Succedo Markets 2025 Review: Everything You Need to Know

Executive Summary

Succedo Markets is an unregulated forex broker. It has raised big concerns within the trading community since its start in 2023. Multiple industry reports show that this Succedo Markets review reveals a company registered in Saint Lucia. This location is known for minimal regulatory oversight in financial services. The broker claims to offer various financial services including forex, futures, indices, and stock trading. However, it lacks proper licensing from any recognized financial regulatory body.

User feedback across multiple review platforms consistently rates Succedo Markets poorly. The average score is 2 out of 10. The low ratings come from concerns about legitimacy, safety, and overall trading experience. Fraud recovery experts and industry watchdogs say the broker operates without proper authorization. This poses big risks to potential clients' funds and trading activities.

The primary target audience appears to be traders seeking high-risk, high-return opportunities. However, financial experts strongly advise caution when dealing with unregulated entities. The lack of regulatory oversight, combined with consistently negative user experiences, makes Succedo Markets a questionable choice for serious traders. These traders are looking for reliable and secure trading environments.

Important Notice

This review is based on publicly available information and user feedback collected from various sources as of February 2025. Succedo Markets is registered in Saint Lucia. This jurisdiction has notably less stringent financial services regulation compared to major financial centers. Potential differences may exist between regional entities or operational structures that are not reflected in available public documentation.

The information presented in this analysis does not guarantee completeness or absolute accuracy. Regulatory status and operational details can change without public notice. Readers should conduct independent verification before making any financial decisions related to this broker.

Rating Framework

Broker Overview

Succedo Markets entered the online trading scene in 2023. It came as a financial services provider registered in Saint Lucia. Domain registration records from Scamadviser show the company's website was registered on December 22, 2023. This makes it a relatively new entity in the competitive forex brokerage landscape. The broker's registration in Saint Lucia immediately raises red flags among industry experts. This jurisdiction is frequently chosen by operators seeking to avoid stringent regulatory requirements imposed by major financial authorities.

The company presents itself as a comprehensive trading platform. It offers access to multiple asset classes including foreign exchange, futures contracts, stock indices, and individual equity securities. However, detailed analysis of available information reveals significant gaps in transparency regarding the company's operational structure, management team, and business model specifics. Unlike established brokers that typically provide extensive corporate information and regulatory documentation, Succedo Markets maintains limited public disclosure about its operations.

WikiFX and other broker monitoring services say Succedo Markets operates without holding licenses from recognized financial regulatory bodies. These include the FCA, CySEC, ASIC, or other tier-one regulators. This absence of proper authorization represents a fundamental concern for potential clients. Unregulated brokers offer no investor protection schemes or regulatory oversight that typically safeguard client funds and ensure fair trading practices.

The broker's website uses basic SSL encryption provided by Let's Encrypt. This offers minimal security compared to enterprise-grade certificates used by legitimate financial institutions. This Succedo Markets review indicates that while the website appears functional, it lacks the robust security infrastructure expected from professional trading platforms. These platforms handle sensitive financial data and client funds.

Regulatory Status: Succedo Markets operates as an unregulated entity registered in Saint Lucia. Financial services oversight is minimal there compared to established financial centers. The broker does not hold licenses from any recognized regulatory authorities. This creates significant compliance and safety concerns for potential clients.

Deposit and Withdrawal Methods: Available information does not specify the payment methods supported by Succedo Markets. This includes bank transfers, credit cards, or electronic payment systems. This lack of transparency regarding financial transactions represents a major red flag for potential clients.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts required to open trading accounts. This is unusual for legitimate brokers that typically provide clear account opening requirements and fee structures.

Bonus and Promotional Offers: No information is available regarding welcome bonuses, deposit bonuses, or other promotional incentives. These are commonly offered by established brokers to attract new clients.

Available Trading Assets: Company claims say Succedo Markets provides access to forex pairs, futures contracts, stock indices, and individual stocks. However, the specific number of instruments, major currency pairs, or exotic options remains undisclosed in available documentation.

