HND 2025 Review: Everything You Need to Know

Executive Summary

HND is a UK-registered brokerage company that operates without proper regulatory oversight. This raises big concerns among traders and industry experts. This hnd review reveals troubling patterns of user complaints and potential fraudulent activities that prospective clients should carefully consider.

Despite offering a diverse range of trading instruments including forex, commodities, cryptocurrencies, and indices, the broker's lack of regulatory compliance overshadows these offerings. The company markets itself to investors seeking exposure to multiple asset classes through features such as swap-free trading options and demo accounts.

However, extensive user feedback indicates serious issues with customer service quality, fund security, and overall business practices. The broker's positioning in the UK market without Financial Conduct Authority authorization creates additional legal uncertainties for both the company and its clients. Our comprehensive analysis reveals that while HND attempts to attract traders with varied investment tools, the fundamental lack of regulatory protection and mounting user complaints suggest significant risks.

Potential clients should exercise extreme caution when considering this broker, particularly given the availability of well-regulated alternatives in the competitive UK trading market.

Important Disclaimer

This review is based on available public information and user feedback as of 2025. HND operates as an unregulated broker, which presents inherent legal and financial risks across different jurisdictions.

Regulatory requirements vary significantly between regions, and traders should verify compliance with local laws before engaging with any unregulated financial service provider. The analysis presented here reflects current market information and user experiences, though individual trading outcomes may vary. Given the dynamic nature of regulatory environments and the broker's unregulated status, prospective clients should conduct independent due diligence and consider consulting with financial advisors familiar with their specific jurisdictional requirements.

