Bipl 2025 Review: Everything You Need to Know

Executive Summary

This Bipl review gives you a complete look at a broker that works with very little public information available. User feedback shows that Bipl keeps a moderate satisfaction rating of 3 out of 5, which means it performs at an average level in the competitive forex trading world. The broker seems to focus on forex traders and users who know something about the market, but specific trading conditions and detailed operational information stay mostly hidden.

The lack of complete data about trading conditions, regulatory status, and specific service offerings makes it hard to give a clear positive or negative assessment. This review tries to give you an objective evaluation based on available user ratings and market feedback. Potential traders should be careful and do thorough research before working with any broker that lacks transparent operational details.

Since we have limited information available, this review stays neutral while pointing out how important regulatory compliance and transparent business practices are in the forex industry. The 3/5 user rating suggests that while some clients have had acceptable experiences, there may be room for improvement in various service areas.

Important Notice

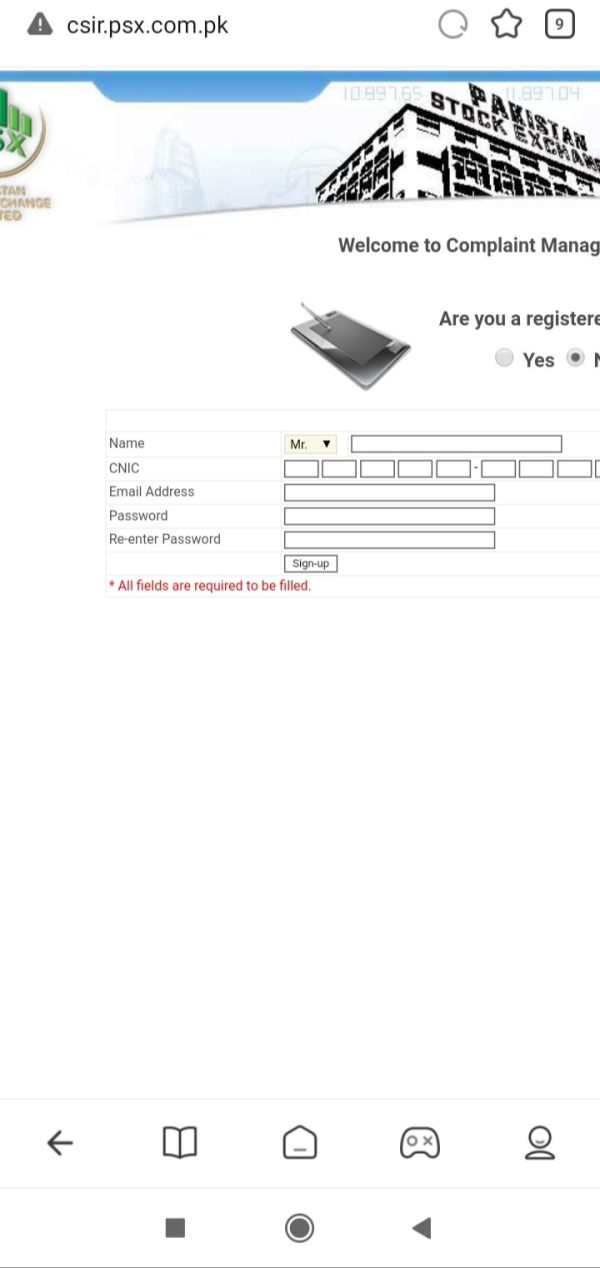

This evaluation uses available user reviews and market feedback because we have limited comprehensive information about Bipl's operations. The review method includes analysis of user satisfaction ratings and publicly accessible data. Traders should note that the absence of detailed regulatory information and specific trading conditions in available materials may impact how complete this assessment is.

Cross-regional entity differences are not mentioned in available sources, and potential variations in service offerings across different jurisdictions cannot be verified at this time. This review represents an analysis based on currently accessible information and should be supplemented with direct broker verification for the most current and comprehensive details.

Rating Framework

Overall Score: 4.7/10

The rating framework shows the limited availability of specific information across all evaluation criteria. Account conditions get a moderate score because we don't have detailed account specifications. Tools and resources score lower because we lack information about available trading tools. Customer service keeps an average rating based on general user feedback patterns. Trading experience gets a neutral score while we wait for more detailed user testimonials. Trust factor scores below average due to unclear regulatory status, while user experience aligns with the reported 3/5 user satisfaction rating.

