ZANK Review 1

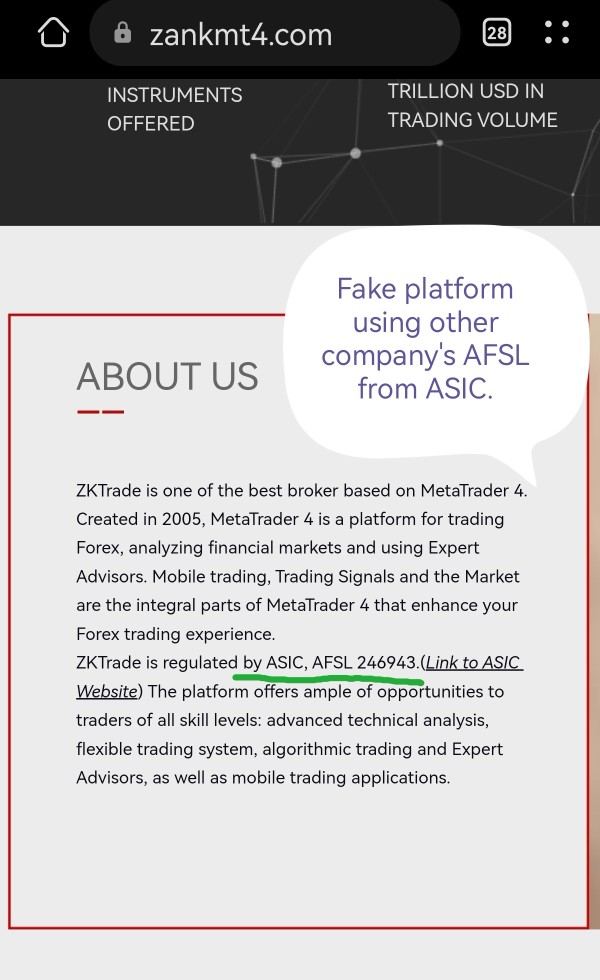

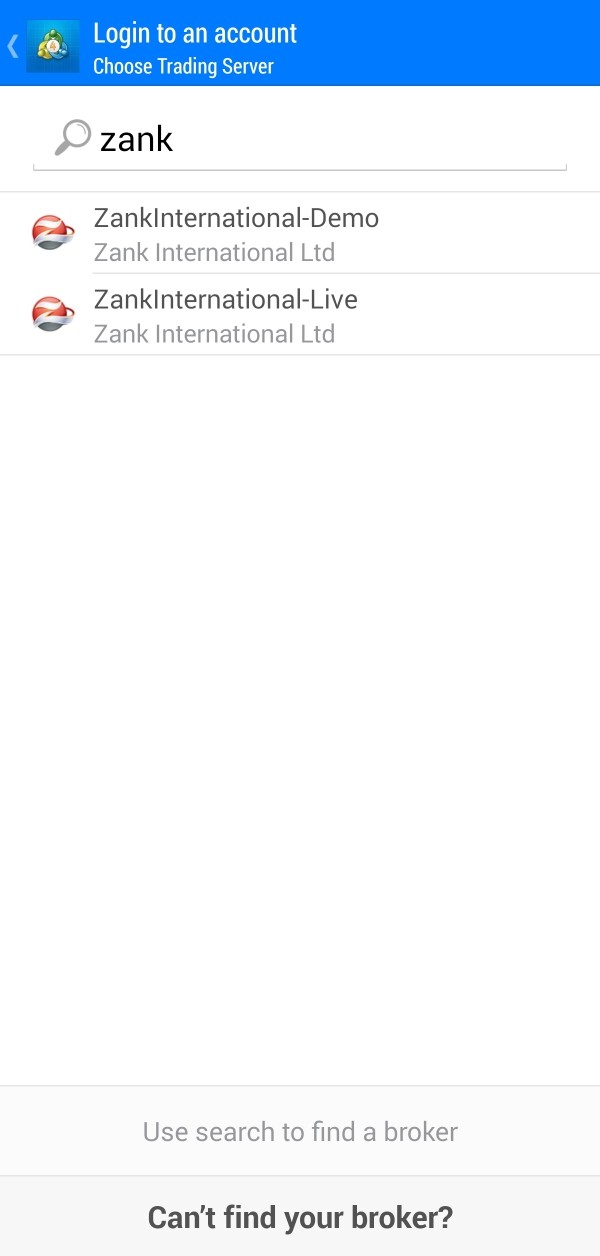

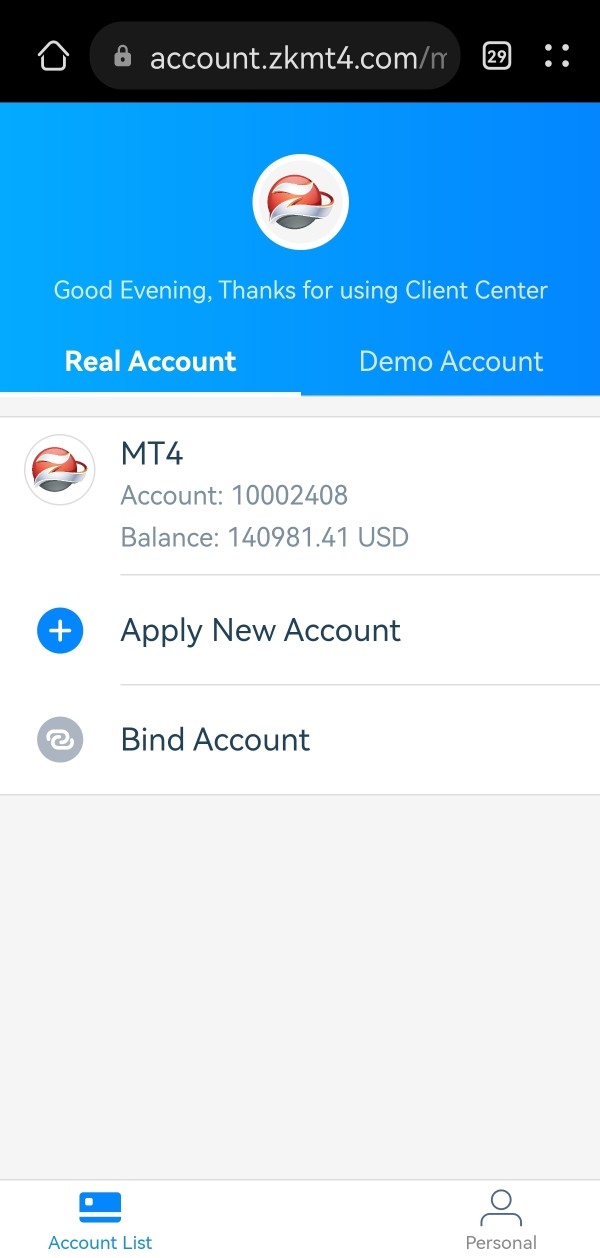

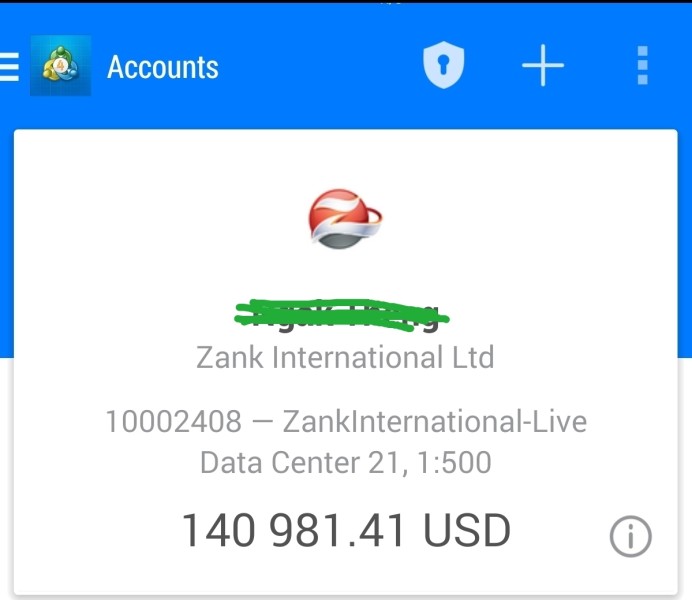

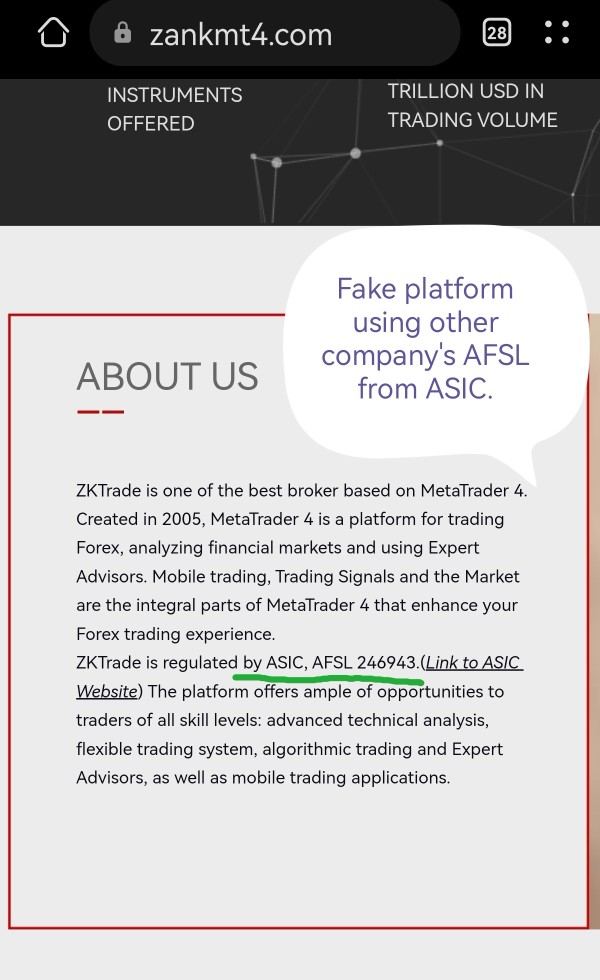

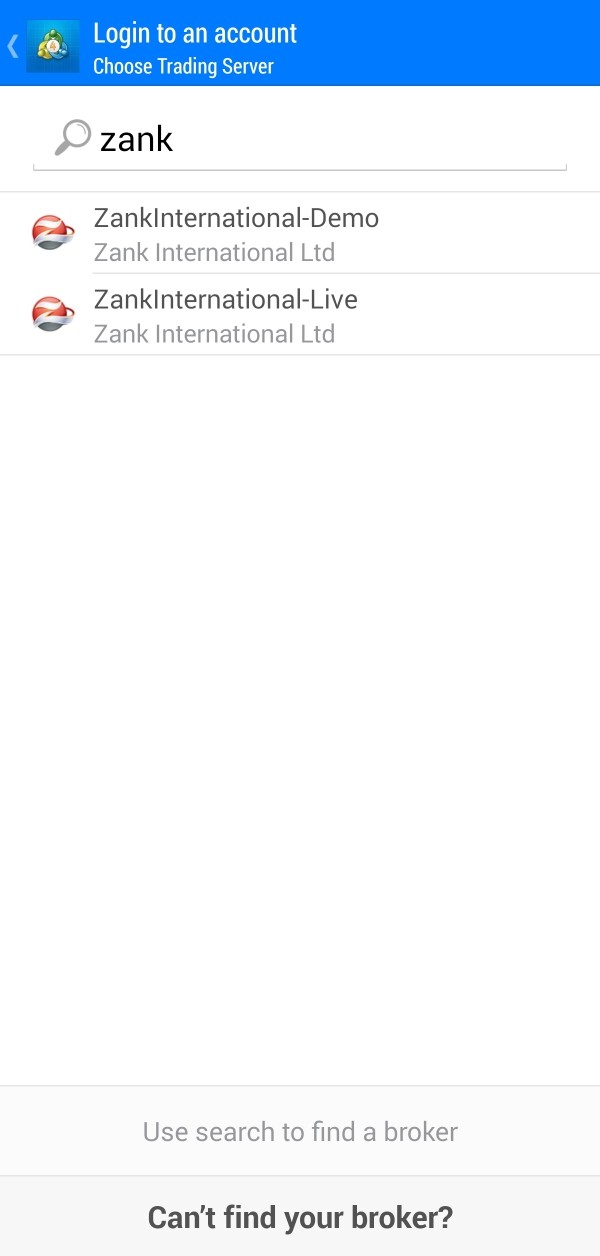

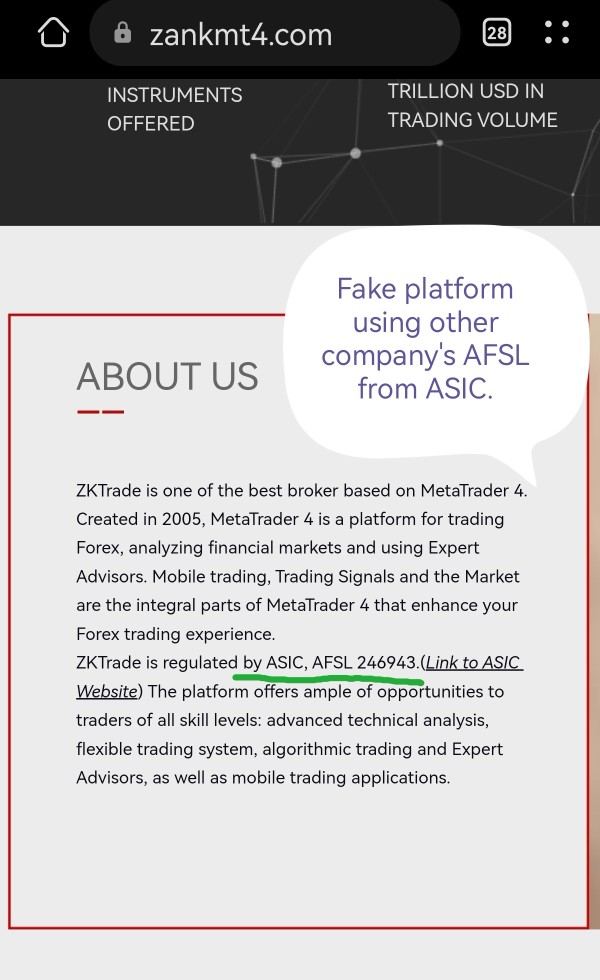

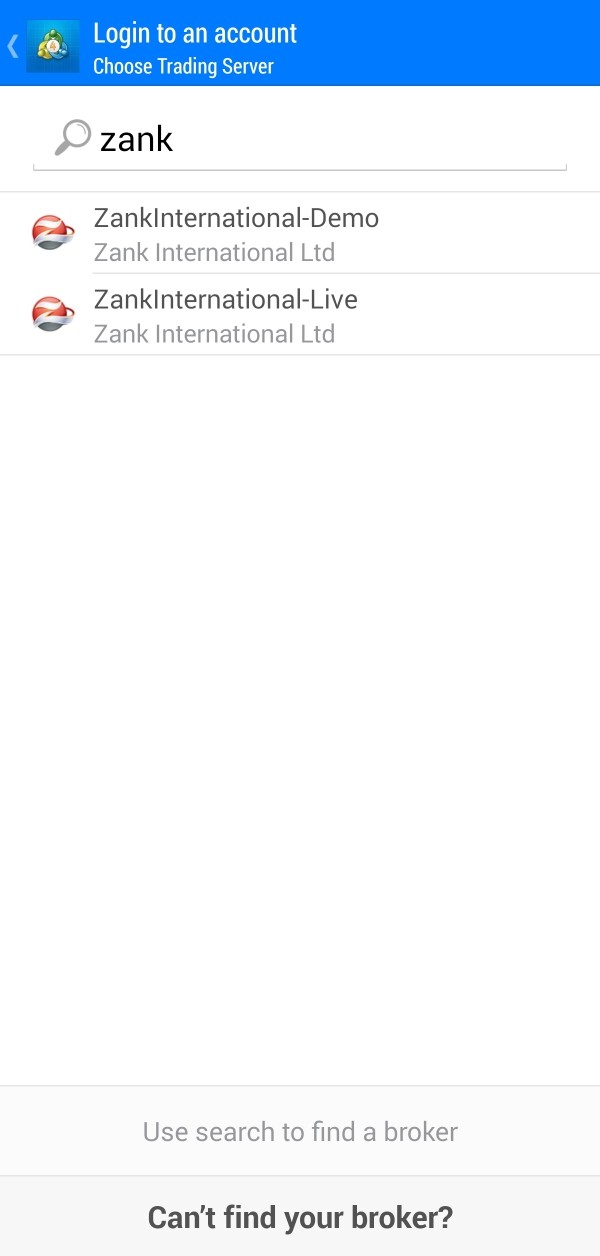

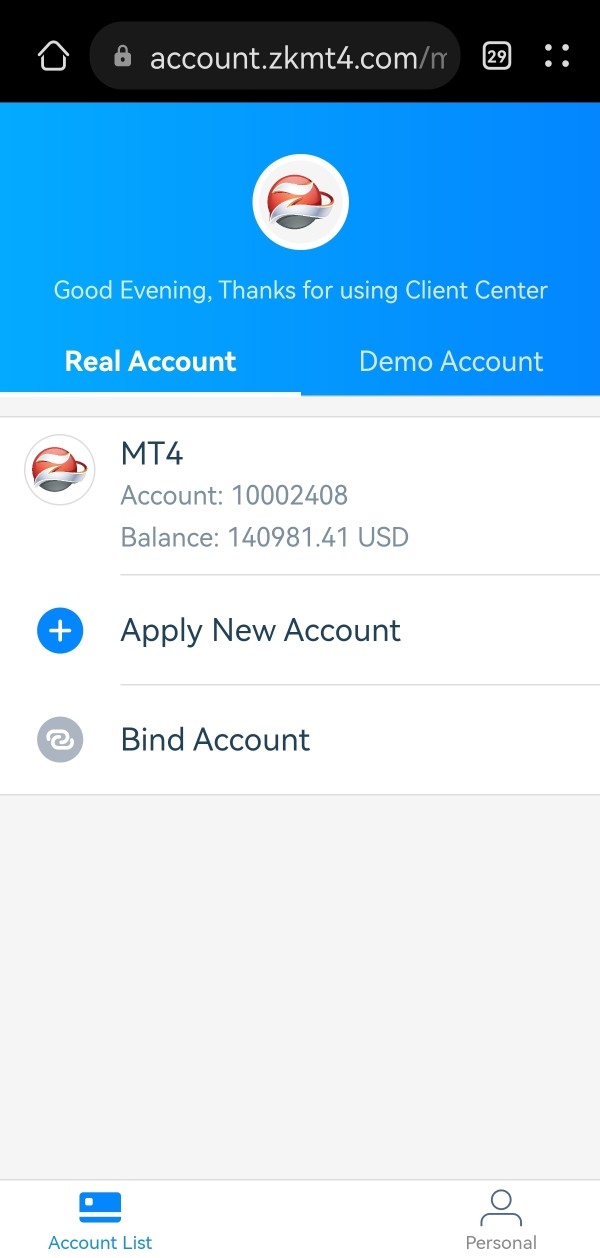

