Capital Street FX 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Capital Street FX is an offshore broker that presents a compelling offer: high leverage options (up to 1:10,000), a diverse range of trading instruments including forex, commodities, and cryptocurrencies, all available through its proprietary trading platform. However, this enticing proposition is coupled with significant risks, primarily stemming from its regulatory status under the Financial Services Commission (FSC) of Mauritius, a tier-3 regulator. This article will explore the inherent advantages of trading with Capital Street FX, alongside the alarming issues surrounding fund safety and withdrawal processes that users have reported. Consequently, while it may attract experienced traders who thrive on high leverage, the uncertainties associated with this broker may render it less suitable for individuals seeking a more secure trading environment.

⚠️ Important Risk Advisory & Verification Steps

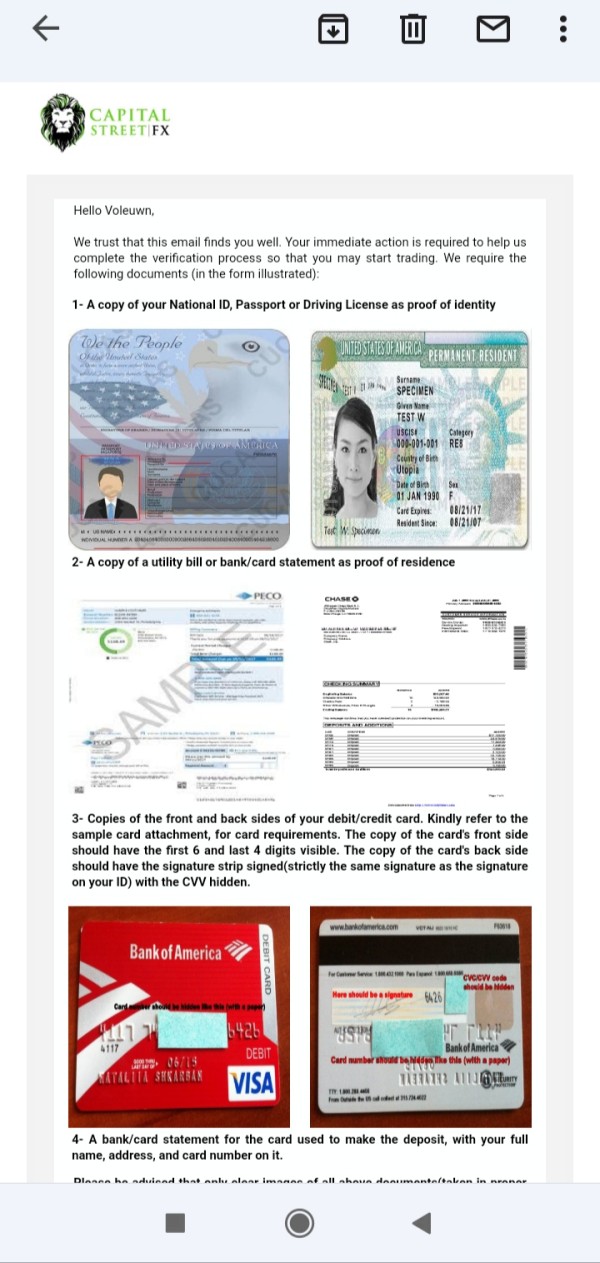

Choosing the right broker is critical in today‘s complex trading landscape. When considering Capital Street FX, it’s essential to conduct thorough due diligence to safeguard your investments. The following steps are crucial for self-verification:

- Check Regulatory Status: Confirm the broker's registration with the Financial Services Commission of Mauritius, understanding its implications on investor protection.

- Read User Reviews: Explore varied reviews from different sources to gain insights into other traders' experiences regarding fund safety and withdrawal capabilities.

- Understand Bonus Conditions: Familiarize yourself with the terms attached to any bonuses, as they can include stringent trading requirements that significantly limit fund accessibility.

- Assess Withdrawal Procedures: Investigate the withdrawal processes by seeking reviews from current users, focusing on any reported delays or issues.

Be cautious—it is advisable to thoroughly assess any offshore broker before committing your capital.

