USDC 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

The USDC Investment platform emerges as an intriguing proposition for experienced traders seeking diverse trading opportunities across various asset classes, including forex, indices, commodities, stocks, and cryptocurrencies. However, serious concerns surrounding its regulatory environment and user experiences cast doubt on the overall viability of investing through this broker. Market analysis indicates that, despite appealing trading conditions, potential investors should proceed with caution given the alarming number of negative reviews from active users. For seasoned traders, USDC Investment may hold potential—but only if they are willing to assume considerable risks without adequate regulatory protections and customer support. This review aims to equip investors with crucial insights into USDC's operations, emphasizing the importance of conducting thorough due diligence before monetary commitment.

⚠️ Important Risk Advisory & Verification Steps

Investing in USDC Investment poses significant risks, including:

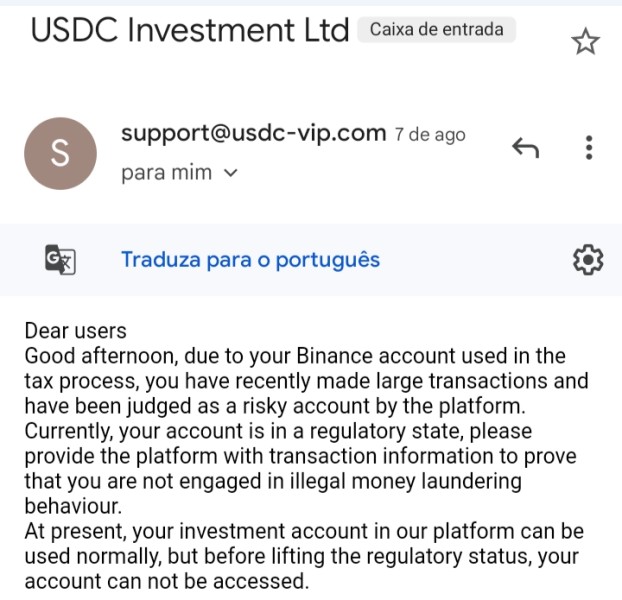

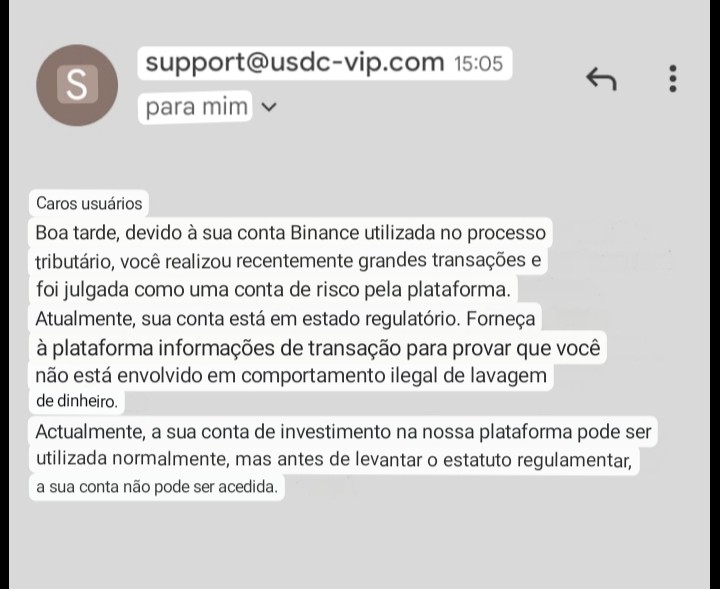

- Unregulated Status: USDC operates without valid regulatory oversight, exposing investors to potential financial loss and fraud.

- Negative User Experiences: Many customers report severe issues related to fund withdrawals and unresponsive customer service, raising alarms about trustworthiness.