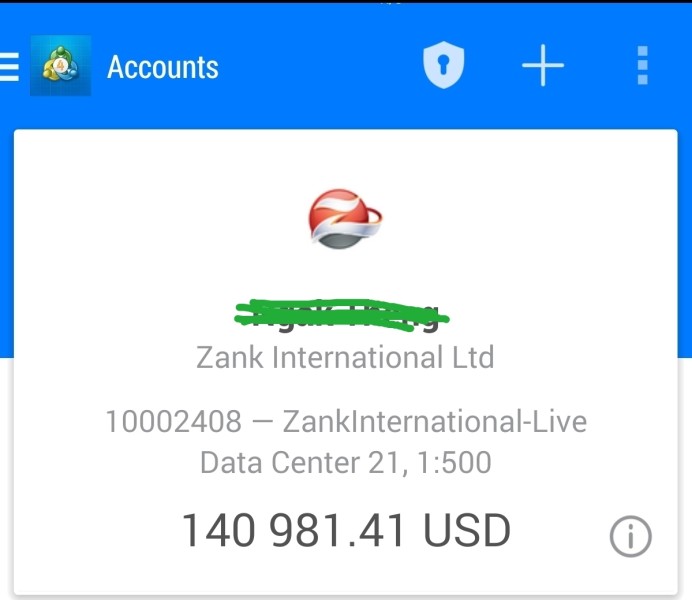

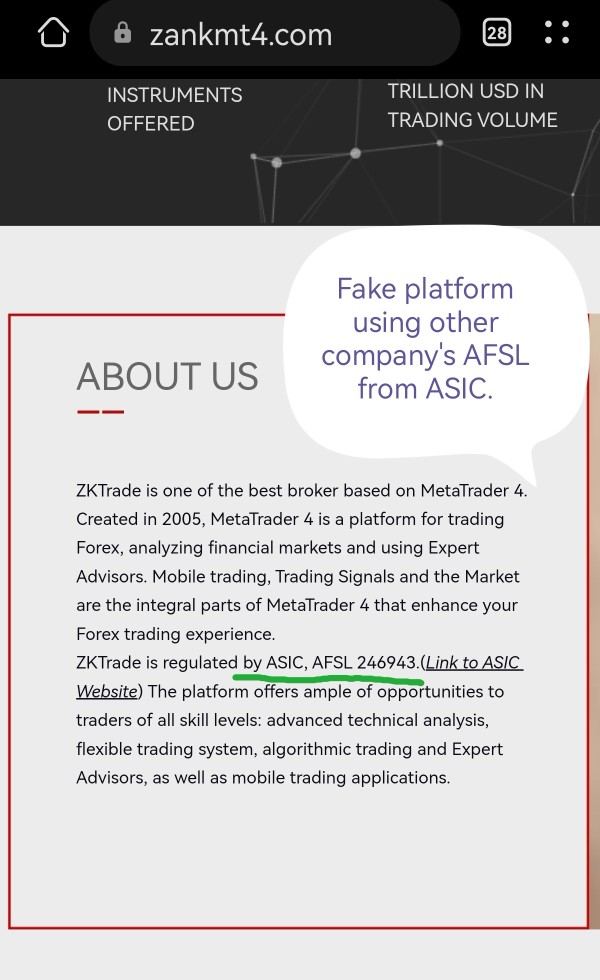

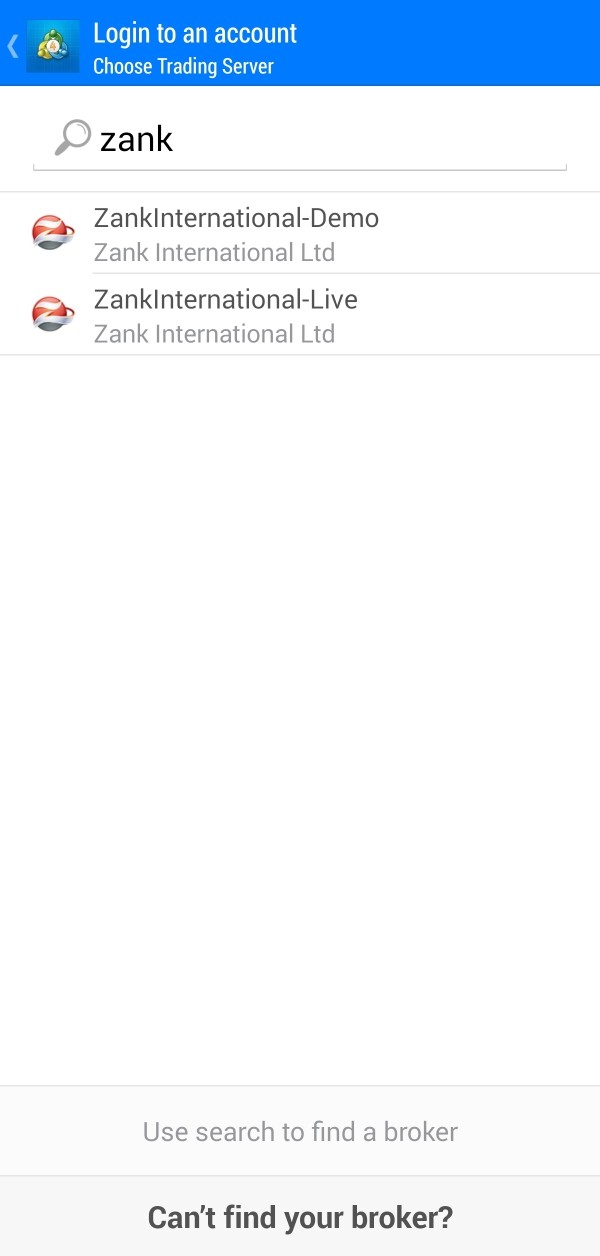

This ZANK just updated the logo and changed the new website name to ZKTrade to defraud. It uses someone else's supervision number. Please don't be deceived! ! I have been scammed by them, please stay away!

ZANK Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

This ZANK just updated the logo and changed the new website name to ZKTrade to defraud. It uses someone else's supervision number. Please don't be deceived! ! I have been scammed by them, please stay away!

This Zank review looks at a young forex broker that shows promise but lacks clear rules. Zank started in 2014 and first worked in Australian real estate before moving to forex and CFD trading services. The company now works as an online trading platform that mainly serves Chinese traders, offering different financial tools including foreign exchange and contracts for difference.

Trustpilot data shows Zank has a 4-star rating. This means users generally have good experiences with the broker. However, this Zank review finds big gaps in information about rules, trading conditions, and platform features that traders need to know about.

The broker targets traders who want different financial tools, especially in forex and CFD markets. Still, full details about their services are hard to find in public sources. User feedback suggests the broker works well, but potential clients should be careful because of unclear regulatory information and limited transparency about trading conditions and company operations.

Regional Entity Differences: Zank works mainly in China while claiming registration in the United Kingdom. Traders must know about big legal and regulatory differences across different areas where they operate. The rules that apply to your trading may change a lot depending on where you live and which Zank entity you work with.

