Regarding the legitimacy of EC markets forex brokers, it provides ASIC, FCA, FMA, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is EC markets safe?

Pros

Cons

Is EC markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

EC MARKETS FINANCIAL LIMITED

Effective Date: Change Record

2012-02-17Email Address of Licensed Institution:

sargon.e@ecmarkets.com.auSharing Status:

No SharingWebsite of Licensed Institution:

https://ecmarkets.com.au/Expiration Time:

--Address of Licensed Institution:

LEVEL 13, 1 ALBERT ST AUCKLAND CENTRAL AUCKLAND 1010 NEW ZEALANDPhone Number of Licensed Institution:

+64 9 302 0798Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

EC MARKETS GROUP LTD

Effective Date:

2012-08-08Email Address of Licensed Institution:

compliance@ecmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.ecmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

3rd Floor 30 City Road London EC1Y 2AY UNITED KINGDOMPhone Number of Licensed Institution:

+44 2076217978Licensed Institution Certified Documents:

FMA Market Making License (MM)

Financial Markets Authority

Financial Markets Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

EC MARKETS FINANCIAL LIMITED

Effective Date: Change Record

2012-02-14Email Address of Licensed Institution:

info@ecmarkets.co.nzSharing Status:

No SharingWebsite of Licensed Institution:

www.ctrlinvestments.com, www.ecmarkets.co.nzExpiration Time:

--Address of Licensed Institution:

Level 1, 1 Albert Street, Auckland Central, Auckland, 1010, New ZealandPhone Number of Licensed Institution:

+093020798, +64 09 3020798Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

EC MARKETS FINANCIAL LIMITED

Effective Date:

2022-05-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

LEVEL ONE 1 ALBERT STREET AUCKLAND CENTRAL AUCKLAND NEW ZEALAND 1010Phone Number of Licensed Institution:

+649 3020798Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

EC Markets Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@ecmarkets.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.ecmarkets.scExpiration Time:

--Address of Licensed Institution:

Suite 4B, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4224099Licensed Institution Certified Documents:

Is EC Markets A Scam?

Introduction

EC Markets is a forex broker that positions itself as a reliable platform for traders looking to access a wide range of financial instruments, including forex, commodities, and indices. Founded in 2012 and based in the UK, EC Markets has made a name for itself by offering competitive trading conditions and a user-friendly interface. However, the forex market can be fraught with risks, and traders must exercise caution when selecting a broker. Given the prevalence of scams and unregulated entities in the industry, it is essential for traders to conduct thorough due diligence before committing their funds. This article aims to evaluate the safety and legitimacy of EC Markets by analyzing its regulatory status, company background, trading conditions, customer fund security, client feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a crucial factor in determining its reliability. EC Markets claims to be regulated by multiple authorities, which adds a layer of credibility to its operations. Below is a summary of its regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (UK) | 571881 | United Kingdom | Verified |

| FSA (Seychelles) | SD009 | Seychelles | Verified |

| FSC (Mauritius) | GB2100130 | Mauritius | Verified |

The Financial Conduct Authority (FCA) in the UK is known for its rigorous standards and oversight, making it a Tier-1 regulator. This means that EC Markets must adhere to strict financial regulations, including maintaining client funds in segregated accounts and providing negative balance protection. However, the presence of Tier-3 regulators like the FSA and FSC raises questions about the overall regulatory robustness of EC Markets. While these regulators do provide some level of oversight, their standards are generally less stringent than those of Tier-1 regulators.

Historically, EC Markets has not faced any significant regulatory issues, and there are no known sanctions or complaints against it from the FCA. This clean regulatory history further supports the broker's legitimacy. However, traders should remain vigilant and verify the broker's claims through the official websites of the regulatory bodies.

Company Background Investigation

EC Markets was established in 2012 and is registered in the UK, with additional entities in Seychelles and Mauritius. The company's ownership structure is not extensively detailed in public disclosures, which could raise transparency concerns. However, the fact that it operates under multiple jurisdictions suggests an effort to cater to a global clientele.

Management's background is another critical aspect of a broker's credibility. While specific details about the management team at EC Markets are sparse, the presence of experienced professionals in the trading and financial sectors would typically enhance the broker's reputation. Transparency regarding the management team and their qualifications is essential for building trust with potential clients.

Overall, EC Markets appears to be committed to providing a transparent trading environment, as indicated by its regulatory compliance and operational practices. However, the broker could improve its transparency by offering more information about its ownership and management team.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is vital. EC Markets offers a competitive fee structure that is generally favorable for traders. Below is a comparison of its core trading costs:

| Fee Type | EC Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 pips |

| Commission Model | $3 per lot (ECN) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

EC Markets provides two primary account types: the Standard account, which offers spreads starting from 1.2 pips with no commissions, and the ECN account, which offers spreads from 0.0 pips but charges a commission of $3 per lot. This competitive structure is appealing to both novice and experienced traders.

However, potential clients should be aware of any unusual fees that may not be immediately apparent. For instance, while EC Markets does not charge for deposits or withdrawals, some payment providers may impose their fees. Additionally, the lack of clarity regarding overnight interest rates could be a concern for traders who hold positions long-term.