Rating Overview

Broker Overview

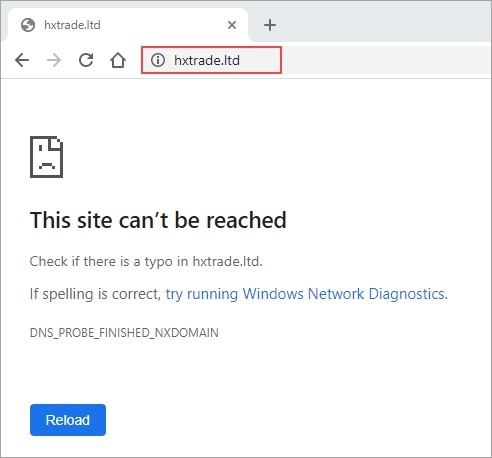

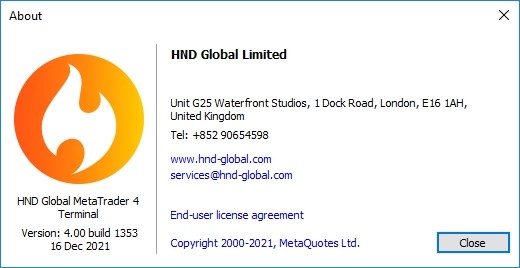

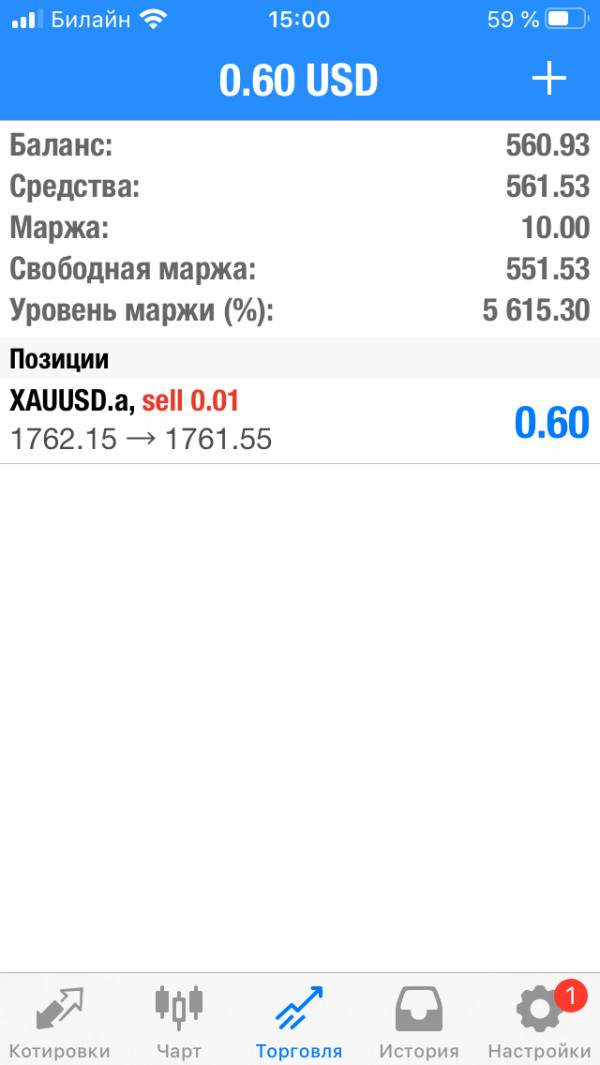

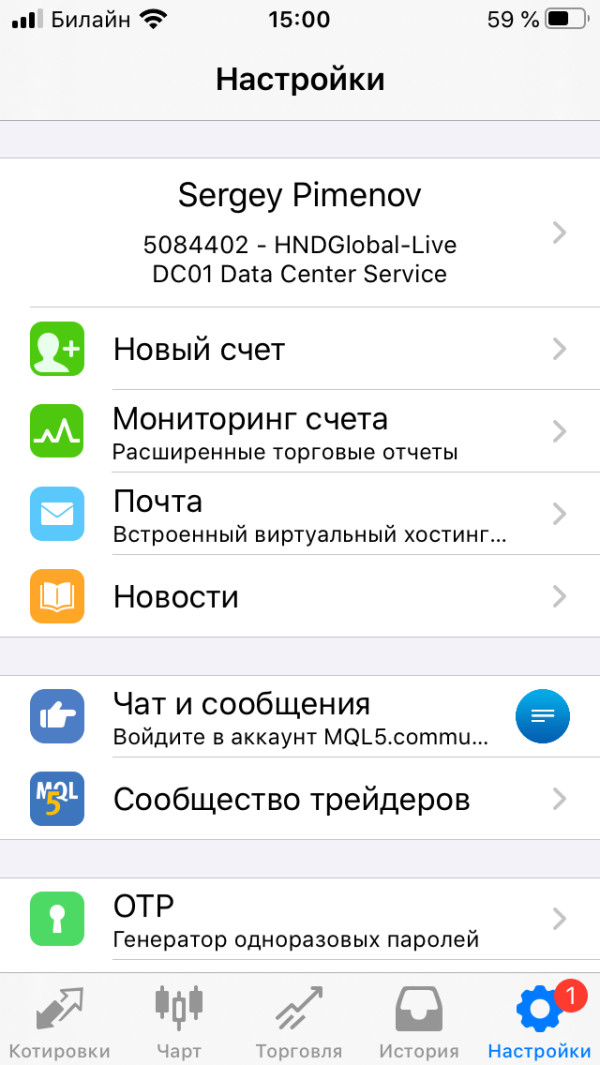

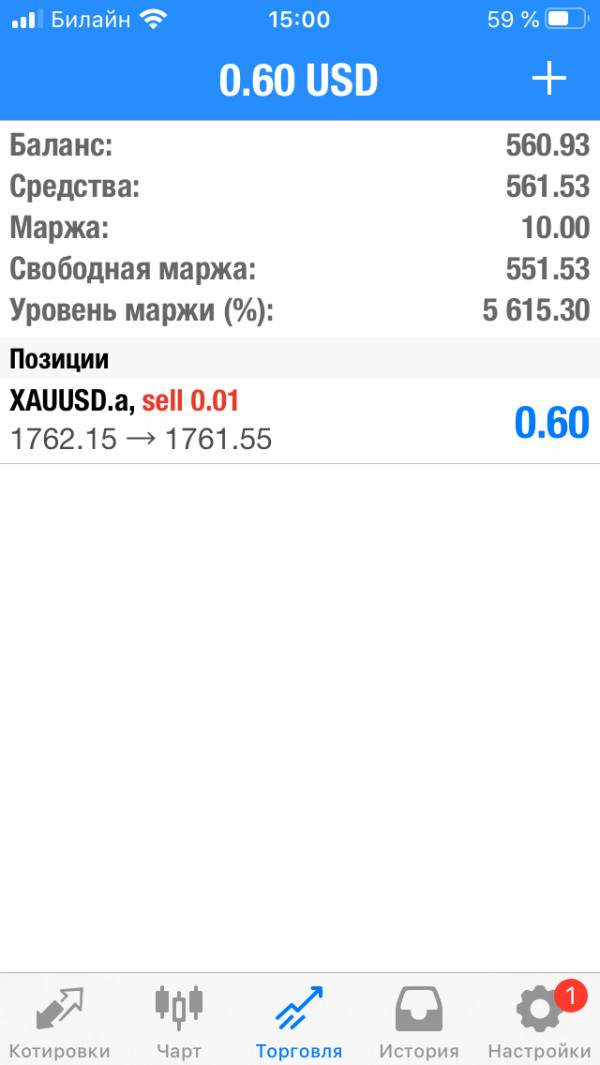

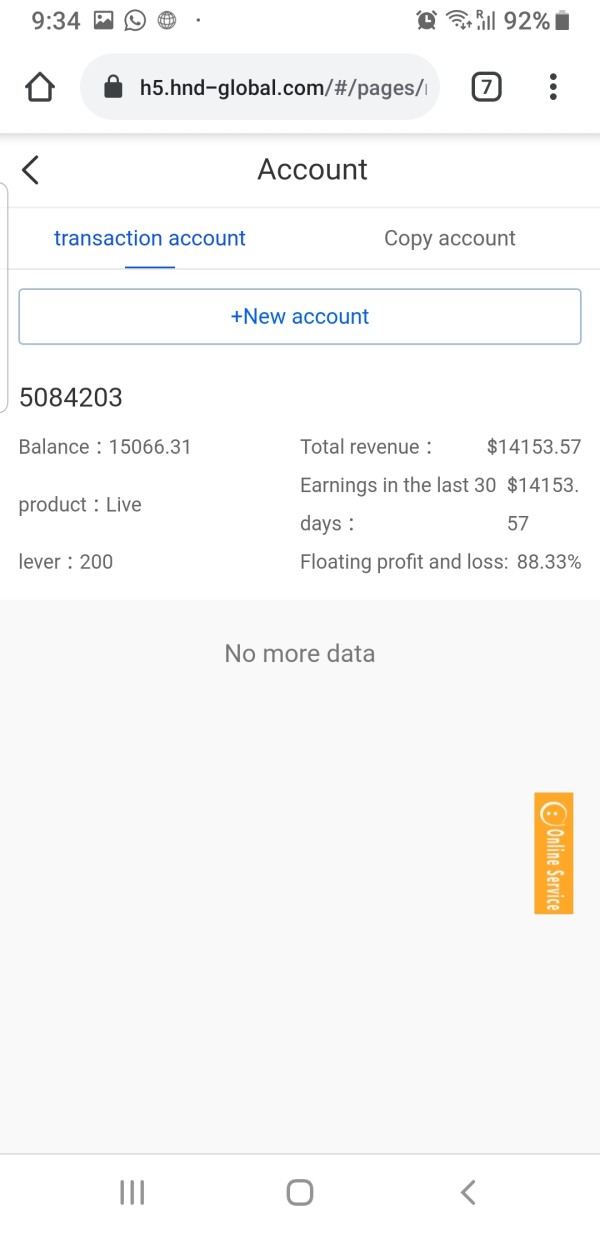

HND positions itself as a UK-based brokerage offering multi-asset trading services. However, its operational history and founding details remain unclear from available documentation. The company operates without regulatory oversight from major financial authorities, which immediately raises questions about its legitimacy and client protection measures.

The broker's business model centers on providing access to various financial markets including foreign exchange, commodities, digital currencies, and stock indices. According to available information, HND targets traders seeking diversified portfolio exposure across multiple asset classes. The company emphasizes its provision of swap-free trading options, which typically appeals to traders following Islamic finance principles or those seeking to avoid overnight financing charges.

Additionally, the broker offers demo accounts for practice trading, though specific platform details and technical specifications remain limited in public documentation. The broker's regulatory status represents a significant concern in this hnd review. Operating from the UK without Financial Conduct Authority authorization creates substantial legal and financial risks for clients.

Unlike regulated brokers that must maintain segregated client funds and provide compensation scheme protection, HND's unregulated status offers no such safeguards. This fundamental weakness undermines confidence in the broker's ability to protect client interests and maintain operational standards expected in modern financial services.

Regulatory Status: HND operates without regulatory authorization in the UK. This presents significant compliance concerns for potential clients seeking protected trading environments.

Deposit and Withdrawal Methods: Specific information regarding funding options and withdrawal procedures is not detailed in available documentation, creating transparency concerns for prospective traders. Minimum Deposit Requirements: The broker's minimum account funding requirements are not specified in accessible materials, making it difficult for traders to assess entry barriers.

Bonus and Promotions: Available documentation does not detail specific promotional offerings or bonus structures, though unregulated brokers often use aggressive promotional tactics to attract clients. Tradable Assets: HND offers access to forex pairs, commodity markets, cryptocurrency trading, and stock indices, providing diversified investment opportunities across major asset classes.

Cost Structure: Detailed information about spreads, commissions, and fee structures is not readily available in public documentation, creating uncertainty about total trading costs. Leverage Options: Specific leverage ratios and margin requirements are not detailed in available materials, though this information is crucial for risk management.

Platform Selection: Trading platform options and technical specifications are not comprehensively detailed in accessible broker documentation. Geographic Restrictions: Specific jurisdictional limitations and service availability by region are not clearly outlined in available materials.

Customer Support Languages: Multi-language support capabilities are not specified in current documentation. This hnd review highlights significant information gaps that prospective clients should address directly with the broker before making any commitments.

Account Conditions Analysis

The account structure and conditions offered by HND remain largely opaque. Limited publicly available information exists about specific account types, their features, or associated requirements. This lack of transparency represents a significant red flag for potential clients seeking clear understanding of trading conditions and account specifications.

Unlike regulated brokers that must provide comprehensive terms and conditions, HND's documentation appears insufficient for informed decision-making. User feedback suggests dissatisfaction with account management processes, though specific details about minimum deposit requirements, account tiers, or special features remain unclear. The absence of detailed information about Islamic accounts, professional trading conditions, or institutional services further compounds concerns about the broker's operational transparency.

The account opening process appears to lack the robust verification procedures typically required by regulated financial service providers. This raises questions about know-your-customer compliance and anti-money laundering procedures that legitimate brokers must implement. Without proper regulatory oversight, clients have limited recourse if account-related disputes arise.

