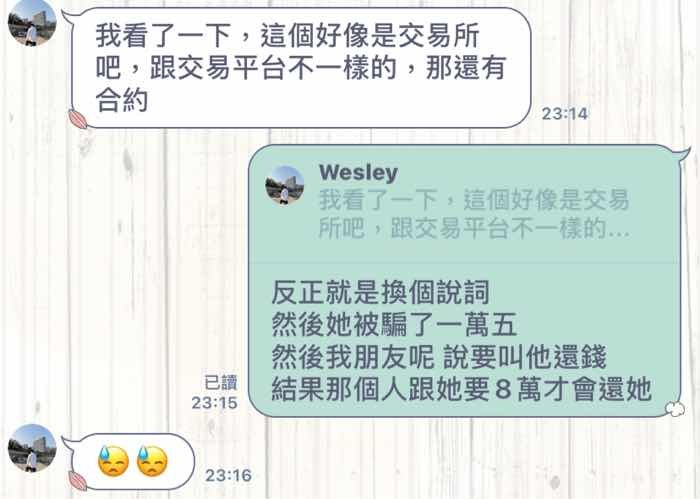

GIC Review 1

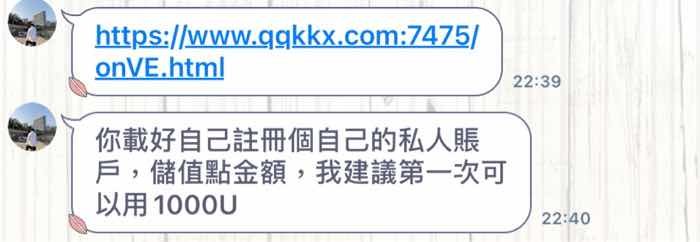

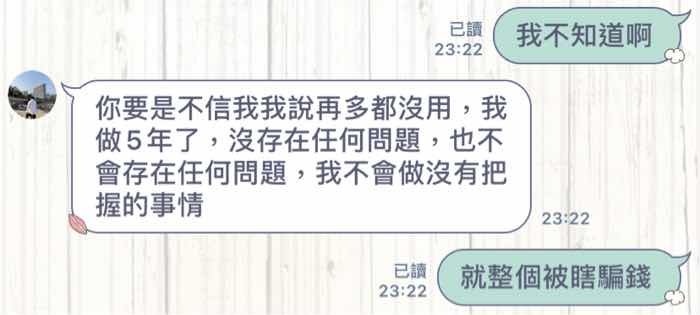

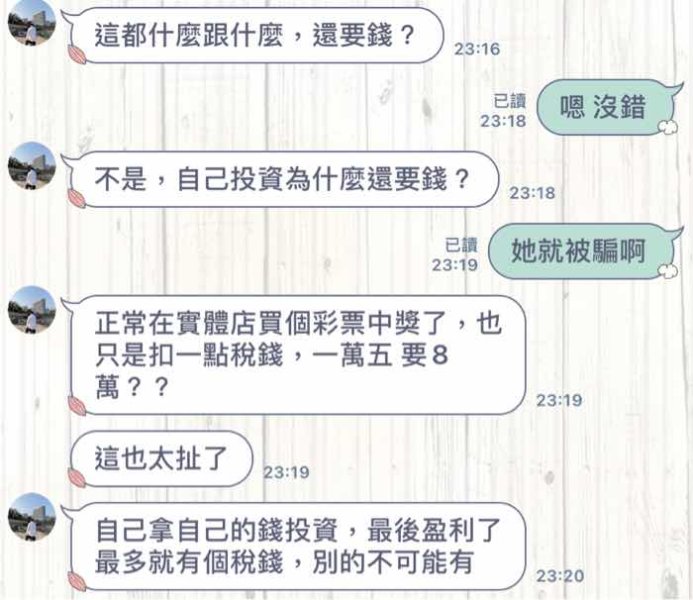

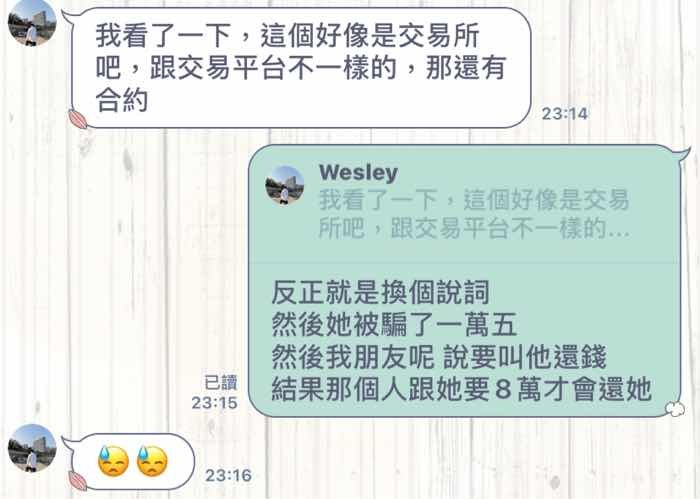

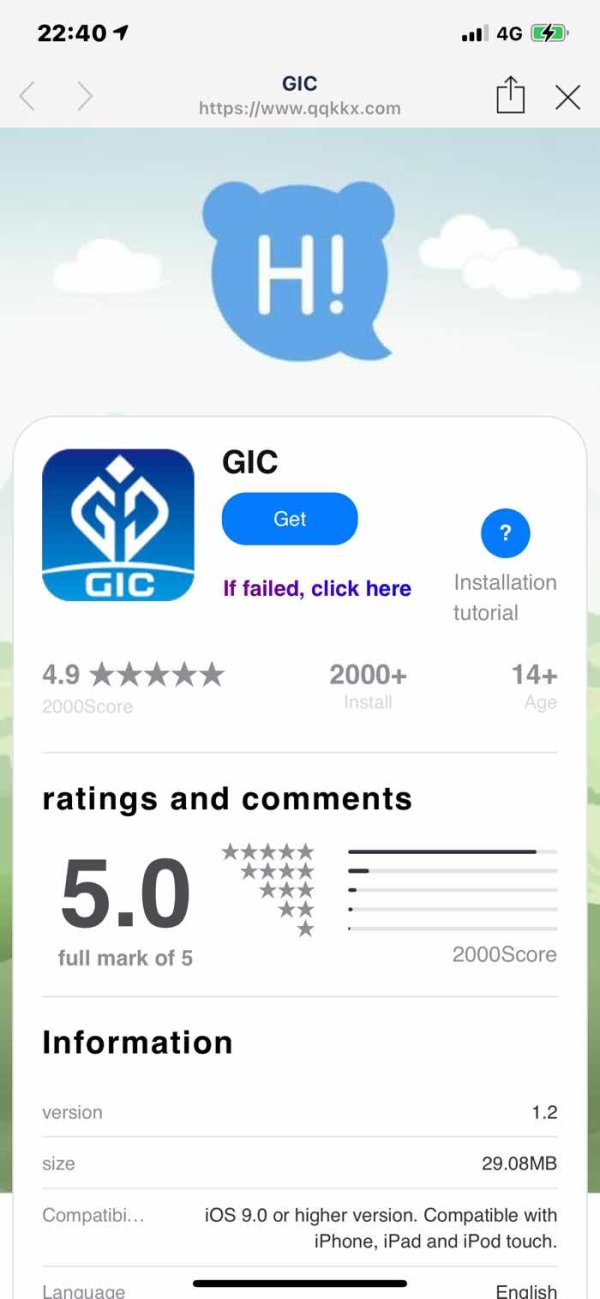

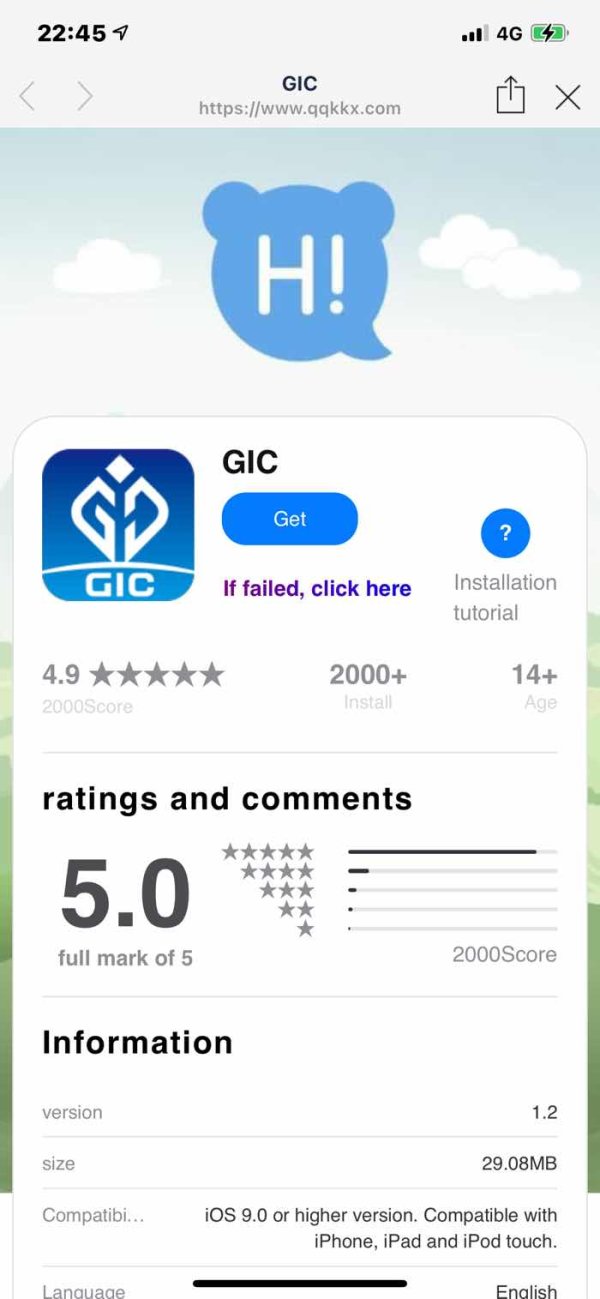

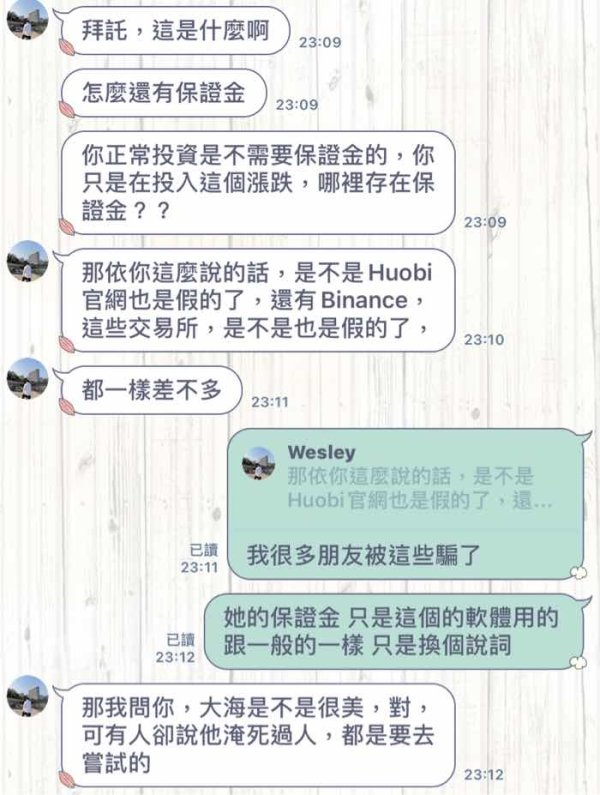

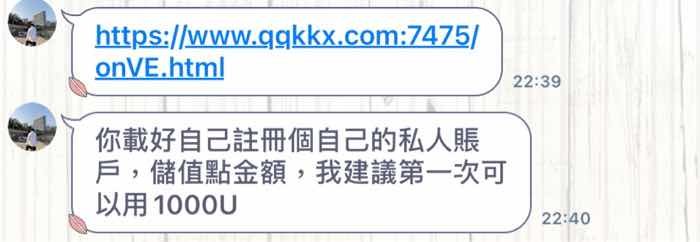

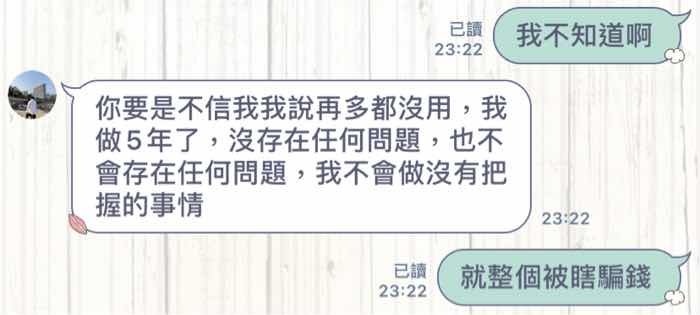

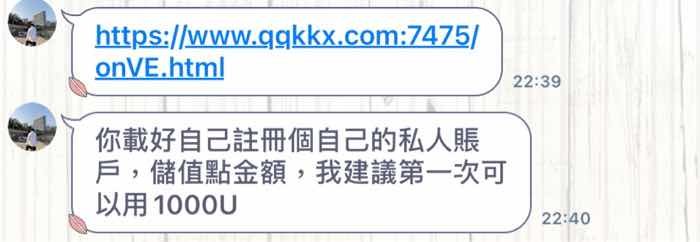

