world.

Important Notice

Traders should know that HXEX's regulatory and legal status may differ greatly across different countries. The broker's suspicious clone designation under NFA regulation suggests possible compliance issues that could affect investors' legal protections in their home countries. Potential clients must verify the platform's legitimacy and regulatory standing in their specific region before starting any trading activities.

This review uses publicly available information and limited user feedback available at the time of analysis. Due to the broker's recent establishment and concerning regulatory status, information accuracy and timing may be compromised. Traders should independently verify all claims and seek professional financial advice before making investment decisions with this platform.

Rating Framework

Broker Overview

HXEX entered the financial markets in 2024 as a Singapore-based brokerage firm that specializes in forex and cryptocurrency trading services. The company positions itself as a modern trading platform designed to serve the growing demand for digital asset trading alongside traditional foreign exchange markets. Despite its recent establishment, the broker tries to attract both newcomers to trading and experienced investors seeking diversified portfolio options.

The platform's business model centers on providing access to volatile cryptocurrency markets and established forex pairs. It capitalizes on the increasing mainstream adoption of digital currencies. However, the broker's extremely recent market entry raises questions about its operational maturity and ability to handle the complexities of modern financial markets effectively.

HXEX operates under NFA oversight, but critically, its license status has been flagged as a suspicious clone. This indicates serious concerns about the broker's legitimacy and operational integrity. The suspicious clone designation typically means that the entity may be impersonating a legitimate regulated broker or operating without proper authorization, creating substantial risks for potential investors who might assume they have regulatory protection when they do not.

Regulatory Status: HXEX operates under NFA regulation, but its license status is marked as suspicious clone, requiring extreme caution from potential investors. This designation suggests the broker may not have legitimate regulatory oversight despite claims otherwise.

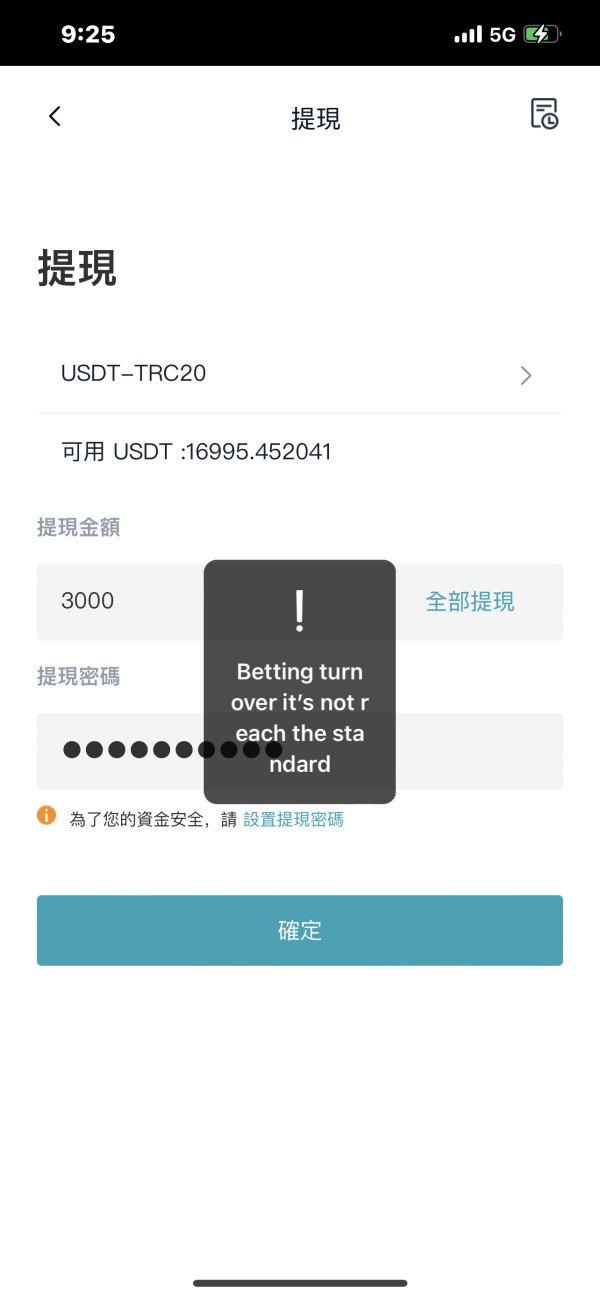

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. This creates transparency concerns for potential clients seeking clarity about funding procedures.

Minimum Deposit Requirements: The platform has not disclosed minimum deposit requirements in available documentation. This makes it difficult for traders to assess accessibility and entry barriers.

Bonuses and Promotions: No information about bonus offerings or promotional activities is available. This suggests either the absence of such programs or lack of transparency in marketing practices.

Tradeable Assets: The platform offers cryptocurrency and forex trading opportunities. However, specific asset lists and available trading pairs remain undisclosed in public information.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is not available in current sources. This creates significant transparency issues for cost-conscious traders.

