BBT 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive bbt review examines a brokerage that has generated mixed feedback from the trading community. Based on available user testimonials and platform information, BBT presents itself as a multi-asset trading provider, though concerns have emerged regarding fee transparency and customer treatment practices. The broker's primary offering centers around the InfoReach Trade Management System, which integrates various trading tools and technologies into a single platform environment.

BBT appears to target traders seeking comprehensive multi-asset trading capabilities. However, user feedback indicates significant issues with unexpected overdraft charges and questionable customer service practices that potential clients should carefully consider. While the platform offers technological integration benefits, the reported customer experience challenges suggest traders should approach this broker with heightened caution. Thorough due diligence before committing funds is essential.

Important Notice

This evaluation is based on publicly available information and user feedback collected from various sources. We have not conducted direct testing of BBT's services or platforms. Information regarding regulatory status and specific operational details was not comprehensively available in source materials, requiring traders to conduct independent verification of licensing and regulatory compliance before engaging with this broker.

Cross-regional entity differences and specific jurisdictional variations in service offerings could not be confirmed through available documentation. Prospective clients should verify regulatory status and service availability in their specific region directly with the broker.

Rating Framework

Broker Overview

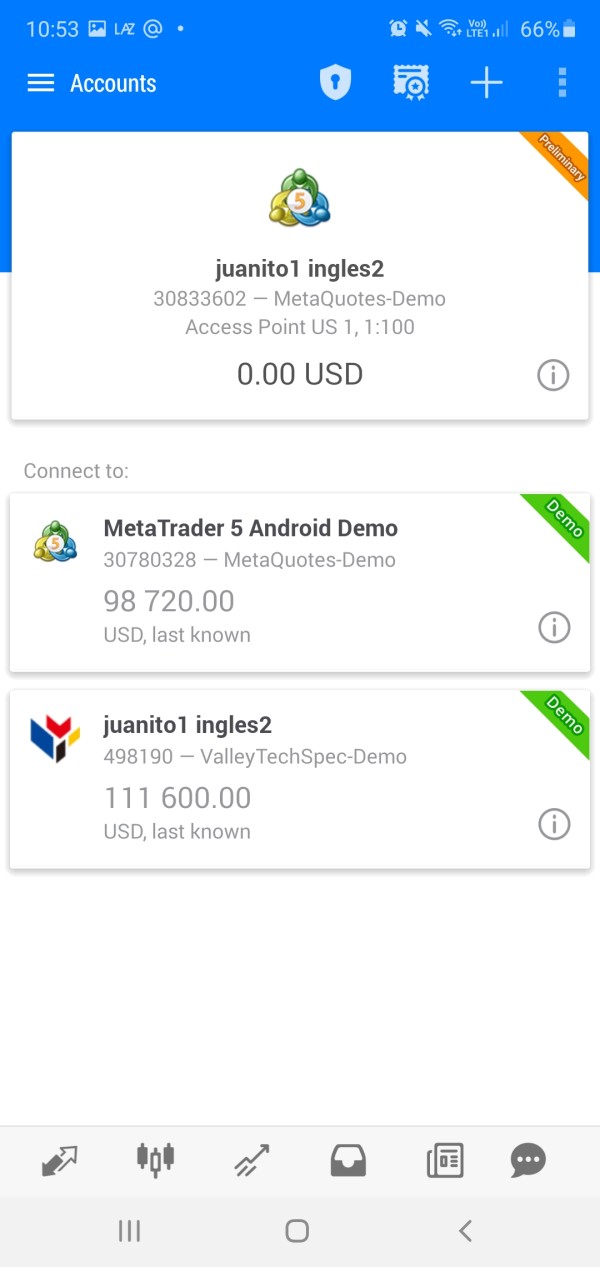

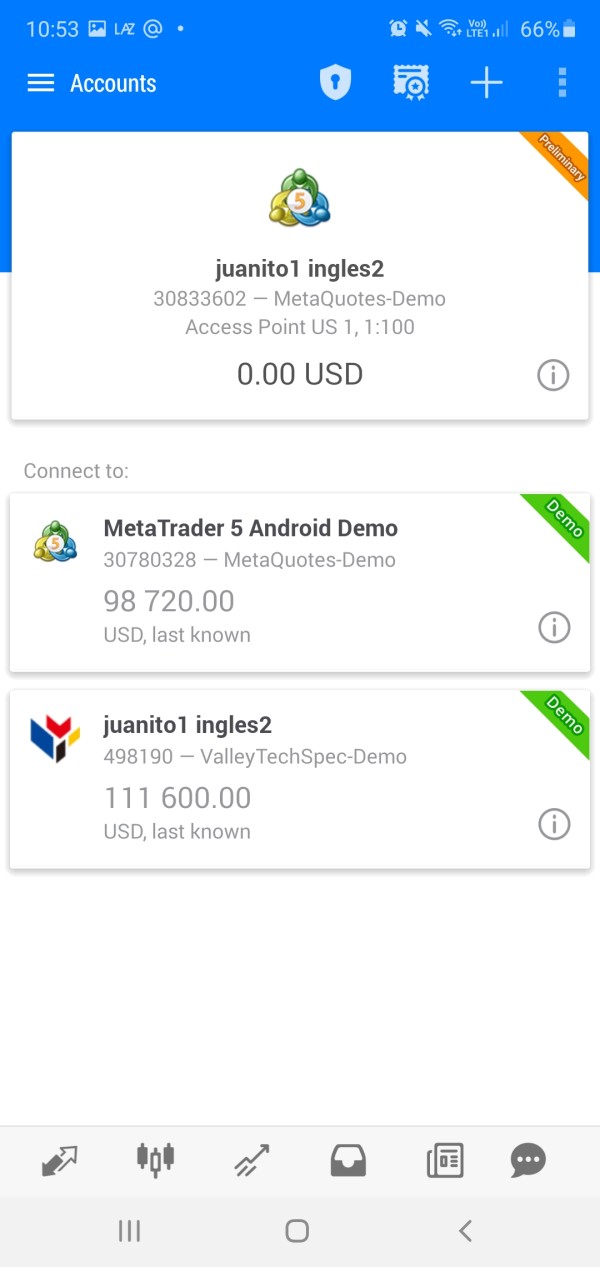

BBT operates as a multi-asset trading platform provider. Comprehensive background information including establishment date and detailed company history was not available in reviewed materials. The broker's primary business model focuses on delivering trading services through technological integration, specifically leveraging the InfoReach Trade Management System to provide traders with consolidated access to various market instruments and trading functionalities.

The platform architecture suggests BBT positions itself as a technology-forward solution for traders requiring multi-asset capabilities. The InfoReach TMS integration indicates the broker prioritizes providing professional-grade trading infrastructure, though specific details about asset coverage, execution models, and operational scope require direct verification with the broker. Available information suggests the platform accommodates foreign exchange trading alongside CFD instruments. Comprehensive asset listings were not detailed in source materials.

Regulatory Status: Specific regulatory information was not detailed in available source materials. Independent verification of licensing and compliance status is required.