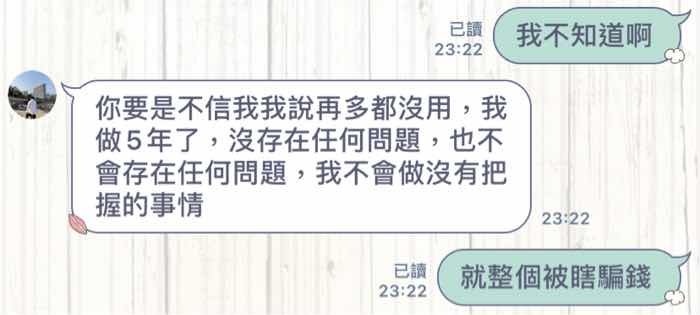

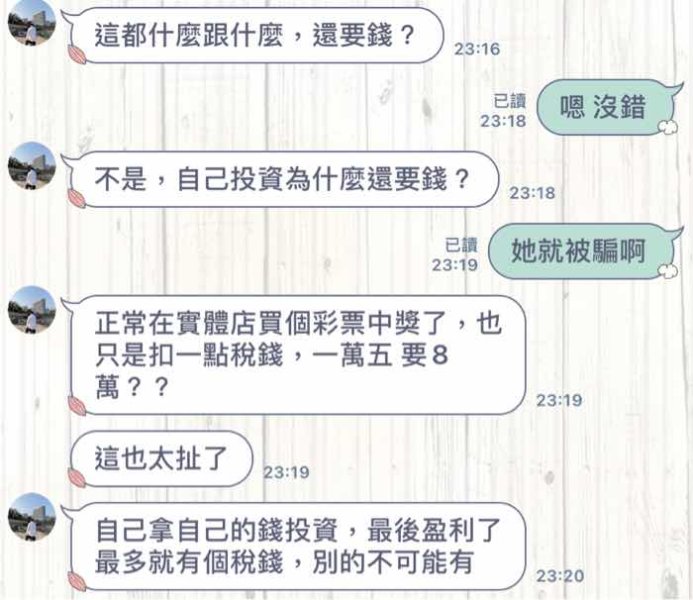

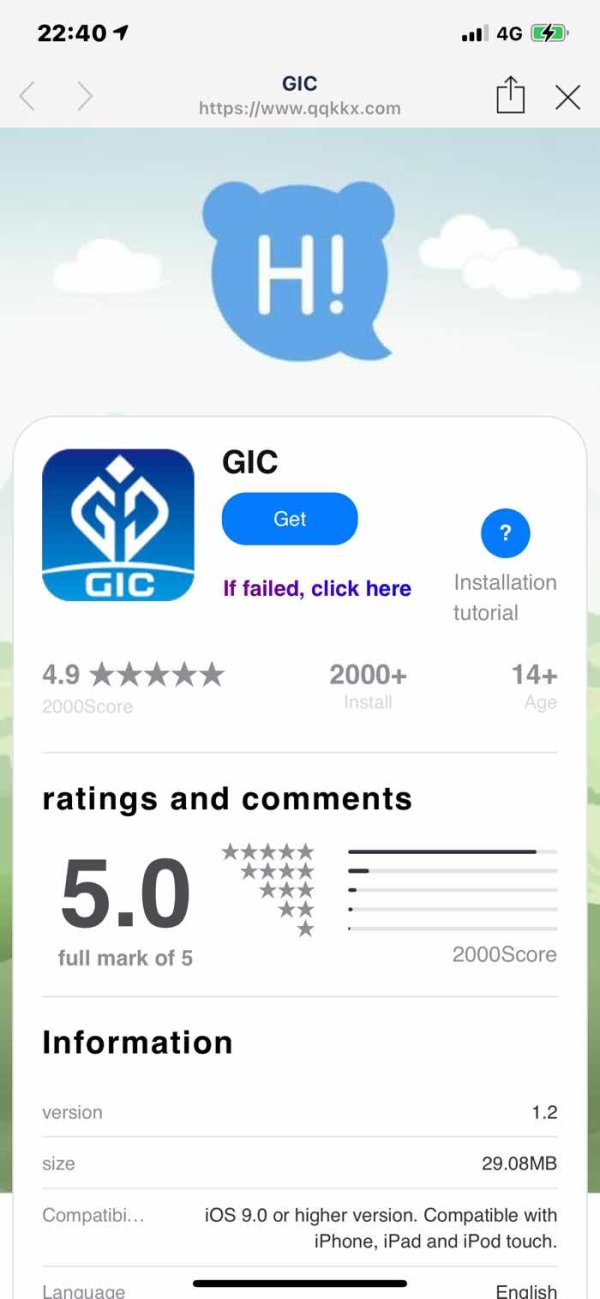

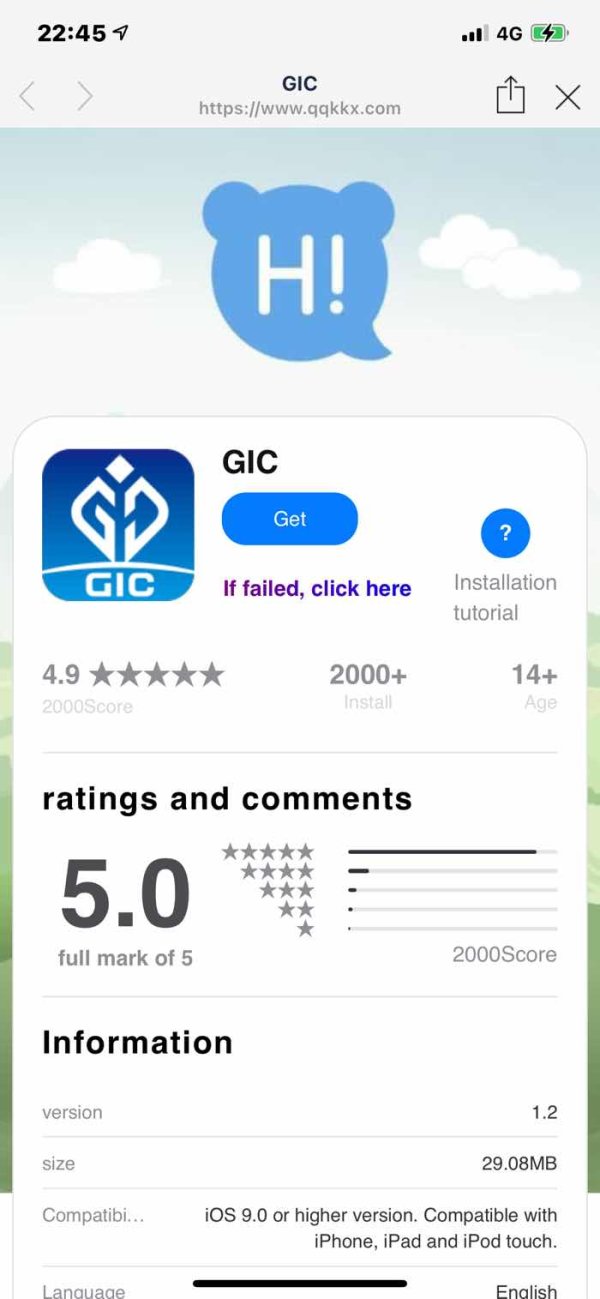

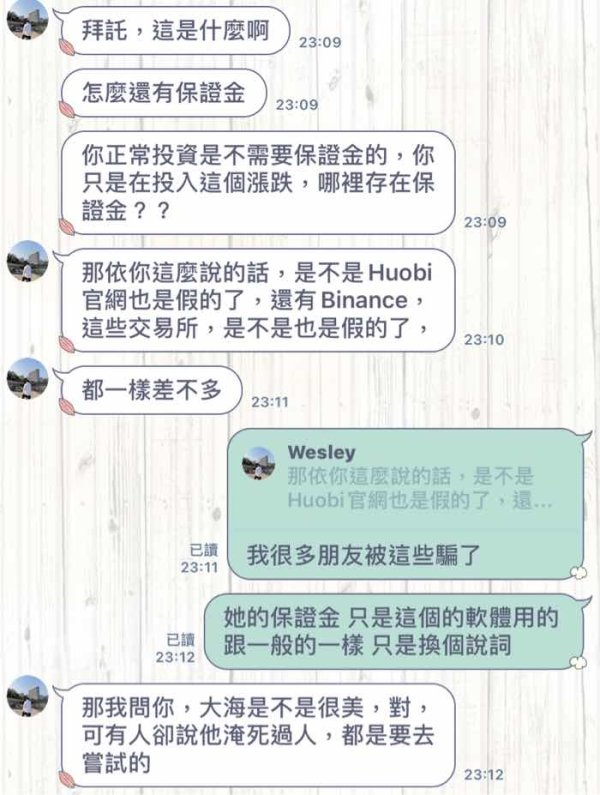

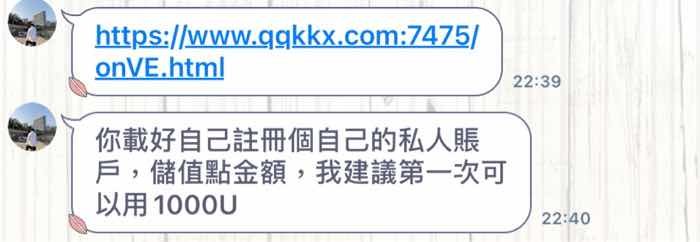

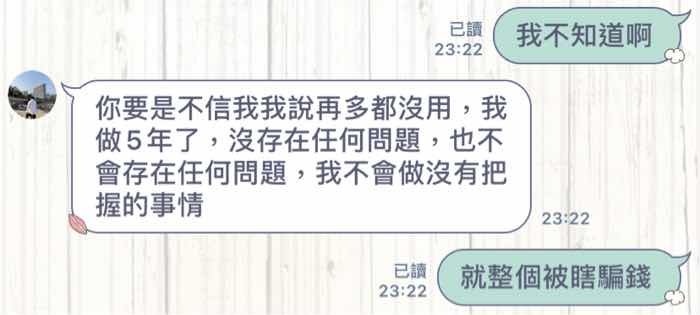

The following app will lead you to depositing through link, which is actually a scam. Beware of it.

GIC Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

The following app will lead you to depositing through link, which is actually a scam. Beware of it.

This GIC review looks at one of the financial industry's established entities. Comprehensive trading information remains limited in available public sources though. GIC appears to be referenced in various contexts within the financial services sector, particularly in relation to investment products and brokerage services for Canadian investors seeking Guaranteed Investment Certificates.

Based on available information, GIC-related services have gained renewed attention due to current high interest rate environments. This makes GIC investments more attractive to portfolio diversification strategies. The recent market conditions have revitalized interest in GIC products, with many investors incorporating them into their investment portfolios as safer alternatives to volatile market instruments.

However, specific details regarding trading conditions, regulatory oversight, and operational frameworks are not comprehensively detailed in accessible resources. This GIC review focuses on available information while noting significant data gaps that potential users should consider when evaluating their options.

The primary user base appears to target conservative investors and those seeking guaranteed returns through traditional investment vehicles. This particularly applies within the Canadian market context where GIC products maintain strong regulatory protection under deposit insurance frameworks.

Due to limited comprehensive information available in public sources, this review may not cover all operational aspects typically expected in broker evaluations. Users should be aware that different regional entities or service offerings may exist with varying legal and compliance frameworks that are not detailed in currently accessible materials.

