MaxFX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

MaxFX, a Cyprus-based broker under the regulatory supervision of the Cyprus Securities and Exchange Commission (CySEC), offers an enticing proposition for experienced traders: high leverage up to 1:500 and competitive trading conditions characterized by low commissions. However, the broker's reputation is mired in controversy—with numerous user complaints regarding withdrawal issues, fund mismanagement, and overall service quality. These red flags suggest that while MaxFX presents significant advantages for seasoned traders, the risks and potential pitfalls make it a questionable option for new investors or those requiring reliable customer support.

⚠️ Important Risk Advisory & Verification Steps

Before engaging with MaxFX, its crucial for potential clients to take a moment to assess the associated risks:

- High Leverage Risks: With leverage reaching up to 1:500, potential gains can quickly transform into devastating losses.

- Negative User Feedback: Numerous complaints highlight serious issues with fund withdrawals and customer service.

- Regulatory Concerns: Allegations suggest MaxFX may be operating under a dubious or clone regulatory license.

Risk Verification Steps

- Check Regulatory Status: Visit the official CySEC website to confirm MaxFX's licensing.

- Read User Reviews: Consult third-party review sites for a comprehensive view of user experiences.

- Contact Support: Perform a test inquiry to assess the responsiveness of customer support.

Rating Framework

Broker Overview

Company Background and Positioning

MaxFX operates as the trading name of TopFX Ltd, founded in 2011 and based in Cyprus. Regulated by CySEC under license number 138/11, it ostensibly offers a secure trading environment and operates under the Markets in Financial Instruments Directive (MiFID). Despite its regulatory claims, doubts persist as the broker has been labeled a "clone" and faces scrutiny due to various user complaints regarding financial management and operational integrity.

Core Business Overview

MaxFX caters primarily to forex and commodity traders, providing access to over 60 currency pairs, precious metals, and various CFDs. While the broker offers competitive terms, including variable spreads starting as low as 0.1 pips, considerable caution is advised due to the growing number of complaints over fund access and user treatment. Additionally, the presence of PAMM account options indicates attempts to attract a diverse client base.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

