Is Fine Capitals safe?

Business

License

Is Fine Capitals A Scam?

Introduction

Fine Capitals is a relatively new player in the forex market, having been established in 2022. Positioned as an online forex broker, it claims to offer a wide range of trading instruments, including forex pairs, commodities, and indices. However, as with any financial service provider, traders must exercise caution and perform due diligence before engaging with Fine Capitals. The forex market is rife with potential scams and unregulated brokers, making it essential for traders to carefully evaluate the legitimacy and safety of their chosen brokers. This article aims to investigate the trustworthiness of Fine Capitals by analyzing its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

One of the primary indicators of a forex broker's trustworthiness is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client interests. Unfortunately, Fine Capitals operates without any valid regulatory oversight, which is a significant red flag for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Fine Capitals is not subject to the scrutiny of any recognized financial authority, such as the UK's Financial Conduct Authority (FCA) or the U.S. Securities and Exchange Commission (SEC). This lack of oversight raises concerns about the broker's operational practices and the potential for fraudulent behavior. Without a regulatory framework, traders have limited recourse in the event of disputes or fund mismanagement, making it crucial to consider whether is Fine Capitals safe for trading.

Company Background Investigation

Fine Capitals Ltd is registered in the United Kingdom, with its office located at 20-22 Wenlock Road, London. However, the broker has a relatively short operational history and lacks transparency regarding its ownership and management structure. The absence of publicly available information about the company's founders and executive team raises questions about its credibility.

The management team's qualifications and experience are critical in assessing the broker's reliability. A well-experienced team can significantly contribute to a broker's operational integrity and customer service quality. Unfortunately, Fine Capitals does not provide sufficient information regarding its management, which further obscures its legitimacy. The company's transparency level, particularly in terms of ownership and operational history, is inadequate, leading to skepticism among potential clients about whether is Fine Capitals safe for trading.

Trading Conditions Analysis

When evaluating a forex broker, one must consider the trading conditions it offers, including fees, spreads, and commissions. Fine Capitals claims to provide competitive trading conditions; however, the lack of regulatory oversight raises concerns about the transparency of its fee structure.

| Fee Type | Fine Capitals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (from 1.2 pips) | 1.0 - 1.5 pips |

| Commission Model | None for Classic Account | $5 - $10 per trade |

| Overnight Interest Range | Unspecified | Varies by broker |

The spreads offered by Fine Capitals start from 1.2 pips, which is slightly higher than the industry average. Additionally, the broker does not disclose any commission fees for its Classic account, which could lead to hidden costs that may arise unexpectedly. Such opacity in fee structures can be a tactic employed by unregulated brokers to lure traders into unfavorable trading conditions, prompting further investigation into whether is Fine Capitals safe for potential investors.

Client Funds Security

The safety of client funds is paramount when selecting a forex broker. Fine Capitals has not established any clear measures to protect client funds, such as segregated accounts or investor protection schemes. Segregated accounts are essential as they separate client funds from the broker's operational funds, providing an extra layer of security in case of financial difficulties.

Moreover, Fine Capitals does not offer negative balance protection, which means that traders could potentially lose more than their initial deposits. This lack of protection raises serious concerns about the safety of funds held with Fine Capitals, making it imperative for traders to evaluate the risks associated with trading with an unregulated broker. The absence of a robust security framework further complicates the question of whether is Fine Capitals safe for trading.

Customer Experience and Complaints

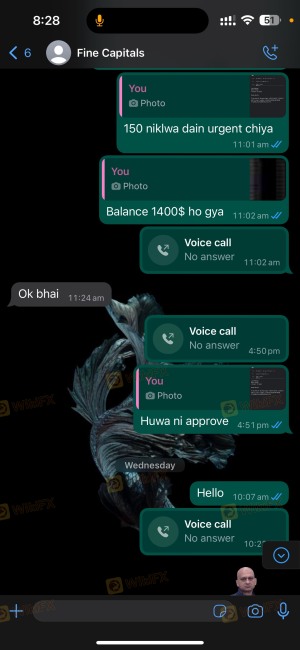

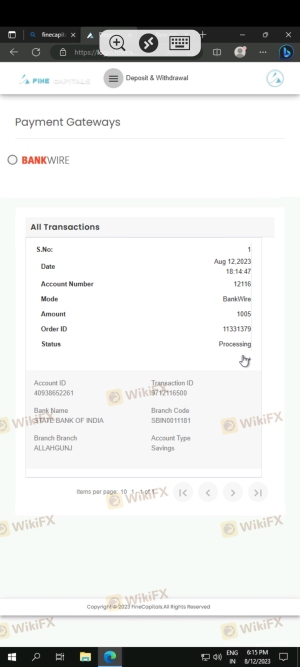

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Reviews of Fine Capitals reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Unclear Fee Structure | High | Inadequate |

Many users have reported difficulties in withdrawing their funds, with some claiming that their withdrawal requests were ignored or delayed indefinitely. Additionally, the overall quality of customer support has been criticized, with many users noting that their inquiries went unanswered. Such patterns of complaints should raise alarm bells for potential traders, as they indicate a lack of responsiveness and accountability, further questioning whether is Fine Capitals safe for trading.

Platform and Execution

The trading platform offered by Fine Capitals is MetaTrader 4 (MT4), a widely recognized trading platform known for its robust features and user-friendly interface. However, the absence of mobile or web-based trading options limits accessibility for traders who prefer flexibility.

In terms of order execution, reports of slippage and rejections have surfaced, which can significantly impact trading performance. The lack of transparency regarding execution quality raises concerns about potential platform manipulation, making it vital for traders to consider the implications of using Fine Capitals for their trading activities.

Risk Assessment

Engaging with Fine Capitals presents several risks that traders should be aware of. The absence of regulation, poor customer feedback, and questionable trading conditions contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential for fund mismanagement and losses |

| Operational Risk | Medium | Issues with customer service and support |

| Market Risk | High | High leverage options increase potential losses |

To mitigate these risks, traders should consider using regulated brokers that offer greater transparency, accountability, and investor protection. Additionally, maintaining a cautious approach and conducting thorough research before committing funds is crucial.

Conclusion and Recommendations

In conclusion, the investigation into Fine Capitals raises significant concerns regarding its legitimacy and safety. The lack of regulation, combined with numerous customer complaints and questionable trading conditions, suggests that traders should exercise extreme caution when considering this broker.

For those seeking to engage in forex trading, it is advisable to choose regulated brokers that provide a transparent operational framework and robust customer support. Alternatives such as brokers regulated by the FCA or ASIC can offer a safer trading environment. Ultimately, the question of whether is Fine Capitals safe remains largely unanswered, leaning towards a cautious "no" based on the available evidence.

Is Fine Capitals a scam, or is it legit?

The latest exposure and evaluation content of Fine Capitals brokers.

Fine Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fine Capitals latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.