Trade Gains 2025 Review: Everything You Need to Know

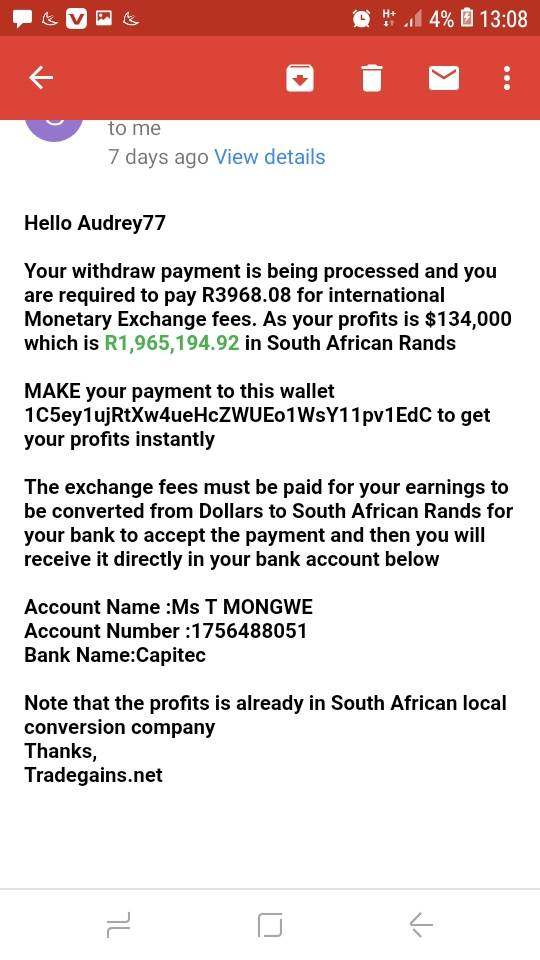

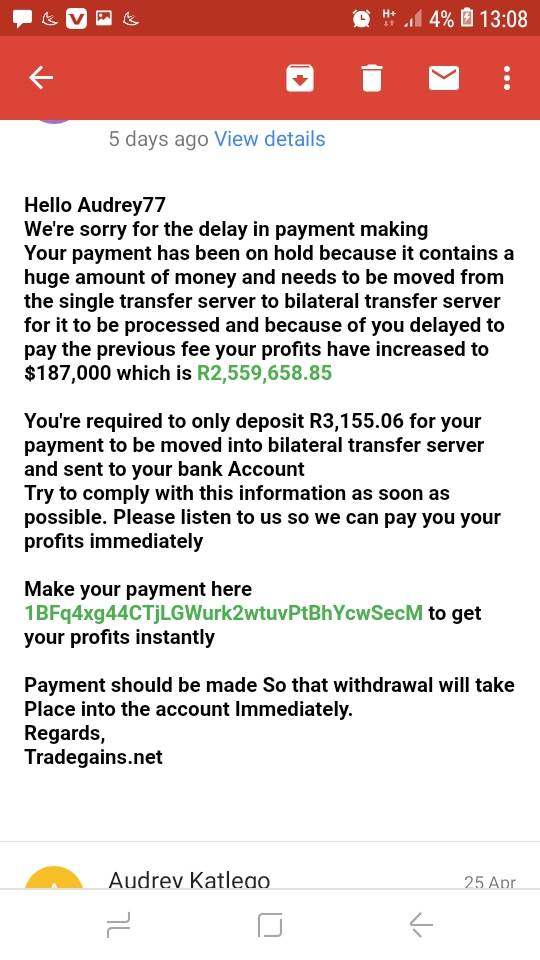

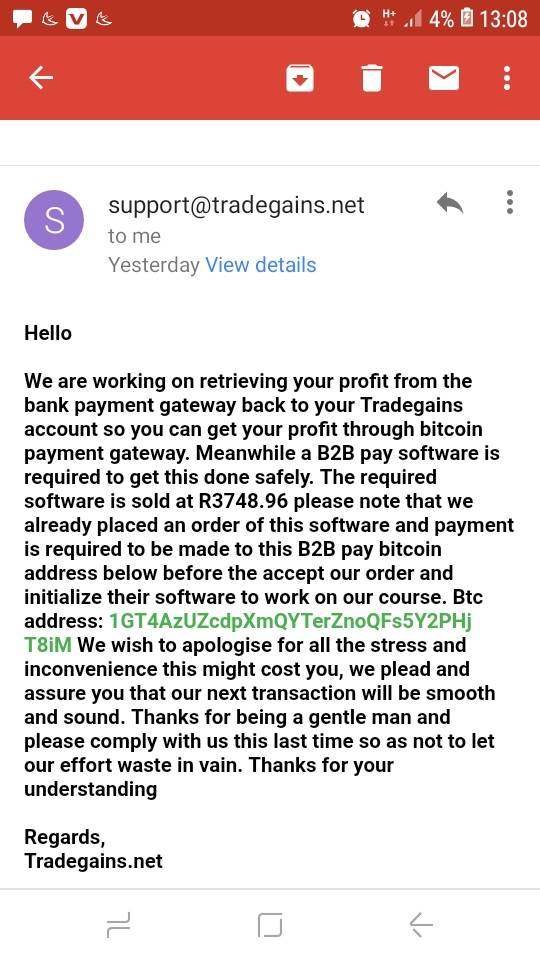

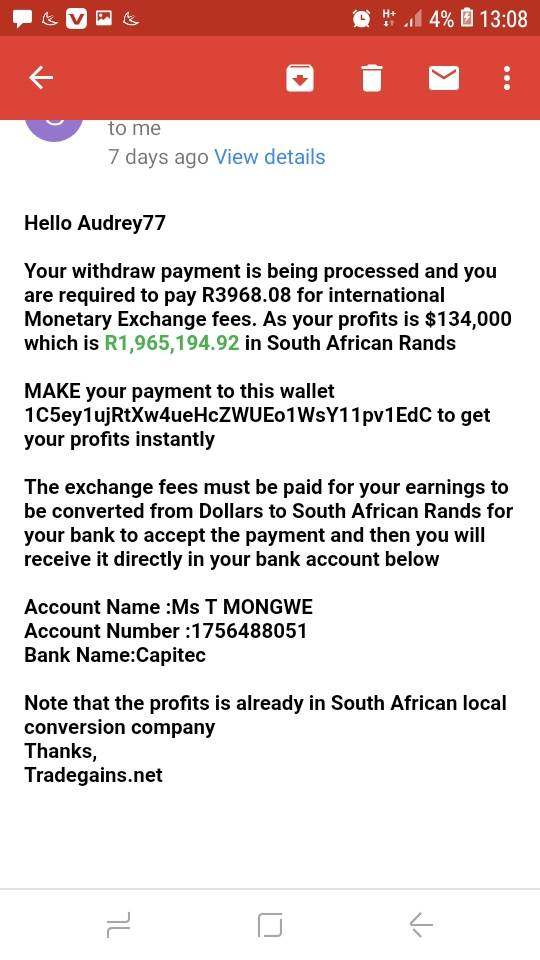

Trade Gains, established in 2018 and based in the United Kingdom, has garnered significant attention in the forex trading community. However, the consensus among various reviews indicates a predominantly negative perception of this broker. While it offers competitive trading conditions, the lack of regulation raises serious concerns about the safety and security of client funds. Users have reported difficulties in withdrawing funds, leading many to label the platform as a potential scam. This review will delve into the key features, pros and cons, and expert opinions surrounding Trade Gains.

Note: It is crucial to recognize that different entities may operate under the Trade Gains name in various regions, which can affect the regulatory landscape and user experience. This review is based on the most reliable sources available to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are based on a combination of user reviews, expert analysis, and factual data regarding the broker's operations.

