ICL Markets 2025 Review: Everything You Need to Know

Summary

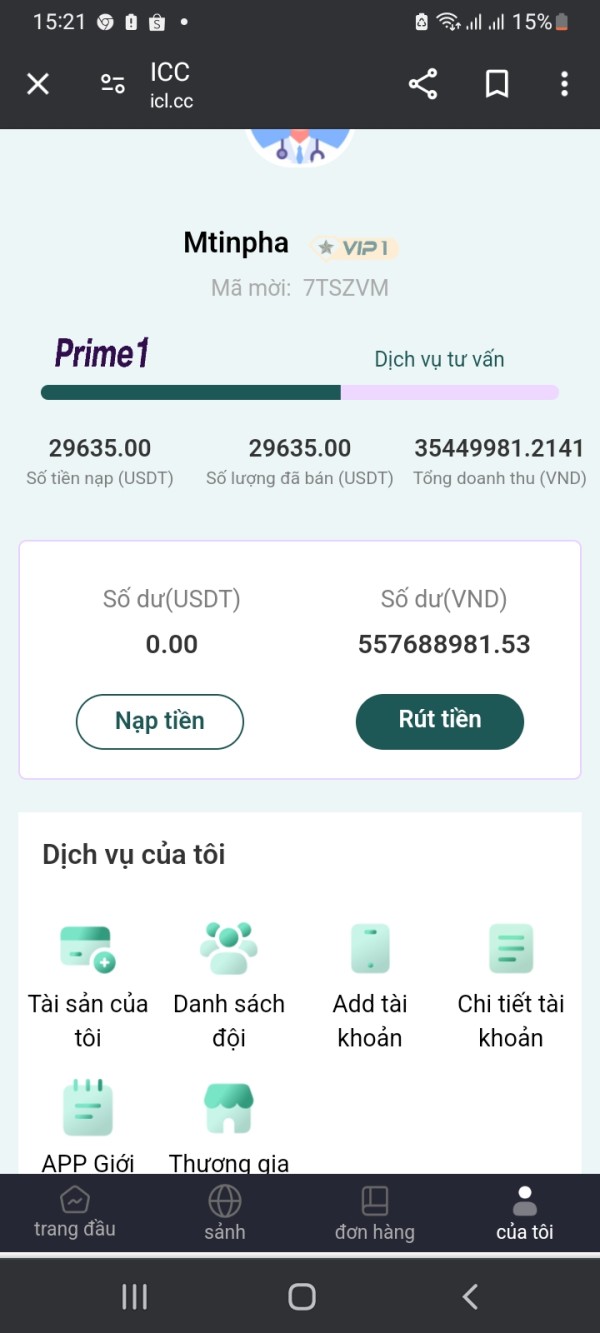

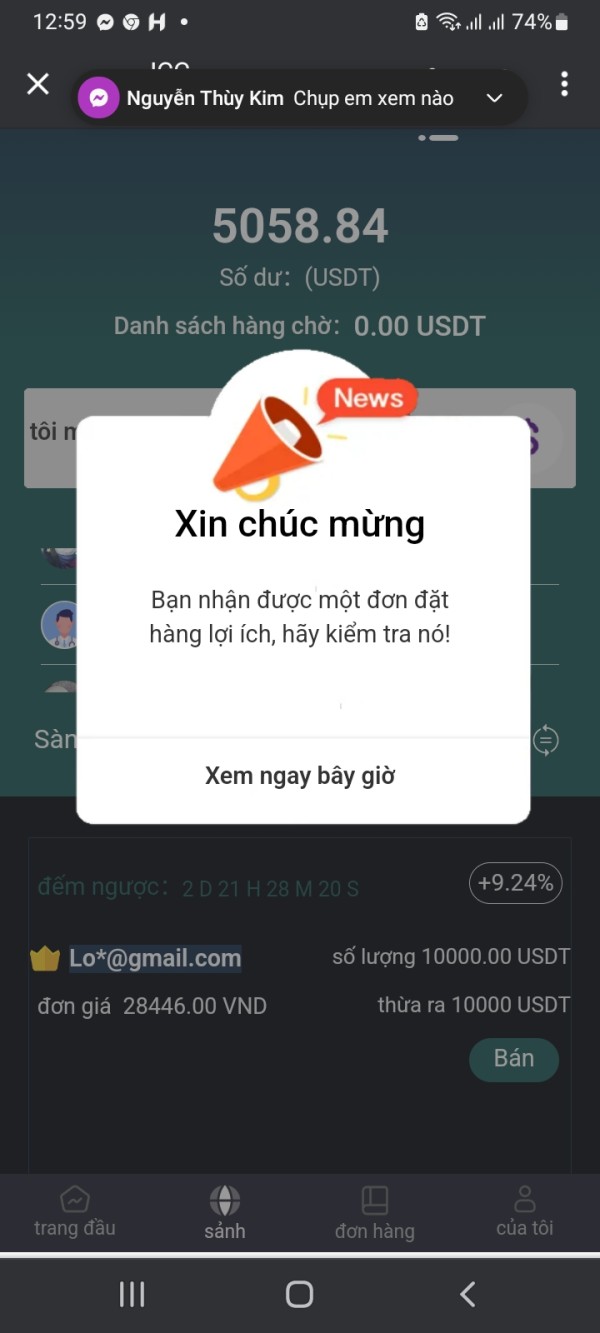

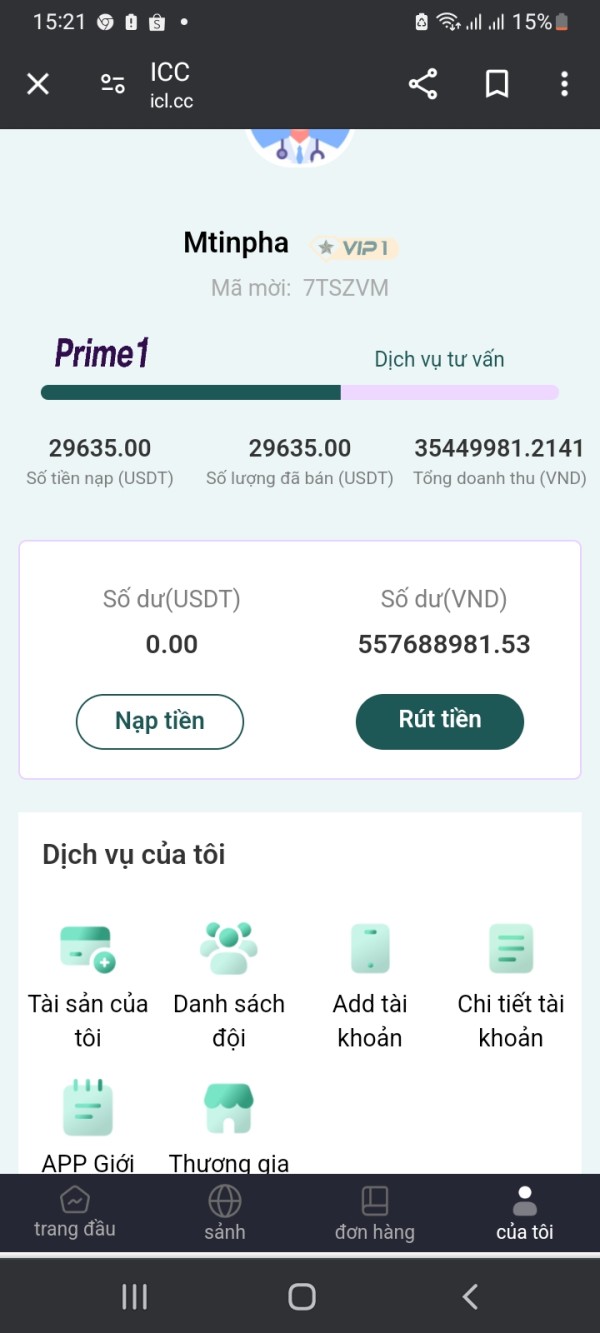

ICL Markets has emerged as a trading platform that attempts to cater to traders of various experience levels. Its performance in the market tells a complex story, though the platform continues to evolve. This icl review reveals a broker that emphasizes competitive spreads, swift trade execution, and a diverse selection of trading instruments. The platform positions itself as a cost-effective solution for frequent traders who need reliable market access. The platform's core value proposition centers around providing over 200 financial instruments while maintaining lower trading costs through reduced spreads.

However, the reality of user experiences presents a more nuanced picture that requires careful consideration. While ICL Markets promotes quick recovery times and immediate improvements in trading conditions, the platform faces significant challenges in user satisfaction and regulatory transparency. The broker targets traders who prioritize instrument diversity and cost efficiency. This focus particularly appeals to those engaged in frequent trading activities where spread costs can significantly impact profitability over time.

According to available market analysis, ICL Markets operates in a competitive landscape where swift execution and diverse asset offerings are essential differentiators. The platform's emphasis on reducing trading costs through competitive spreads addresses a critical need in the trading community. This approach especially benefits active traders who require efficient execution across multiple asset classes including cryptocurrencies, forex, stocks, and commodities.

Important Notice

This evaluation is based on available market information and platform analysis conducted in 2025. Readers should note that trading platforms may vary in their offerings and regulatory compliance across different jurisdictions, which can affect user experience significantly. ICL Markets' specific regulatory status and regional compliance details were not comprehensively detailed in available documentation. This lack of information may affect user experience depending on geographical location and local regulatory requirements.

The assessment methodology incorporates platform feature analysis, available user feedback, and market positioning evaluation. Potential traders should conduct additional due diligence and verify current regulatory status in their specific jurisdiction before making investment decisions that could impact their financial well-being.

