Is GIC safe?

Business

License

Is GIC Safe or a Scam?

Introduction

GIC Markets has emerged as a player in the Forex trading arena, claiming to offer a wide range of financial instruments, including forex pairs, commodities, and cryptocurrencies. Given the volatile nature of the forex market, traders must exercise caution when selecting a broker. The choice of a reliable broker can significantly impact a trader's success and financial security. This article aims to investigate whether GIC Markets is a safe trading platform or merely a scam. We will explore various aspects of the broker, including its regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is crucial for any trading platform, as it ensures that brokers adhere to specific standards that protect traders' interests. GIC Markets claims to be registered in Seychelles, a location often associated with less stringent regulatory oversight. The following table summarizes the core regulatory information for GIC Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Seychelles | Unregulated |

As indicated in the table, GIC Markets operates without any valid regulatory license, which raises significant concerns regarding its legitimacy. The absence of regulatory oversight means that traders may lack legal recourse in the event of disputes or issues related to fund security. Furthermore, warnings have been issued by various regulatory bodies, including Indonesia's Bappebti, highlighting the broker's dubious practices. The lack of transparency and accountability associated with unregulated brokers poses a high risk for traders, making it imperative to question is GIC safe for trading.

Company Background Investigation

GIC Markets appears to have a relatively short history, having been established in 2016. The company claims to operate under the name "Global Integrated Capitech Markets Ltd," but there is limited information available about its ownership structure and management team. This lack of transparency is concerning, as it makes it difficult for potential clients to evaluate the qualifications and experience of those running the firm.

The company's website does not provide detailed information about its operations, and there are no clear indicators of its physical address or contact information, which further fuels skepticism about its legitimacy. In an industry where trust is paramount, the absence of accessible information about the broker's history and ownership raises red flags. Consequently, traders should carefully assess whether is GIC safe before committing their funds.

Trading Conditions Analysis

When it comes to trading conditions, GIC Markets presents a mixed bag. The broker offers a variety of trading instruments, including forex, commodities, and cryptocurrencies, with leverage reaching up to 1:500. However, the overall fee structure is not clearly outlined, which can lead to unexpected costs for traders. Below is a table comparing core trading costs:

| Fee Type | GIC Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While GIC Markets advertises competitive spreads, the lack of clarity regarding commissions and overnight interest raises concerns. Traders may find themselves facing hidden fees, making it essential to scrutinize the terms and conditions before trading. This ambiguity in trading costs can lead to financial losses, further questioning whether is GIC safe for traders.

Customer Fund Security

The security of client funds is a paramount concern for any trading platform. GIC Markets has not demonstrated robust measures to protect traders' funds. The broker does not promote any fund protection mechanisms, such as segregated accounts or negative balance protection. Without these safeguards, traders' investments are at significant risk.

Furthermore, the absence of investor protection schemes raises questions about the broker's commitment to safeguarding client funds. Historical complaints regarding delayed withdrawals and unresponsive customer service suggest that traders may face challenges when attempting to access their funds. Given these factors, it becomes increasingly vital to evaluate is GIC safe for trading.

Customer Experience and Complaints

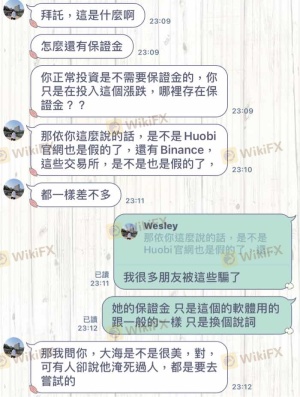

Customer feedback serves as a critical indicator of a broker's reliability. A review of online testimonials reveals a concerning trend: many users report difficulties with withdrawals and poor customer service. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Unresponsive |

| Customer Service Delays | High | Unresolved |

For instance, one user reported that after making a profit, they faced significant delays in withdrawing their funds, with the broker providing no clear reason for the hold-up. Such experiences raise alarm bells and lead to the question of whether is GIC safe for traders looking to invest their hard-earned money.

Platform and Trade Execution

The trading platform offered by GIC Markets is primarily MetaTrader 5 (MT5), a widely recognized and reputable trading software. However, user experiences regarding platform performance and trade execution quality have been mixed. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The platform's stability is essential for executing trades efficiently, and any signs of manipulation or technical issues can undermine traders' confidence. Therefore, assessing the execution quality and reliability of the trading platform is crucial when determining if is GIC safe for trading.

Risk Assessment

Using GIC Markets presents various risks that traders must consider. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | Ambiguous fee structure and withdrawal issues |

| Operational Risk | Medium | Mixed reviews on platform performance |

Given the high-risk levels associated with GIC Markets, traders should approach this broker with caution. It is advisable to seek alternative, regulated brokers that provide greater security and transparency.

Conclusion and Recommendations

In conclusion, the investigation into GIC Markets raises significant concerns regarding its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that traders should be wary of this broker. The risks associated with trading on an unregulated platform far outweigh any potential benefits.

For traders seeking reliable and secure trading options, it is recommended to consider alternative brokers that are regulated by reputable authorities. Brokers such as Pepperstone and XM are known for their robust regulatory frameworks and positive user experiences. Ultimately, the question remains: is GIC safe? Based on the evidence presented, it is prudent for traders to exercise extreme caution before engaging with GIC Markets.

Is GIC a scam, or is it legit?

The latest exposure and evaluation content of GIC brokers.

GIC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GIC latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.