This evaluation is based on available public information and industry context. The absence of detailed operational data may impact the comprehensiveness of this assessment, and potential users are advised to conduct additional due diligence before making investment decisions.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available sources |

| Tools and Resources | N/A | Trading tools and resources not specified in accessible materials |

| Customer Service and Support | N/A | Customer service details not available in current information |

| Trading Experience | N/A | Trading experience specifics not documented in available sources |

| Trust and Regulation | N/A | Regulatory information not comprehensively detailed |

| User Experience | N/A | User experience data not available in accessible materials |

GIC-related financial services have emerged as a significant consideration for investors. This is particularly true in the current high-rate environment that has revitalized interest in guaranteed investment products. The financial landscape surrounding GIC investments has evolved substantially, with many traditional and online brokers now offering enhanced services for investors seeking these conservative investment vehicles.

The business model appears to focus on serving investors who prioritize capital preservation and guaranteed returns over higher-risk, higher-reward trading strategies. This approach aligns with current market conditions where interest rate increases have made fixed-income products more attractive compared to previous low-rate periods.

According to available industry information, the GIC review landscape has become increasingly relevant as brokers adapt their service offerings to meet growing demand for guaranteed investment certificates. The Canada Deposit Insurance Corporation provides protection for eligible deposits, adding an additional layer of security that appeals to conservative investors.

The operational framework appears designed to serve both individual investors and those working with financial advisors to incorporate GIC products into diversified portfolios. However, specific details regarding platform technology, account structures, and service delivery mechanisms are not comprehensively documented in available public sources.

Regulatory Framework: Specific regulatory information is not detailed in available sources. GIC products in Canada typically fall under federal and provincial oversight with deposit insurance protection though.

Deposit and Withdrawal Methods: Available sources do not specify particular deposit and withdrawal mechanisms for GIC-related services.

Minimum Deposit Requirements: Minimum deposit information is not detailed in accessible materials.

Promotional Offers: Current promotional offerings are not specified in available sources.

Available Assets: While GIC products are the primary focus, additional asset classes are not detailed in current information.

Cost Structure: Specific fee structures and cost details are not comprehensively outlined in available sources.

Leverage Options: Leverage information is not applicable or detailed for traditional GIC investment products.

Platform Options: Specific trading platform details are not provided in accessible materials.

Geographic Restrictions: Regional availability information is not detailed in current sources.

Customer Support Languages: Language support details are not specified in available information.

This GIC review highlights the need for more comprehensive information regarding operational specifics and service delivery mechanisms.

The account conditions for GIC-related services are not comprehensively detailed in available public sources. Traditional GIC investments typically involve straightforward account structures focused on term deposits rather than complex trading account configurations common with forex or equity brokers.

Account opening processes for GIC investments generally follow standard financial services protocols. Specific requirements and procedures are not detailed in accessible materials though. The nature of GIC products suggests that account structures would prioritize security and regulatory compliance over advanced trading functionalities.

Minimum deposit requirements and account tier structures are not specified in current information sources. Traditional GIC investments often have varying minimum amounts depending on term length and interest rate offerings, but specific thresholds are not documented in available materials.

Special account features such as registered account options would be expected for Canadian GIC products. Details regarding these offerings are not comprehensively outlined though. The regulatory environment typically supports various account types for tax-advantaged investing, but specific implementations are not detailed in accessible sources.

This GIC review section underscores the importance of obtaining detailed account information directly from service providers. Publicly available documentation lacks comprehensive coverage of account conditions and requirements.

Trading tools and resources specific to GIC investments are not detailed in available public sources. Traditional GIC investing typically requires fewer sophisticated trading tools compared to active trading platforms, focusing instead on term selection, rate comparison, and maturity management capabilities.

Research and analysis resources would be expected to include interest rate forecasting, economic analysis, and portfolio allocation guidance. Specific offerings are not documented in accessible materials though. The nature of GIC investments suggests that educational resources would focus on fixed-income fundamentals rather than technical analysis tools.

Investment calculators and term comparison tools would be standard resources for GIC investors. These allow for evaluation of different term lengths and compounding options. However, specific tool availability and functionality are not detailed in current information sources.

Automated features for GIC investments might include automatic renewal options and laddering strategies. Such capabilities are not specified in available materials though. The conservative nature of GIC products typically involves less automation compared to active trading strategies.

Educational resources for GIC investing would be expected to cover topics such as interest rate risk, inflation protection, and portfolio diversification strategies. Specific educational offerings are not comprehensively documented in accessible sources though.

Customer service and support details for GIC-related services are not comprehensively outlined in available public sources. Traditional financial services for conservative investment products typically emphasize relationship-based support rather than high-frequency trading assistance.