Leverage Ratios: Leverage offerings and maximum ratios available to traders are not specified in available materials. This limits traders' ability to assess risk management options.

Platform Options: Specific trading platform software and technology solutions offered by HXEX are not detailed in current information sources.

Regional Restrictions: Information about geographical limitations or restricted countries is not available in current documentation.

Customer Service Languages: Available customer support languages are not specified in current materials.

This hxex review reveals concerning gaps in essential trading information that reputable brokers typically provide transparently to potential clients.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by HXEX remain largely unclear, contributing to the platform's poor rating in this category. Available information fails to specify account types, their distinguishing features, or the benefits associated with different tier levels. This lack of transparency immediately raises concerns about the broker's commitment to clear communication with potential clients.

Minimum deposit requirements, a fundamental consideration for traders assessing platform accessibility, are not disclosed in available materials. This omission prevents potential clients from making informed decisions about whether the platform aligns with their financial capabilities and investment strategies. Reputable brokers typically provide clear, upfront information about entry requirements to build trust and transparency.

The account opening process details are similarly absent from public information. This creates uncertainty about verification requirements, documentation needs, and timeline expectations. This lack of clarity can frustrate potential clients and suggests inadequate attention to user experience design.

Special account features, such as Islamic accounts, professional trader options, or premium services, are not mentioned in available sources. This absence of information about specialized offerings limits the platform's appeal to diverse trader segments and suggests a potentially limited service range.

This hxex review finds that the lack of comprehensive account condition information significantly undermines investor confidence and practical decision-making capabilities.

HXEX's offering of trading tools and resources appears severely limited based on available information, resulting in a below-average rating for this critical category. The platform fails to provide details about analytical tools, charting capabilities, or technical indicators available to traders, which are essential components of modern trading platforms.

Research and analysis resources, including market commentary, economic calendars, and expert insights, are not mentioned in current documentation. These resources are typically fundamental offerings that help traders make informed decisions and stay updated with market developments. Their absence suggests either a lack of such services or poor communication about available features.

Educational resources, crucial for supporting trader development and platform adoption, are not detailed in available materials. Modern brokers typically invest heavily in educational content, including webinars, tutorials, and market analysis, to support client success and retention. The absence of such information raises questions about HXEX's commitment to trader education and development.

Automated trading support, including expert advisors, copy trading, or algorithmic trading capabilities, is not mentioned in current sources. These features have become increasingly important for traders seeking to optimize their strategies and manage risk effectively. The lack of information about automation support suggests potential limitations in the platform's technological sophistication.

Customer Service and Support Analysis

Customer service quality represents a significant concern for HXEX, with available information indicating responsiveness issues that affect trader satisfaction and support quality. The platform's customer service channels and availability are not clearly specified in current documentation, creating uncertainty about how clients can access support when needed.

Response time performance appears problematic based on available feedback, though specific metrics about average response times across different communication channels are not provided. Slow response times can be particularly problematic in fast-moving financial markets where timely support can significantly impact trading outcomes and client satisfaction.

Service quality assessments are limited due to insufficient user feedback and testimonials in available sources. However, the mentioned responsiveness issues suggest potential challenges in meeting client expectations and resolving problems effectively. Quality customer service is essential for building trust and maintaining long-term client relationships in the competitive brokerage industry.

Multilingual support capabilities are not detailed in current information, potentially limiting the platform's accessibility to international clients. Global brokers typically provide support in multiple languages to serve diverse client bases effectively. The absence of such information raises questions about the platform's international service capabilities and commitment to serving global markets.

Customer service hours and availability across different time zones are not specified. This creates uncertainty about when clients can expect to receive support for urgent issues or general inquiries.

Trading Experience Analysis

The trading experience offered by HXEX remains largely unknown due to insufficient information about platform performance, stability, and functionality. Available sources do not provide details about platform stability, server uptime, or system reliability during high-volume trading periods, which are critical factors affecting trader success and satisfaction.

Order execution quality, including execution speeds, slippage rates, and fill quality, is not documented in available materials. These technical performance metrics are essential for evaluating whether the platform can meet the demands of active traders and provide competitive execution standards expected in modern financial markets.

Platform functionality completeness, including advanced order types, risk management tools, and analytical capabilities, remains undisclosed. Modern traders expect sophisticated tools for managing positions, analyzing markets, and implementing complex strategies. The absence of detailed functionality information suggests potential limitations or inadequate communication about platform capabilities.

Mobile trading experience details are not available in current sources, despite mobile trading becoming increasingly important for modern traders who require flexibility and constant market access. The lack of mobile platform information raises questions about the broker's adaptation to contemporary trading preferences and technological expectations.

Trading environment specifics, including market depth information, pricing transparency, and execution model details, are not provided in available documentation. These factors significantly impact trading costs and execution quality, making their absence a notable concern for potential clients.

This hxex review identifies significant information gaps that prevent accurate assessment of the platform's trading experience quality and competitiveness.