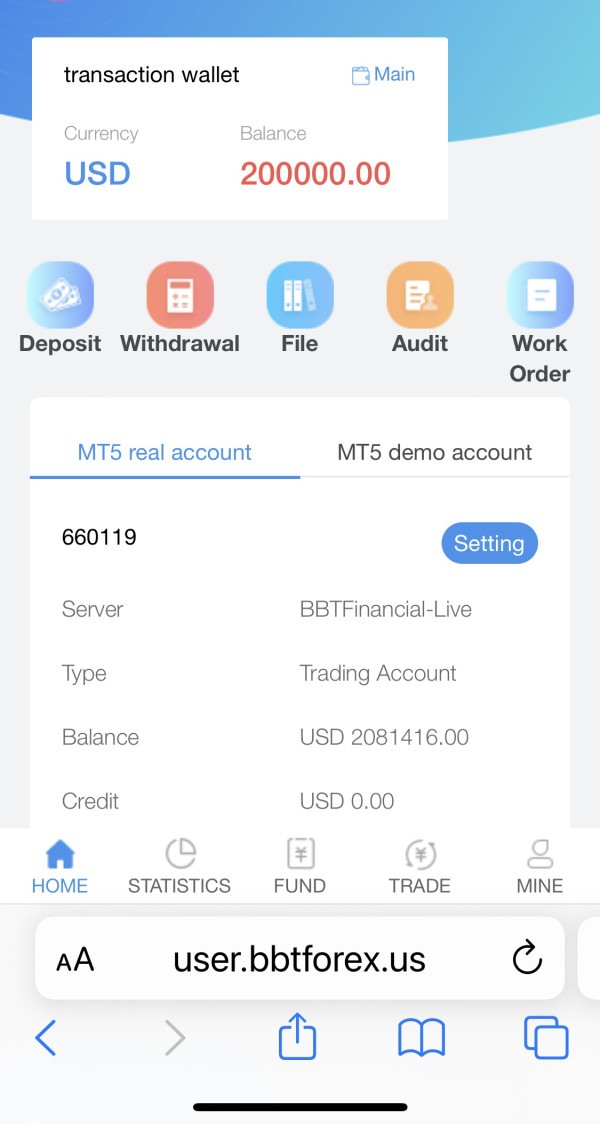

Deposit and Withdrawal Methods: Payment processing options and procedures were not comprehensively outlined in reviewed documentation.

Minimum Deposit Requirements: Specific minimum deposit thresholds were not specified in available information.

Promotional Offerings: Bonus structures and promotional programs were not detailed in source materials.

Tradeable Assets: The platform supports multi-asset trading including foreign exchange and CFD instruments. Comprehensive asset listings require direct broker confirmation.

Cost Structure: Detailed information regarding spreads, commissions, and fee structures was not available. User feedback indicates concerns about overdraft charges and fee transparency.

Leverage Ratios: Specific leverage offerings were not detailed in reviewed materials.

Platform Options: Primary trading infrastructure centers on the InfoReach Trade Management System.

Geographic Restrictions: Regional availability limitations were not specified in available documentation.

Customer Support Languages: Supported languages for customer service were not detailed in source materials.

This bbt review highlights the importance of direct broker communication to clarify operational specifics not covered in publicly available information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of BBT's account conditions faces significant limitations due to insufficient information in available source materials. Specific details regarding account types, tier structures, and associated benefits were not comprehensively documented. This makes it challenging to assess the broker's competitive positioning in this area.