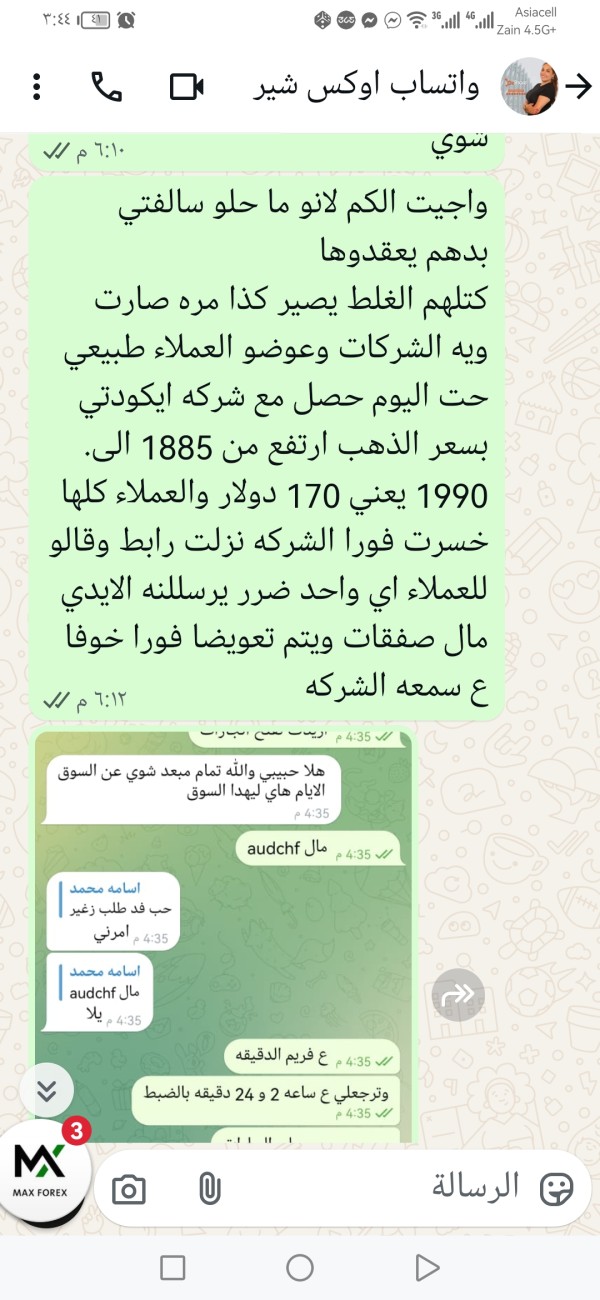

Regulatory information surrounding MaxFX presents inconsistencies, leading to increased scrutiny from potential investors. Many sources indicate suspicion about whether the broker genuinely operates under a valid CySEC license or if it has characteristics of a “clone” broker, which is often an operational entity masquerading as a legitimate firm.

Analysis of Regulatory Information Conflicts

Despite claiming regulation, multiple user testimonials suggest that MaxFX does not meet legitimate operational standards associated with CySEC. For instance, complaints consistently reference withdrawal issues and delayed responses from regulatory channels.

User Self-Verification Guide

To confirm the legitimacy of MaxFX:

Visit the CySEC website.

Search using the license number: 138/11.

Cross-reference additional regulatory databases if available.

Look for third-party verification services like WikiFX for real-time scoring and reviews.

Read historical complaints against the broker documented on platforms like Forex Peace Army and Myfxbook.

Industry Reputation and Summary

MaxFX has amassed a significant amount of negative feedback regarding fund safety. As stated,

"Nobody cares about an office without regulation. Just another broker who threw a bunch of people for money."

This sentiment encapsulates the overall skepticism within the trading community regarding MaxFX's reliability.

Trading Costs Analysis

The fee structure of MaxFX has its merits and pitfalls.

Advantages in Commissions

MaxFX promotes a competitive environment with trading costs around 1.4 pips, inclusive of the $3.5 commission per lot. This might seem attractive against many brokers in the market but should be further scrutinized.

The "Traps" of Non-Trading Fees

However, numerous users have reported hidden fees and unexpected charges:

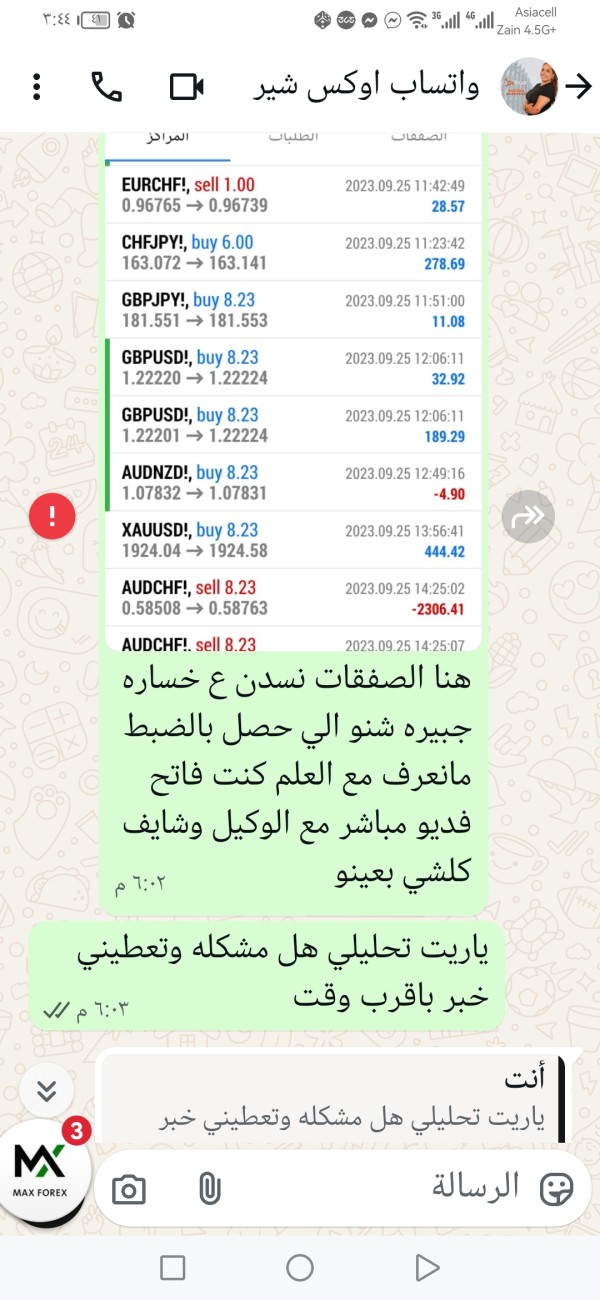

"I was maliciously charged with $21,000 commission fee!"