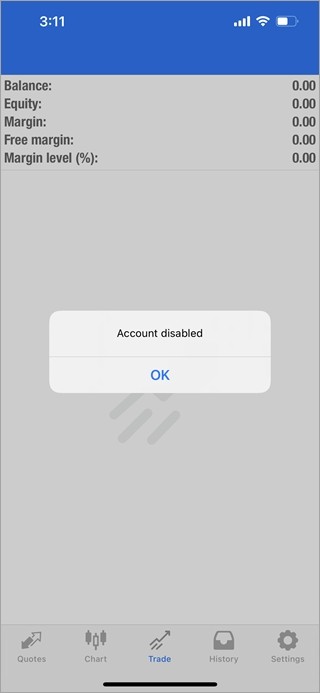

Several user reports indicate concerns about account accessibility and fund security, suggesting potential issues with the broker's account management systems. The combination of limited transparency, user complaints, and regulatory absence creates substantial uncertainty about account safety and operational reliability. This hnd review emphasizes that prospective clients should demand comprehensive account documentation and clear terms before considering any deposits with this unregulated broker.

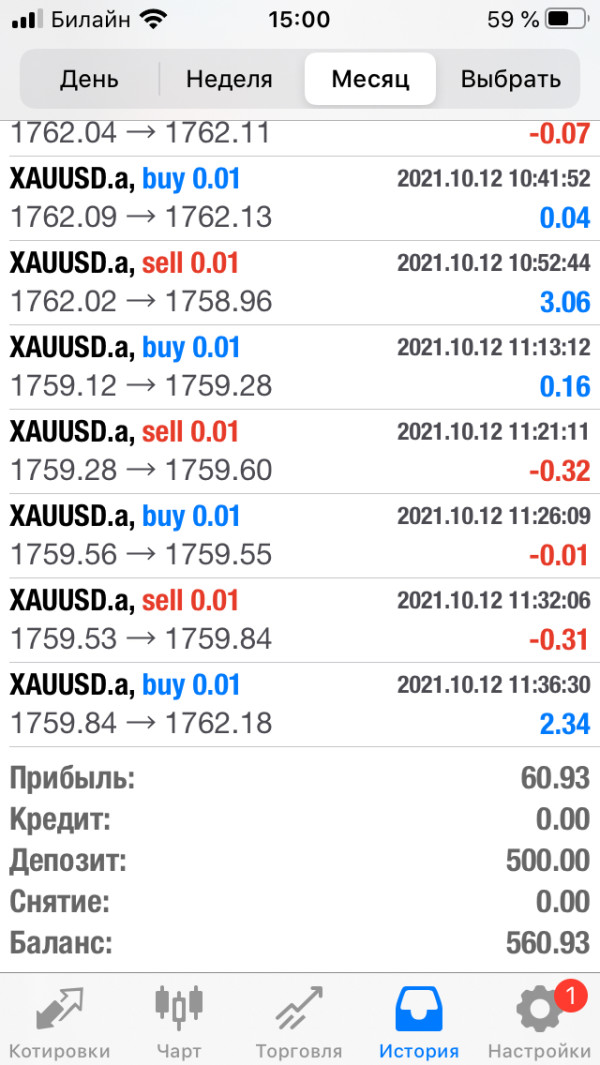

HND markets itself as offering diverse trading instruments across multiple asset classes. These include foreign exchange pairs, commodity markets, cryptocurrency trading opportunities, and stock index access. This multi-asset approach potentially appeals to traders seeking portfolio diversification through a single brokerage platform.

The inclusion of digital currencies reflects current market trends toward cryptocurrency integration in traditional trading environments. The broker advertises swap-free trading options, which can benefit traders following Islamic finance principles or those seeking to avoid overnight financing charges. However, the specific implementation of these features and their associated costs remain unclear from available documentation.

Demo account availability suggests some commitment to trader education and practice opportunities, though the platform's technical capabilities and educational resources are not comprehensively detailed. User feedback regarding trading tools quality appears mixed, with some questioning the reliability and functionality of available instruments. The lack of detailed information about research resources, market analysis tools, or educational materials raises concerns about the broker's commitment to trader development and informed decision-making support.

Without regulatory oversight, there are no guarantees about tool reliability, data accuracy, or system stability. Traders accustomed to regulated brokers' comprehensive research departments and professional-grade analysis tools may find HND's offerings inadequate for serious trading activities. The absence of third-party platform integrations or advanced trading technologies further limits the broker's appeal to sophisticated traders.

