Bt Global 2025 Review: Everything You Need to Know

Executive Summary

This Bt Global review shows troubling patterns in how traders feel about the service. User feedback analysis reveals that Bt Global Services faces big challenges in meeting what traders expect, with about 90% of users giving 1-star ratings based on available review data. The broker says it offers multiple trading tools with zero spreads. However, the huge amount of negative feedback raises serious questions about how good and reliable their service really is.

The platform seems to target traders who want different trading chances. Current user happiness levels show big gaps between what services they promise and what they actually give. Key features include access to various trading tools and competitive spread offers, but service quality problems overshadow these benefits. The broker performs poorly in important areas like customer support, platform reliability, and overall user experience compared to industry standards.

Traders who want excellent service and reliable support should look at other options based on current market feedback. They should wait until Bt Global fixes these basic service problems.

Important Notice

This Bt Global review uses available user feedback and public information. Traders should know that specific regulatory details were not found in available sources, which may affect trading experiences in different areas. The review method includes user ratings, service feedback, and market comparison analysis to give a complete assessment.

Limited regulatory transparency in available materials means potential users should do more research before making trading decisions. Service may vary by region, and traders should check specific terms and conditions that apply to their location.

Rating Framework

Broker Overview

Bt Global Services works as part of the larger BT Group system. The company started in July 2000. It keeps its headquarters in London, United Kingdom, and sees itself as a global telecommunications and technology services provider.

The company is mainly known for telecommunications infrastructure but has grown into various service areas including network security and cloud computing solutions. The company's global reach covers 180 countries, which suggests extensive international infrastructure and operational abilities. However, moving from telecommunications to financial services trading creates unique challenges that seem to show up in current user satisfaction numbers.

In the trading services sector, Bt Global says it offers diverse trading instruments with competitive spread structures. The specific trading platform design and asset organization details stay unclear from available information sources. This Bt Global review notes that while the company uses its global infrastructure background, the specialized needs of forex and financial trading seem to create ongoing operational challenges shown in user feedback patterns.

Detailed Service Analysis

Regulatory Framework: Available information does not name specific regulatory authorities watching over trading operations. This creates uncertainty about compliance standards and trader protections.