Broker Evaluation Table

Company Background and Positioning

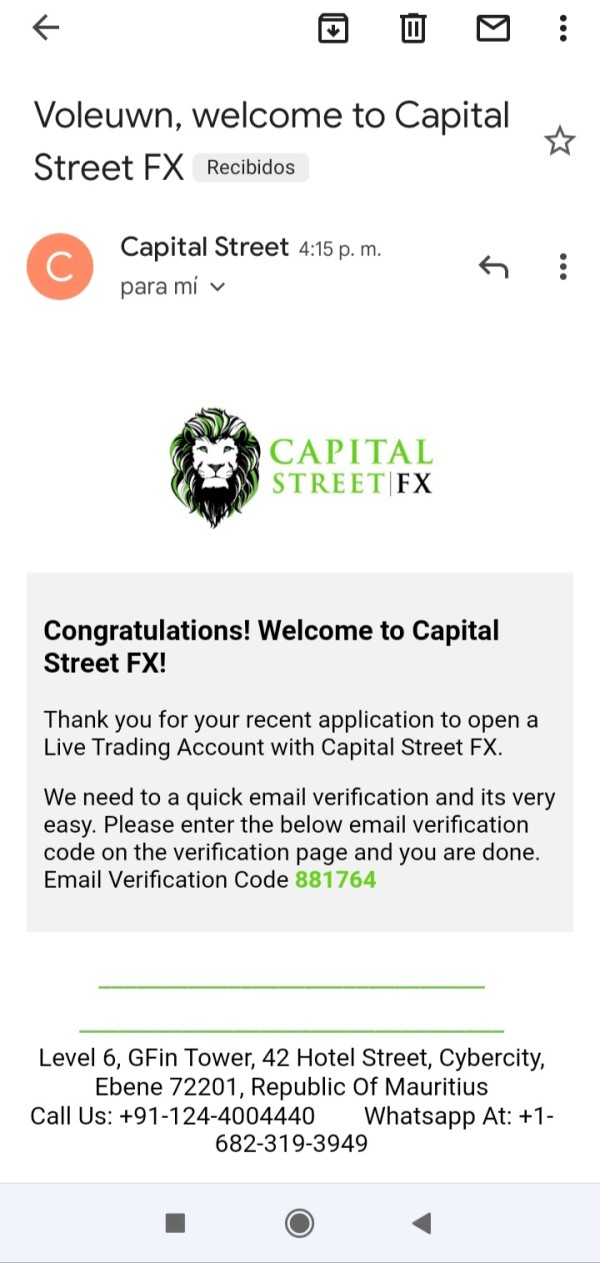

Capital Street FX was founded in 2002 and is operated by Capital Street Intermarkets Limited, located in Mauritius. It is regulated by the Financial Services Commission (FSC) of Mauritius, a regulatory body regarded as relatively weak compared to tier-1 regulators globally. As an offshore broker, it caters primarily to traders seeking high leverage and diverse trading options without the stringent oversight found in more established jurisdictions.