By offering a transparent and competitive fee structure, EC Markets positions itself as a viable option for traders looking for cost-effective trading solutions. Nonetheless, it is essential for traders to read the fine print and understand all potential costs before opening an account.

Customer Fund Security

The security of client funds is a paramount concern for any trader. EC Markets claims to employ several measures to ensure the safety of customer deposits. The broker maintains segregated accounts for client funds, which means that traders' money is kept separate from the company's operational funds. This practice is crucial in the event of insolvency, as it protects clients' investments.

Additionally, EC Markets provides negative balance protection, which prevents traders from losing more money than they have deposited. This feature is particularly beneficial for novice traders who may be less familiar with the risks associated with leveraged trading.

While EC Markets has not faced any significant issues related to fund security, it is essential for traders to remain cautious. The broker's regulatory status, particularly with Tier-1 regulators like the FCA, adds an extra layer of protection. However, traders should always verify the broker's claims regarding fund safety and ensure that their deposits are adequately protected.

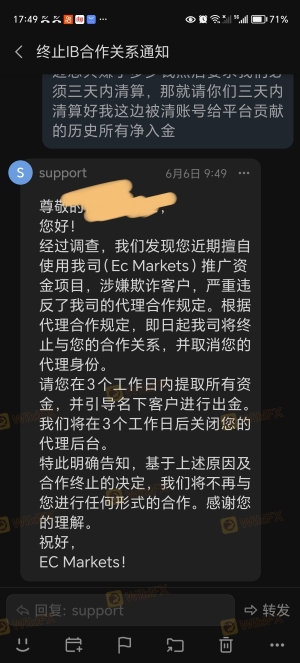

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. EC Markets has received a mix of reviews from clients, with many praising its competitive trading conditions and responsive customer support. However, some common complaints have also emerged.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive, but some delays reported |

| Lack of Educational Resources | Low | Limited materials available for beginners |

Typical complaints include delays in withdrawal processing, which can be a significant concern for traders who wish to access their funds quickly. While many users report satisfactory experiences with withdrawals, the inconsistency in processing times has led to frustration among some clients.

One notable case involved a trader who experienced a delay in receiving funds after a withdrawal request, leading to concerns about the broker's reliability. However, the company's customer support team was eventually able to resolve the issue, highlighting the importance of effective communication in addressing client concerns.

Overall, while EC Markets has received positive feedback for its trading conditions and customer service, potential clients should be aware of the common complaints and consider their own risk tolerance before opening an account.

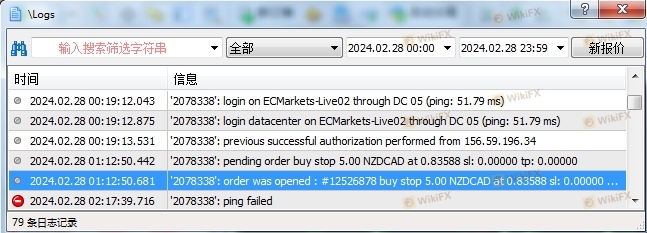

Platform and Trade Execution

The performance of a trading platform is a critical factor in a trader's overall experience. EC Markets offers the widely used MetaTrader 4 (MT4) platform, known for its stability and robust features. The platform provides a user-friendly interface, advanced charting tools, and the ability to automate trading through Expert Advisors (EAs).

In terms of order execution, EC Markets generally maintains a high level of efficiency, with many users reporting minimal slippage and fast trade execution times. However, some traders have expressed concerns about occasional issues with order rejections during high volatility periods.

The platform's performance is crucial for day traders and scalpers who rely on quick execution to capitalize on market movements. While there are no widespread reports of platform manipulation, traders should remain vigilant and monitor their execution quality, especially during significant market events.

Risk Assessment

Using EC Markets does come with certain risks, as with any broker. Below is a summary of key risk areas associated with trading through this platform:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight; primarily regulated by Tier-1 authority (FCA) but also by less stringent bodies. |

| Fund Security Risk | Low | Segregated accounts and negative balance protection in place. |

| Execution Risk | Medium | Generally efficient, but occasional slippage and order rejections reported. |

| Customer Service Risk | Medium | Mixed reviews; some delays in withdrawals noted. |

While EC Markets appears to be a legitimate broker with strong regulatory oversight, traders should be aware of the inherent risks associated with forex trading. It is advisable to start with a demo account to familiarize oneself with the platform and its features before committing real funds.

Conclusion and Recommendations

In conclusion, EC Markets is not a scam but rather a regulated broker with a solid foundation in the forex market. Its multiple regulatory licenses, particularly from the FCA, lend credibility to its operations. However, potential clients should be aware of the mixed customer feedback, particularly concerning withdrawal processing times and the availability of educational resources.

For traders looking for a reliable broker, EC Markets offers competitive trading conditions and a user-friendly platform. However, it may not be the best fit for those seeking extensive educational materials or advanced trading features like social trading.

If you're considering opening an account with EC Markets, it is advisable to conduct further research and weigh your options. For those who prioritize robust educational support and a wider range of trading tools, alternative brokers such as IG or OANDA may be worth exploring. Always remember to trade responsibly and stay informed about the risks involved in forex trading.

Is EC markets a scam, or is it legit?

The latest exposure and evaluation content of EC markets brokers.

EC markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EC markets latest industry rating score is 9.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 9.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.