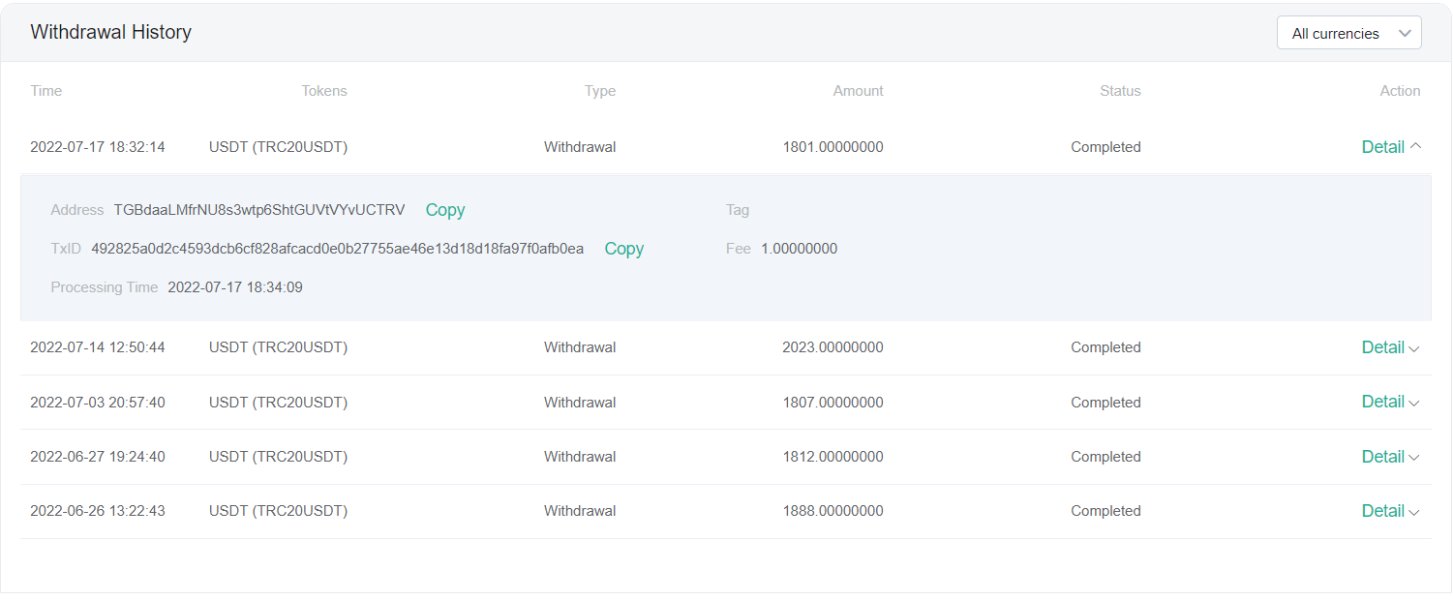

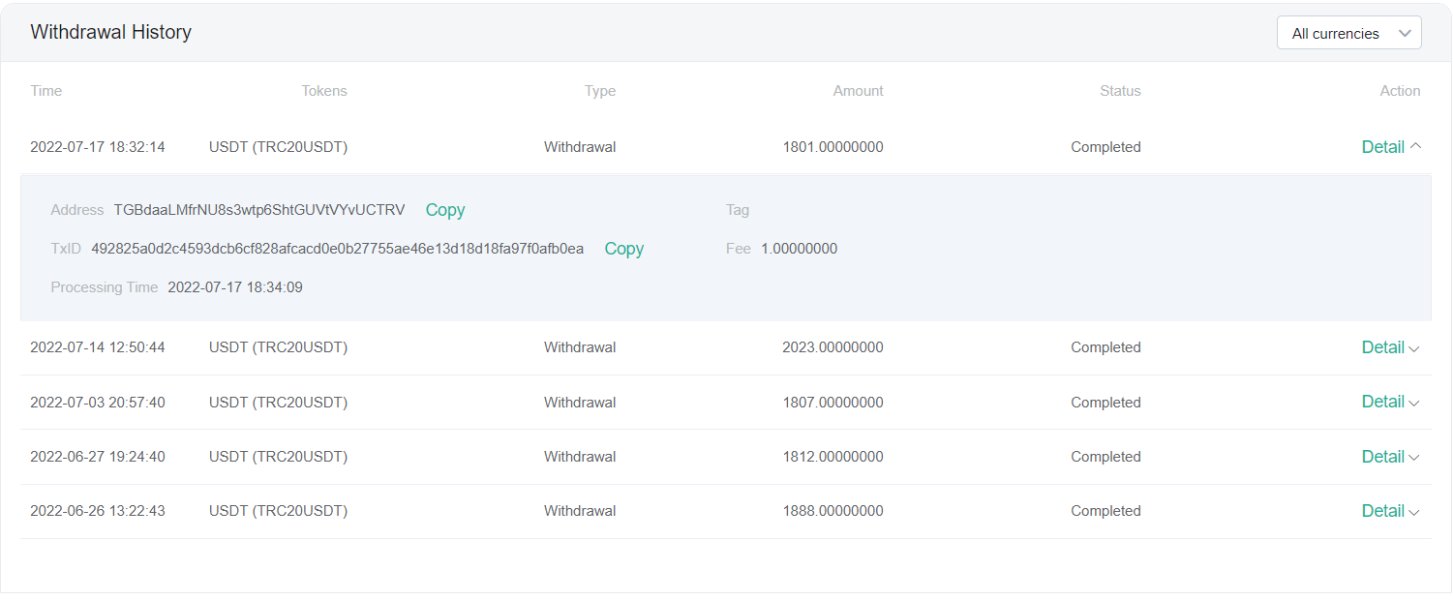

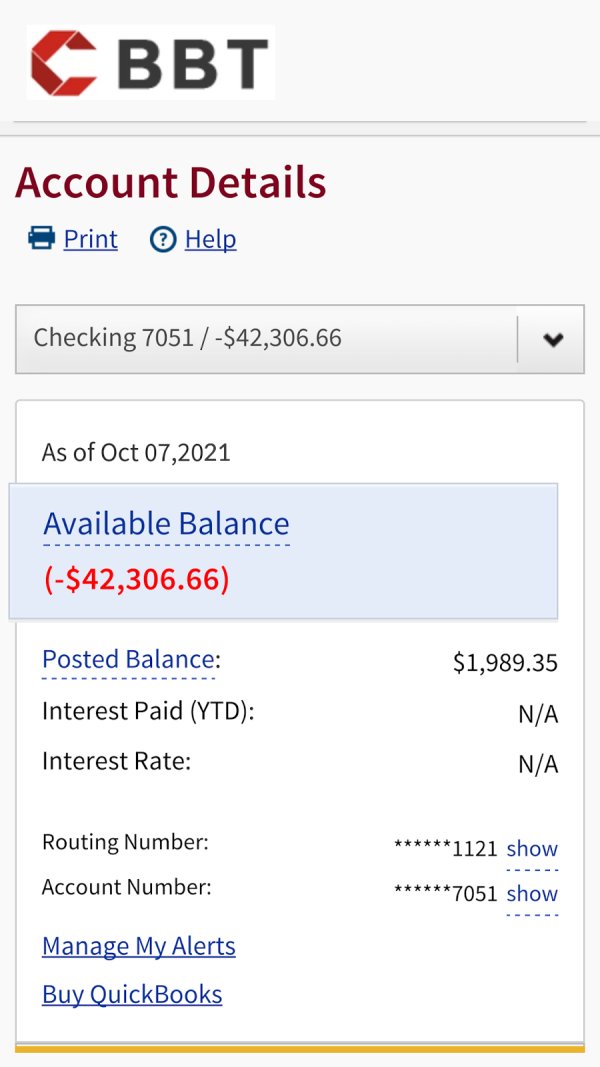

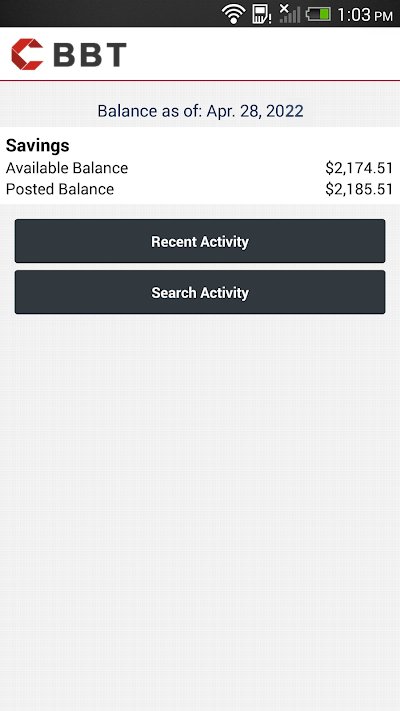

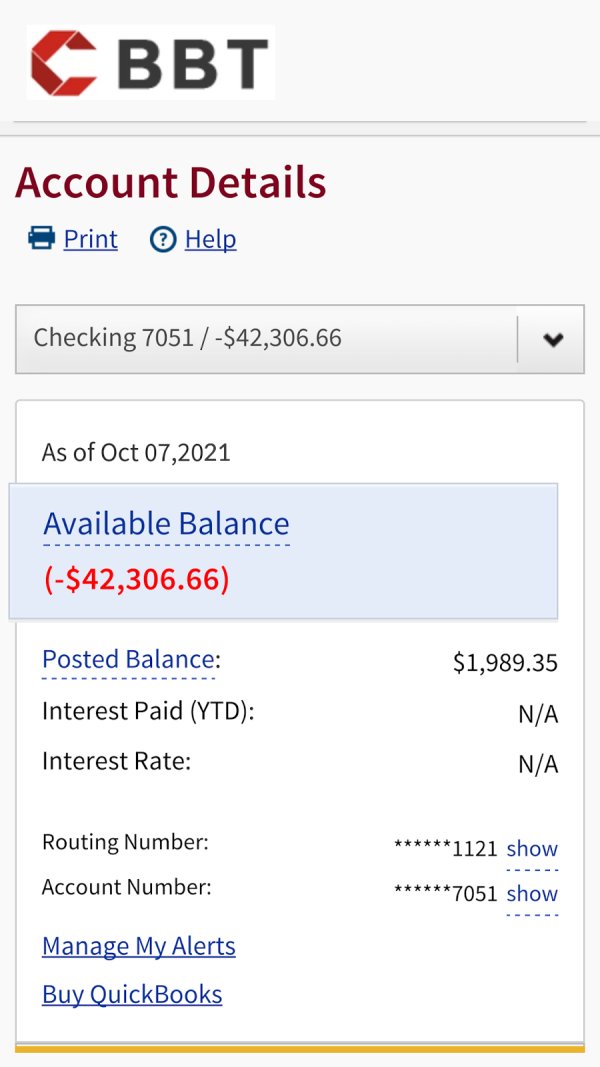

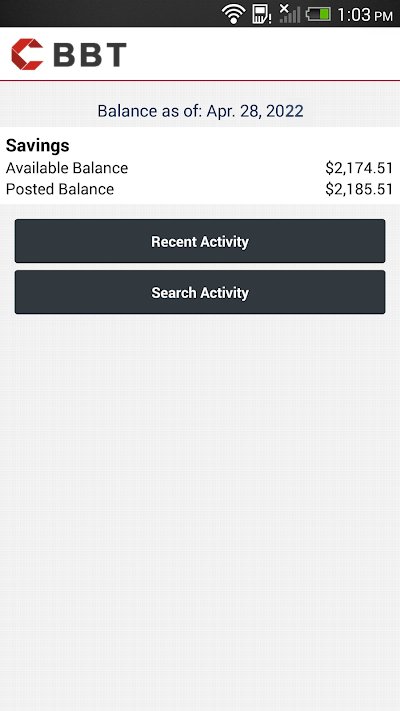

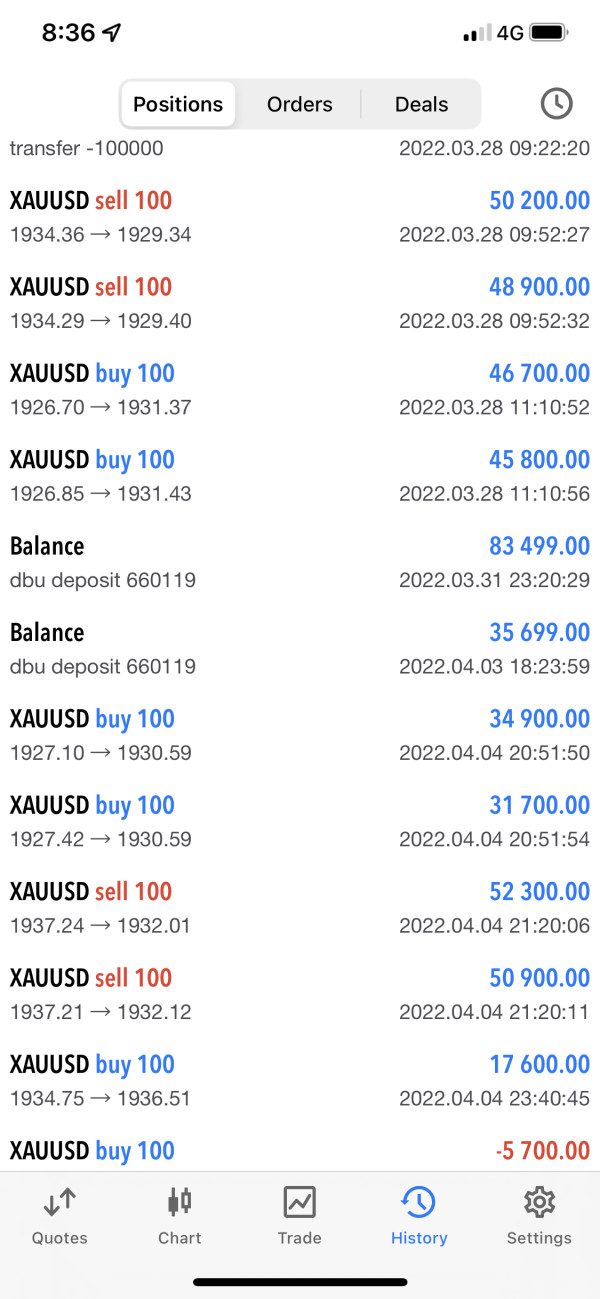

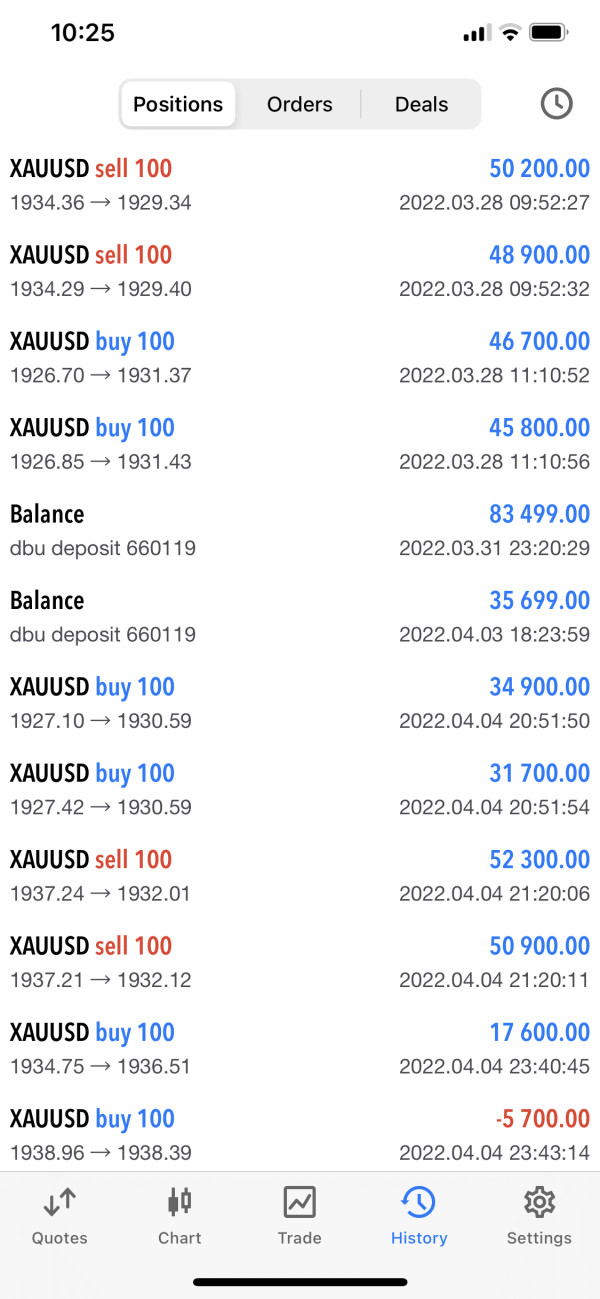

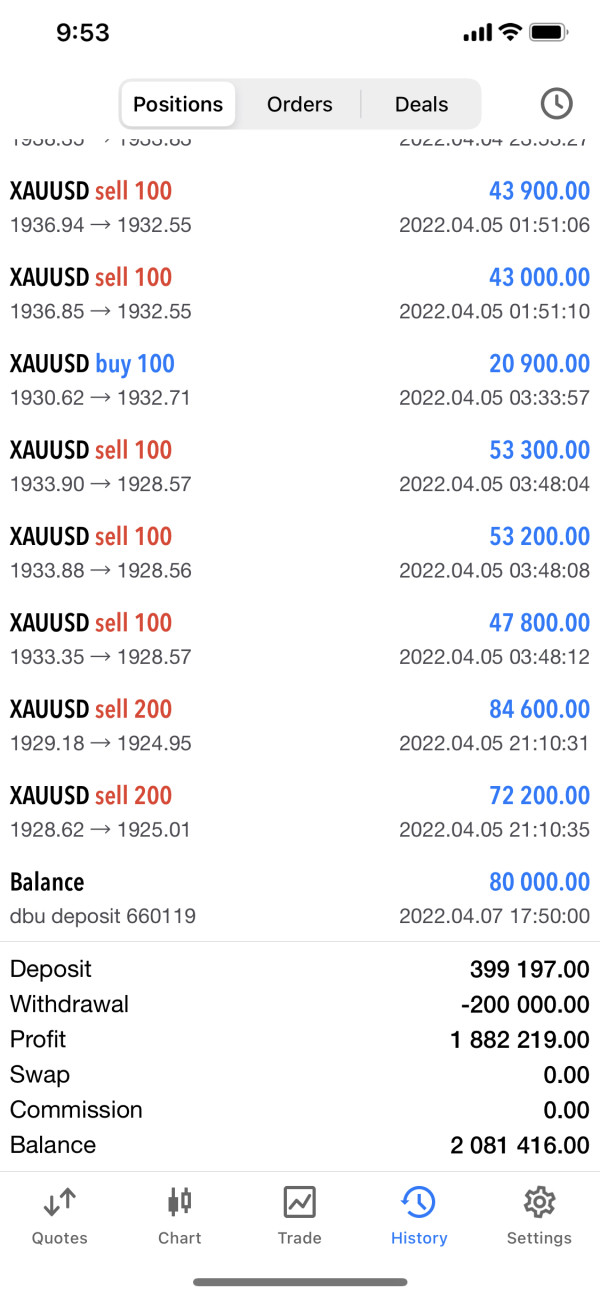

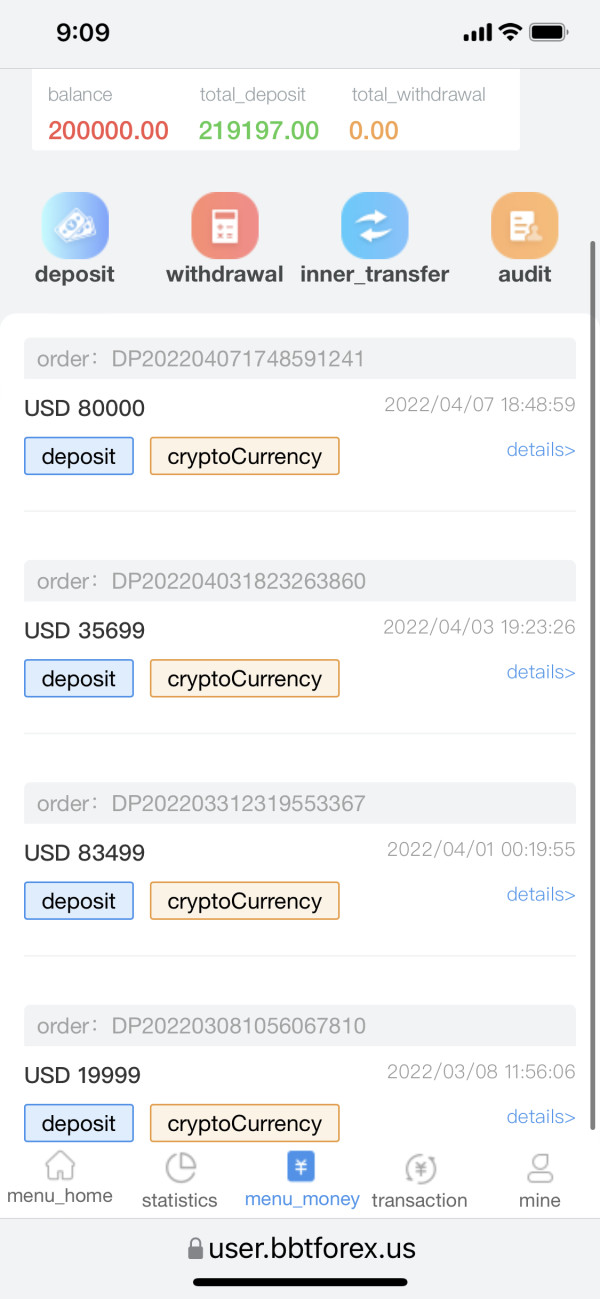

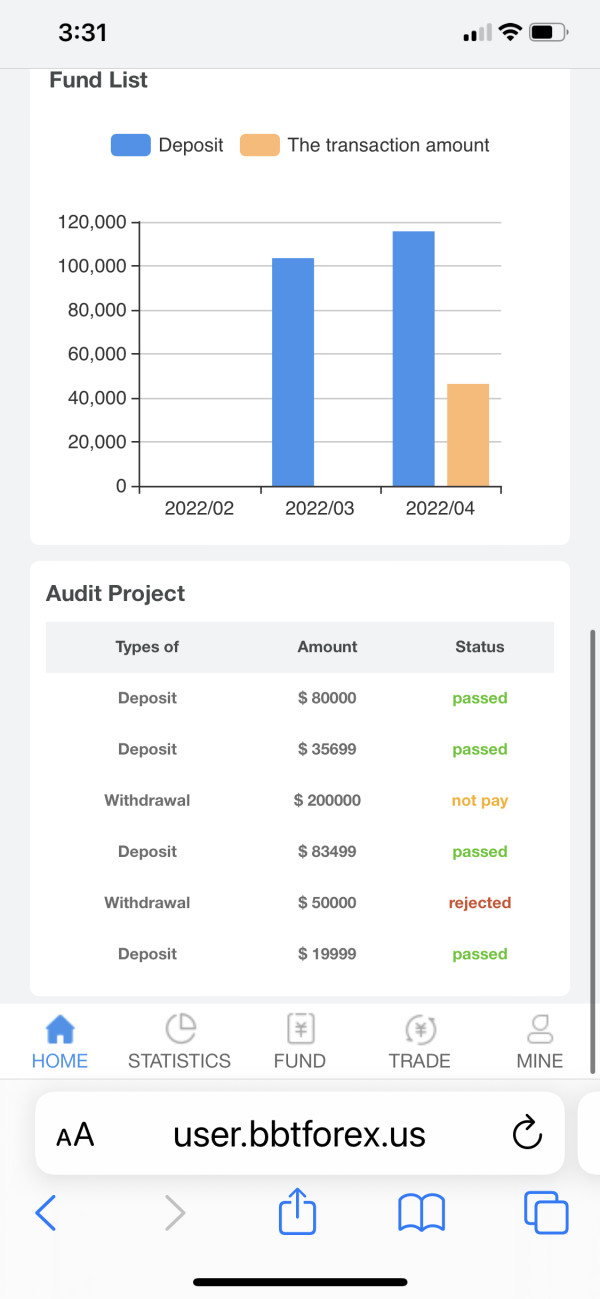