Rating Framework

Broker Overview

ICL Markets positions itself as a comprehensive trading platform designed to serve traders across different experience levels and trading preferences. The platform's foundation rests on providing access to an extensive range of financial instruments while maintaining competitive trading conditions that appeal to cost-conscious traders. According to platform documentation, ICL Markets emphasizes swift trade execution as a core differentiator. The company recognizes that execution speed can significantly impact trading outcomes, particularly in volatile market conditions where timing is crucial.

The broker's business model centers around offering lower spreads to reduce overall trading costs. This cost-focused approach is particularly beneficial for frequent traders who execute multiple transactions daily and need to minimize transaction expenses. The platform's diverse instrument selection spans multiple asset classes, providing traders with opportunities across various markets from a single platform. This comprehensive approach eliminates the need for multiple brokerage accounts while offering extensive market access.

ICL Markets operates with a focus on technological efficiency and market access. Specific details about the company's founding date and corporate background remain limited in available documentation, which may concern some potential users. The platform's icl review indicates an emphasis on providing immediate improvements in trading conditions and quick recovery times for order processing. This suggests significant investment in technological infrastructure to support high-frequency trading activities and maintain competitive execution speeds.

The broker's approach to market making and order execution emphasizes competitive spreads across its instrument range. The diverse offering includes cryptocurrencies, forex pairs, stocks, and commodities, creating a comprehensive trading environment. This diverse offering positions ICL Markets as a one-stop solution for traders seeking exposure to multiple asset classes. Traders can implement complex strategies without maintaining accounts across different platforms, simplifying their trading operations significantly.

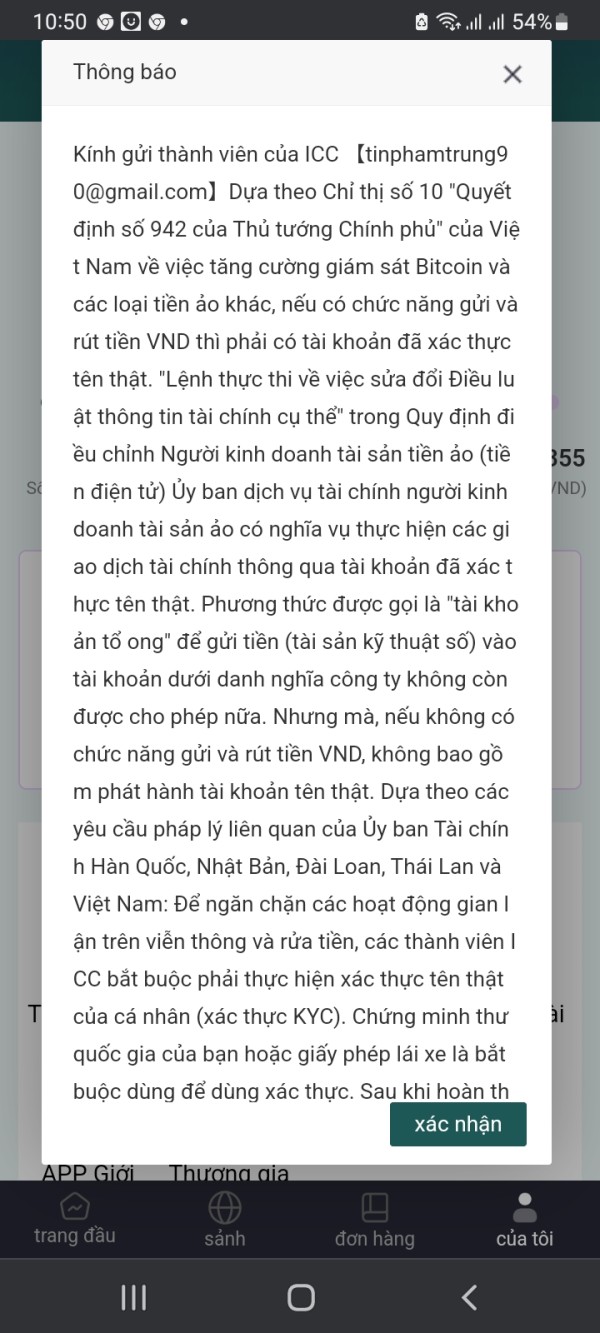

Regulatory Status

Specific regulatory information for ICL Markets was not comprehensively detailed in available documentation. This lack of clear regulatory disclosure represents a significant consideration for potential traders who prioritize regulatory oversight and investor protection measures that ensure account safety.