Customer Service and Support Analysis

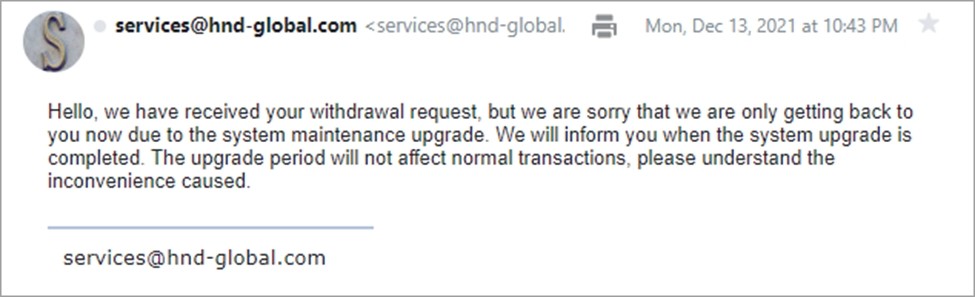

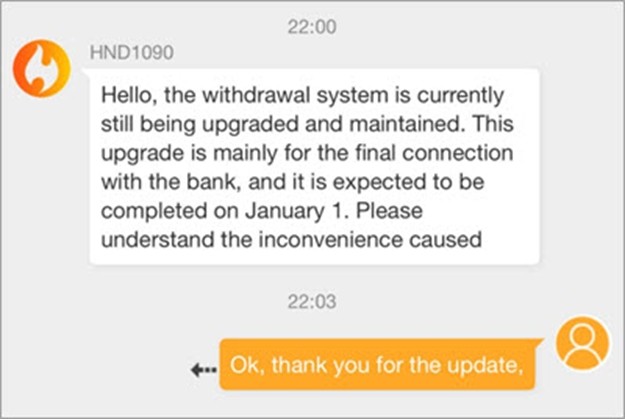

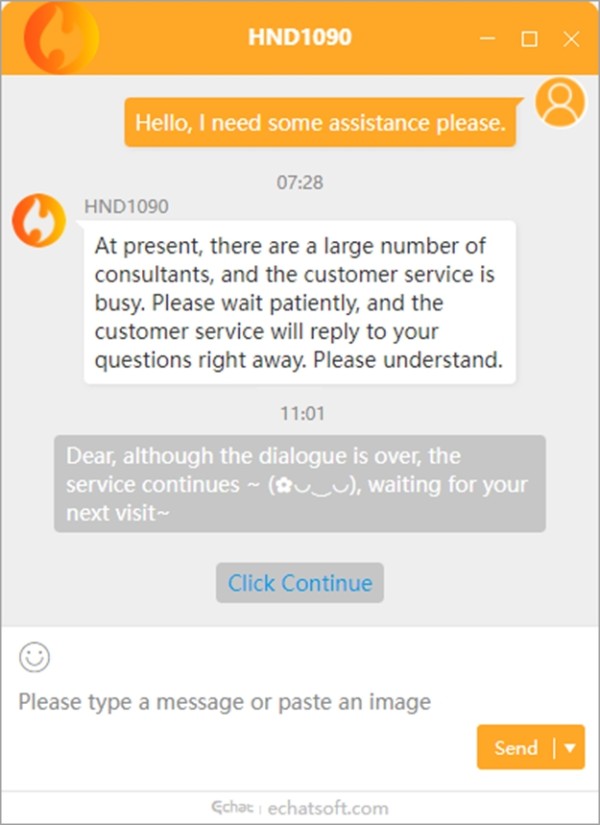

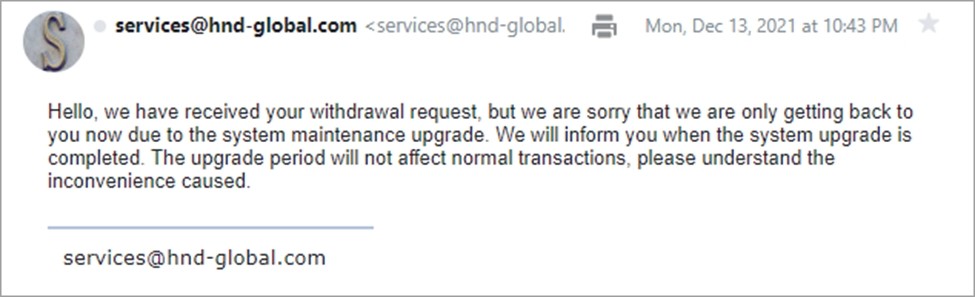

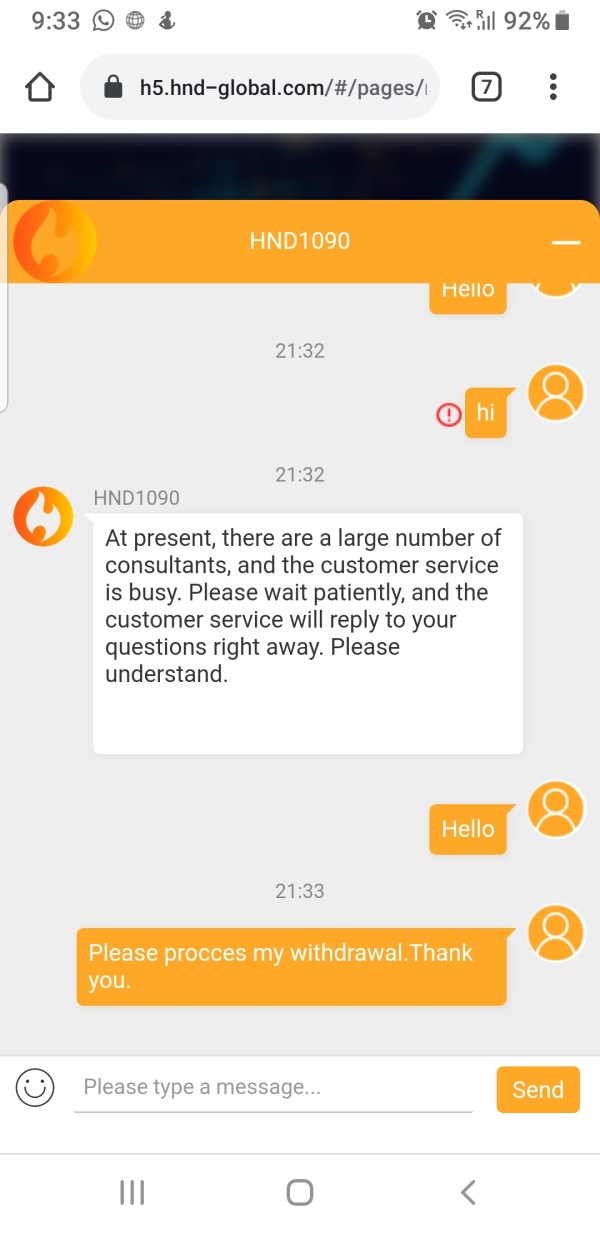

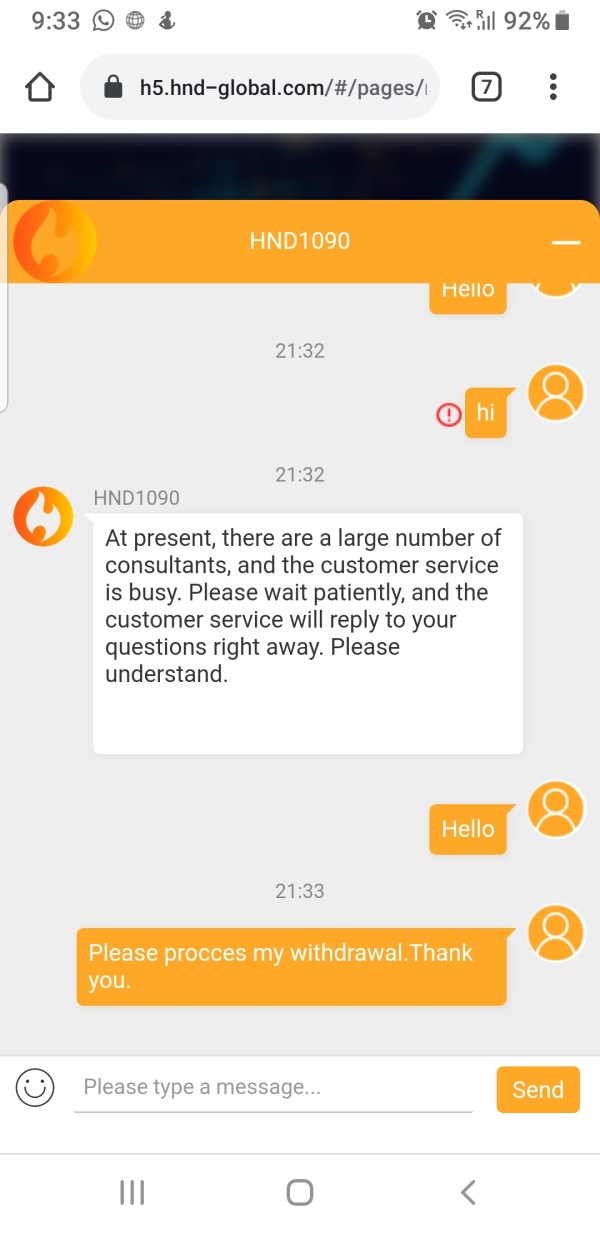

Customer service quality represents a significant weakness in HND's operations. This assessment is based on available user feedback and operational evidence. Multiple user reports indicate poor responsiveness from support staff, creating frustration for clients seeking assistance with account issues, technical problems, or general inquiries.

The lack of detailed contact information and support channel specifications compounds these concerns. Response times appear inconsistent and often lengthy, according to user experiences shared in various forums and review platforms. This contrasts sharply with regulated brokers that typically maintain professional support standards and clear escalation procedures for client concerns.

The absence of regulatory oversight means no external standards govern HND's customer service quality or response obligations. Language support capabilities remain unclear, potentially limiting accessibility for international clients. Professional brokers typically offer multi-language support with native speakers, while HND's capabilities in this area are not well-documented.

The lack of comprehensive FAQ sections, educational resources, or self-service options further indicates limited commitment to customer support infrastructure. Problem resolution procedures appear inadequate based on user feedback, with several reports indicating unresolved issues and unsatisfactory outcomes. Without regulatory protection, clients have limited recourse when standard customer service channels fail to address their concerns.

This creates additional risk for traders who may encounter technical issues, account problems, or dispute situations requiring professional intervention.