Core Business Overview

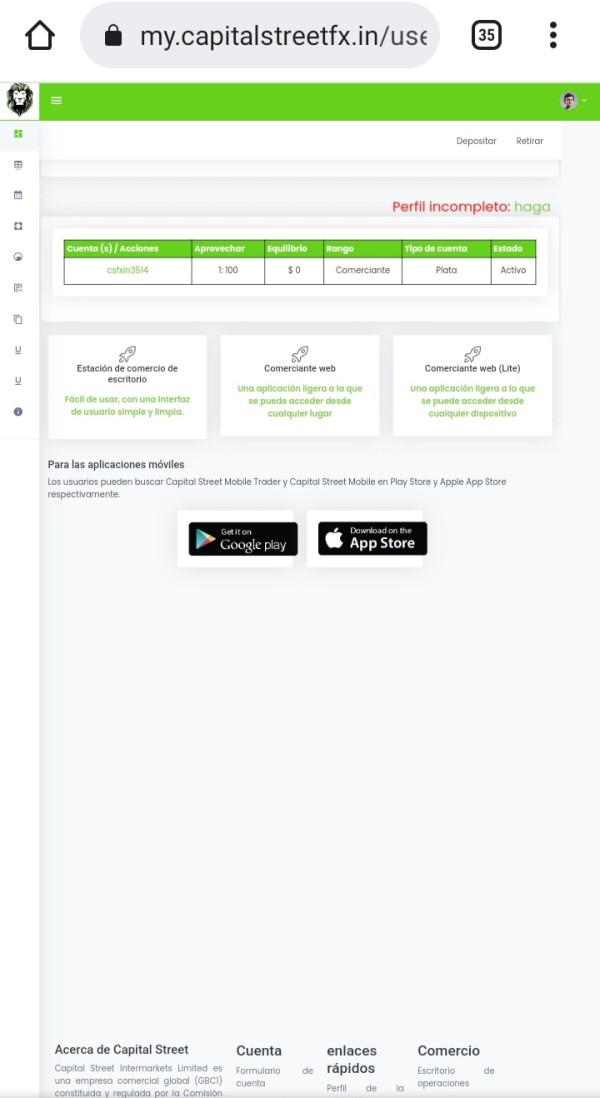

Capital Street FX operates on a hybrid business model that combines traditional forex brokerage services with access to a wide array of financial instruments, including over 55 currency pairs, stocks, indices, commodities, and cryptocurrencies. It promotes its proprietary trading platforms—namely the Act Trader and mobile trading applications—giving users the ability to trade seamlessly across devices. The mix of high leverage, which can reach 1:10,000, alongside various account types, from Basic to VIP, aims to attract an experienced trading clientele.

Quick-Look Details Table

Trustworthiness Analysis

Capital Street FX operates within a regulatory landscape that presents challenges for traders. It is important to interpret the regulatory status critically and be mindful of the potential risks involved.

Regulatory Information Conflicts: While the broker claims strict adherence to regulatory protocols, the FSC's reputation as a tier-3 regulator raises questions about the level of investor protection provided to traders, leaving many to question the legitimacy of their investment safety.

User Self-Verification Guide:

Check if the broker is listed on the regulatory bodys site to confirm its registration.

Read user reviews on multiple platforms to gauge user satisfaction and report incidents of fund withdrawal issues.

Investigate the broker's historical operating records to assess its reliability.

Be cautious of offerings that include high bonuses with complex terms.

Industry Reputation: Gathering insights via various trading forums can indicate general sentiment towards the broker. Concerns regarding withdrawal processes, lack of transparency, and complex bonus structures have led to numerous complaints, questioning the overall trustworthiness of Capital Street FX.

Trading Costs Analysis

The trading costs associated with Capital Street FX reflect a dual nature, appealing to some traders while posing risks to others.

Advantages in Commissions: Capital Street FX offers competitive commission structures, particularly appealing to traders engaging in high volume trading due to leverage of up to 1:10,000.

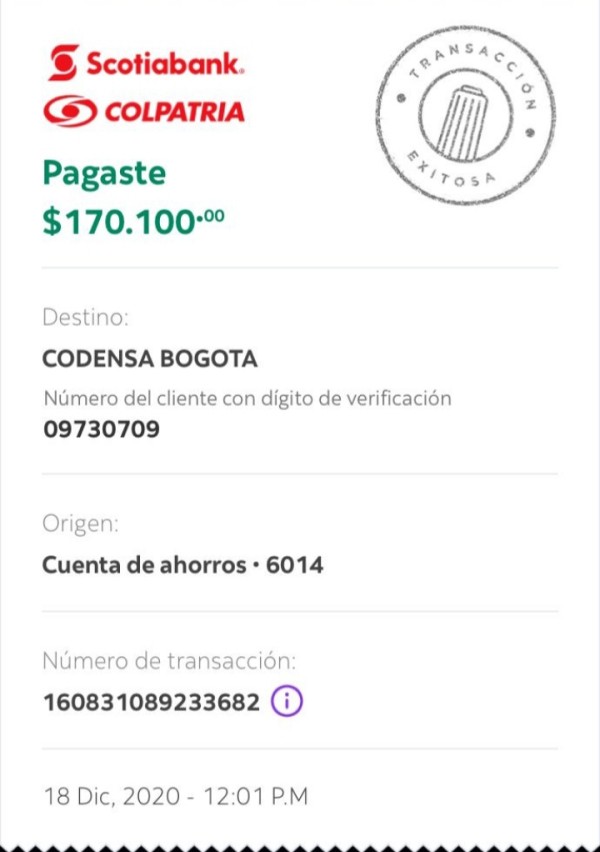

Non-Trading Fees and Hidden Costs: User complaints highlight concerns around withdrawal fees and spreads. Reports indicate withdrawal fees exceeding $35, and spreads can be as high as 3 pips under certain conditions. These supplementary costs can significantly impact trading profitability.

Cost Structure Summary: Traders focusing on high-frequency strategies may benefit from lower commission structures; however, those utilizing lower volumes or who require frequent withdrawals could face substantial costs that offset potential gains.

Capital Street FX utilizes its own proprietary trading platform, which caters to a specific clientele.

Platform Diversity and Features: The Act Trader platform lacks the familiarity of industry-standard platforms like MetaTrader 4 or 5 but offers unique features such as algorithmic trading and a user-friendly interface.

Quality of Tools and Resources: Although some users have praised the platform's functionality, it does not completely align with the expectations set by competitors, notably in areas like customizable indicators and comprehensive trading analytics.