Trust and Security Analysis

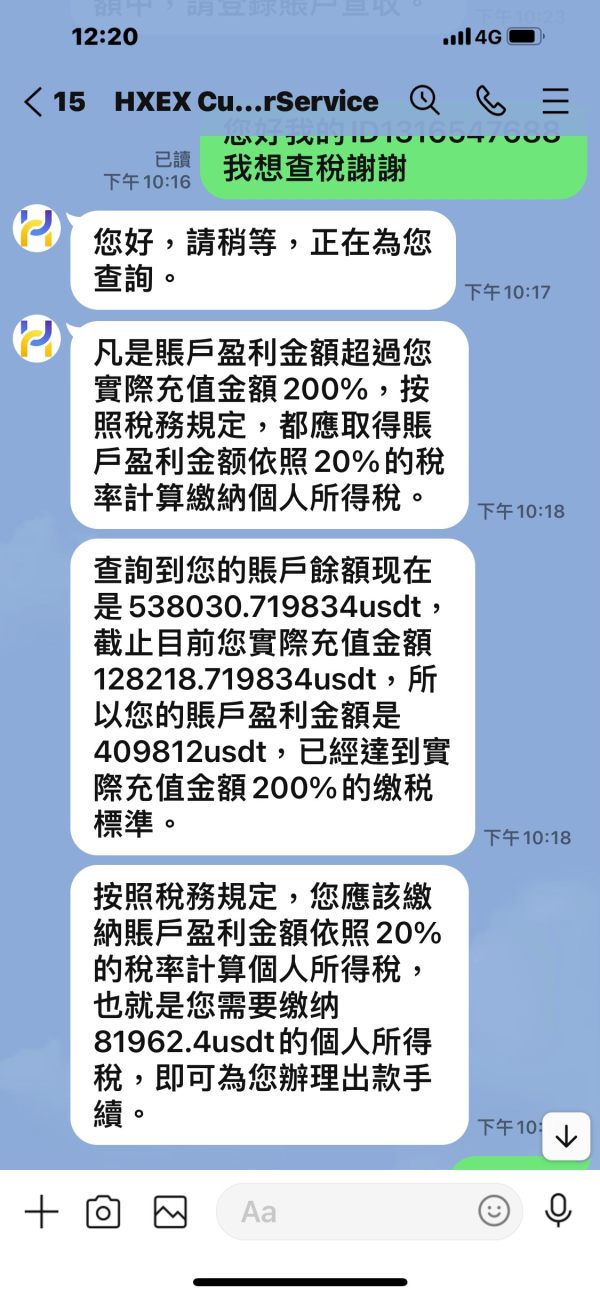

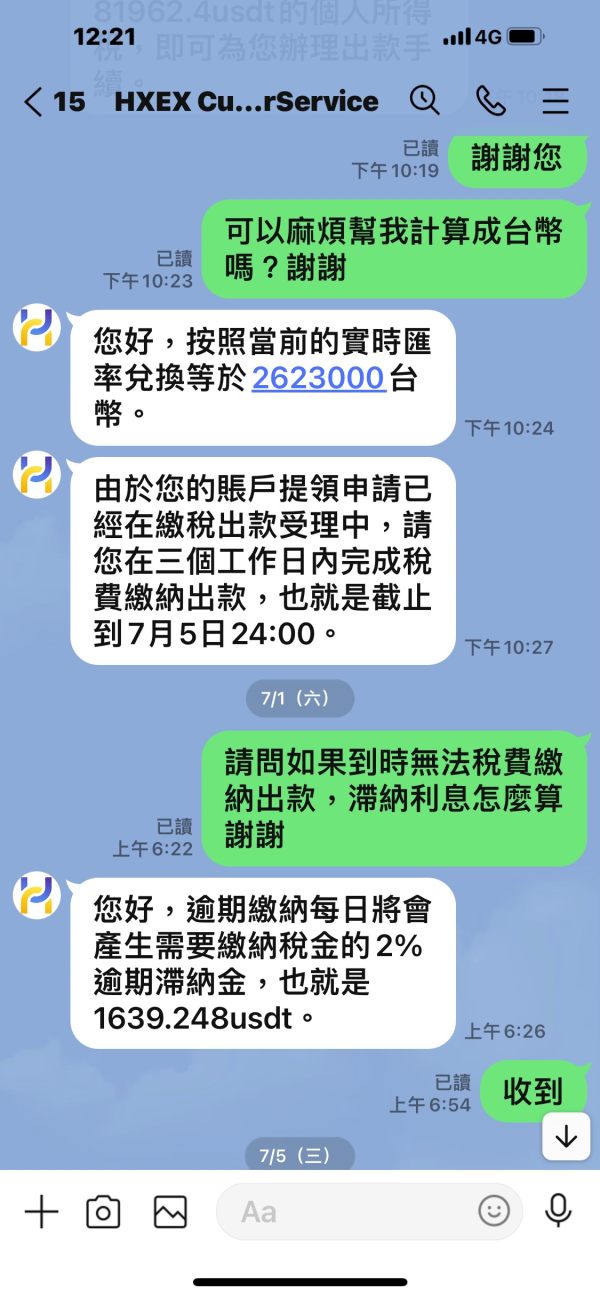

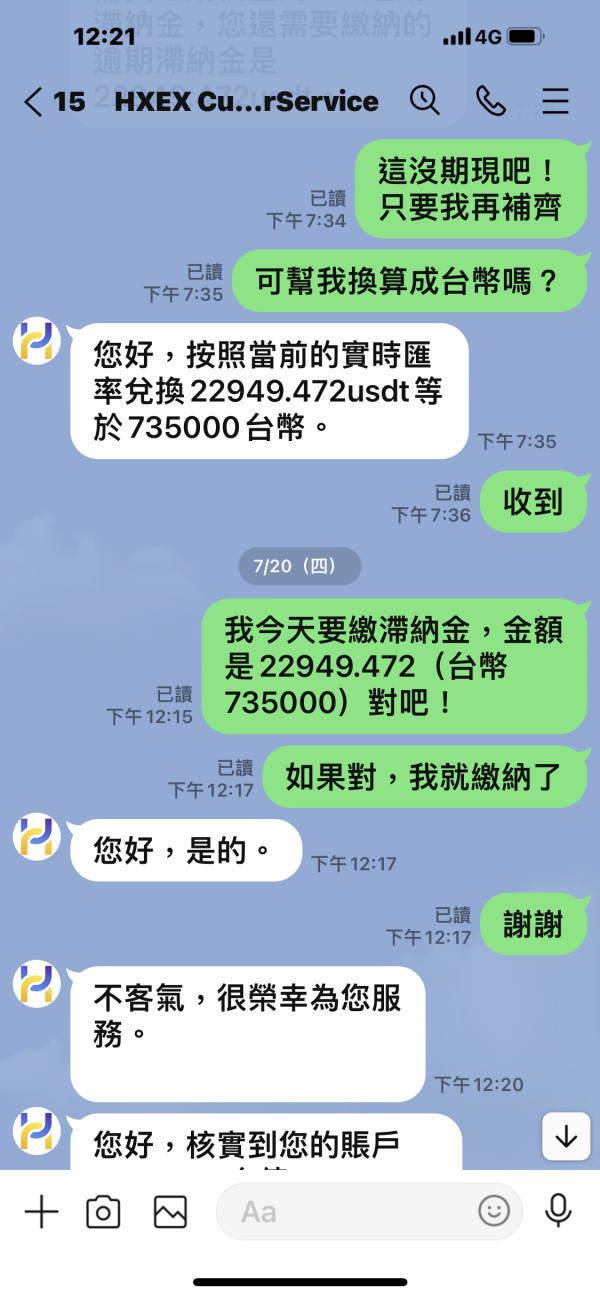

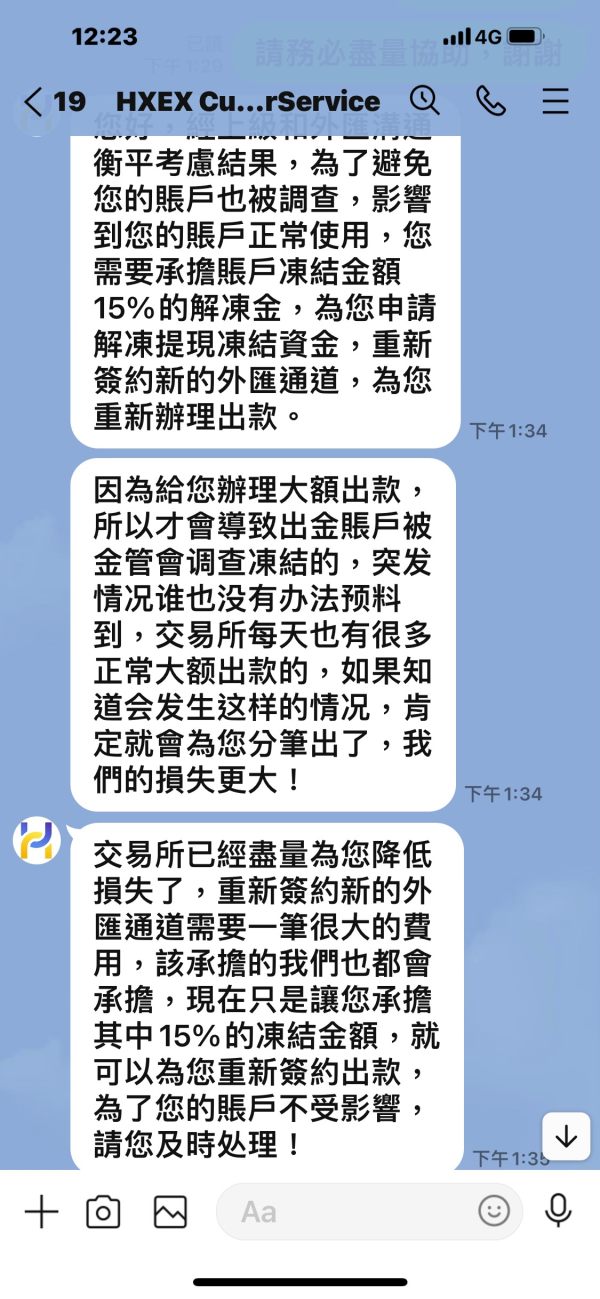

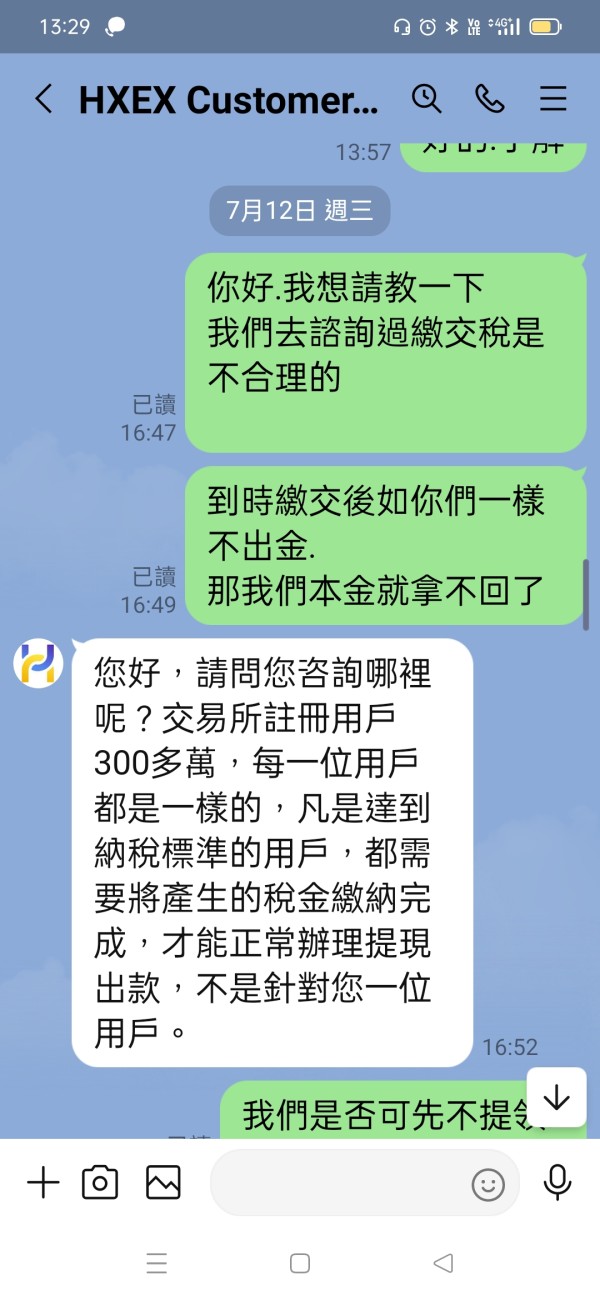

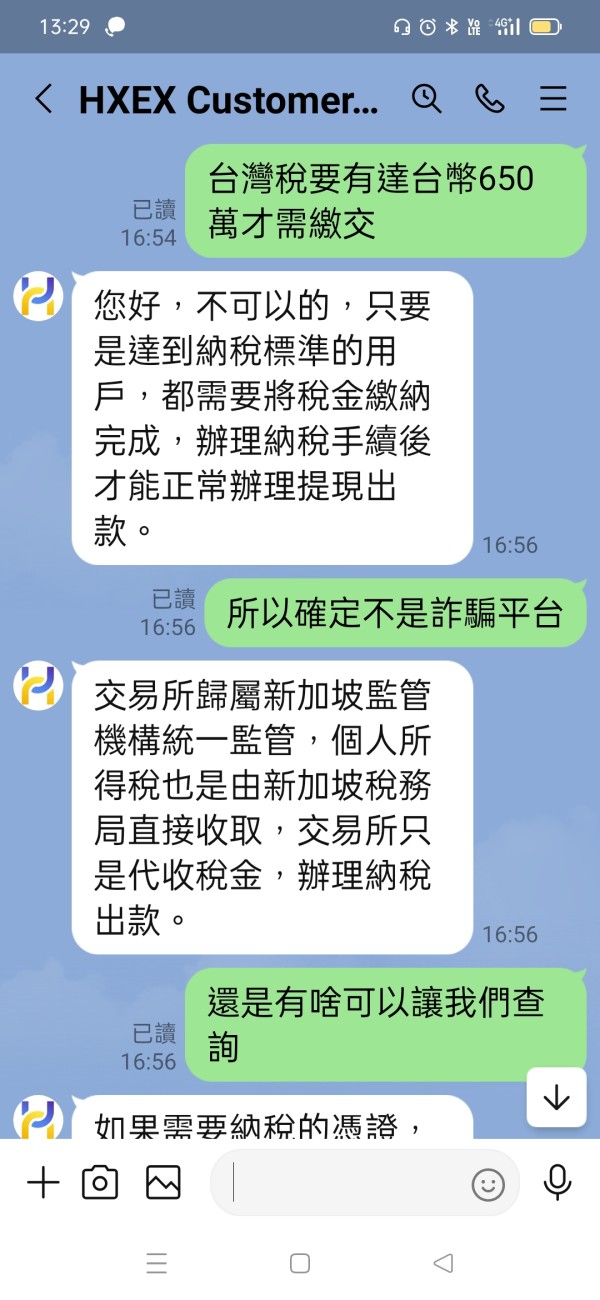

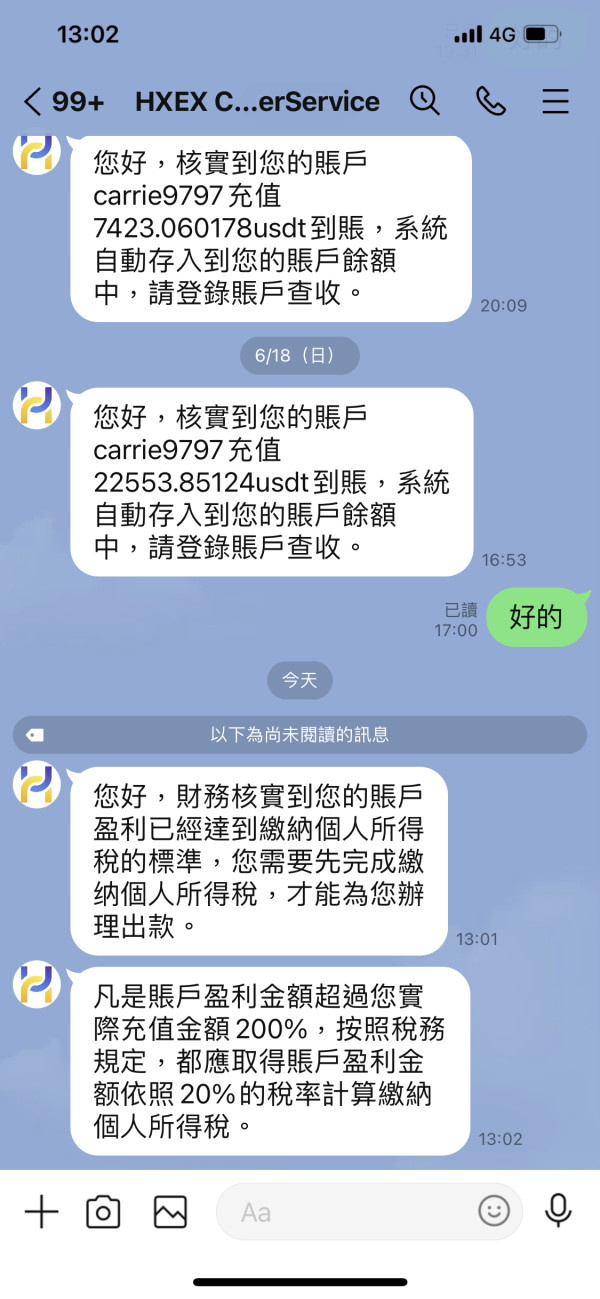

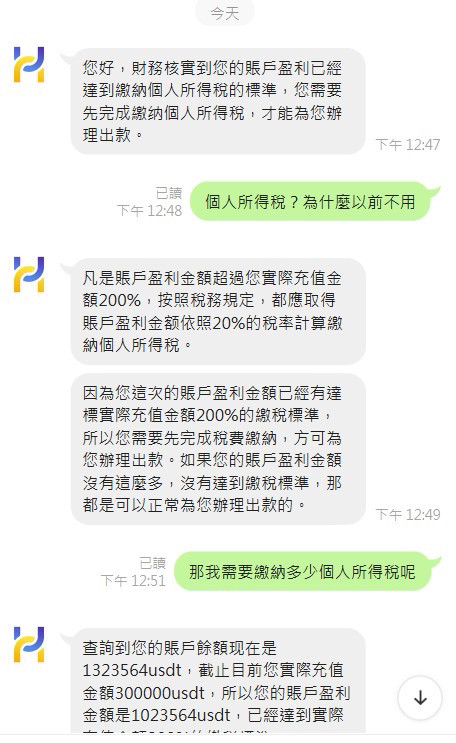

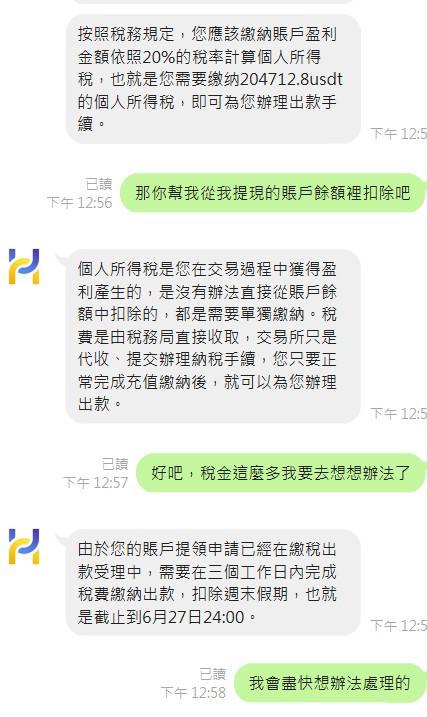

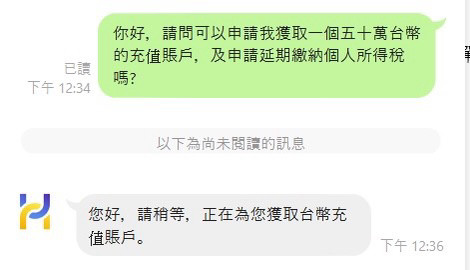

Trust and security represent HXEX's most critical weakness, earning the lowest possible rating due to serious regulatory concerns and transparency issues. The broker's designation as a suspicious clone under NFA oversight creates immediate and severe trust concerns that potential investors cannot ignore.