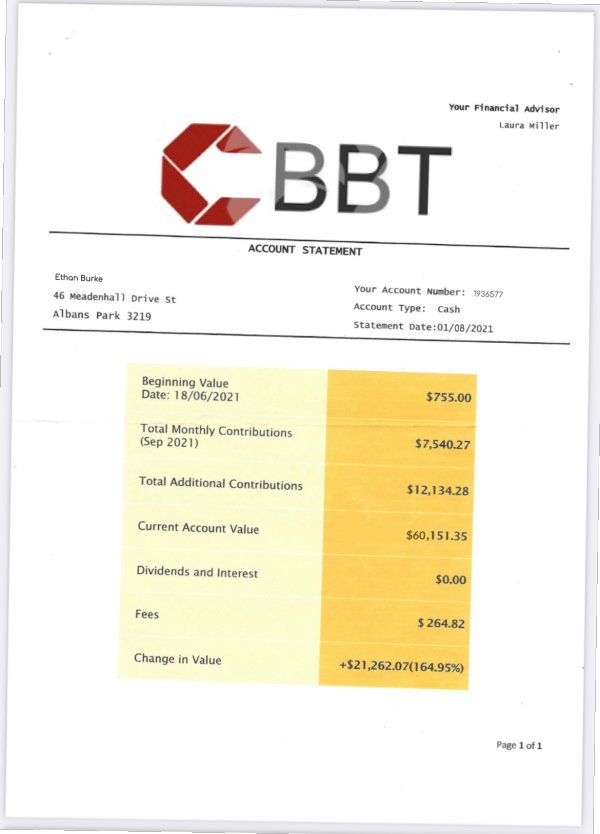

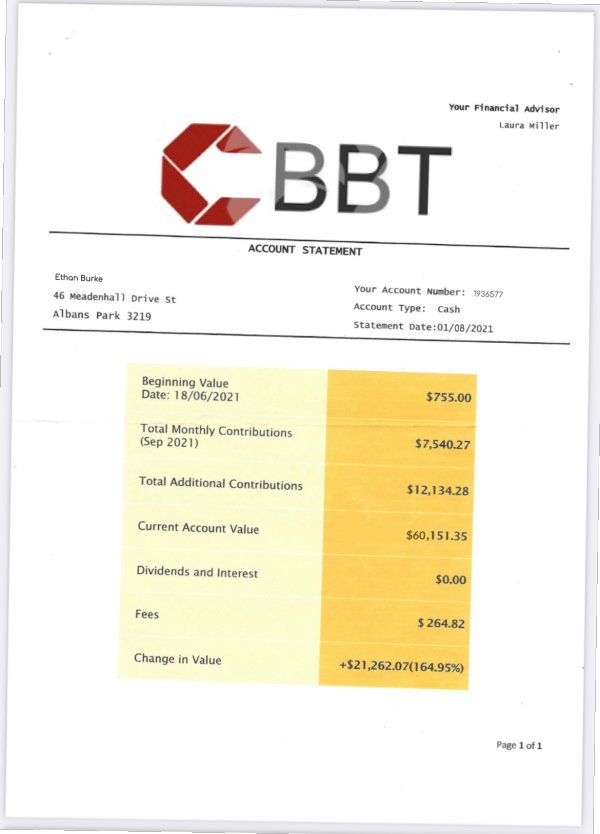

Without clear information about minimum deposit requirements, account opening procedures, or special account features, potential clients cannot adequately evaluate whether BBT's account offerings align with their trading needs. User feedback does highlight concerns about unexpected overdraft fees, suggesting that account terms and conditions may include charges that are not clearly communicated upfront. This raises questions about fee transparency and whether traders fully understand the cost implications of their account selection.

The lack of detailed account information in promotional materials or user testimonials suggests that BBT may not prioritize clear communication about account structures. This could be problematic for traders seeking straightforward account terms. This bbt review cannot provide a definitive rating for account conditions due to insufficient available data.

