Global Edge Review 1

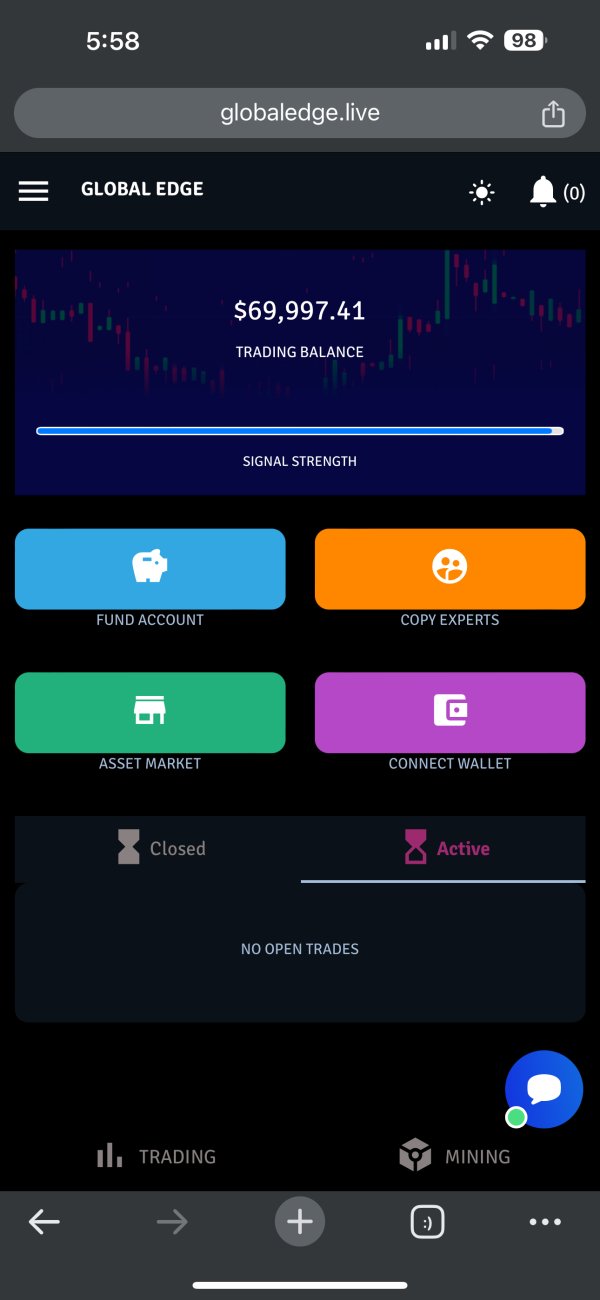

they make a funnel using fake telegram account addresses of famous traders for copying…then get you to invest “enough so it starts copying properly with enough margin/leverage amount”. website is sketch

Global Edge Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

they make a funnel using fake telegram account addresses of famous traders for copying…then get you to invest “enough so it starts copying properly with enough margin/leverage amount”. website is sketch

Global Edge positions itself as a forex and CFD broker, primarily targeting experienced traders seeking high leverage and a variety of trading instruments. However, it is crucial to note that this broker operates without regulatory oversight, which significantly heightens the risk associated with trading on its platform. As an unregulated entity, Global Edge poses considerable threats to traders' funds, with reports indicating withdrawal issues and misleading claims about regulatory compliance. This review systematically explores these concerns, providing potential clients with essential insights to make informed trading decisions, particularly cautioning beginners and conservative investors about the high risks involved.

WARNING: Global Edge poses significant risks. Before trading, exercise caution by following these steps:

Remember, investing with an unregulated broker like Global Edge exposes you to potential financial loss and fraud. Make informed decisions!

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Global Edge lacks regulation and has numerous negative user reviews indicating potential fraud. |

| Trading Costs | 2 | The broker's trading conditions are sparse, with some high non-trading fees reported. |

| Platforms & Tools | 2 | Limited trading tools compared to industry standards, primarily offering TradingView charts. |

| User Experience | 1 | User feedback suggests a confusing interface and poor withdrawal experiences, creating frustration. |

| Customer Support | 2 | Support options are limited, and clients frequently report slow responses and ineffectiveness. |

| Account Conditions | 3 | While the minimum deposit requirement of $500 is high, the account types offer some flexibility. |

Global Edge is an offshore broker that emerged in 2023 and presents itself as a potential gateway to forex trading, promising high leverage and various trading opportunities. However, its foundational claims lack verified backing from regulatory bodies. In addition to this vulnerability, the companys inability to provide transparent information regarding its operations raises significant concerns about investor safety. Without established regulatory support, traders should approach this broker with extreme caution.

Global Edge claims to offer a diverse array of trading instruments, including currencies, stocks, and commodities, with significant leverage options. Despite presenting itself as a legitimate broker, it is not licensed to operate in the United States or under any recognized authority, misleading potential clients. The operational structure is notably flawed, as Global Edge is not only unregulated but has also received warnings from various financial watchdogs, adding to the cloud of uncertainty surrounding its business model.

| Detail | Information |

|---|---|

| Regulation | Unregulated |

| Minimum Deposit | $500 |

| Leverage | Not Specified |

| Spread | Not Specified |

| Withdrawal Fee | Up to 5% (ambiguous terms) |

| Payment Methods | Cryptocurrency-only (BTC, ETH) |

Analyzing Global Edge reveals substantial concerns regarding its legitimacy in the brokerage market. The primary issue is the absence of regulatory oversight, as the broker is not registered with any recognized financial authority. This significantly escalates the risk profile for potential traders.

"I invested a substantial amount, expecting to trade safely, only to face repeated issues trying to withdraw my funds."

Global Edge claims to have attractive commission structures but is hampered by significant hidden fees:

"I attempted a withdrawal and was shocked to find a $30 fee suddenly appeared, despite no prior warning."

3. For beginners, the high minimum deposit and overall costs overshadow the benefits presented, possibly steering users towards more reliable options.

Global Edge attempts to cater to various trading needs; however, its offering falls short:

User experiences on Global Edge paint a concerning picture:

"Every time I try to navigate through their site, I feel lost; its cumbersome and inefficient."

3. Withdrawal difficulties amplify frustrations, further deteriorating the overall user sentiment.

Customer support serves as a critical element in the trading experience:

"When I needed help, their support channel was unresponsive, and my issues remained unresolved."

The account conditions as set forth by Global Edge reflect a mixed bag:

In summary, while Global Edge markets itself as an innovative broker offering extensive trading opportunities, the reality presents a starkly different picture. Its unregulated status poses significant risks, compounded by numerous user complaints regarding withdrawal difficulties, misleading claims, and inadequate support systems. The allure of high leveraging and flexible trading options must be weighed against the clear red flags surrounding the broker's operational legitimacy. Investors are advised to conduct thorough research and consider alternative options with established regulatory frameworks for a safer trading experience.

FX Broker Capital Trading Markets Review