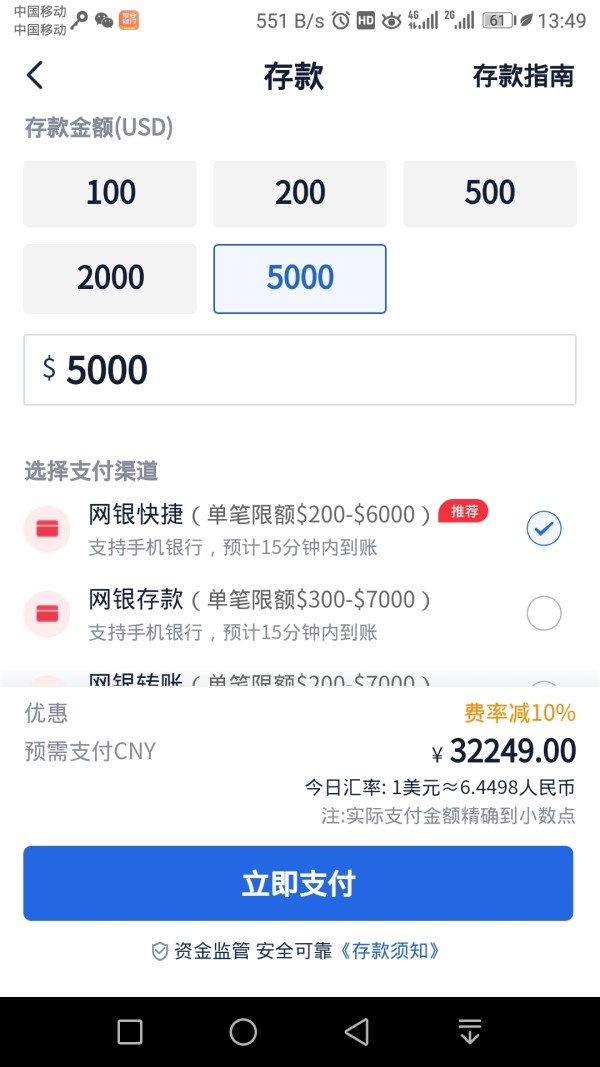

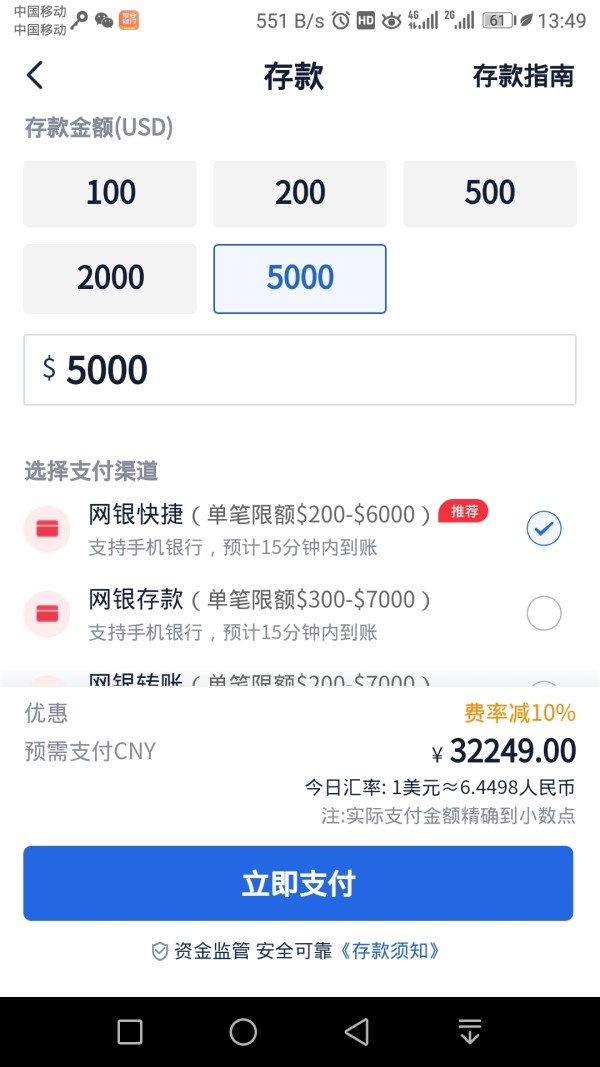

Deposit and Withdrawal Methods: Specific funding mechanism details were not outlined in available source materials. This potentially affects user planning and account management strategies.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in accessible information. This makes it hard for potential traders to assess entry barriers.

Promotional Offerings: Current bonus structures and promotional campaigns are not detailed in available materials. This limits insight into potential account enhancement opportunities.

Tradeable Assets: The platform advertises multiple trading instruments. However, specific asset categories, including forex pairs, commodities, indices, and cryptocurrencies, need further clarification from the provider.

Cost Structure: Zero spreads are prominently advertised, representing a potentially competitive advantage. However, commission structures and other trading costs remain unspecified, making complete cost assessment challenging.

Leverage Options: Specific leverage ratios and margin requirements are not detailed in available information. This limits risk management planning capabilities.

Platform Selection: Trading platform specifications and technology infrastructure details require additional clarification from the service provider.

Geographic Restrictions: Specific regional limitations and service availability parameters are not fully outlined in accessible materials.

This Bt Global review emphasizes the need for greater transparency across these basic service areas. This would help traders make informed decisions.

Comprehensive Rating Analysis

Account Conditions Analysis

The account structure and conditions at Bt Global present big transparency challenges. These directly affect trader confidence and planning abilities. Available information lacks important details about account types, tier structures, and associated benefits that traders typically need for informed decision-making.

Minimum deposit requirements remain unspecified. This creates uncertainty for traders trying to assess entry barriers and capital allocation strategies. This information gap particularly affects new traders who need clear guidance on initial investment requirements and account funding expectations.

The account opening process details are not fully outlined. This potentially creates confusion during onboarding and registration procedures. Standard industry practices typically include detailed verification requirements, documentation needs, and timeline expectations that seem absent from available materials.

Specialized account features are not addressed in accessible information. These include Islamic accounts for Sharia-compliant trading, educational accounts for learning purposes, and VIP accounts for high-volume traders. This Bt Global review notes that such missing information limits the platform's appeal to diverse trader segments with specific requirements.

User feedback about account conditions consistently shows dissatisfaction. This suggests that even existing account holders face challenges with current structures and support systems.

The trading tools and resources system at Bt Global needs substantial improvement to meet modern trader expectations and industry standards. Multiple trading instruments are advertised, but specific tool categories and functionality details remain poorly documented.

Research and analysis resources are basic for informed trading decisions but are not fully outlined in available materials. Modern traders expect access to market analysis, economic calendars, technical indicators, and expert commentary that support strategic decision-making processes.

Educational resources are crucial for trader development and skill enhancement but appear limited or poorly promoted. Complete educational programs typically include webinars, tutorials, market guides, and interactive learning modules that help traders improve their abilities.

