Is Global Edge safe?

Business

License

Is Global Edge A Scam?

Introduction

Global Edge, an online forex and CFD broker, has positioned itself as a player in the highly competitive trading market. With claims of offering various trading instruments, including forex, stocks, and cryptocurrencies, the platform seeks to attract both novice and experienced traders. However, the surge of online trading platforms has also led to an increase in scams and unregulated brokers, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to investigate whether Global Edge is a safe trading environment or a potential scam. To achieve this, we will analyze its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

A broker's regulatory standing is a crucial factor in determining its legitimacy. A regulated broker is typically subject to oversight by a financial authority, providing a layer of security for traders. In the case of Global Edge, the broker claims to operate under U.S. regulations; however, investigations reveal significant discrepancies.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

Global Edge does not hold any valid licenses from recognized regulatory bodies such as the National Futures Association (NFA) in the U.S. Furthermore, the Central Bank of the Russian Federation has issued warnings against the broker, labeling its services as unregulated and unauthorized. This lack of regulation raises serious concerns about the safety of traders' funds and the overall credibility of the platform. Engaging with an unregulated broker like Global Edge can expose traders to significant risks, including potential financial losses without any recourse for recovery.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its trustworthiness. Global Edge presents itself as a modern brokerage service, yet its background information is sparse. The company lacks transparency regarding its ownership structure and operational history. There is no available data on the founding date, management team, or the company's history, which raises red flags about its legitimacy.

The absence of a robust corporate structure and the lack of information about the management team further compound concerns. A reputable broker typically provides detailed information about its leadership, including their qualifications and industry experience. The lack of such information in Global Edge's case makes it challenging to evaluate the company's credibility. Without a clear understanding of who is managing the broker, traders may find themselves in a precarious position, especially if issues arise during their trading experience.

Trading Conditions Analysis

When evaluating a trading platform, understanding its fee structure is essential for making informed decisions. Global Edge claims to offer competitive trading conditions; however, the absence of transparent information raises concerns. Traders are often left in the dark regarding spreads, commissions, and other fees associated with their trades.

| Fee Type | Global Edge | Industry Average |

|---|---|---|

| Spread for Major Pairs | Not Specified | 1-2 Pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of specified spreads and commissions is particularly troubling. Traders rely on clear and transparent pricing to make informed decisions, and the absence of such information from Global Edge suggests potential hidden costs. Additionally, the broker's minimum deposit requirement of $500 is significantly higher than many reputable brokers, which typically range from $10 to $250. This high barrier to entry may deter potential traders and indicates a lack of accessibility.

Client Fund Security

The safety of client funds is paramount when choosing a broker. Global Edge's lack of regulatory oversight raises questions about its fund security measures. Reputable brokers typically utilize segregated accounts to protect client funds, ensuring that traders' money is kept separate from the company's operational funds. Unfortunately, Global Edge does not provide any information regarding such measures.

Moreover, the absence of negative balance protection is concerning. This feature is crucial for safeguarding traders from losing more than their initial investment, particularly in volatile markets. The lack of transparency surrounding fund security measures raises alarms about the potential risks involved in trading with Global Edge. Traders should be wary of engaging with a broker that does not prioritize the safety of their funds.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Global Edge has received numerous negative reviews and complaints from users, indicating a troubling trend regarding customer satisfaction. Common complaints include withdrawal issues, lack of transparency, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Poor |

| Customer Service Issues | High | Poor |

One notable case involved a trader who reported difficulties withdrawing funds after several attempts. The trader claimed that their requests were met with delays and vague responses from customer support. Such experiences highlight the importance of choosing a broker with a proven track record of addressing customer concerns promptly. The consistent pattern of complaints against Global Edge suggests that it may not provide the level of service expected from a legitimate broker.

Platform and Trade Execution

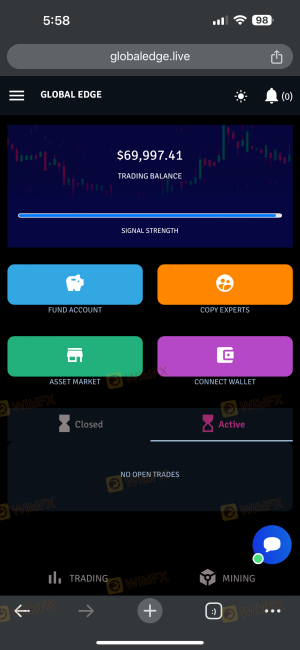

The trading platform's performance is another critical aspect for traders. Global Edge claims to offer advanced trading tools and a user-friendly interface; however, user experiences indicate otherwise. Reports of frequent platform outages and slow execution times have surfaced, raising concerns about the reliability of the trading environment.

Traders have also reported instances of slippage and order rejections, which can significantly impact trading outcomes. A reliable broker should provide a seamless trading experience with minimal disruptions. The issues experienced by users on Global Edge's platform suggest that it may not meet the standards expected by traders seeking a dependable trading environment.

Risk Assessment

Engaging with Global Edge presents several risks that potential traders should consider. The lack of regulation, transparency, and customer support raises significant concerns about the safety of funds and the overall trading experience.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | No segregated accounts |

| Customer Service Risk | Medium | Poor responsiveness |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Global Edge. Exploring alternative brokers with established regulatory frameworks and positive customer feedback can provide safer trading options.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Global Edge may not be a safe trading environment. The lack of regulation, transparency, and consistent negative feedback from users raises significant red flags. Traders should approach Global Edge with caution, as engaging with an unregulated broker poses substantial risks to their funds and trading experience.

For those seeking reliable alternatives, consider brokers that are well-regulated, transparent about their fees, and have a proven track record of positive customer experiences. Options such as FP Markets, XM, or Forex.com may provide a safer trading environment with robust customer support and reliable trading conditions. Always prioritize due diligence when selecting a broker to ensure the safety of your investments.

Is Global Edge a scam, or is it legit?

The latest exposure and evaluation content of Global Edge brokers.

Global Edge Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global Edge latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.