Trading Experience Analysis

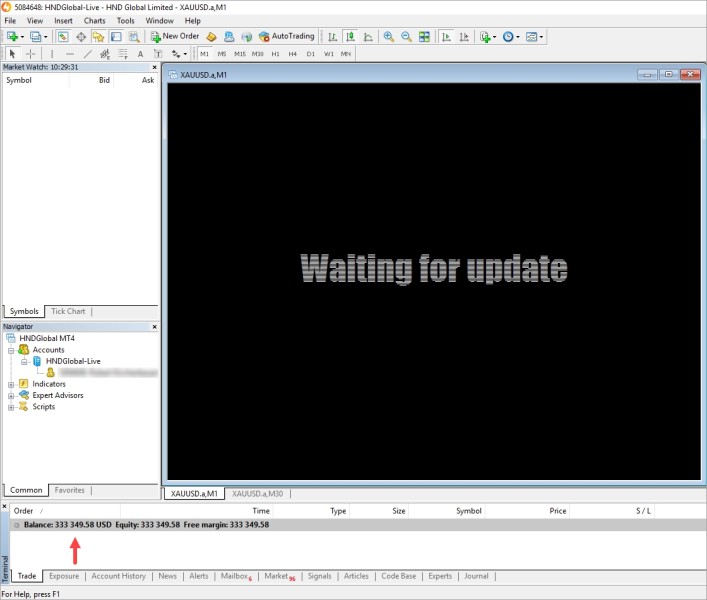

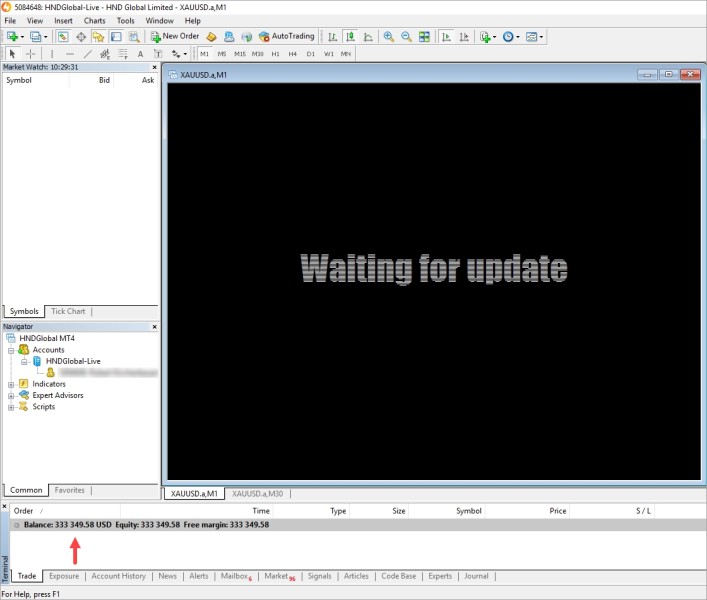

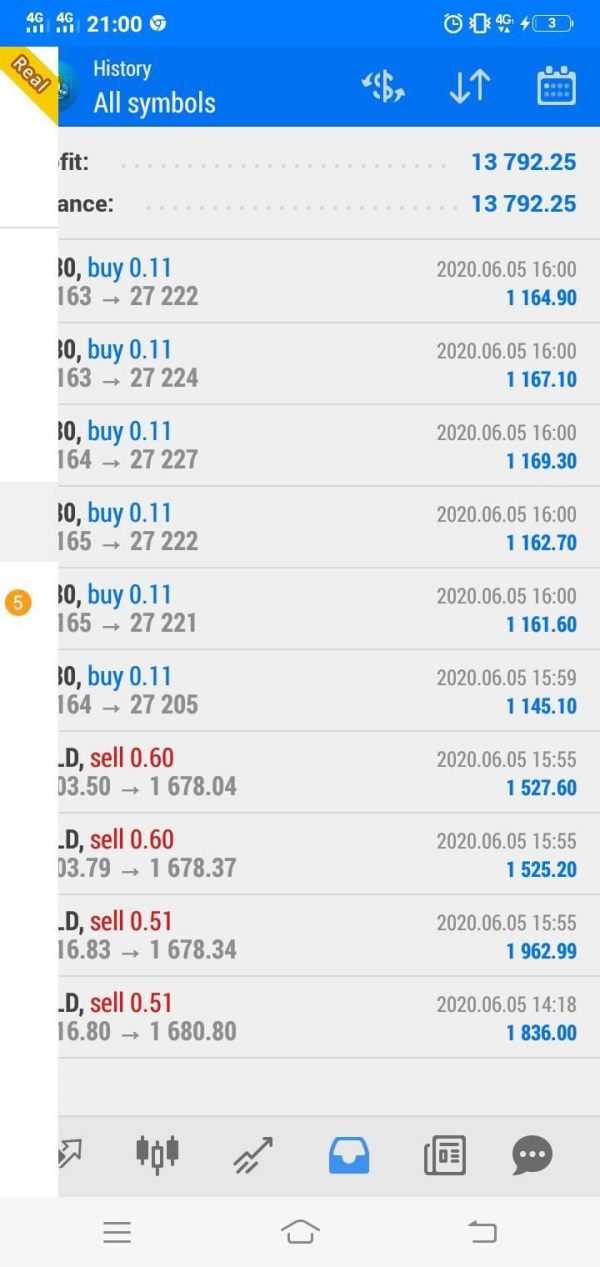

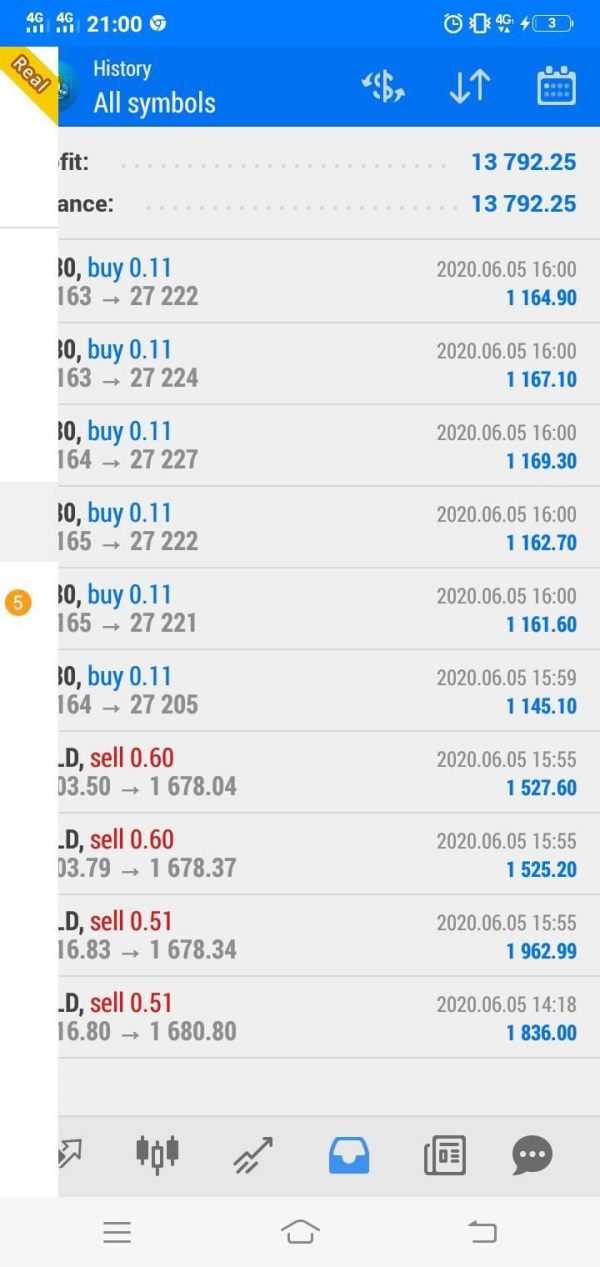

The trading experience with HND appears inconsistent based on available user feedback and platform information. While the broker offers access to multiple asset classes, the actual execution quality and platform stability remain questionable according to several user reports.

The lack of detailed technical specifications makes it difficult to assess platform capabilities or performance benchmarks. Platform functionality and user interface design are not comprehensively documented, creating uncertainty about the actual trading environment clients will encounter. This contrasts with regulated brokers that typically provide detailed platform demonstrations, technical specifications, and performance metrics.

The absence of mobile trading information further limits understanding of the complete trading experience. Order execution quality represents a crucial concern, as user feedback suggests potential issues with trade processing and price accuracy. Without regulatory oversight, there are no external standards governing execution quality or price transparency.