Automated trading support and algorithmic trading capabilities are not detailed. This potentially limits advanced traders who rely on sophisticated trading strategies and execution methods. The missing clear information about API access, copy trading features, and automated system integration represents a significant gap.

User feedback about available tools consistently shows disappointment with current offerings. This suggests that existing resources fail to meet trader expectations for complete market analysis and trading support capabilities.

Customer Service and Support Analysis

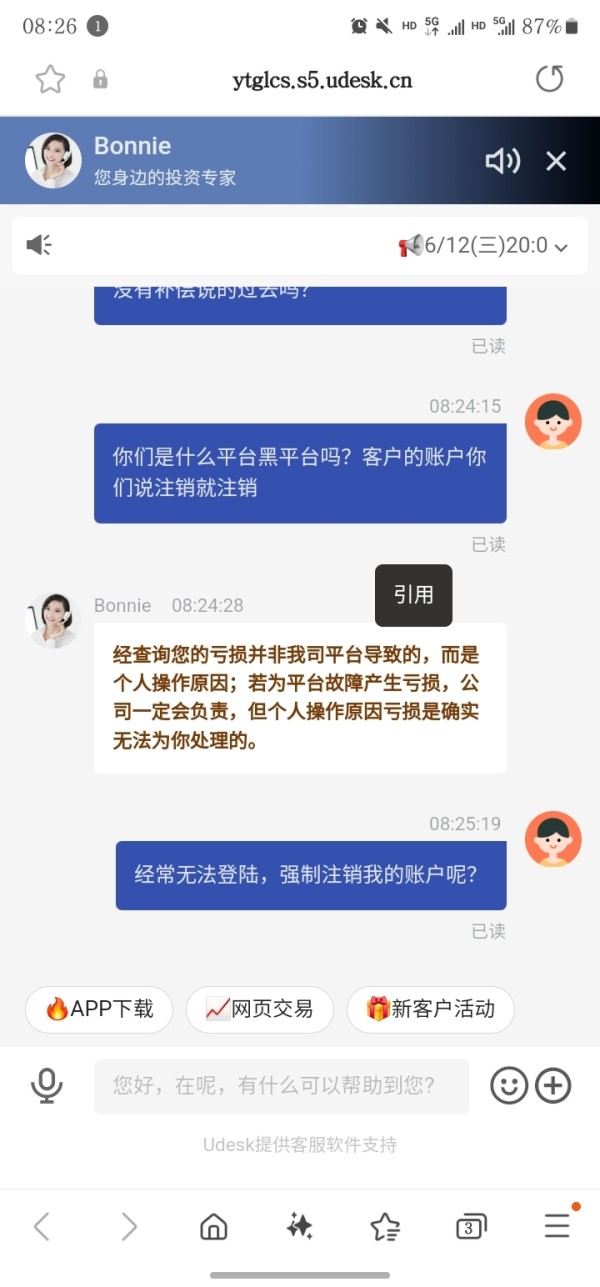

