Exchange 2025 Review: Everything You Need to Know

Executive Summary

This exchange review gives you a complete look at cryptocurrency trading platforms. Our research shows mixed results for these exchange platforms, especially those focused on crypto trading. These platforms mainly target people who love cryptocurrency and want fast, reliable, and clear trading experiences.

N.exchange calls itself "a fast, reliable and completely transparent cryptocurrency exchange built by crypto enthusiasts for crypto enthusiasts." But our research shows big gaps in information about rules, trading details, and user support systems. We stay neutral because there isn't enough information that traders need to make smart choices.

The exchange platforms seem to focus only on cryptocurrency trading and offer digital asset trading features. However, they don't give enough details about forex trading, following rules, or customer service, which makes it hard for users who want well-documented trading places.

Important Notice

This review uses public information, user feedback, and market research to give traders honest insights into exchange platforms. We use many sources to make sure we cover both good and bad points about these platforms.

We should note that we couldn't find information about differences between regions. Traders should check the rules and locations themselves before using any exchange platform. This review gives you facts while pointing out areas where detailed information is missing.

Rating Framework

Broker Overview

Exchange platforms in the cryptocurrency space have become special trading places designed for the growing digital asset community. The N.exchange platform markets itself as a solution built by cryptocurrency fans for cryptocurrency fans, focusing on speed, reliability, and transparency as main principles. However, background information like when they started and detailed company histories are not shared in available materials.

The business model focuses on cryptocurrency trading services, though specific details about platform design, technology, and operations are not well documented. The platforms seem to focus only on digital asset trading rather than traditional forex or stock trading, which represents a specialized approach to financial services.

About rules and compliance, the available information doesn't give detailed disclosure of main regulatory authorities or licensing locations. This represents a big information gap for traders seeking complete understanding of regulatory protections and compliance standards. The asset class focus stays clearly on cryptocurrencies, though specific trading pairs and supported digital assets need more investigation through direct platform contact.

Regulatory Regions: Available sources don't specify particular regulatory locations or oversight authorities governing the exchange operations. This lack of regulatory transparency creates concerns for traders seeking regulated trading environments.

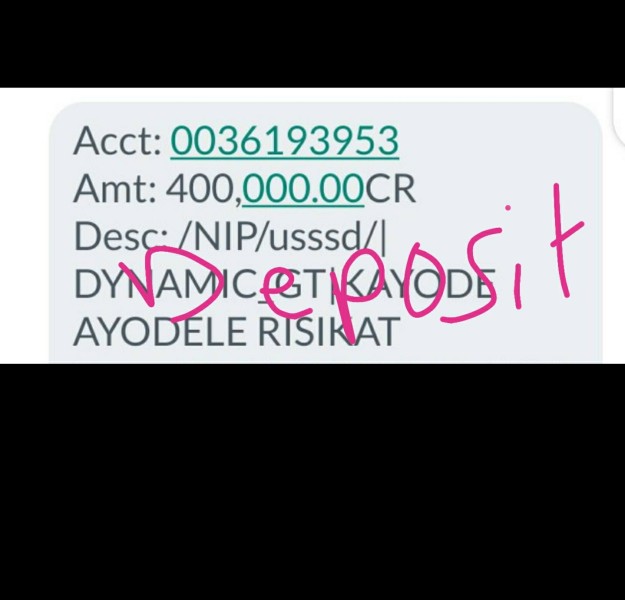

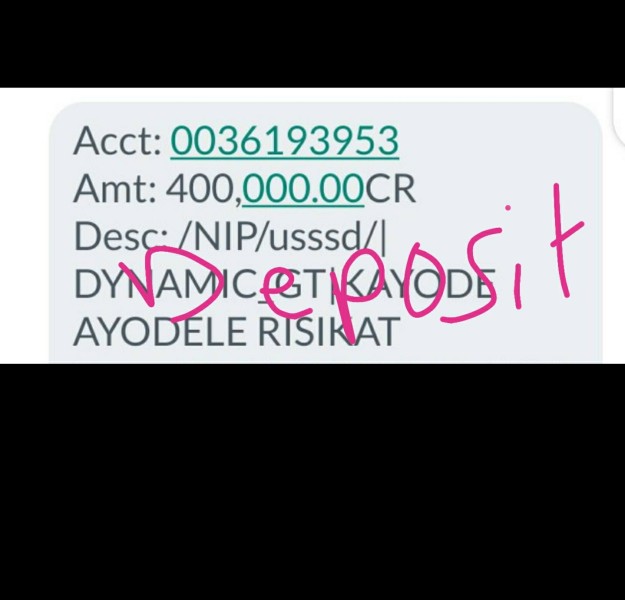

Deposit and Withdrawal Methods: Specific information about supported deposit and withdrawal methods, including regular currency options and cryptocurrency transfer capabilities, is not detailed in current available materials.