Regulatory credentials are fundamentally compromised by the suspicious clone status, which typically indicates that the entity may be impersonating a legitimate regulated broker or operating without proper authorization. This designation suggests that clients may not have the regulatory protections they believe they possess, creating substantial financial and legal risks.

Fund safety measures are not detailed in available information, raising concerns about client asset protection and segregation practices. Reputable brokers typically provide clear information about how client funds are protected, including segregated account arrangements and insurance coverage. The absence of such information is particularly concerning given the suspicious regulatory status.

Company transparency is severely limited, with minimal information available about company ownership, management, financial statements, or operational practices. This lack of transparency prevents potential clients from conducting proper due diligence and assessing the company's stability and legitimacy.

Industry reputation information is not available in current sources, though the suspicious clone designation already significantly damages credibility. The recent establishment in 2024 means the company lacks a track record that could demonstrate reliability and trustworthiness over time.

Negative event handling capabilities cannot be assessed due to the broker's recent establishment. However, the existing regulatory concerns suggest potential challenges in crisis management and client protection.

User Experience Analysis

User experience assessment for HXEX is severely limited by the lack of available user feedback and detailed platform information, resulting in a poor rating for this important category. Overall user satisfaction metrics are not available in current sources, preventing accurate assessment of how well the platform meets client expectations and needs.

Interface design and usability details are not provided in available materials. This makes it impossible to evaluate whether the platform offers intuitive navigation, clear information presentation, and efficient workflow design that modern traders expect from professional trading platforms.

Registration and verification process convenience is not detailed in current documentation, creating uncertainty about onboarding efficiency and user-friendliness. Streamlined account opening processes are increasingly important for competitive positioning in the brokerage industry.

Funding operation experience, including deposit and withdrawal convenience, processing times, and fee structures, is not documented in available sources. These operational aspects significantly impact user satisfaction and platform attractiveness to potential clients.

Common user complaints cannot be identified due to limited feedback availability, though the mentioned customer service responsiveness issues suggest potential areas of user dissatisfaction. The lack of comprehensive user feedback prevents identification of recurring problems or areas needing improvement.

User profile analysis is not possible due to insufficient information about the types of traders who find success with the platform or those who encounter difficulties.

