Leeds Capital 2025 Review: Everything You Need to Know

Executive Summary

This Leeds Capital review examines a London-based financial services firm. The company operates in the competitive forex and investment landscape. Leeds Capital Limited has its headquarters in London, United Kingdom, and presents itself as a financial services provider, though detailed information about their specific trading offerings remains limited in publicly available sources.

The company operates from their registered address at SPM House Rear No 2 Glenthorne Road London. This positions them within the UK's established financial sector. Based on available information, Leeds Capital appears to target forex traders and financial investors seeking professional financial services.

However, the lack of detailed information about their trading platforms, regulatory status, and specific service offerings makes it challenging to provide a comprehensive assessment. This review aims to present an objective analysis based on currently available data while highlighting areas where more transparency would benefit potential clients. The firm's London location suggests alignment with UK financial standards, though specific regulatory details require further verification for prospective traders considering their services.

Important Notice

This review is based on limited publicly available information about Leeds Capital Limited. Traders should note that financial services firms may operate under different regulatory frameworks across various jurisdictions, and it's essential to verify current regulatory status before engaging with any broker.

Our evaluation methodology combines available company information, industry standards, and general market practices to provide a balanced assessment. However, the absence of comprehensive data in certain areas limits the depth of analysis possible for this Leeds Capital review.

Rating Framework

Broker Overview

Leeds Capital Limited operates as a financial services company based in London, United Kingdom. The firm is registered at SPM House Rear No 2 Glenthorne Road London, N11 3HT, positioning itself within the UK's established financial services sector.

While the company identifies itself within the financial services industry, specific details about their founding date, company history, and core business development remain undisclosed in available public information. The company's London headquarters suggests potential alignment with UK financial regulations and standards, though specific regulatory authorizations and compliance details require verification.

Leeds Capital's business model and primary service offerings are not explicitly detailed in accessible sources. This makes it difficult to categorize their exact approach to financial services delivery and client engagement. Regarding trading platforms and available assets, this Leeds Capital review finds that specific information about supported trading platforms, available financial instruments, and asset classes is not clearly outlined in current public materials.

Similarly, details about regulatory oversight, licensing jurisdictions, and compliance frameworks are not readily apparent. This represents a significant information gap for potential clients seeking transparency in broker selection.

Regulatory Jurisdictions: Specific regulatory information is not detailed in available sources, though the London location suggests potential UK regulatory framework application.

Deposit and Withdrawal Methods: Payment processing options and supported funding methods are not specified in current available materials.

Minimum Deposit Requirements: Entry-level investment requirements have not been disclosed in accessible company information.

Bonus and Promotions: Current promotional offerings and bonus structures are not outlined in available sources. This requires direct inquiry for specific details.

Available Trading Assets: The range of tradeable financial instruments, including forex pairs, commodities, indices, and other assets, is not specified in current materials.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in current sources. This represents a significant transparency gap for cost-conscious traders.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not detailed in available information.

Platform Options: Specific trading platform availability, including MetaTrader support or proprietary platform features, requires clarification through direct contact.

Regional Restrictions: Geographic limitations and restricted jurisdictions are not clearly outlined in current materials.

Customer Support Languages: Available support languages and communication options are not specified in accessible sources.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for this Leeds Capital review reveals significant information gaps regarding available account types and their specific features. Without detailed information about account tiers, minimum deposit requirements, or special account features, it becomes challenging to assess the competitiveness of their offerings.

Standard industry practices suggest that reputable brokers typically offer multiple account types to accommodate different trader profiles, from beginners to institutional clients. The absence of clear information about Islamic account availability, demo account access, or account opening procedures represents a transparency concern.

Professional traders typically require detailed account specifications, including funding requirements, maintenance fees, and account benefits, to make informed decisions. The lack of specific account condition details in available sources suggests potential clients would need to contact the company directly for comprehensive account information. This Leeds Capital review notes that without transparent account condition information, traders cannot effectively compare offerings against industry competitors or assess suitability for their specific trading requirements and capital allocation strategies.

The evaluation of trading tools and resources reveals limited publicly available information about Leeds Capital's offerings in this crucial area. Modern forex trading requires sophisticated analytical tools, real-time market data, and comprehensive research resources to support informed trading decisions.

However, specific details about chart analysis tools, technical indicators, economic calendars, or market research provisions are not outlined in current available materials. Educational resources represent another critical component for trader development, particularly for newcomers to forex markets.

The availability of webinars, tutorials, market analysis, or educational content remains unclear based on current information sources. Professional traders also typically require advanced tools such as automated trading support, custom indicator capabilities, and integration with third-party analysis platforms. Without clear information about the technological infrastructure and resource offerings, this Leeds Capital review cannot definitively assess their competitive position in the tools and resources category, highlighting the need for enhanced transparency in their service specifications.

Customer Service and Support Analysis

Customer service quality represents a fundamental component of broker evaluation, yet specific information about Leeds Capital's support infrastructure remains limited in available sources. Essential service elements including available contact channels, response time commitments, and service quality standards are not clearly outlined in current materials.

Modern traders expect multiple communication options including live chat, phone support, and email assistance with reasonable response timeframes. The availability of multilingual support, particularly important for international clients, is not specified in current information sources.

Additionally, customer service operating hours, weekend support availability, and emergency contact procedures require clarification for comprehensive service assessment. Professional trading often requires immediate technical support, account assistance, and platform troubleshooting capabilities. User feedback and testimonials about service quality experiences are not readily available in current sources, making it difficult to assess real-world customer service performance.

This Leeds Capital review notes that enhanced transparency regarding customer support capabilities would benefit potential clients in their evaluation process.

