FDEX Review 4

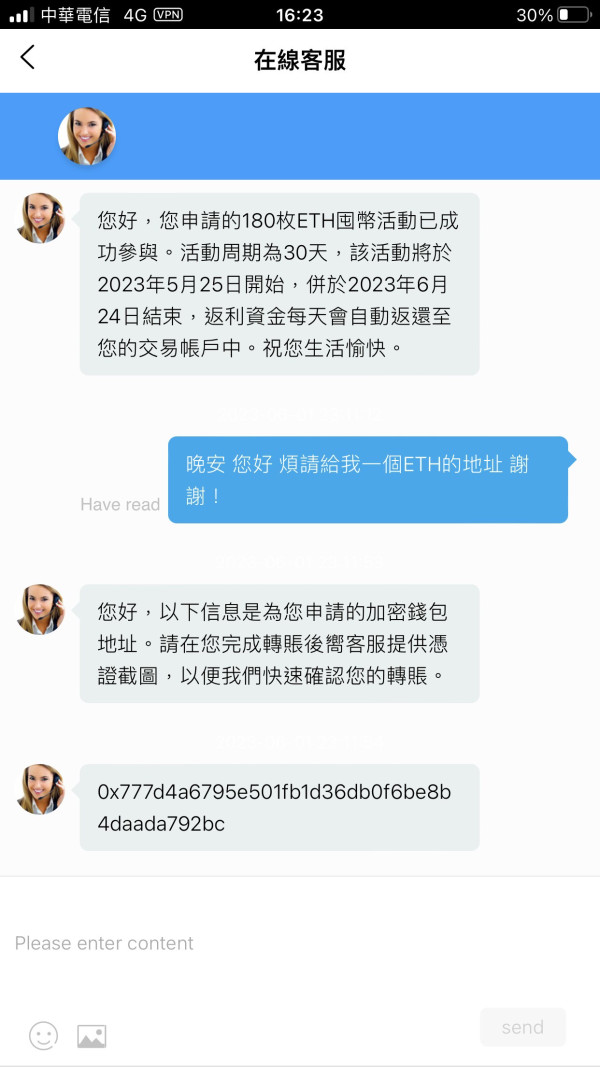

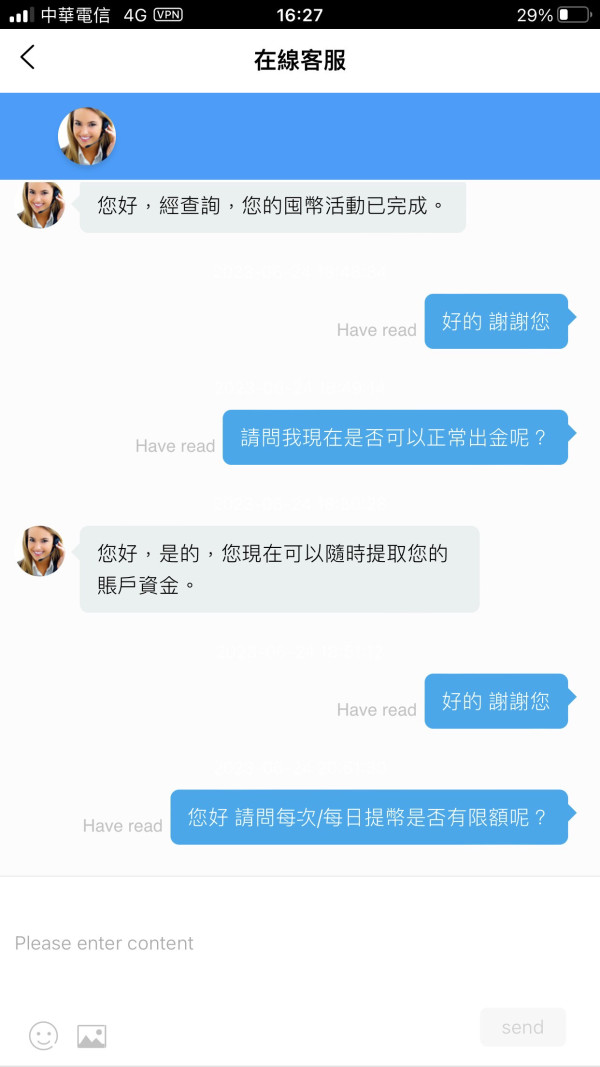

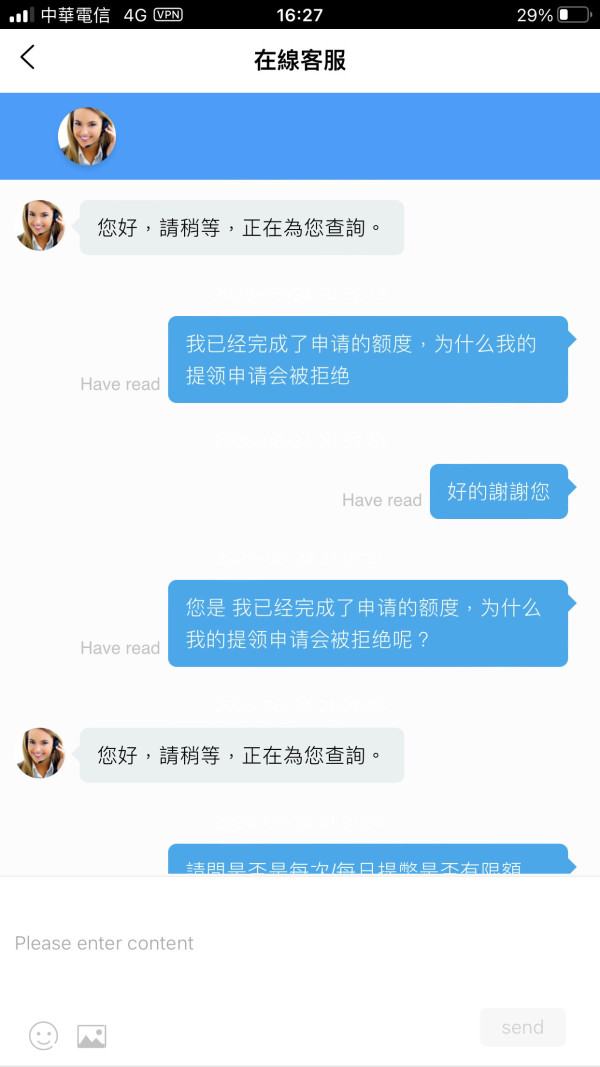

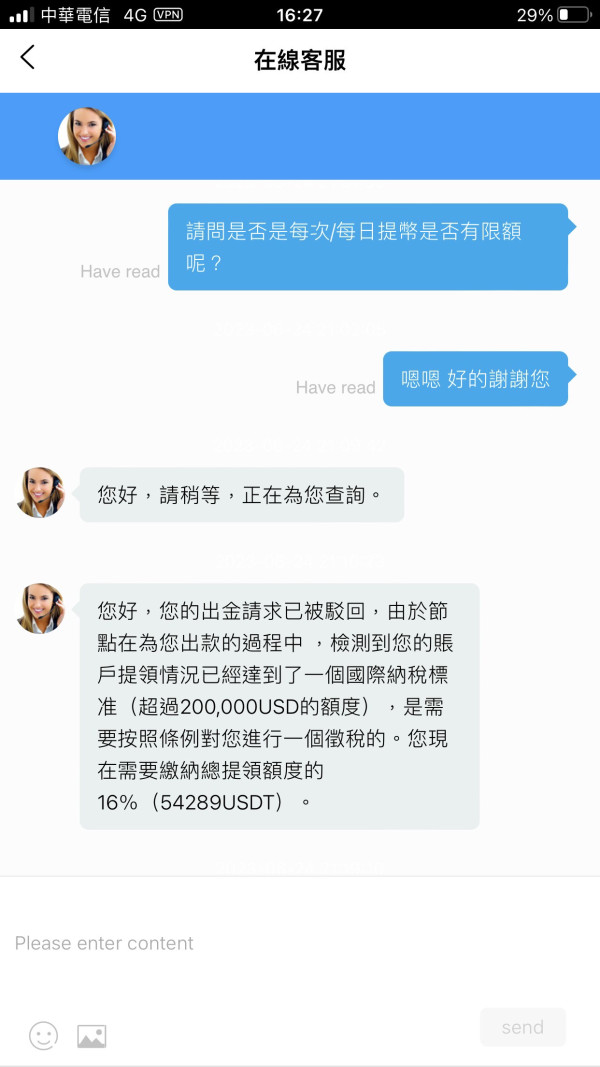

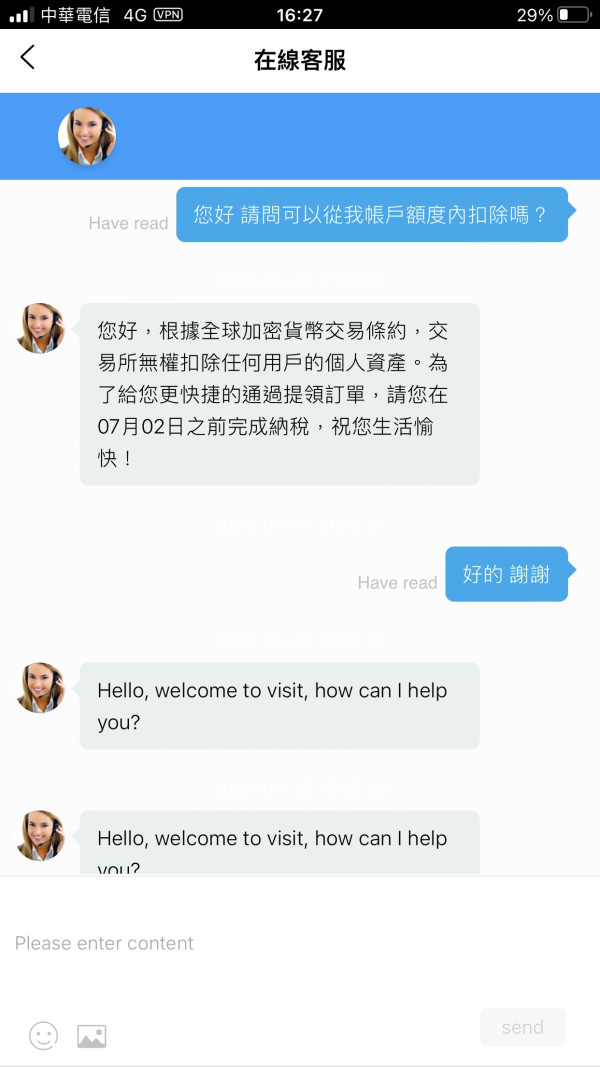

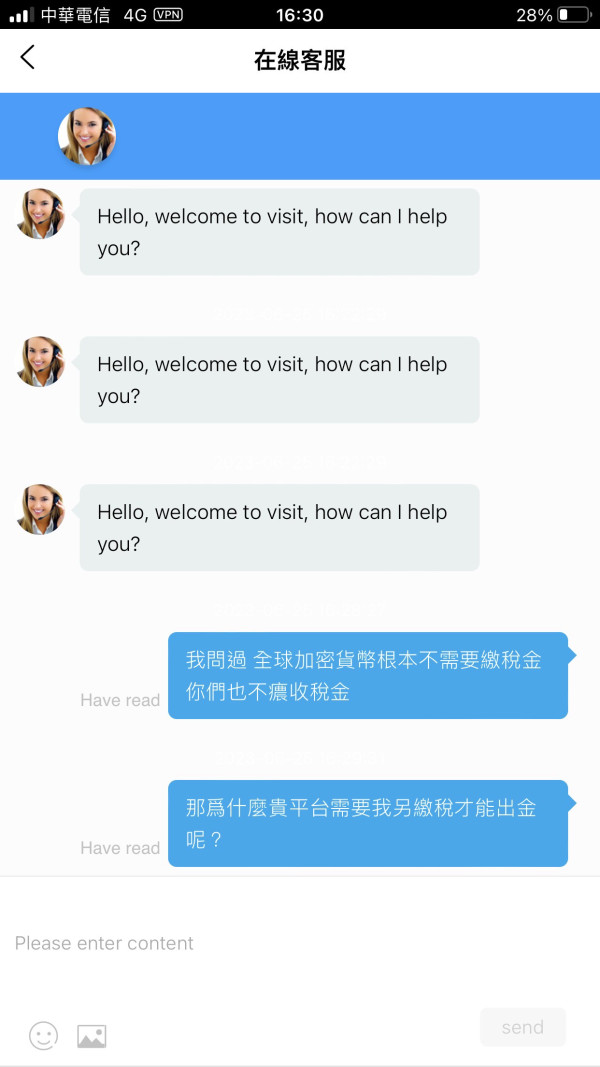

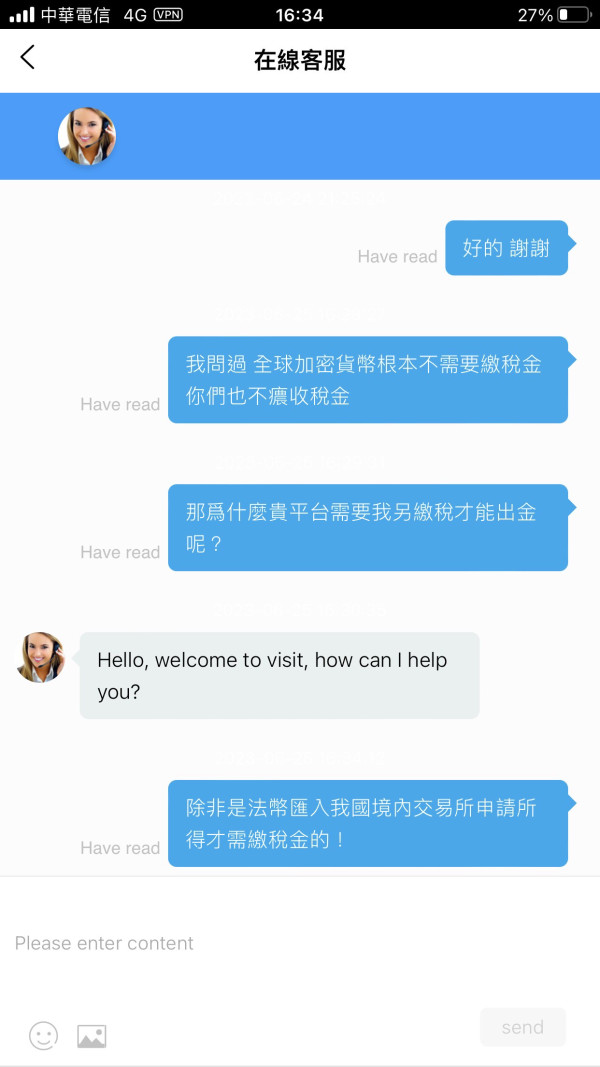

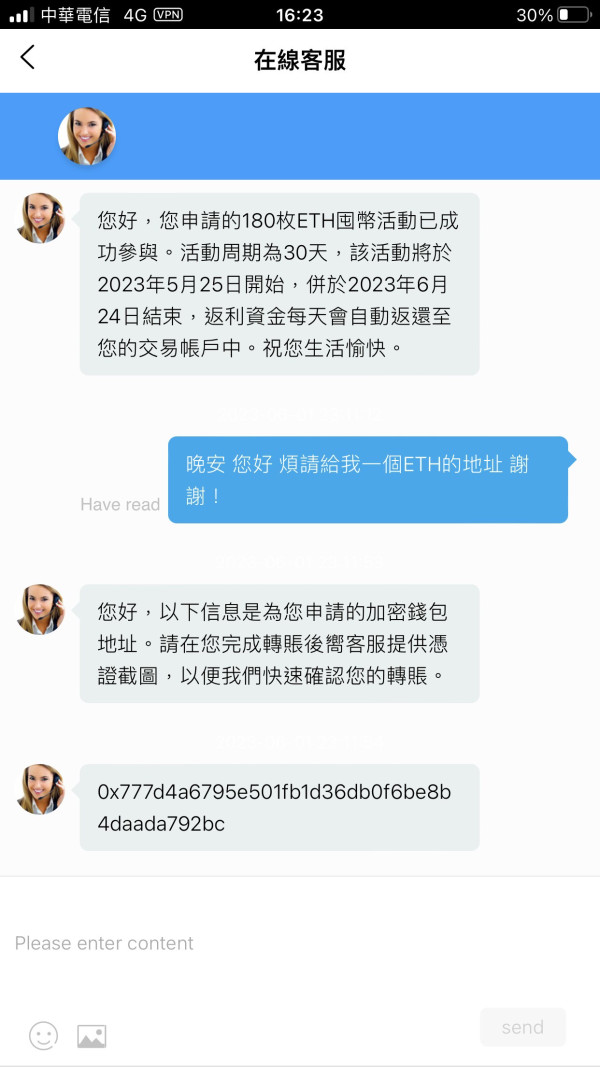

I was squeezed out of bankruptcy by the fraudulent exchange platform! At the end of April this year, I met a netizen on IG who came into contact with this platform. At the beginning, I made a small deposit and made money. Later, my friend bravely suggested that I increase the amount. I kept depositing nearly one million Taiwan dollars to buy USDT and made a little money, and I also