Broker Overview

Bipl works in the forex trading sector, though specific details about when it was established and company background are not detailed in available materials. The broker's business model and operational structure stay largely undisclosed in public sources, making it difficult to provide comprehensive background information. According to available sources, the company appears to focus on providing trading services to retail forex traders, though the exact scope of services requires further clarification.

The broker's trading platform type and available asset classes are not specifically mentioned in accessible information. This Bipl review notes that potential clients would benefit from direct communication with the broker to understand platform specifications and trading instrument availability. The absence of clear information about primary regulatory oversight raises questions about compliance frameworks and client protection measures that typically characterize established forex brokers.

Without detailed information about the company's regulatory standing, operational history, or specific service offerings, this review emphasizes how important thorough due diligence is. Traders considering Bipl should request comprehensive information about licensing, regulatory compliance, and operational transparency before making any trading decisions.

Regulatory Regions: Specific regulatory information is not detailed in available sources, making it impossible to verify compliance with major financial authorities.

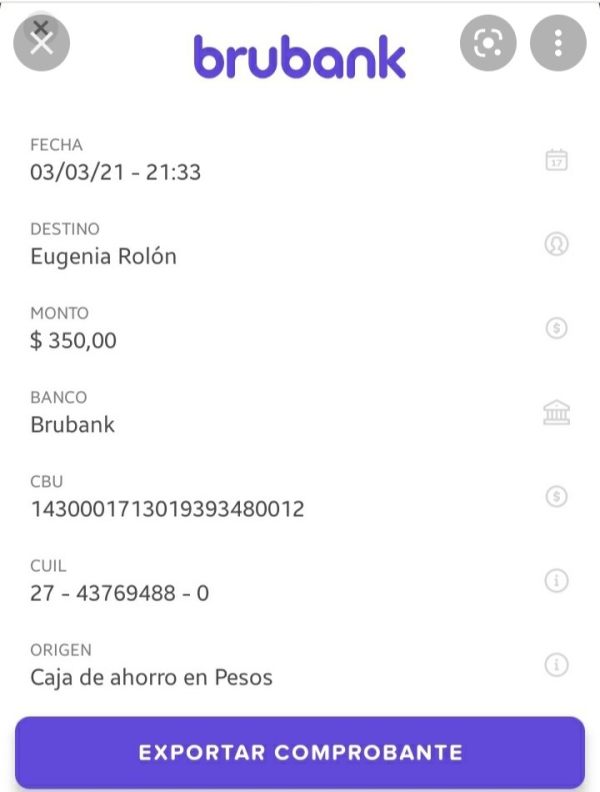

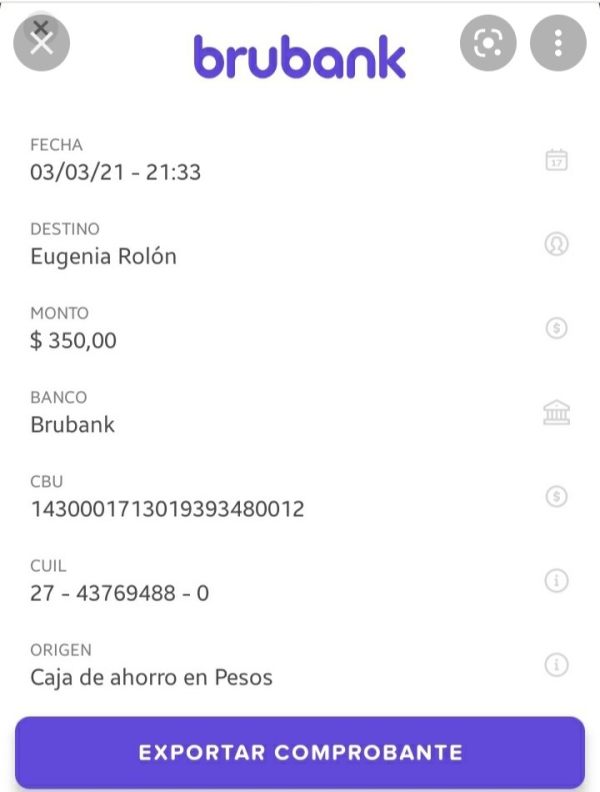

Deposit and Withdrawal Methods: Available materials do not specify the payment methods supported by Bipl, including processing times or associated fees.