Broker Overview

Trade Gains operates as an unregulated broker, which is a significant red flag for potential investors. Founded in 2018, the platform offers trading services primarily through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Traders can access a variety of assets, including forex, commodities, indices, and cryptocurrencies. However, the absence of oversight from any recognized financial authority raises questions about the protection of client funds and the overall reliability of the trading environment.

Detailed Breakdown

-

Regulated Regions: Trade Gains is unregulated, which means it lacks the oversight that typically ensures a level of security for traders. This is a major concern, especially for those looking to invest significant capital.

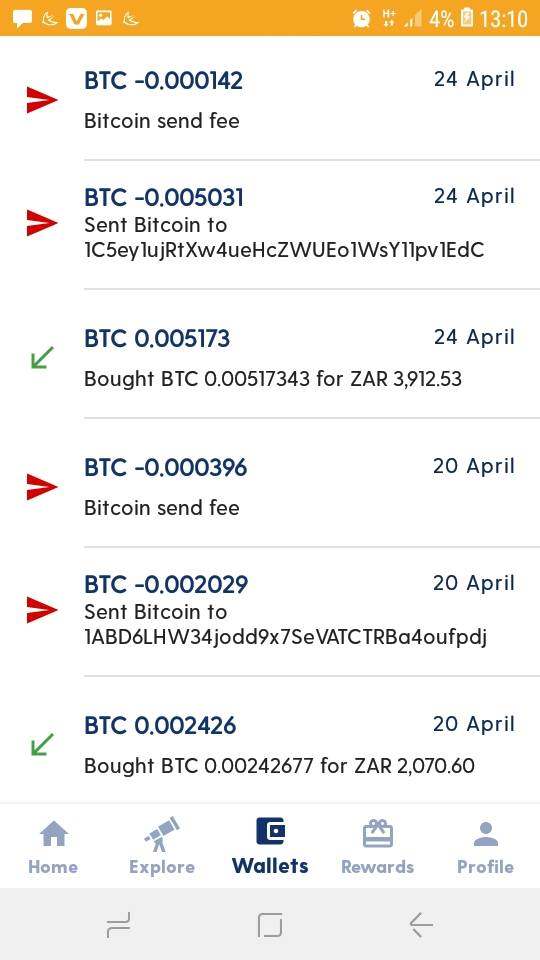

Deposit/Withdrawal Currencies: The platform allows deposits and withdrawals through various methods, including bank transfers and credit/debit cards. However, the specific currencies supported are not clearly outlined in the available reviews.