Cost Structure and Fees: Critical information about spreads, commissions, overnight financing charges, and withdrawal fees is not publicly available. This makes it impossible for potential clients to assess the true cost of trading with this broker.

Leverage Options: The broker has not disclosed maximum leverage ratios available to clients. This is essential information for risk assessment and trading strategy development.

Trading Platform Options: Available sources do not specify whether Succedo Markets offers popular platforms like MetaTrader 4, MetaTrader 5, or proprietary trading software. This leaves potential clients uninformed about execution capabilities and platform features.

Geographic Restrictions: Information regarding restricted countries or regional limitations is not available in current documentation. However, the Saint Lucia registration may limit access in certain jurisdictions.

Customer Support Languages: The broker has not disclosed supported languages for customer service. This Succedo Markets review suggests limited multilingual capabilities based on available website content.

Account Conditions Analysis

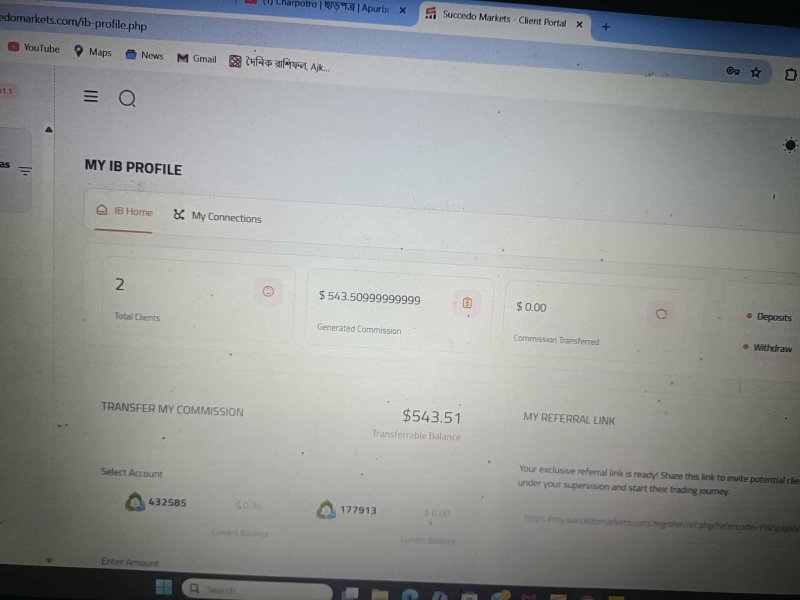

The account conditions offered by Succedo Markets remain largely unclear. Minimal information is available about account types, requirements, or special features. Unlike established brokers that typically offer multiple account tiers such as basic, premium, and VIP accounts with clearly defined benefits and requirements, Succedo Markets provides no detailed account structure information.

User feedback consistently indicates dissatisfaction with account-related services. However, specific complaints about minimum deposits, account verification processes, or account management tools are not detailed in available reviews. The absence of transparent account information represents a significant departure from industry standards. Legitimate brokers provide comprehensive details about account opening procedures, required documentation, and ongoing account maintenance requirements.

The lack of information about Islamic accounts, demo accounts, or professional trading accounts suggests either limited service offerings or poor communication of available features. Established brokers typically highlight these specialized account types to attract diverse client segments. Succedo Markets appears to provide minimal account-related information.

Account opening processes, verification timeframes, and document requirements remain undisclosed. This creates uncertainty for potential clients about the practical aspects of establishing trading relationships. The consistently low user ratings suggest that clients who have attempted to open accounts have encountered significant difficulties or unsatisfactory conditions.

This Succedo Markets review indicates that the broker's approach to account management falls well below industry standards. This contributes to the overall poor user experience and low trust ratings observed across multiple review platforms.

The trading tools and resources provided by Succedo Markets appear limited based on available information and user feedback. Unlike comprehensive brokers that typically offer advanced charting packages, technical analysis tools, economic calendars, and market research, Succedo Markets provides minimal details about its analytical capabilities and trading support tools.