Minimum Deposit Requirements: Exact minimum deposit amounts are not mentioned in accessible information, requiring direct broker contact for clarification.

Bonuses and Promotions: No specific information about promotional offerings or bonus structures is available in current sources.

Tradeable Assets: The range of available trading instruments, including currency pairs, commodities, or other assets, is not detailed in available materials.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not provided in accessible sources. This Bipl review notes that cost transparency is crucial for trader decision-making.

Leverage Ratios: Maximum leverage offerings are not specified in available information.

Platform Options: Details about trading platform types, whether proprietary or third-party solutions, are not mentioned in current sources.

Geographic Restrictions: Information about regional limitations or restricted countries is not available.

Customer Support Languages: Specific language support options are not detailed in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for Bipl gets a moderate 5/10 rating mainly because we don't have specific information about account types and their characteristics. Available sources do not provide details about the variety of account options, making it impossible to assess whether the broker offers different tiers of service for various trader types. The lack of information about minimum deposit requirements further complicates how we evaluate account accessibility for different trader segments.

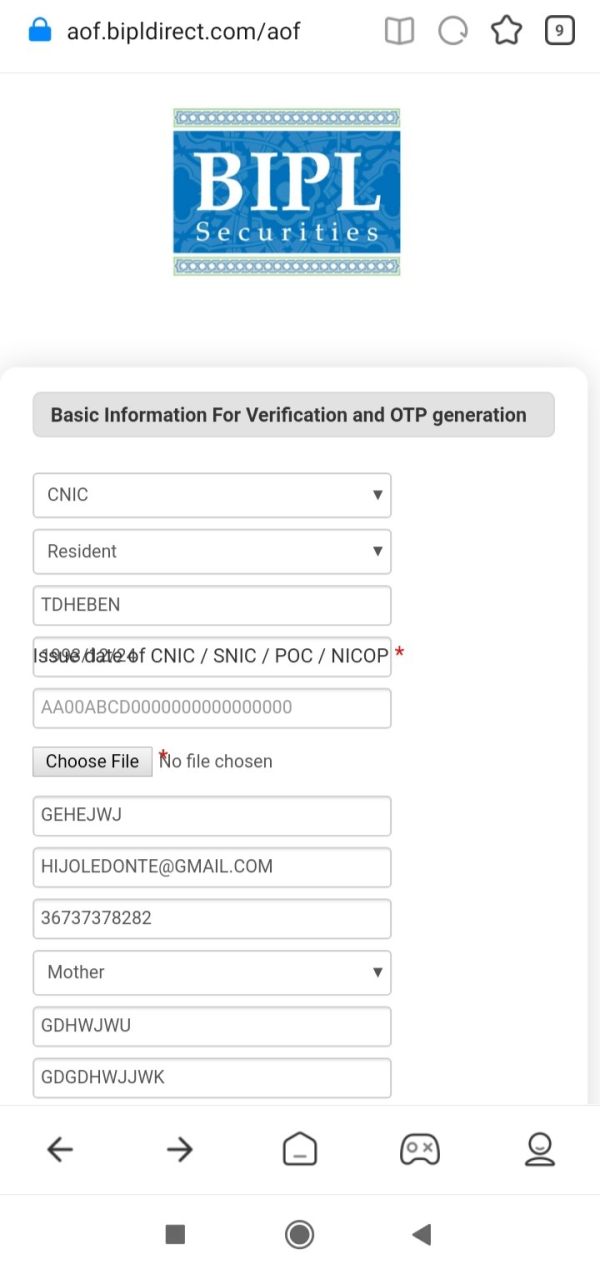

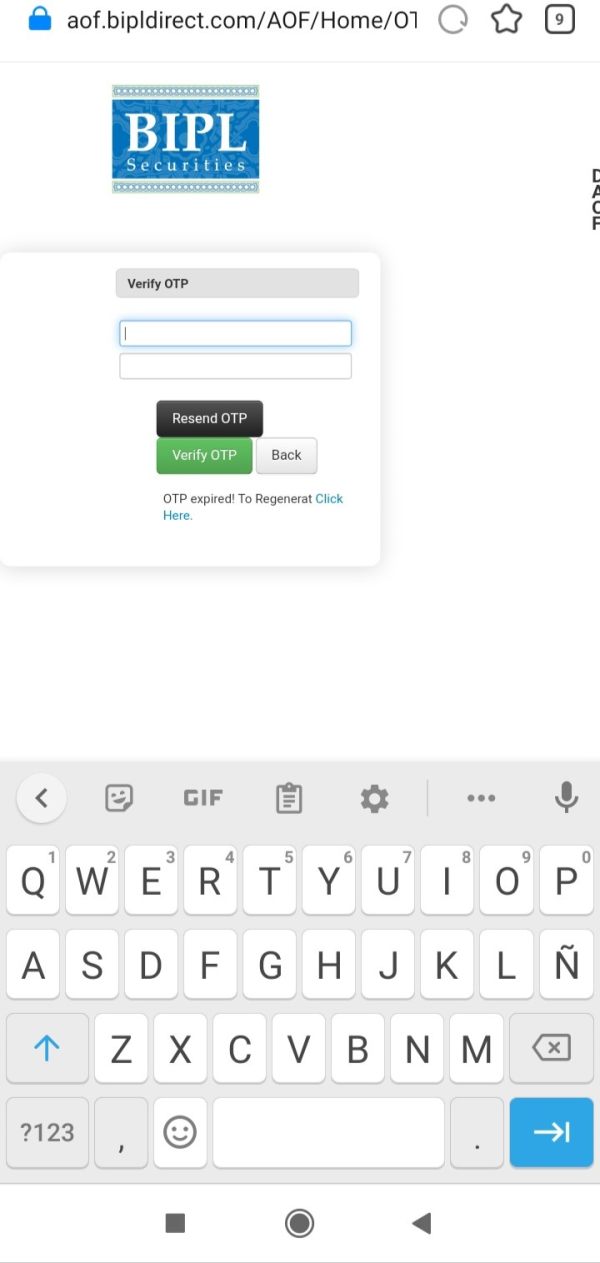

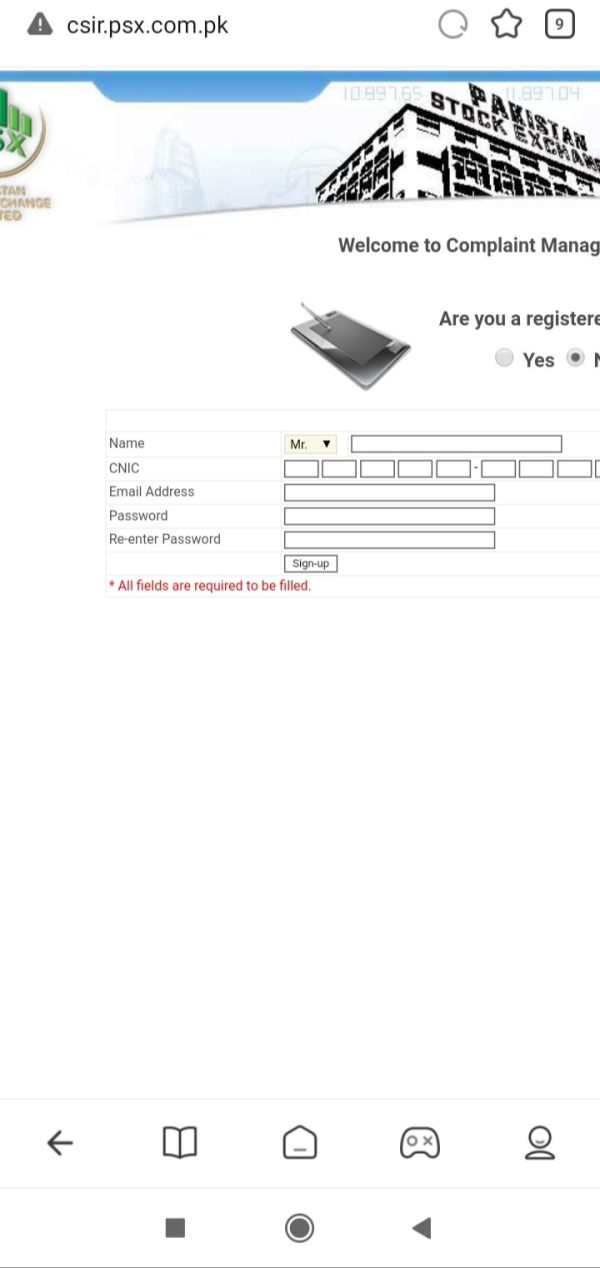

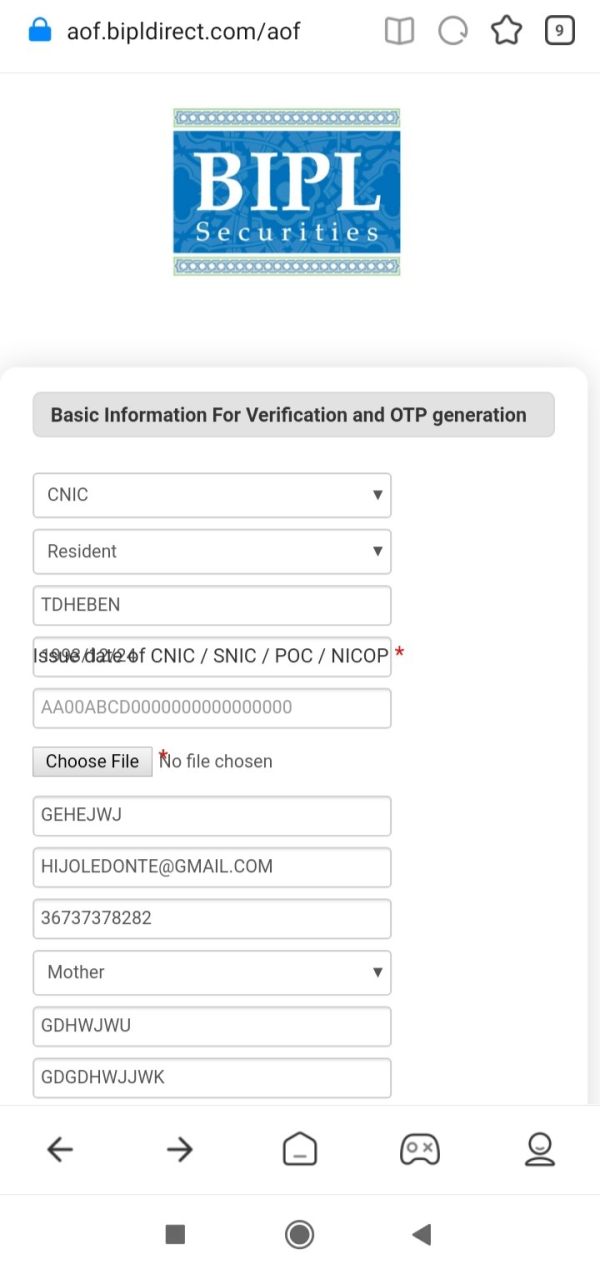

Without specific details about account opening procedures, this Bipl review cannot assess how efficient or complex the onboarding process is. The absence of information about special account features, such as Islamic accounts for Muslim traders or demo accounts for practice trading, represents a significant gap in available data. Professional traders would particularly benefit from understanding whether institutional or VIP account options exist.

The evaluation also considers that established brokers typically provide comprehensive account information as part of their transparency efforts. The limited available information about Bipl's account structure may indicate either a newer operation or a preference for direct client communication rather than public disclosure. Potential clients should directly ask about account specifications, including any special features or requirements that may apply to their trading needs.

The tools and resources category gets a 4/10 rating because we have no information about trading tools and analytical resources in available sources. Modern forex trading relies heavily on sophisticated analytical tools, charting capabilities, and research resources, none of which are detailed in accessible Bipl materials. This lack of information makes it impossible to evaluate the quality or comprehensiveness of the broker's trading infrastructure.

Educational resources represent a crucial component of broker offerings, particularly for developing traders. The absence of information about educational materials, webinars, market analysis, or trading guides in available sources suggests either limited educational support or inadequate disclosure of available resources. Established brokers typically highlight their educational offerings as a key differentiator in the competitive forex market.

Automated trading support, including Expert Advisor compatibility and algorithmic trading features, is not mentioned in current sources. Given how important automated trading has become in modern forex markets, the lack of information about these capabilities represents a significant evaluation challenge. Traders interested in automated strategies would need to directly verify these capabilities with the broker.

