Elan Financial 2025 Review: Everything You Need to Know

Executive Summary

This elan financial review gives you a complete look at Elan Financial Services. The company is part of U.S. Bank and mainly helps smaller banks and credit unions with credit cards. Elan Financial works from Pittsburgh, Pennsylvania, and has built a strong reputation in specialized banking services. Our review shows big gaps in information about forex trading, rules for retail trading, and trading details that clients would want from a regular broker.

WalletHub shows that Elan Financial Services has 425 user ratings with 2.5 stars. This means customers have mixed experiences with the company. The company focuses on credit card services instead of forex or CFD trading, which makes us question if it works well for retail traders. Senior Vice President Peter Klukken leads the team with 25 years of financial services experience, bringing solid industry knowledge, but we don't see specific trading credentials in the available information.

We think potential users should be careful with this platform. The company lacks clear information about trading conditions, rules for retail trading, and customer protection that forex brokers usually provide.

Important Notice

Regional Entity Differences: This review uses public information about Elan Financial Services. The company's regulatory status for forex trading in different areas is not clearly explained in available documents, which may greatly affect service availability and investor protection for users in various regions.

Review Methodology: This evaluation comes from public data sources, user feedback platforms, and company information. Some parts of this review may not cover all possible services or features because specific trading details are limited.

Rating Framework

Broker Overview

Elan Financial Services works as a special division of U.S. Bank. The company mainly helps smaller financial institutions with credit card programs instead of offering direct forex or trading services to consumers. This makes Elan Financial Services different in the financial services world because it works more as a business-to-business service provider than a regular retail broker.

The company's leadership shows its focus on traditional banking services. Senior Vice President Peter Klukken has 25 years of financial services experience, including past roles at Fiserv, while Senior Vice President Matt Carpenter has spent 25 years specifically with Elan Financial Services in finance, business development, and strategy roles. This experienced management team shows the company is stable, though their backgrounds seem more connected to traditional banking rather than forex trading services.

Available information does not specify when the company started trading services, what trading platforms they offer, or what assets traders can usually expect from forex brokers. The lack of this basic information creates concerns about the company's position as a retail trading provider and suggests potential users should ask the company directly about available trading services.

Regulatory Jurisdictions: Specific regulatory information for forex trading activities is not detailed in available materials. This creates a big concern for potential trading clients who want regulatory protection.

Deposit and Withdrawal Methods: Available documents do not specify supported payment methods, processing times, or fees for trading account funding and withdrawals.

Minimum Deposit Requirements: No information is available about minimum deposit amounts for trading accounts or different account tier requirements.

Promotional Offers: Current bonus structures, welcome promotions, or trading incentives are not detailed in accessible company materials.

Tradeable Assets: The range of forex pairs, CFDs, commodities, or other trading instruments is not specified in available documentation.

Cost Structure: Important information about spreads, commissions, overnight fees, and other trading costs is not provided in accessible materials. This makes cost comparison impossible.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available company information.