This creates additional risk for traders who depend on reliable order processing for their trading strategies. The availability of demo accounts suggests some recognition of trader needs for practice environments, though the demo platform's similarity to live trading conditions remains unclear. Professional traders typically require comprehensive testing capabilities before committing real funds, making platform transparency essential for informed decision-making.

This hnd review indicates that the trading experience may not meet professional standards expected from legitimate brokers, particularly regarding execution reliability and platform stability.

Trustworthiness Analysis

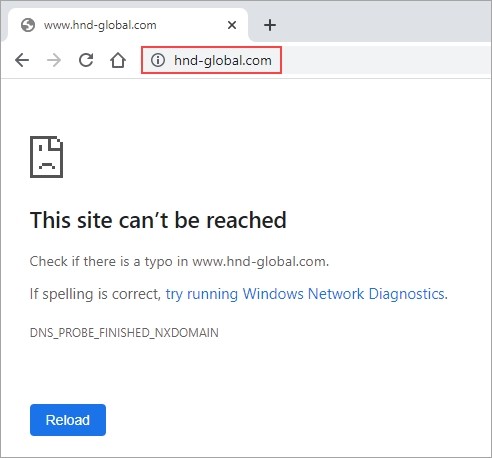

Trustworthiness represents HND's most significant weakness. The broker's unregulated status creates fundamental concerns about operational legitimacy and client protection. Operating without Financial Conduct Authority authorization in the UK violates standard industry practices and removes essential safeguards that protect trader interests.

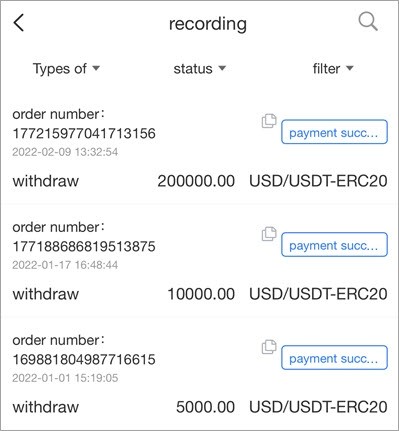

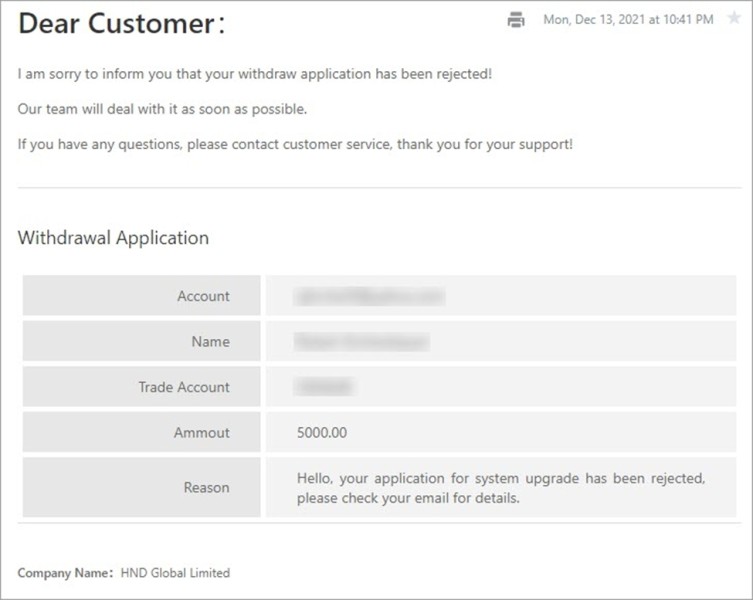

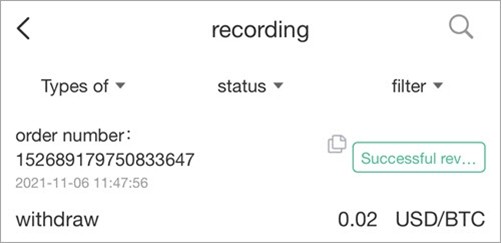

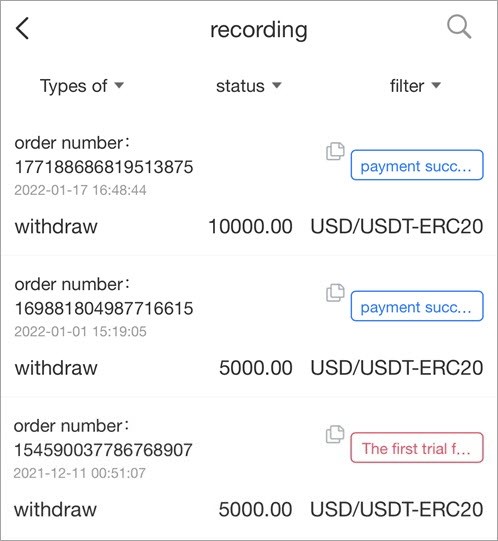

This regulatory absence immediately raises red flags about the company's commitment to professional standards. User complaints and negative feedback patterns suggest potential fraudulent activities, with several reports characterizing HND as a scam operation. These allegations, combined with the lack of regulatory oversight, create substantial credibility concerns for prospective clients.

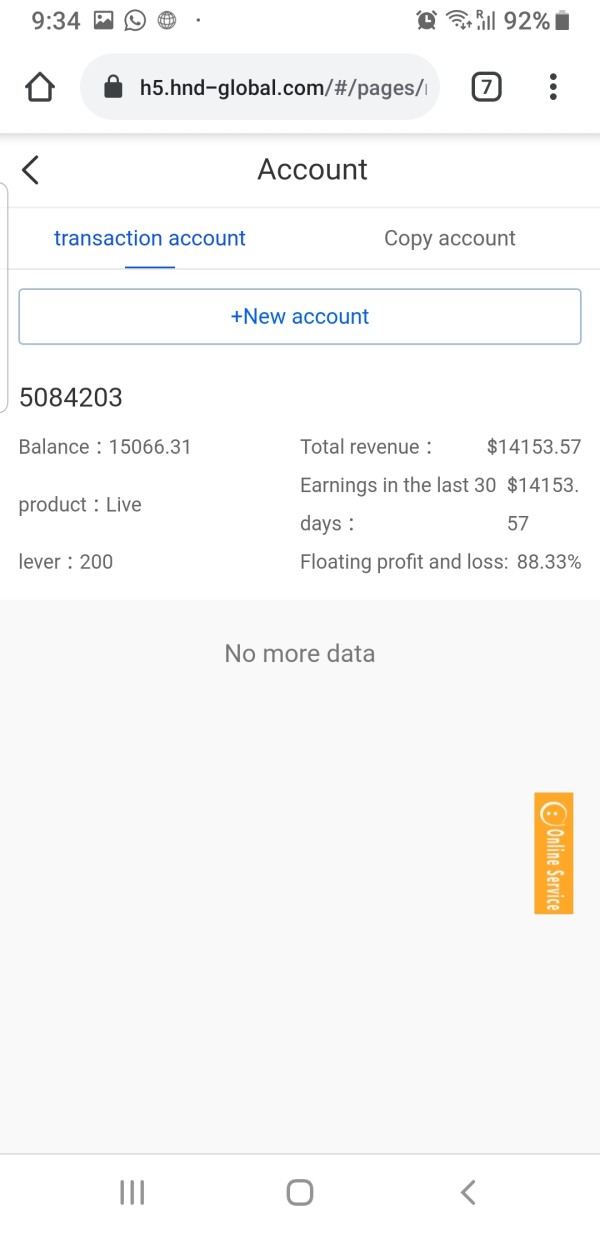

Legitimate brokers typically maintain transparent operations and regulatory compliance to build market confidence. Fund security measures appear inadequate or non-existent based on available information. Regulated brokers must maintain segregated client accounts and participate in compensation schemes, while HND's unregulated status provides no such protections.