Such complaints highlight the potential pitfalls of engaging in trading with MaxFX, particularly when leveraging advanced trading techniques.

- Cost Structure Summary

While the competitive trading costs remain appealing, it is essential for traders to actively manage their account statements to avoid excessive fees that could negate the perceived cost benefits.

MaxFX offers traders access to various platforms, notably MetaTrader 4 and cTrader. This combination caters to a wide spectrum of users from experienced to less skilled traders.

Platform Diversity

The two primary platforms offer distinct advantages. MetaTrader 4 is revered for its advanced charting and expert advisors, while cTrader is recognized for its user-friendly interface and fast execution speeds.

Quality of Tools and Resources

However, user reviews indicate that execution speeds as advertised may not always align with the actual experience, with reports of significant slippage during high volatility periods.

Platform Experience Summary

User feedback suggests:

"The execution and pricing—spreads are quite high for an ECN account."

This statement reflects broader concerns about the efficiency of the platform and the potential impact on trading efficacy.

User Experience Analysis

User experience with MaxFX tends to vary significantly, largely influenced by operational performance and customer service.

Evaluating Platform Usability

While some users enjoyed the interface, many expressed frustrations with lagging responses and challenges during peak trading times.

Customer Service Landscape

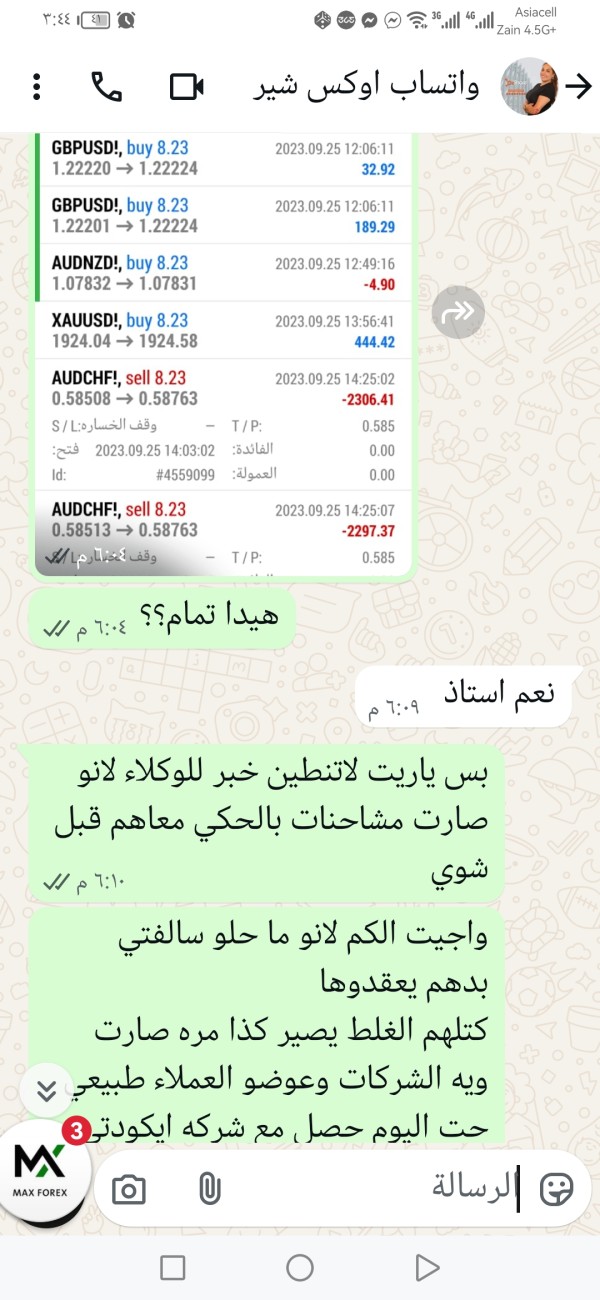

Numerous testimonials fail to provide a positive outlook on customer service, with complaints mentioning:

"They cancel any profit you did, especially if your account has more than $2K."

Such experiences suggest a need for potential clients to approach with caution.