Market analysis and research resources are notably absent from available documentation. These are considered essential by serious traders. Established brokers usually provide daily market commentary, weekly outlooks, technical analysis reports, and fundamental analysis to help clients make informed trading decisions. The lack of such resources suggests either inadequate research capabilities or poor communication of available services.

Educational resources are not mentioned in available sources. These include trading guides, webinars, video tutorials, and market education materials. This absence is particularly concerning for newer traders who rely on broker-provided education to develop their trading skills and market understanding.

Automated trading support remains unspecified. This includes Expert Advisor compatibility, algorithmic trading capabilities, or copy trading services. Modern traders increasingly demand sophisticated automation tools. The lack of such features may limit the broker's appeal to technically advanced clients.

User feedback regarding tools and resources quality is generally negative. However, specific complaints about platform functionality, analytical tools, or research quality are not detailed in available reviews. The moderate rating in this category reflects the availability of basic trading services despite the lack of advanced features and comprehensive support tools.

Customer Service and Support Analysis

Customer service quality at Succedo Markets has received consistently poor ratings from users. This indicates significant deficiencies in support infrastructure and service delivery. Available feedback suggests that clients have experienced difficulties in reaching customer support representatives and obtaining satisfactory resolutions to their inquiries and concerns.

The broker has not disclosed specific customer service channels. These include live chat, telephone support, email ticketing systems, or callback services. This lack of transparency about support accessibility represents a major concern for potential clients. They may require assistance with account issues, trading problems, or technical difficulties.

Response time performance appears to be a significant issue based on user complaints. However, specific metrics about average response times or service level agreements are not available. Legitimate brokers typically provide clear expectations about support availability and response timeframes. Succedo Markets offers no such transparency.

Service quality issues reported by users include inadequate problem resolution, unprofessional communication, and limited technical expertise among support staff. These concerns align with the overall pattern of poor service delivery that characterizes unregulated brokers. They operate without proper oversight or professional standards.

Multilingual support capabilities remain unclear. However, the limited website content suggests restricted language options compared to established international brokers. These typically offer support in multiple languages to serve diverse client bases.

The absence of comprehensive support documentation, FAQ sections, or self-service resources further compounds the customer service challenges. This leaves clients dependent on direct support interactions that appear to be inadequate based on available feedback.

Trading Experience Analysis

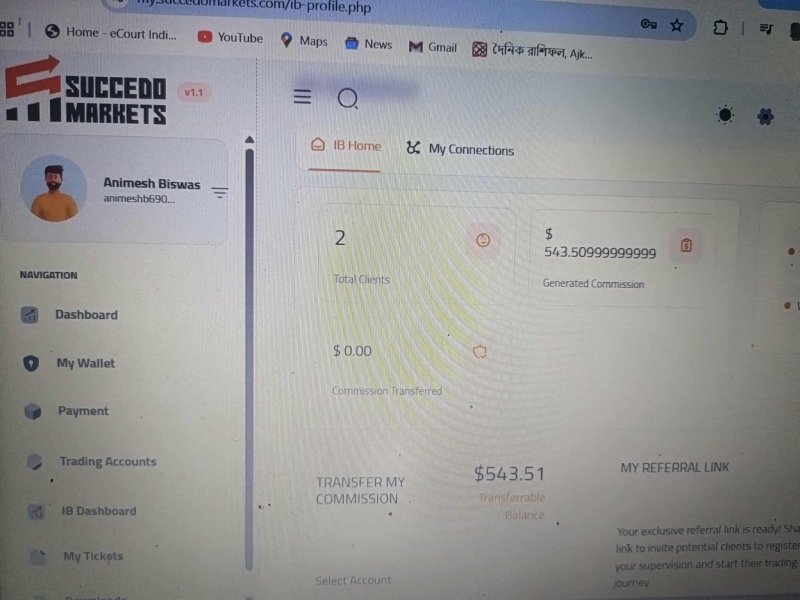

The trading experience provided by Succedo Markets has received particularly harsh criticism from users. Multiple reports indicate significant platform stability and execution quality issues. Available user feedback shows that traders have encountered problems with platform reliability, order execution speed, and overall trading environment quality.