User Feedback on Usability: Reviews indicate that while the platform is relatively ease to navigate, the absence of MetaTrader 4 as a trusted option leaves a gap for seasoned traders who rely on that specific platform for consistent performance.

User Experience Analysis

User experiences with Capital Street FX often reflect a mix of positive trading conditions and unsettling service elements.

Platform Usability: Many users have reported a smooth trading experience, highlighting the platform's ease of use and quick order execution times which contribute to overall satisfaction with trading functions.

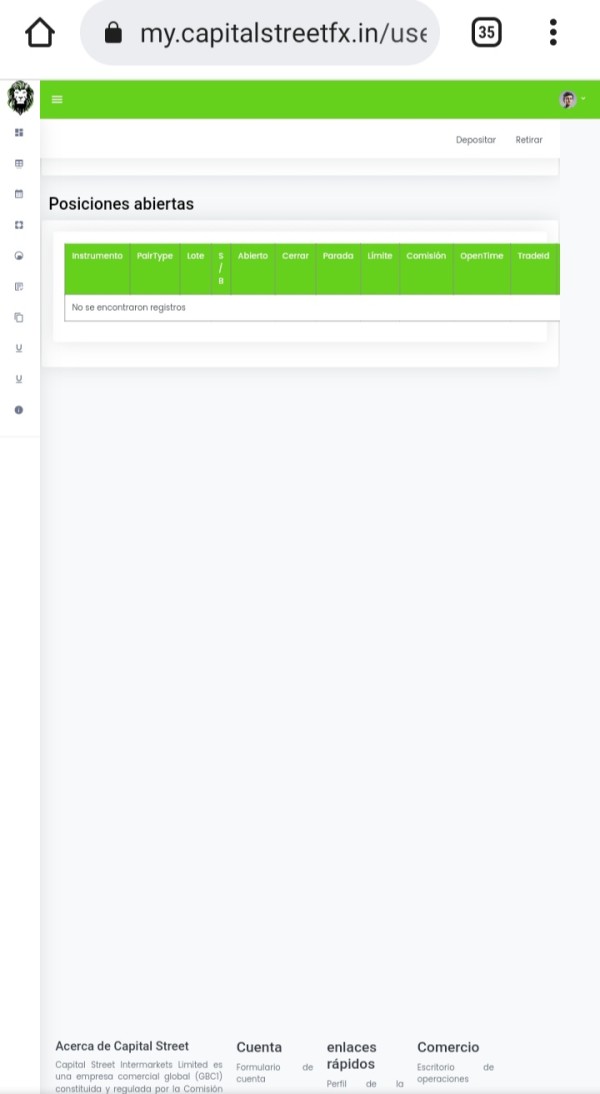

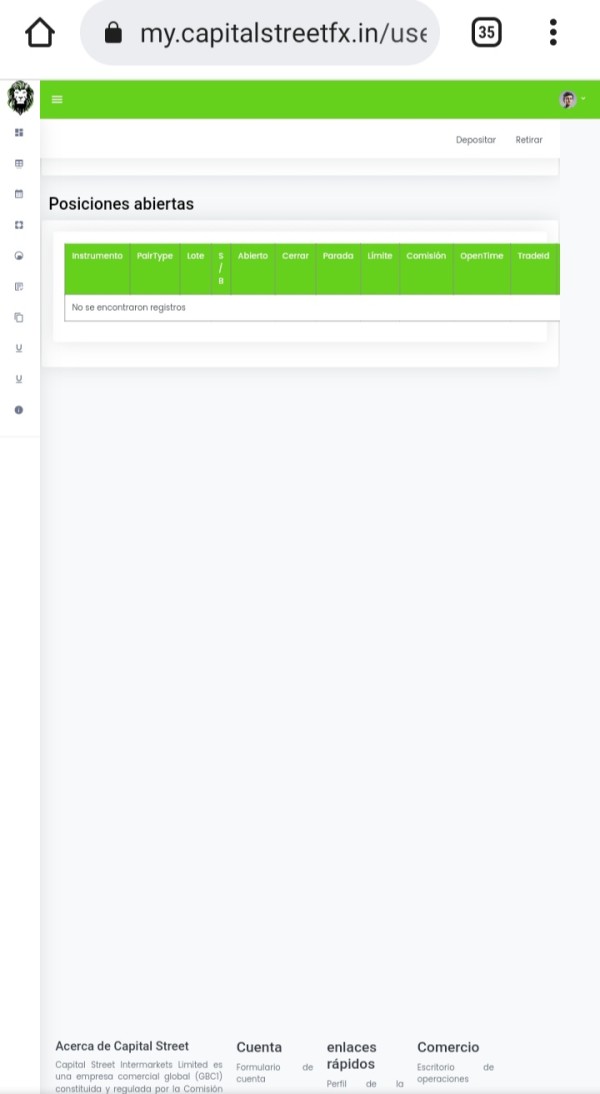

Withdrawals and Support Issues: However, reports of problems with withdrawals—ranging from delays to lack of response from customer support—contrast sharply with the positive trading reviews, raising concerns about customer support reliability.

