CM Trade Review 1

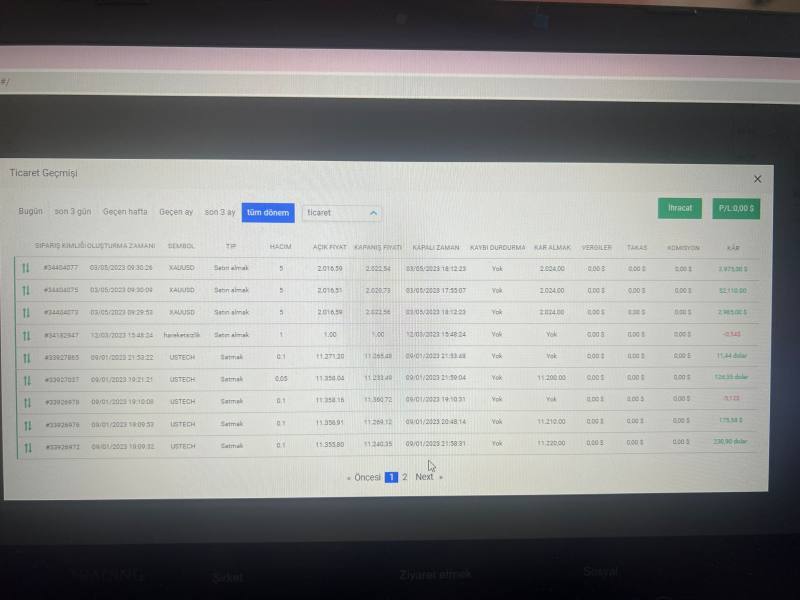

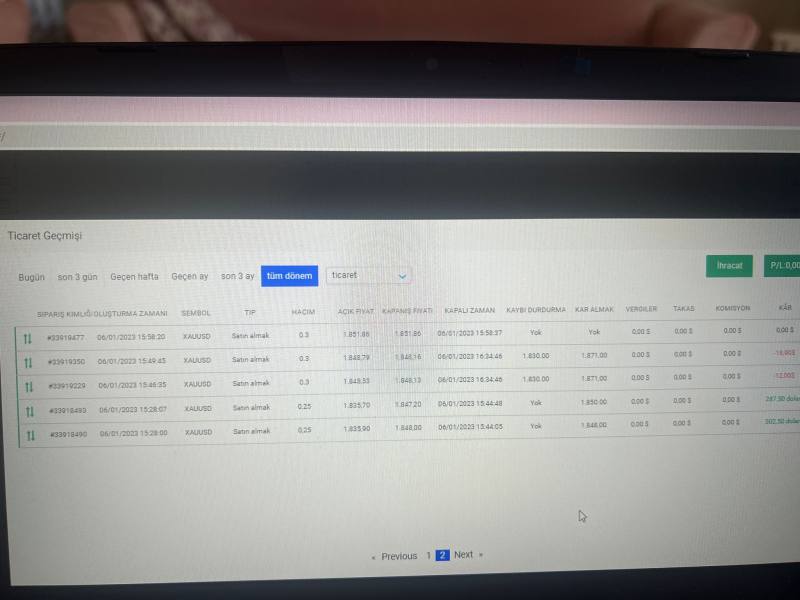

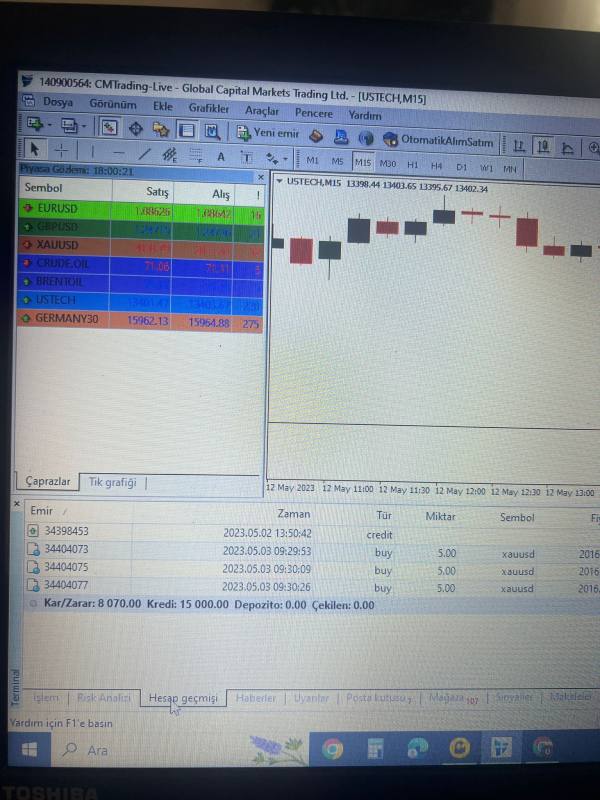

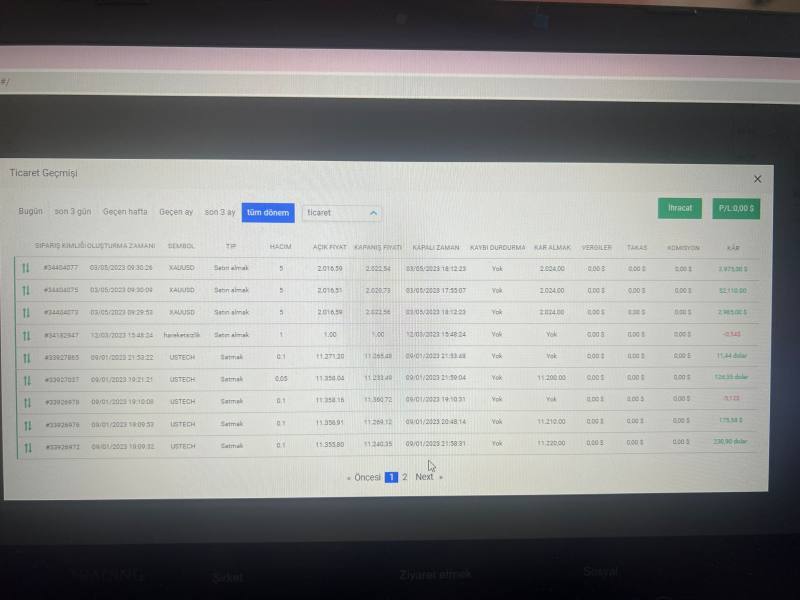

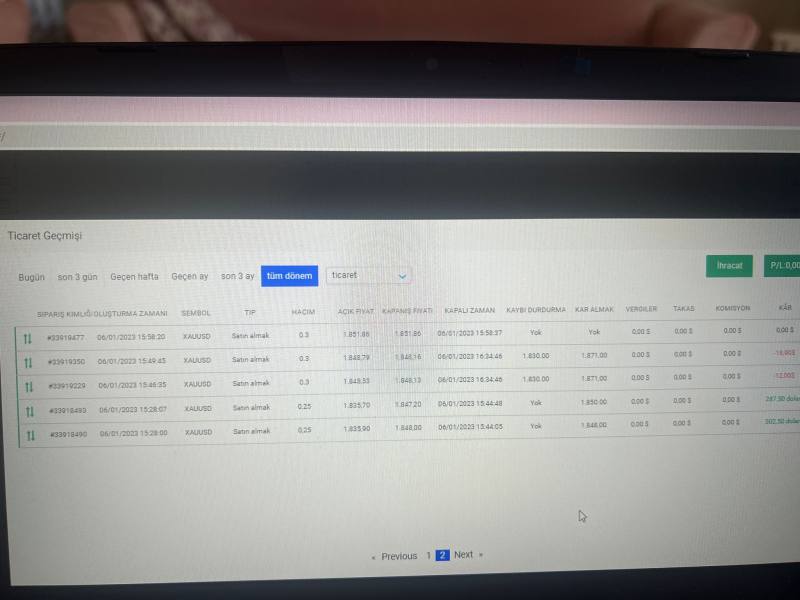

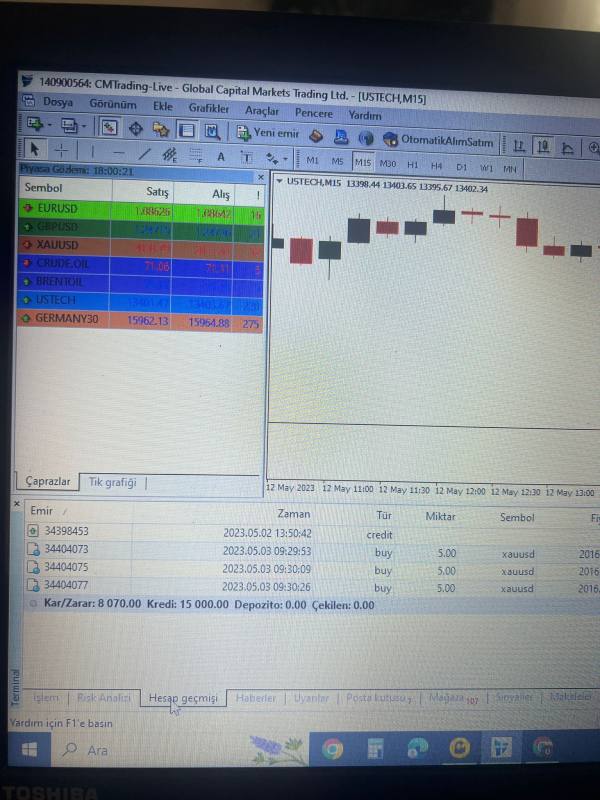

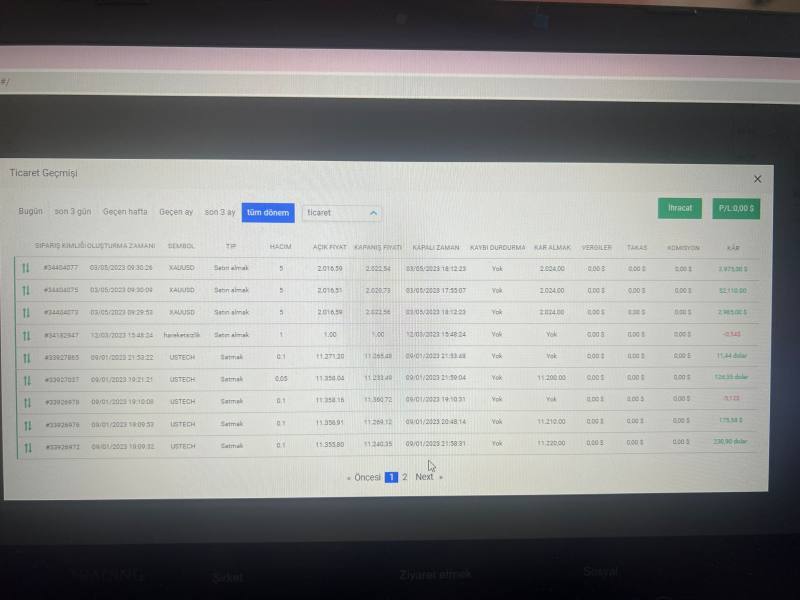

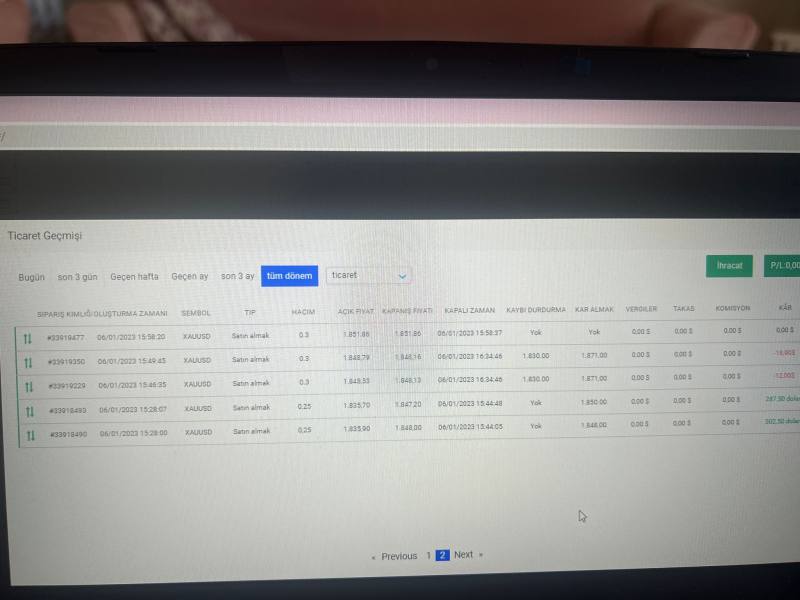

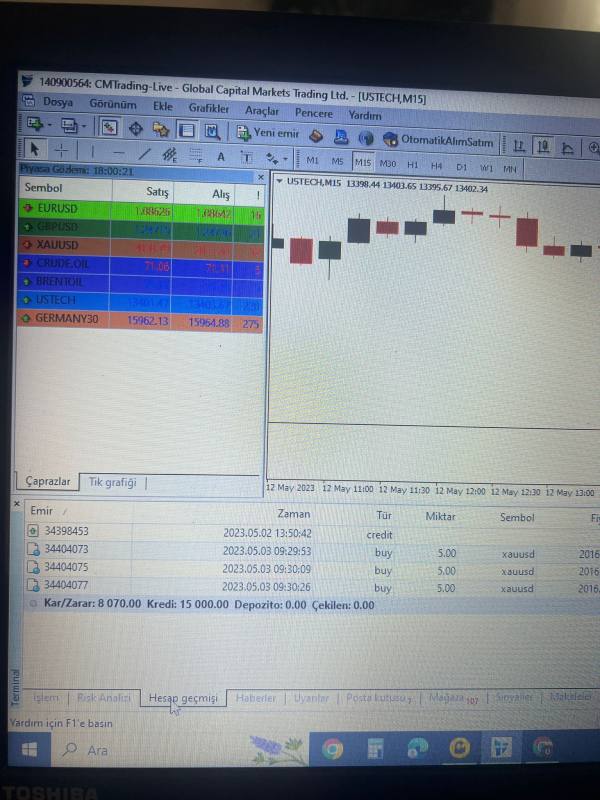

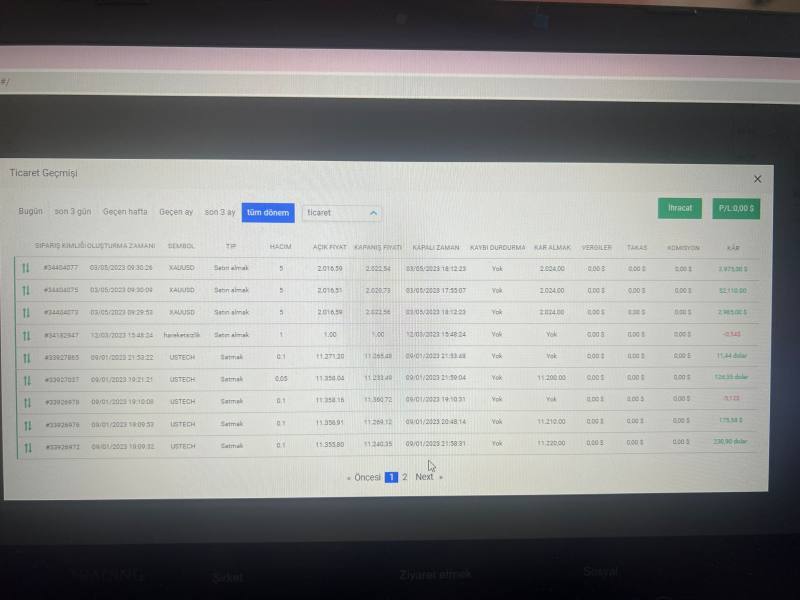

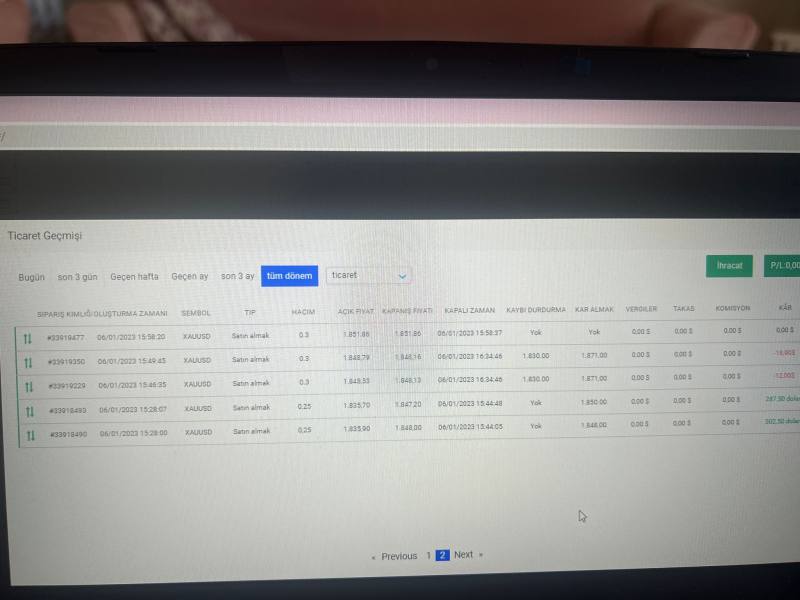

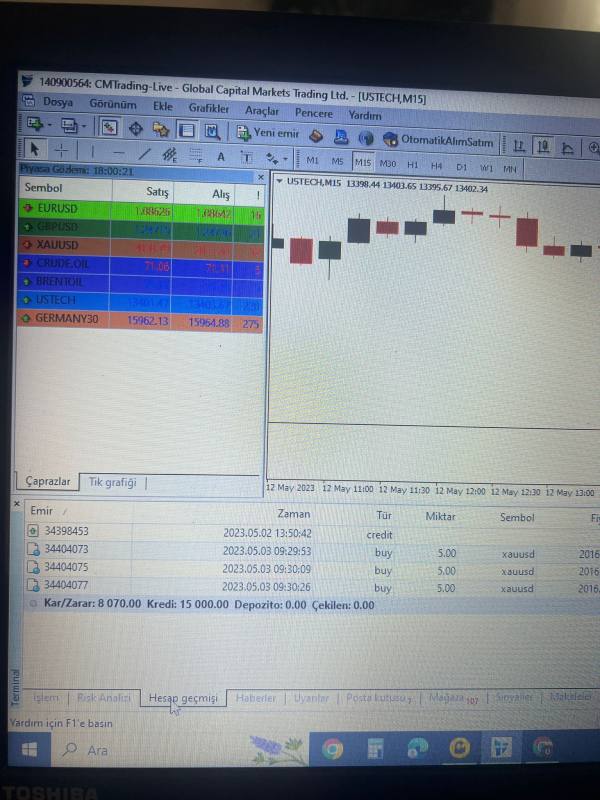

After long efforts, I made a profit. The institution did not pay my profit, only sent my principal. I cannot find a contact person.

CM Trade Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