Trading Experience Analysis

The trading experience evaluation encompasses platform stability, execution quality, and overall trading environment assessment. However, specific information about Leeds Capital's trading infrastructure, platform performance metrics, and execution standards is not detailed in available sources.

Critical factors such as order execution speed, slippage rates, and platform uptime statistics require verification through direct experience or detailed disclosure. Platform functionality, including advanced order types, charting capabilities, and mobile trading options, represents essential components of modern trading experience.

The availability of features such as one-click trading, partial fills, and algorithmic trading support remains unclear based on current information sources. Mobile trading capabilities, increasingly important for active traders, require specific assessment regarding app availability and functionality. Without comprehensive platform specifications and performance data, this Leeds Capital review cannot provide definitive assessment of the trading experience quality, emphasizing the importance of demo testing and direct evaluation for prospective clients considering their services.

Trust Factor Analysis

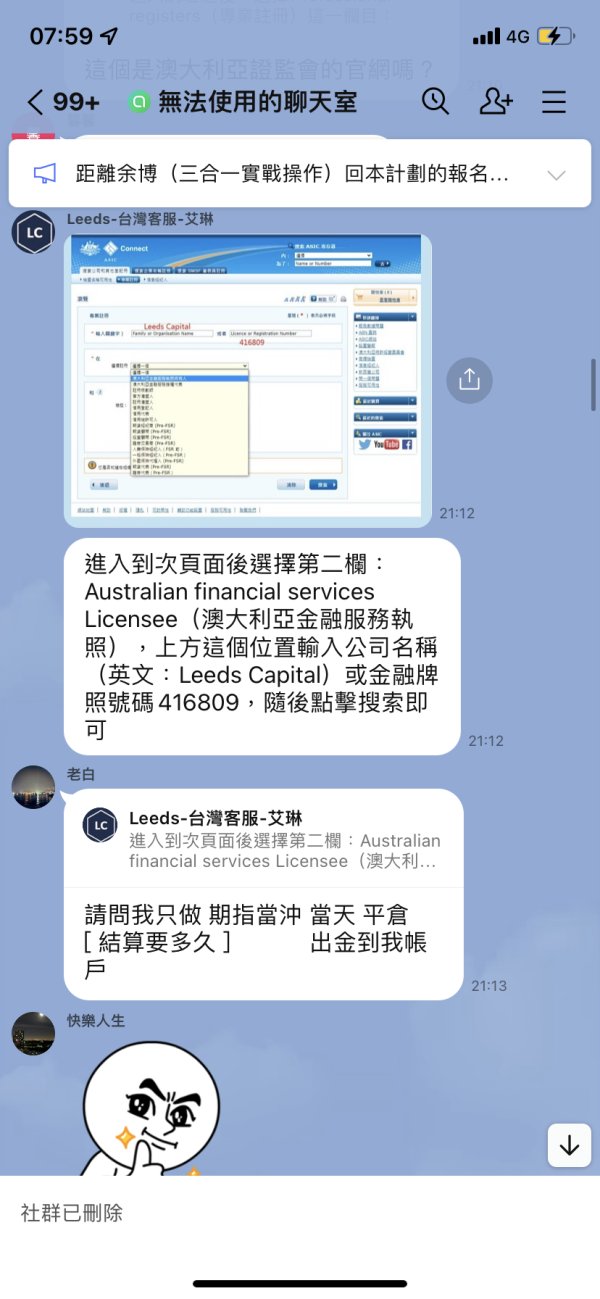

Trust factor assessment focuses on regulatory compliance, financial security measures, and overall company transparency. While Leeds Capital's London location suggests potential alignment with UK regulatory standards, specific regulatory authorizations and compliance details are not clearly outlined in available sources.

Regulatory oversight represents a crucial component of broker trustworthiness, providing client protection and operational standards enforcement. Client fund security measures, including segregated accounts, deposit protection schemes, and financial auditing practices, require verification for comprehensive trust assessment.

The absence of detailed regulatory information and security measure specifications represents a significant transparency gap for risk-conscious traders. Company history, ownership structure, and financial stability indicators are not readily available in current sources. Industry reputation, third-party ratings, and professional recognition details would enhance trust factor evaluation but are not specified in available materials.

This Leeds Capital review emphasizes the importance of regulatory verification and security measure confirmation before engaging with any financial services provider.

User Experience Analysis

User experience assessment encompasses overall platform usability, account management efficiency, and client satisfaction levels. However, specific information about interface design, navigation simplicity, and user-friendly features is not detailed in available sources.

Modern trading platforms require intuitive design, efficient workflow, and customizable interfaces to support diverse trader preferences and experience levels. Account opening procedures, verification processes, and onboarding efficiency represent crucial user experience components.

The streamlining of documentation requirements, identity verification, and account activation timelines affects initial client experience significantly. Similarly, funding and withdrawal processes, including transaction processing times and fee transparency, impact ongoing user satisfaction. User feedback compilation, satisfaction surveys, and common user concerns are not readily available in current sources, limiting comprehensive user experience assessment.

This Leeds Capital review notes that enhanced user experience transparency, including client testimonials and satisfaction metrics, would provide valuable insights for prospective clients evaluating service quality expectations.

Conclusion

This Leeds Capital review reveals a London-based financial services firm operating with limited publicly available information about their specific trading offerings and operational details. While the company's UK location suggests potential regulatory alignment with established financial standards, the absence of comprehensive service details, regulatory specifications, and transparent operational information presents significant evaluation challenges for prospective clients.

The firm appears positioned to serve forex traders and financial investors, though specific target market focus and service specializations require clarification through direct inquiry. Potential clients should prioritize regulatory verification, service specification confirmation, and platform evaluation before engaging with their services, given the limited transparency in current available materials.