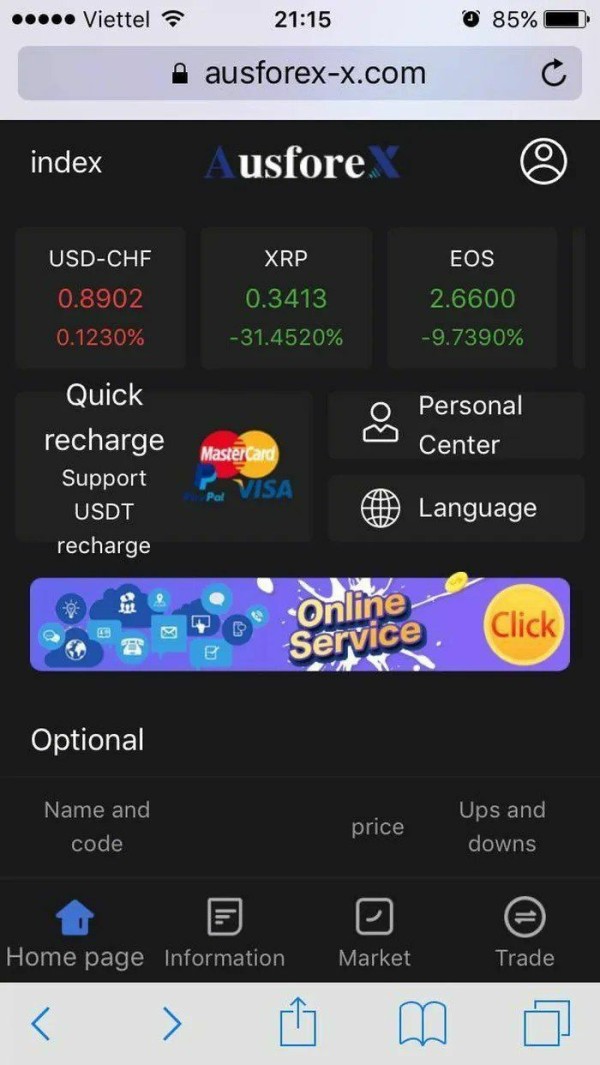

Ausforex 2025 Review: Everything You Need to Know

Executive Summary

Ausforex is a regulated forex broker. It offers diverse trading instruments and competitive trading conditions suitable for various trader profiles. This Ausforex review reveals a broker that provides leverage up to 1:500, spreads starting from 0.9 pips, and comprehensive platform support through MT4 and MT5. The broker serves both experienced traders seeking high leverage opportunities and newcomers interested in automated trading solutions.

Ausforex operates under ASIC regulation. This ensures compliance with Australian financial standards according to available market data. The platform stands out through integration with advanced trading tools including Autochartist, Trading View, and Capitalise AI for algorithmic trading. With minimum spreads of 0.9 pips on standard accounts and maximum leverage reaching 1:500, the broker positions itself competitively within the Australian forex market.

The broker appeals to experienced traders who want to use high leverage for their trading strategies. It also offers automated trading tools that benefit newcomers to the forex market. The combination of regulatory oversight, competitive spreads, and comprehensive platform support makes Ausforex a noteworthy option in the Australian forex brokerage landscape.

Important Notice

Ausforex operations may face different legal restrictions depending on the country of operation. This happens because regulatory frameworks and market environments vary across different jurisdictions. Traders should verify specific regulatory compliance in their respective regions before engaging with the platform.

This review uses publicly available information and market feedback. It aims to provide potential users with a comprehensive assessment of Ausforex services. The evaluation reflects current market conditions and available data as of 2025, though specific operational details may vary based on account type and geographic location.