Minimum Deposit Requirements: Minimum deposit amounts and account funding requirements are not specified in the accessible information, requiring direct platform inquiry for accurate details.

Bonus Promotions: Information about promotional offers, trading bonuses, or incentive programs is not available in the current exchange review materials.

Tradeable Assets: The platforms focus on cryptocurrency trading, though specific digital assets, trading pairs, and supported cryptocurrencies need verification through direct platform access.

Cost Structure: Detailed fee schedules, including trading commissions, spread information, and additional charges, are not completely outlined in available documentation. This represents a big information gap for cost-conscious traders.

Leverage Ratios: Leverage availability and maximum leverage ratios for cryptocurrency trading are not specified in current materials.

Platform Options: Specific trading platform software, mobile applications, and web-based trading interfaces need direct investigation through platform access.

Regional Restrictions: Geographic limitations and restricted locations are not detailed in available information.

Customer Service Languages: Supported languages for customer service and platform interfaces are not specified in current materials.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of account conditions for exchange platforms shows big information limitations that impact our ability to give complete evaluation. Available sources don't detail specific account types, their features, or the differences between various account levels that might be available to traders.

Minimum deposit requirements, which represent crucial information for potential traders, stay unspecified in current materials. This lack of transparency about entry-level funding requirements creates uncertainty for traders trying to evaluate platform accessibility. The account opening process, including verification requirements, documentation needs, and approval timeframes, is not detailed in available sources.

Special account features, such as Islamic-compliant trading options, professional trader accounts, or institutional trading facilities, are not mentioned in current documentation. This exchange review cannot give specific guidance on account condition suitability without access to complete account specification details.

User feedback about account setup experiences, funding processes, and account management capabilities is not available in current source materials. The absence of detailed account condition information represents a big limitation in evaluating platform suitability for different trader categories.

The evaluation of trading tools and analytical resources shows limited detailed information about specific capabilities offered by exchange platforms. While N.exchange claims to provide transparent trading environments, the specific tools, indicators, and analytical resources available to traders are not completely documented.

Research and analysis resources, including market data feeds, price charts, technical analysis tools, and fundamental analysis support, need direct platform investigation to assess properly. Educational resources, such as trading guides, market analysis, and cryptocurrency education materials, are not detailed in available information.

Automated trading support, including API access, algorithmic trading capabilities, and third-party integration options, represents important functionality for advanced traders but stays undocumented in current materials. The absence of detailed tool specifications limits our ability to assess platform suitability for different trading strategies and experience levels.

User feedback about tool effectiveness, resource quality, and platform capabilities for technical analysis is not available in current source materials. This limits our ability to provide user-experience-based assessments of platform tools and resources.

Customer Service and Support Analysis

Customer service evaluation shows big information gaps about support infrastructure, availability, and service quality metrics. Available sources don't detail specific customer service channels, such as live chat, email support, phone assistance, or help desk systems.

Response time metrics, which represent critical service quality indicators, are not documented in available materials. Service quality assessments, including problem resolution effectiveness and customer satisfaction measurements, need additional investigation beyond current source availability.

Multi-language support capabilities, particularly important for international cryptocurrency trading platforms, are not specified in current documentation. Customer service operating hours, timezone coverage, and 24/7 support availability stay unclear from available information.

User feedback about customer service experiences, problem resolution cases, and support quality is not detailed in current materials. This exchange review cannot provide complete customer service assessment without access to user experience data and service quality metrics.

Trading Experience Analysis

Trading experience evaluation focuses on platform performance characteristics that directly impact user trading activities. User feedback suggests that platforms emphasize speed and reliability as core performance metrics, though specific performance data and execution quality measurements are not detailed in available sources.

Platform stability considerations, including uptime statistics, system reliability during high-volume periods, and technical performance metrics, need additional investigation beyond current source availability. Order execution quality, including slippage analysis and execution speed measurements, represents crucial trading experience factors not documented in available materials.

Platform functionality completeness, covering order types, trading interfaces, and execution options, needs direct platform assessment for complete evaluation. Mobile trading experience, including mobile application capabilities and responsive web design performance, is not detailed in current documentation.

The trading environment assessment, including market depth, liquidity considerations, and trading condition transparency, needs additional investigation to provide complete trader guidance. User experience feedback specific to trading execution and platform performance is limited in current source materials.