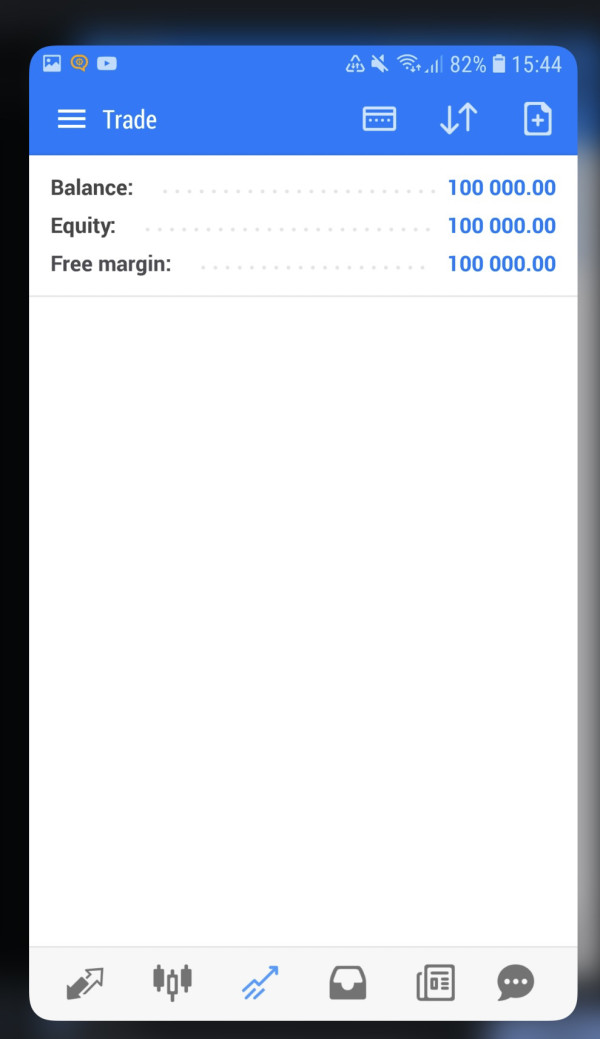

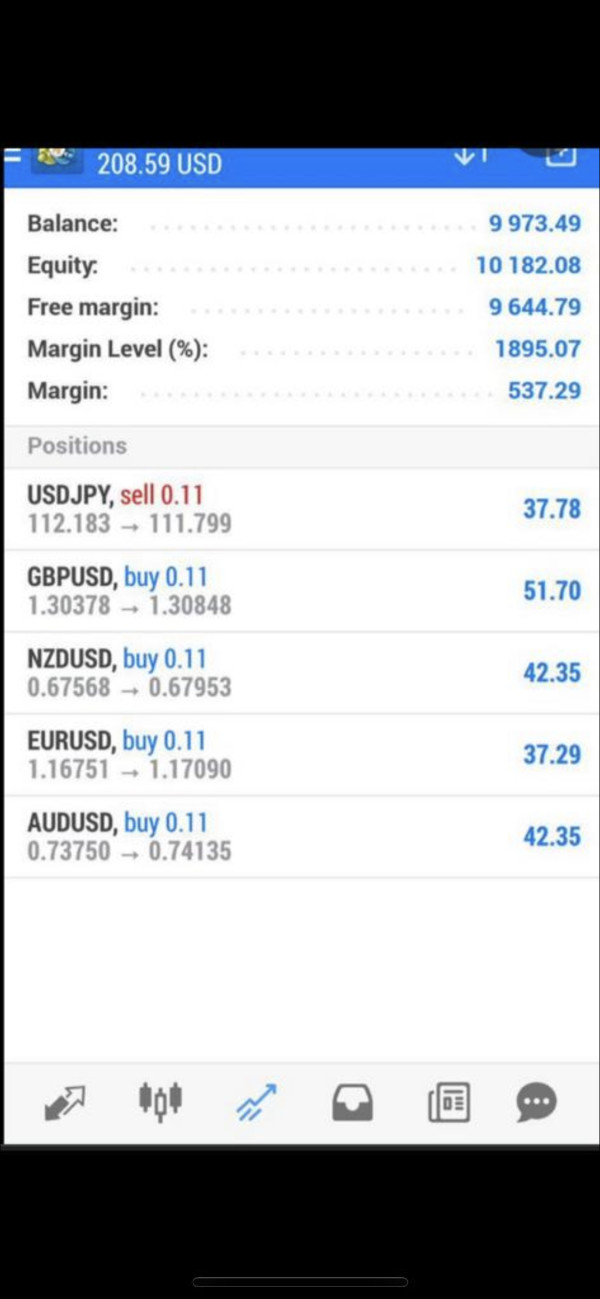

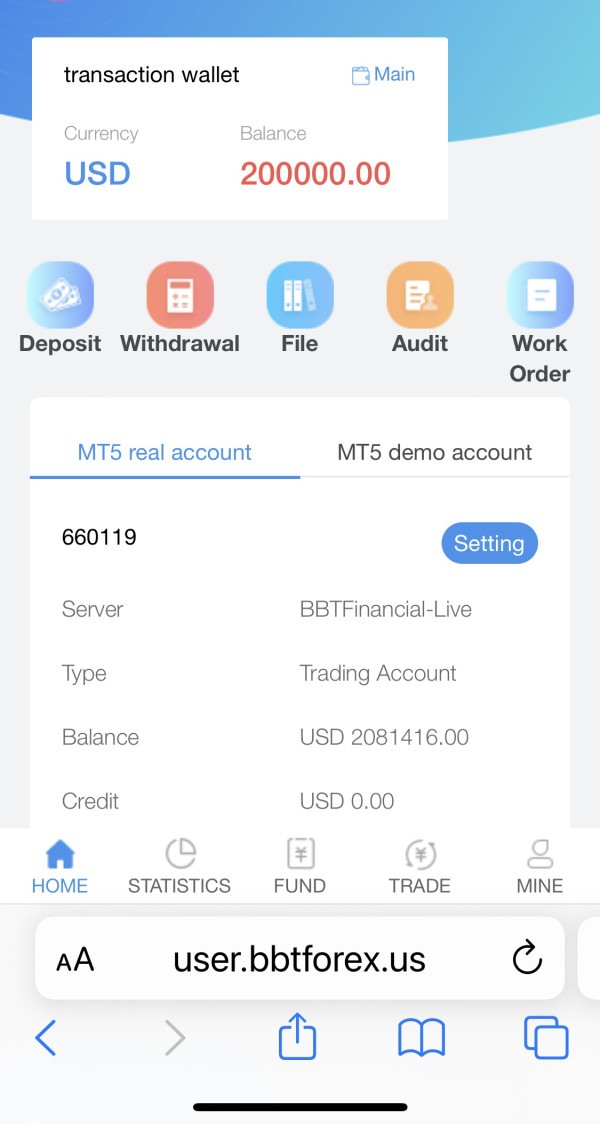

BBT's strength appears to lie in its technological infrastructure, specifically through the InfoReach Trade Management System integration. This platform represents a comprehensive approach to trading technology, consolidating multiple tools and functionalities into a unified environment. The InfoReach TMS is recognized in the industry for providing professional-grade trading capabilities, suggesting that BBT offers traders access to sophisticated market analysis and execution tools.

The platform integration indicates that traders can access various trading instruments and market data through a single interface. This potentially streamlines the trading process and reduces the need for multiple platform subscriptions. However, specific details about research resources, educational materials, or automated trading support were not available in source documentation.

The technological foundation appears solid, but the lack of information about supplementary resources such as market analysis, trading guides, or educational content limits the overall assessment. While the core platform technology receives positive marks, the absence of detailed information about additional trader resources prevents a higher rating in this category.

Customer Service and Support Analysis

Customer service represents a significant concern area for BBT based on available user feedback. Reports indicate problematic customer treatment practices that raise serious questions about the broker's commitment to client satisfaction and professional service standards. Users have specifically mentioned inappropriate handling of customer concerns, suggesting that the broker's support infrastructure may be inadequately equipped to address client needs effectively.

The absence of detailed information about customer service channels, response times, and support availability further compounds these concerns. Professional forex brokers typically provide multiple contact methods, extended support hours, and multilingual assistance to serve their diverse client base. The lack of transparent information about these basic service elements, combined with negative user experiences, suggests that customer support is not a priority area for BBT.