Platform stability concerns include frequent disconnections, slow loading times, and system crashes during critical trading periods. These technical issues are particularly problematic for active traders who require consistent platform performance to execute their trading strategies effectively. The lack of redundant systems and backup infrastructure appears to compromise the overall trading experience.

Order execution quality has been a major source of user complaints. Reports include significant slippage, requotes, and delayed order processing. These execution problems can substantially impact trading profitability and represent serious concerns for traders seeking reliable price execution and minimal market impact.

Platform functionality completeness remains questionable. Users have not reported access to advanced trading features such as one-click trading, advanced order types, or sophisticated risk management tools. The absence of these features limits trading flexibility and may frustrate experienced traders accustomed to comprehensive platform capabilities.

Mobile trading experience information is not available in current documentation. However, modern traders increasingly demand robust mobile platforms for on-the-go trading access. The lack of mobile platform information suggests either limited mobile capabilities or poor communication of available features.

This Succedo Markets review reveals that the trading environment fails to meet basic industry standards for execution quality, platform reliability, and feature completeness. This contributes significantly to the overall poor user experience ratings.

Trust and Reliability Analysis

Trust and reliability represent the most significant concerns regarding Succedo Markets. The broker receives the lowest possible rating in this critical category. The fundamental issue stems from the company's unregulated status and registration in Saint Lucia. This jurisdiction is known for minimal financial services oversight and limited investor protection mechanisms.

The absence of regulatory authorization from recognized financial authorities eliminates essential safeguards. These authorities include the FCA, CySEC, ASIC, or other tier-one regulators that protect client funds and ensure fair trading practices. Regulated brokers are required to maintain segregated client accounts, participate in compensation schemes, and submit to regular audits. Succedo Markets operates without these crucial protections.

Company transparency is severely lacking. There is minimal disclosure about management structure, financial backing, operational procedures, or corporate governance. Legitimate brokers typically provide comprehensive information about their leadership teams, regulatory compliance, and business operations. Succedo Markets maintains opacity about these fundamental aspects.

Fund safety measures are not disclosed or apparently unavailable. These include client money protection, segregated accounts, and deposit insurance. This absence of financial protection represents an unacceptable risk for clients considering depositing funds with an unregulated entity. It offers no guarantees about capital safety.

Industry reputation analysis reveals consistently negative assessments from multiple review platforms and regulatory warning services. The broker's registration in a low-regulation jurisdiction, combined with user complaints and lack of proper licensing, has resulted in warnings from fraud recovery experts and trading community watchdogs.

The handling of negative events, disputes, or client complaints remains unclear. This is due to the absence of regulatory oversight and formal dispute resolution mechanisms. These are typically available through regulated brokers and their respective regulatory authorities.

User Experience Analysis

Overall user satisfaction with Succedo Markets is extremely poor. The average rating is 2 out of 10 across multiple review platforms. This consistently low rating reflects widespread dissatisfaction with various aspects of the broker's services. These range from account management to trading execution and customer support.

User interface design and platform usability information is limited in available sources. However, the negative feedback suggests that clients have encountered difficulties navigating the trading environment and accessing necessary features. Modern traders expect intuitive interfaces and streamlined workflows. These appear to be lacking based on user experiences.

Registration and verification processes have apparently created frustrations for users attempting to open accounts. However, specific details about documentation requirements, verification timeframes, or onboarding procedures are not available. The negative user experiences suggest that account opening may be more complicated or problematic than with established brokers.

