Regarding the legitimacy of GCM forex brokers, it provides FCA and WikiBit, .

Is GCM safe?

Pros

Cons

Is GCM markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Fortrade Limited

Effective Date:

2014-04-17Email Address of Licensed Institution:

compliance.uk@fortrade.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fortrade.comExpiration Time:

--Address of Licensed Institution:

Michelin House 81 Fulham Road London SW3 6RD UNITED KINGDOMPhone Number of Licensed Institution:

+442077102700Licensed Institution Certified Documents:

Is GCM Safe or a Scam?

Introduction

GCM, a forex and CFD broker, has been making waves in the trading community since its inception. Operating primarily in Turkey and catering to a diverse clientele, GCM claims to offer a wide range of trading instruments, including forex pairs, commodities, and indices. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders' hard-earned money is at stake, and the risks associated with unregulated or poorly regulated brokers can lead to significant financial losses. This article aims to provide a comprehensive assessment of GCM, focusing on its regulatory status, company background, trading conditions, client safety, and overall reputation. Our analysis is based on a thorough review of available online resources, including user reviews, regulatory data, and expert opinions.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any forex broker's credibility. GCM operates under the supervision of the Capital Markets Board of Turkey (CMB), which is responsible for overseeing financial markets in the country. However, the quality of regulation and its implications for traders is a topic of concern.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Capital Markets Board | G-039(398) | Turkey | Verified |

While the CMB is a legitimate authority, it is categorized as a tier-2 regulator, which means it does not impose the same stringent requirements as tier-1 regulators like the UK's Financial Conduct Authority (FCA) or Australia's ASIC. This raises questions about the level of investor protection provided. Furthermore, there have been reports suggesting that GCM may be operating with a suspicious regulatory status, with allegations of being a "clone" of another regulated entity. This ambiguity surrounding its regulatory standing is a significant red flag for potential clients.

Company Background Investigation

GCM was established in 2012 and has since positioned itself as a prominent player in the Turkish forex market. The company is registered in Istanbul and claims to have a robust operational framework. However, the lack of transparency regarding its ownership structure and management team raises concerns.

The management team at GCM is said to comprise experienced professionals in the financial sector, yet specific details about their backgrounds are scarce. This lack of information can be detrimental to building trust with potential clients. Additionally, the company's disclosure practices appear to be inadequate, as crucial information about its operations, financial health, and compliance history is not readily available.

Trading Conditions Analysis

When assessing a broker, understanding the trading conditions they offer is paramount. GCM presents a variety of trading instruments and claims to provide competitive spreads and no commissions on certain account types. However, traders should be cautious of any hidden fees that may not be immediately apparent.

| Fee Type | GCM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The spread for major currency pairs at GCM is reported to be higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of clarity regarding overnight interest rates may suggest potential hidden costs that could catch traders off guard. Such discrepancies in trading conditions warrant a cautious approach when considering GCM as a trading partner.

Client Fund Safety

The safety of client funds is a critical concern for any trader. GCM claims to implement various safety measures, including segregating client funds from operational funds. However, the effectiveness of these measures remains questionable, given the regulatory environment in which GCM operates.

The absence of a robust investor compensation scheme further exacerbates the risk for traders. In the event of financial difficulties or insolvency, clients may find it challenging to recover their funds. Historical data regarding GCM's handling of client funds does not indicate any major controversies, but the lack of a solid regulatory framework raises concerns about the overall safety of investments with the broker.

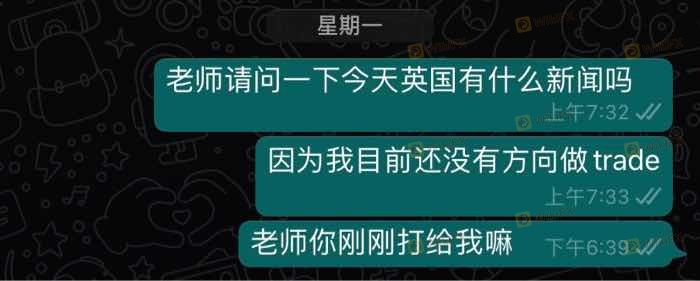

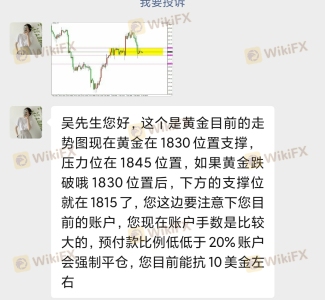

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real-world experience of traders with GCM. A review of user experiences reveals a mix of satisfaction and dissatisfaction. Common complaints include issues related to withdrawal delays, high spreads, and inadequate customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Spreads | Medium | No resolution |

| Customer Support Quality | High | Mixed reviews |

One notable case involved a trader who reported significant delays in withdrawing funds, leading to frustration and a loss of trust in the broker. This incident highlights the importance of assessing a broker's responsiveness and reliability in addressing client concerns. The mixed reviews regarding customer support further emphasize the need for potential clients to proceed with caution when considering GCM.

Platform and Trade Execution

The performance and stability of a trading platform are critical factors that can influence a trader's success. GCM offers the popular MetaTrader 4 platform, which is known for its user-friendly interface and advanced charting capabilities. However, traders have reported issues with order execution quality, including slippage and rejections.

The execution quality of trades at GCM has been a point of contention among users, with some claiming that they experienced significant slippage during volatile market conditions. This raises questions about the broker's ability to handle high-volume trading effectively and may indicate potential platform manipulation.

Risk Assessment

When evaluating the risks associated with trading through GCM, several factors come into play. The overall risk profile of the broker can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of tier-1 regulation raises concerns. |

| Financial Stability | Medium | Limited transparency regarding financial health. |

| Customer Service Risk | High | Reports of inadequate response to client issues. |

Given these risk factors, potential traders should approach GCM with caution. It is advisable to consider alternative brokers with stronger regulatory oversight and better customer service records.

Conclusion and Recommendations

In conclusion, the evidence suggests that GCM may not be the safest option for traders. The broker's regulatory status is questionable, and there are significant concerns regarding client fund safety, trading conditions, and customer service. While GCM offers a range of trading instruments and platforms, the potential risks outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is recommended to consider alternative brokers with robust regulatory frameworks and positive customer feedback. Brokers such as OANDA, IG, and Forex.com are known for their strong compliance and customer service, making them more suitable choices for those looking to trade in the forex market.

Ultimately, the question remains: Is GCM safe? The answer leans towards caution, as the broker's track record and regulatory standing necessitate a careful evaluation before entrusting them with your investments.

Is GCM a scam, or is it legit?

The latest exposure and evaluation content of GCM brokers.

GCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GCM latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.