This creates significant risk for client deposits and trading proceeds. Company transparency remains extremely limited, with minimal information available about management, operational history, or business practices. Professional brokers typically provide comprehensive corporate information, regulatory documentation, and operational transparency to build client confidence.

HND's opacity in these areas further undermines trustworthiness. The combination of regulatory absence, user complaints, and operational opacity creates a trustworthiness profile that falls far below industry standards for legitimate financial service providers.

User Experience Analysis

Overall user satisfaction with HND appears predominantly negative based on available feedback and review patterns. Multiple users express concerns about various aspects of their experience, ranging from customer service quality to fund security and platform reliability.

This negative sentiment pattern is particularly concerning given the limited positive feedback available in public forums. Interface design and platform usability information remains limited in available documentation, making it difficult to assess the actual user experience quality. Professional brokers typically invest significantly in user experience design and provide comprehensive platform documentation, while HND's limited transparency suggests minimal commitment to user experience optimization.

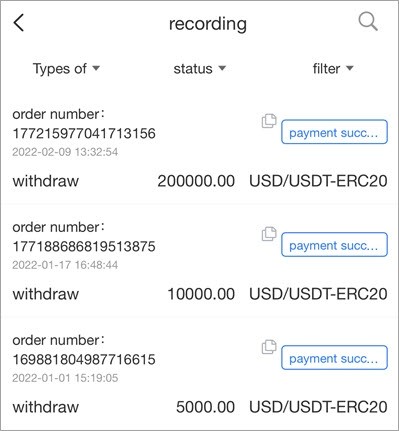

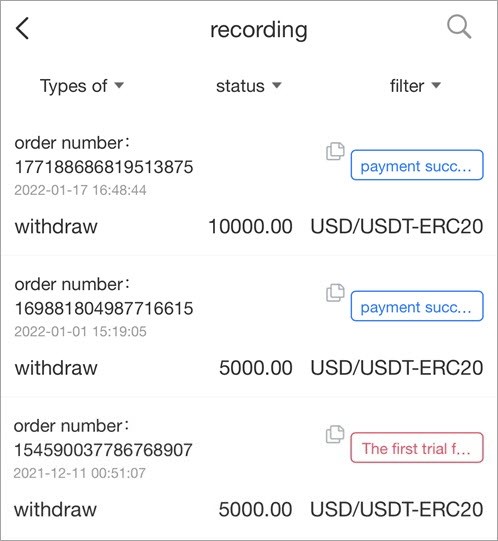

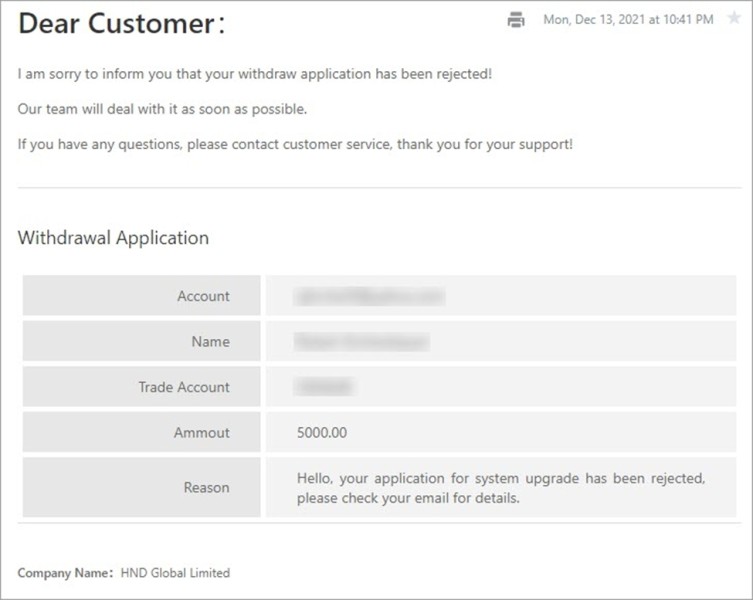

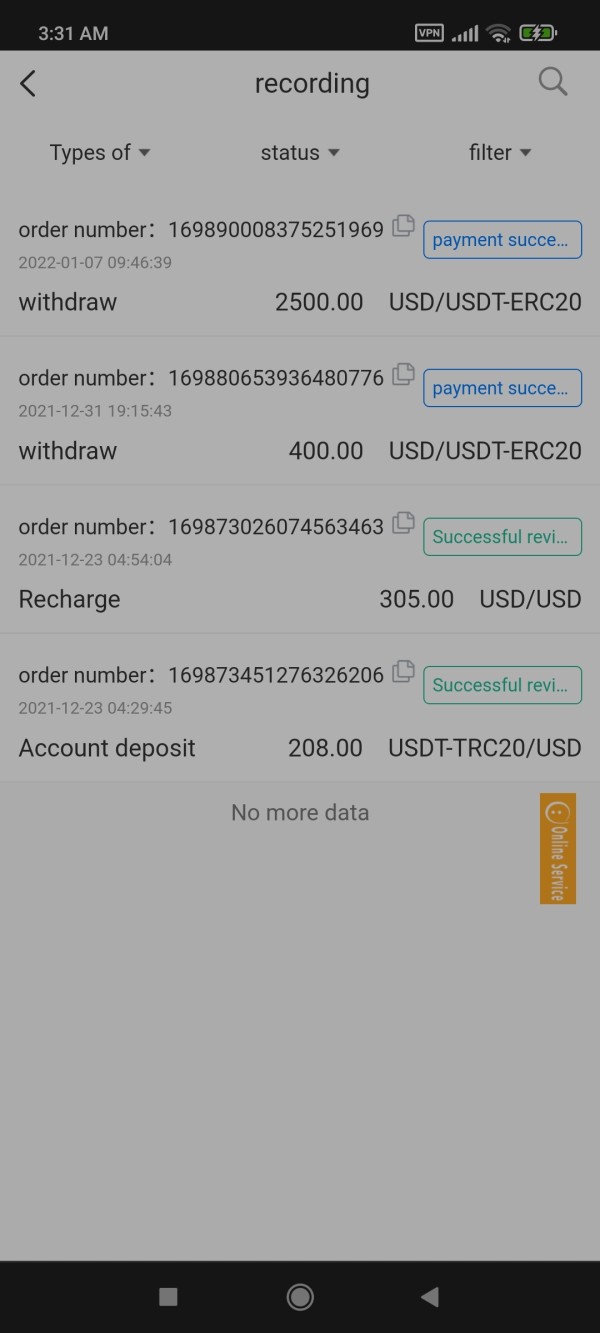

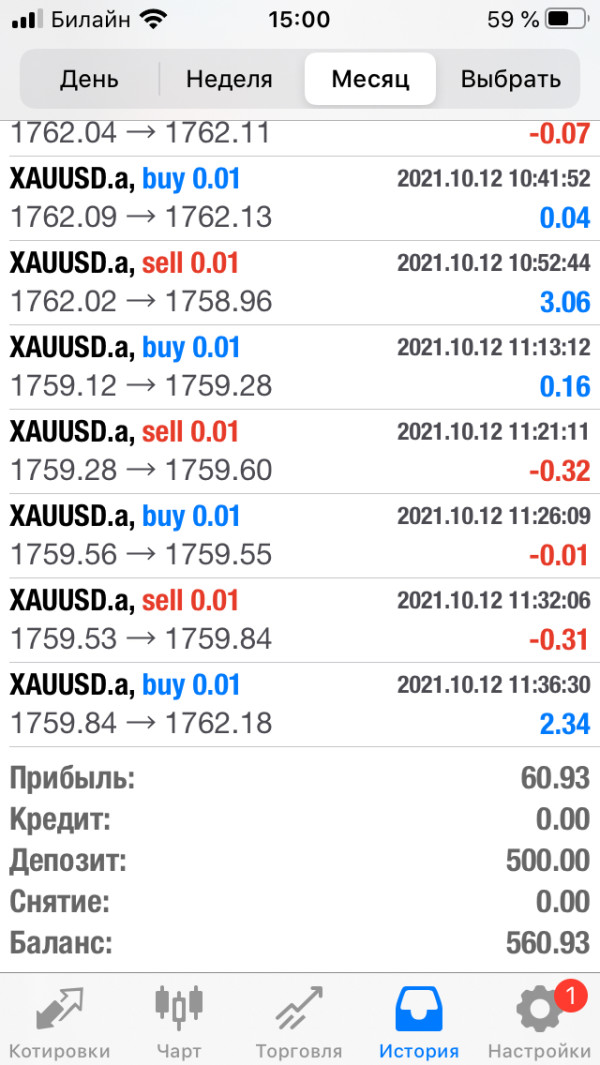

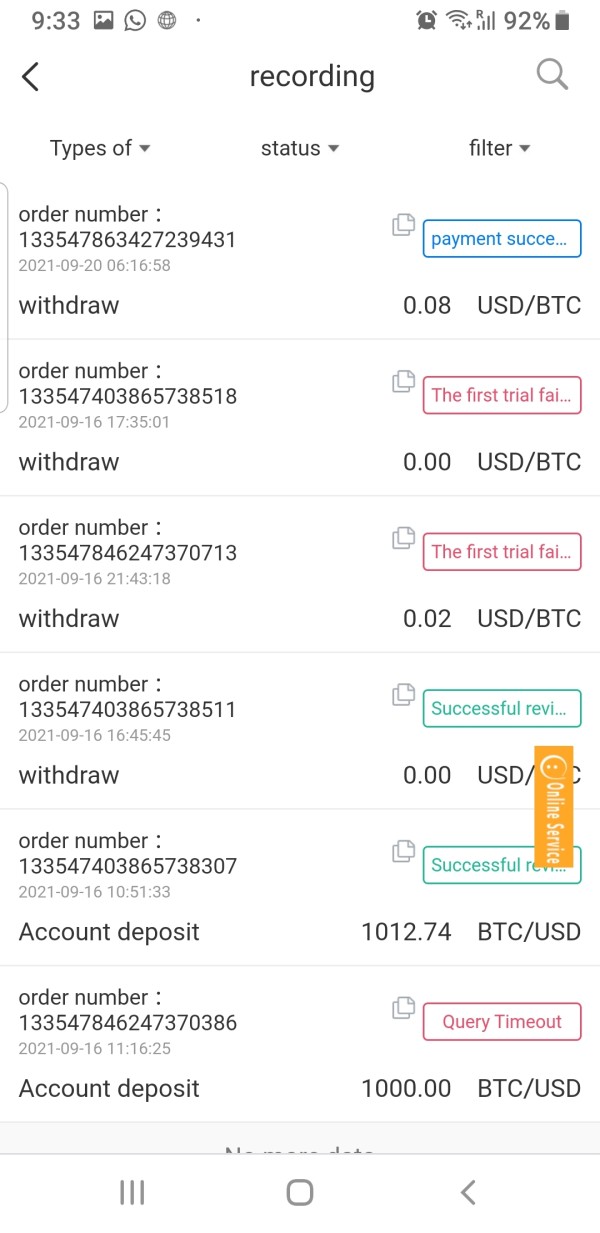

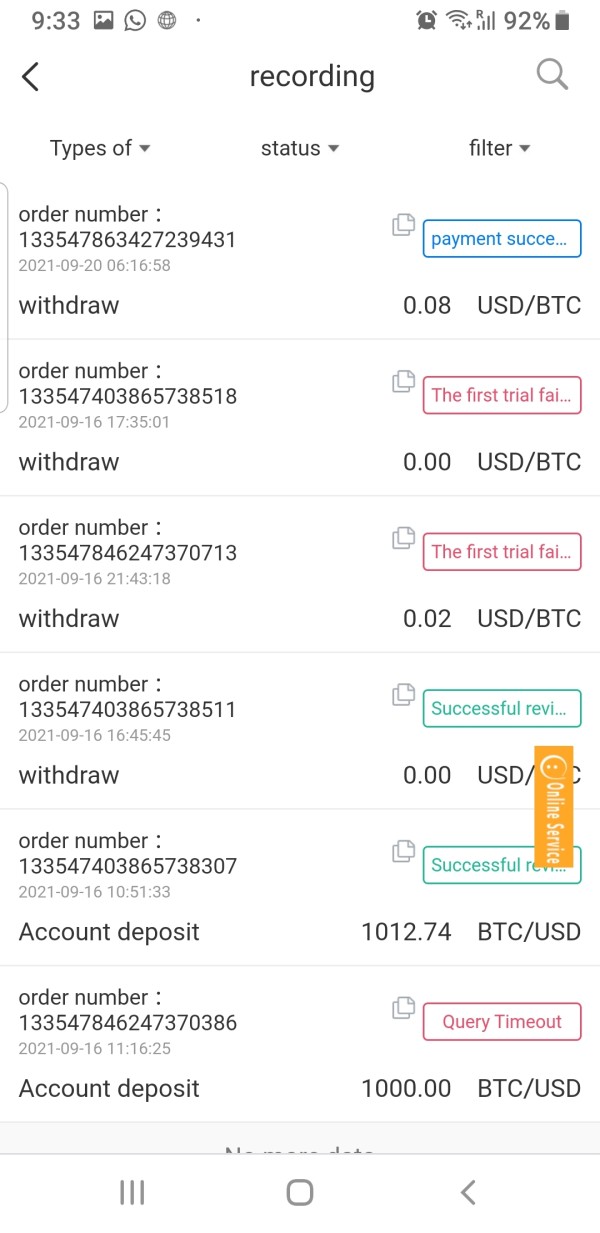

Registration and verification processes appear to lack the comprehensive procedures required by regulated brokers, potentially creating both convenience and security concerns. While simplified onboarding might seem attractive, it often indicates insufficient compliance procedures that could create problems for both clients and the broker. Common user complaints focus on customer service responsiveness, fund withdrawal difficulties, and general concerns about the broker's legitimacy.

These recurring themes suggest systemic issues rather than isolated problems, indicating fundamental operational weaknesses that affect overall user experience. The target user profile appears to include traders seeking diverse asset exposure, though the negative feedback patterns suggest that even this target audience finds the experience unsatisfactory. Improvements in regulatory compliance, customer service quality, and operational transparency would be essential for meaningful user experience enhancement.

Conclusion

This comprehensive hnd review reveals significant concerns about the broker's operations, regulatory status, and overall client protection measures. While HND offers diverse trading instruments across multiple asset classes, the fundamental lack of regulatory oversight and mounting user complaints create substantial risks that outweigh potential benefits.

The broker's unregulated status removes essential safeguards that professional traders expect from legitimate financial service providers. The analysis indicates that HND is not suitable for risk-averse investors or traders seeking regulated broker protection. The combination of poor customer service feedback, regulatory absence, and transparency concerns suggests that clients would be better served by choosing established, regulated alternatives in the competitive UK trading market.

Key advantages include multi-asset trading availability and swap-free options, while significant disadvantages encompass regulatory absence, negative user feedback, poor customer service, and fundamental trustworthiness concerns. The risk-reward profile heavily favors avoiding this broker in favor of regulated alternatives that provide comprehensive client protection and professional service standards.