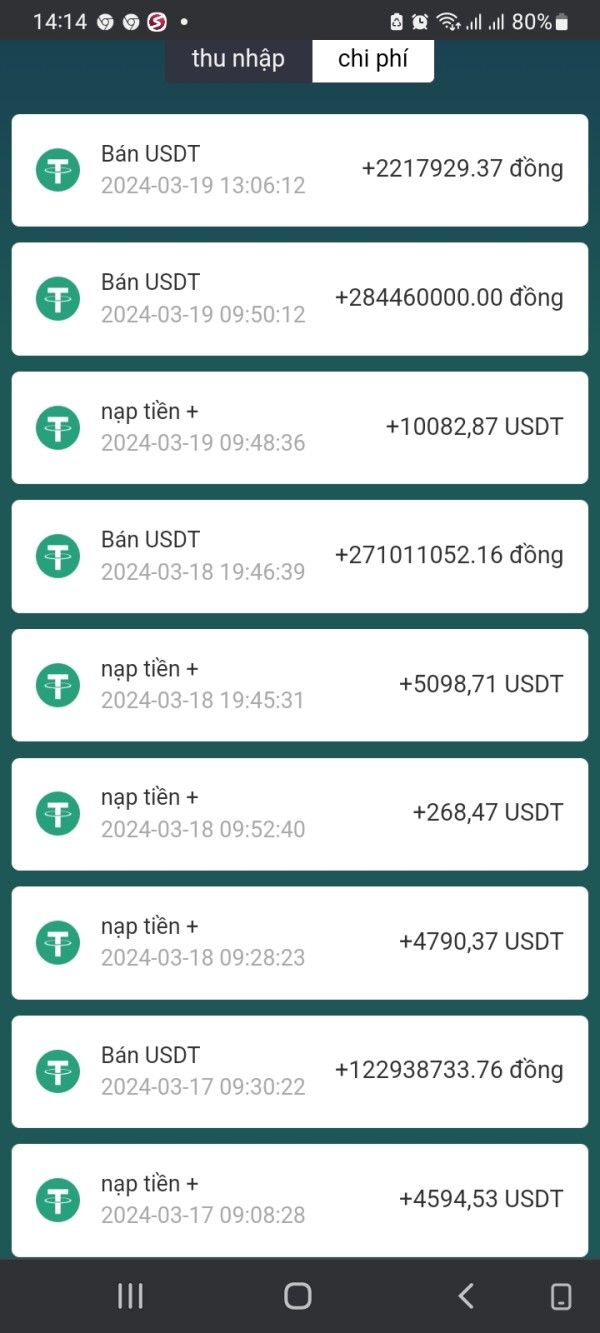

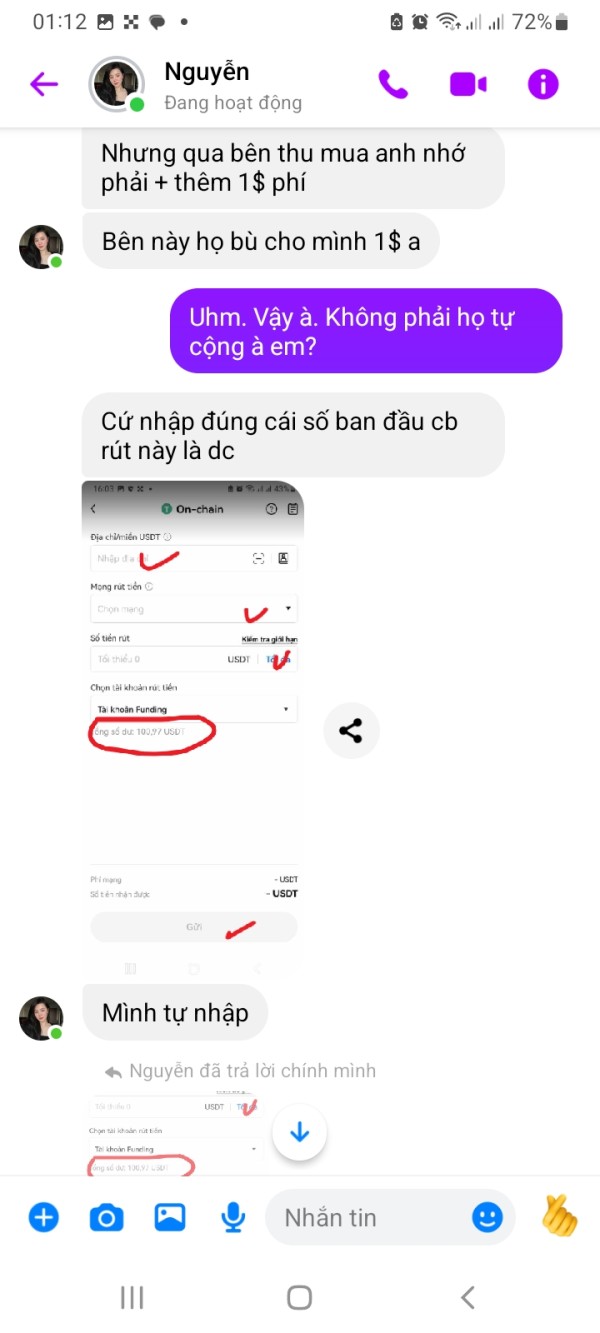

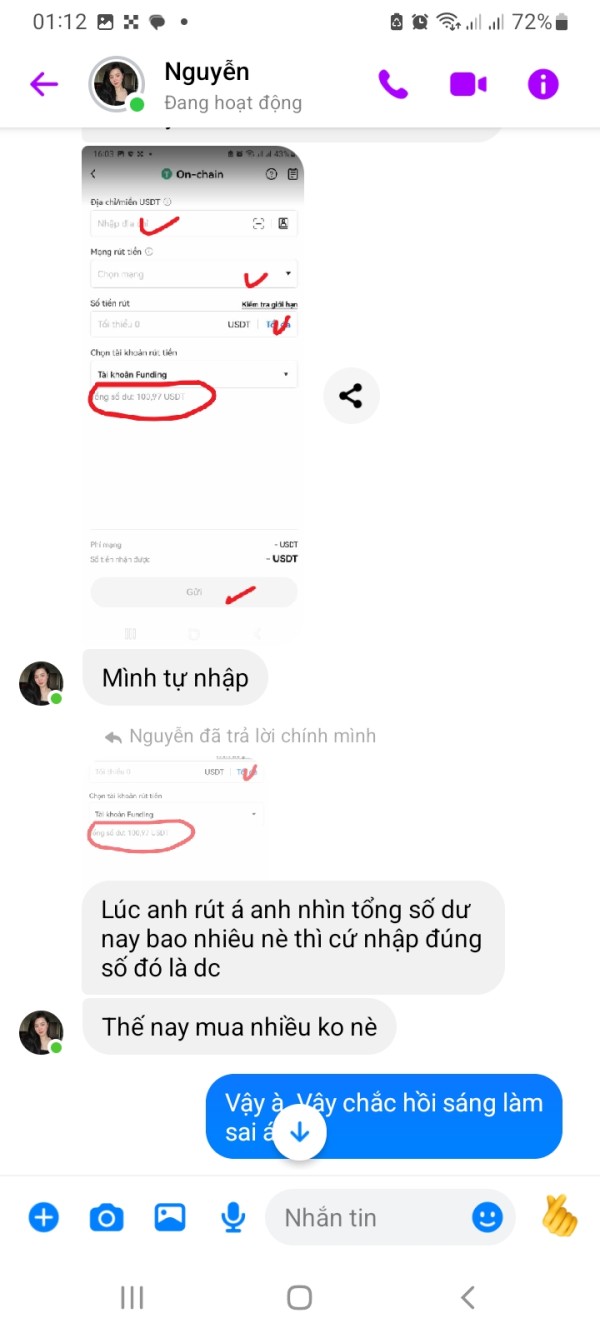

Deposit and Withdrawal Methods

Available documentation does not provide detailed information about supported deposit and withdrawal methods, processing times, or associated fees for funding operations.

Minimum Deposit Requirements

Specific minimum deposit requirements were not clearly outlined in available platform information. These requirements may vary based on account type and geographical location, creating uncertainty for potential users.

Current promotional offerings and bonus structures were not detailed in available documentation. This suggests either limited promotional activities or lack of comprehensive disclosure about available incentives.

Tradeable Assets

ICL Markets offers access to over 200 financial instruments across multiple asset classes. The platform provides trading opportunities in cryptocurrencies, forex pairs, stocks, and commodities, creating a comprehensive trading environment for diversified portfolio strategies that can adapt to changing market conditions.

Cost Structure

The platform emphasizes competitive spreads as a primary cost advantage. Specific spread ranges and commission structures were not detailed in available documentation, though lower spreads are positioned as critical for reducing trading costs. This approach particularly benefits frequent traders who execute multiple transactions and need to minimize cumulative trading expenses.

Leverage Options

Specific leverage ratios and margin requirements were not comprehensively detailed in available platform documentation.

ICL Markets operates its proprietary trading platform. Detailed platform specifications and advanced features were not extensively documented in available materials, limiting evaluation of technical capabilities.

Geographic Restrictions

Specific geographic restrictions and availability limitations were not clearly outlined in accessible documentation.

Customer Support Languages

Available customer support languages and service hours were not specified in the reviewed documentation.

This icl review reveals that while ICL Markets emphasizes certain core features like competitive spreads and diverse instruments, comprehensive operational details remain limited in publicly available information.

Account Conditions Analysis

ICL Markets' account structure appears designed to accommodate different trading preferences. Specific account type details remain limited in available documentation, which may create uncertainty for potential users. The platform's emphasis on competitive spreads suggests a focus on cost-efficient trading conditions. This approach is particularly relevant for active traders who prioritize reduced transaction costs over other features like educational resources or advanced analytical tools.

