Fine Capitals 2025 Review: Everything You Need to Know

Executive Summary

Fine Capitals started in 2022. The forex broker shows a complex picture in the trading world, with some users sharing good experiences while others report serious problems with withdrawals and possible fraud. This fine capitals review shows a clear split in user experiences. Testimonials range from "very good" service to clear warnings telling people to "avoid using Fine Capitals."

The broker gives access to many financial markets. These include forex, spot metals, energy, and indices, but the company has only been running for a short time and lacks clear regulatory information. For investors thinking about this platform, the mixed user feedback and lack of clear regulatory oversight create big concerns. People should think carefully before opening an account.

Important Notice

This evaluation uses available user feedback and company information from 2025. Fine Capitals does not have complete regulatory information in public sources, which may hurt investor confidence in different countries. The lack of clear licensing details creates questions about the broker's compliance with international financial rules.

Our assessment uses user testimonials, company background checks, and analysis of available service features. Given the limited transparency about regulatory status, potential clients should be extra careful and do more research before using this broker.

Rating Framework

Broker Overview

Fine Capitals appeared in the forex brokerage sector in 2022. The UK-based online trading platform positions itself as a provider of multi-market access, offering trading opportunities across various financial instruments, but despite its recent establishment, the broker has attracted mixed attention from traders seeking exposure to international markets.

The company's business model centers on online forex trading services. It extends beyond traditional currency pairs to include spot metals, energy commodities, and stock indices, and this diversified approach aims to serve traders with different risk appetites and market preferences. However, the broker's short operational history means that long-term performance data and established market reputation remain limited.

Fine Capitals operates from the United Kingdom according to available information. Specific regulatory authorization details are not clearly documented in accessible sources, and this fine capitals review finds that while the company claims to provide comprehensive trading services, the absence of transparent regulatory information raises questions about oversight and client protection measures. Potential users should carefully consider these concerns.

Regulatory Status: Available sources do not provide specific information about Fine Capitals' regulatory authorization or licensing. This absence of clear regulatory details represents a significant concern for potential clients seeking regulated trading environments.