applied for withdrawals in the middle, which was normal. Until last month, on May 25, this friend advocated and asked me to participate in the coin hoarding activity of this fraudulent platform. This netizen said. He also participated in the event on the same day. I thought about it for a few days because it was the first contact, and then my friend suggested that I participate in the 180 ETH hoarding activity. I have been advocating that I register as soon as possible, but after I signed up, I asked this netizen how much 180ETH is in USDT. When the netizen told me that my account is 110,000 USDT, there is still a shortfall of 220,000 USDT to complete the event! I was completely dumbfounded before I realized that I still have to make up the amount. The netizen said that he would help me find a way to make up for it. After all, he wanted me to participate in the event. In the past month, I have borrowed money from friends and even sold cars to get loans. A netizen said one after another that he would deposit tens of thousands of USDT for me to complete the event. It was not until June 24th that I finally made up and completed the activity. I asked the customer service of the platform whether I could apply for deposit after completing the activity. The customer service replied that I was sure that I had completed the activity and could apply for withdrawal at any time. Rejected and rejected, I applied for the second time to divide into three withdrawals of 110,000 USDT each, but was still rejected, so I asked the customer service again, and the customer service replied that my account withdrawal exceeds 200,000 USDT according to the international tax standard. 16% of the withdrawal amount ($54,289 USDT)! Now I found out where did this rule come from? The total amount of 180 ETH hoarding activities totaling 339,308 USDT would have been exceeded. (My own part is only 140,000 USDT) I asked a netizen that the exchange required me to pay taxes, and the netizen replied that taxes are normal. It's just that he didn't think about the tax issue! I asked the customer service again if it is possible to deduct from my assets. The customer service said no. According to the global currency encryption treaty, I have to pay taxes before July 2. So I left a message with the customer service and said that I have never heard that the exchange will need to pay taxes. To pay is also remitted into our country to pay taxes to our government! At the moment, I realized that this is simply a fraudulent exchange platform, and this netizen is also a member of a fraudulent group! In order to complete the event, I should sell what I should sell and borrow money from friends everywhere! No money now! One steak is not enough for one layer of skin, and I want to continue to eat up people! Now I have no money, and I am still in debt and they want me to pay taxes. The black-hearted and evil defrauded the exchange to pay me back!