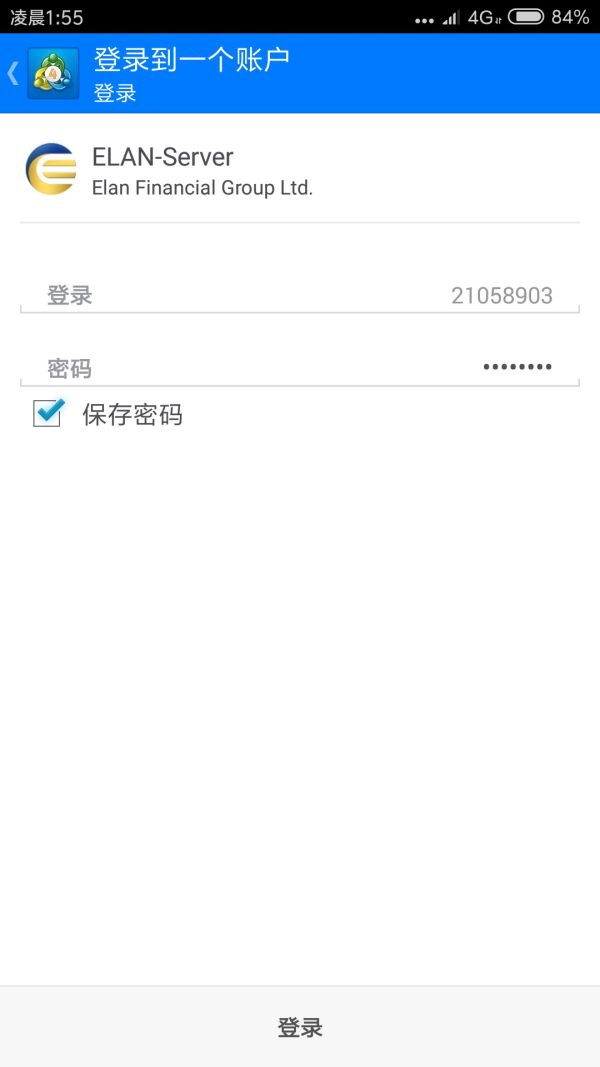

Platform Options: Details about trading platforms, mobile applications, or web-based trading interfaces are not available in current documentation.

Geographic Restrictions: Service availability by country or region is not clearly outlined in accessible materials.

Customer Support Languages: Supported languages for customer service are not specified in available information.

This elan financial review shows the big information gaps that potential trading clients would need answered before considering the platform for forex or CFD trading activities.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The review of Elan Financial Services' account conditions shows big information problems that hurt the assessment. No specific details are available about account types, tier structures, or minimum deposit requirements that you would typically expect from a forex broker. The lack of information about Islamic accounts, professional trading accounts, or beginner-friendly options makes it impossible to determine if the platform works for different trader types.

Account opening procedures, required documents, and verification processes are not detailed in available materials. This lack of transparency creates concerns about the user onboarding experience and compliance procedures. Also, no information is provided about account maintenance fees, inactivity charges, or other account-related costs that traders would need to consider.

The company focuses on credit card services for partner institutions, which suggests that individual trading accounts may not be a main offering. This could explain why detailed account condition information is missing. However, this creates uncertainty for potential clients who want traditional forex trading services.

Without clear account structure information, potential users cannot make smart decisions about whether elan financial review standards meet their trading needs or financial abilities.

The assessment of trading tools and resources available through Elan Financial Services shows minimal information about capabilities that traders would expect from a modern forex broker. Research and analysis resources such as market commentary, economic calendars, technical analysis tools, or fundamental analysis reports are not clear in available documentation.

Educational resources are crucial for trader development but appear to be missing or not prominently featured. No information is available about webinars, trading tutorials, market analysis videos, or educational content that would support both new and experienced traders. This absence is particularly concerning given how important trader education is in the current regulatory environment.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or API access for institutional clients, is not mentioned in accessible materials. The lack of advanced trading tools such as sentiment indicators, volatility measures, or sophisticated charting capabilities further limits the platform's appeal to serious traders.

The overall impression suggests that Elan Financial Services may not prioritize the comprehensive tool suite that competitive forex brokers typically offer. This potentially limits its effectiveness for active trading strategies.

Customer Service and Support Analysis (4/10)

Customer service evaluation for Elan Financial Services presents a mixed picture based on available user feedback data. WalletHub reports indicate 425 user ratings with an overall 2.5-star rating, suggesting significant room for improvement in customer satisfaction. This large volume of reviews indicates an active customer base, though the moderate rating suggests inconsistent service experiences.

Available information does not specify customer service channels, operating hours, or response time commitments that would allow for comprehensive service quality assessment. The absence of information about live chat availability, phone support hours, or email response guarantees makes it difficult for potential clients to understand support accessibility.

Multilingual support capabilities are not detailed in accessible documentation, which could be a significant limitation for international clients. Also, no information is available about dedicated account managers, priority support for higher-tier accounts, or specialized trading support services.