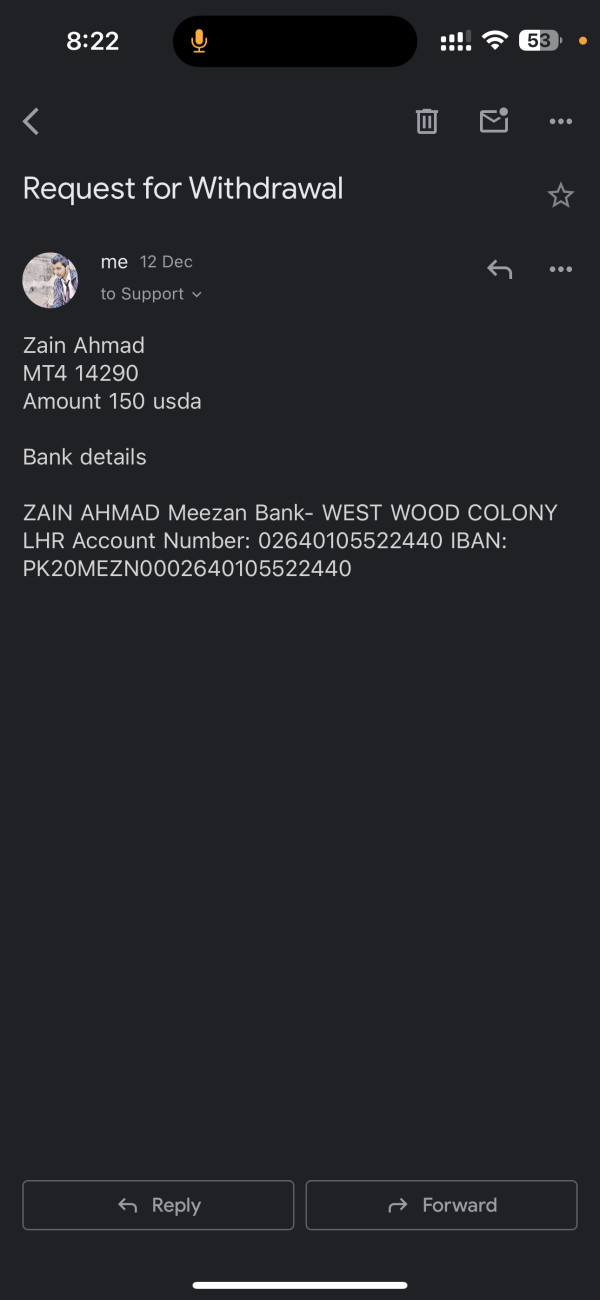

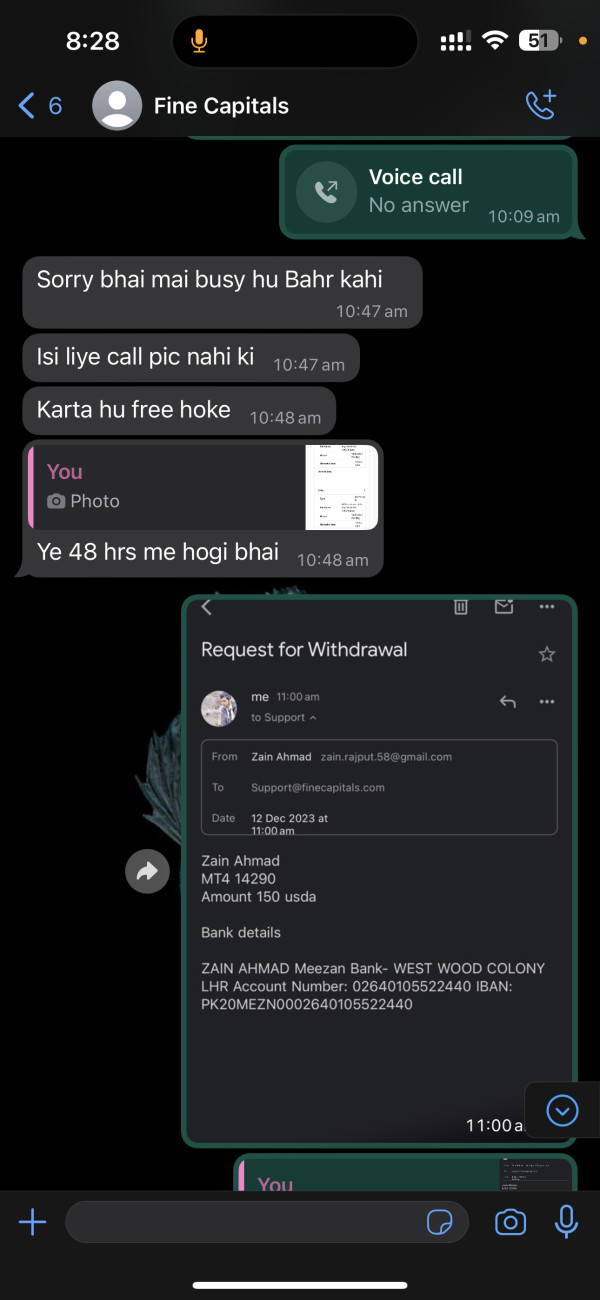

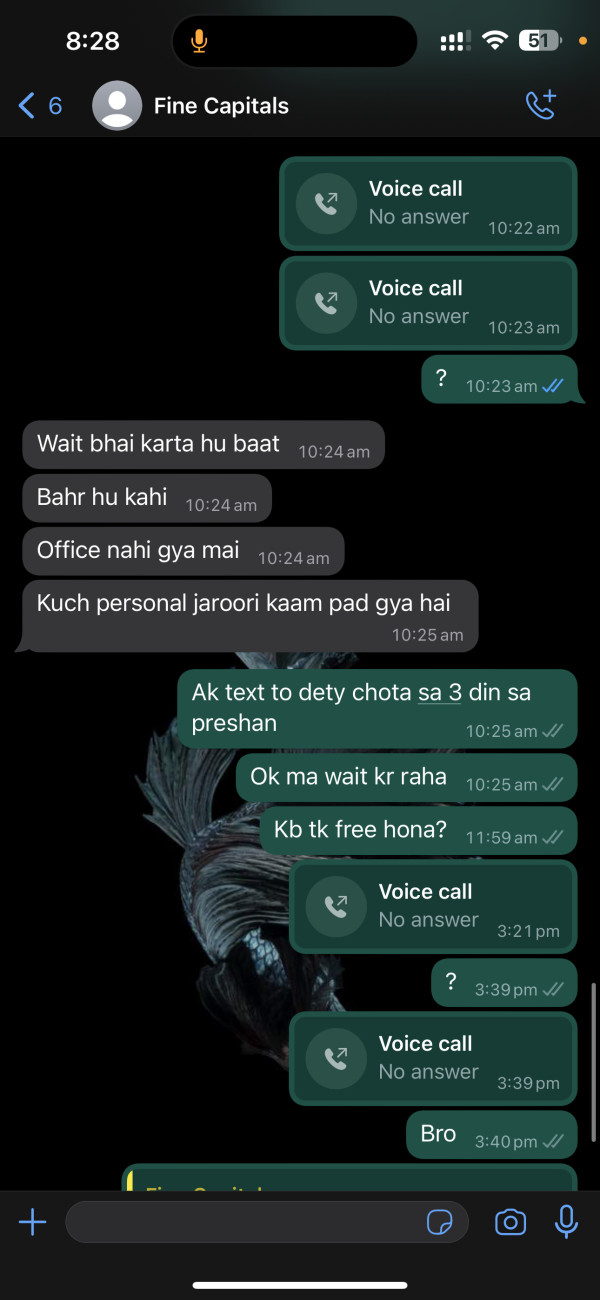

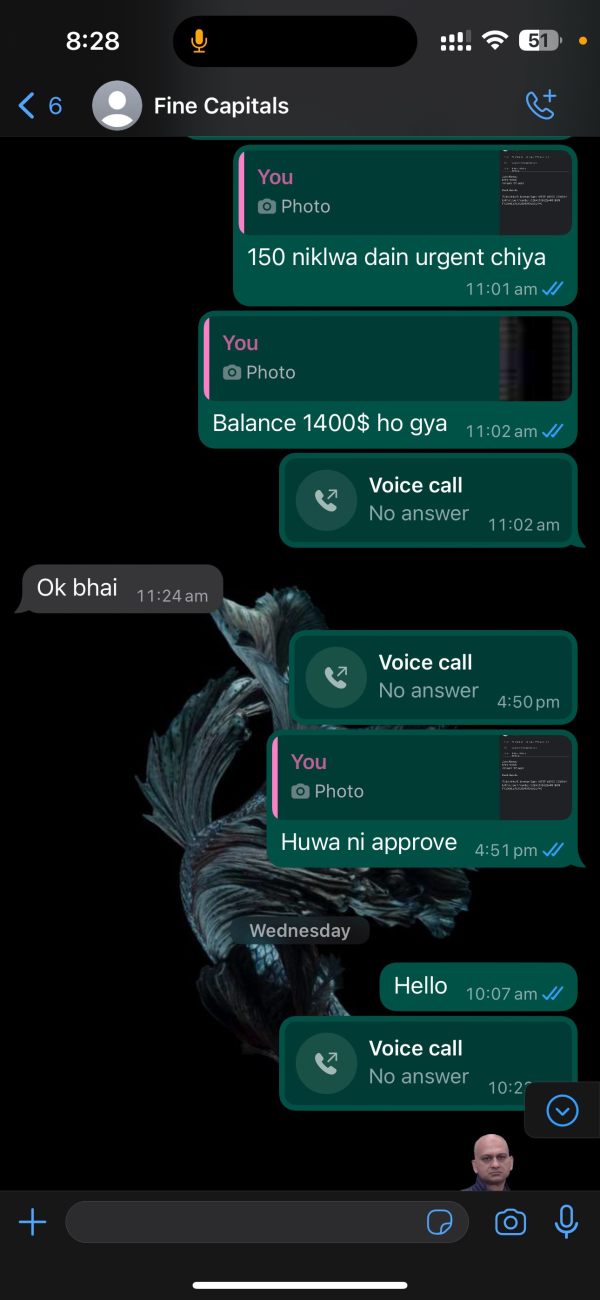

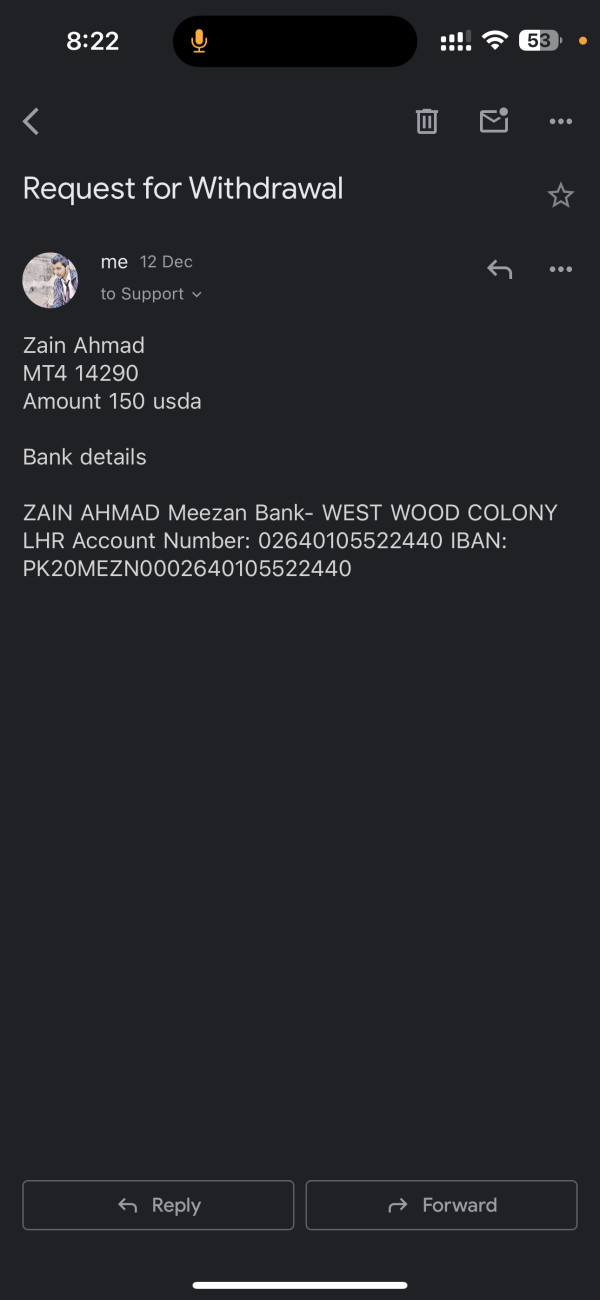

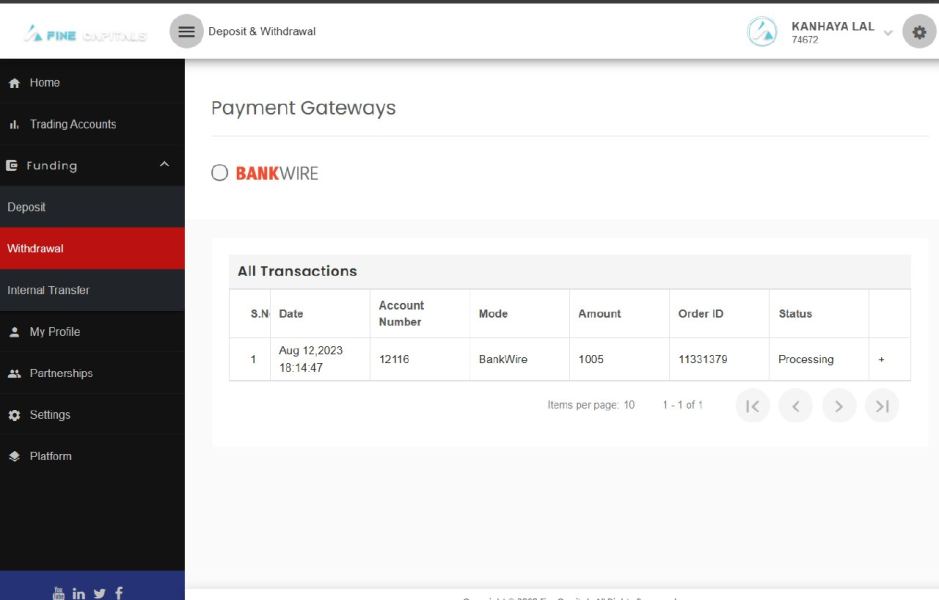

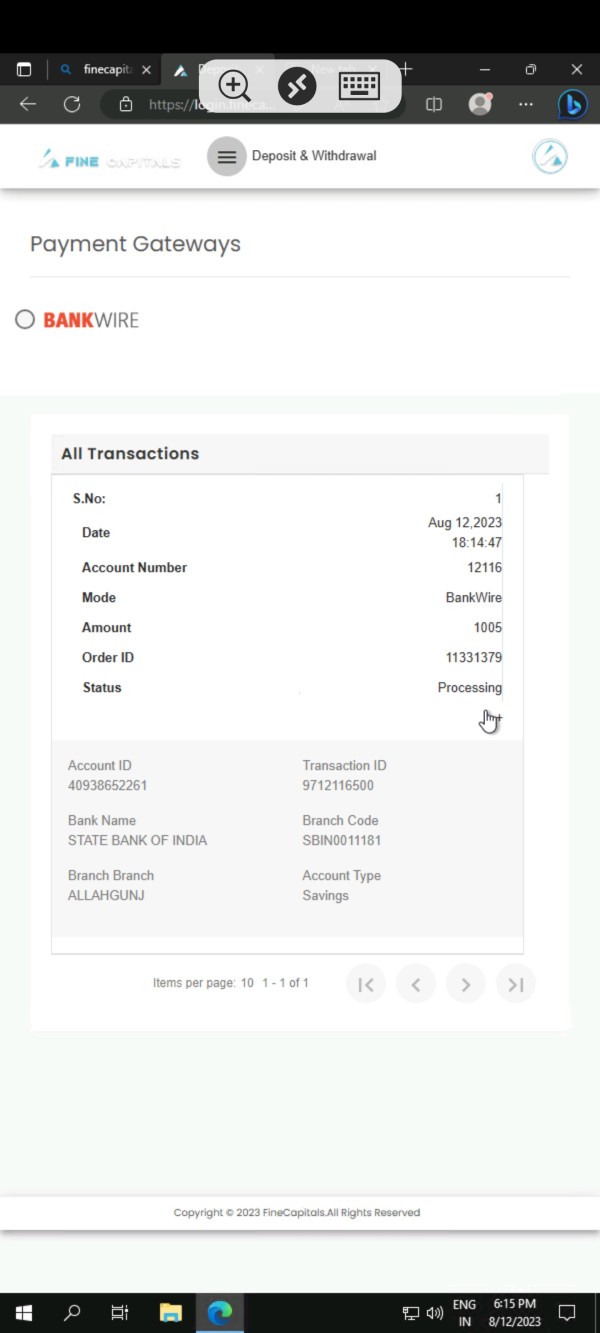

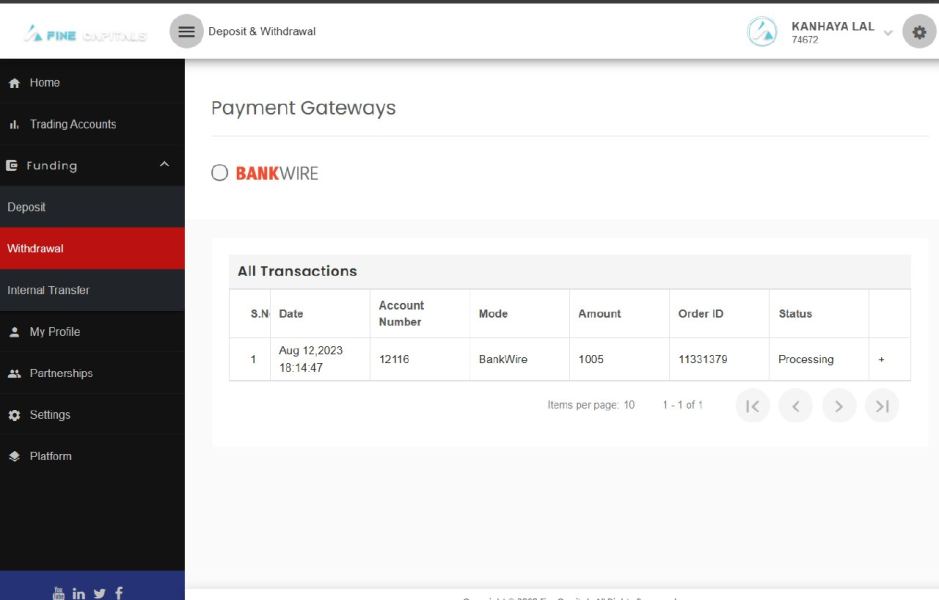

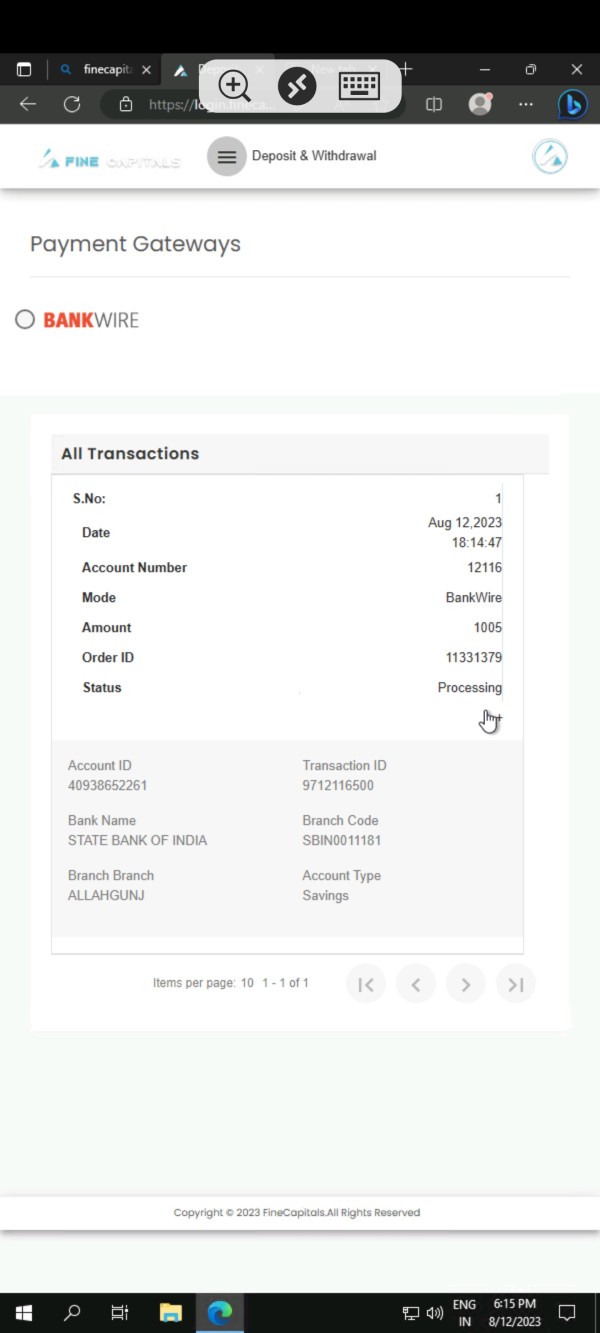

Deposit and Withdrawal Methods: Specific information about available payment methods and processing procedures is not detailed in accessible sources. User feedback suggests potential difficulties with withdrawal processes, though exact payment options remain unclear.

Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in available documentation. This makes it difficult for potential clients to assess entry-level investment requirements.

Promotional Offers: Information regarding bonus structures, promotional campaigns, or special offers is not available in current sources.

Tradeable Assets: Fine Capitals provides access to multiple asset classes including foreign exchange pairs, spot metals, energy commodities, and stock indices. This diversified offering suggests an attempt to serve various trading strategies and market interests.

Cost Structure: Detailed information about spreads, commissions, overnight financing charges, and other trading costs is not provided in available sources. This lack of transparency regarding fee structures makes cost comparison with other brokers challenging.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in accessible documentation.