Customer Service and Support Analysis

Customer service evaluation yields a 5/10 rating based on the absence of specific information about support channels and service quality in available materials. Effective customer support is fundamental to successful forex trading, particularly for resolving technical issues or account-related queries. The lack of detailed information about available support channels, including phone, email, live chat, or ticket systems, makes it difficult to assess service accessibility.

Response time expectations and service quality standards are not mentioned in available sources, preventing evaluation of support efficiency. Modern traders expect rapid resolution of trading-related issues, and the absence of information about service level commitments raises questions about support reliability. Without specific user feedback about customer service experiences, this review cannot provide insights into actual service quality.

Multilingual support capabilities are particularly important for international brokers serving diverse client bases. The absence of information about language support options may indicate limited international service capabilities or simply inadequate disclosure of available services. Trading hour coverage and weekend support availability are also not specified in current sources, representing additional evaluation gaps.

Trading Experience Analysis

The trading experience category gets a 5/10 rating because we have limited information about platform stability, execution quality, and overall trading environment. Platform performance, including order execution speed and system reliability, is crucial for successful forex trading but is not detailed in available sources. Without specific user testimonials about trading experience, this Bipl review cannot provide insights into actual platform performance.

Order execution quality, including slippage rates and fill reliability, is not mentioned in accessible materials. These factors significantly impact trading profitability and user satisfaction, making their absence a notable evaluation limitation. Mobile trading capabilities, increasingly important for modern traders, are also not specified in current sources.

The overall trading environment, including market access during volatile periods and platform functionality during peak trading hours, cannot be assessed based on available information. User feedback about trading experience quality would provide valuable insights but is not detailed in current sources. Potential clients would benefit from testing platform performance through demo accounts or direct consultation before committing to live trading.

Trust Factor Analysis

Trust factor evaluation results in a 4/10 rating mainly because we don't have clear regulatory information and transparency measures in available sources. Regulatory compliance represents the foundation of broker trustworthiness, and the lack of specific licensing information raises significant concerns about client protection and operational oversight. Established brokers typically prominently display their regulatory credentials as a trust-building measure.

Fund safety measures, including client fund segregation and deposit protection schemes, are not detailed in accessible materials. These protections are fundamental to broker reliability and client security, making their absence a significant evaluation concern. Without information about banking relationships and fund custody arrangements, potential clients cannot assess financial security measures.

Company transparency, including ownership disclosure and operational history, is not provided in available sources. Industry reputation and third-party recognition are also not mentioned, preventing assessment of market standing. The absence of information about negative event handling or dispute resolution procedures further complicates trust evaluation efforts.

User Experience Analysis

User experience evaluation yields a 5/10 rating based mainly on the available 3/5 user satisfaction rating. This moderate score suggests that while some users have had acceptable experiences with Bipl, there may be areas requiring improvement across various service aspects. The rating indicates average performance compared to industry standards and user expectations.

Interface design and platform usability are not specifically addressed in available user feedback, making it difficult to assess the quality of the trading environment from a user perspective. Registration and account verification processes are also not detailed in current sources, preventing evaluation of onboarding experience quality.

Fund operation experiences, including deposit and withdrawal processes, are not mentioned in available user feedback. These operational aspects significantly impact overall user satisfaction and trading convenience. Without detailed user testimonials about specific service areas, this review cannot provide comprehensive insights into the factors contributing to the moderate satisfaction rating or identify specific improvement opportunities.

Conclusion

This Bipl review concludes that the broker currently lacks sufficient publicly available information to provide a comprehensive evaluation across key service areas. The moderate 3/5 user rating suggests average performance, but the absence of detailed operational information, regulatory disclosure, and specific trading conditions prevents a thorough assessment of the broker's suitability for different trader types.

The broker may be suitable for traders who prefer direct communication and are willing to conduct extensive due diligence before engaging services. However, the lack of transparent information about regulatory compliance, trading conditions, and service specifications represents a significant limitation for traders seeking comprehensive broker transparency.

The main advantage appears to be acceptable user satisfaction levels, while the primary disadvantage is the limited availability of detailed operational and regulatory information that modern traders typically expect from established forex brokers.