After long efforts, I made a profit. The institution did not pay my profit, only sent my principal. I cannot find a contact person.

CM Trading is a notable player in the forex and CFD brokerage world. The company has been around since 2011 and has built a solid reputation. This cm trade review looks at a broker that serves traders at all skill levels, with special attention to underserved regions around the world.

The company operates under the Seychelles Financial Services Authority with license number SD070. This gives the broker a foundation of regulatory compliance for its operations. Industry reports show that CM Trading has built a user base of about 1,000,000 traders, which shows strong market reach and user adoption.

The broker targets both new traders who want to get into forex and commodities markets, as well as experienced traders looking for complete trading solutions. The platform lets people trade forex pairs, commodities, and various indices, which works for different trading strategies and preferences. CM Trading focuses on providing easy-to-use online trading platforms with transparency and market access.

With a minimum deposit of $100, CM Trading makes itself accessible to retail traders. The company has won multiple industry awards, though we need to verify these through current industry sources.

CM Trading operates under Seychelles jurisdiction, which may have different compliance requirements and investor protections compared to brokers in major financial centers. Prospective clients should carefully think about what it means to trade with a Seychelles-regulated entity, especially regarding dispute resolution and compensation schemes.

This comprehensive cm trade review uses publicly available information, industry reports, and user feedback from various financial review platforms. The analysis aims to give an objective look at the broker's services, though individual trading experiences may vary a lot based on personal situations and trading approaches.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Reasonable $100 minimum deposit, substantial user base |

| Tools and Resources | 5/10 | Basic asset coverage across forex, commodities, and indices |

| Customer Service | N/A | Insufficient data available for assessment |

| Trading Experience | N/A | Platform details not specified in available sources |

| Trust and Reliability | 7/10 | FSA regulation and industry awards recognition |

| User Experience | N/A | Limited user feedback data available |

CM Trading started in the financial services sector in 2011. The company set up its headquarters in Seychelles to serve the growing demand for accessible forex and CFD trading platforms. The company's main mission focuses on making financial markets more accessible, especially targeting regions where comprehensive trading services have been limited.