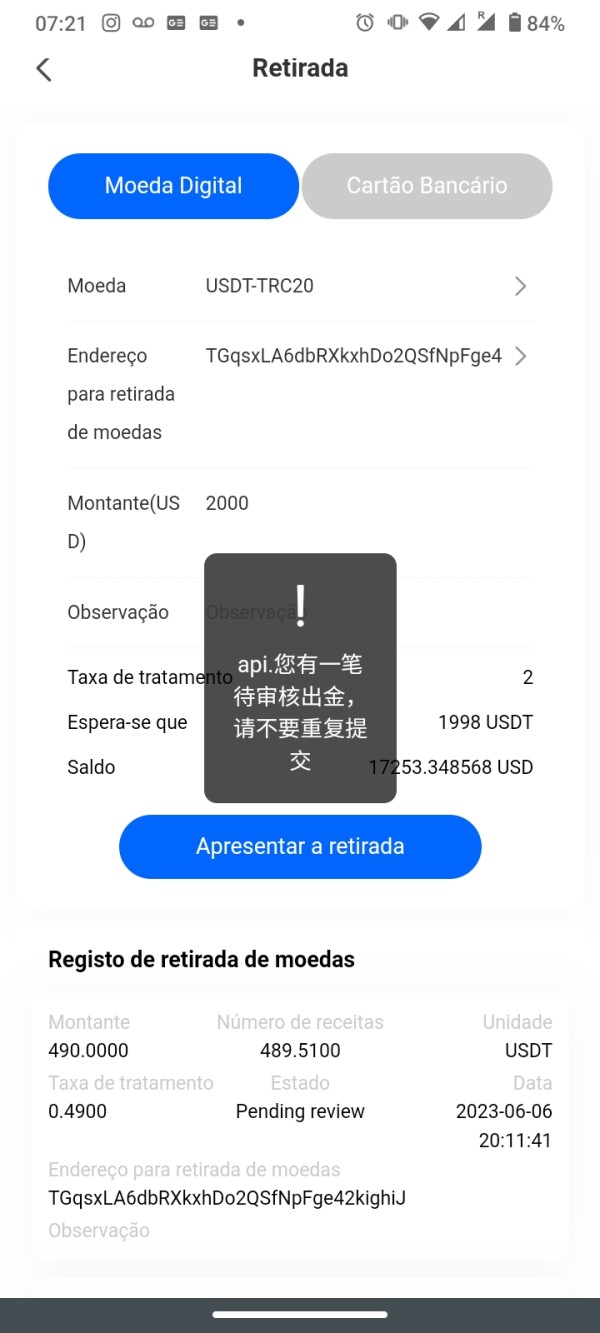

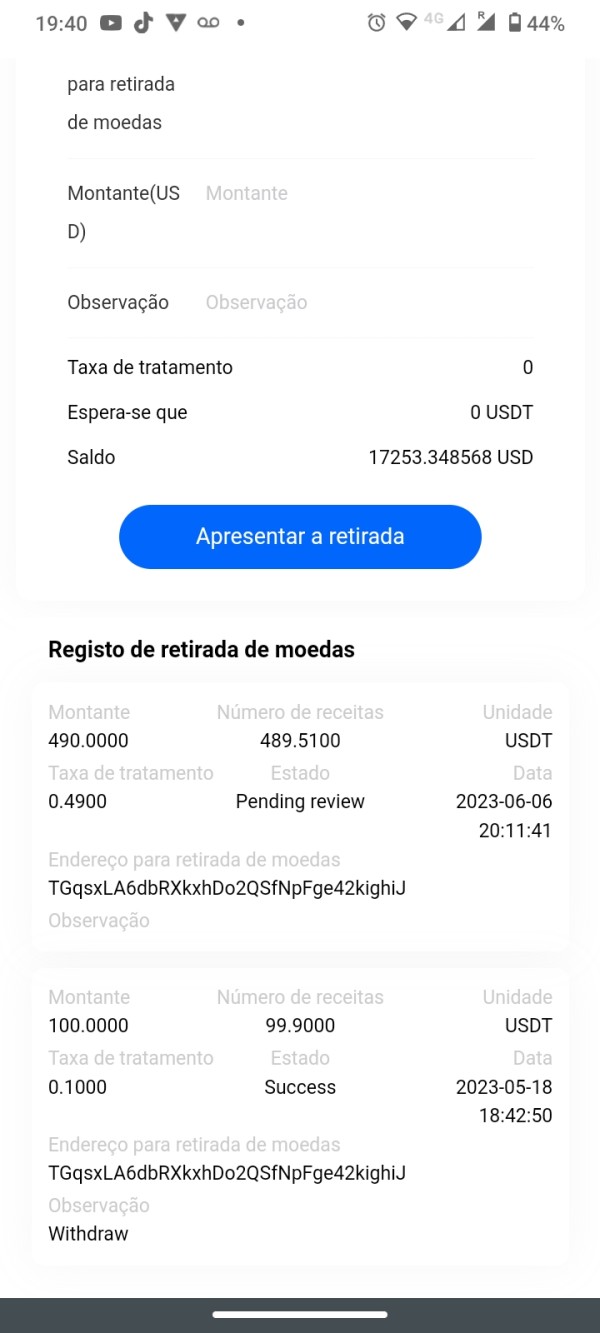

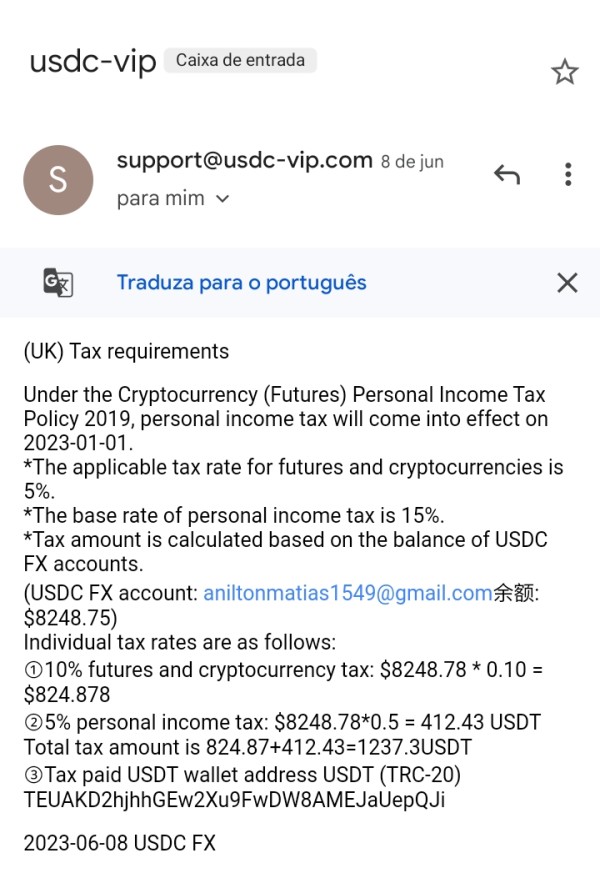

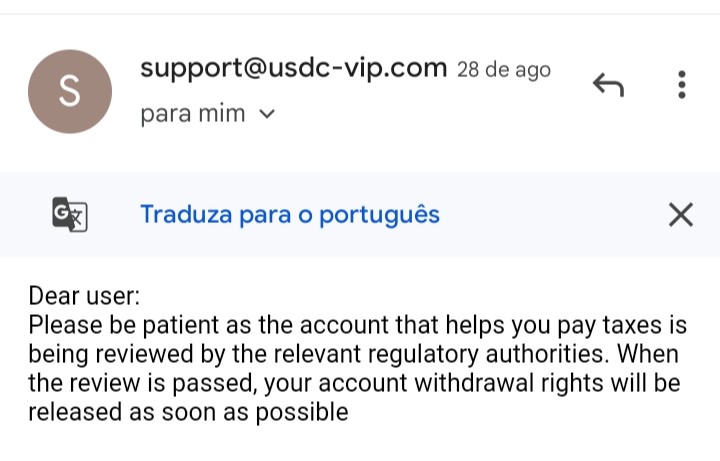

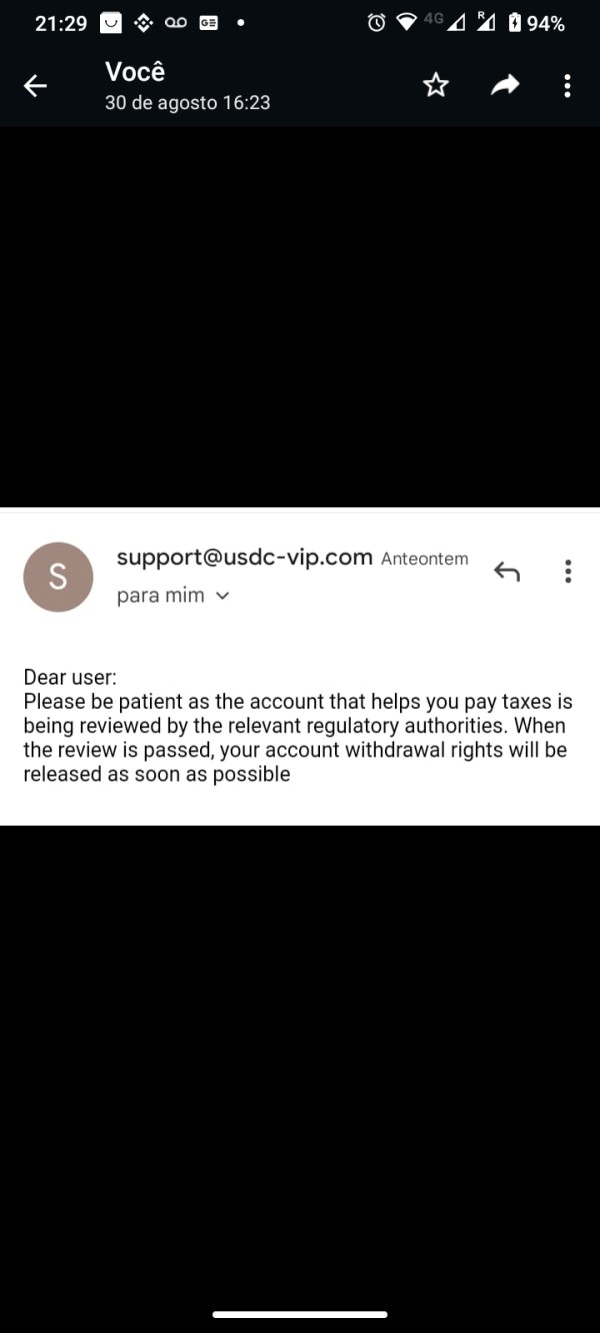

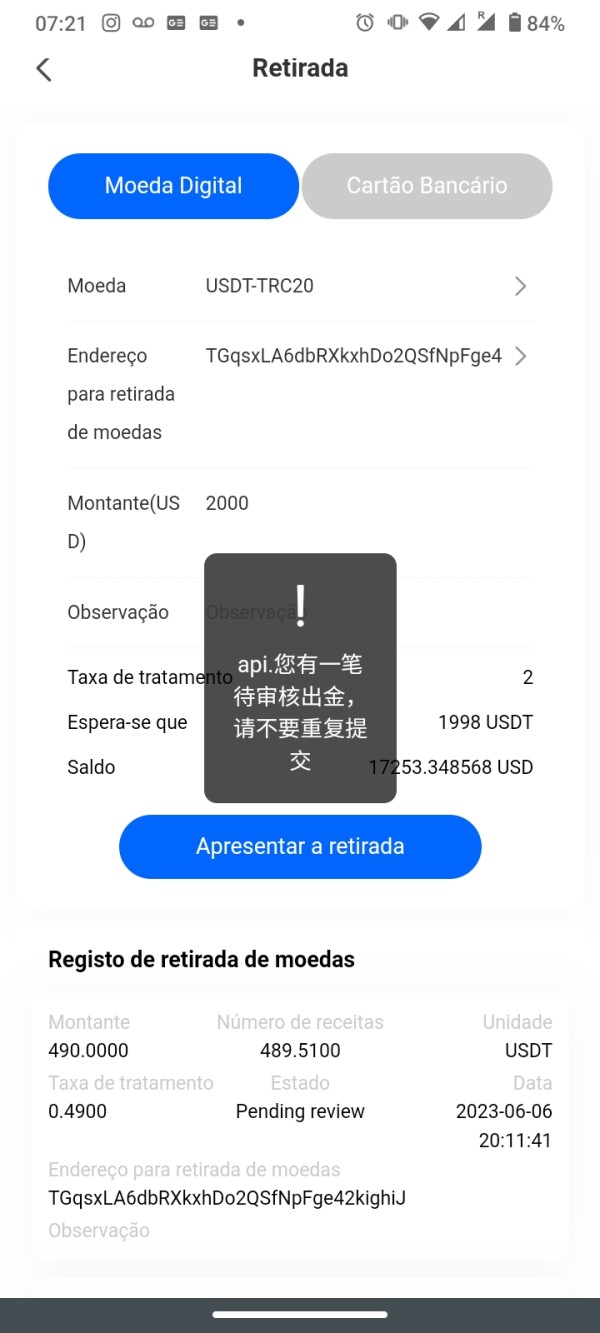

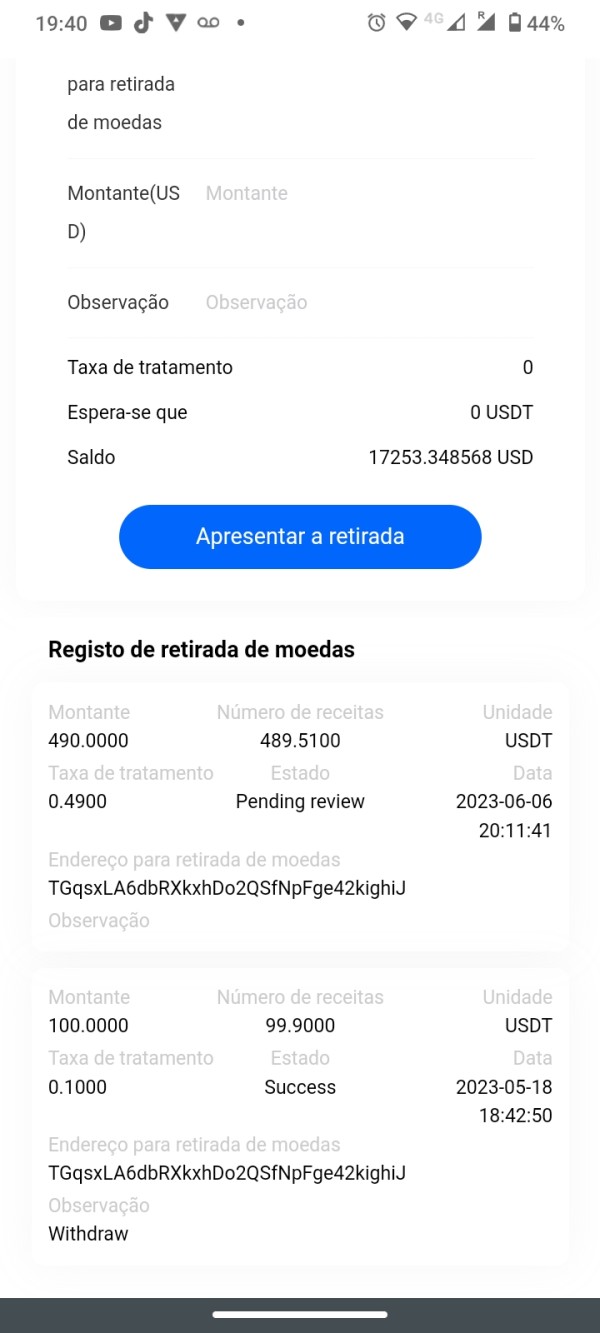

- Pressure Tactics: Complaints highlight tactics that urge users to deposit additional funds before they can access their own money.

Self-Verification Steps:

- Check Regulatory Claims: Use official websites, such as those from the Financial Conduct Authority (FCA) or the National Futures Association (NFA), to verify claims of regulatory endorsement.

- Monitor User Reviews: Search multiple review platforms like Trustpilot and SiteJabber for the latest user experiences and complaints about USDC Investment.