Response times and service availability would be expected to align with standard financial services practices. Specific metrics and availability schedules are not detailed in accessible materials though. The nature of GIC investments suggests that support needs would focus on account management and investment guidance rather than immediate trade execution assistance.

Service quality expectations for GIC products typically involve knowledgeable staff capable of explaining term options, interest calculations, and regulatory protections. However, specific service quality measures and client satisfaction data are not documented in current information sources.

Multilingual support capabilities would be expected in diverse markets, particularly for Canadian financial services. Specific language offerings are not detailed in available materials though. Support channel options and communication preferences are similarly not specified in accessible sources.

The conservative investor demographic typically served by GIC products often values personalized service and clear communication. Specific service delivery approaches are not comprehensively documented in available public information though.

The trading experience for GIC investments differs significantly from traditional active trading platforms. It focuses on term selection and investment timing rather than continuous market participation. However, specific platform features and user interface details are not documented in available sources.

Platform stability and reliability would be crucial for GIC services, particularly during term maturity and renewal periods. Specific performance metrics are not detailed in accessible materials though. The nature of GIC investments typically involves less frequent transactions compared to active trading strategies.

Order execution for GIC products involves term commitment and interest rate locking rather than market order processing. Specific execution procedures are not outlined in current information sources though. The investment process typically emphasizes clarity and confirmation rather than speed of execution.

Mobile accessibility and digital platform features would be expected for modern GIC services. These allow investors to monitor terms and manage renewals. Specific mobile capabilities are not detailed in available materials though.

The overall trading environment for GIC review considerations focuses on user-friendly interfaces that simplify term selection and investment tracking. Specific implementation details are not comprehensively documented in accessible public sources though.

Regulatory oversight information for GIC-related services is not comprehensively detailed in available public sources. Canadian GIC products typically benefit from deposit insurance protection through the Canada Deposit Insurance Corporation, providing significant security for eligible deposits up to specified limits.

Funds safety measures would be expected to include segregated account structures and regulatory compliance monitoring. Specific implementation details are not documented in accessible materials though. The conservative nature of GIC products inherently provides principal protection through guaranteed return mechanisms.

Company transparency and disclosure practices are not detailed in current information sources. Regulatory requirements typically mandate clear communication of terms, conditions, and risk factors for investment products though.

Industry reputation and standing are not specifically documented in available materials. The broader GIC market benefits from established regulatory frameworks and institutional oversight that enhance overall credibility though.

Negative event handling and dispute resolution procedures are not outlined in accessible sources. Regulatory frameworks typically provide investor protection mechanisms and complaint resolution processes for financial services though.

User experience information for GIC-related services is not comprehensively detailed in available public sources. The target demographic for GIC investments typically includes conservative investors who prioritize simplicity and clarity over advanced functionality.

Interface design and usability expectations for GIC platforms would emphasize clear term presentation, easy comparison tools, and straightforward investment processes. Specific design implementations are not documented in accessible materials though.

Registration and verification processes would be expected to follow standard financial services protocols with appropriate identity verification and suitability assessment procedures. Specific requirements are not detailed in current sources though.

Fund operation experiences would focus on deposit processing, term management, and maturity handling rather than frequent trading activities. Specific operational procedures are not outlined in available information though.

Common user concerns for GIC investments typically involve interest rate timing, term selection, and renewal options. Specific user feedback and satisfaction data are not documented in accessible public sources though. The conservative investor base often values security and predictability over advanced features or high-yield potential.

This GIC review reveals significant information gaps in publicly available sources regarding specific operational details and service offerings. While GIC investments have gained renewed relevance in current market conditions, comprehensive evaluation requires additional information beyond what is currently accessible.

The service appears most suitable for conservative investors seeking guaranteed returns and capital preservation. This particularly applies within the Canadian market context where regulatory protections enhance security. However, the lack of detailed information regarding account conditions, platform features, and service delivery mechanisms limits comprehensive assessment.

Primary advantages appear to include the inherent security of GIC products and regulatory protection frameworks. Disadvantages center on limited available information and the conservative return profile typical of guaranteed investment products. Potential users should conduct thorough due diligence and seek detailed information directly from service providers before making investment decisions.

FX Broker Capital Trading Markets Review