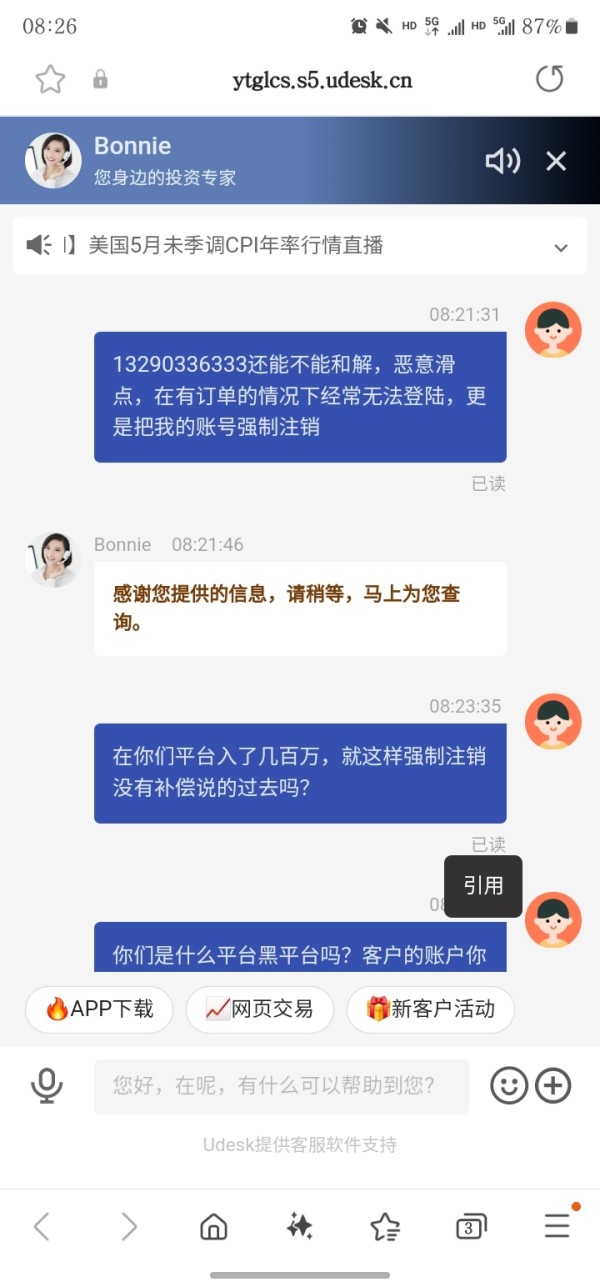

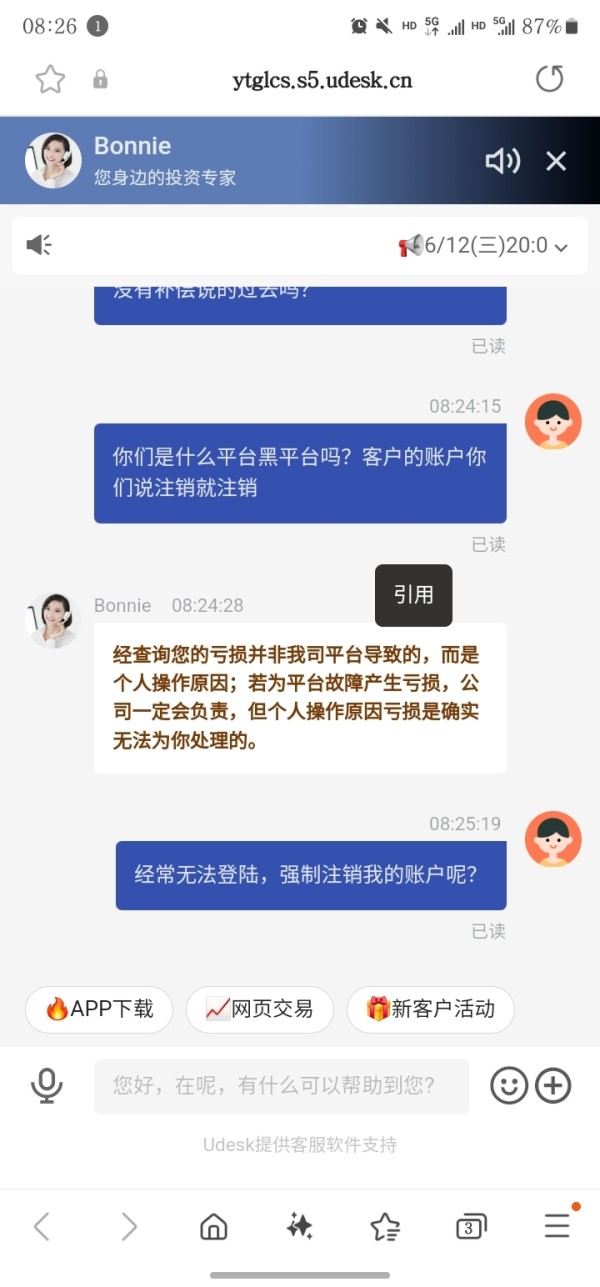

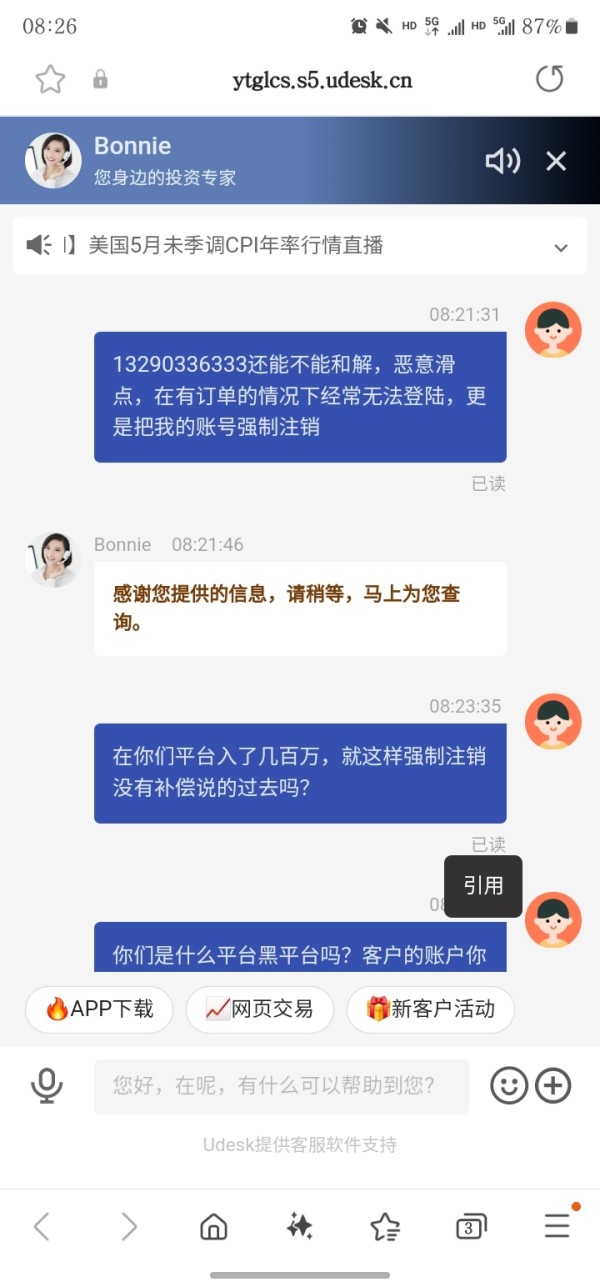

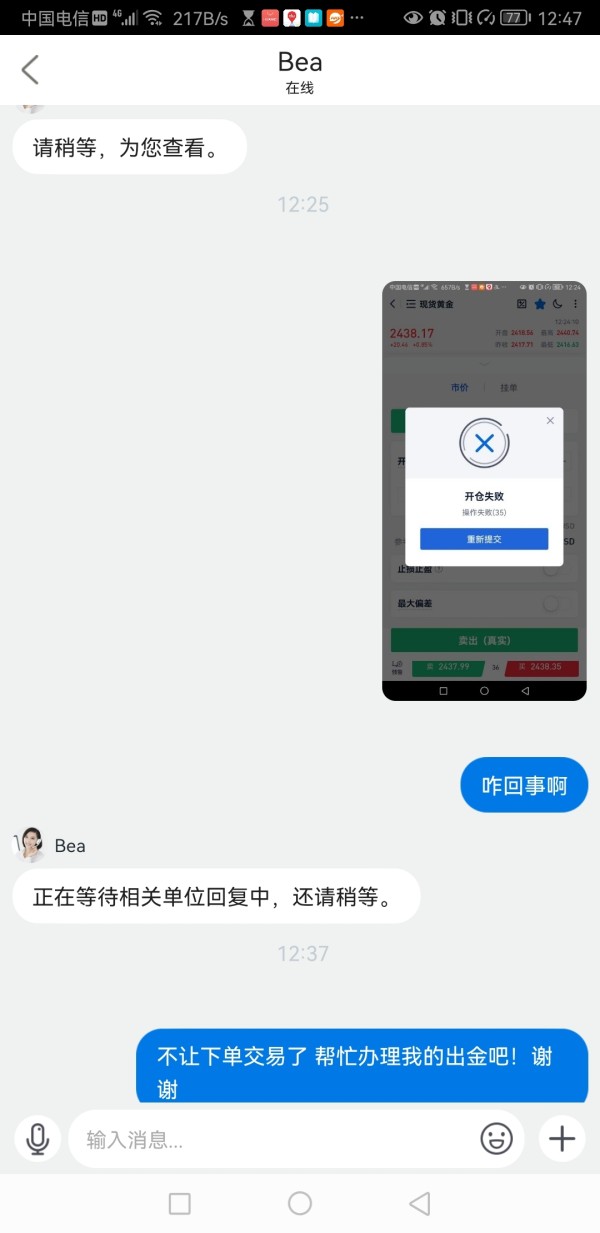

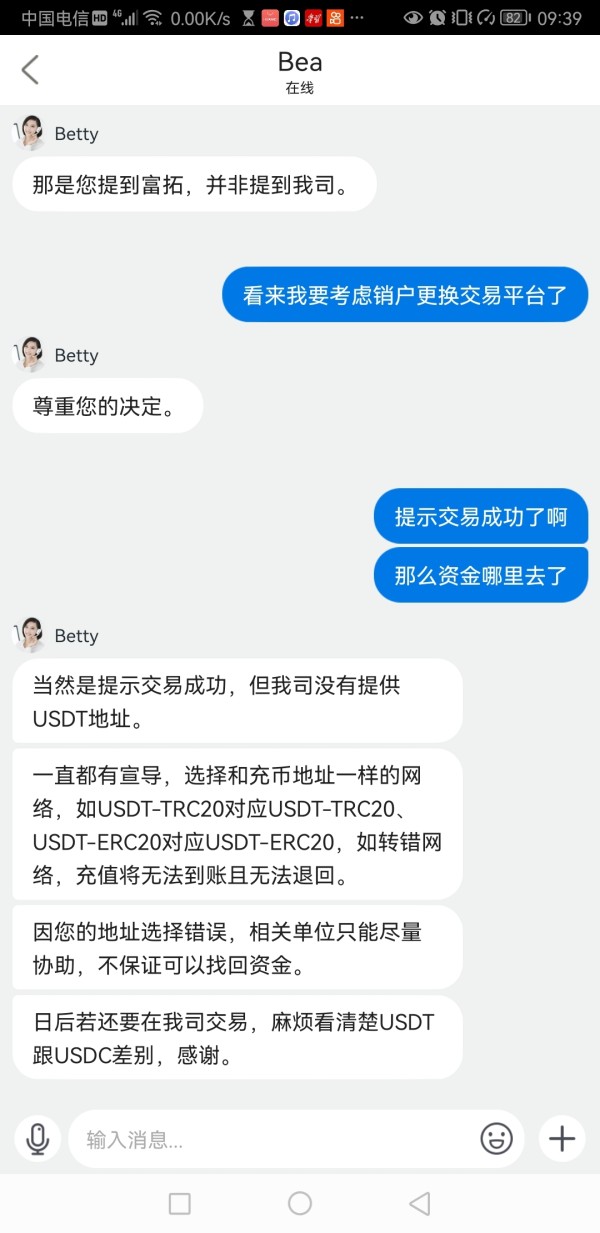

Customer service performance represents one of the most critical weaknesses identified in this Bt Global review. User feedback consistently highlights poor support experiences across multiple touchpoints. The overwhelming negative sentiment suggests systemic issues in support delivery and customer relationship management.

Available support channels and accessibility options are not clearly defined. This creates confusion for users seeking help with account issues, technical problems, or trading inquiries. Modern traders expect multiple communication options including live chat, email support, phone assistance, and complete FAQ resources.

Response time performance appears problematic based on user feedback patterns. Many traders report delayed responses and inadequate resolution timeframes. Efficient customer support typically provides immediate acknowledgment and rapid issue resolution that appears lacking in current operations.

Service quality consistency presents ongoing challenges. Users report varying levels of support effectiveness and professional competency. Standardized support protocols and complete staff training programs appear necessary to address these basic service delivery issues.

Multilingual support capabilities and global service coverage details are not specified. This potentially limits accessibility for international traders who need assistance in their native languages or during regional business hours.

Trading Experience Analysis

The overall trading experience at Bt Global reveals significant gaps between advertised capabilities and actual user satisfaction levels. Zero spreads represent a potentially attractive feature, but broader platform performance issues appear to overshadow this competitive advantage.