Minimum Deposit: The minimum deposit required to open an account with Trade Gains is £100, making it accessible for new traders. However, this low barrier to entry should be weighed against the risks associated with unregulated brokers.

Bonuses/Promotions: There is little information available regarding bonuses or promotions, which is often a tactic used by unregulated brokers to entice new clients.

Asset Classes Available: Trade Gains offers a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies. This variety allows traders to diversify their portfolios, but the risks involved remain high due to the broker's unregulated status.

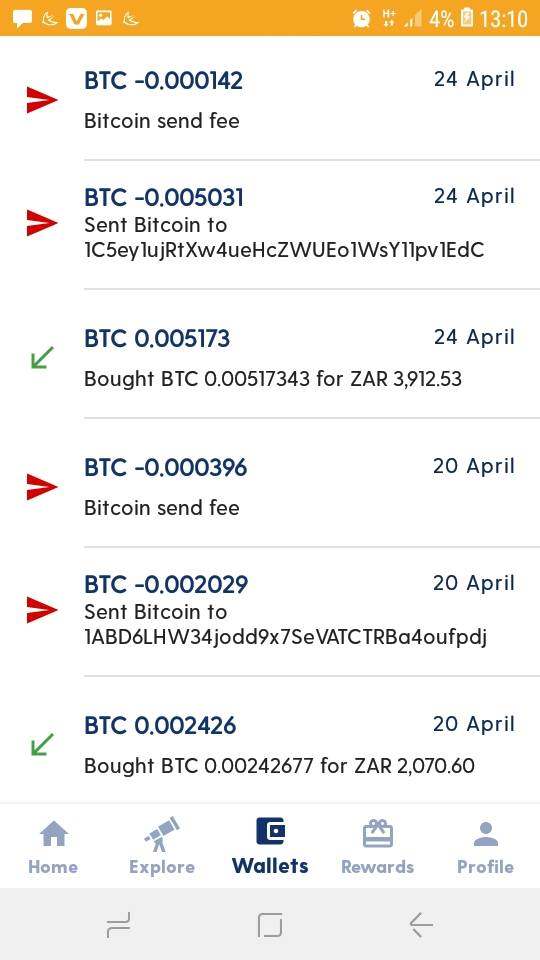

Costs (Spreads, Fees, Commissions): The broker advertises spreads as low as 0 pips with no commissions, which can be attractive to traders. However, the lack of transparency regarding additional fees poses a risk, as users have reported unexpected withdrawal fees.

Leverage: Information regarding leverage options is not explicitly mentioned in the reviews, which could be a concern for traders looking to utilize margin trading.

Allowed Trading Platforms: Trade Gains supports both MT4 and MT5, which are widely recognized for their robust features and user-friendly interfaces.

Restricted Regions: The reviews do not specify any particular regions where Trade Gains is restricted, but the unregulated nature of the broker suggests that it may not have a clear operational jurisdiction.

Available Customer Service Languages: Customer support appears to be limited to email communication, which may not be sufficient for traders requiring immediate assistance. This limitation has been cited as a significant drawback in user reviews.

Repeated Ratings Overview

Detailed Rating Breakdown

-

Account Conditions (4/10): The minimum deposit is relatively low, but the unregulated status casts a shadow over the overall account conditions. Users have expressed concerns about the platform's reliability and safety.

Tools and Resources (5/10): Trade Gains provides access to popular trading platforms like MT4 and MT5, which are equipped with essential trading tools. However, the lack of educational resources or advanced analytical tools limits the support available to traders.

Customer Service and Support (3/10): Support is primarily available via email, which can lead to delays in resolving issues. Users have reported dissatisfaction with the responsiveness and effectiveness of the customer service team.

Trading Setup (Experience) (6/10): The trading experience on MT4 and MT5 is generally positive, with a user-friendly interface. However, the overall experience is marred by concerns over fund security and withdrawal issues.

Trustworthiness (2/10): The absence of regulation is a significant concern. Many users have reported difficulties in withdrawing funds, leading to allegations of the broker operating as a scam.

User Experience (4/10): While the platform offers a range of trading instruments, the overall user experience is negatively impacted by the lack of regulatory oversight and customer support deficiencies.

In conclusion, while Trade Gains offers attractive trading conditions and a variety of assets, the significant concerns surrounding its unregulated status and user experiences highlight the risks involved. Potential clients should conduct thorough research and consider these factors before investing. As noted in various reviews, exercising caution is essential when dealing with unregulated brokers like Trade Gains.