Through its online trading infrastructure, CM Trading aims to connect retail traders with global financial markets. The broker believes in transparency and accessibility, positioning itself as a gateway for traders who want exposure to international currency markets, commodity trading, and index-based instruments. This approach has helped CM Trading build a significant presence in the retail trading space.

The company reports a user base that has grown to about one million registered traders across its operational territories. From a regulatory standpoint, CM Trading operates under the supervision of the Seychelles Financial Services Authority, holding license number SD070. This regulatory framework provides the legal foundation for the company's operations, though traders should understand the specific protections and limitations that come with Seychelles-based financial regulation.

The broker's asset offering includes multiple categories such as major and minor forex pairs, precious metals and energy commodities, along with popular stock indices from various global markets.

Regulatory Jurisdiction: CM Trading maintains its primary regulatory relationship with the Seychelles Financial Services Authority under license number SD070. This regulatory framework governs the broker's operational standards and compliance requirements within the Seychelles financial services sector.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current available sources. Prospective clients should contact the broker directly to understand the full range of funding options and processing requirements.

Minimum Deposit Requirements: The broker sets its minimum account opening deposit at $100. This positions the company as accessible to retail traders with modest initial capital requirements. The threshold aligns with industry standards for retail-focused brokerage services.

Promotional Offerings: Current promotional structures and bonus programs are not specified in available documentation. Traders interested in potential incentive programs should verify current offerings directly with the broker.

Available Trading Assets: CM Trading provides access to forex currency pairs, commodities markets including precious metals and energy products, and major stock indices. The specific number of instruments and detailed asset lists require verification through current broker documentation.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in current sources. This represents a significant information gap for potential clients evaluating the broker's competitive positioning.

Leverage Ratios: Specific leverage offerings are not detailed in available materials. This requires direct inquiry with the broker for current leverage policies and restrictions.

Trading Platform Options: Platform specifications and technology infrastructure details are not provided in current available sources.

Geographic Restrictions: Information about regional limitations or restricted territories is not specified in available documentation.

Customer Support Languages: Available customer service languages are not detailed in current sources.

CM Trading's account structure starts with a minimum deposit threshold of $100. This positions the broker competitively within the retail trading segment. The entry point shows the company's commitment to serving traders with varying capital levels, from beginners testing the waters to more experienced traders seeking additional platform options.

The substantial user base of about one million registered traders suggests that the broker's account conditions have found market acceptance across diverse trading demographics. However, specific details about account types, tier structures, and associated benefits remain unclear in available documentation. The absence of detailed account specifications represents a significant information gap that prospective clients should address through direct broker consultation.

Industry standards typically include multiple account tiers with varying features, minimum deposits, and trading conditions, but CM Trading's specific offerings in this regard require clarification. The account opening process, verification requirements, and timeline for account activation are not detailed in current available sources. Similarly, specialized account options such as Islamic accounts for Sharia-compliant trading, corporate accounts, or managed account services lack specific documentation.

This cm trade review notes that potential clients should thoroughly investigate account terms, conditions, and available options before committing to the platform.

The trading tools and resources landscape for CM Trading presents limited visibility in current available documentation. While the broker offers access to forex, commodities, and indices markets, the specific analytical tools, research resources, and trading aids provided to clients remain largely unspecified. This represents a crucial evaluation gap for traders who depend on comprehensive market analysis and trading support tools.

Educational resources, which form a cornerstone of retail broker services, are not detailed in available sources. Modern traders typically expect access to market analysis, trading guides, webinars, and educational content to support their trading development. The absence of clear information about CM Trading's educational offerings makes it difficult to assess the broker's commitment to trader development and support.

Automated trading capabilities, including expert advisor support, algorithmic trading tools, and social trading features, are not specified in current documentation. These features have become increasingly important for retail traders seeking to implement sophisticated trading strategies or benefit from community-driven trading approaches. The lack of clear information about these capabilities limits the ability to fully evaluate CM Trading's technological offerings.

Customer service quality and availability represent critical factors in broker selection. Yet specific information about CM Trading's support infrastructure remains limited in available sources. The absence of detailed information about customer service channels, availability hours, response times, and support quality creates uncertainty for potential clients who prioritize reliable customer assistance.