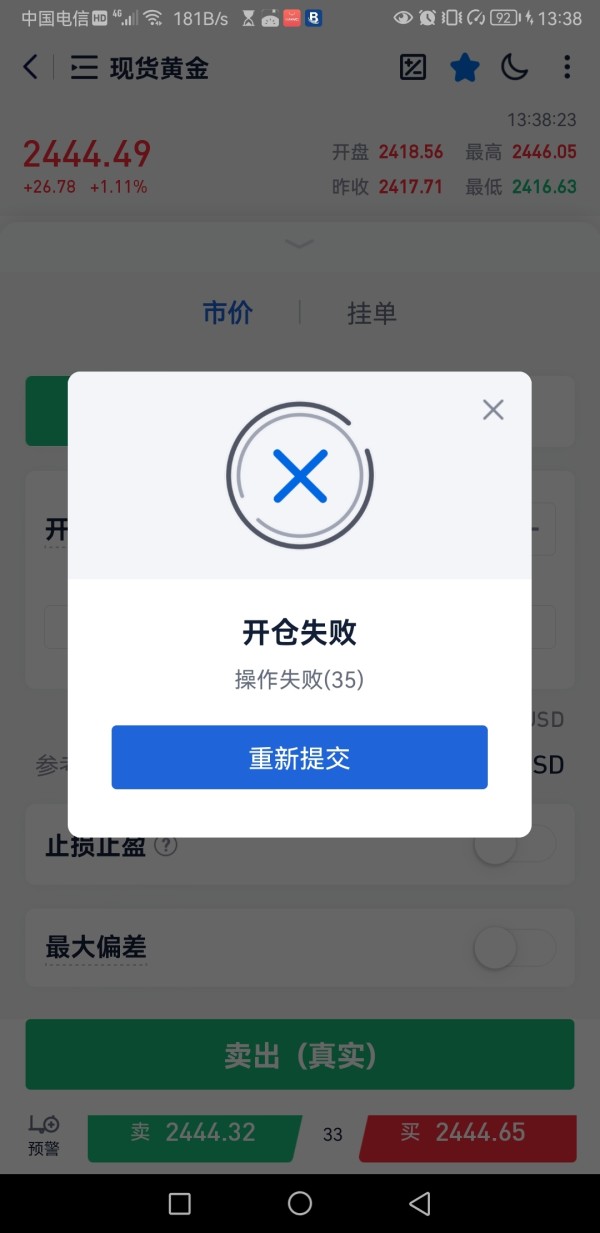

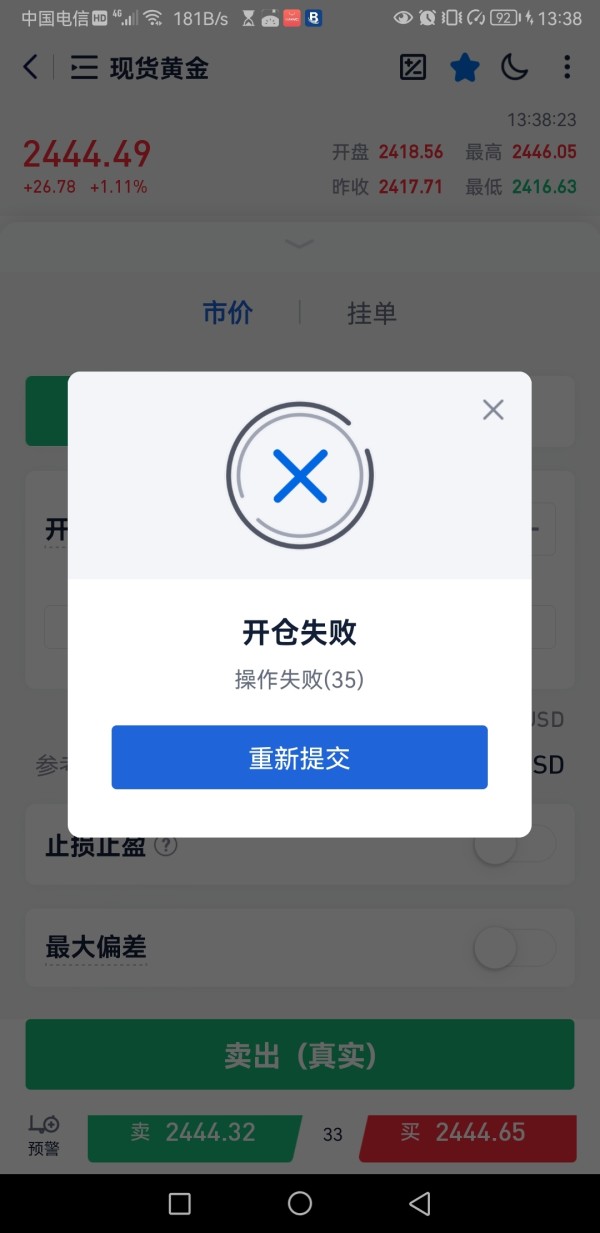

Platform stability and execution reliability concerns emerge consistently in user feedback. This suggests technical infrastructure challenges that affect trading effectiveness. Stable platform performance is basic for successful trading, particularly during high-volatility market periods when reliable execution becomes critical.

Order execution quality and speed metrics are not fully documented. This makes it difficult to assess actual trading conditions and slippage performance. Transparent execution statistics typically help traders understand real trading costs and platform efficiency levels.

Platform functionality and feature completeness appear limited based on user experiences. Many traders report inadequate tools and interface limitations. Modern trading platforms typically offer advanced charting, multiple order types, risk management tools, and customizable interfaces that may need enhancement.

Mobile trading experience details are not specified. This potentially limits traders who need flexible access and mobile platform capabilities. This Bt Global review notes that mobile trading has become essential for contemporary traders who need constant market access and portfolio management capabilities.

Trust and Security Analysis

Trust and security considerations present the most significant concerns identified in this complete evaluation. The missing detailed regulatory information in available materials creates substantial uncertainty about trader protection and compliance standards.

Regulatory oversight and licensing details are not clearly specified. This makes it difficult to assess the level of regulatory protection and compliance standards that govern trading operations. Established regulatory frameworks provide crucial trader protections and dispute resolution mechanisms that appear unclear in current documentation.