Response time and problem resolution capabilities appear questionable based on user testimonials. This indicates that traders may face difficulties when seeking assistance with account issues, technical problems, or dispute resolution. The reported customer treatment problems suggest systemic issues rather than isolated incidents, which is particularly concerning for traders who require reliable support for their trading activities.

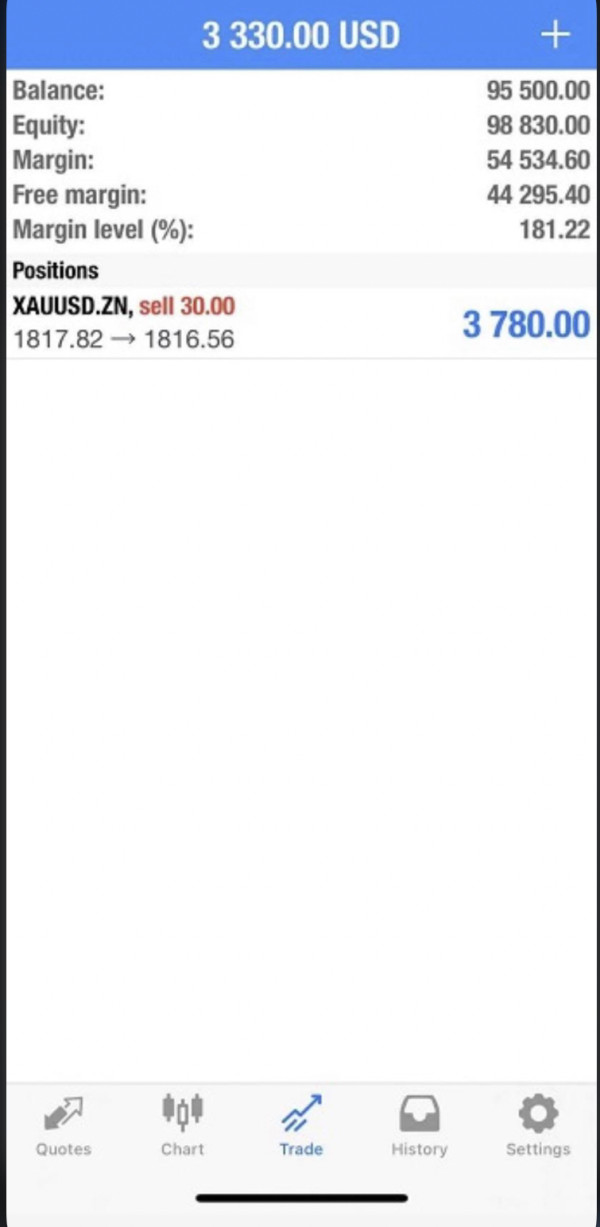

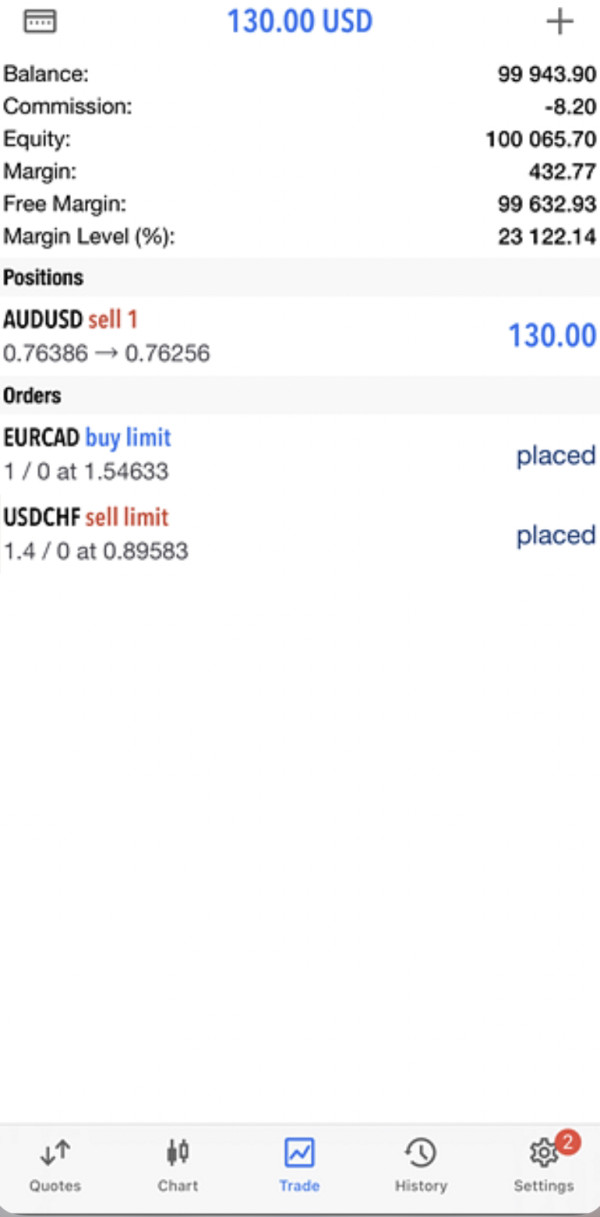

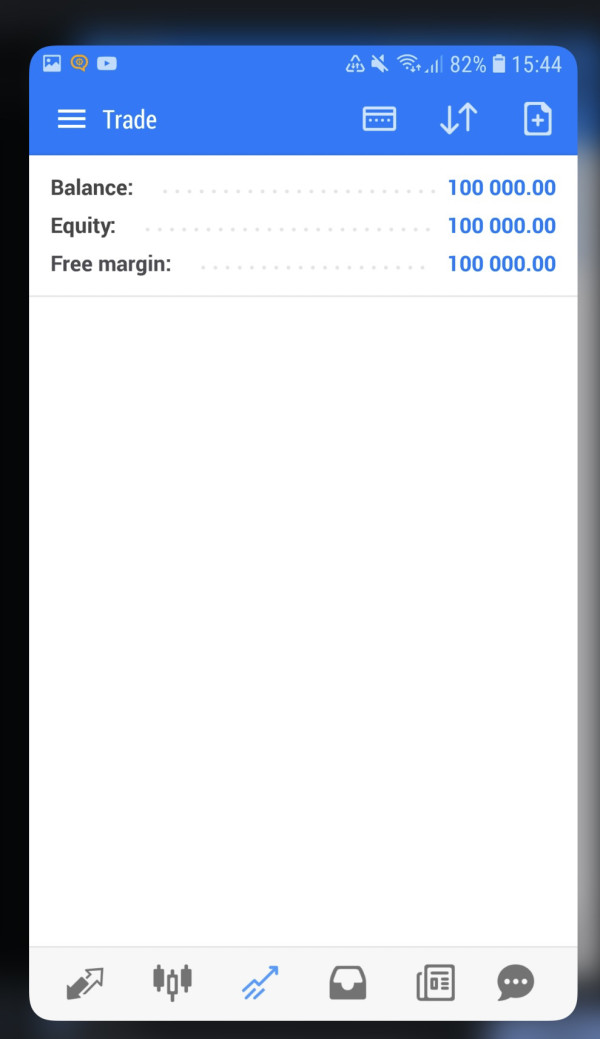

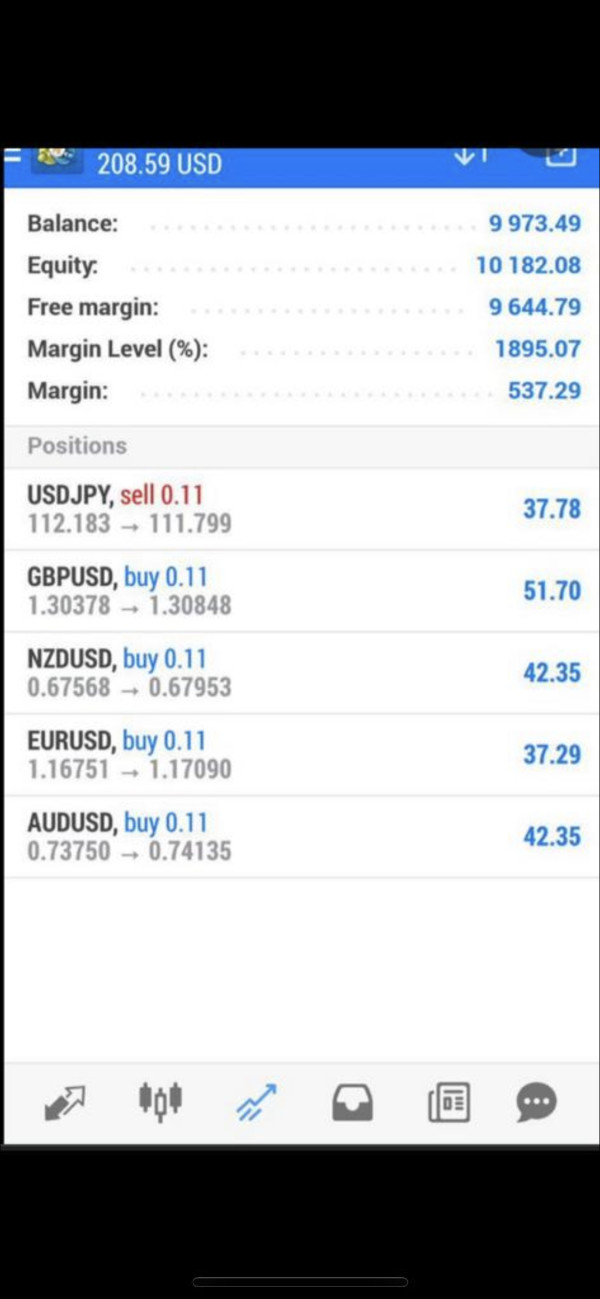

Trading Experience Analysis

The assessment of BBT's trading experience is limited by the lack of comprehensive performance data and detailed user feedback about platform functionality. While the InfoReach TMS platform provides a technological foundation that suggests professional-grade trading capabilities, specific information about execution quality, platform stability, and order processing efficiency was not available in reviewed materials.

The multi-asset trading capability indicates that the platform can accommodate diverse trading strategies and instrument preferences. This potentially offers traders flexibility in their market approach. However, critical performance metrics such as execution speeds, slippage rates, platform uptime, and mobile trading functionality were not detailed in available sources.

These factors are essential for evaluating the practical trading experience that clients can expect. Without specific data about order execution quality, platform responsiveness during high-volatility periods, or mobile application performance, this bbt review cannot provide definitive insights into the day-to-day trading experience. The technological infrastructure appears promising, but the absence of performance validation and user experience feedback limits the ability to assess whether the platform delivers on its technological potential in real trading conditions.

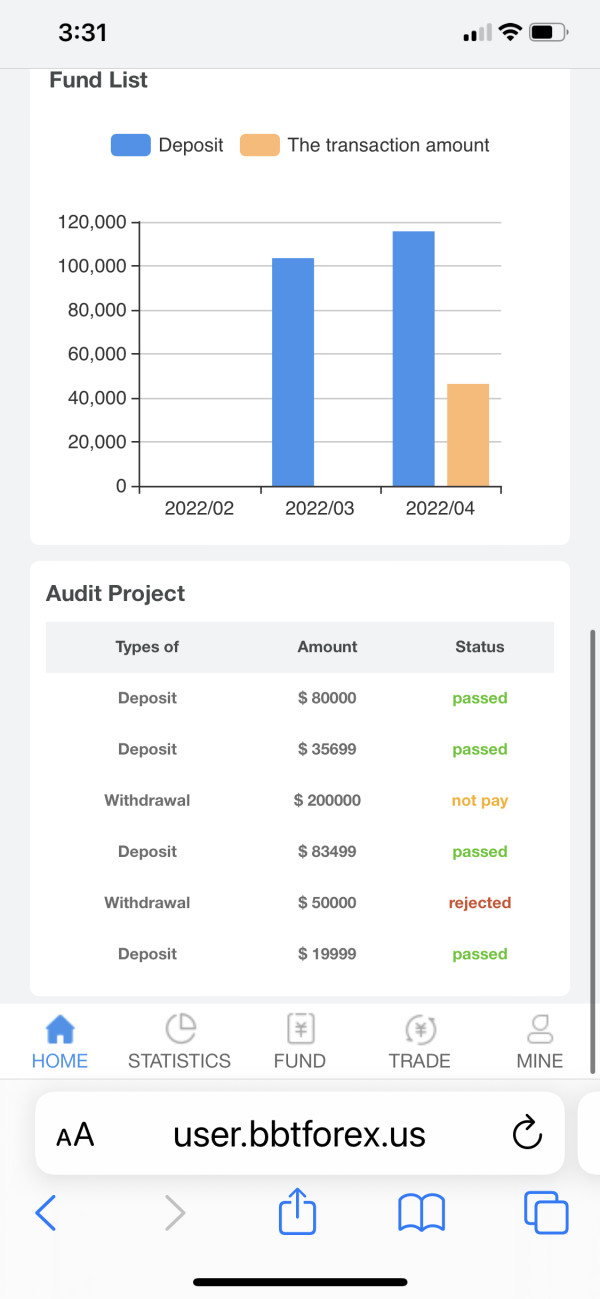

Trust and Reliability Analysis

Trust and reliability concerns represent the most significant challenges identified in this evaluation of BBT. User feedback consistently highlights issues with fee transparency, particularly regarding unexpected overdraft charges that appear to catch clients by surprise. This suggests potential problems with terms and conditions disclosure or client education about account fee structures.

The absence of detailed regulatory information in available materials raises additional concerns about transparency and compliance standards. Professional forex brokers typically provide clear regulatory disclosure, client fund protection details, and operational transparency to build trust with potential clients. The lack of this information makes it difficult for traders to assess the safety and security of their funds.