The lack of clearly defined minimum deposit requirements presents both opportunities and challenges for potential traders. While this may indicate flexibility in account opening procedures, it also creates uncertainty about actual capital requirements for different trading strategies and account types. The platform's emphasis on swift execution suggests that account holders can expect responsive order processing. However, specific execution statistics were not provided to validate these claims about performance quality.

Available information indicates that ICL Markets prioritizes reducing overall trading costs through spread optimization rather than complex fee structures. This approach may benefit traders who prefer transparent, spread-based pricing over commission-heavy models that can complicate cost calculations. However, the absence of detailed account condition information makes it difficult to assess the complete cost structure. Traders cannot evaluate total expenses for different trading volumes and strategies without comprehensive fee disclosure.

The platform's focus on immediate improvements and quick recovery times suggests that account holders may experience efficient order processing and platform responsiveness. However, without specific details about account tiers, minimum balance requirements, or special features like Islamic accounts, potential traders cannot fully evaluate alignment with their needs. This lack of detailed information may discourage traders who require specific account features for their trading strategies.

User feedback regarding account conditions was not comprehensively available in reviewed documentation. This limits the ability to assess real-world account performance and satisfaction levels from actual platform users. This icl review indicates that while the platform emphasizes competitive conditions, transparency in account specifications could be enhanced. Better disclosure would serve potential clients' decision-making processes and build greater confidence in the platform's offerings.

ICL Markets' offering of over 200 financial instruments represents a significant strength in terms of trading diversity and market access. This extensive instrument selection spans multiple asset classes including cryptocurrencies, forex pairs, stocks, and commodities. The breadth of available instruments provides traders with comprehensive market exposure from a single platform, eliminating the need for multiple brokerage relationships. This diversity suggests that traders can implement diversified strategies without maintaining accounts across different platforms.

However, the specific details about trading tools, analytical resources, and research capabilities were not extensively documented in available materials. Modern traders typically require access to advanced charting tools, technical indicators, fundamental analysis resources, and market research to make informed trading decisions effectively. The absence of detailed information about these analytical capabilities represents a significant gap. Traders cannot evaluate the platform's comprehensive trading support without understanding available analytical resources.

Educational resources, which are crucial for trader development and platform adoption, were not specifically outlined in available documentation. Quality educational materials, including webinars, tutorials, market analysis, and trading guides, are essential components of a comprehensive trading platform. These resources are particularly important for less experienced traders who require guidance and skill development. Without clear information about educational support, new traders cannot assess whether the platform provides adequate learning resources.

Automated trading support and algorithmic trading capabilities were not detailed in the reviewed materials. Given the increasing importance of automated trading strategies and expert advisors in modern trading, the absence of clear information about automation support may limit appeal. Technically sophisticated traders often require robust automation features for strategy implementation and portfolio management.

The platform's emphasis on swift execution suggests robust technological infrastructure. Specific details about execution algorithms, order types, and advanced trading features were not comprehensively covered in available documentation. Without detailed information about available order types, risk management tools, and platform customization options, traders cannot fully assess platform suitability. The lack of technical specifications may discourage traders who require specific features for effective trading operations.