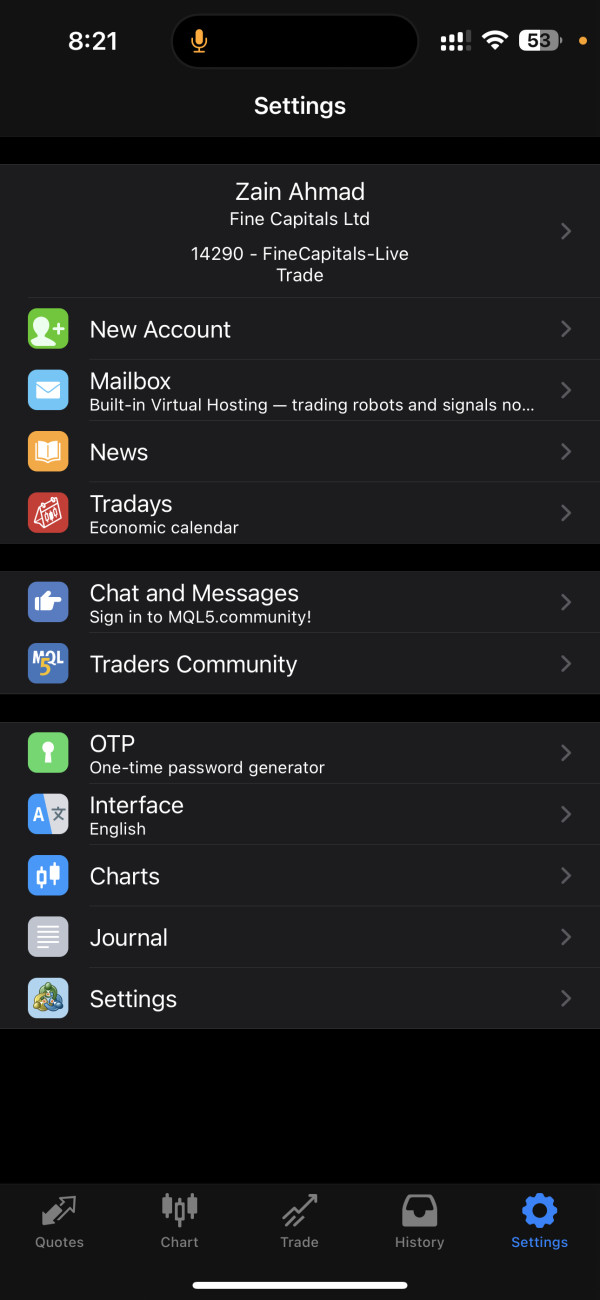

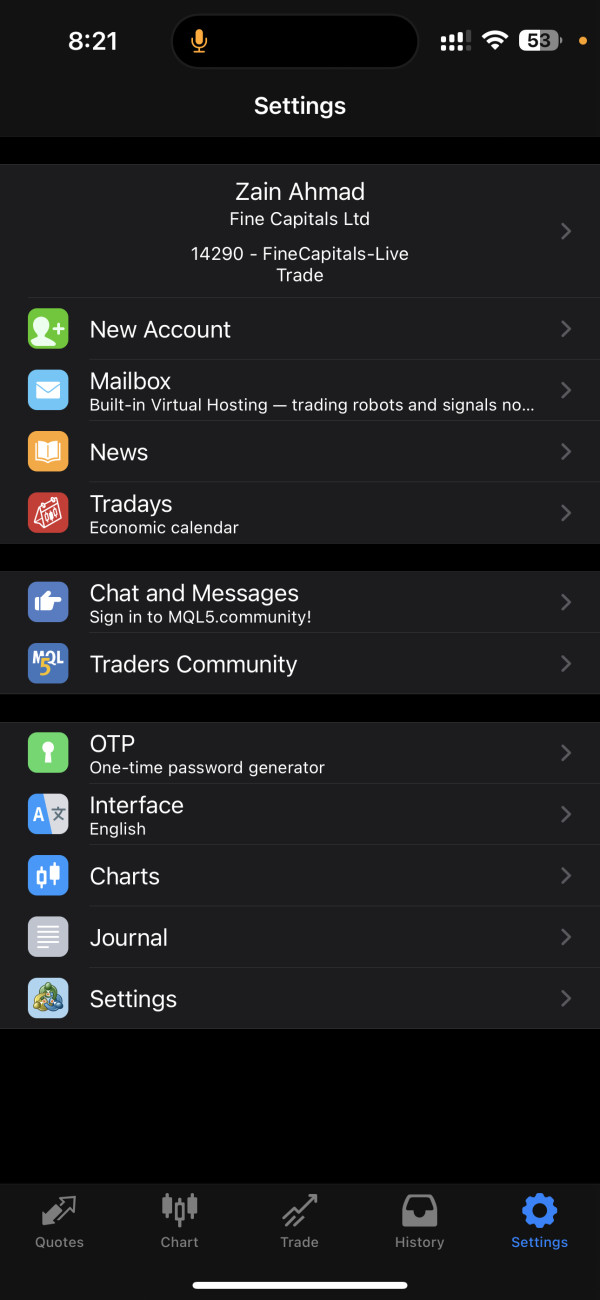

Trading Platforms: Information about supported trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified in current sources.

Geographic Restrictions: Details about regional limitations or restricted jurisdictions are not provided in available materials.

Customer Support Languages: Specific information about supported languages for customer service is not documented in accessible sources.

This fine capitals review highlights the significant information gaps that potential clients face when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