Conclusion

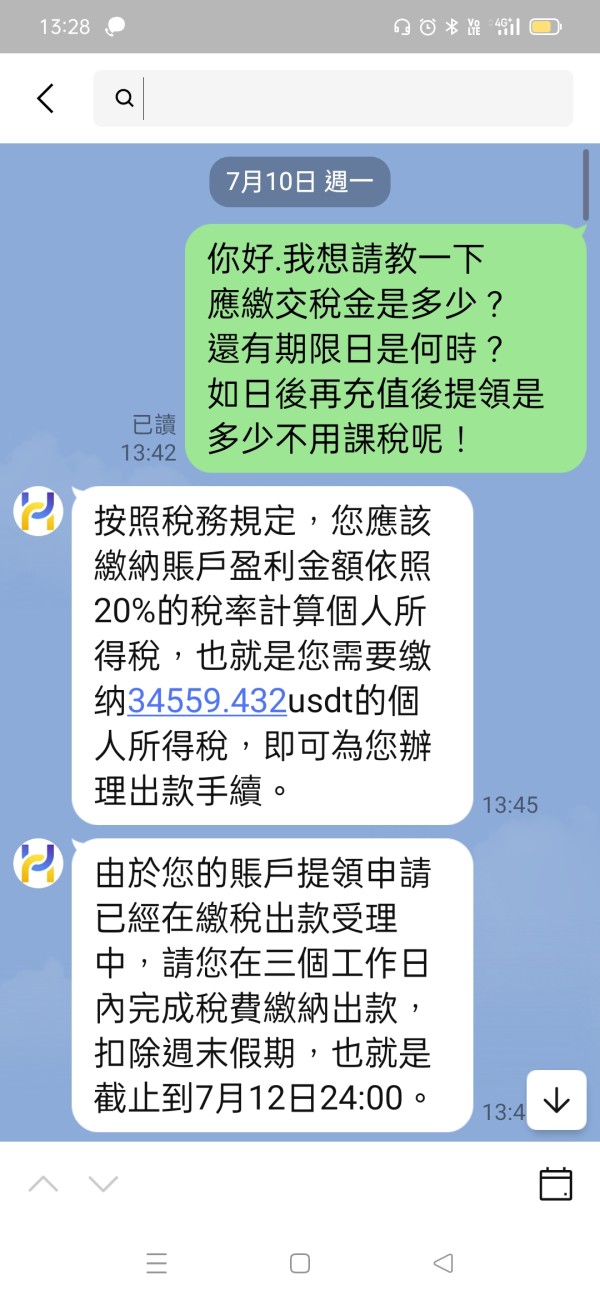

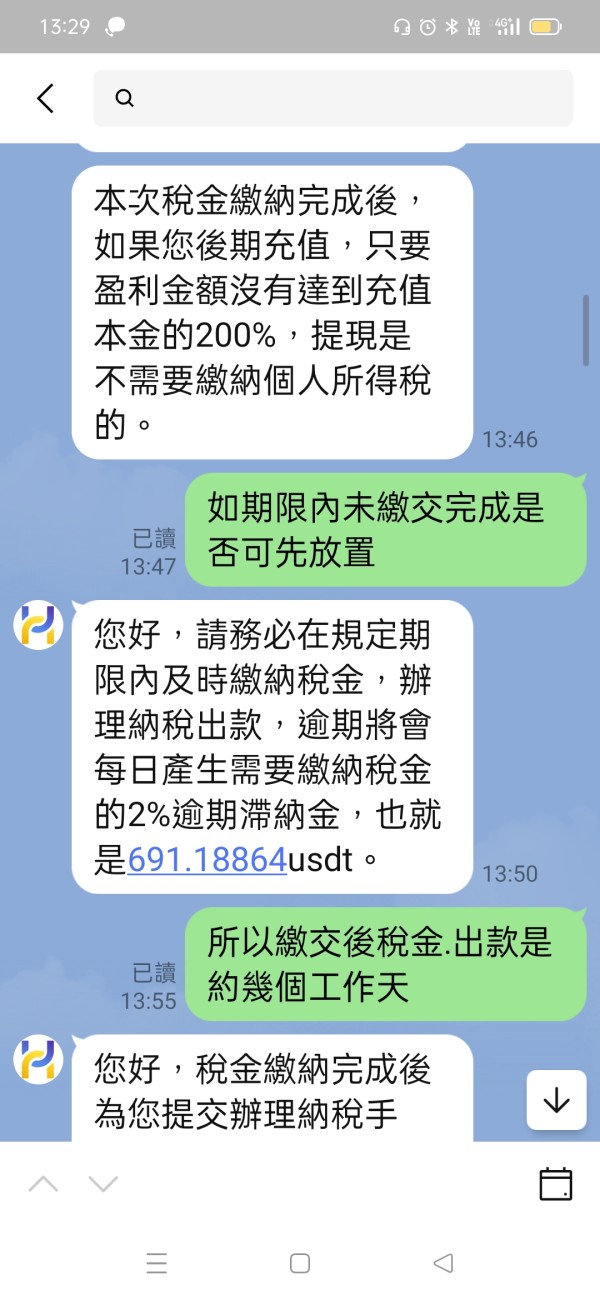

This comprehensive hxex review reveals that HXEX presents significant risks that far outweigh any potential benefits for retail traders. As a newly established broker facing serious regulatory concerns, including its designation as a suspicious clone under NFA oversight, the platform fails to meet basic trust and transparency standards expected from reputable financial service providers.

The extensive lack of information about essential trading conditions, platform features, cost structures, and safety measures creates an environment of uncertainty that is unsuitable for most investors. Combined with customer service responsiveness issues and the absence of clear regulatory protection, these factors make HXEX an unsuitable choice for typical retail traders seeking reliable and transparent brokerage services.

We strongly recommend that investors avoid HXEX and instead choose well-established, properly regulated brokers with transparent operations and proven track records. For those specifically interested in cryptocurrency and forex trading, numerous reputable alternatives offer better security, transparency, and regulatory protection without the substantial risks associated with this platform.