Review Methodology: This review uses only public information and user reviews from different sources. The analysis does not include direct trading experience or hands-on platform testing that would give more complete insights. All assessments reflect information available at the time of writing and may not reflect current conditions or recent changes to the broker's services.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 5/10 | Limited information available regarding account types, minimum deposits, and specific terms |

| Tools and Resources | 4/10 | Insufficient data on trading tools, research capabilities, and educational resources |

| Customer Service | 6/10 | Basic online support available, but comprehensive service details unclear |

| Trading Experience | 5/10 | Lack of detailed user feedback on platform performance and execution quality |

| Trust and Security | 4/10 | Absence of clear regulatory information significantly impacts trustworthiness assessment |

| User Experience | 6/10 | Trustpilot 4-star rating suggests positive user sentiment, though detailed feedback limited |

Zank started in the financial services sector in 2014. The company first worked as a commercial brokerage firm that specialized in Australian real estate transactions. The company's business model changed a lot as it moved toward online financial trading services, eventually becoming a forex and CFD broker that mainly serves Asian markets with particular focus on Chinese traders.

Moving from real estate brokerage to forex trading represents a big shift in business focus. This change reflects the company's ability to adapt to new market opportunities in the online trading sector. Zank's current operations focus on giving access to different financial tools through digital trading platforms, though specific details about their technology and platform capabilities remain unclear in available documentation.

Zank mainly helps clients access foreign exchange markets and contracts for difference. This lets clients do leveraged trading across multiple asset classes. However, full information about additional tradeable instruments, market coverage, and specific product offerings is not detailed in public sources that traders can easily find. The broker's regulatory status remains unclear, with available information not specifying particular regulatory bodies that watch their operations or provide investor protection frameworks.

Regulatory Jurisdiction: Available information does not specify particular regulatory authorities that watch Zank's operations. This creates uncertainty about investor protection and operational oversight standards that traders expect from regulated brokers.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and fees for deposits and withdrawals is not detailed in available sources.

Minimum Deposit Requirements: Available documentation does not specify minimum deposit amounts required to open trading accounts with Zank.

Bonus and Promotions: No information about promotional offers, welcome bonuses, or ongoing incentive programs is mentioned in accessible sources.

Tradeable Assets: The broker mainly offers foreign exchange trading and contracts for difference. However, detailed asset coverage and specific instruments available are not fully documented in public sources.

Cost Structure: Specific information about spreads, commission structures, overnight financing charges, and other trading costs is not available in current documentation.

Leverage Ratios: Available sources do not specify the maximum leverage ratios offered to clients. They also don't explain how these may vary across different asset classes that traders want to access.

Platform Options: Details about trading platforms, whether proprietary or third-party solutions like MetaTrader, are not specified in available information.

Geographic Restrictions: Information about countries or regions where Zank's services may be restricted or unavailable is not documented in accessible sources.

Customer Service Languages: Available documentation does not specify the languages in which customer support services are provided to international clients.

The assessment of Zank's account conditions faces big limitations because of insufficient public information. This Zank review cannot give full analysis of account types, as specific details about different account tiers, their features, and benefits are not documented in accessible sources. The absence of clear information about account classifications makes it hard for potential clients to understand what options may be available to them.

Minimum deposit requirements represent another area where information is notably lacking. Without specific figures, traders cannot properly assess whether Zank's entry requirements align with their financial capabilities or trading objectives that they want to achieve. The account opening process, including verification requirements, documentation needs, and approval timeframes, remains undocumented in available sources that potential clients can review.

Specialized account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, are not mentioned in current documentation. This information gap significantly limits the ability to evaluate whether Zank accommodates diverse client needs and religious considerations that some traders require. The lack of transparency about account conditions contributes to the moderate rating, as traders require clear information to make informed decisions about broker selection.

The evaluation of Zank's trading tools and resources reveals big information gaps that impact the overall assessment. Available sources do not give detailed information about the specific trading tools offered to clients, making it impossible to assess the quality and scope of analytical capabilities, charting functions, or technical indicators available on the platform. Research and analysis resources, which are crucial for informed trading decisions, are not documented in accessible information.

The absence of details about market analysis, economic calendars, news feeds, or research reports suggests either limited offerings in this area or insufficient transparency about available resources. Educational materials, including webinars, tutorials, trading guides, or market education content, are similarly not mentioned in current documentation that traders can access. Automated trading support, including expert advisors, algorithmic trading capabilities, or copy trading features, remains unclear from available sources.

Modern traders increasingly rely on automated solutions for better trading results. The lack of information about such capabilities represents a significant knowledge gap that affects trader decision-making. The limited transparency about tools and resources contributes to the below-average rating in this category.

Customer service evaluation for Zank is limited by scarce available information about support channels, availability, and service quality. While some form of online support appears to be available, specific details about contact methods, including phone support, email response systems, or live chat capabilities, are not fully documented in accessible sources. Response time expectations and service level commitments are not specified in available documentation, making it difficult to assess the efficiency and reliability of customer support operations.