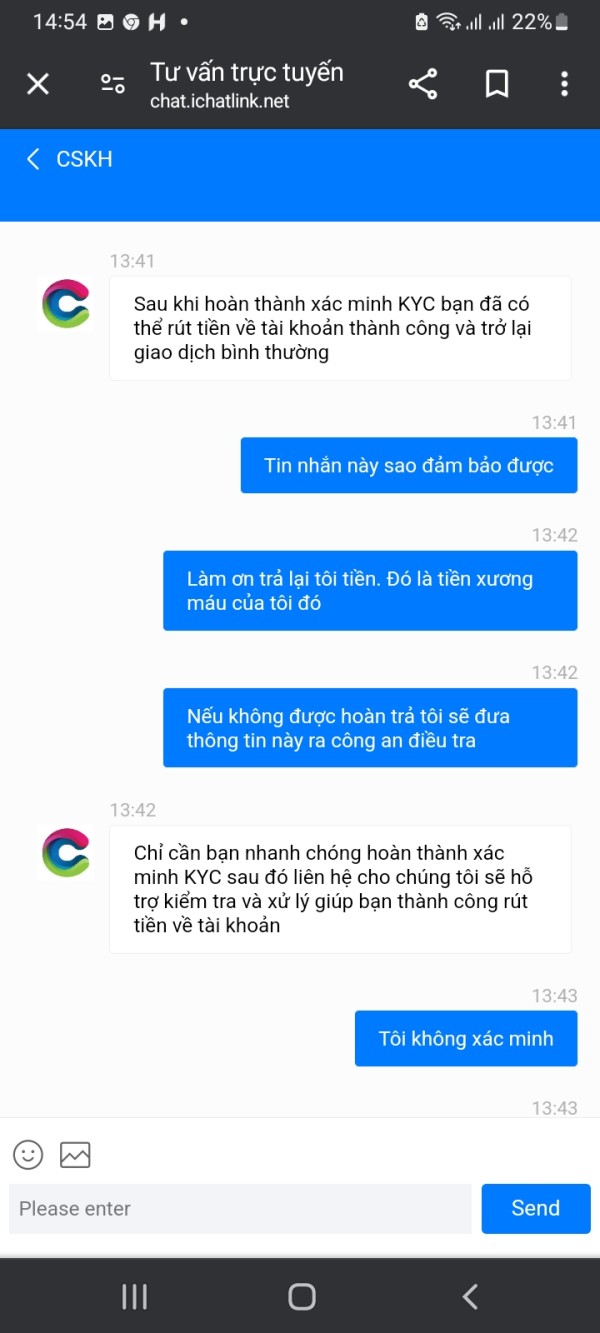

Customer Service and Support Analysis

Customer service quality represents a critical component of any trading platform's value proposition. Specific information about ICL Markets' support infrastructure was limited in available documentation, creating concerns about support quality. The absence of detailed information about support channels, response times, and service quality creates uncertainty. Traders cannot assess the platform's commitment to customer assistance and problem resolution without comprehensive support information.

Modern trading platforms typically offer multiple support channels including live chat, phone support, email assistance, and comprehensive FAQ sections. The availability of 24/7 support is particularly important in forex and cryptocurrency trading, where markets operate continuously across global time zones. Without clear information about support availability and response times, traders cannot assess adequacy of assistance during critical trading periods. This lack of information may discourage traders who require reliable support access.

Multilingual support capabilities were not specified in available documentation. This may limit the platform's accessibility for international traders who require assistance in their native languages for effective communication. Quality customer support should include knowledgeable representatives who understand trading operations. Support staff should provide technical assistance beyond basic account inquiries to help traders resolve complex issues effectively.

The platform's emphasis on swift execution and immediate improvements suggests a focus on technical efficiency. This technological focus should be complemented by responsive human support for complex issues and account management needs that require personal attention. Effective customer service includes not only problem resolution but also educational support, account guidance, and technical assistance. Comprehensive support helps traders optimize their platform usage and trading strategies.

Without specific user feedback about support experiences, response quality, and problem resolution effectiveness, this evaluation cannot provide comprehensive assessment of customer service performance. The lack of detailed support information may indicate either minimal support infrastructure or insufficient disclosure of available assistance options. Both scenarios represent potential concerns for traders who prioritize reliable customer service and comprehensive support access.

Trading Experience Analysis

ICL Markets emphasizes swift trade execution as a core component of its trading experience. The platform recognizes that execution speed significantly impacts trading outcomes, particularly in fast-moving markets where timing is crucial. The platform's focus on quick recovery times and immediate improvements suggests investment in technological infrastructure. This infrastructure is designed to minimize latency and optimize order processing efficiency for better trading outcomes.

The availability of over 200 financial instruments creates opportunities for diverse trading strategies and portfolio diversification across multiple markets. This instrument variety allows traders to respond to market opportunities across different asset classes without platform limitations that might restrict strategy implementation. However, the quality of execution across all instrument types requires consistent performance standards. Traders need reliable trading experiences regardless of market conditions or asset class selection.

Platform stability and reliability are crucial factors in trading experience. Specific uptime statistics and performance metrics were not detailed in available documentation, limiting evaluation of platform reliability. Traders require consistent platform access, especially during volatile market periods when trading opportunities may be time-sensitive and profitable. The platform's emphasis on technological efficiency suggests attention to these performance factors. However, quantitative performance data would strengthen confidence in platform reliability and operational consistency.

Mobile trading capabilities and cross-device synchronization were not specifically addressed in available materials. Modern traders increasingly rely on mobile platforms for market monitoring and trade execution, making mobile functionality essential for comprehensive trading access. Without detailed information about mobile app features and performance, traders cannot assess the platform's suitability for on-the-go trading activities. This limitation may discourage traders who require flexible access to their trading accounts.

The trading environment's overall user interface design, customization options, and ease of navigation were not comprehensively covered in reviewed documentation. User experience factors including chart quality, order placement efficiency, and information accessibility significantly impact daily trading operations and overall satisfaction. This icl review indicates that while execution speed is prioritized, comprehensive user experience details would enhance evaluation. Better documentation of the platform's overall trading environment quality would help potential users make informed decisions.

Trust and Reliability Analysis

Trust and reliability form the foundation of any successful trading platform relationship. ICL Markets faces significant challenges in this area due to limited regulatory transparency that raises concerns about platform oversight. The absence of clear regulatory information in available documentation represents a substantial concern. Traders who prioritize regulatory oversight and investor protection measures may find this lack of transparency problematic for their investment security.

