Is HXEX safe?

Pros

Cons

Is HXEX A Scam?

Introduction

HXEX, a forex broker registered in Saint Vincent and the Grenadines, claims to provide a variety of trading instruments to its clients. As the forex market continues to grow, it becomes increasingly important for traders to carefully evaluate the legitimacy and safety of their chosen brokers. With numerous reports of scams and fraudulent activities in the industry, the need for due diligence has never been more crucial. This article aims to assess whether HXEX is a safe trading platform or a potential scam. The analysis is based on a thorough examination of regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects to consider when evaluating its legitimacy. A well-regulated broker is more likely to adhere to industry standards and provide a safer trading environment for its clients. In the case of HXEX, the broker operates without valid regulatory oversight, raising significant concerns regarding its legitimacy and client protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0517064 | United States | Suspicious Clone |

The NFA license claimed by HXEX appears to be a suspicious clone, indicating that it may not be genuine. Furthermore, the absence of regulation from reputable financial authorities means that traders have little recourse in the event of disputes or issues with fund withdrawals. This lack of oversight is a significant red flag, and potential investors should exercise extreme caution when considering this broker.

Company Background Investigation

HXEX is operated by HX Investments Limited, a company that has not provided sufficient transparency regarding its ownership structure and management team. The company's history is unclear, with limited information available about its establishment, development, and operational practices. The lack of publicly accessible data raises concerns about the broker's transparency and accountability.

The management team behind HXEX has not been adequately disclosed, leaving potential investors without the necessary information to assess their qualifications and experience. A reputable broker typically provides detailed profiles of its management team, including their backgrounds and expertise in the financial markets. The absence of this information further exacerbates the doubts surrounding HXEX's legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structures is essential. HXEX claims to offer competitive trading conditions, but due to the unavailability of its official website, specific details regarding fees and spreads remain inaccessible. However, based on user reviews and third-party reports, several concerning practices have come to light.

| Fee Type | HXEX | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

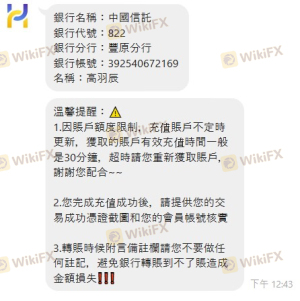

The lack of clear information on spreads and commissions is troubling, as it prevents traders from making informed decisions regarding their trading costs. Additionally, reports indicate that HXEX may impose unusual fees or create obstacles during the withdrawal process, which is a common tactic employed by fraudulent brokers to retain client funds.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. HXEX has not provided adequate information regarding its fund safety measures, such as segregated accounts, investor protection schemes, or negative balance protection policies. The absence of these safeguards raises significant concerns about the security of client investments.

Historical accounts of clients experiencing difficulties in withdrawing their funds further highlight the potential risks associated with trading with HXEX. Reports indicate that clients have faced considerable delays and obstacles when attempting to access their funds, which is a common issue among unregulated brokers. The lack of transparency and accountability in this area is a strong indicator that HXEX may not be a safe option for traders.

Customer Experience and Complaints

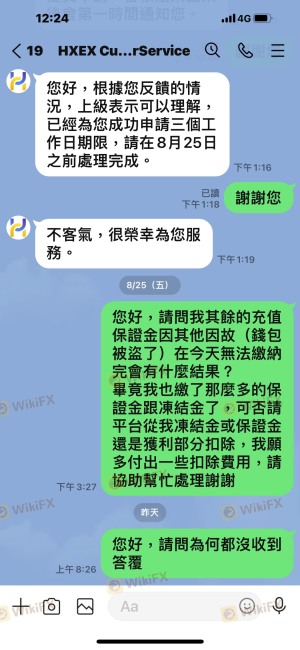

Analyzing customer feedback and experiences is crucial in determining the overall reliability of a broker. In the case of HXEX, numerous negative reviews and complaints have surfaced, indicating a pattern of issues faced by clients. Common complaints include difficulties in fund withdrawals, lack of customer support, and pressure to deposit additional funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

Two notable cases illustrate the issues faced by clients. One user reported being unable to withdraw their funds for over a month, while another claimed that the broker imposed unexpected fees during the withdrawal process. These accounts suggest that HXEX may not prioritize customer satisfaction or transparency, raising further doubts about its legitimacy.

Platform and Execution

The performance and reliability of a trading platform are key factors in a trader's experience. While HXEX claims to offer a robust trading platform, there are concerns regarding its stability, order execution quality, and potential manipulation. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Without access to the official website, it is challenging to assess the platform's features and capabilities fully. However, the absence of transparency regarding the trading environment raises concerns about the broker's commitment to providing a fair and efficient trading experience.

Risk Assessment

Using HXEX as a trading platform presents several risks that potential investors should consider. The lack of regulation, transparency, and historical issues with fund withdrawals contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of safeguards for client funds |

| Customer Service Risk | Medium | Poor response to client complaints |

To mitigate these risks, traders should thoroughly research any broker before investing and consider starting with smaller amounts to test the platform's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that HXEX may not be a safe and legitimate trading platform. The lack of regulation, transparency issues, and numerous negative client experiences raise significant red flags. Traders should exercise extreme caution when considering this broker, as the potential for financial loss is high.

For those seeking reliable alternatives, it is advisable to consider brokers that are well-regulated, transparent in their operations, and have a history of positive customer feedback. Some reputable options include brokers regulated by the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). Always prioritize safety and due diligence when engaging in forex trading to protect your investments.

Is HXEX a scam, or is it legit?

The latest exposure and evaluation content of HXEX brokers.

HXEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HXEX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.