Trust Score Analysis

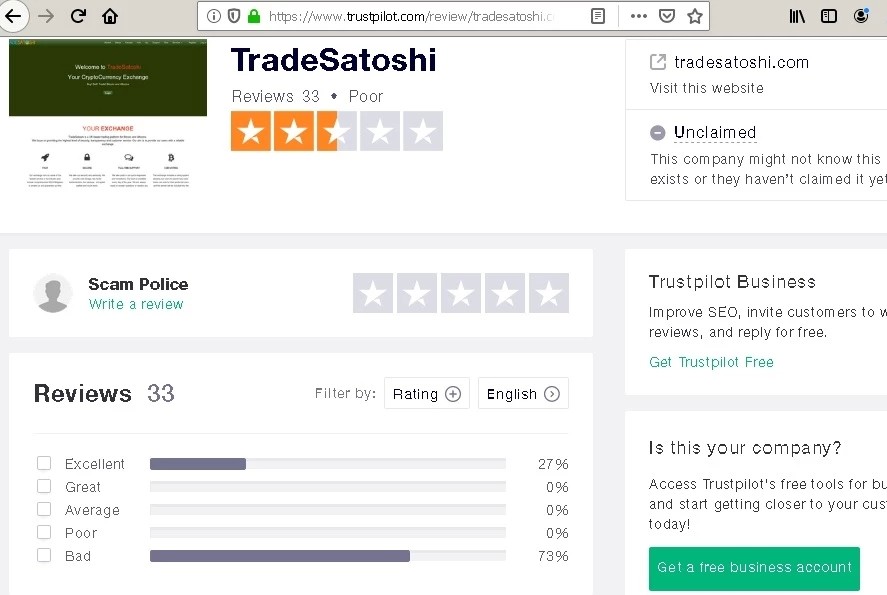

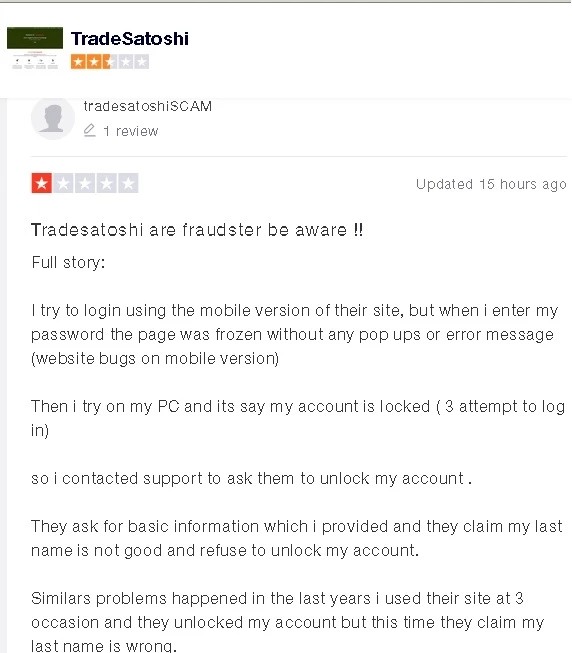

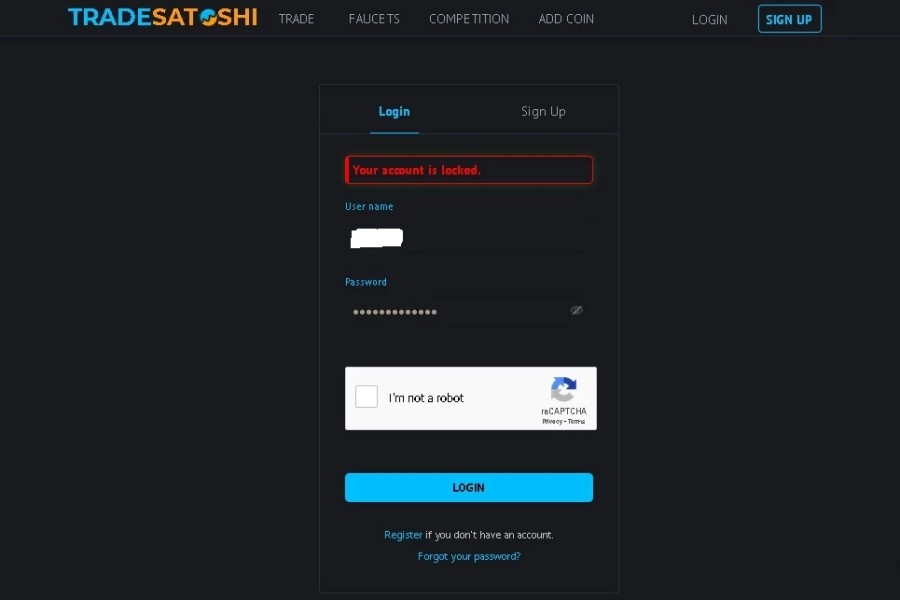

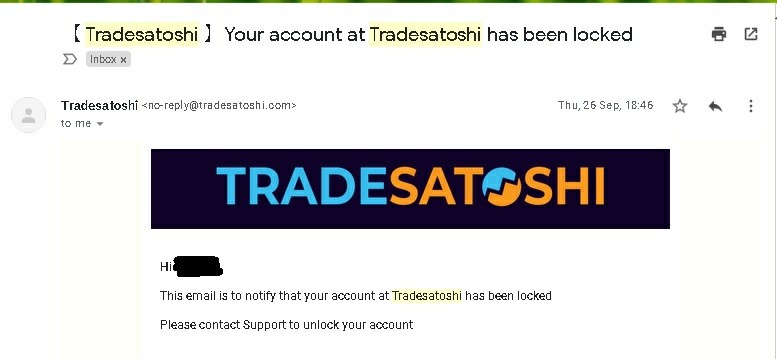

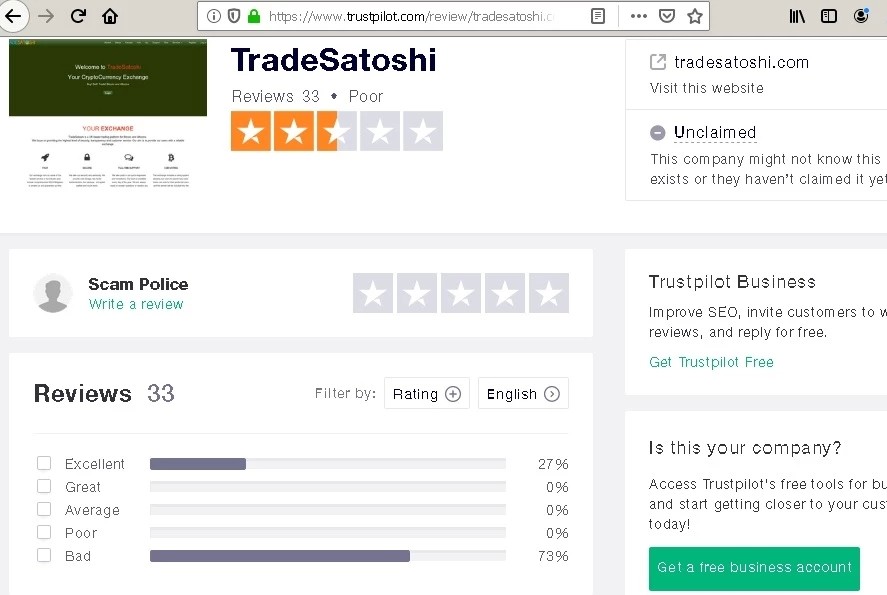

Trust score evaluation shows concerning variations in platform reliability metrics that need careful consideration. Available information indicates TrustScore fluctuations, with some exchange-related platforms showing low ratings that suggest potential trust concerns for prospective users.

Regulatory qualification assessment faces big limitations due to insufficient disclosure of specific regulatory authorities, licensing numbers, and compliance frameworks. This lack of regulatory transparency represents a substantial concern for traders seeking regulated trading environments with appropriate oversight protections.

Fund security measures, including segregated account policies, insurance coverage, and security protocols, are not detailed in available documentation. Company transparency about operational procedures, financial reporting, and business practices needs additional investigation beyond current source availability.

Industry reputation assessment is limited by the availability of third-party evaluations and independent reviews. The handling of negative events, dispute resolution procedures, and crisis management capabilities are not documented in current materials, limiting trust assessment capabilities.

User Experience Analysis

User experience evaluation faces big limitations due to insufficient detailed feedback and complete platform assessment data. Overall user satisfaction metrics, including retention rates and user recommendation scores, are not available in current source materials.