Rating Framework

Broker Overview

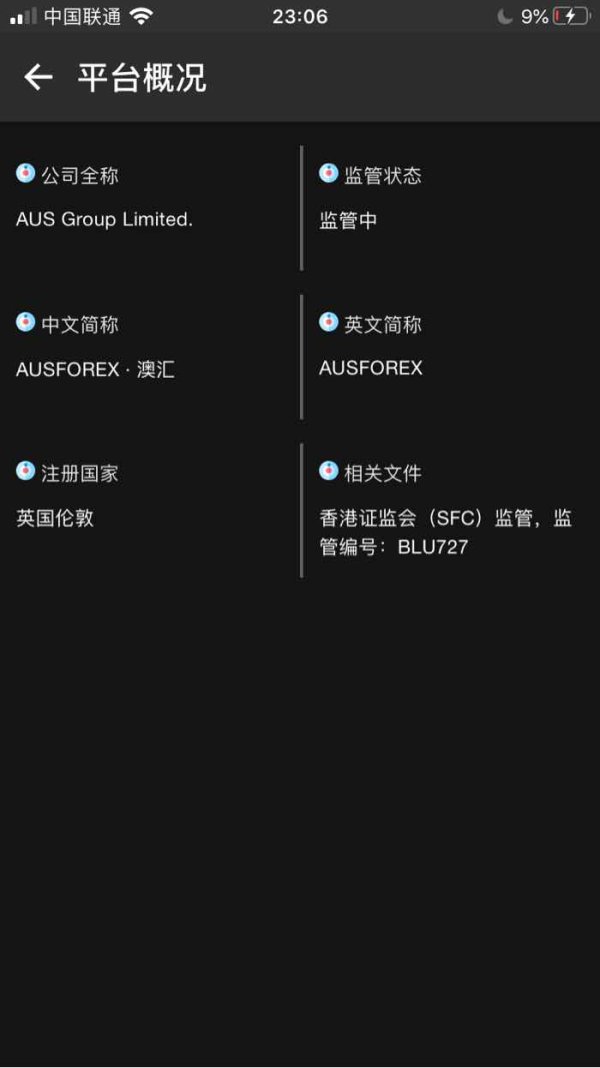

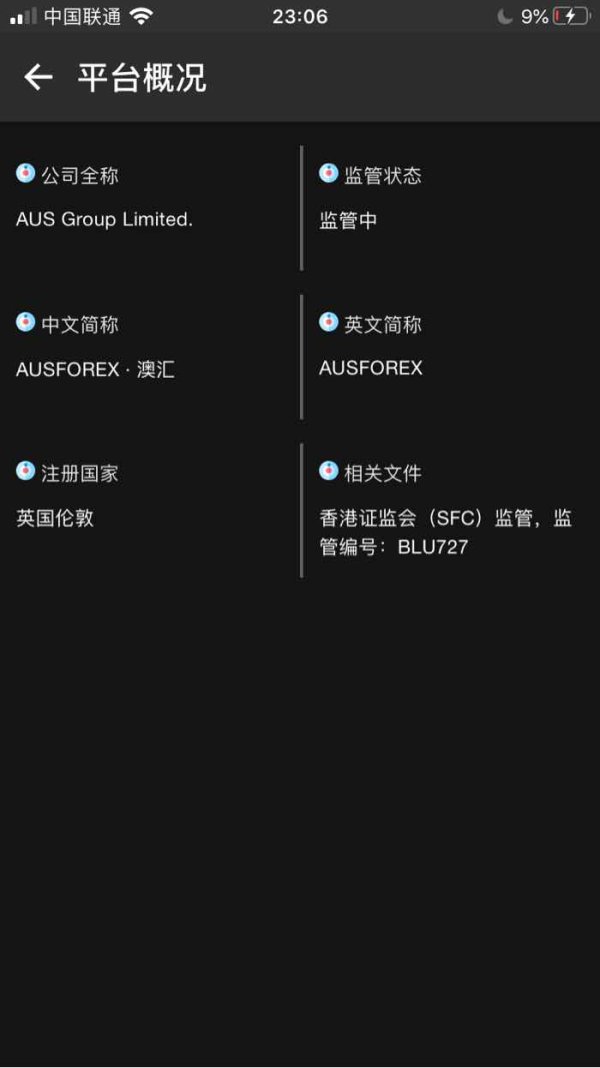

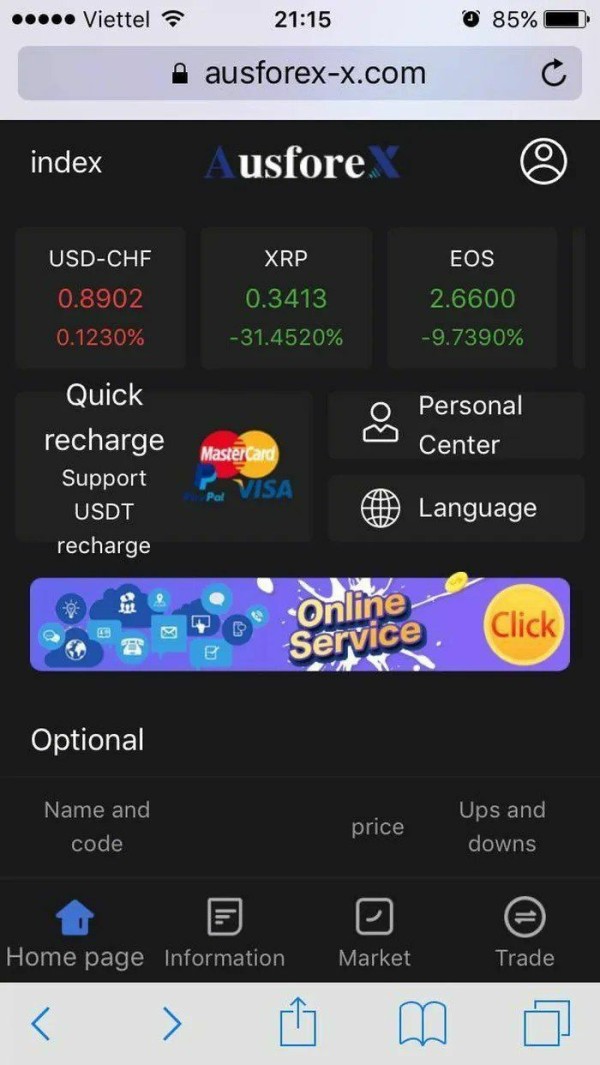

Ausforex operates as an online forex trading broker. The company dedicates itself to providing quality forex and CFD trading services to global users. The company focuses on delivering competitive trading conditions through regulated operations, positioning itself within the Australian financial services sector under ASIC oversight. While specific founding details are not detailed in available information, the broker has established itself as a provider of multi-platform trading solutions.

The broker's business model centers on online forex trading. It offers clients access to international currency markets through sophisticated trading platforms. Ausforex supports both MT4 and MT5 trading platforms, providing traders with comprehensive technical analysis tools and automated trading capabilities. The company's approach emphasizes regulatory compliance and competitive trading conditions, making it accessible to both retail and professional traders.

Ausforex provides forex and CFD trading services under ASIC regulation according to market reports. This ensures adherence to Australian financial standards. The broker's platform integration includes advanced tools such as Autochartist for technical analysis, Trading View for charting capabilities, and Capitalise AI for algorithmic trading support. This Ausforex review indicates that the broker maintains focus on providing diverse trading instruments while maintaining regulatory compliance standards expected in the Australian market.

Regulatory Jurisdiction: Ausforex operates under the supervision of the Australian Securities and Investments Commission. ASIC provides regulatory oversight and compliance with Australian financial services standards. This regulation ensures adherence to strict operational guidelines and client fund protection measures.