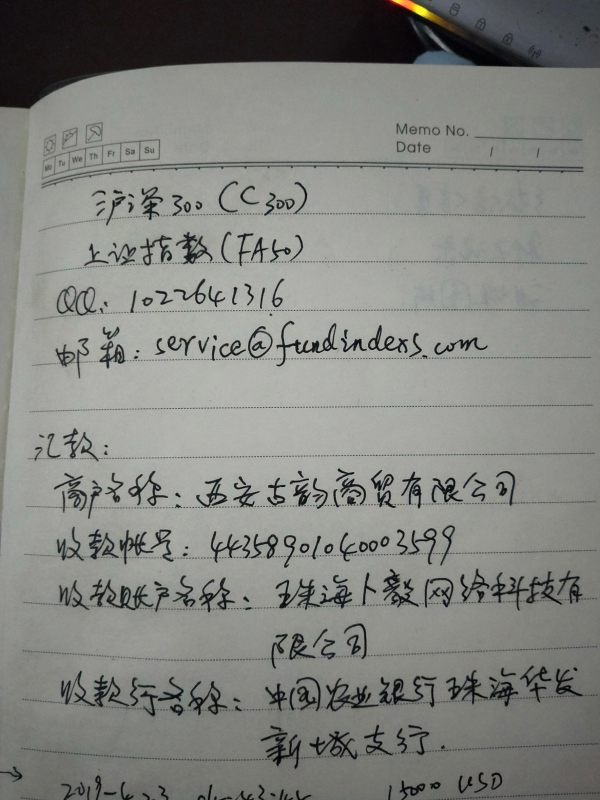

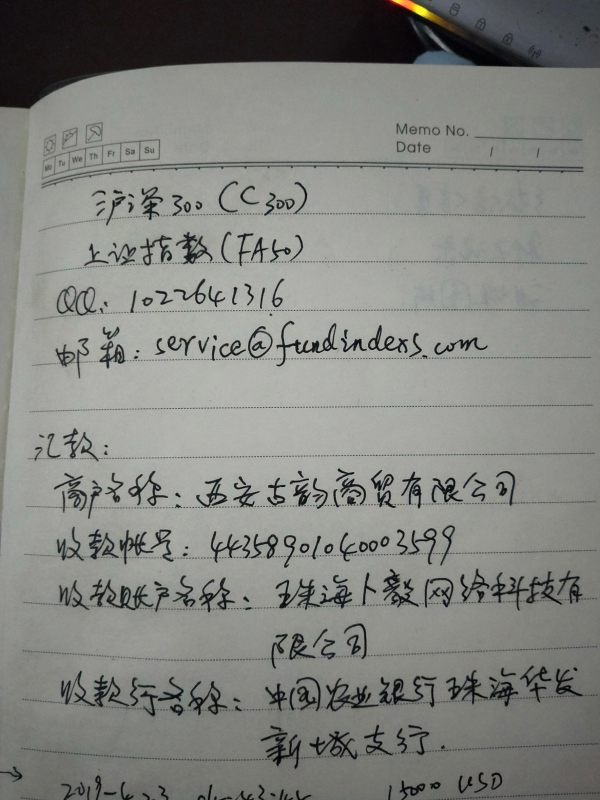

From March to late April in 2019, I’d been taking stock lectures in Wechat group and invested in the platform recommended by those swindlers. Under their guidance, I invested A50 and earned a little at first. Then I increased my investment. In April 30th, I placed an order without closing position. After opening market in May 1st, all my positions were liquidated. Then I called police. This is a scam platform. Now I can’t even open their website.

In this March,I knew that a teacher named Chen he who gave free lessons on stock trading on the internet.I added him and was pulled into a lesson-giving platform named Huixintianxia.I have listened to lessons for 2 months,during which I bought some stocks,earning some money. Then he recommended the MT4 platform of FDEX,saying that profits can be made both in going up-and-down market instead of in a rising market.With the customer service’s instruction,I installed the APP and opened an account,depositing some money into it.Operating on some orders,I made some profits.With his induction of more profits,I deposited $60000 in all.On April 30th,I placed an order of second-hand China 50,without closing position.After May Day,ma account became forced liquidation,owing $17000.When I contacted him,he said that the losses were caused by my improper operation,without setting the stop-loss price.After that,he was out of contact.I called the police on May 9th. Hope you raise your vigilance and avoid being cheated by this platform!!!!

In March, I saw an article on a WeChat’ official account, getting the stock index. Then I applied to join in a QQ group named Guhai Haoqing (it has been dissolved). There are 4 advisers in the group, giving live lessons on stock. They are Hong Tao, Shen Wenbin, Chen Qingquan, Wang Liang and an assistant Li Yue, a commissioner for opening accounts Xiaoya. The live stream studio: "Golden Stone Collection", the website http://zb.rxtbcys.net/3999. At the beginning, they told about stocks. Since I thought their lessons are professional, I trusted Hong Tao. From then, I went to their trap step by step. Later, when Shen Wenbin was in the studio, he deliberately revealed that he guided his friend to invest fa50.f on MetaTrader 4. He said as the stock market was not very good, the stock futures could hedge the stock losses. He added that he had helped his friend gain profits many times. Given that many audiences asked the adviser to guide them too. Hong Tao negotiated with Jinshi Investment’ boss, applying for guiding 1,000 people to trade. In the middle and late April, he started to give advice on a live stream studio. I thought it was very likely to gain profits, so I also opened an account a few days later. I didn't take the chance to make profits before. Later, I followed they every time, but earn a small amount and lost a lot. They ask me not to stop loss. Later, they didn’t give recommendations on the live studio, but on QQ group. I re-entered the group named platinum assault camp. Later, I lost a lot and decided not to follow them. On August 1st, I applied for withdrawing 6240. US dollars. So far the money has not arrived. The platform has run away. I am very miserable, with a cumulative loss of more than 160,000