The quality of support interactions, including the expertise of support staff and their ability to resolve complex trading or technical issues, cannot be properly evaluated based on current information. Multilingual support capabilities, particularly important for an international broker, are not detailed in available sources that potential clients can review. Given Zank's apparent focus on Chinese markets, language support would be a crucial consideration for potential clients who need assistance.

Operating hours for customer service, including whether 24/7 support is available to accommodate global trading schedules, remain unclear from accessible documentation.

The assessment of trading experience with Zank faces big limitations because of insufficient user feedback and technical performance data in available sources. Platform stability and execution speed, critical factors for successful trading operations, cannot be properly evaluated without detailed user experiences or independent testing results that would give more insight. Order execution quality, including slippage rates, rejection frequencies, and fill rates during high-volatility periods, is not documented in accessible information.

These factors significantly impact trading profitability and user satisfaction for active traders. Yet current sources provide no specific data or user feedback about execution performance that traders need to know. Platform functionality completeness, including advanced order types, risk management tools, and analytical capabilities, remains unclear from available documentation that potential clients can access.

Mobile trading experience, increasingly important for modern traders, is not specifically addressed in current sources. The trading environment, including server locations, latency considerations, and platform reliability during market sessions, lacks detailed coverage in accessible information that would help traders make informed decisions. This comprehensive Zank review cannot provide definitive conclusions about trading experience quality without more substantial user feedback and performance data.

The trust and security assessment of Zank reveals concerning information gaps that significantly impact the overall evaluation. Regulatory credentials, fundamental to broker trustworthiness, are not clearly specified in available documentation that traders can review. The absence of specific regulatory body oversight or license numbers creates uncertainty about investor protection standards and operational compliance requirements that traders expect.

Client fund security measures, including segregated account arrangements, investor compensation schemes, or third-party fund custody arrangements, are not detailed in accessible sources. These protections are essential for trader confidence and represent standard industry practices for reputable brokers that serve international clients. Company transparency about ownership structure, financial statements, or operational history is limited in available information.

The lack of comprehensive corporate disclosure makes it difficult to assess the broker's stability and long-term viability for traders. Industry reputation and recognition from established financial industry organizations or awards are not mentioned in current documentation that would build confidence. Negative incident handling, including how the company addresses complaints, disputes, or operational issues, cannot be evaluated based on available information that traders can access.

The significant information gaps about regulatory oversight and security measures contribute to the below-average rating in this critical category.

User experience evaluation for Zank benefits from the Trustpilot 4-star rating, which suggests generally positive client satisfaction levels. However, detailed feedback about specific aspects of the user experience is limited in available sources, constraining comprehensive analysis of interface design, platform usability, and overall client satisfaction factors that matter to traders. Registration and verification processes, crucial first impressions for new clients, are not detailed in accessible documentation.

The efficiency and user-friendliness of account opening procedures remain unclear for potential clients. The specific requirements and timeframes involved in account verification and approval processes are also not well documented in sources that traders can easily find. Fund management operations, including the ease of deposits and withdrawals, processing efficiency, and user interface quality for financial transactions, lack detailed coverage in available sources.

These operational aspects significantly impact overall user satisfaction and trading convenience for active traders. Common user complaints or areas for improvement are not specifically documented in accessible information, limiting the ability to identify potential pain points or service deficiencies that could affect the trading experience. While the Trustpilot rating suggests positive experiences, the lack of detailed user feedback prevents comprehensive understanding of specific strengths and weaknesses in the user experience domain.

This comprehensive Zank review reveals a forex broker with mixed characteristics that present both opportunities and concerns for potential clients. Zank represents an emerging player in the forex brokerage sector, demonstrating some positive user sentiment as evidenced by its 4-star Trustpilot rating, yet facing significant transparency challenges that impact overall assessment for traders considering their services.

The broker appears most suitable for traders seeking access to forex and CFD markets, particularly those comfortable with limited regulatory transparency and willing to accept associated risks. However, the substantial information gaps about trading conditions, platform features, and regulatory oversight suggest that Zank may be more appropriate for experienced traders who can navigate uncertainty rather than beginners requiring comprehensive support and clear operational frameworks that help them learn.

The primary advantages include generally positive user feedback and apparent focus on serving specific market segments that some traders prefer. The significant disadvantages include the lack of regulatory clarity, insufficient transparency about trading conditions, and limited publicly available information about service offerings that traders need to make informed decisions. Potential clients should conduct additional due diligence and consider these limitations carefully before engaging with Zank's services.

FX Broker Capital Trading Markets Review