- Wrapping Up User Experience

Overall, traders should weigh the risks of poor user experience against the potential trading opportunities available.

Customer Support Analysis

Customer support plays a crucial role in the overall trading environment at MaxFX.

Nature of Support Offered

Users consistently report long waiting times for responses, citing instances where customer inquiries went unanswered for days at a time.

Effectiveness of Resolution Mechanisms

Several accounts indicate that engagement initiated through customer support often led to scant resolution or clarity. As one user lamented:

"I requested withdrawal—and waited two weeks. No live support!"

- Customer Support Summary

User feedback strongly indicates that MaxFXs customer support is lacking, reinforcing a hesitance for prospective clients.

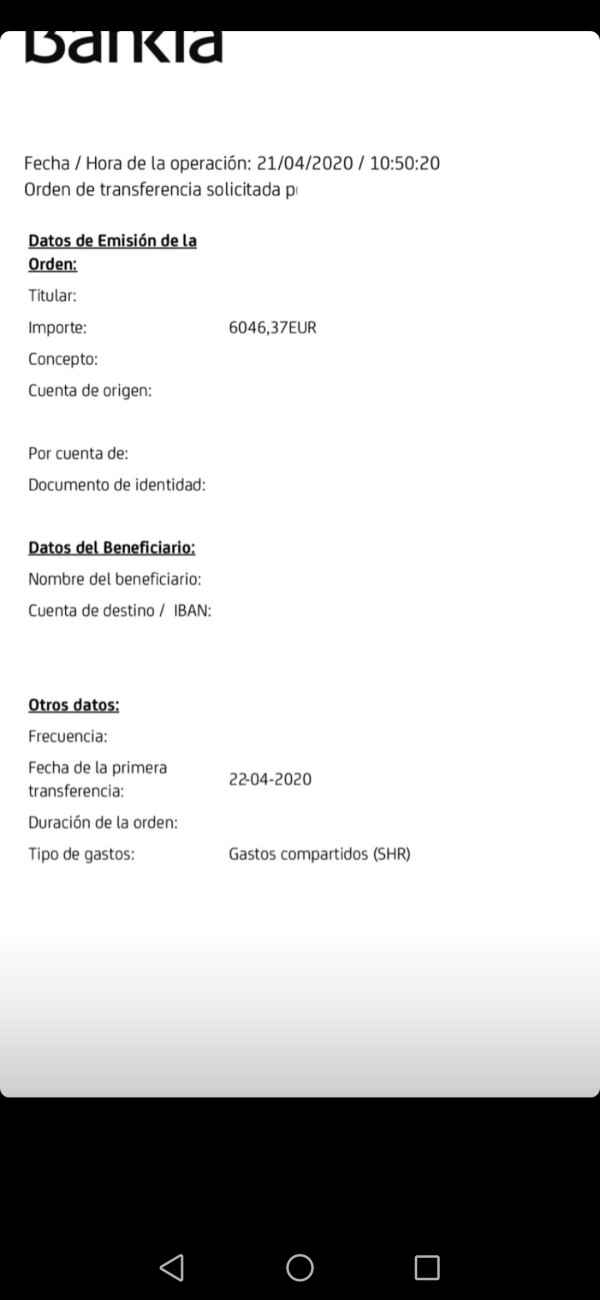

Account Conditions Analysis

MaxFX provides a single account type requiring a minimum deposit of $500, a threshold higher than several competitors.

Evaluating Minimum Deposit

This requirement might pose a barrier for less experienced traders, particularly given the low initial capital ethos prevalent among many forex brokers today.

Diversity within Account Conditions

While MaxFX does offer a dedicated VIP service for large-volume traders, many find the account options restrictive, particularly when the competition provides multiple tailored accounts.

Account Conditions Summary

Traders should consider their specific needs and financial abilities before making commitments with MaxFX due to both the minimum deposit and lack of various account types.

Conclusion

In conclusion, while MaxFX offers competitive trading conditions and features that can be advantageous for experienced traders, the brokers reputation is tainted by numerous complaints, regulatory concerns, and an apparent lack of reliable customer support. This confluence of factors necessitates careful consideration from potential clients, who must weigh the high leveraging possibilities against the significant risks underscored by user experiences. Those seeking to engage with MaxFX should conduct thorough due diligence and consider safer alternatives before committing their resources.