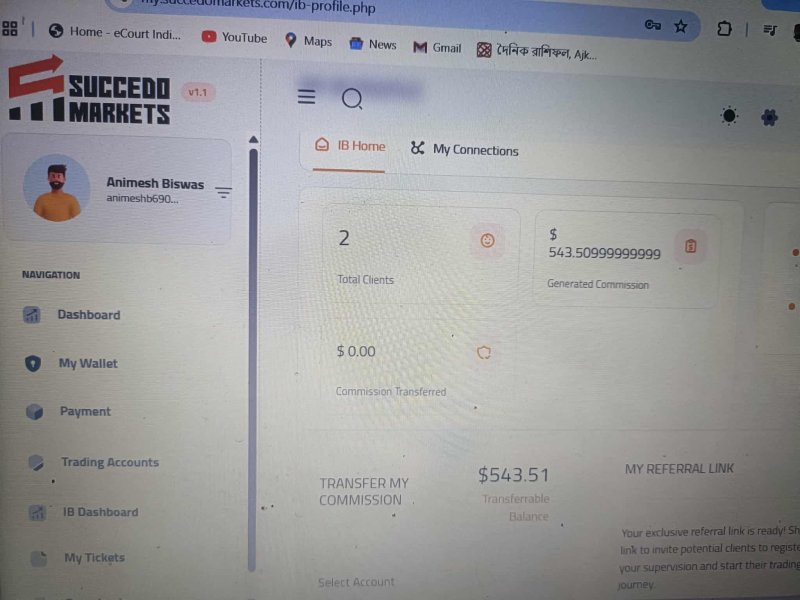

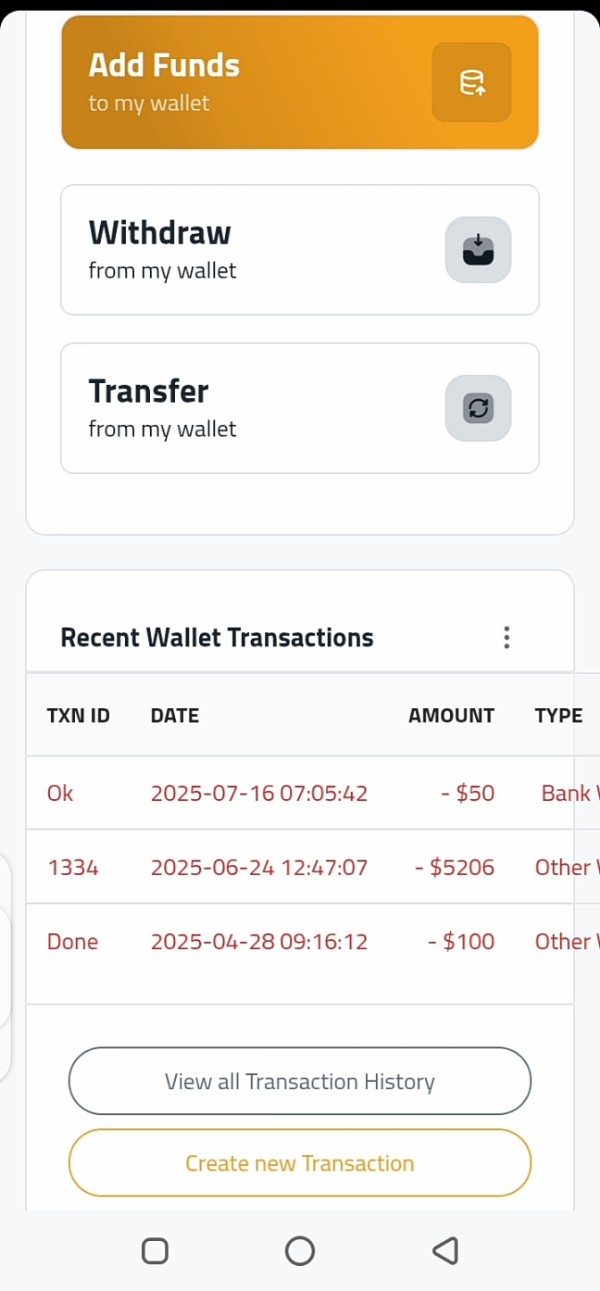

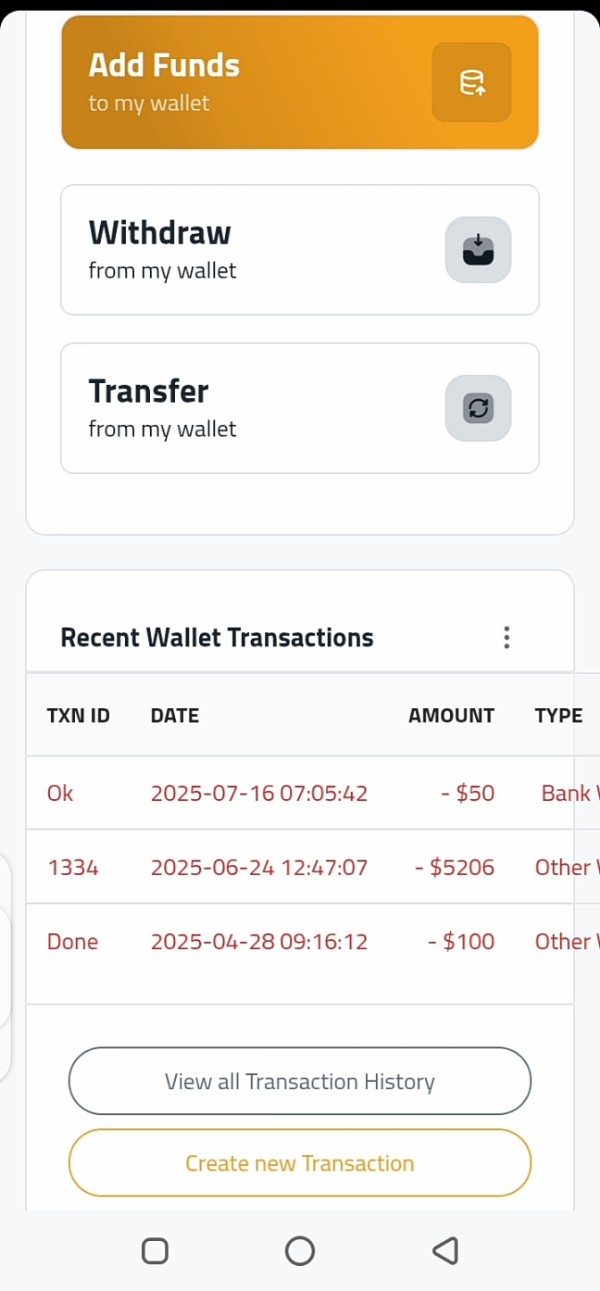

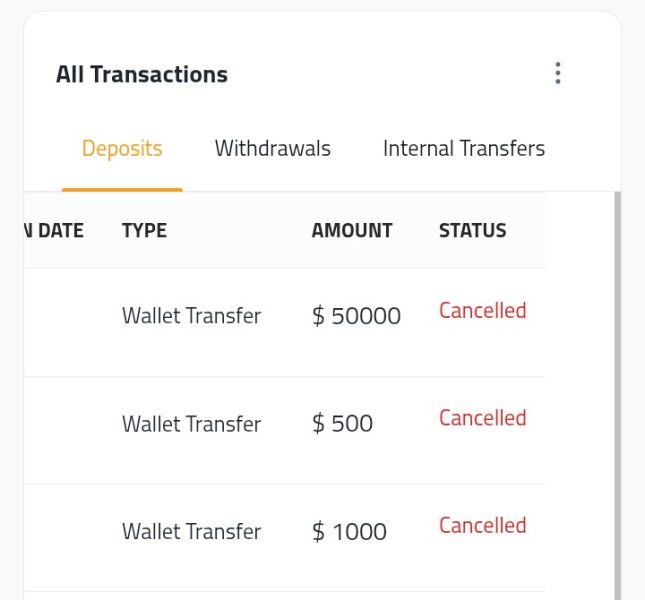

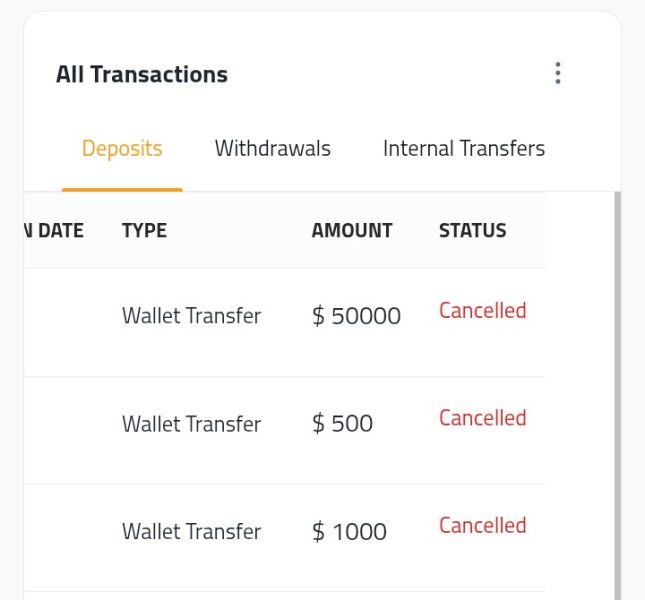

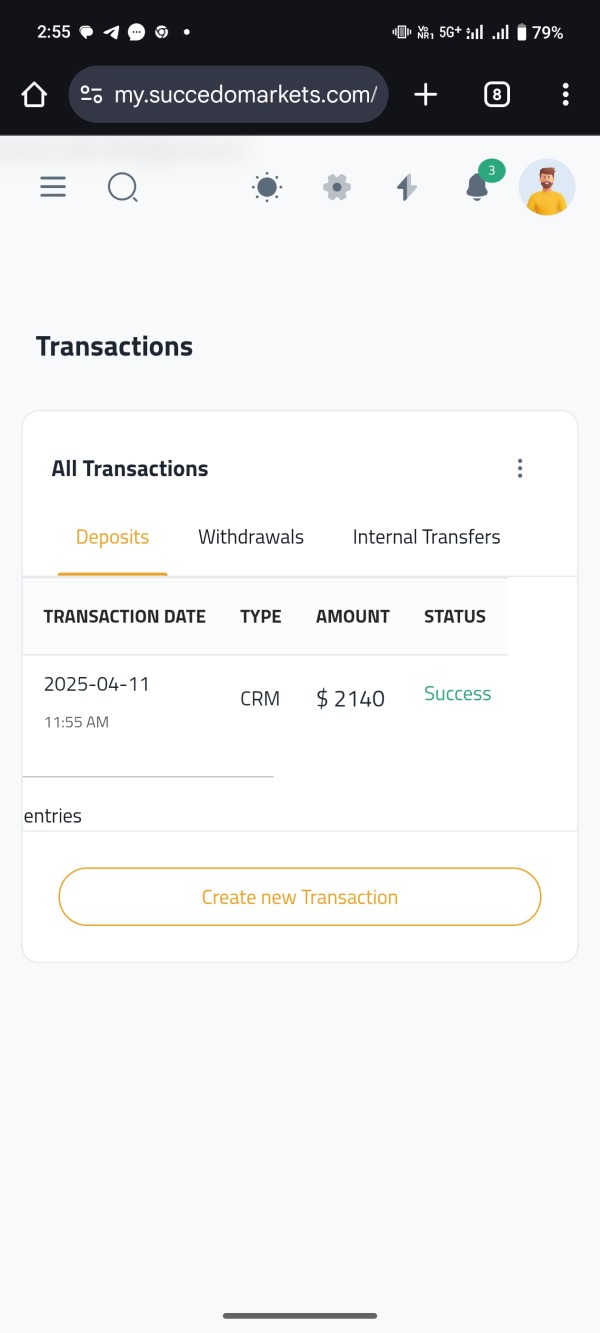

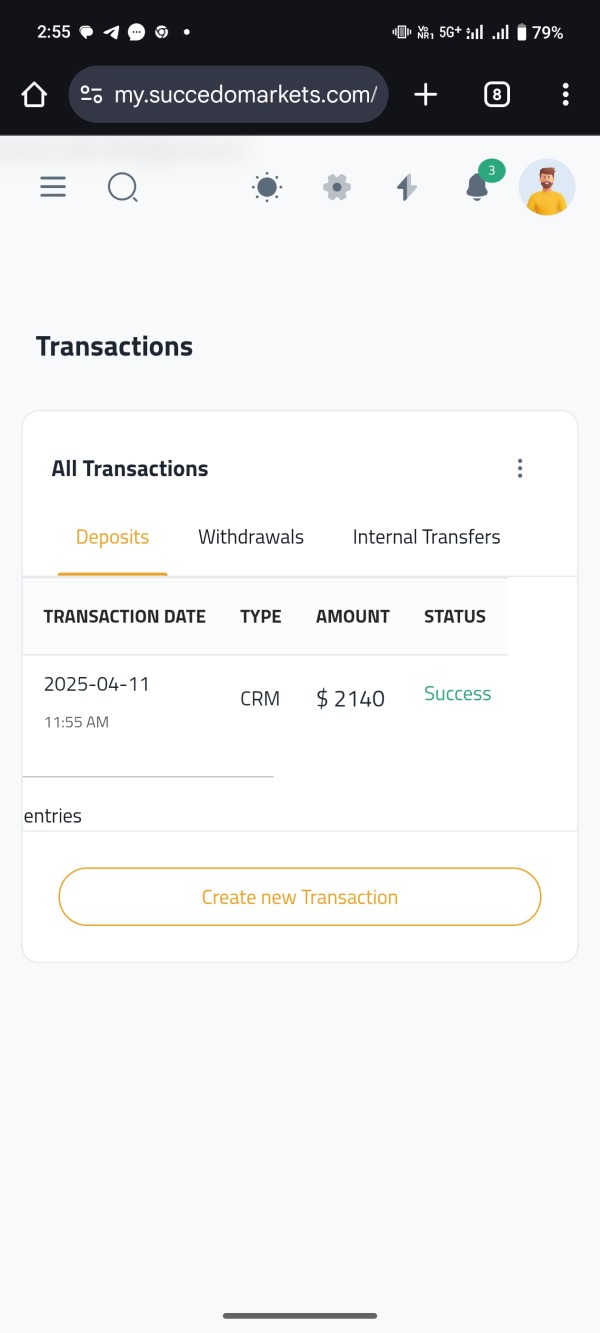

Funding and withdrawal experiences represent a major source of user complaints. Reports suggest difficulties in processing transactions, unclear fee structures, and potential problems with fund accessibility. These financial transaction issues are particularly concerning given the unregulated nature of the broker and lack of regulatory protection for client funds.