Multi-language support capabilities, which are essential for international brokers serving diverse client bases, are not specified in current documentation. Given CM Trading's apparent focus on underserved regions and international markets, comprehensive language support would be expected, but verification of these capabilities requires direct broker contact. Response time expectations, escalation procedures, and support ticket systems are not detailed in available materials.

Similarly, the availability of phone support, live chat, email assistance, and other communication channels lacks clear documentation. These gaps in available information make it challenging to assess CM Trading's commitment to customer service excellence and support quality standards.

The core trading experience offered by CM Trading remains largely unspecified in available documentation. This creates significant evaluation challenges for potential clients. Platform stability, execution speed, order processing quality, and overall trading environment characteristics are not detailed in current sources.

These factors represent fundamental considerations for traders evaluating broker options. Mobile trading capabilities, which have become essential for modern traders, are not specified in available materials. The quality of mobile applications, cross-platform synchronization, and mobile-specific features require direct investigation.

Similarly, platform functionality, advanced order types, charting capabilities, and technical analysis tools lack detailed documentation. Order execution policies, including slippage management, requote handling, and execution speed metrics, are not provided in current sources. This cm trade review emphasizes that trading experience quality depends heavily on these technical factors, making their absence in available documentation a significant concern for evaluation purposes.

CM Trading's trustworthiness foundation rests primarily on its regulatory status with the Seychelles Financial Services Authority. This provides a basic framework of oversight and compliance. The FSA license number SD070 offers verification of the broker's legal authorization to provide financial services, though traders should understand the specific protections and limitations associated with Seychelles regulation compared to major financial centers.

The broker's reported industry awards provide additional credibility indicators, suggesting recognition within the financial services sector. However, specific details about these awards, including issuing organizations, award categories, and timeframes, require verification through current industry sources. Such recognition typically reflects positive industry perception and operational standards.

Fund security measures, client money segregation policies, and investor protection schemes are not detailed in available documentation. These factors represent crucial trust elements that modern traders expect from their chosen brokers. The absence of clear information about these protective measures creates uncertainty about client fund safety and broker financial practices.

Company transparency regarding ownership structure, financial statements, and operational policies is not evident in available sources. Modern regulatory environments increasingly emphasize transparency and disclosure, making this information gap notable for potential clients evaluating the broker's overall trustworthiness and operational integrity.

Overall user satisfaction metrics and experience quality indicators for CM Trading are not comprehensively available in current sources. This limits the ability to assess real-world client experiences. User feedback, satisfaction ratings, and experience testimonials would typically provide valuable insights into the broker's service quality and client relationship management.

Platform usability, interface design quality, and navigation efficiency are not detailed in available documentation. These factors significantly impact daily trading activities and overall user satisfaction, making their absence in evaluation materials a notable limitation. Modern traders expect intuitive, responsive, and feature-rich trading environments.

Account registration processes, verification procedures, and onboarding experiences lack specific documentation in available sources. Similarly, funding and withdrawal experiences, processing times, and transaction efficiency are not detailed. These operational aspects directly impact user experience and satisfaction levels.

Common user complaints, recurring issues, and broker responsiveness to client concerns are not documented in available materials. Understanding typical user challenges and the broker's approach to problem resolution would provide valuable insights for potential clients considering CM Trading services.

CM Trading presents itself as an established forex and CFD broker with over a decade of market presence and regulatory oversight from the Seychelles Financial Services Authority. The broker's substantial user base of about one million traders indicates significant market acceptance and operational scale. The accessible $100 minimum deposit and focus on underserved markets demonstrate the company's commitment to retail trader accessibility.

However, this comprehensive evaluation reveals significant information gaps about platform specifics, trading conditions, customer service quality, and detailed user experiences. While the broker's regulatory status and industry recognition provide basic credibility foundations, potential clients require additional due diligence to fully understand the trading environment and service quality offered by CM Trading. The broker appears suitable for traders seeking entry into forex and commodities markets, particularly those in regions with limited broker options.

However, the lack of detailed information about trading tools, customer support, and user experiences suggests that prospective clients should conduct thorough direct research and possibly consider demo trading before committing significant capital to the platform.

FX Broker Capital Trading Markets Review