Compromising Reviews: Satisfaction varies significantly, showing that while many users appreciate the trading conditions, unresolved issues regarding fund withdrawals and ineffective customer support can tarnish the user experience.

Customer Support Analysis

Customer support remains a critical area of scrutiny for Capital Street FX, with mixed feedback from users.

Response Quality and Availability: Feedback indicates a generally responsive customer service team, although users have noted exceptions, particularly concerning withdrawal-related queries that were not adequately addressed.

Multi-Channel Communication: Despite offering multiple communication channels—email, phone, WhatsApp—the quality of interaction has been uneven, leading to frustration among users facing urgent issues.

Support Suggestions from Users: To enhance customer service, recommendations from users include improving the response time and effectiveness of support during high-pressure trading periods, especially surrounding withdrawals and bonus queries.

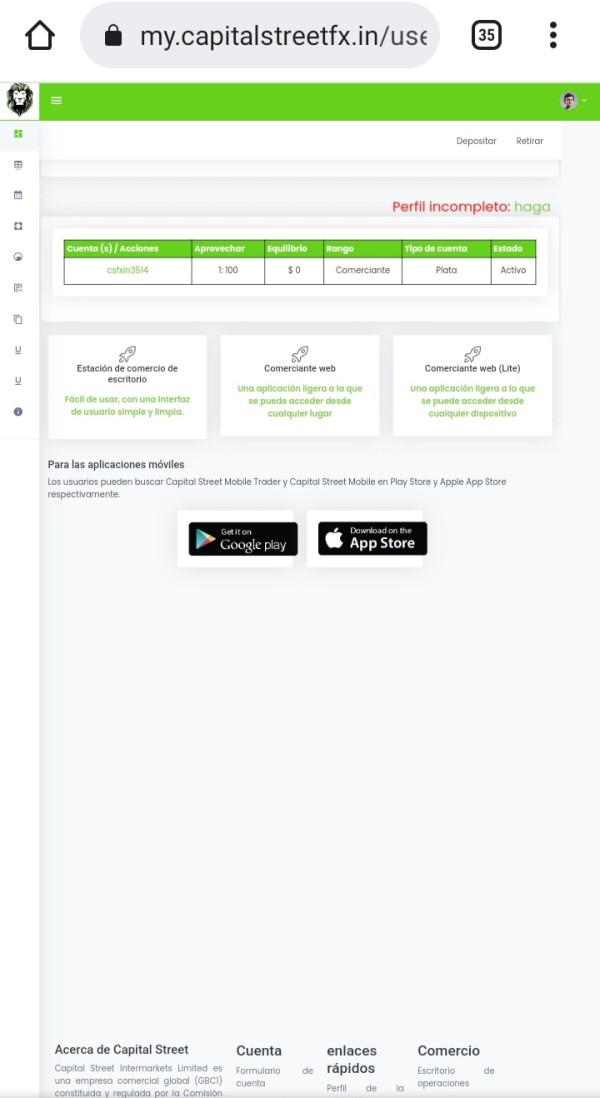

Account Conditions Analysis

Capital Street FX provides a range of account types, designed to cater to diverse trader needs.

Account Types Overview: The broker offers several account variations, from a Basic account requiring a minimum deposit of $100, to a VIP account with a $10,000 threshold, providing differentiated services and features.

Leverage and Margin Settings: Maximum leverage varies across account types; while it can reach up to 1:10,000 for VIP accounts, lower-tier accounts face restrictions, which could limit trading opportunities for less capitalized traders.

Additional Account Features Summary: Users must consider the restrictive conditions for bonus withdrawal and associated trading requirements, which could impact overall trader satisfaction and account performance.

In conclusion, while Capital Street FX offers many attractive features appealing to experienced traders—especially high leverage and varied instrument offerings—it simultaneously presents significant regulatory risks and mixed user experiences regarding fund safety and customer service. Traders should carefully consider these factors before engaging with this offshore broker.