Interface design and usability assessments, covering navigation effectiveness, visual design quality, and user-friendly features, need direct platform interaction for complete evaluation. Registration and verification process efficiency, including KYC procedures and account activation timeframes, is not detailed in available documentation.

Fund operation experience, including deposit processing times, withdrawal efficiency, and payment method reliability, represents crucial user experience factors not completely covered in current materials. Common user complaints and frequently reported issues need additional investigation through user community engagement.

User demographic analysis and trader profile assessments would provide valuable insights into platform suitability for different user categories, but this information is not available in current sources. Improvement recommendations based on user feedback need access to complete user experience data not currently available.

Conclusion

This complete exchange review shows a cryptocurrency trading platform environment with mixed characteristics that need careful consideration by prospective traders. The overall evaluation stays neutral due to big information gaps about regulatory oversight, detailed trading conditions, and complete operational transparency.

The platforms appear most suitable for cryptocurrency enthusiasts seeking digital asset trading capabilities, particularly users comfortable with less traditional regulatory frameworks. However, traders prioritizing complete regulatory protection and detailed operational transparency may find the current information disclosure insufficient for confident platform selection.

The primary advantages center on claimed platform speed and transparency, while big disadvantages include insufficient regulatory information disclosure and limited detailed user feedback availability. Prospective users should conduct thorough independent research and consider their risk tolerance before engaging with these exchange platforms.