Customer treatment issues reported by users further undermine trust and suggest that the broker may not maintain the professional standards expected in the financial services industry. When combined with fee transparency concerns, these issues create a pattern that raises questions about the broker's overall reliability and commitment to client welfare. The reported negative experiences appear to reflect systemic issues rather than isolated problems, which is particularly concerning for potential clients.

User Experience Analysis

Overall user satisfaction with BBT appears to be significantly impacted by the service and fee issues identified in user feedback. The negative experiences reported by clients suggest that the broker's operational practices may not align with industry standards for customer treatment and service delivery. Users have specifically mentioned problems with unexpected fees and inappropriate customer handling, indicating fundamental issues with the client experience.

The lack of detailed information about user interface design, registration processes, and fund management procedures makes it difficult to assess the practical aspects of working with BBT. However, the reported problems with customer service and fee transparency suggest that users may face frustrations beyond just platform functionality issues.

Common user complaints center on financial transparency and customer treatment, which are fundamental aspects of the broker-client relationship. These issues can significantly impact trader confidence and satisfaction, regardless of platform technological capabilities. The pattern of negative feedback suggests that BBT may need substantial improvements in operational practices and client communication to provide a satisfactory user experience.

Conclusion

This bbt review reveals a mixed picture of a broker that offers technological capabilities through the InfoReach TMS platform but faces significant challenges in customer service and operational transparency. While the multi-asset trading platform may appeal to traders seeking comprehensive trading tools, the reported issues with fee transparency and customer treatment present serious concerns that potential clients should carefully consider.

BBT appears most suitable for traders who prioritize technological platform capabilities and are comfortable conducting extensive due diligence about fees and terms before committing funds. However, the customer service concerns and fee transparency issues make this broker unsuitable for traders who value straightforward communication and reliable customer support. The main advantages include access to professional-grade trading technology, while the primary disadvantages involve customer service quality and fee transparency problems that could significantly impact the overall trading experience.