- Assess Technological Security Features: Analyze the platforms security measures, including encryption standards, to ensure personal data and funds remain protected.

Rating Framework

Broker Overview

Company Background and Positioning

USDC Investment is a relatively new brokerage established between 2021 and 2023, with its claimed headquarters in the United Kingdom. Despite the assertion of being a credible broker, its regulation status remains dubious, as no verifiable licenses have been found across major regulatory bodies. The company purports to offer a myriad of trading instruments, yet its operational credibility is undermined by the plethora of negative feedback from users alleging unfulfilled promises.

Core Business Overview

USDC operates primarily as an online trading platform allowing clients access to diverse financial markets, including forex, commodities, and cryptocurrencies. While it claims affiliation with regulatory authorities like the National Futures Association (NFA), thorough searches yield no confirmations of its legitimacy. Additionally, the broker has not made its account types and tiered services transparent, heightening the overall risk associated with using its platform.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

USDC Investments claims of regulatory backing present significant discrepancies. The absence of valid regulatory oversight raises considerable alarm regarding the protection of client funds and overall trustworthiness. Investors are advised to scrutinize claims made on the broker's website closely, cross-referencing with official databases.

Regulatory Information Conflicts

Recent investigations have exposed that USDC claims affiliation with the NFA; however, inquiries reveal that USDC lacks a forex license and valid authorizations to operate.

User Self-Verification Guide

To verify USDCs regulatory claims:

Navigate to the NFA website or the equivalent regulatory body in your jurisdiction.

Use their search tools to search for USDC or any associated brand.

If no verification is received, consider further investigations into the broker or avoid trading with them altogether.

Industry Reputation and Summary

The general consensus among user feedback indicates an overwhelmingly negative sentiment, underscoring the necessity of due diligence in assessing fund safety before investing with USDC.