Regulatory compliance provides essential safeguards including segregated client funds, dispute resolution mechanisms, and operational oversight by financial authorities. Without clear regulatory status disclosure, traders cannot assess the level of protection available for their invested capital or evaluate recourse options. This uncertainty becomes particularly important in case of disputes or operational issues that require regulatory intervention. The lack of regulatory information may discourage risk-averse traders who prioritize account protection.

Corporate transparency, including company background, management information, and operational history, was not comprehensively detailed in available materials. Traders typically seek information about company leadership, corporate structure, and business history to assess platform stability and long-term viability effectively. The limited availability of this information may impact trader confidence in the platform's reliability. Comprehensive corporate disclosure helps build trust and demonstrates commitment to transparency in business operations.

Financial security measures, including client fund protection, insurance coverage, and operational safeguards, were not specifically outlined in reviewed documentation. These protections are essential for trader confidence and represent standard industry practices for reputable trading platforms worldwide. Without clear information about financial security measures, traders cannot adequately assess the safety of their invested capital. This uncertainty may discourage traders who prioritize capital protection and financial security.

Third-party audits, independent reviews, and industry certifications were not referenced in available materials. Independent validation of platform operations, financial practices, and technological security provides additional assurance for traders considering platform selection decisions. The absence of such third-party validation may limit confidence in platform reliability and operational integrity. The platform's emphasis on competitive spreads and swift execution suggests operational capability, though these technical features should be supported by comprehensive regulatory compliance and transparency measures. Complete trust and reliability for serious traders requires both technical competence and regulatory transparency.

User Experience Analysis

User experience encompasses the complete interaction between traders and the ICL Markets platform, from initial registration through daily trading operations. While the platform emphasizes swift execution and diverse instrument access, comprehensive user experience evaluation requires detailed analysis of interface design, navigation efficiency, and overall platform usability. The registration and account verification process details were not extensively covered in available documentation, creating uncertainty about onboarding procedures.

Streamlined onboarding procedures with clear verification requirements and reasonable processing times are essential for positive initial user experiences. Complex or lengthy registration processes can create barriers to platform adoption, particularly for traders seeking quick market access in time-sensitive situations. Platform interface design and customization options significantly impact daily trading efficiency and user satisfaction levels. Modern traders require intuitive navigation, customizable layouts, and efficient access to essential trading functions for optimal productivity.

The ability to personalize workspace arrangements, chart configurations, and information displays enhances trading productivity and user comfort with the platform environment. Order placement procedures and trade management interfaces were not specifically detailed in available materials, limiting evaluation of operational efficiency. Efficient order entry, modification, and closure procedures are crucial for effective trading operations. These features become particularly important during volatile market conditions when rapid response capabilities are essential for capitalizing on trading opportunities.

User-friendly order management systems reduce operational errors and improve overall trading confidence by providing clear feedback and control. Account management features including balance monitoring, transaction history, and performance analytics contribute to overall user experience quality and trader satisfaction. Comprehensive account oversight tools help traders track their trading progress, analyze performance patterns, and manage risk effectively over time. Without detailed information about these management features, traders cannot assess whether the platform provides adequate tools for effective account oversight.

The platform's emphasis on immediate improvements and quick recovery times suggests attention to user experience optimization and continuous platform development. However, specific user interface details and usability features would enhance evaluation of the complete user experience quality offered by ICL Markets. Better documentation of interface features and user experience elements would help potential users understand platform capabilities and make informed adoption decisions.

Conclusion

ICL Markets presents a trading platform with notable strengths in instrument diversity and execution efficiency. Significant limitations in transparency and comprehensive feature disclosure impact its overall evaluation and may concern potential users. The platform's emphasis on competitive spreads and swift trade execution addresses important trader needs. This focus particularly benefits active traders who prioritize cost efficiency and responsive order processing for their trading strategies.

The availability of over 200 financial instruments across multiple asset classes represents a genuine strength for the platform. This instrument variety provides traders with comprehensive market access and diversification opportunities that can enhance portfolio management. This instrument variety, combined with the platform's focus on reduced trading costs, may appeal to traders seeking efficient access to diverse markets. The single-platform approach eliminates the complexity of maintaining multiple brokerage relationships while providing extensive market coverage.

However, the limited regulatory transparency and insufficient disclosure of operational details present substantial concerns for traders who prioritize security and comprehensive platform understanding. The absence of clear regulatory information, detailed account conditions, and comprehensive feature descriptions limits the ability to make fully informed platform selection decisions. This lack of transparency may discourage traders who require detailed information before committing to a trading platform.

ICL Markets may be suitable for traders who prioritize instrument diversity and are comfortable with limited transparency regarding regulatory status and operational details. However, traders who require comprehensive regulatory protection, detailed platform information, and extensive support documentation may find the available information insufficient for confident platform adoption and long-term use.