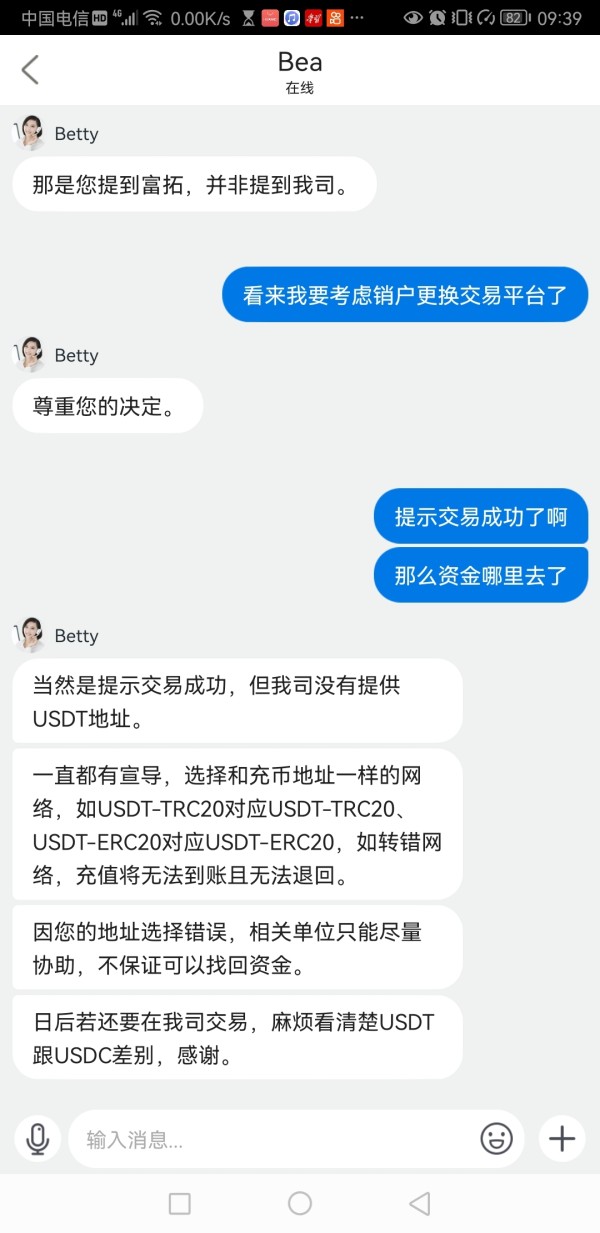

Fund security measures and client money protection protocols are not fully outlined. This creates uncertainty about asset safety and segregation practices. Industry-standard practices typically include segregated client accounts, insurance coverage, and transparent fund handling procedures that need clarification.

Company transparency and financial disclosure practices appear limited. There is insufficient information about company financial health, ownership structure, and operational transparency. These factors significantly affect trader confidence and long-term relationship viability.

User trust feedback overwhelmingly shows skepticism and concern. The majority of traders express doubt about platform reliability and security measures. Addressing these basic trust issues requires complete transparency improvements and enhanced communication about security protocols.

User Experience Analysis

Overall user satisfaction levels at Bt Global consistently rank among the lowest in available feedback. About 90% of users provide minimum ratings that show widespread dissatisfaction across multiple service areas.

Interface design and platform usability details need significant attention. User feedback suggests navigation difficulties and functionality limitations that prevent effective trading activities. Modern platforms typically prioritize intuitive design and user-friendly interfaces that help efficient trading workflows.

Registration and account verification processes appear problematic based on user experiences. Many traders report complications during onboarding procedures. Streamlined verification processes typically enhance user satisfaction and reduce abandonment rates during account setup.

Funding and withdrawal experience feedback shows challenges with financial transactions and account management procedures. Efficient fund management capabilities are essential for trader satisfaction and operational effectiveness.

Common user complaints center on service quality issues, platform limitations, and support inadequacies. These collectively create negative user experiences. This Bt Global review emphasizes that addressing these basic user experience challenges requires complete service improvements across multiple operational areas.

Conclusion

This complete Bt Global review reveals substantial challenges across critical service areas that significantly affect trader satisfaction and platform viability. The overwhelming negative user feedback, with 90% of users providing minimum ratings, shows systemic issues requiring immediate attention and complete operational improvements.

The platform may appeal to traders specifically seeking zero-spread trading opportunities. However, current service quality limitations make it unsuitable for traders prioritizing reliable customer support, platform stability, and regulatory transparency. The missing detailed regulatory information particularly concerns security-conscious traders who need clear compliance frameworks.

Primary advantages include advertised zero spreads and multiple trading instrument access. Significant disadvantages include poor customer service, limited transparency, platform reliability issues, and inadequate user support systems. Until substantial improvements address these basic service challenges, traders should carefully consider alternative platforms that show stronger performance across these critical operational areas.