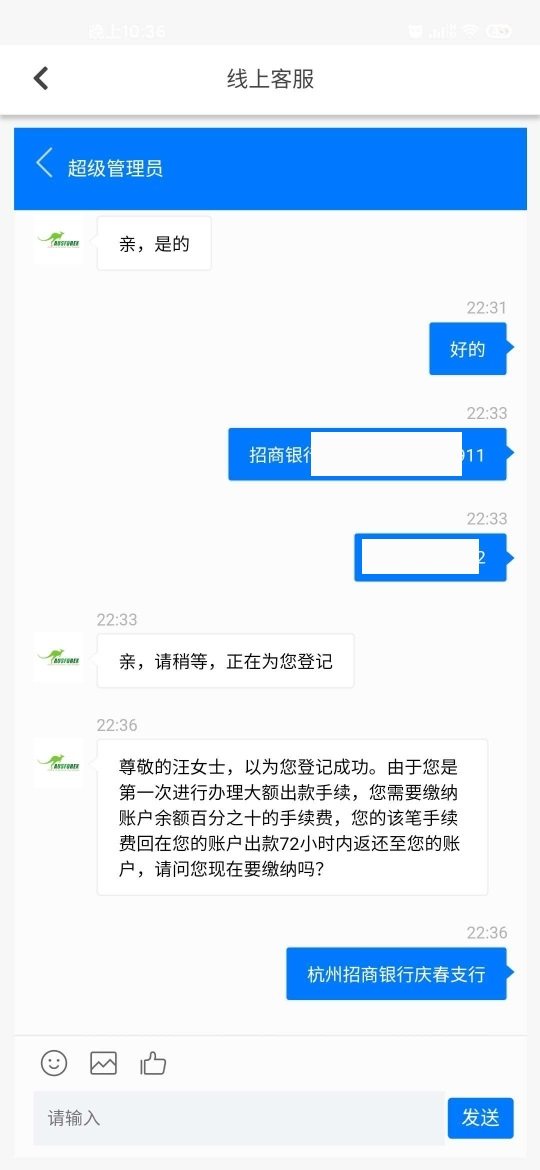

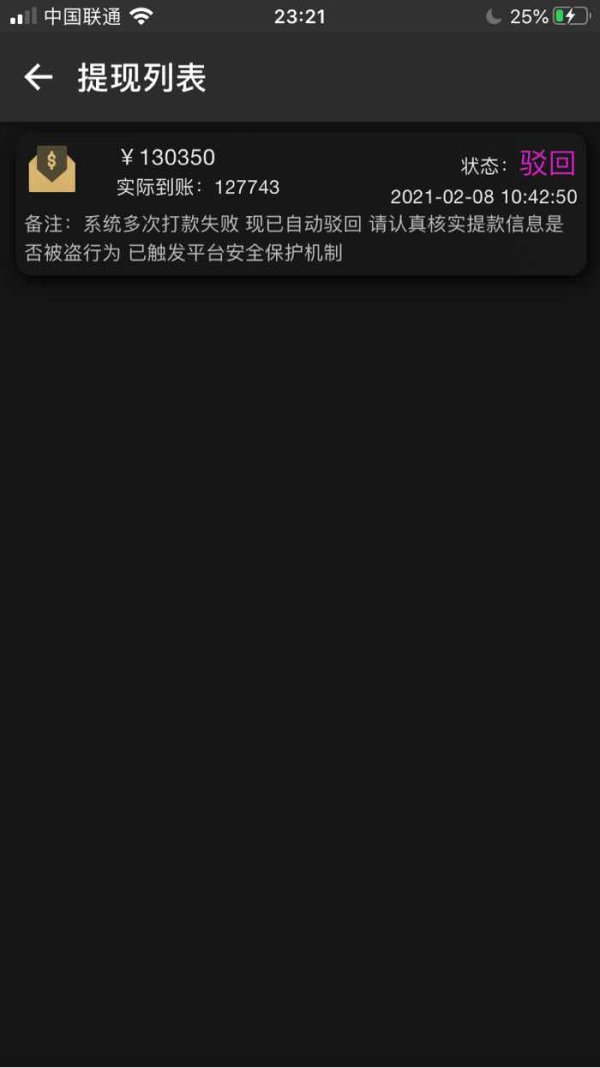

Deposit and Withdrawal Methods: Available sources do not detail specific information regarding deposit and withdrawal methods. Regulated brokers typically offer standard banking and electronic payment options though.

Minimum Deposit Requirements: Current available information does not specify minimum deposit requirements. This requires direct inquiry with the broker for specific account funding details.

Bonus and Promotions: Available information sources do not detail current promotional offerings. Traders should verify any available incentives directly with the broker though.

Tradeable Assets: The platform provides access to forex and CFD trading instruments. This allows clients to trade currency pairs and contracts for difference across various markets.

Cost Structure: Standard accounts feature minimum spreads starting from 0.9 pips. Available information does not specifically detail commission structures though. This Ausforex review notes that cost transparency may require direct broker consultation.

Leverage Ratios: Maximum leverage reaches 1:500. This provides significant trading power for qualified clients while maintaining compliance with ASIC leverage restrictions.

Platform Options: Trading gets support through MT4 and MT5 platforms. These offer comprehensive charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Available information does not detail specific geographic limitations. ASIC regulation typically involves certain jurisdictional considerations though.

Customer Service Languages: Current available sources do not specify supported customer service languages.

Detailed Rating Analysis

Account Conditions Analysis

Ausforex offers standard account options with competitive spreads beginning at 0.9 pips. This positions the broker favorably within the Australian forex market. The spread structure appears competitive compared to industry standards, though specific details about account tiers and their respective features require further clarification from available sources.

Current information does not extensively cover the account opening process details. This suggests potential clients should contact the broker directly for comprehensive account setup procedures. While minimum deposit requirements are not specified, the competitive spread offering indicates the broker aims to accommodate various trading capital levels.

Available information does not detail special account features such as Islamic accounts or professional trader classifications. The focus on ASIC regulation suggests standard compliance with Australian financial services requirements, though specific account customization options may be available upon direct inquiry. This Ausforex review indicates that while basic account information is available, detailed account specifications may require direct broker consultation.