Common user complaints include platform reliability issues, poor customer service responsiveness, execution problems, and general concerns about the broker's legitimacy and safety. The pattern of negative feedback across multiple review sources indicates systemic problems rather than isolated incidents.

The target user profile for Succedo Markets appears to be limited to high-risk tolerance traders. These traders must be willing to accept significant regulatory and operational uncertainties in exchange for potentially higher returns. However, even risk-tolerant traders should carefully consider the substantial disadvantages and safety concerns associated with unregulated brokers.

User feedback consistently recommends avoiding this broker in favor of properly regulated alternatives. These offer better protection, transparency, and service quality.

Conclusion

This comprehensive Succedo Markets review reveals a broker that fails to meet basic industry standards for safety, reliability, and service quality. The company's unregulated status, registration in a minimal oversight jurisdiction, and consistently poor user ratings create an unacceptable risk profile for most traders.

Succedo Markets claims to offer multiple asset classes and trading services. However, the lack of regulatory protection, transparent operations, and quality service delivery makes it unsuitable for serious traders. These traders seek reliable and secure trading environments. The absence of proper licensing eliminates essential investor protections and regulatory oversight that safeguard client interests.

The broker may only be considered by extremely high-risk tolerance traders. These traders must fully understand and accept the substantial risks associated with unregulated entities. However, even risk-seeking traders would likely find better opportunities with properly regulated brokers. These offer similar services with significantly better protection and service quality.