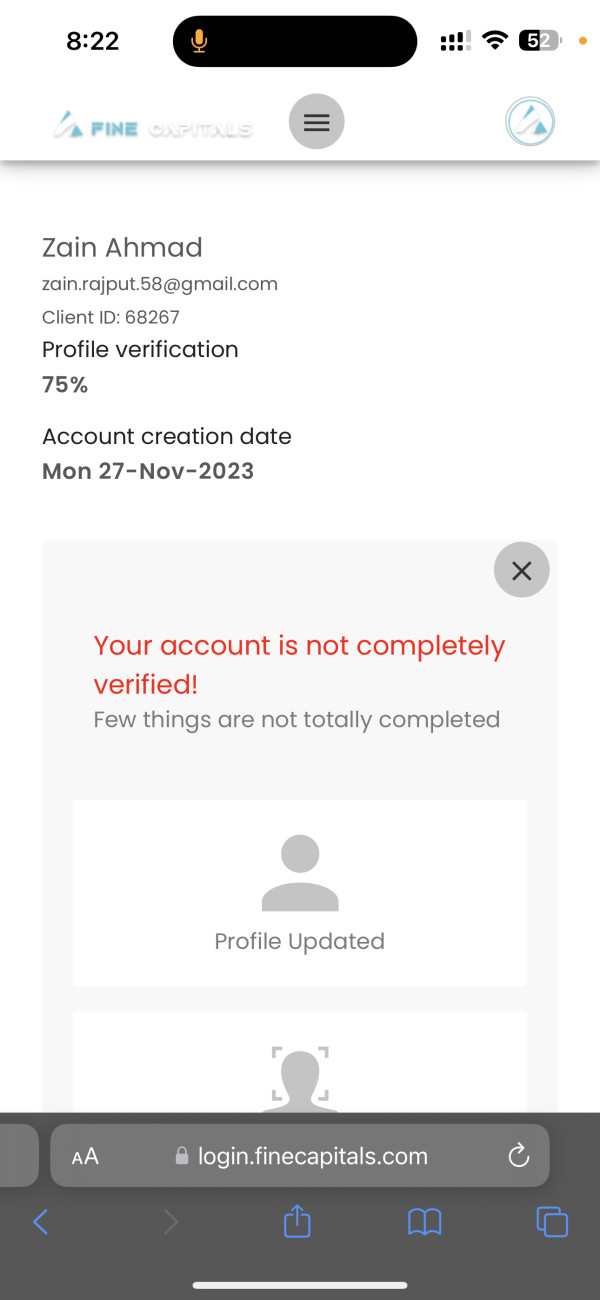

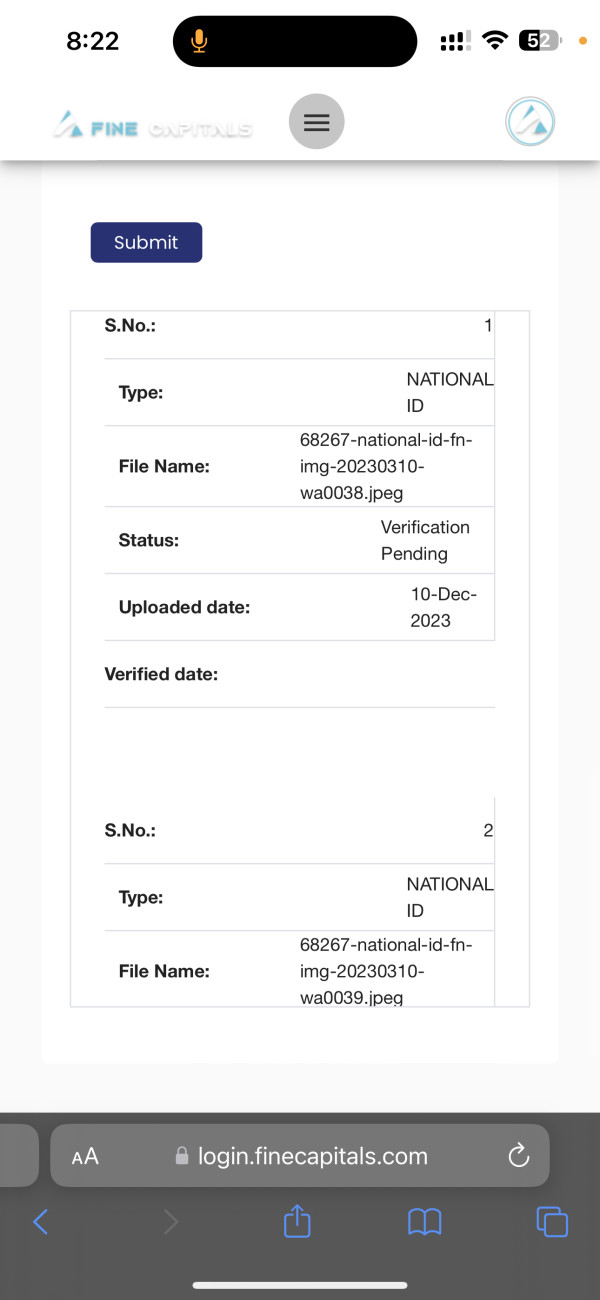

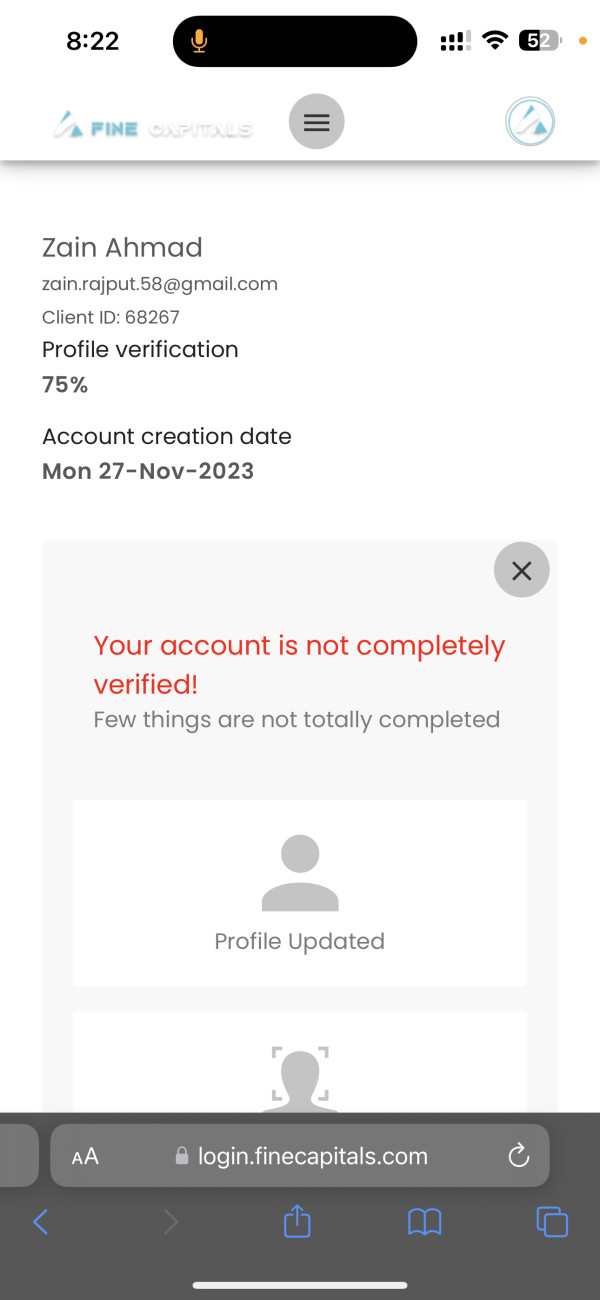

The evaluation of Fine Capitals' account conditions faces big limitations due to insufficient publicly available information. Standard account features such as account types, minimum balance requirements, and specific terms of service are not clearly documented in accessible sources, and this lack of transparency makes it challenging for potential clients to understand what they can expect from different account tiers.

Without detailed information about account opening procedures, verification requirements, or special account features, prospective clients cannot make informed decisions. The absence of clear documentation regarding account benefits, restrictions, or upgrade pathways further complicates the assessment process.

The limited information available suggests that Fine Capitals may offer standard retail trading accounts. Specific features, benefits, and limitations remain unclear, and this lack of transparency in account conditions contributes to the overall concerns about the broker's operational transparency and client communication standards.

In this fine capitals review, the account conditions receive a below-average rating primarily due to the insufficient information available to potential clients. This fails to meet industry standards for transparency and disclosure.