The customer feedback volume suggests operational scale, but the moderate satisfaction rating indicates that service quality improvements may be necessary to meet competitive standards in the forex brokerage industry.

Trading Experience Analysis (3/10)

The evaluation of trading experience at Elan Financial Services faces significant limitations due to the absence of detailed information about trading platforms, execution quality, and overall trading environment. Platform stability and execution speed data are not available in accessible documentation, making it impossible to assess critical factors that directly impact trading success.

Order execution quality, including information about slippage rates, requotes frequency, or execution statistics, is not provided in available materials. This absence of transparency about execution standards creates uncertainty for potential clients, particularly those engaged in scalping or high-frequency trading strategies where execution quality is paramount.

Mobile trading capabilities and platform functionality details are not specified, limiting the ability to assess the platform's suitability for modern trading approaches that require mobile accessibility. Also, no information is available about platform customization options, advanced order types, or professional trading features.

The overall trading environment assessment is hampered by the lack of information about market access, liquidity providers, or trading conditions that would typically be transparent in a competitive forex brokerage offering. This elan financial review suggests potential clients would need to seek additional information directly from the company.

Trust and Security Analysis (2/10)

Trust and security evaluation reveals concerning gaps in publicly available information about regulatory compliance and investor protection measures. Regulatory authorization for forex trading activities is not clearly specified in accessible documentation, which represents a fundamental concern for potential trading clients seeking regulatory protection.

Fund security measures, including segregated account policies, investor compensation schemes, or third-party fund custody arrangements, are not detailed in available materials. This absence of security information creates significant uncertainty about client fund protection, which is a critical consideration for forex trading activities.

Company transparency about ownership structure, financial statements, or regulatory reporting is limited in accessible documentation. While the company operates as a division of U.S. Bank, specific regulatory oversight for trading activities is not clearly outlined, creating potential confusion about applicable investor protections.

The lack of information about negative balance protection, dispute resolution procedures, or regulatory complaint mechanisms further adds to trust concerns. Without clear regulatory framework disclosure, potential clients cannot properly assess the safety and legitimacy of trading services.

User Experience Analysis (5/10)

User experience assessment for Elan Financial Services shows moderate engagement levels but concerning satisfaction indicators. The 425 user ratings on WalletHub demonstrate substantial customer interaction, suggesting operational scale and active service delivery. However, the 2.5-star average rating indicates significant user experience challenges that impact overall satisfaction.

Interface design and usability information is not available in accessible documentation, making it impossible to assess the quality of user interaction with trading platforms or account management systems. Registration and verification process details are similarly absent, creating uncertainty about the user onboarding experience.

Account funding and withdrawal experiences are not detailed in available user feedback, limiting the ability to assess financial transaction efficiency and user satisfaction with money management processes. This absence of operational feedback makes it difficult to understand practical aspects of platform usage.

Common user complaints and satisfaction drivers are not clearly identified in available documentation, though the moderate rating suggests mixed experiences. The lack of detailed user experience data indicates that potential clients should seek additional feedback sources or direct platform testing before committing to trading services.

Conclusion

This elan financial review reveals a complex picture of a financial services company that appears to focus primarily on credit card services for institutional partners rather than direct retail forex trading. The significant absence of information about trading conditions, regulatory oversight, and platform capabilities raises substantial concerns about the suitability of Elan Financial Services for traditional forex trading activities.

The platform may be most appropriate for clients seeking credit card services through partner banks and credit unions, which aligns with the company's apparent business model. However, for individuals seeking comprehensive forex trading services, the lack of transparent information about spreads, platforms, regulation, and trading conditions suggests this may not be an optimal choice.

Key limitations include the absence of clear regulatory information for trading activities, lack of detailed trading condition disclosure, and insufficient transparency about platform capabilities and security measures. While the company's association with U.S. Bank provides some institutional credibility, the specific protections and services for retail trading clients remain unclear based on available information.