Is EIG safe?

Pros

Cons

Is EIG A Scam?

Introduction

EIG, or Elita Invest Global, emerged in the forex market as a broker offering trading services in currencies, CFDs, and cryptocurrencies. Established in 2020 and based in Hong Kong, EIG has garnered attention for its low-cost trading options and user-friendly platform. However, potential traders need to exercise caution when evaluating EIG, as the forex market is rife with both legitimate and fraudulent brokers. The importance of due diligence cannot be overstated; traders must assess a broker's regulatory status, operational history, and user experiences to safeguard their investments. This article employs a comprehensive investigative framework, utilizing public sources and user reviews, to analyze whether EIG is safe or a scam.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining the safety of any forex broker. A regulated broker is typically subject to stringent standards that protect clients' funds and ensure fair trading practices. Unfortunately, EIG operates without any recognized regulatory license. This lack of oversight raises significant concerns regarding the broker's legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that EIG is not held accountable to any financial authority, which can lead to increased risks for traders. In contrast, regulated brokers must adhere to strict compliance requirements, including regular audits and maintaining client funds in segregated accounts. The lack of regulatory history and oversight for EIG suggests a higher risk for investors, as they may not have recourse in cases of disputes or financial loss.

Company Background Investigation

EIG's relatively short history in the forex market makes it difficult to assess its long-term viability and trustworthiness. Founded in 2020, the broker does not provide detailed information about its ownership structure or the backgrounds of its management team. This lack of transparency is a red flag for potential investors. A robust company history often indicates stability and reliability, while a vague or non-existent background can lead to suspicions about the broker's intentions.

The management team behind EIG has not been publicly disclosed, which further complicates the assessment of the broker's credibility. Without information about the qualifications and experience of the people running the company, traders are left in the dark regarding the broker's operational standards and ethical practices. Transparency about ownership and management is essential for building trust, and EIG's failure to provide this information raises questions about its legitimacy.

Trading Conditions Analysis

EIG claims to offer competitive trading conditions, including low spreads and no commission fees. However, a closer examination of the fee structure reveals potential hidden costs that may not be immediately apparent to traders. Understanding the overall cost of trading is crucial for effective risk management and profitability.

| Fee Type | EIG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.9 pips | 1.3 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The spreads offered by EIG are significantly higher than the industry average, which could eat into traders' profits. Additionally, the lack of transparency regarding overnight interest rates and potential commissions raises concerns about the overall trading costs. Traders should be wary of brokers that do not provide clear and comprehensive information about their fee structures, as this can lead to unexpected expenses and reduced returns.

Client Funds Safety

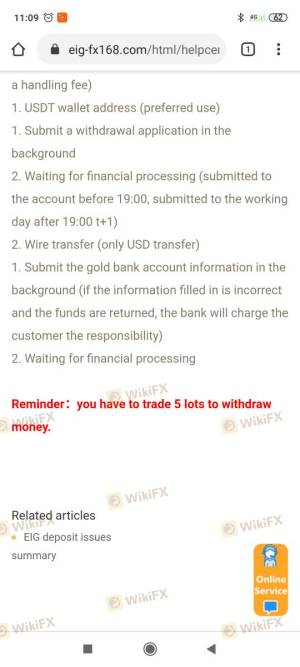

The safety of client funds is paramount when choosing a forex broker. EIG has not provided adequate information regarding its fund protection measures. The absence of clear policies on fund segregation, investor protection, and negative balance protection is alarming.

Traders should expect that their funds are kept in segregated accounts, separate from the broker's operating funds, to ensure that their capital is protected in the event of financial difficulties. Furthermore, negative balance protection is crucial to prevent clients from losing more than their initial investment. EIG's failure to disclose these safety measures raises serious concerns about the security of client funds, making it imperative for traders to exercise caution when considering this broker.

Customer Experience and Complaints

User feedback is an essential aspect of assessing any broker's reliability. Reviews of EIG reveal a mixed bag of experiences, with several users reporting issues related to account access and withdrawal difficulties.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Suspension After Deposit | High | Poor |

| Withdrawal Issues | High | Poor |

Many traders have reported that their accounts were suspended shortly after making deposits, which is a significant red flag. Additionally, some users have noted that they faced challenges when attempting to withdraw their funds, leading to suspicions about the broker's practices. EIG's response to these complaints has been described as inadequate, further fueling concerns about its legitimacy and customer service quality.

Platform and Execution

EIG utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading features. However, the performance of the platform, including order execution quality and slippage, is crucial for traders' success.

While MT4 is generally reliable, reports from users suggest that EIG's execution quality may be subpar, with instances of slippage and order rejections. Such issues can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. Traders should be vigilant about the potential for platform manipulation or execution delays, which can further exacerbate the risks associated with trading with EIG.

Risk Assessment

Engaging with EIG presents several risks that traders should consider before opening an account.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Financial Risk | High | Lack of transparency regarding fees and fund safety. |

| Operational Risk | Medium | Potential issues with platform performance and execution. |

Given the high regulatory risk associated with EIG, potential traders should approach with caution. The absence of regulatory oversight means that there is little recourse in the event of disputes or financial losses. Additionally, the lack of transparency regarding fees and fund safety raises further concerns about the viability of this broker. Traders are advised to consider alternative, regulated brokers to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that EIG exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, transparency regarding company operations, and numerous user complaints raise significant concerns about its legitimacy. While EIG may offer attractive trading conditions, the associated risks far outweigh the potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative options that are regulated by reputable authorities. Brokers such as IG, OANDA, and Forex.com offer robust regulatory frameworks and transparent trading conditions, ensuring a safer trading experience. Always conduct thorough research and due diligence before committing funds to any broker, especially one like EIG, which lacks the necessary safeguards to protect investors.

Is EIG a scam, or is it legit?

The latest exposure and evaluation content of EIG brokers.

EIG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EIG latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.