Available sources show an absence of detailed minimum deposit information. This represents a transparency limitation that potential clients should address through direct broker communication. Account conditions appear competitive based on spread offerings, though comprehensive evaluation requires additional information gathering.

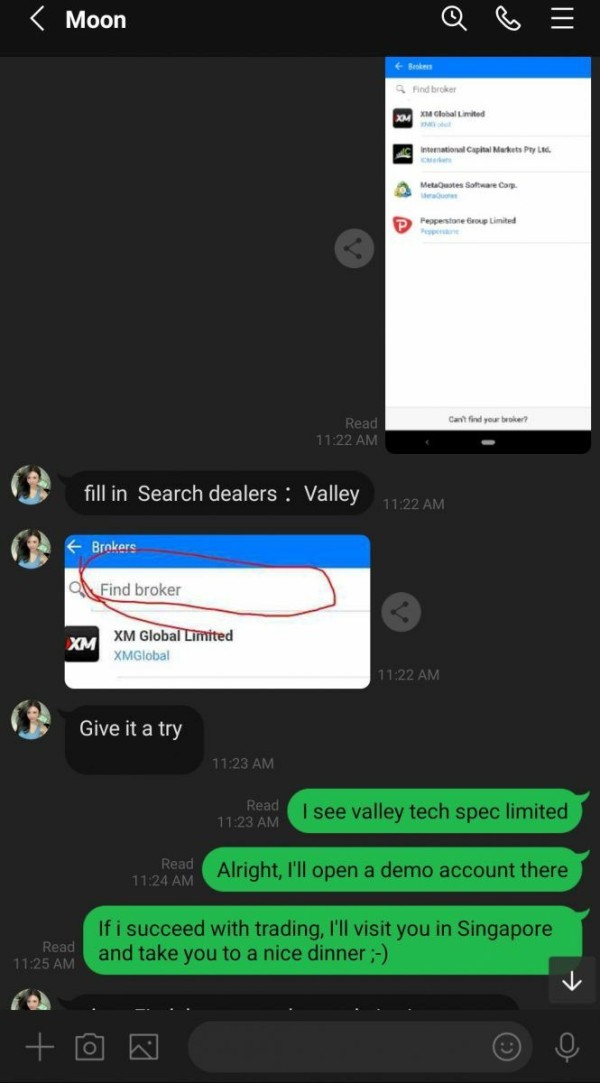

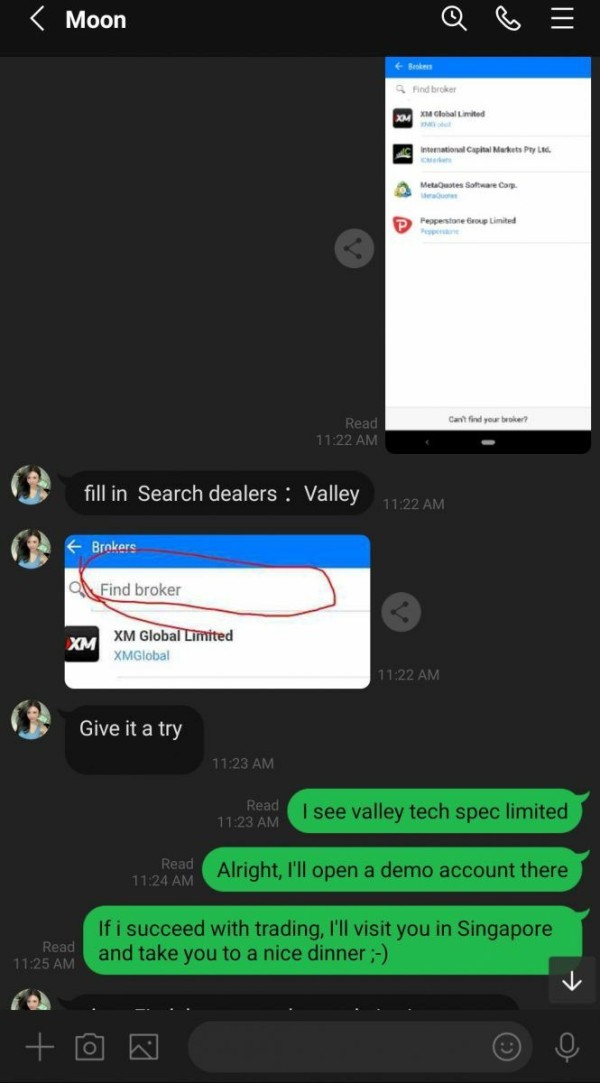

Ausforex demonstrates strong commitment to trading tools and resources through comprehensive platform integration. The broker supports MT4 and MT5 platforms, providing traders with industry-standard charting capabilities, technical indicators, and automated trading support. These platforms offer extensive customization options and expert advisor functionality.

Advanced tool integration includes Autochartist for pattern recognition and technical analysis, Trading View for professional charting capabilities, and Capitalise AI for code-free algorithmic trading development. This combination provides both novice and experienced traders with sophisticated analysis and automation options.

The Capitalise AI integration particularly stands out for traders interested in algorithmic trading without extensive programming knowledge. This tool enables strategy development and automated execution, expanding trading possibilities for users seeking systematic approaches to market participation.

Available information does not detail research and analysis resources beyond the mentioned tools. The platform integration suggests comprehensive market analysis capabilities though. Educational resources are not specifically mentioned, representing a potential area for improvement or clarification in service offerings.