Trading Costs Analysis

While USDC touts competitive commission structures appealing to leverage-seeking traders, it is essential to assess the entire cost landscape.

Advantages in Commissions

USDC promotes a trading model with negligible commissions, which can be enticing for traders who favor lower upfront costs when transacting.

The "Traps" of Non-Trading Fees

Nonetheless, numerous customer submissions highlight burdensome withdrawal fees and hidden costs that can quickly negate the benefits of low trading commissions:

"I was asked to pay a withdrawal fee of $30, which was unexpectedly high compared to my initial expectations." - A user review

- Cost Structure Summary

While the low trading costs may appeal to short-term traders, the substantial charges upon withdrawal are a deterrent and necessitate caution from potential investors.

The technology offered by USDC Investment plays a crucial role in user experience.

Platform Diversity

USDC provides access to platforms such as MT4 and MT5. These are well-known within the trading community for their reliability and functionalities; however, they are not proprietary to USDC itself.

Quality of Tools and Resources

Despite offering charting and analytical capabilities, many users have reported that educational resources are lacking:

"There were no tutorials or helpful guides on how to utilize the platform effectively, rendering it frustrating for newcomers." - User feedback

- Platform Experience Summary

Overall, the user feedback suggests a disappointing experience characterized by usability issues and insufficient technical support.

User Experience Analysis

User experience at USDC is deeply intertwined with customer service quality.

- Customer Service Deficiencies

Users have expressed frustration over inadequate support channels:

"It seemed impossible to get in contact with anyone when I had urgent questions about my account."

Insights from Customer Reviews

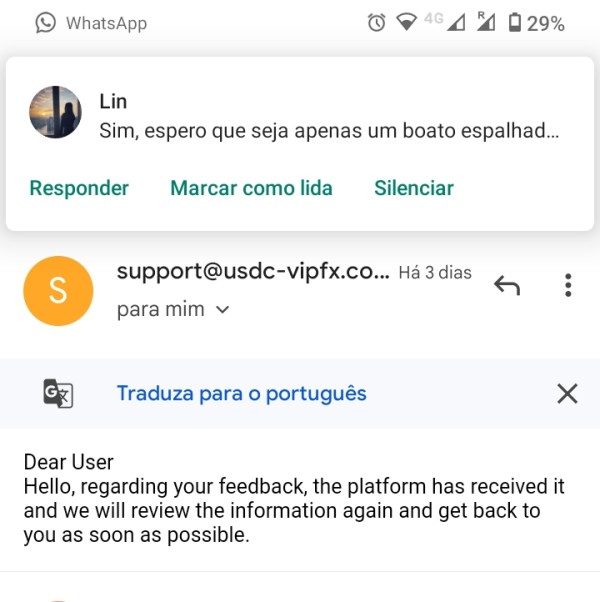

The repetitive themes in negative reviews highlight problems not just in withdrawal processes, but also in receiving timely and relevant assistance from customer support.

User Experience Summary

The prevailing sentiment is one of disappointment, prompting warnings against banking on USDC for any level of critical customer interactions.

Customer Support Analysis

Customer support channels are crucial for any investor seeking assistance.

Support Availability

USDC limits their avenues for customer support, offering only email and live chat options.

Feedback on Services

Feedback illustrates systemic failures:

"Whenever I tried to reach out, there were delays, and many of my queries went unanswered."

- Overall Assessment of Support

Unfortunately, the user experiences reinforce skepticism regarding USDCs ability to provide efficient and effective customer resolution pathways.

Account Conditions Analysis

Understanding account types, fees, and other conditions is fundamental.

Transparency Issues

The broker has not fully disclosed information about account types, spreads, or any promotional offers.

User Insights

Many traders have voiced concerns over seemingly hidden terms that negatively impact their experience, representing another warning signal for potential investors.

Account Conditions Summary

The lack of transparency surrounding account management further exacerbates the skepticism associated with USDC Investment.

Conclusion

In summary, while USDC Investment offers attractive trading opportunities through a variety of asset classes, the significant lack of regulatory oversight, coupled with negative user experiences, makes it a high-risk option for investors. Individuals interested in using this platform must be wary of potential pitfalls and should conduct thorough research or consider alternative platforms that provide stronger regulatory assurances and customer support. Caution is paramount when engaging with USDC Investment; understanding the landscape is vital to safeguarding your financial interests.