Fine Capitals' trading tools and educational resources cannot be adequately assessed due to the lack of detailed information in available sources. Modern forex brokers typically provide comprehensive suites of analytical tools, market research, and educational materials to support trader development and decision-making processes.

The absence of information about charting capabilities, technical analysis tools, economic calendars, or market research reports raises questions about the broker's commitment to providing value-added services. Educational resources such as webinars, trading guides, tutorials, or market analysis are not documented in accessible materials.

Automated trading support, including expert advisors or algorithmic trading capabilities, is not mentioned in available sources. This absence of information about advanced trading features may concern experienced traders who rely on sophisticated tools for their strategies, and without clear documentation of the tools and resources available to clients, potential users cannot evaluate whether the platform meets their analytical and educational needs.

The lack of transparency in this area suggests either limited offerings or poor communication of available features.

Customer Service and Support Analysis (5/10)

Customer service evaluation for Fine Capitals reveals mixed feedback from users. This creates an inconsistent picture of support quality, and while some clients report satisfactory service experiences, others have raised concerns about responsiveness and problem resolution effectiveness.

The specific customer support channels available are not clearly documented in accessible sources. Response times and availability hours remain unclear, making it difficult for potential clients to understand when and how they can access assistance.

User feedback indicates varying experiences with customer service quality. This suggests inconsistent support standards, and some traders report positive interactions, while others express frustration with communication and problem resolution processes. This disparity in user experiences points to potential issues in service delivery consistency.

The absence of clear information about multilingual support capabilities and specialized support for different account types further limits the assessment of customer service quality. Without documented service level agreements or support guarantees, clients cannot set appropriate expectations for assistance when needed.

Trading Experience Analysis (4/10)

The trading experience assessment for Fine Capitals faces significant challenges due to limited available information about platform performance, execution quality, and user interface design. Critical factors such as order execution speed, platform stability, and system uptime are not documented in accessible sources.

User feedback regarding trading experience shows mixed results. Some traders report satisfactory platform performance while others express concerns about various aspects of the trading environment, and the absence of specific performance metrics makes it difficult to verify these user experiences objectively.

Mobile trading capabilities and application functionality are not detailed in available sources. This is particularly concerning given the importance of mobile access in modern trading, and platform features such as one-click trading, advanced order types, and customization options remain undocumented.

The lack of information about platform technology, server locations, and infrastructure investment raises questions about the broker's commitment to providing competitive trading conditions. Without clear data on slippage rates, execution quality, or platform reliability, potential clients cannot adequately assess whether the trading environment meets their requirements.

This fine capitals review finds that the trading experience rating reflects the uncertainty created by insufficient information and mixed user feedback regarding platform performance.

Trust and Reliability Analysis (2/10)

Trust and reliability represent the most concerning aspects of Fine Capitals' evaluation. The absence of clear regulatory information creates significant questions about oversight, client protection, and operational compliance with financial services standards.

Regulatory authorization details are not provided in accessible sources. This makes it impossible to verify the broker's licensing status with recognized financial authorities, and this lack of regulatory transparency is particularly troubling given the importance of oversight in protecting client interests and ensuring fair trading practices.

User feedback includes specific warnings about potential fraudulent activities and difficulties with fund withdrawals. These raise serious red flags about the broker's operational integrity, and these concerns are compounded by the company's relatively recent establishment in 2022, providing limited operational history for assessment.

Fund security measures, such as segregated client accounts, deposit insurance, or compensation schemes, are not documented in available sources. The absence of information about financial safeguards leaves potential clients uncertain about asset protection measures.

The combination of regulatory uncertainty, user warnings about fraudulent behavior, and lack of transparency regarding client protection measures results in the lowest rating in this assessment category.

User Experience Analysis (3/10)

User experience evaluation reveals significant disparities in client feedback. This creates an inconsistent picture of overall satisfaction with Fine Capitals' services, and the stark contrast between positive testimonials and serious warnings suggests highly variable service delivery or potentially concerning business practices.

Interface design and platform usability information is not available in accessible sources. This makes it difficult to assess the quality of user interaction with the broker's systems, and registration and account verification processes are not documented, leaving potential clients uncertain about onboarding procedures.

The most significant user experience concern relates to withdrawal difficulties reported by some clients. These reports suggest potential problems with fund access that could seriously impact client satisfaction and trust, and the nature and extent of these withdrawal issues remain unclear due to limited detailed documentation.

User feedback ranges from descriptions of "very good" service to explicit recommendations to "avoid using Fine Capitals." This indicates extreme variations in client experiences, and this disparity suggests either inconsistent service delivery or the presence of fake reviews, both of which raise concerns about reliability.

The absence of detailed user testimonials, case studies, or comprehensive feedback analysis makes it challenging to understand the typical client journey or identify common issues that users might encounter.

Conclusion

This comprehensive fine capitals review reveals a broker with significant transparency and reliability concerns that potential clients should carefully consider. While Fine Capitals offers access to multiple financial markets and some users report positive experiences, the overwhelming lack of regulatory information and warnings about withdrawal difficulties create substantial red flags.

The broker appears unsuitable for risk-averse investors or those requiring transparent, well-regulated trading environments. The absence of clear licensing information, combined with user reports of potential fraudulent activities, suggests that traders should exercise extreme caution when considering this platform.

The main advantages appear limited to some positive user testimonials. The disadvantages include lack of regulatory oversight, withdrawal concerns, insufficient transparency about trading conditions, and mixed user feedback, and given these factors, potential clients are advised to thoroughly research alternative brokers with established regulatory credentials and transparent operational practices before making any investment decisions.