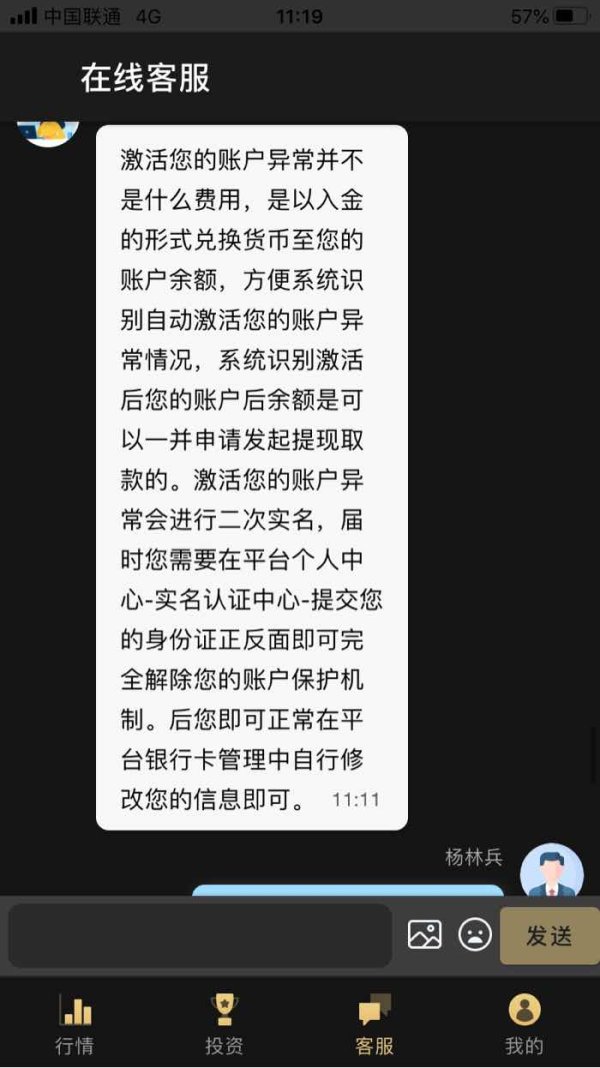

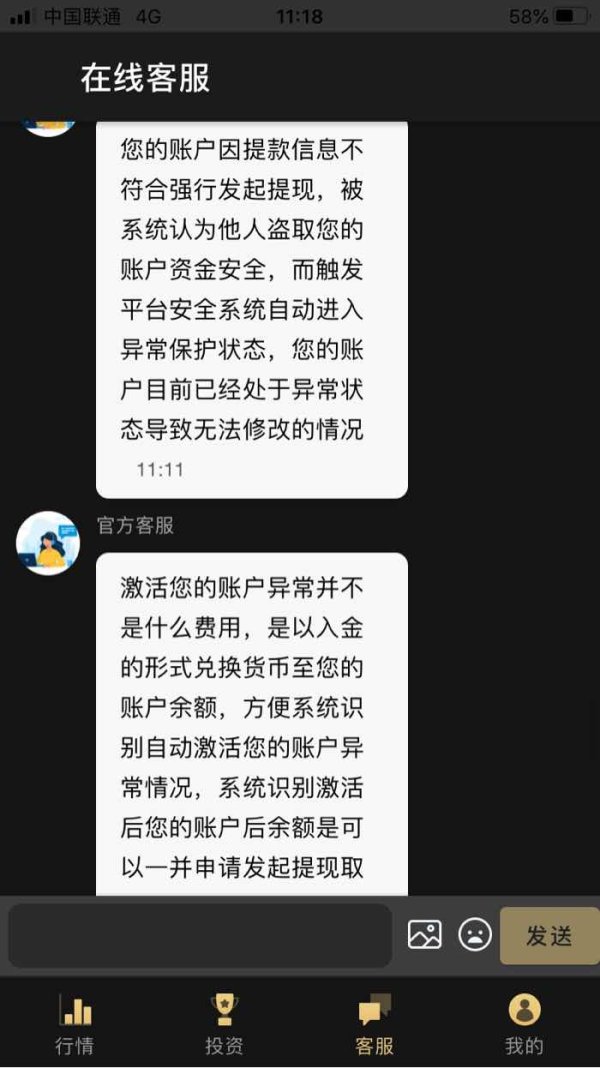

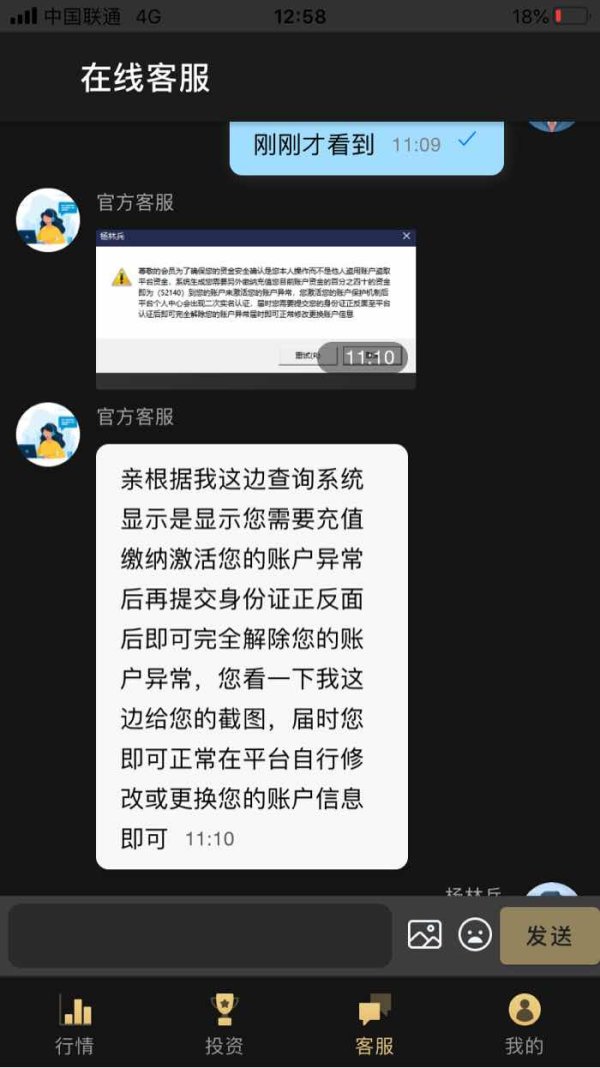

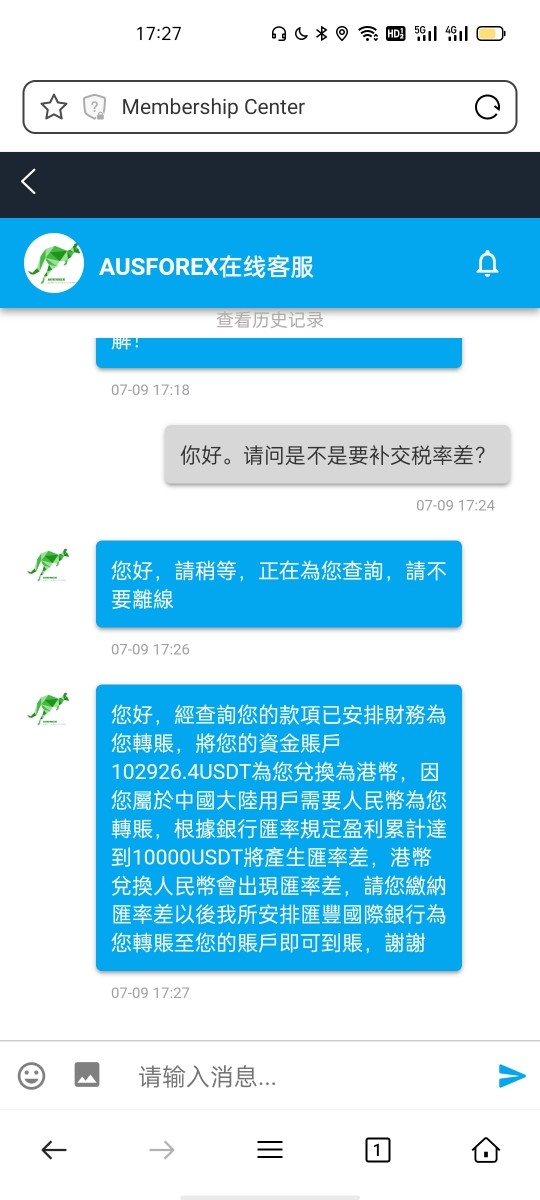

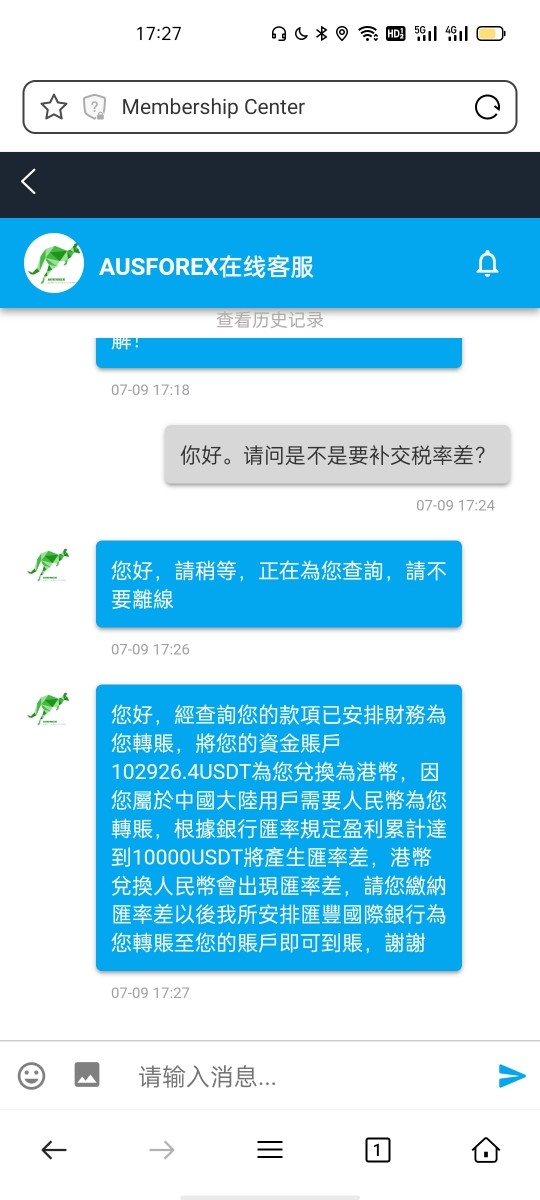

Customer Service and Support Analysis

Current available sources do not detail specific customer service channels and availability information. This represents a significant information gap for this review. Response time metrics, service quality assessments, and multi-language support details require direct broker inquiry for comprehensive evaluation.

Available sources show an absence of detailed customer service information. This suggests potential transparency limitations that prospective clients should address through direct communication. Standard regulated brokers typically provide email, phone, and live chat support, though Ausforex's specific offerings are not confirmed in current information.

Available sources do not specify service hours, regional support availability, and escalation procedures. This information gap represents a notable limitation for traders seeking comprehensive customer service evaluation before account opening.

Current information sources do not provide problem resolution processes and customer satisfaction metrics. This makes it difficult to assess service quality comprehensively. Potential clients should prioritize gathering this information through direct broker communication or third-party review sources.

Trading Experience Analysis

Available information does not specifically detail platform stability and execution speed metrics. MT4 and MT5 platform support suggests standard industry performance expectations though. These platforms typically provide reliable execution and comprehensive technical analysis capabilities.

Current sources do not extensively cover order execution quality details. ASIC regulation implies adherence to best execution principles required under Australian financial services legislation though. Specific execution statistics and latency measurements require direct broker inquiry.

Platform functionality appears comprehensive through MT4 and MT5 support. This offers complete technical indicator libraries, charting tools, and automated trading capabilities. The integration of additional tools like Autochartist and Trading View enhances analytical capabilities beyond standard platform offerings.

Available information does not specify mobile trading experience details. MT4 and MT5 typically include mobile applications for iOS and Android devices though. This Ausforex review notes that mobile functionality assessment requires direct platform evaluation.

Minimum spreads of 0.9 pips indicate trading environment competitiveness. Comprehensive cost analysis requires additional information about commission structures and potential additional fees though.

Trust and Regulation Analysis

ASIC regulation significantly enhances Ausforex's trustworthiness through compliance with stringent Australian financial services requirements. This regulatory oversight includes client fund segregation, operational transparency, and adherence to professional conduct standards established by Australian financial authorities.

The regulatory framework provides important protections for client funds and ensures operational transparency standards. ASIC regulation requires brokers to maintain adequate capital reserves and implement robust risk management procedures, contributing to overall platform reliability.

Available information does not detail fund security measures beyond basic regulatory requirements. ASIC oversight implies standard segregated account procedures and professional indemnity insurance coverage typical of Australian financial services providers though.

Available sources do not extensively detail company transparency regarding ownership structure, financial statements, and operational procedures. While ASIC regulation requires certain disclosure standards, specific transparency measures may require direct inquiry with the broker.

Current information sources do not detail industry reputation and third-party assessments. These represent areas where potential clients should seek additional verification through independent review platforms and regulatory databases.

User Experience Analysis

Current information sources do not provide overall user satisfaction metrics. This makes comprehensive user experience assessment challenging. The combination of competitive spreads, high leverage options, and advanced trading tools suggests potential for positive user experiences among suitable trader profiles.

Available sources do not extensively cover interface design and platform usability details. MT4 and MT5 platform support indicates access to well-established, user-friendly trading interfaces familiar to most forex traders though.

Available information does not detail registration and verification processes. ASIC regulation implies standard know-your-customer procedures and identity verification requirements typical of Australian financial services providers though.

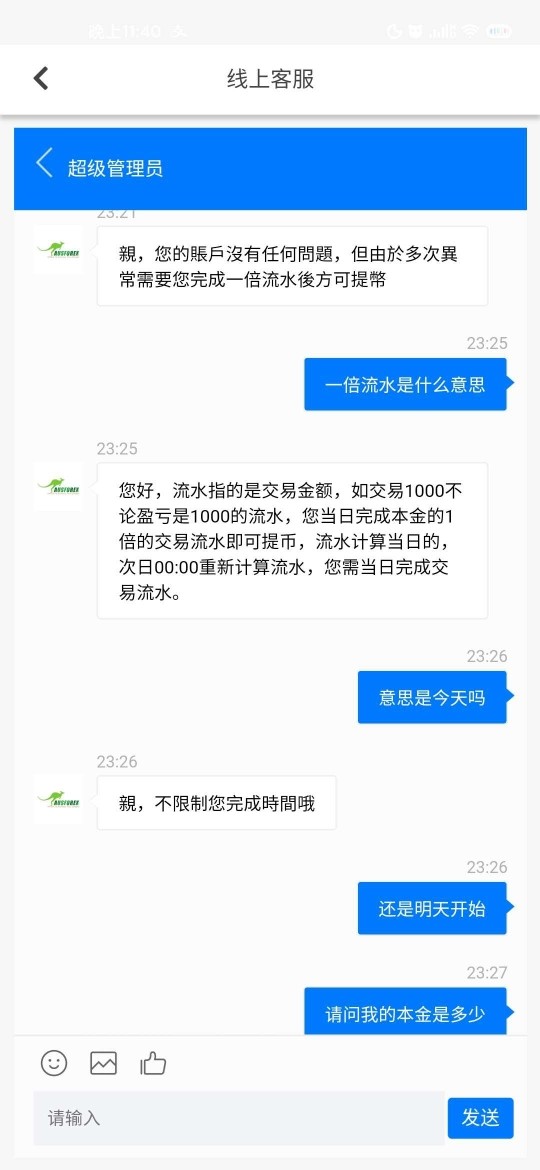

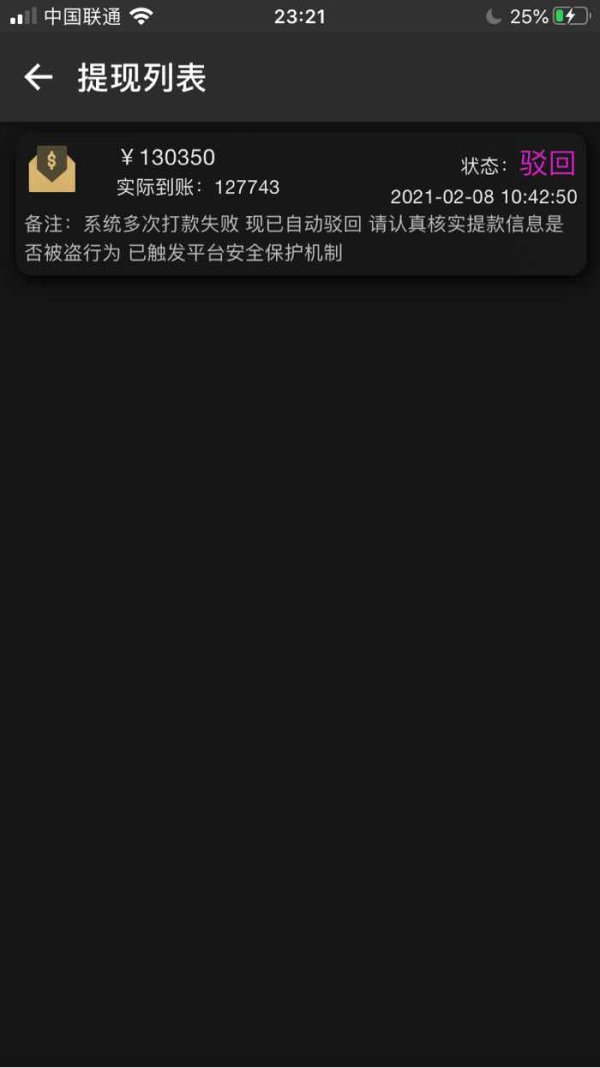

Available sources do not document fund operation experiences and common user complaints. This represents significant information gaps for comprehensive user experience evaluation. Potential clients should prioritize gathering user feedback through independent review platforms.

The target user profile appears to include experienced traders seeking high leverage opportunities and newcomers interested in automated trading solutions. Specific user satisfaction data requires additional research beyond current available information though.

Conclusion

Ausforex presents itself as a regulated forex broker offering competitive trading conditions through ASIC oversight, low spreads starting from 0.9 pips, and comprehensive platform support. The broker demonstrates strength in regulatory compliance and trading tool integration, making it potentially suitable for various trader profiles.

The platform particularly appeals to experienced traders seeking high leverage opportunities up to 1:500 and newcomers interested in automated trading through Capitalise AI integration. The combination of MT4/MT5 platform support with advanced analytical tools provides a solid foundation for diverse trading strategies.

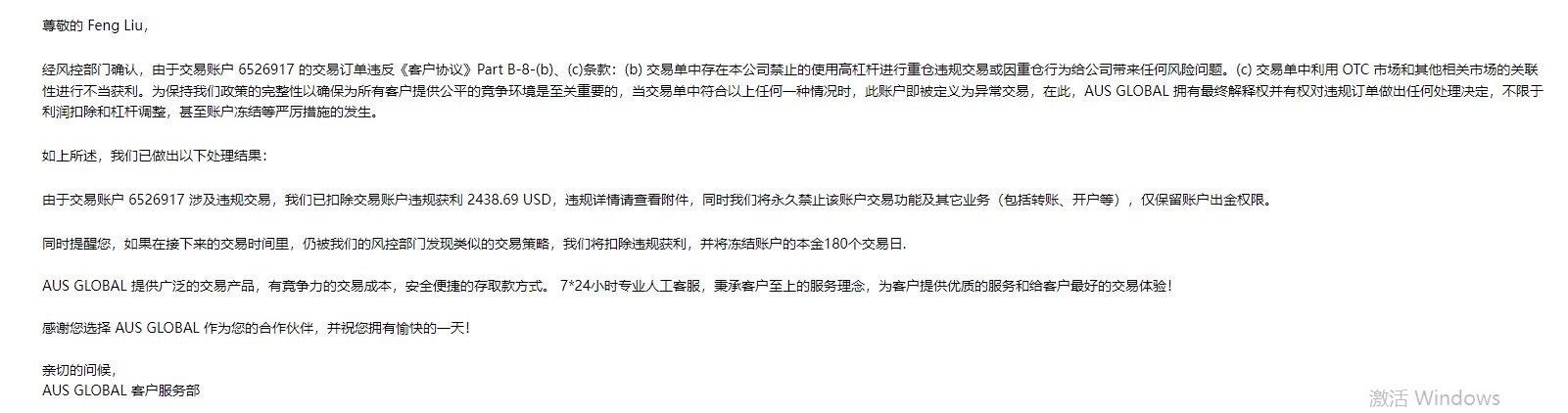

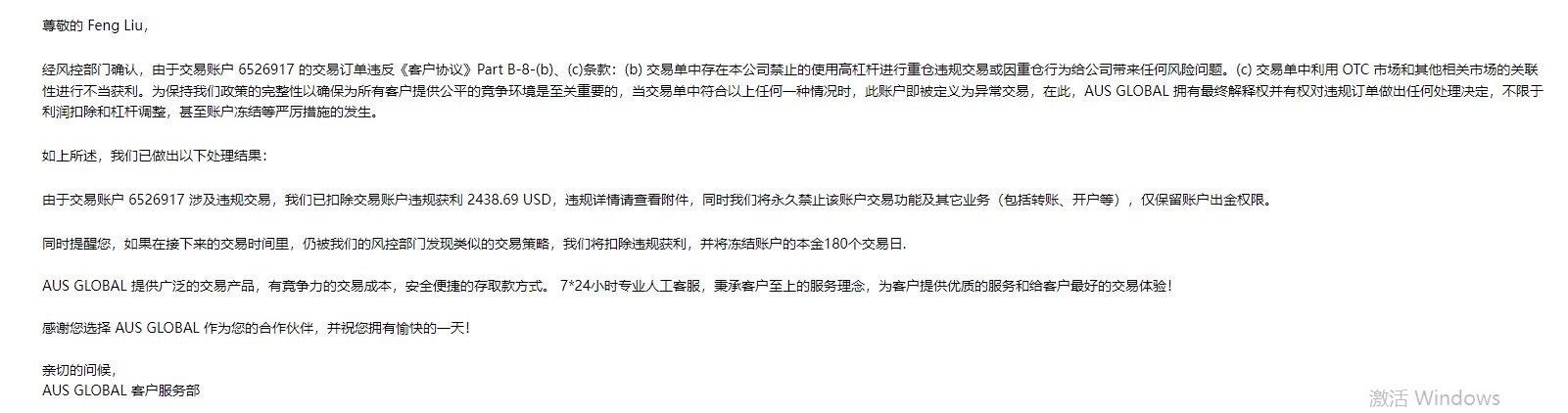

This review identifies significant information transparency limitations though. These particularly affect customer service, detailed account conditions, and user feedback areas. Prospective clients should prioritize gathering additional information through direct broker communication to make fully informed decisions about platform suitability for their specific trading needs.